Global Tactical Protective Headset Market Market Size, Share, Growth Analysis By Classification (IP67, IP68, IPX5, IPX7), By Technology (Wired, Wireless), By Communication Mode (Single Mode, Dual Mode), By Application (Military, Civil), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 166926

- Number of Pages: 235

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

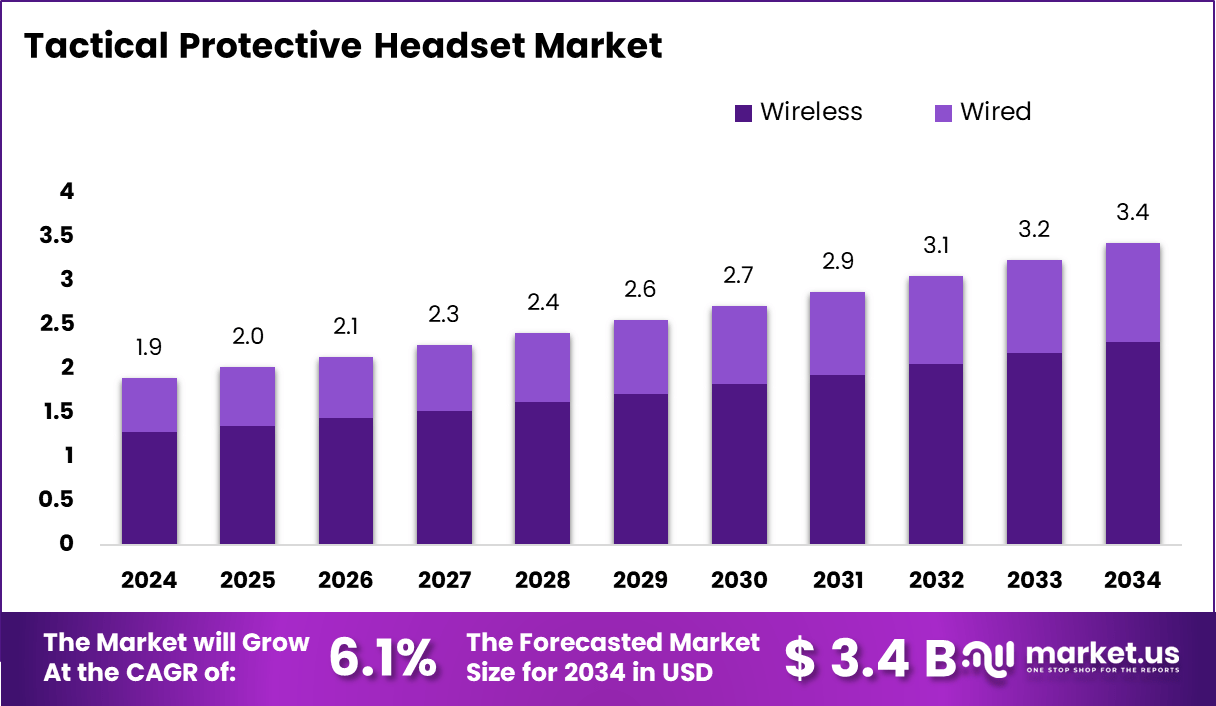

The Global Tactical Protective Headset Market size is expected to be worth around USD 3.4 billion by 2034, from USD 1.9 billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The Tactical Protective Headset Market represents a specialized segment supporting soldier survivability, team coordination, and battlefield situational awareness through advanced communication and noise-attenuation systems. It focuses on rugged headsets engineered to filter impulse noise, enhance speech clarity, and protect hearing during high-intensity missions across defense, law enforcement, and tactical operations.

Growth accelerates as armed forces modernize soldier-borne equipment and invest in next-generation communication gear to strengthen mission agility. Rising border security challenges, increased tactical training frequency, and expanding adoption of adaptive sound-processing systems further stimulate procurement programs. Additionally, integrated digital features support enhanced command-and-control workflows, creating stronger adoption momentum.

