Global Tamping Rammer Machine Market Size, Share, Growth Analysis By Product Type (Vibratory Rammers, Percussion Rammers, Walk-Behind Rammers, Remote-Controlled Rammers), By Power Source (Gasoline-powered, Electric-powered, Battery-powered), By Category (Manual, Automatic, Semi-automatic), By End Use (Construction, Infrastructure, Mining, Landscaping & Gardening, Agriculture, Others), By Distribution Channel (Indirect Sales, Direct Sales), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174310

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Product Type Analysis

- Power Source Analysis

- Category Analysis

- End Use Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Tamping Rammer Machine Company Insights

- Key Companies

- Recent Developments

- Report Scope

Report Overview

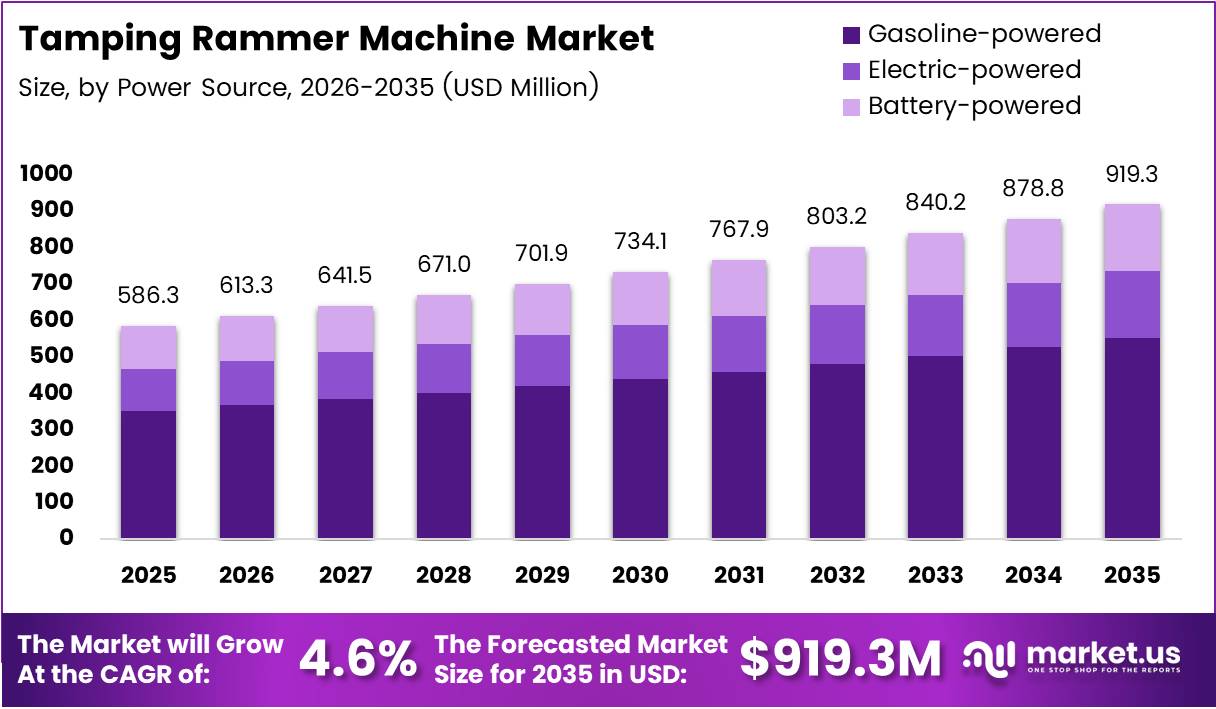

The global Tamping Rammer Machine Market is projected to reach approximately USD 919.3 Million by 2035, up from USD 586.3 Million in 2025. Moreover, the market demonstrates steady expansion at a CAGR of 4.6% throughout the forecast period from 2026 to 2035.

Tamping rammer machines represent specialized soil compaction equipment designed for confined spaces and trench work. These devices deliver high-impact compaction force through rapid striking action. Consequently, they are essential tools in construction, infrastructure development, and utility installation projects requiring precise soil densification.

