Global Swiss Watch Market Size, Share, Growth Analysis By Type (Mechanical, Quartz), By End Use (Men, Women), By Distribution Channel (Offline, Online), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159707

- Number of Pages: 266

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

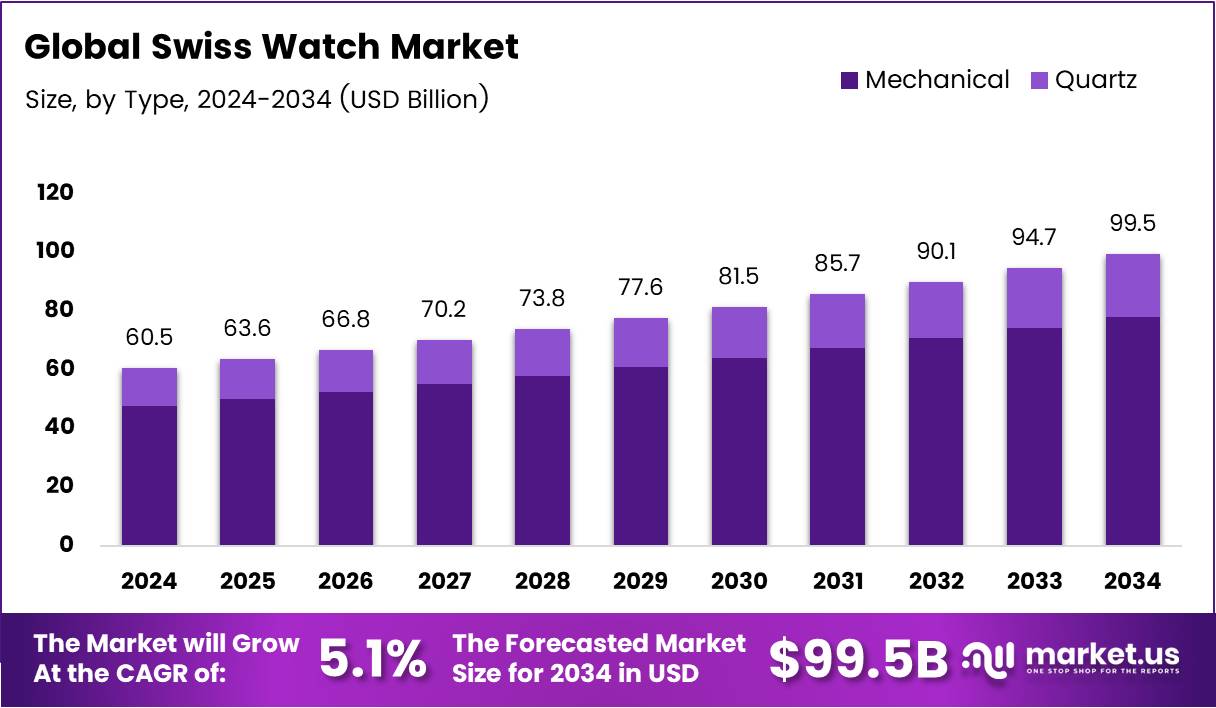

The Global Swiss Watch Market size is expected to be worth around USD 99.5 Billion by 2034, from USD 60.5 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034.

The Swiss watch market has long been synonymous with luxury, craftsmanship, and innovation. Renowned for its precision, Swiss watches remain a symbol of status and quality. The market, while facing some challenges, continues to hold significant global appeal, with established brands driving the majority of market value and consumer demand.

As the global economy faces ongoing disruptions, the Swiss watch industry is seeing shifting trends. Consumers are increasingly looking for both value and exclusivity in their purchases. Furthermore, the rising demand for sustainable and innovative designs is pushing manufacturers to adapt, offering more eco-friendly materials and designs.

Growth in the Swiss watch market is also driven by the ongoing digital transformation. Smartwatches and hybrid models are attracting new consumers, particularly younger buyers. These products combine traditional Swiss craftsmanship with modern technology, thus appealing to a broader market. Manufacturers are investing in this growing segment, creating opportunities for long-term growth.

Government investment in the watchmaking sector has also contributed to industry stability. Various initiatives have aimed at supporting innovation while protecting the heritage of Swiss watchmaking. Regulatory frameworks ensure that high standards of quality and precision are upheld, benefiting both consumers and manufacturers in maintaining global trust in Swiss timepieces.

In recent market developments, Swiss watch exports faced a decline of 16.5% year-over-year to 1.64 billion Swiss francs (approximately $1.64 billion) in August, according to the industry report. Despite this setback, brands like Rolex remain strong players, continuing to dominate the market with a 32% share of the total market value. As these challenges unfold, manufacturers are expected to focus on diversifying their portfolios to capture emerging markets.