Furthermore, expanding R&D pipelines around electronic hearing protection, voice-enabled interfaces, and smart battlefield headsets creates scalable opportunities. Governments emphasize soldier protection technologies, prompting rising funding for advanced auditory systems with AI-based environmental awareness tools. Defense digitization programs also encourage broader integration of tactical communication gear in emerging markets.

Meanwhile, regulatory compliance around hearing conservation, noise exposure thresholds, and military safety protocols influences procurement preferences. Defense agencies increasingly mandate certified headsets that meet strict acoustic performance standards. These requirements push manufacturers toward innovations aligned with MIL-STD- and OSHA-driven guidelines, reinforcing steady product advancements.

In addition, governments allocate higher budgets for soldier modernization initiatives, improving demand for tactical protective headsets featuring digital signal processing, situational-awareness amplification, and secure communication layers. Procurement roadmaps across North America, Europe, and Asia enhance long-term market attractiveness for mission-critical acoustic panel protection solutions.

According to published research, weak battlefield sounds can now be amplified to audible levels to support personnel with partial hearing loss, strengthening communication precision. Furthermore, according to defense publications, over 600,000 systems have been delivered to global military forces, highlighting rising operational dependence. Additionally, according to US military sources, 20,000 TCAPS units are currently deployed by the US Military, underscoring the growing adoption of tactical hearing-protection platforms.

Together, these factors position the Tactical Protective Headset Market for sustained expansion supported by defense investment, evolving mission requirements, and increasing prioritization of soldier safety and communication efficiency.

Key Takeaways

- The Global Tactical Protective Headset Market is expected to reach USD 3.4 billion by 2034 from USD 1.9 billion in 2024.

- The market grows at a steady 6.1% CAGR between 2025 and 2034.

- IP67 leads the classification segment with a 38.9% share.

- Wireless technology dominates with a 67.2% segment share.

- Single-mode communication holds the largest segment share at 58.8%.