The market benefits significantly from accelerating urbanization and infrastructure modernization initiatives globally. Additionally, expanding utility trenching projects and drainage installations drive consistent demand for compact compaction equipment. Therefore, vibratory and percussion rammers continue gaining traction across multiple construction applications.

Government investments in public construction further strengthen market prospects considerably. According to the U.S. Census Bureau, the value of U.S. public construction in 2024 reached $492.7 billion, representing a 9.3% increase versus 2023. Furthermore, this growth reflects substantial infrastructure rehabilitation and road development programs.

Equipment rental penetration creates additional revenue opportunities for manufacturers and distributors. The American Rental Association projected construction and general tool rental revenue of $77.3 billion in 2024, marking a 7.9% increase. Subsequently, rental demand for tamping rammers continues expanding among contractors.

Technological advancements in power sources and operator comfort features enhance market competitiveness. However, industry participants must address challenges including maintenance costs and operator skill requirements. Nevertheless, emerging economies present substantial growth potential through smart city developments and landscaping applications.

Key Takeaways

- Global Tamping Rammer Machine Market valued at USD 586.3 Million in 2025, expected to reach USD 919.3 Million by 2035 at 4.6% CAGR.

- Vibratory Rammers segment dominates By Product Type with 41.6% market share in 2025.

- Gasoline-powered segment leads By Power Source category with 67.4% share.

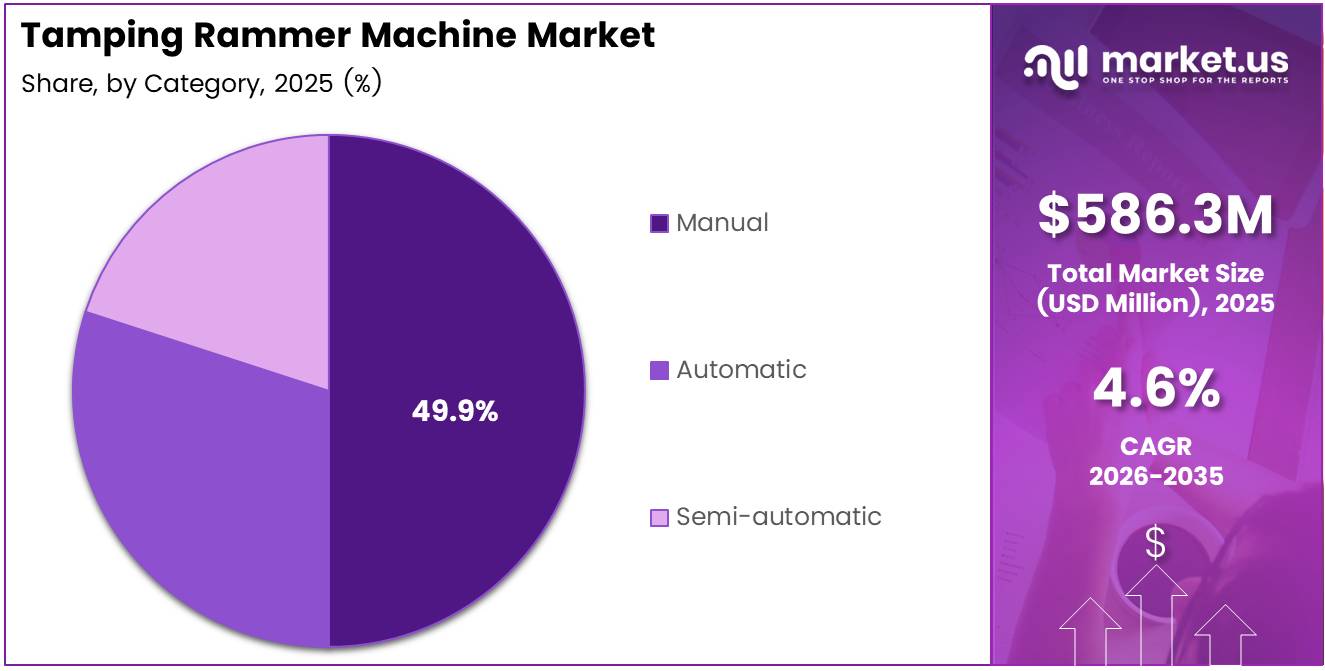

- Manual category holds 49.9% share in By Category segment.