Key Takeaways

- Global Swiss Watch Market size expected to reach USD 99.5 Billion by 2034, from USD 60.5 Billion in 2024, growing at a CAGR of 5.1%.

- Mechanical watches dominate the market with a 78.5% market share in 2024, driven by craftsmanship and investment value.

- Men’s watches hold a 67.7% share of the Swiss watch market, reflecting strong demand for luxury timepieces.

- Offline distribution channels account for 89.1% of the Swiss watch market, highlighting the importance of physical retail.

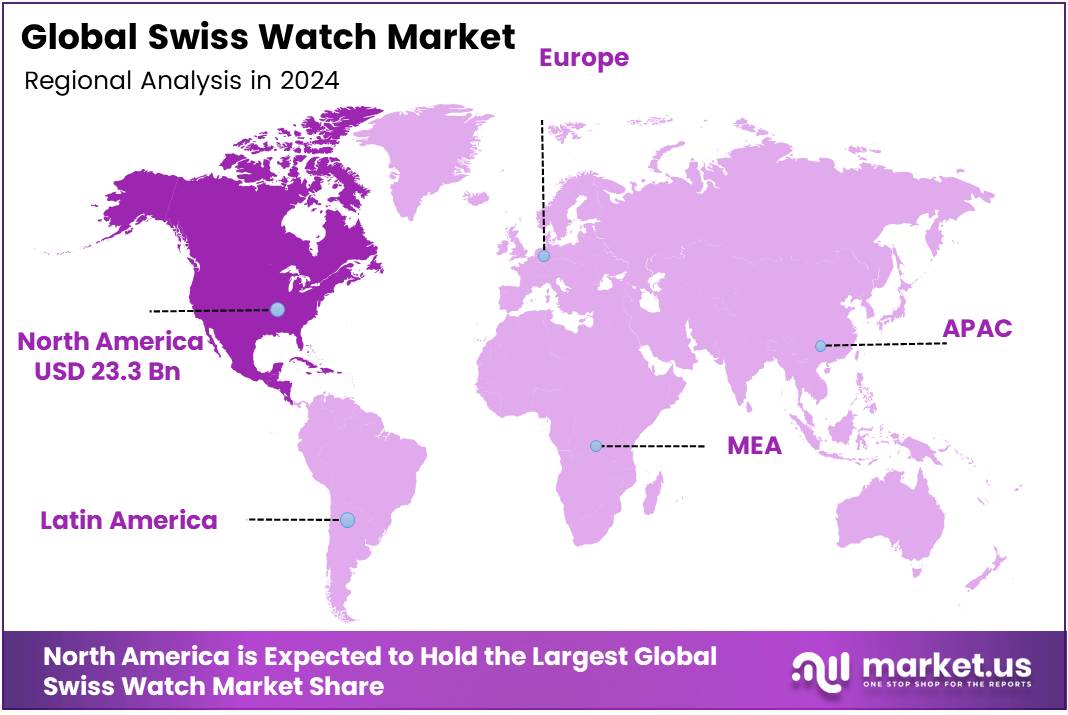

- North America leads the Swiss watch market with a 38.6% share, valued at USD 23.3 Billion.

By Type Analysis

Mechanical watches dominate with 78.5% due to their superior craftsmanship and luxury appeal.

Mechanical watches continue to lead the Swiss watch market with an impressive 78.5% market share in 2024. These timepieces represent the pinnacle of horological artistry, featuring intricate movements powered by springs and gears.

Furthermore, mechanical watches appeal to collectors and enthusiasts who appreciate traditional Swiss craftsmanship. Additionally, their investment value and prestige factor contribute significantly to their market dominance.

Quartz watches hold the remaining market share, offering precision and reliability through electronic movements. Moreover, these timepieces provide accurate timekeeping with minimal maintenance requirements.

Subsequently, quartz technology appeals to consumers seeking practical functionality over traditional mechanics. Despite mechanical dominance, quartz watches maintain their position through affordability and consistent performance standards.

By End Use Analysis

Men’s watches dominate with 67.7% due to higher purchasing power and brand loyalty.

Men’s watches command 67.7% of the Swiss watch market, reflecting strong male consumer preference for luxury timepieces. Consequently, men demonstrate greater willingness to invest in high-end mechanical watches as status symbols.

Additionally, business professionals often view premium watches as essential accessories for corporate environments. Therefore, men’s segment continues driving overall market growth through consistent demand patterns.

Women’s watches represent the complementary market segment, focusing on elegant designs and refined aesthetics. Furthermore, female consumers increasingly appreciate Swiss watchmaking heritage and quality craftsmanship.

Subsequently, women’s timepieces often feature precious metals and gemstone embellishments. Nevertheless, this segment shows promising growth potential through targeted marketing and innovative designs tailored to feminine preferences.

