Global Sustainable Construction Market Size, Share, And Enhanced Productivity By Product Type (Interior, Exterior), By Material (Green Building, Energy Efficient, Recycled, Others, By End-User (Residential, Infrastructure, Commercial) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177249

- Number of Pages: 373

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

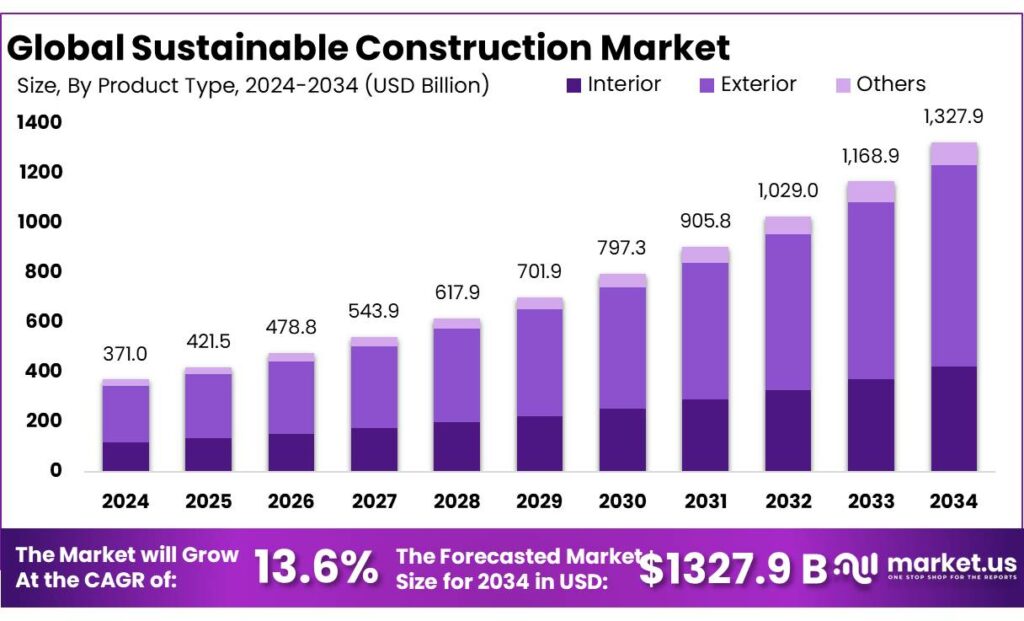

The Global Sustainable Construction Market is expected to be worth around USD 1327.9 Billion by 2034, up from USD 371. Billion in 2024, and is projected to grow at a CAGR of 13.6% from 2025 to 2034. The North America segment maintained 36.1%, supporting a Glass Fiber Reinforced Polymer Rebars value of USD 192.0 Mn.

Sustainable construction refers to the planning, design, material selection, and operation of buildings and infrastructure in ways that reduce lifetime environmental impact while improving resilience and occupant wellbeing. In today’s industrial context, it is moving from a “nice-to-have” label to a measurable performance standard, because the built environment is now one of the clearest levers for national decarbonization and energy-security goals. The sector’s impact is material: the buildings and construction system consumes about 32% of global energy and contributes about 34% of global CO₂ emissions, based on the latest global tracking from UNEP and the GlobalABC program.

Key driving factors are intensifying through policy and codes. In European Commission markets, the revised Energy Performance of Buildings Directive (EU/2024/1275) entered into force on 28 May 2024, pushing faster renovation and higher performance requirements across member states. Corporate procurement and real-estate tenant expectations reinforce this direction, visible in certification activity: Green Business Certification Inc. reported that in 2024, 370 projects in India were LEED-certified, covering 8.5 million gross square meters.

Third, regulation is tightening in ways that directly steer building specifications: the EU’s Energy Performance of Buildings Directive agenda is explicitly aimed at moving the stock toward “zero-emission buildings,” with the Council communicating a pathway where all new buildings should be zero-emission by 2030 and the building stock transitions by 2050. In parallel, the economics of construction continue to expand: global construction “work done” was estimated at US$9.7 trillion (2022) and projected to reach US$13.9 trillion by 2037, creating a large runway for sustainability-linked upgrades and standards.