- Construction end-use segment captures 44.8% market share.

- Indirect Sales channel accounts for 59.7% distribution share.

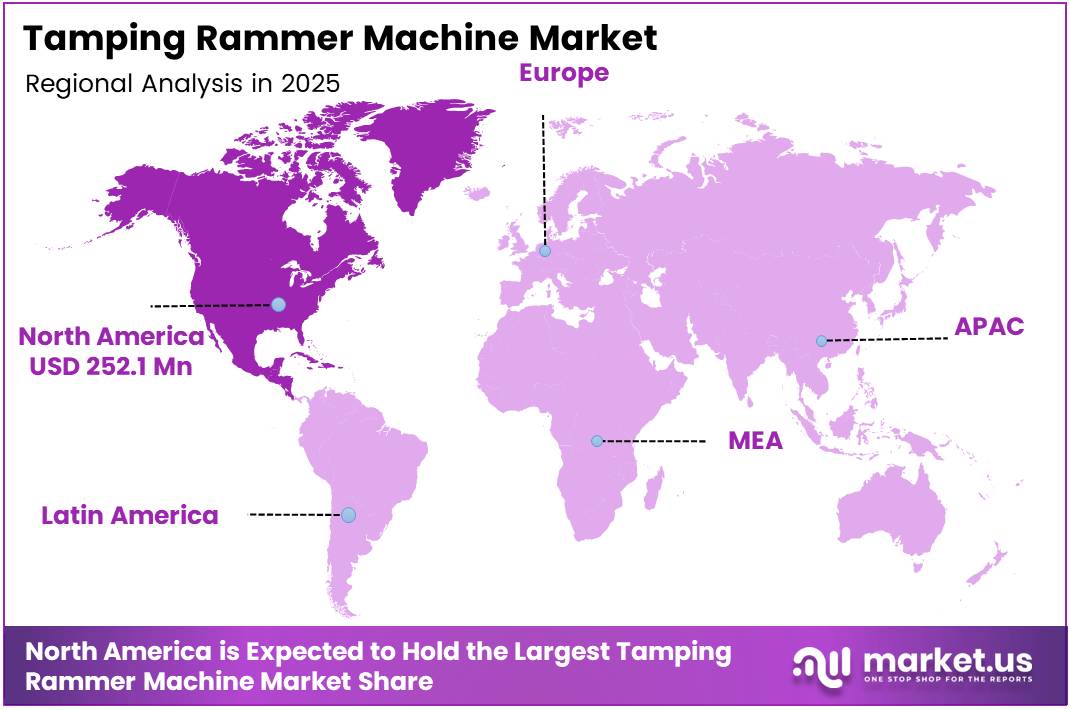

- North America dominates regional market with 43.1% share, valued at USD 252.1 Million.

Product Type Analysis

Vibratory Rammers dominate with 41.6% due to superior compaction efficiency and versatile application capabilities.

In 2025, Vibratory Rammers held a dominant market position in the By Product Type segment of Tamping Rammer Machine Market, with a 41.6% share. These machines utilize rapid vibration technology combined with percussion action for enhanced soil compaction. Consequently, they deliver superior performance in cohesive and granular soil conditions across various construction applications.

Percussion Rammers represent traditional compaction equipment utilizing direct impact force for soil densification. These units excel in confined trench work and utility installations. Moreover, their simple mechanical design ensures reliable operation and straightforward maintenance procedures for contractors and operators.

Walk-Behind Rammers offer operator-guided control for precision compaction in restricted access areas. These machines provide excellent maneuverability around obstacles and existing structures. Additionally, their ergonomic design reduces operator fatigue during extended compaction operations across construction sites.

Remote-Controlled Rammers incorporate advanced automation technology for enhanced safety and productivity. These units enable operators to work from safe distances in hazardous environments. Furthermore, wireless control systems improve operational efficiency in challenging terrain and confined underground construction applications.

Power Source Analysis

Gasoline-powered segment dominates with 67.4% due to high power output and widespread fuel availability.

In 2025, Gasoline-powered held a dominant market position in the By Power Source segment of Tamping Rammer Machine Market, with a 67.4% share. These engines deliver robust performance and extended runtime for demanding compaction tasks. Moreover, gasoline fuel infrastructure remains readily accessible across construction sites globally, ensuring operational continuity.

