Global Textile Winding Machine Market Size, Share, Growth Analysis By Operation Mode (Automatic, Semi-Automatic, Manual), By Machine Type (Precision Winder, Cone Winder, Non-Precision Winder, Spool & Other Winders), By Yarn Type (Cotton/Cellulosics, Polyester/Nylon, Blends/Specialty, Wool/Silk, Others), By Automation & Speed (High-Speed Automatic, Semi-Automatic, Manual/Basic), By End Use (Spinning Mills, Weaving/Knitting Units, Technical Textiles, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175644

- Number of Pages: 244

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

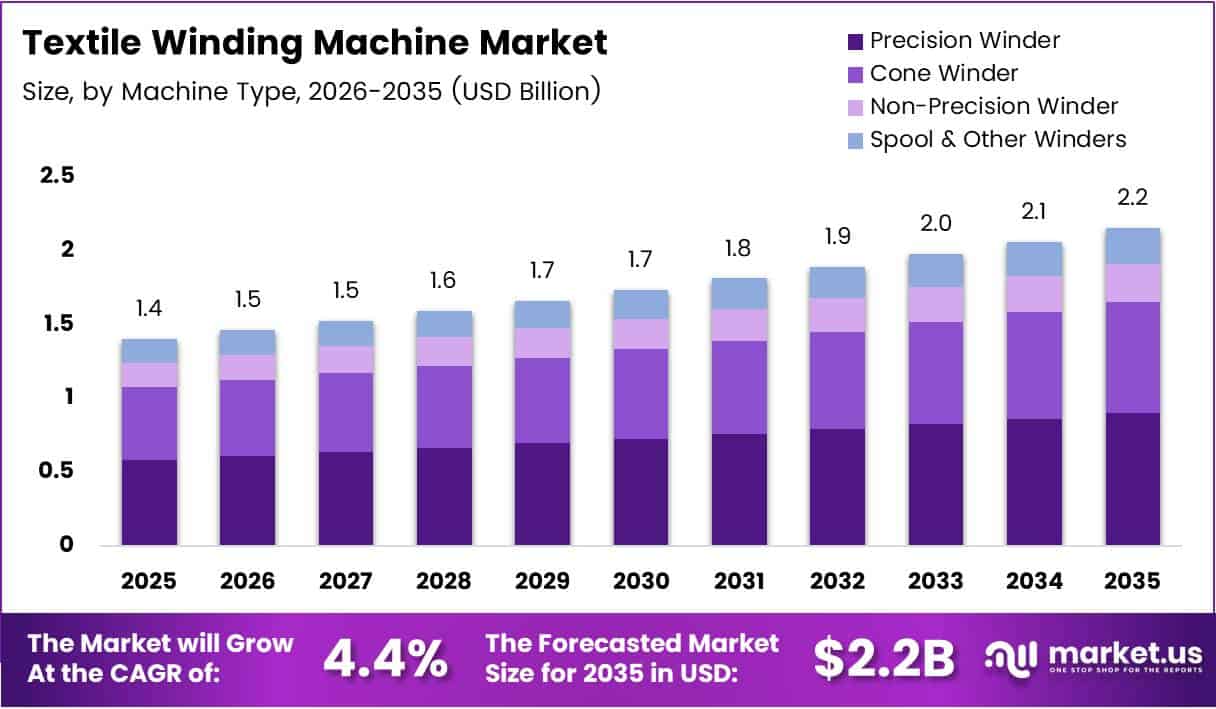

Global Textile Winding Machine Market size is expected to be worth around USD 2.2 Billion by 2035 from USD 1.4 Billion in 2025, growing at a CAGR of 4.4% during the forecast period 2026 to 2035.

Textile winding machines transform yarn from spinning bobbins into uniform packages for weaving and knitting. These systems ensure consistent tension control and eliminate defects through electronic monitoring. Consequently, manufacturers achieve higher productivity and reduced waste in textile processes.