Key Takeaways

- Sustainable Construction Market is expected to be worth around USD 1327.9 Billion by 2034, up from USD 371. Billion in 2024, and is projected to grow at a CAGR of 13.6%.

- Exterior held a dominant market position, capturing more than a 61.2% share.

- Green Building held a dominant market position, capturing more than a 43.5% share.

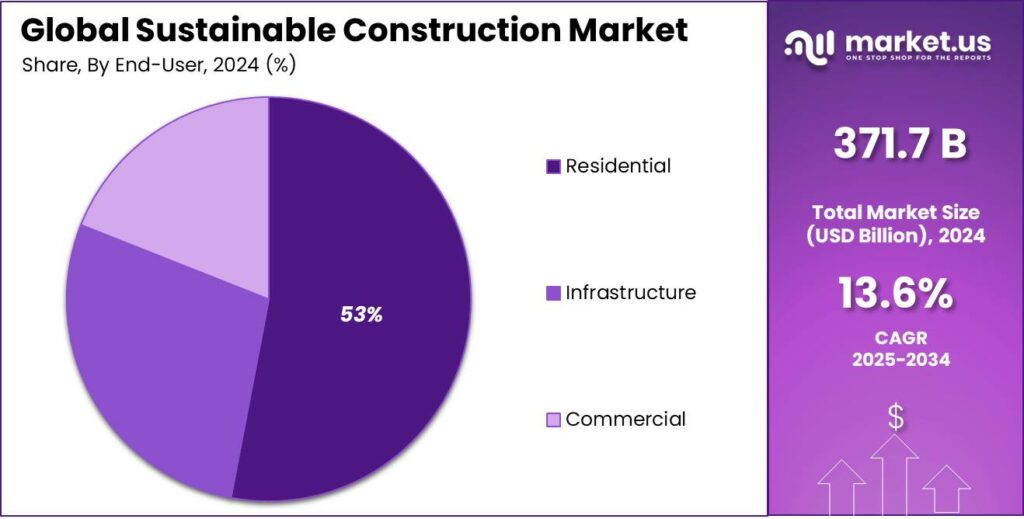

- Residential held a dominant market position, capturing more than a 53.7% share of the Sustainable Construction Market.

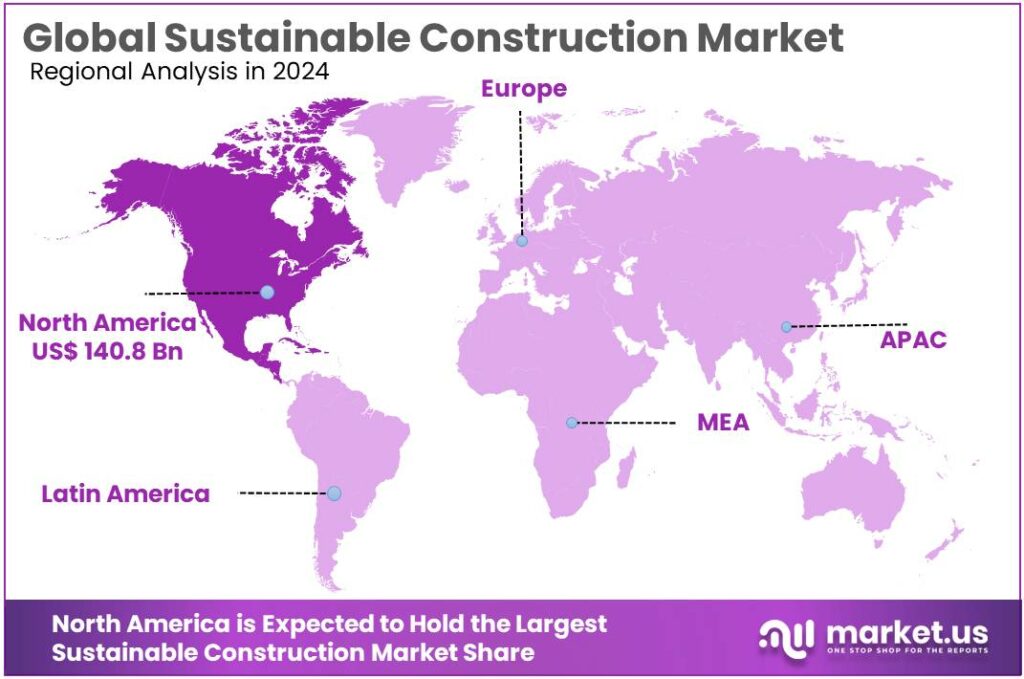

- North America accounts for 37.9% of the market, valued at USD 140.8 Bn.