Electric-powered rammers provide emission-free operation ideal for indoor and enclosed space applications. These units eliminate exhaust fumes and reduce noise pollution significantly. Consequently, they align with environmental regulations and sustainability requirements in urban construction projects and sensitive work zones.

Battery-powered variants offer cordless mobility without sacrificing compaction effectiveness in modern applications. These machines combine environmental benefits with operational flexibility across diverse job sites. Additionally, advancing battery technology extends runtime and reduces charging frequency for improved productivity.

Category Analysis

Manual category dominates with 49.9% due to cost-effectiveness and operator control precision.

In 2025, Manual held a dominant market position in the By Category segment of Tamping Rammer Machine Market, with a 49.9% share. These operator-controlled units provide direct tactile feedback for precise compaction depth and density control. Therefore, they remain preferred for specialized applications requiring experienced operator judgment and technique.

Automatic rammers incorporate programmable controls and sensors for consistent compaction performance across applications. These systems reduce operator variability and ensure uniform soil densification. Furthermore, automation features enhance productivity while minimizing physical strain on construction personnel throughout extended operations.

Semi-automatic variants balance manual control flexibility with automated assistance features for optimized performance. These machines offer adjustable automation levels based on soil conditions and project requirements. Consequently, they provide versatility for contractors handling diverse compaction challenges across multiple site conditions.

End Use Analysis

Construction segment dominates with 44.8% due to extensive soil compaction requirements in building projects.

In 2025, Construction held a dominant market position in the By End Use segment of Tamping Rammer Machine Market, with a 44.8% share. Building foundations, basement excavations, and structural backfilling require precise soil compaction for stability. Moreover, residential and commercial construction growth sustains consistent demand for compact rammer equipment.

Infrastructure applications encompass road construction, bridge foundations, and railway embankments requiring robust compaction solutions. These large-scale projects demand reliable equipment for achieving specified soil density standards. Additionally, government infrastructure investment programs drive sustained equipment procurement across developed and emerging markets.

Mining operations utilize tamping rammers for haul road maintenance and excavation site preparation activities. These machines compact loose material around mining infrastructure and access routes. Furthermore, remote mining locations require durable equipment capable of withstanding harsh operating conditions.

Landscaping and Gardening applications include pathway construction, retaining wall installation, and decorative paving projects. These rammers provide precise compaction in residential and commercial outdoor spaces. Consequently, growing urban beautification initiatives expand market opportunities beyond traditional construction applications.

Agriculture sector employs tamping equipment for farm road maintenance and irrigation channel construction. These machines compact soil around agricultural infrastructure including drainage systems. Additionally, mechanization trends in farming operations increase adoption of specialized compaction equipment.

Others category encompasses utility installations, telecommunications trenching, and emergency repair work requiring portable compaction solutions. These diverse applications sustain niche market segments with specialized equipment requirements.

Distribution Channel Analysis

Indirect Sales dominates with 59.7% due to extensive dealer networks and rental availability.

In 2025, Indirect Sales held a dominant market position in the By Distribution Channel segment of Tamping Rammer Machine Market, with a 59.7% share. Distributors and dealers provide localized inventory, technical support, and after-sales service accessibility. Moreover, equipment rental companies expand market reach by offering flexible access without capital investment requirements.

Direct Sales channel enables manufacturers to establish relationships with large contractors and construction companies. This approach facilitates customization options and bulk procurement arrangements for major projects. Additionally, direct engagement provides valuable customer feedback for product development and market intelligence gathering.

Key Market Segments

By Product Type

- Vibratory Rammers

- Percussion Rammers

- Walk-Behind Rammers

- Remote-Controlled Rammers

By Power Source

- Gasoline-powered

- Electric-powered

- Battery-powered

By Category

- Manual

- Automatic

- Semi-automatic

By End Use

- Construction

- Infrastructure

- Mining

- Landscaping & Gardening

- Agriculture

- Others

By Distribution Channel

- Indirect Sales

- Direct Sales

Drivers

Rapid Expansion of Urban Infrastructure Drives Tamping Rammer Machine Demand

Urban infrastructure development accelerates globally as cities expand residential and commercial zones continuously. Consequently, road construction, utility installations, and drainage projects require extensive soil compaction equipment. Moreover, rehabilitation programs for aging infrastructure create sustained replacement demand across developed markets.