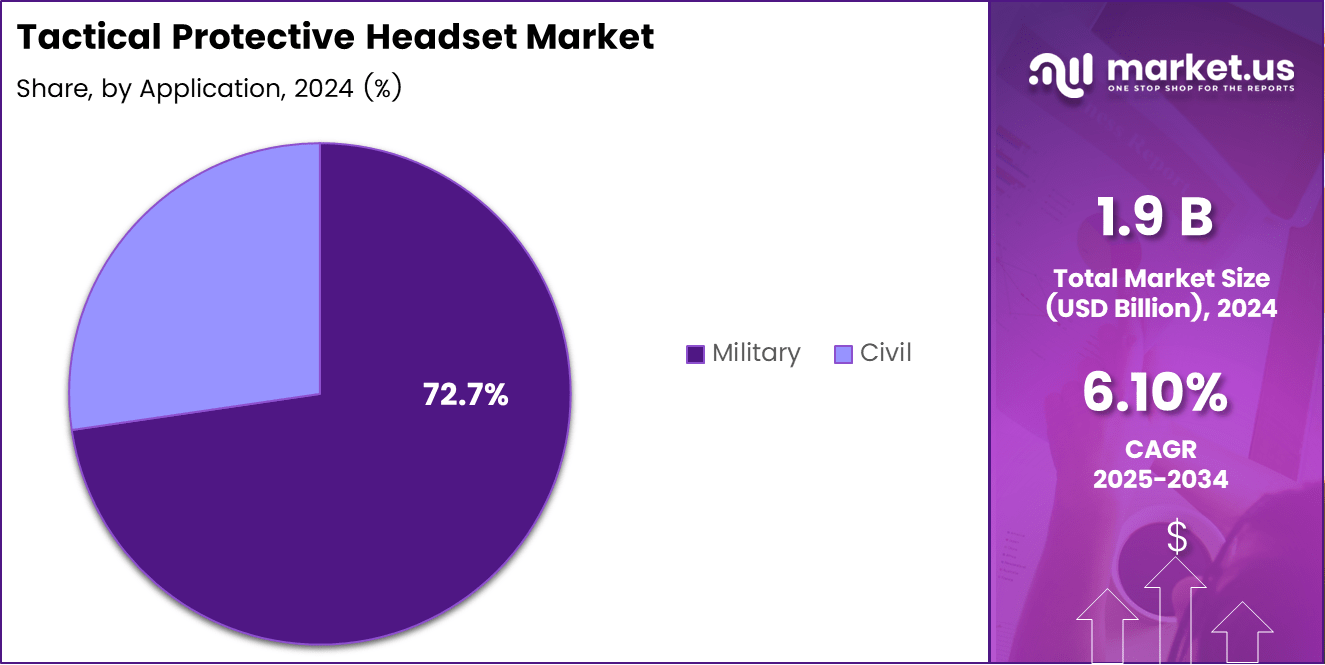

- Military applications account for a strong 72.7% share of total adoption.

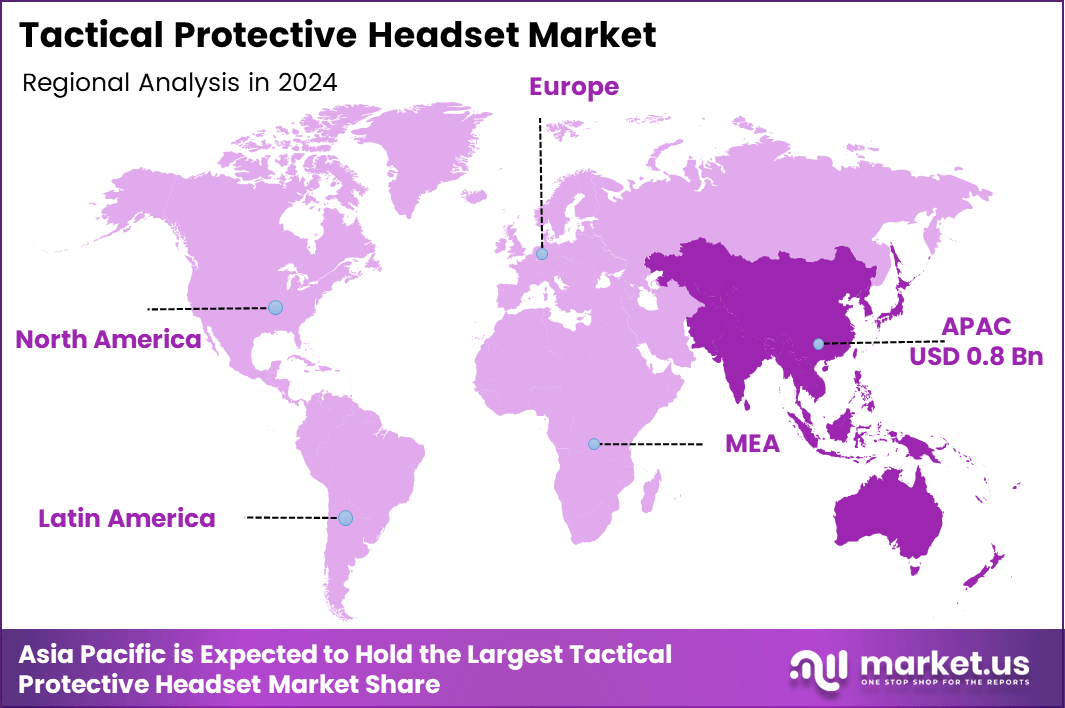

- Asia Pacific remains the top regional market with a 43.80% share valued at USD 0.8 billion.

By Classification Analysis

IP67 dominates with 38.9% due to its strong balance of ruggedness, moisture protection, and field reliability.

In 2024, IP67 held a dominant market position in the By Classification segment of the Tactical Protective Headset Market, with a 38.9% share. This rating supports users across harsh terrains where dust, debris, and moisture exposure remain frequent. Its protection level enhances mission-readiness and strengthens user confidence during extended tactical deployments.