The market experiences robust expansion driven by automation adoption in spinning mills worldwide. Modern equipment incorporates precision sensors detecting slubs and weak spots in real time. Moreover, manufacturers prioritize quality standards meeting export requirements for global brands. Therefore, investment in advanced technology continues accelerating.

Synthetic fiber production fuels demand for high-speed automatic systems handling polyester and nylon variants. Technical textile applications require specialized parameters for industrial yarns in automotive sectors. Additionally, integrated spinning-winding lines optimize mill layouts and reduce handling costs. These factors collectively strengthen market fundamentals.

In July 2024, Rieter secured orders for more than 700 Autoconer X6 machines from Shanghai Digital Intelligence World Industrial Technology Group. This partnership demonstrates accelerating modernization among Asian textile manufacturers seeking productivity improvements.

Sustainability mandates encourage mills to replace legacy equipment with energy-efficient models minimizing power consumption. Digital connectivity enables predictive maintenance protocols reducing unplanned downtime and extending machinery lifespan. Furthermore, modular designs support flexible yarn count changes without extensive reconfiguration.

Labor cost inflation in textile hubs accelerates adoption of automated solutions requiring minimal operator intervention. Smart factory integration allows centralized monitoring of multiple units through cloud-based platforms. However, capital intensity remains a consideration for small-scale producers. Nevertheless, long-term operational savings justify initial investments.

Export-oriented spinning mills prioritize winding quality to meet stringent yarn specifications from international buyers. Specialty yarn segments including carbon fiber require precision winding to preserve fiber integrity. Therefore, manufacturers develop application-specific solutions addressing diverse requirements across industrial categories.

Key Takeaways

- Global Textile Winding Machine Market valued at USD 1.4 Billion in 2025, projected to reach USD 2.2 Billion by 2035 at 4.4% CAGR

- Automatic operation mode dominates with 49.2% market share driven by labor efficiency requirements

- Precision winder machine type leads with 38.8% share due to quality control capabilities

- Polyester/Nylon yarn type captures 34.6% share reflecting synthetic fiber production growth

- High-speed automatic systems command 48.3% share enabling maximum spindle utilization rates