By Distribution Channel Analysis

Offline channels dominate with 89.1% due to tactile experience and trust factors.

Offline distribution channels maintain overwhelming market dominance with 89.1% share in the Swiss watch industry. Consequently, consumers prefer physically examining luxury timepieces before making significant investments.

Additionally, authorized dealers provide expert guidance and after-sales service support. Therefore, traditional retail environments remain crucial for building customer confidence and facilitating high-value transactions through personal consultation.

Online channels capture the remaining market share, offering convenience and broader product accessibility. Furthermore, digital platforms enable detailed product comparisons and competitive pricing research.

Subsequently, younger consumers increasingly embrace online purchasing for certified pre-owned and entry-level Swiss watches. Nevertheless, online sales face challenges regarding authentication concerns and limited tactile product experience opportunities.

Key Market Segments

By Type

- Mechanical

- Quartz

By End Use

- Men

- Women

By Distribution Channel

- Offline

- Online

Drivers

Increasing Demand for Luxury Timepieces Drives Market Growth

The Swiss watch market continues to benefit from strong consumer appetite for premium timepieces. Wealthy buyers increasingly view Swiss watches as investment pieces and status symbols, creating steady demand for established brands like Rolex and Patek Philippe.

Swiss watchmakers are embracing cutting-edge technology while maintaining traditional craftsmanship. New manufacturing techniques improve precision and durability, while innovative materials like ceramic and titanium attract modern consumers seeking both luxury and functionality.

Growing global wealth, particularly in Asia and emerging markets, is expanding the customer base for Swiss watches. Younger consumers are also changing their preferences, valuing heritage brands that combine traditional watchmaking with contemporary design elements.

The smartwatch revolution has surprisingly benefited Swiss brands, as manufacturers now create hybrid models that blend smart features with classic Swiss aesthetics. This fusion appeals to tech-savvy consumers who still appreciate traditional watchmaking excellence.

Restraints

Growing Competition from Smartwatch Brands Restrains Market Growth

Apple, Samsung, and other tech giants are capturing significant market share with smartwatches that offer connectivity and health monitoring features. These devices appeal to younger demographics who prioritize functionality over traditional luxury.

Global supply chain issues have disrupted Swiss watch production, causing delays and increased costs. Component shortages, particularly for electronic parts in hybrid models, have forced manufacturers to adjust production schedules and pricing strategies.

The proliferation of fake Swiss watches damages brand reputation and reduces legitimate sales. Advanced counterfeiting techniques make it difficult for consumers to distinguish authentic products, creating trust issues that affect the entire industry and forcing brands to invest heavily in authentication technologies.

Growth Factors

Expansion into Emerging Markets Creates Growth Opportunities

Swiss watch brands are finding new revenue streams in developing economies across Asia, Latin America, and Africa. Rising middle classes in these regions represent untapped potential for both entry-level and luxury timepieces.

Partnerships with fashion houses and lifestyle brands are opening new distribution channels and attracting different customer segments. These collaborations help Swiss watchmakers reach younger audiences and expand beyond traditional luxury retail environments.

Consumer demand for personalized products is driving growth in custom watch services. Swiss manufacturers are offering engraving, unique dial designs, and bespoke complications to create one-of-a-kind timepieces that command premium prices.

Online sales platforms and direct-to-consumer strategies are revolutionizing Swiss watch retail. E-commerce allows brands to reach global customers while reducing overhead costs, making luxury timepieces more accessible to international buyers seeking authentic Swiss quality.

Emerging Trends

Sustainable and Ethical Watch Manufacturing Practices Shape Market Trends

Environmental consciousness is pushing Swiss watchmakers toward sustainable practices. Brands are adopting recycled materials, ethical sourcing of precious metals, and carbon-neutral manufacturing processes to appeal to environmentally aware consumers.

Swiss manufacturers are successfully combining traditional mechanics with smart technology. Hybrid models offer smartphone connectivity while maintaining the classic appearance and craftsmanship that define Swiss watchmaking heritage.

Focus on creating long-lasting timepieces is becoming a key selling point. Swiss brands emphasize superior materials and construction techniques that ensure watches can be passed down through generations, justifying premium pricing.

Social media influencers and celebrity endorsements significantly impact brand perception and sales. Swiss watchmakers are investing in partnerships with high-profile figures to maintain relevance and attract younger demographics through authentic storytelling and lifestyle marketing.

Regional Analysis

North America Dominates the Swiss Watch Market with a Market Share of 38.6%, Valued at USD 23.3 Billion

In 2024, North America led the Swiss watch market with a dominant share of 38.6%, valued at USD 23.3 billion. This region benefits from high consumer spending power and a strong preference for premium brands, alongside an established retail network. The demand for luxury watches is anticipated to remain strong, driven by both established and emerging markets.