IP68 gained traction in the same segment as missions shifted toward high-moisture and submerged operational environments. Its deeper waterproofing capability improved headset durability in amphibious tasks. Adoption expanded as tactical teams prioritized long-lasting acoustic components engineered for extreme protection and continuous field communication stability.

IPX5 advanced as a practical option for agencies seeking lightweight splash-resistant protection. This rating supported rapid-response units exposed to unpredictable rain conditions. Its adaptability made it suitable for training programs and mobility-focused missions where equipment flexibility and consistent tactical performance were essential throughout varied weather scenarios.

IPX7 also expanded usage across sectors requiring short-term submersion protection. Tactical Communication teams operating around rivers, port security zones, and flood-prone geographies valued this rating. It ensured stable headset operation during accidental water exposure, maintaining communication clarity and reducing operational downtime in dynamic mission environments.

By Technology Analysis

Wireless dominates with 67.2% due to its flexibility, mobility, and ease of integration with tactical gear.

In 2024, the Wireless segment held a dominant market position in the By Technology segment of the Tactical Protective Headset Market, with a 67.2% share. Troops increasingly preferred cable-free designs for improved agility, reduced snagging risks, and seamless pairing with modern communication platforms supporting fast-moving mission workflows.

In 2024, Wired systems continued serving specialized operations requiring uninterrupted, interference-free audio channels. These setups supported command units functioning in dense electronic-warfare zones. Their reliability, predictable signal strength, and compatibility with legacy tactical radios sustained steady adoption across structured defense communication ecosystems.

By Communication Mode Analysis

Single Mode dominates with 58.8% as it provides simplicity, clarity, and mission-focused communication.

In 2024, Single Mode held a dominant market position in the By Communication Mode segment of the Tactical Protective Headset Market, with a 58.8% share. This mode supported operations requiring direct, uninterrupted communication channels. Users valued its reduced complexity and stable acoustic performance across high-pressure tactical environments.

In 2024, Dual Mode gained adoption among multi-team operations and cross-unit coordination activities. Its ability to switch between channels enabled smooth communication layering across overlapping missions. Tactical units deployed in urban warfare, joint exercises, and surveillance tasks found added value in its communication versatility.

By Application Analysis

The military dominates with 72.7% driven by rising modernization programs, soldier protection needs, and tactical communication upgrades.

In 2024, the Military segment held a dominant market position in the By Application segment of the Tactical Protective Headset Market, with a 72.7% share. Defense agencies accelerated investment in protective headsets supporting situational awareness, noise suppression, and secure communication across ground forces, special units, and rapid-response formations.

In 2024, Civil applications grew as law enforcement teams, emergency response forces, and security agencies demanded improved auditory protection. Public-safety operations relied on tactical headsets to manage crowd control, disaster response, and critical-infrastructure protection, strengthening adoption across non-military professional sectors.

Key Market Segments

By Classification

- IP67

- IP68

- IPX5

- IPX7

By Technology

- Wired

- Wireless

By Communication Mode

- Single Mode

- Dual Mode

By Application

- Military

- Civil

Drivers

Rising Modernization Programs Strengthen Tactical Protective Headset Market Growth

Growing modernization programs in infantry communication suites are increasing the demand for advanced tactical protective headsets. Militaries emphasize clearer voice transmission, better noise filtering, and reliable communication in crowded acoustic environments, pushing defense agencies to upgrade soldier-worn equipment with more capable and durable headset systems.

Adoption of dual-mode situational awareness and active hearing systems further drives market expansion. These technologies allow soldiers to hear critical ambient sounds while blocking harmful noise, improving both safety and operational effectiveness. Armies increasingly consider these dual-mode capabilities essential for modern battlefield communication standards.

The integration of tactical headsets with body-worn camera and sensor platforms also boosts growth. Forces worldwide are adopting digital ecosystems where audio, video, and sensor data work together. Headsets that support synchronized data flow and seamless connectivity become valuable assets in mission planning, surveillance, and real-time intelligence operations.