By Product Type Analysis

Exterior dominates the sustainable construction landscape with a strong 61.2% market share.

In 2024, Exterior held a dominant market position, capturing more than a 61.2% share of the Sustainable Construction Market, reflecting its essential role in energy-efficient building design. Exterior components—such as façades, cladding systems, roofing, insulation panels, and shading structures—have become the primary focus for developers because they directly influence thermal performance, durability, and long-term operational savings.

Throughout 2024, demand strengthened as builders adopted upgraded envelopes to reduce heat loss and meet evolving green building codes. This shift also stemmed from rising material innovation, with recyclable cladding, low-carbon concrete panels, and cool-roof coatings gaining wider use, especially in large commercial and residential projects prioritizing sustainability targets.

By Material Analysis

Green Building leads the material landscape with a firm 43.5% share.

In 2024, Green Building held a dominant market position, capturing more than a 43.5% share of the Sustainable Construction Market, reflecting its strong adoption across both public and private development projects. The segment’s rise is closely tied to growing awareness of environmentally responsible materials, including recycled aggregates, low-carbon cement, energy-efficient insulation, and sustainably sourced timber.

Throughout 2024, project owners increasingly preferred materials that reduce embodied carbon, improve energy efficiency, and support long-term building performance. This shift was further reinforced by green certification systems that encouraged the use of eco-friendly materials in new buildings and major refurbishments.

By End-User Analysis

Residential segment leads the market with a strong 53.7% share.

In 2024, Residential held a dominant market position, capturing more than a 53.7% share of the Sustainable Construction Market. This leadership reflects growing homeowner awareness, rising utility costs, and stronger green building norms across cities and emerging urban centers. During the year, residential developers increasingly used efficient insulation, low-carbon materials, and renewable-energy–ready designs to meet stricter local building rules. Consumers also showed more interest in sustainable homes as they sought healthier indoor environments and long-term savings. As a result, sustainable methods became a core focus in both new home projects and large-scale renovation programs.

Key Market Segments

By Product Type

- Interior

- Exterior

By Material

- Green Building

- Energy Efficient

- Recycled

- Others

By End-User

- Residential

- Infrastructure

- Commercial

Emerging Trends

Integration of Food-Waste-Based Materials Is Emerging as a Key Trend in Sustainable Construction

One of the latest and most interesting trends reshaping sustainable construction is the use of materials derived from food waste and agricultural by-products. As the world grapples with rising waste and shrinking natural resources, builders and material innovators are increasingly looking beyond traditional raw materials. Instead, they are turning to renewable, lower-impact options created from what would otherwise be discarded. This shift is grounded not just in good intentions but in stark realities highlighted by major food and agriculture organizations, which are waking the world up to the scale of the global food-waste problem.

The Food and Agriculture Organization (FAO) estimates that about 1.3 billion tonnes of food is lost or wasted every year, equivalent to nearly one-third of all food produced globally. This massive waste burden provides both a challenge and a raw material opportunity. Traditionally, food waste has struggled to find economically viable uses beyond composting or livestock feed. But as researchers uncover new ways to convert agricultural residues such as rice husks, wheat straw, coconut coir, and sugarcane bagasse into building products, sustainable construction is beginning to tap into this vast, underutilized resource stream.

Governments are beginning to recognize and support these kinds of innovations. In the European Union, the Circular Economy Action Plan encourages reuse and recycling across industries, including construction, which creates policy space for food-derived materials to enter mainstream supply chains. In India, initiatives such as the Waste-to-Wealth Mission fund experimentation with alternative materials sourced from agricultural residues and urban organic waste. These policies show that sustainable construction is no longer about eliminating harm in isolation, but about connecting supply chains and resource cycles, including those between food and buildings.