Municipal authorities prioritize improving transportation networks and underground utility systems for growing populations. Therefore, tamping rammers become essential for trench backfilling and pavement preparation work. Additionally, compact equipment proves indispensable in congested urban environments where space constraints limit larger machinery deployment.

Rising utility trenching activities for telecommunications, water, and gas pipeline installations drive equipment adoption. These projects demand precise compaction in confined spaces to prevent future settlement. Furthermore, increasing smart city initiatives incorporate extensive underground infrastructure requiring specialized compaction solutions throughout project lifecycles.

Restraints

High Maintenance Costs Challenge Tamping Rammer Machine Market Growth

Petrol-powered tamping rammers require frequent maintenance including engine servicing, fuel system cleaning, and component replacement. Consequently, operational expenses accumulate significantly over equipment lifecycles for contractors and rental companies. Moreover, fuel price volatility creates budgetary uncertainty affecting equipment utilization rates across construction projects.

Skilled operator dependency limits effective compaction performance and restricts market accessibility for smaller contractors. Therefore, inexperienced personnel may achieve suboptimal soil densification compromising construction quality standards. Additionally, training programs require time and investment that smaller operations struggle to accommodate.

Equipment downtime during maintenance periods reduces productivity and delays project schedules for time-sensitive construction work. Furthermore, replacement parts availability and service accessibility vary significantly across regional markets particularly in remote locations.

Growth Factors

Electric and Battery-Powered Equipment Adoption Creates Market Expansion Opportunities

Environmental regulations increasingly restrict emissions from construction equipment in urban areas and enclosed spaces. Consequently, electric and battery-powered tamping rammers gain market acceptance for sustainable compaction solutions. Moreover, reduced noise levels enable extended working hours in noise-sensitive residential zones improving project efficiency.

Smart city development projects across emerging economies require modern infrastructure with advanced utility systems. Therefore, these initiatives generate substantial demand for compact soil compaction equipment in high-density developments. Additionally, government funding supports infrastructure modernization creating favorable procurement conditions for equipment manufacturers.

Equipment rental penetration expands as contractors prefer operational flexibility over capital investment commitments. Furthermore, rental companies maintain diverse equipment fleets including latest tamping rammer technologies. Consequently, this trend broadens market accessibility for small and medium-sized construction firms.

Landscaping and pavement repair applications increase alongside urban beautification initiatives and maintenance requirements. These specialized uses diversify revenue streams beyond traditional construction applications for equipment manufacturers and distributors.

Emerging Trends

Low-Emission Technology Adoption Shapes Tamping Rammer Machine Development

Manufacturers increasingly prioritize eco-friendly compaction equipment aligning with global sustainability commitments and regulations. Consequently, development focuses on electric motors and advanced battery systems reducing carbon footprints. Moreover, hybrid power solutions emerge combining gasoline engines with electric assist for improved fuel efficiency.

Anti-vibration handles and ergonomic designs enhance operator comfort reducing fatigue during extended compaction operations. Therefore, modern rammers incorporate cushioning systems and adjustable handles improving workplace safety. Additionally, noise-reduction technologies minimize sound emissions complying with occupational health standards across construction sites.

Compact and lightweight designs facilitate transportation and maneuverability in confined construction spaces improving operational efficiency. Furthermore, portability features enable quick deployment across multiple job sites throughout project durations. Consequently, contractors value equipment versatility supporting diverse application requirements with minimal logistical complexity.

Regional Analysis

North America Dominates the Tamping Rammer Machine Market with a Market Share of 43.1%, Valued at USD 252.1 Million

North America holds the dominant position with a 43.1% market share, valued at USD 252.1 Million, driven by extensive infrastructure rehabilitation and construction activity. The region benefits from substantial government investment in public construction and transportation network modernization. Moreover, equipment rental culture remains highly developed supporting consistent demand for advanced tamping rammer technologies across construction sectors.