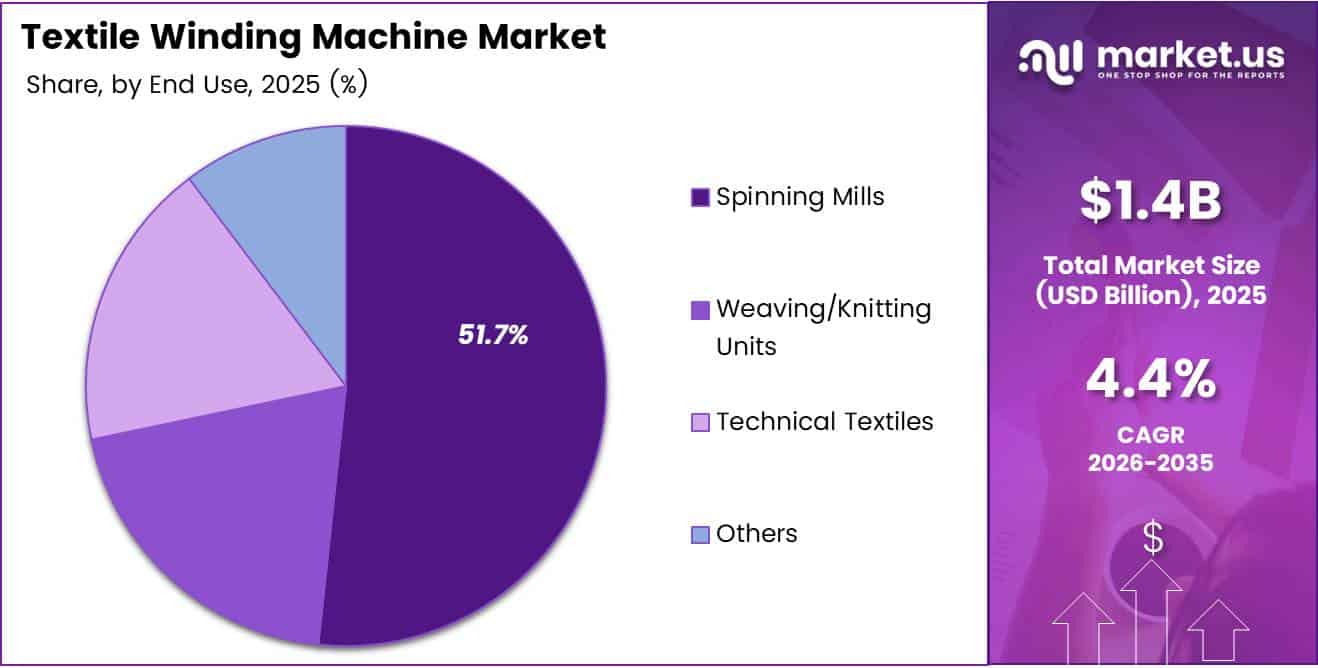

- Spinning mills represent 51.7% of end-use demand as primary yarn production facilities

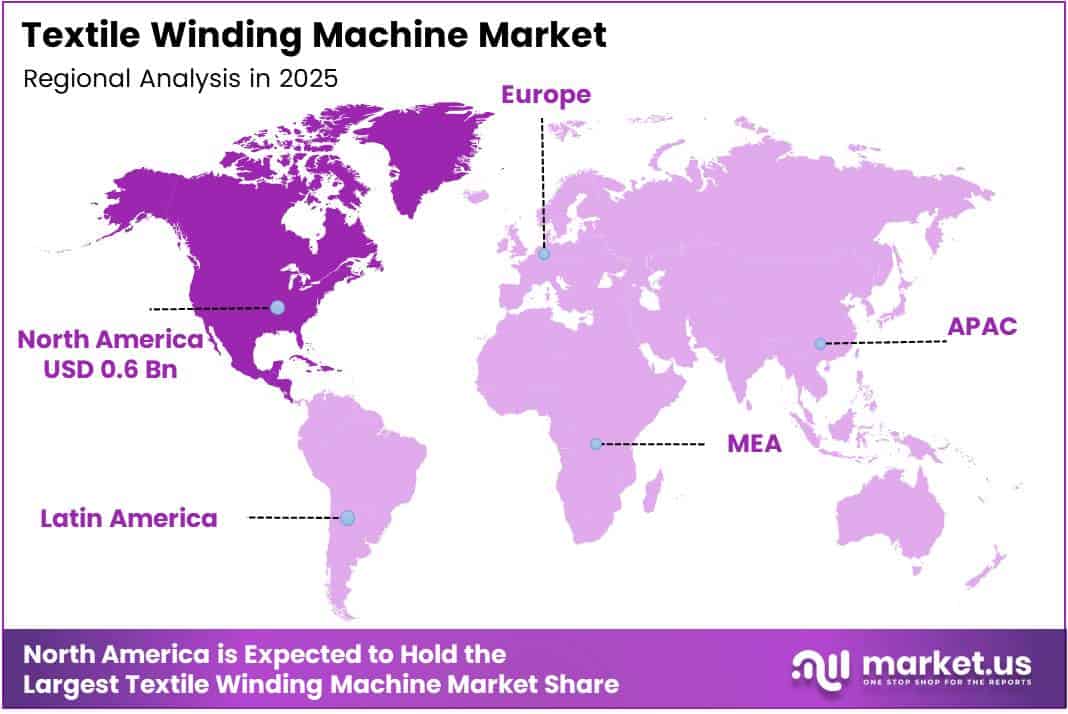

- North America dominates regional market with 45.8% share valued at USD 0.6 Billion

Operation Mode Analysis

Automatic dominates with 49.2% due to superior productivity and reduced labor dependency.

In 2025, Automatic held a dominant market position in the By Operation Mode segment of Textile Winding Machine Market, with a 49.2% share. Fully automated systems integrate electronic yarn clearers and tension sensors eliminating manual intervention. Mills achieve consistent quality across shifts without operator variations.