Drivers

Rising Resource Efficiency Needs Drive Sustainable Construction Forward

One of the strongest driving forces behind sustainable construction today is the global push to use resources more efficiently, especially as major food and agriculture bodies warn about mounting pressure on land, water, and energy. This connection may seem indirect at first, but the systems that feed people and the systems that build cities often rely on the same finite resources. As these resources tighten, construction practices must change, encouraging builders to adopt energy-saving materials, water-efficient systems, and low-carbon processes.

According to the Food and Agriculture Organization (FAO), global freshwater withdrawals already exceed 4,000 km³ per year, with agriculture alone consuming approximately 70% of this supply. This level of demand limits water availability for other sectors, including construction. As a result, policymakers worldwide are encouraging water-efficient buildings—those that recycle greywater, optimize plumbing systems, and use low-water materials. This shift is no longer optional, because water risk directly affects urban development, building approvals, and long-term livability.

A similar pressure appears in energy use. The FAO estimates that the global agrifood system consumes around 30% of the world’s total energy, creating competition with other major sectors. With energy costs rising globally, governments promote efficient building envelopes, smart HVAC systems, and passive-design structures that significantly reduce operational energy use. This is why sustainable construction has become a preferred strategy: it lowers energy dependence at a time when cross-sector demand is increasingly unpredictable.

Government action amplifies this driver. The European Union promotes energy-efficient renovation through its “Renovation Wave,” aiming to double building renovation rates by 2030. India, meanwhile, introduced the Energy Conservation and Sustainable Building Code (ECSBC 2024) to guide greener construction nationwide. These policies reduce long-term infrastructure stress and contribute to broader food-system resilience, creating a cycle where sustainable buildings support sustainable resource use.

Restraints

High Cost Burden Limits Wider Adoption of Sustainable Construction

One of the major restraining factors slowing the growth of sustainable construction is the high upfront cost of eco-friendly materials, energy-efficient systems, and certified construction practices. While sustainable building delivers long-term savings, many developers—especially in emerging markets—struggle with the initial financial load. This challenge is amplified by rising global resource prices, many of which are tracked and reported by leading food and agriculture bodies that evaluate pressures on land, water, and energy systems.

Water scarcity adds another financial barrier. FAO data shows that over 40% of the world’s population is affected by water scarcity, and demand continues to rise. Because water-efficient construction requires advanced plumbing systems, greywater recycling units, and smart monitoring devices, the cost of installation increases significantly. While these systems save water long-term, many builders still choose cheaper traditional systems because the initial investment is far lower.

Government incentives exist, but support is uneven across regions. For example, the European Union promotes sustainable renovation through policies under the Green Deal, but many developing countries lack comparable funding assistance. India has introduced the Energy Conservation and Sustainable Building Code (ECSBC 2024), but adoption varies widely because builders still consider sustainable materials costlier upfront. Without stronger subsidy programs or low-interest green financing, affordability continues to limit adoption.

Another cost-related obstacle is the shortage of skilled labor. Sustainable construction often requires workers trained in installing energy-efficient systems, advanced insulation, renewable-ready wiring, and high-performance building envelopes. However, FAO research shows that nearly 820 million people globally depend on agriculture for income, meaning labor flows remain heavily concentrated in low-skill sectors.

Opportunity

Circular Resource Use Creates a Major Growth Opportunity for Sustainable Construction

A powerful growth opportunity for sustainable construction is emerging from the global push toward circular resource use, especially as food and agricultural organizations highlight the mounting pressure on land, water, and raw materials. These pressures are encouraging governments and industries to rethink how materials are sourced, reused, and recycled—creating a significant opening for construction models that rely on circularity rather than linear consumption.

The Food and Agriculture Organization (FAO) reports that the world generates 1.3 billion tonnes of food waste every year, representing nearly one-third of all food produced. While this is an agricultural statistic, it highlights a broader systems problem: societies produce waste faster than they can responsibly manage it. This growing waste burden has pushed many countries to set circular-economy targets that now extend directly into the construction sector. Sustainable construction can take advantage of this shift by using recycled aggregates, bio-based materials, and innovative composites derived from agricultural waste such as rice husk ash, sugarcane bagasse, or hemp fibers.