Additionally, the expansion of special-operations procurement for high-decibel mission environments strengthens market opportunities. Elite units operating in breaching, artillery, and airborne missions require highly protective hearing systems. The need to maintain communication clarity under extreme noise conditions encourages continuous investment in rugged, high-performance tactical headset technologies.

Restraints

High System Costs and Network Limitations Restrict Tactical Protective Headset Market Expansion

High acquisition and lifecycle upgrade costs for electronic tactical headsets remain a major restraint for the market. These devices use advanced processors, noise-reduction modules, and communication chips, making them expensive for large-scale deployment. Budget-constrained defense forces often delay upgrades, slowing adoption despite rising demand for modern soldier communication tools.

Limited interoperability across multi-vendor tactical communication networks also challenges market growth. Different agencies use diverse radios, encryption formats, and communication protocols, making seamless integration difficult. When headsets are not fully compatible with existing systems, additional adapters or modifications are required, increasing complexity and reducing procurement efficiency for military and law-enforcement users.

Battery dependency during prolonged field operations further restricts adoption. Tactical teams operating in remote or high-intensity missions depend on continuous power for hearing protection and communication clarity. Frequent battery replacements or charging needs disrupt mission flow. These concerns push agencies to evaluate reliability carefully before choosing advanced electronic headset solutions.

Growth Factors

Advancements in Next-Gen Communication Technologies Create Strong Growth Opportunities

The development of lightweight bone-conduction tactical communication headsets presents a major growth opportunity for the market. These systems transmit sound through vibrations on the jawbone, allowing soldiers to hear commands clearly even in high-noise environments. Their lightweight design reduces fatigue, making them ideal for long missions requiring constant mobility and awareness.

Integration of AI-driven noise profiling also opens new possibilities for enhanced battlefield communication. AI algorithms can analyze surrounding sounds in real time, automatically adjusting noise suppression levels for gunfire, machinery, or explosions. This capability improves clarity and reduces cognitive load, helping operators maintain focus during complex missions.

Together, these innovations support the transition toward smarter, more adaptive tactical protective headsets. Defense forces increasingly seek communication tools that enhance safety, improve response speed, and support multi-mission flexibility. As modernization programs expand, demand for AI-enabled and bone-conduction systems is expected to rise steadily.

Emerging Trends

Growing Demand for Rugged and Adaptive Tactical Headset Designs Shapes Market Trends

A major trend in the Tactical Protective Headset Market is the shift toward modular earcup and microphone configurations. Users now prefer headsets that allow quick component changes to match different mission needs. This modularity supports better customization, enhances comfort, and enables tactical teams to maintain performance across varied operational environments.

Another strong trend is the increased adoption of IP68-rated ruggedized headset systems. These models offer superior protection against dust, debris, and deep water exposure, making them suitable for maritime missions, amphibious operations, and extreme climate zones. Their growing acceptance reflects the rising demand for gear that can survive the harshest field conditions.

Additionally, there is a growing preference for adaptive ambient-sound filtering technologies. These systems automatically adjust audio levels based on environmental noise, helping users maintain awareness without being overwhelmed by sudden loud sounds. This adaptive capability enhances both safety and communication clarity, making it an increasingly important feature in modern tactical deployments.

Regional Analysis

Asia Pacific Dominates the Tactical Protective Headset Market with a Market Share of 43.80%, Valued at USD 0.8 Billion

Asia Pacific remained the leading region in the Tactical Protective Headset Market, accounting for a strong 43.80% share and reaching a valuation of USD 0.8 billion in 2024. The region benefits from large-scale defense modernization programs, rising procurement of soldier communication systems, and expanding investment in noise-protection technologies. Growing military training activities and border-security upgrades further strengthen its overall market influence.

North America Tactical Protective Headset Market Trends

North America continued experiencing steady adoption driven by advanced defense spending and high emphasis on soldier survivability technologies. The region’s strong focus on integrating digital communication platforms into infantry systems supports consistent demand. Growing federal investments in high-decibel mission equipment also contribute to the region’s expanding usage of tactical protective headsets.