Semi-Automatic winding machines provide balanced solutions for mills transitioning from manual operations to modernized systems. These units require operator assistance for bobbin loading while automating core winding functions. Additionally, semi-automatic models offer lower capital costs compared to fully automated alternatives. Therefore, medium-scale spinning units favor this segment.

Manual winding machines serve niche applications in specialty yarn production and small-batch operations requiring frequent changes. Operators directly control winding speeds and tension parameters based on yarn characteristics. However, labor intensity limits productivity potential in competitive environments. Nevertheless, manual systems remain relevant for artisanal producers.

Machine Type Analysis

Precision Winder dominates with 38.8% due to export quality requirements and defect elimination capabilities.

In 2025, Precision Winder held a dominant market position in the By Machine Type segment of Textile Winding Machine Market, with a 38.8% share. Precision winders incorporate electronic yarn clearers detecting imperfections during winding operations. Mills producing export-quality yarn prioritize these systems to meet international specifications.

Cone Winder machines create conical yarn packages optimized for direct use in weaving looms and knitting machines. These units provide efficient unwinding characteristics reducing yarn breakage during downstream processing. Additionally, cone packages minimize storage space requirements compared to cylindrical alternatives. Therefore, weaving-focused mills maintain substantial installations.

Non-Precision Winder systems offer cost-effective solutions for applications where quality specifications permit higher defect tolerance. These machines focus on basic winding functions without advanced electronic monitoring capabilities. However, their lower capital costs appeal to budget-conscious operations producing commodity yarn grades.

Spool & Other Winders serve specialized applications including embroidery thread production and technical yarn processing. These machines accommodate diverse package formats required by specific end-use applications. Moreover, spool winders support customized yarn lengths and winding patterns. Therefore, specialty yarn producers maintain dedicated capacity.

Yarn Type Analysis

Polyester/Nylon dominates with 34.6% due to synthetic fiber production growth and technical textile expansion.

Cotton/Cellulosics represent traditional natural fiber winding applications serving apparel and home textile markets worldwide. These yarn types require specific tension control parameters preserving fiber strength during winding. Moreover, cotton yarn quality directly influences fabric hand-feel and appearance. Therefore, spinning mills maintain specialized winding protocols.

In 2025, Polyester/Nylon held a dominant market position in the By Yarn Type segment of Textile Winding Machine Market, with a 34.6% share. Synthetic fibers support high-speed winding operations due to superior strength characteristics compared to natural alternatives. Technical textile applications increasingly utilize polyester variants for automotive and industrial products.

Blends/Specialty yarn types combine natural and synthetic fibers to achieve specific performance characteristics for niche applications. These yarns require adjustable winding parameters accommodating varied fiber properties within single packages. Moreover, specialty yarns including metallic and elastomeric variants serve technical fashion segments. Therefore, flexible winding systems support production.

Wool/Silk premium natural fibers demand gentle winding processes that prevent fiber damage and preserve luxury characteristics. These yarn types serve high-value apparel markets where fiber integrity determines product quality. Additionally, lower production volumes require flexible winding equipment. Nevertheless, specialty capabilities represent important market segments.

Others encompass emerging fiber types including carbon fiber and aramid requiring specialized winding protocols. These technical yarns serve aerospace and protective equipment applications with stringent quality requirements. Moreover, sustainable fiber initiatives increase demand for systems compatible with recycled materials. Therefore, manufacturers develop application-specific solutions.

Automation & Speed Analysis

High-Speed Automatic dominates with 48.3% due to productivity maximization and labor optimization requirements.

In 2025, High-Speed Automatic held a dominant market position in the By Automation & Speed segment of Textile Winding Machine Market, with a 48.3% share. High-speed automatic systems deliver maximum spindle utilization rates through continuous operation with minimal downtime. Mills achieve lowest per-unit winding costs through economies of scale.

Semi-Automatic systems provide intermediate automation levels suitable for mills balancing productivity improvements with capital investment constraints. These machines automate critical winding and tension control functions while requiring operator assistance. Additionally, semi-automatic equipment offers upgrade pathways for traditional spinning operations modernizing production capabilities.