Alongside waste, resource depletion is strengthening the opportunity window. FAO has stated that over 33% of global soils are moderately to highly degraded, largely due to erosion, pollution, and poor land management. As land degradation increases extraction costs for minerals, timber, and raw materials, the construction sector is turning toward reclaimed materials and products that are designed for disassembly. This creates a large market for companies that can supply low-impact materials—whether recycled metals, eco-cement blends, or panels made from agricultural residues.

Regional Insights

North America dominates sustainable construction with 37.9% share, valued at USD 140.8 Bn

North America leads the Sustainable Construction Market as policy incentives, certification uptake, and operating-cost pressure keep green upgrades high on developer agendas. In this region, North America accounts for 37.9% of the market, valued at USD 140.8 Bn, supported by steady demand for energy-efficient envelopes, retrofits, and low-impact materials across the U.S. and Canada. A practical signal of momentum is the depth of green certification activity: the top U.S. states alone certified 1,437 LEED projects totaling over 414 million gross square feet in 2024, pointing to sustained institutional adoption in commercial and public buildings.

From a demand-driver standpoint, the region’s building energy spend remains a clear pain point, strengthening the business case for efficient systems and retrofits. The U.S. Energy Information Administration reports that the estimated 5.9 million U.S. commercial buildings consumed 6.8 quadrillion Btu and spent $141 billion on energy (CBECS 2018), underscoring why owners prioritize HVAC optimization, insulation, lighting upgrades, and smart controls to protect margins.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Alumasc Group plc drives sustainable construction through water-management systems, green roofs, and energy-efficient building products. The company generates around £89 million in annual revenue and exports to more than 25 countries. Its roofing and facade solutions help reduce carbon footprints and improve building durability, supporting long-term performance for commercial and residential developments.

The Turner Corp. is one of the largest contributors to sustainable construction, with annual revenues surpassing $15 billion and a workforce of 10,000+ employees. The company has delivered more than 1,500 LEED-certified projects, emphasizing carbon reduction, efficient building systems, and digital modeling for waste minimization across complex infrastructure and commercial development.

Bauder Ltd. specializes in sustainable roofing systems, generating more than £200 million in annual sales with operations across 6 European regions. The company offers photovoltaic roofs, green roofs, and high-performance insulation, enabling reduced building energy use. Its systems support biodiversity, stormwater management, and long-term thermal efficiency for modern construction projects.

Top Key Players Outlook

- Clark Group

- Gilbane Building company

- Alumasc Group Plc

- The Turner Corp.

- Florbo International SA

- Bauder ltd.

- The Whiting- Turner Contracting Company

- Hensel Phelps

- Alumasc Group Plc,

- Forbo International SA

Recent Industry Developments

In 2025, Clark Group has cemented its position as a leader in sustainable construction across the United States. The company has completed 500+ sustainably certified projects and employs over 360 LEED-accredited professionals, showing a clear commitment to environmentally responsible building practices.

In early 2025 Gilbane Building Company, broke ground on the 330,000 sq ft University of South Carolina Health Sciences Campus, a major sustainable campus development expected to open in 2027, demonstrating Gilbane’s ability to manage complex, community-focused builds.

Report Scope

Report Features Description Market Value (2024) USD 371.0 Bn Forecast Revenue (2034) USD 1327.9 Bn CAGR (2025-2034) 13.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Interior, Exterior), By Material (Green Building, Energy Efficient, Recycled, Others, By End-User (Residential, Infrastructure, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Clark Group, Gilbane Building company, Alumasc Group Plc, The Turner Corp., Florbo International SA, Bauder ltd., The Whiting- Turner Contracting Company, Hensel Phelps, Alumasc Group Plc,, Forbo International SA Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Sustainable Construction MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Sustainable Construction MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Clark Group

- Gilbane Building company

- Alumasc Group Plc

- The Turner Corp.

- Florbo International SA

- Bauder ltd.

- The Whiting- Turner Contracting Company

- Hensel Phelps

- Alumasc Group Plc,

- Forbo International SA