Europe Tactical Protective Headset Market Trends

Europe showed solid market performance supported by cross-border defense cooperation, modernization initiatives, and rising adoption of ruggedized communication gear. Increased readiness programs and joint military exercises encourage procurement of situational-awareness headsets. Efforts to upgrade tactical communication infrastructure continue to have a positive impact on regional market growth.

Middle East & Africa Tactical Protective Headset Market Trends

The Middle East & Africa region is gradually expanding adoption due to strengthening national security priorities and rising modernization across ground forces. Investments in border surveillance, counterterror operations, and rapid-response units fuel the need for durable, mission-ready protective headsets. Emerging procurement activities enhance regional demand.

Latin America Tactical Protective Headset Market Trends

Latin America reflects moderate growth driven by increasing focus on law enforcement modernization and specialized tactical communication systems. Countries are gradually improving emergency-response capabilities, encouraging interest in protective headset technologies. Rising urban-security challenges and training initiatives support the region’s evolving demand patterns.

United States Tactical Protective Headset Market Trends

The United States maintains a strong demand due to advanced infantry programs and continuous upgrades to tactical communication platforms. Investments in soldier-borne sensors, noise-reduction technologies, and situational-awareness solutions remain key drivers. Increased emphasis on battlefield digitization further accelerates adoption across active duty and training environments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Tactical Protective Headset Market Company Insights

The global Automotive Operating System Market in 2024 is being shaped significantly by a handful of dominant technology providers, each steering innovation in software-defined mobility.

BlackBerry Limited continues to strengthen its position through its QNX platform, widely adopted for safety-critical automotive applications. Its emphasis on reliability, cybersecurity, and compliance with functional safety standards keeps it at the core of next-generation vehicle architectures.

Microsoft Corporation leverages its cloud, AI, and edge-computing ecosystem to enable scalable automotive software solutions. Through partnerships across the automotive value chain, Microsoft is helping OEMs accelerate digital cockpit development, streamline over-the-air updates, and improve connected-vehicle services using Azure-based tools.Alphabet Inc. remains a transformative force with its Android Automotive OS, which continues to gain traction as OEMs integrate more consumer-centric digital experiences. By offering a flexible, app-driven infotainment platform, Alphabet enhances in-vehicle personalization while supporting advanced telematics and data-enabled services.

Apple Inc. influences the market more indirectly but powerfully through its expanding CarPlay ecosystem and its push toward deeper integration between personal devices and in-car systems. Although Apple maintains a more controlled approach than its competitors, its software design leadership and seamless UX capabilities continue to drive expectations for next-generation automotive interfaces.

Top Key Players in the Market

- 3M

- Setcom

- Howard Leight

- Recon Brothers

- Sordin

- Safariland

- OTTO

- Gentex

- TEA

Recent Developments

- In Oct 2025, Gentex Corporation was selected by the Czech Ministry of Defence for integrated headborne systems, highlighting global confidence in its proven Ops-Core® integrated ballistic helmet solutions.This selection reinforces Gentex’s position as a trusted supplier for advanced military protection systems across NATO and allied defense forces.

- In Jul 2025, EOTECH acquired VK Integrated Systems, marking a strategic expansion into tactical networking and battlefield sensor integration capabilities. The acquisition enhances EOTECH’s defense technology portfolio and supports the development of connected, next-generation situational awareness solutions.

Report Scope

Report Features Description Market Value (2024) USD 1.9 Billion Forecast Revenue (2034) USD 3.4 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Classification (IP67, IP68, IPX5, IPX7), By Technology (Wired, Wireless), By Communication Mode (Single Mode, Dual Mode), By Application (Military, Civil) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape 3M, Setcom, Howard Leight, Recon Brothers, Sordin, Safariland, OTTO, Gentex, TEA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Tactical Protective Headset MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample

Tactical Protective Headset MarketPublished date: Nov 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 3M

- Setcom

- Howard Leight

- Recon Brothers

- Sordin

- Safariland

- OTTO

- Gentex

- TEA