Manual/Basic winding systems serve small-scale producers and specialty applications where production flexibility outweighs automation benefits. These machines enable operators to adjust parameters in real-time based on yarn characteristics. Moreover, lower capital costs make manual systems accessible to entry-level businesses. Nevertheless, labor intensity restricts manual winding.

End Use Analysis

Spinning Mills dominate with 51.7% as primary yarn production facilities requiring comprehensive winding capacity.

In 2025, Spinning Mills held a dominant market position in the By End Use segment of Textile Winding Machine Market, with a 51.7% share. Spinning mills represent the primary yarn manufacturing facilities transforming fiber into finished yarn packages. These operations require integrated winding capacity to handle daily production volumes efficiently.

Weaving/Knitting Units utilize winding machines to prepare yarn packages in specific formats optimized for loom and knitting machine requirements. These facilities prioritize winding quality ensuring consistent tension and minimal defects during fabric formation. Additionally, re-winding operations create customized package configurations matching specific equipment specifications.

Technical Textiles operations employ specialized winding systems handling industrial yarns for automotive, construction, and protective applications. These facilities require precision winding maintaining fiber integrity in high-performance materials. Moreover, technical textile producers serve markets demanding stringent quality certifications and traceability. Therefore, advanced winding technology supports compliance requirements.

Others encompass embroidery thread manufacturers, sewing thread producers, and specialty yarn processors requiring flexible winding capabilities. These operations serve niche markets with customized package formats and yarn specifications. Additionally, smaller production volumes necessitate versatile equipment supporting multiple configurations. Consequently, specialty producers maintain diversified winding capacity.

Key Market Segments

By Operation Mode

- Automatic

- Semi-Automatic

- Manual

By Machine Type

- Precision Winder

- Cone Winder

- Non-Precision Winder

- Spool & Other Winders

By Yarn Type

- Cotton/Cellulosics

- Polyester/Nylon

- Blends/Specialty

- Wool/Silk

- Others

By Automation & Speed

- High-Speed Automatic

- Semi-Automatic

- Manual/Basic

By End Use

- Spinning Mills

- Weaving/Knitting Units

- Technical Textiles

- Others

Drivers

Rising Demand for High-Speed Automated Winding Systems Drives Market Growth

Labor cost inflation in major textile manufacturing hubs accelerates adoption of automated winding technology reducing workforce requirements. Mills achieve productivity improvements through continuous operation eliminating shift-change downtime and operator variability. Moreover, automated systems deliver consistent yarn quality meeting international export specifications. Therefore, competitive manufacturers prioritize automation investments.

Expansion of synthetic fiber production requires precision yarn tension and uniform winding maintaining product specifications. Technical textile manufacturing demands specialized winding protocols preserving fiber integrity in high-performance materials. Additionally, smart textile machinery improves spindle utilization and reduces yarn breakage rates. Consequently, advanced winding systems become essential infrastructure.

Growing investments in integrated spinning and winding lines enhance overall mill productivity through optimized material flow. Mills eliminate intermediate handling steps reducing yarn damage and contamination risks during processing. Furthermore, integrated systems support real-time quality monitoring across production stages. Therefore, textile manufacturers adopt comprehensive automation strategies driving winding machine demand.

Restraints

High Initial Investment Costs Limit Market Adoption

High upfront capital expenditure associated with advanced automatic and electronic winding machines restricts adoption among budget-constrained operations. Small-scale textile units face financing challenges acquiring modern equipment requiring substantial initial investments. Moreover, return-on-investment timelines extend beyond short-term planning horizons for many producers. Therefore, capital intensity slows market penetration rates.

Limited adoption among small-scale facilities stems from maintenance complexity requiring specialized technical expertise. Skilled operator shortages compound operational challenges for mills transitioning to automated winding systems. Additionally, training programs demand time and resources diverting focus from core production activities. Consequently, workforce capability gaps restrain modernization initiatives.

Equipment financing options remain limited in developing markets where textile manufacturing concentrates geographically. Mills operating on thin profit margins prioritize immediate cost reductions over long-term efficiency gains. Furthermore, uncertain market conditions discourage major capital commitments without guaranteed demand visibility. Therefore, financial constraints create adoption barriers.