Europe Swiss Watch Market Trends

Europe holds a significant share in the Swiss watch market, primarily driven by high-end demand in countries like Switzerland, France, and Germany. The region continues to be a key player in watch manufacturing and exports. With a rich history in watchmaking, European consumers show a deep-rooted preference for craftsmanship and quality.

Asia Pacific Swiss Watch Market Trends

Asia Pacific is a rapidly growing market for Swiss watches, with a growing affluent middle class and increasing demand from countries like China, Japan, and India. The market is expected to grow steadily due to rising disposable incomes and increasing interest in luxury goods. The region is likely to see significant growth, especially in emerging economies.

Middle East and Africa Swiss Watch Market Trends

The Middle East and Africa region exhibits strong demand for Swiss watches, fueled by the high concentration of wealthy consumers in markets such as the UAE and Saudi Arabia. Swiss watches are seen as a symbol of status, which drives the market in this region. The luxury segment is expected to continue flourishing, especially in high-end retail environments.

Latin America Swiss Watch Market Trends

In Latin America, the Swiss watch market is growing at a steady pace, driven by increasing consumer interest in luxury watches, especially in countries like Brazil and Mexico. However, the market remains smaller compared to other regions. The rise of a more affluent middle class is expected to propel the market forward in the coming years.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Swiss Watch Company Insights

In 2024, Rolex remains the dominant player in the Swiss watch market, maintaining its prestigious status with high demand across both entry-level and luxury segments. The brand’s reputation for precision, durability, and exclusivity continues to drive strong sales, particularly in Asia and North America.

Patek Philippe retains a strong position in the luxury segment, with its watches being highly sought after for their craftsmanship and investment value. The brand’s focus on limited production and bespoke designs helps preserve its image as a symbol of timeless luxury.

Audemars Piguet, known for its Royal Oak series, holds a significant share in the high-end luxury market. The brand’s continuous innovation in design, coupled with its consistent delivery of quality timepieces, strengthens its appeal to both collectors and new buyers, especially in emerging markets.

The Swatch Group remains a major force in the Swiss watch industry, with its diverse portfolio catering to a wide range of consumers. While its luxury brands like Omega and Breguet are popular, Swatch’s focus on affordability through its more accessible brands enables it to maintain a broad market presence.

These four companies are pivotal in shaping the competitive landscape of the Swiss watch market. Their ability to adapt to changing consumer preferences while preserving their heritage positions them well for continued success in 2024.

Top Key Players in the Market

- Rolex

- Patek Philippe

- Audemars Piguet

- The Swatch Group

- Richemont

- LVMH Moët Hennessy Louis Vuitton

- Breitling

- Chopard

- Hublot

- Zenith

Recent Developments

- In April 2024, Longines launched a titanium version of its Spirit Zulu Time GMT watch, featuring a bi-color ceramic bezel insert. This addition enhances both the luxury appeal and the durability of the timepiece, making it a standout in the GMT watch segment.

- In January 2024, Bianchet unveiled the Flying Tourbillon Sport GMT, a tonneau-shaped timepiece equipped with an in-house titanium flying tourbillon. The watch also features a rotating Earth dome that synchronizes with the hour hand, combining luxury craftsmanship with innovative design.

- In August 2024, Chanel acquired a 25% stake in Swiss watchmaker MB&F, a company known for its uniquely designed watches inspired by retro futurism, science fiction, and animals. This strategic acquisition is aimed at strengthening Chanel’s foothold in the competitive Swiss watch market.

- In January 2025, Swiss watch exports recorded a decline of 2.8% in 2024, totaling 26.0 billion francs. This downturn suggests a slowdown in demand for luxury personal items, particularly among aspirational customers, impacting the industry’s growth trajectory.

- In January 2025, Swatch Group, the parent company of renowned luxury watch brands such as Longines, Omega, and Tissot, reported a significant decline in sales and operating profits for 2024. This decline was largely attributed to decreased demand from Chinese consumers, marking a challenging period for the brand.

Report Scope

Report Features Description Market Value (2024) USD 60.5 Billion Forecast Revenue (2034) USD 99.5 Billion CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Mechanical, Quartz), By End Use (Men, Women), By Distribution Channel (Offline, Online) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Rolex, Patek Philippe, Audemars Piguet, The Swatch Group, Richemont, LVMH Moët Hennessy Louis Vuitton, Breitling, Chopard, Hublot, Zenith Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rolex

- Patek Philippe

- Audemars Piguet

- The Swatch Group

- Richemont

- LVMH Moët Hennessy Louis Vuitton

- Breitling

- Chopard

- Hublot

- Zenith