Global Surgical Stapling Devices Market By Product (Powered Stapling Device and Manual Stapling Device), By Type (Disposable and Reusable), By Stapling Type, By End-User, By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2032

- Published date: Nov. 2024

- Report ID: 21151

- Number of Pages: 236

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

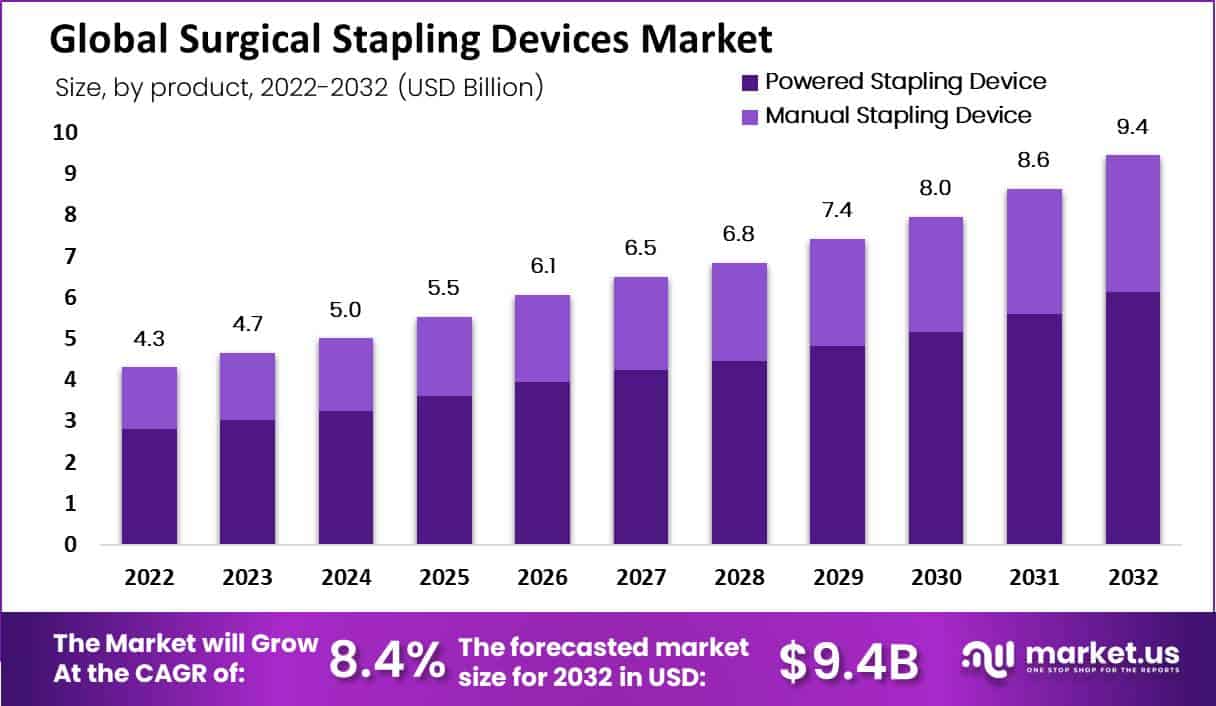

In 2022, the surgical stapling devices market size accounted for USD 4.3 billion and will reach USD 9.4 billion by 2032. Between 2023 and 2032, this market is estimated to register a CAGR of 8.4%.

The surgical stapling device market is increasing rapidly and offers alternatives to traditional suturing techniques for closing wounds as well as incisions. The use of surgical stapling tools is widespread and also includes thoracic gynecological as well as gastrointestinal operations.

Surgery has been revolutionized by the development of surgical stapling tools, which give surgeons a quicker, more effective as well as more reliable way to close incisions. Unlike traditional sutures, which require knotting or hand stitching to close wounds, surgical staplers can be used to quickly close wounds. The surgical stapler can be used to quickly close wounds. They are therefore very helpful in urgent operations and other procedures where time is of the essence.

There are many different surgical stapling tools on the market, including powered as well as manual staplers. Powered staplers employ a motor to drive the staple into the tissue, as opposed to manual staplers, which require the surgeon to exert force on the instrument to activate the staple.

Key Takeaways

- The market reached USD 4.3 billion in 2022 and is set to grow at an 8.4% CAGR to reach USD 9.4 billion by 2032.

- Powered staplers hold a 65% market share due to their quick tissue-sealing capabilities.