Growth Factors

Technological Advancements Accelerate Market Expansion

Accelerating replacement demand for legacy winding equipment in aging textile mills across Asia-Pacific creates substantial market opportunities. Mills upgrade outdated machinery unable to meet modern quality standards and productivity requirements. Moreover, government modernization initiatives provide financial incentives supporting equipment replacement programs. Therefore, retrofit market segments experience robust growth.

Rising penetration of compact and energy-efficient winding machines aligns with sustainability mandates reducing industrial power consumption. Mills achieve operational cost savings through equipment consuming less electricity per spindle hour. Additionally, environmental regulations encourage adoption of technologies minimizing carbon footprints. Consequently, energy-efficient designs gain market preference.

In May 2025, Rieter signed a definitive agreement to acquire the Barmag business from OC Oerlikon to expand its portfolio in filament and man-made fiber machinery. Growing yarn exports boost demand for export-quality winding and packaging standards meeting international buyer specifications. Specialty yarn segments including glass fiber experience increased winding machine adoption.

Emerging Trends

Digital Transformation Reshapes Market Landscape

Integration of IoT-enabled monitoring systems enables real-time yarn quality and machine performance tracking across production facilities. Mills implement predictive analytics identifying maintenance requirements before equipment failures occur. Moreover, cloud connectivity supports centralized management of geographically dispersed manufacturing operations. Therefore, digital textile factories prioritize smart winding equipment.

In September 2025, Savio showcased its latest winding technology including the Proxima Smartconer® at ITMA Asia + CITME 2025 in Singapore. Adoption of modular winding machine designs supports multi-yarn and multi-count flexibility accommodating diverse production requirements. Mills reduce changeover times through equipment handling multiple yarn specifications without extensive reconfiguration.

Growing preference for low-vibration and noise-reduction winding technologies improves working conditions in modern textile plants. Mills address occupational health requirements through equipment minimizing acoustic pollution and mechanical stress. Additionally, increased focus on machine designs supporting recycled and blended yarn processing aligns with circular economy initiatives.

Regional Analysis

North America Dominates the Textile Winding Machine Market with a Market Share of 45.8%, Valued at USD 0.6 Billion

North America maintains market leadership through advanced textile manufacturing infrastructure and automation adoption rates. In 2025, the region held 45.8% market share valued at USD 0.6 Billion, driven by technical textile production and specialty yarn manufacturing. Moreover, established machinery suppliers provide comprehensive service networks supporting installed equipment bases. Therefore, North American mills sustain productivity advantages.

Europe Textile Winding Machine Market Trends

Europe demonstrates strong market presence through high-value textile production emphasizing quality and sustainability standards. Mills invest in energy-efficient winding technology meeting stringent environmental regulations across EU member states. Additionally, technical textile manufacturers require precision equipment for automotive and industrial applications. Consequently, European market sustains steady demand.

Asia Pacific Textile Winding Machine Market Trends

Asia Pacific represents the largest textile manufacturing region driving substantial winding machine demand growth. Mills across China, India, and Southeast Asia modernize production facilities replacing legacy equipment. Moreover, government initiatives support textile industry competitiveness through technology adoption incentives. Therefore, regional market experiences highest growth rates.

Latin America Textile Winding Machine Market Trends

Latin America shows moderate market development through established textile industries in Brazil and Mexico. Mills focus on cost-effective winding solutions balancing productivity improvements with capital constraints. Additionally, regional trade agreements support textile exports requiring quality-compliant yarn production. Consequently, market maintains stable growth trajectory.

Middle East & Africa Textile Winding Machine Market Trends

Middle East & Africa demonstrates emerging market potential through expanding textile manufacturing capacity. Mills invest in modern equipment establishing competitive production capabilities for regional and export markets. Moreover, government diversification strategies promote non-oil industrial development including textiles. Therefore, market presents long-term growth opportunities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Murata Machinery Ltd. maintains global leadership in textile winding technology through comprehensive product portfolios serving spinning and weaving sectors. The company delivers advanced automatic winding systems incorporating electronic yarn clearing and tension control technologies. Moreover, Murata’s extensive service networks support installed equipment bases across major textile manufacturing regions. Therefore, the company sustains competitive advantages through innovation and customer support capabilities.