Europe Tamping Rammer Machine Market Trends

Europe demonstrates strong market presence supported by stringent environmental regulations favoring low-emission compaction equipment. Countries prioritize sustainable construction practices and urban infrastructure upgrades throughout established cities. Additionally, aging infrastructure requires ongoing maintenance and rehabilitation creating sustained equipment demand across the region.

Asia Pacific Tamping Rammer Machine Market Trends

Asia Pacific exhibits rapid market growth driven by accelerating urbanization and infrastructure development across emerging economies. China and India lead regional expansion through massive smart city projects and transportation network construction. Furthermore, government infrastructure investment programs support robust equipment procurement supporting regional market expansion significantly.

Latin America Tamping Rammer Machine Market Trends

Latin America shows moderate growth potential as countries invest in infrastructure modernization and urban development projects. Brazil and Mexico represent primary markets with ongoing construction activity across residential and commercial sectors. However, economic volatility occasionally impacts equipment investment decisions throughout the region.

Middle East & Africa Tamping Rammer Machine Market Trends

Middle East & Africa region experiences growth through large-scale infrastructure projects and urban expansion initiatives. GCC countries maintain substantial construction activity driven by economic diversification strategies and tourism development. Additionally, mining operations across African nations create specialized demand for robust compaction equipment.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tamping Rammer Machine Company Insights

Ammann Group maintains a prominent position in the global compaction equipment market through comprehensive product portfolios and technological innovation. The company focuses on delivering high-performance vibratory and percussion rammers for diverse construction applications. Moreover, Ammann’s strategic acquisitions strengthen market presence, evidenced by their 2024 completion of Volvo CE’s ABG paving product line acquisition.

Atlas Copco leverages extensive industrial equipment expertise to deliver robust tamping rammer solutions for construction and mining sectors. The company emphasizes durability and performance in harsh operating environments across global markets. Additionally, Atlas Copco’s established distribution networks ensure comprehensive service support and parts availability for customers worldwide.

Bomag GmbH represents a leading manufacturer specializing in soil and asphalt compaction equipment with decades of engineering experience. The company develops innovative rammer designs incorporating advanced vibration technology and operator comfort features. Furthermore, Bomag’s commitment to quality manufacturing establishes strong brand recognition among contractors and equipment rental companies.

Chicago Pneumatic provides reliable pneumatic and gasoline-powered tamping rammers targeting professional construction and infrastructure applications. The company focuses on delivering cost-effective solutions without compromising performance standards or build quality. Consequently, Chicago Pneumatic maintains competitive positioning in price-sensitive market segments while ensuring dependable equipment operation.

Key Companies

- Ammann Group

- Atlas Copco

- Bomag GmbH

- Chicago Pneumatic

- Doosan Corporation

- Husqvarna Group

- MBW Inc.

- Mikasa Sangyo Co., Ltd.

- Multiquip Inc.

- Toro Company

Recent Developments

- In June 2024, Ammann finalised the acquisition of Volvo CE’s ABG paving product line, expanding their compaction equipment portfolio and strengthening market positioning across road construction applications.

- In October 2024, Milwaukee Tool announced the introduction of the MX FUEL™ 70 kg Rammer, representing their entry into battery-powered compaction equipment segment.

Report Scope

Report Features Description Market Value (2025) USD 586.3 Million Forecast Revenue (2035) USD 919.3 Million CAGR (2026-2035) 4.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Vibratory Rammers, Percussion Rammers, Walk-Behind Rammers, Remote-Controlled Rammers), By Power Source (Gasoline-powered, Electric-powered, Battery-powered), By Category (Manual, Automatic, Semi-automatic), By End Use (Construction, Infrastructure, Mining, Landscaping & Gardening, Agriculture, Others), By Distribution Channel (Indirect Sales, Direct Sales) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Ammann Group, Atlas Copco, Bomag GmbH, Chicago Pneumatic, Doosan Corporation, Husqvarna Group, MBW Inc., Mikasa Sangyo Co., Ltd., Multiquip Inc., Toro Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Tamping Rammer Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Tamping Rammer Machine MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Ammann Group

- Atlas Copco

- Bomag GmbH

- Chicago Pneumatic

- Doosan Corporation

- Husqvarna Group

- MBW Inc.

- Mikasa Sangyo Co., Ltd.

- Multiquip Inc.

- Toro Company