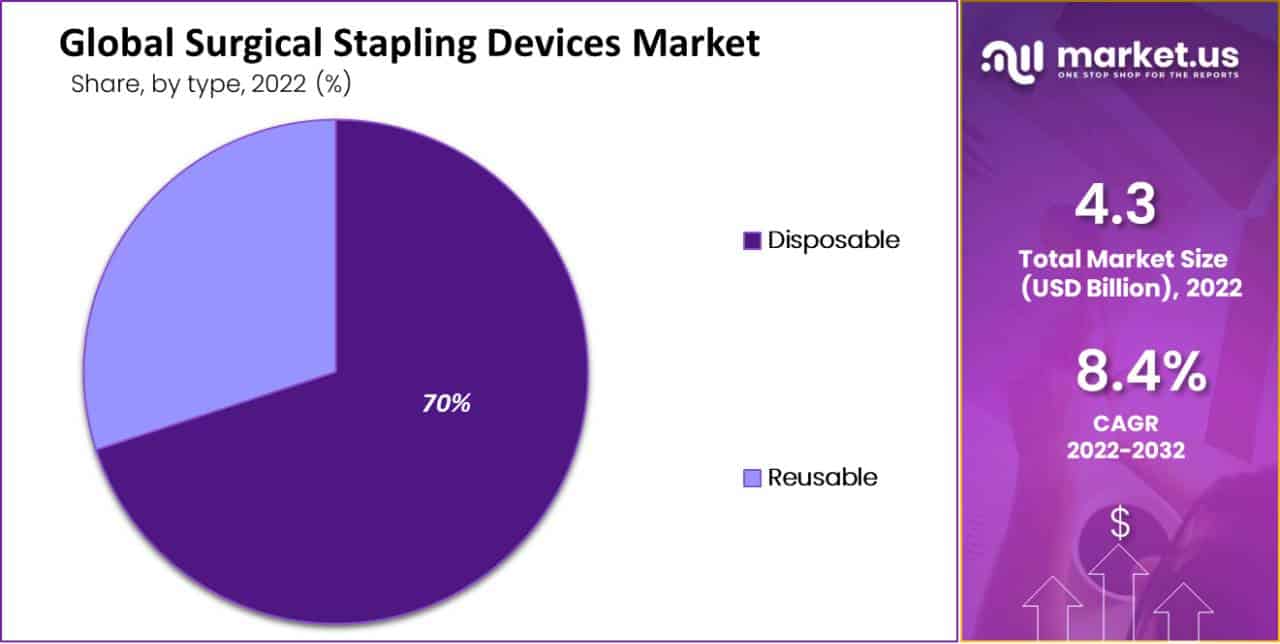

- Disposable surgical stapling devices constitute 70% of the market, essential for various surgical procedures.

- Hospitals account for 45% of the market, utilizing a range of stapling tools across surgical disciplines.

- Asia Pacific is projected to be the fastest-growing region in the surgical stapling devices market.

- Market trends show a rise in mergers and acquisitions, reflecting industry efforts to diversify and gain a competitive edge.