Saurer Group provides integrated textile machinery solutions including winding systems for synthetic and natural fiber processing. The company emphasizes modular equipment designs supporting flexible production configurations across diverse yarn types. Additionally, Saurer’s digital connectivity solutions enable smart factory implementations optimizing mill operations. Consequently, the group maintains strong market positions in European and Asian markets.

Rieter Holding AG specializes in spinning and winding machinery serving integrated textile manufacturing operations worldwide. The company’s Autoconer series represents industry-standard automatic winding technology adopted by leading spinning mills. Moreover, Rieter’s strategic acquisitions expand capabilities in filament and man-made fiber processing equipment. Therefore, the company strengthens its comprehensive textile machinery portfolio.

SSM Schärer Schweiter Mettler AG focuses on precision winding solutions for technical textiles and specialty yarn applications. The company delivers customized winding systems handling high-performance fibers including aramid and carbon fiber materials. Additionally, SSM’s expertise in low-tension winding preserves fiber integrity in sensitive applications. Consequently, the company serves premium market segments requiring specialized equipment capabilities.

Key Players

- Murata Machinery Ltd.

- Saurer Group

- Rieter Holding AG

- SSM Schärer Schweiter Mettler AG

- SAVIO Macchine Tessili S.p.A.

- Peass Industrial Engineers Pvt. Ltd.

- Vandewiele NV

- Vandewiele Group

- Jwell Machinery Co., Ltd.

- TMT Machinery Pvt. Ltd.

Recent Developments

- March 2024 – Rieter entered a strategic partnership with Shanghai Digital Intelligence World Industrial Technology Group to collaborate on intelligent and digitalized textile manufacturing solutions. This partnership strengthens Rieter’s position in Chinese markets emphasizing smart factory implementations and Industry 4.0 integration capabilities.

- September 2025 – Rieter unveiled the NEO-BD precision winding machine at ITMA Asia + CITME 2025, highlighting enhanced winding performance and automation. The new equipment incorporates advanced electronic yarn clearing technology and real-time quality monitoring systems improving productivity and yarn quality standards.

- December 2025 – Rieter confirmed receipt of all regulatory approvals related to the acquisition of the Barmag business. This strategic acquisition expands Rieter’s portfolio into filament yarn machinery strengthening its comprehensive textile equipment offerings across spinning and chemical fiber processing segments.

Report Scope

Report Features Description Market Value (2025) USD 1.4 Billion Forecast Revenue (2035) USD 2.2 Billion CAGR (2026-2035) 4.4% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Operation Mode (Automatic, Semi-Automatic, Manual), By Machine Type (Precision Winder, Cone Winder, Non-Precision Winder, Spool & Other Winders), By Yarn Type (Cotton/Cellulosics, Polyester/Nylon, Blends/Specialty, Wool/Silk, Others), By Automation & Speed (High-Speed Automatic, Semi-Automatic, Manual/Basic), By End Use (Spinning Mills, Weaving/Knitting Units, Technical Textiles, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Murata Machinery Ltd., Saurer Group, Rieter Holding AG, SSM Schärer Schweiter Mettler AG, SAVIO Macchine Tessili S.p.A., Peass Industrial Engineers Pvt. Ltd., Vandewiele NV, Vandewiele Group, Jwell Machinery Co., Ltd., TMT Machinery Pvt. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Textile Winding Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Textile Winding Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Murata Machinery Ltd.

- Saurer Group

- Rieter Holding AG

- SSM Schärer Schweiter Mettler AG

- SAVIO Macchine Tessili S.p.A.

- Peass Industrial Engineers Pvt. Ltd.

- Vandewiele NV

- Vandewiele Group

- Jwell Machinery Co., Ltd.

- TMT Machinery Pvt. Ltd.