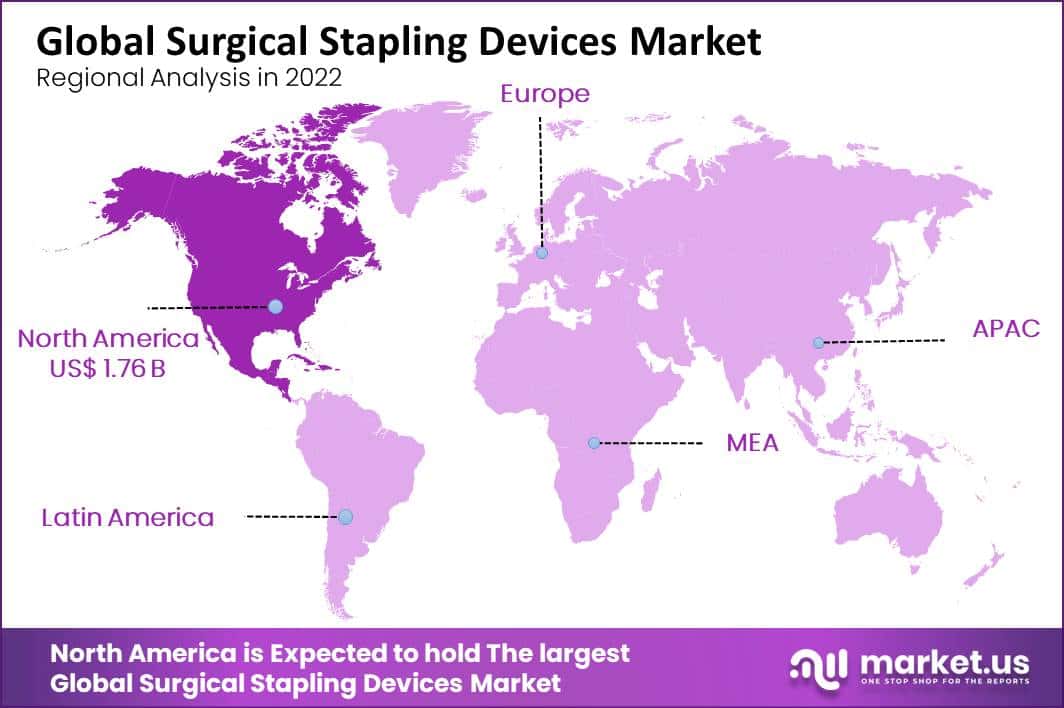

- North America leads with a 41% market share, driven by high chronic condition prevalence and major industry players.

Driving Factors

The increased use of minimally invasive surgical techniques.

In recent years, The Market for surgical stapling devices has been growing quickly owing to a number of factors. The increasing number of surgical producers being carried out internationally is one of the key factors in this market. The number of surgeries has increased for the rising prevalence of chronic conditions such as cancer, obesity, and cardiovascular diseases.

The demand for surgical stapling instruments, which are used to close surgical incisions as well as anastomoses, has grown, as a result, in comparison to conventional suturing methods, the use of surgical stapling devices has several advantages like shorter operation time, faster wound healing as well as increased precision. The increased use of minimally invasive surgical techniques is another factor boosting the market for surgical stapling devices.

Because they have various advantages over conventional open surgeries, such as quicker hospital stays, quicker recovery times, and less postoperative pain, minimally invasive procedures are growing in popularity. In minimally invasive procedures, surgical stapling tools are essential because they allow for fewer incisions and more accurate tissue approximation. Further boosting the market’s expansion is the ability to undertake complex surgical procedures using minimally invasive methods thanks to the development of new and cutting-edge surgical stapling technologies.

Restraining Factors

The Availability of Alternative Surgical Methods Is Another Aspect That Could Restrict Market Expansion.

Due to the rising demand for simpler surgical procedures, the market for surgical stapling devices is anticipated to expand significantly during the forecast period. Certain variables, nevertheless, could limit market expansion.

The high price of these instruments is one of the main problems limiting the market for surgical stapling equipment. The high cost of surgical stapling equipment may prevent widespread use, especially in developing nations with constrained healthcare budgets.

The availability of alternative surgical methods is another aspect that could restrict market expansion. Although surgical stapling devices have several benefits, including less bleeding and quicker healing times, other techniques may be more practical and affordable for some surgeries. Furthermore, there have been allegations of issues with surgical stapling tools, like misfiring or tissue damage.

Even though the market for surgical stapling devices is anticipated to grow significantly over the next some years. Many factors could limit this growth, including the high cost of the device, worries about complications related to their use as well as the availability of substitute techniques.

Product Analysis

The Powered Stapling Device Segment Accounted for the Largest Revenue Share in Surgical Stapling Device Market in 2022.

Based on the product, the Powered stapling device dominates the surgical stapling device market with a 65% market share. Powered staplers come in a variety of shapes and sizes depending on the intended purpose. Others are made for minimally invasive treatment like laparoscopic surgery.

Some staplers are made for open surgery. Speed, as well as effectiveness, are the key benefits of powered stapling over conventional suturing. Compared to suturing, staplers can seal tissue considerably more quickly, which helps speed up operations and lower the chance of infection.

The Manual Stapling Device Segment Is Fastest Growing Product Segment in Surgical Stapling Device Market

The manual segment is projected as the fastest-growing segment in the surgical stapling device market, from 2023 to 2032. Handheld tools called manual stapling devices are used to stitch up cuts as well as wounds. These tools include a straightforward mechanism for shooting the staples, making them simple to use. There are primarily two types of manual staplers: reloadable and disposable. Disposable devices are meant to be used just once before being thrown away, whereas reloadable devices can be reloaded with fresh staples after each usage.

Type Analysis

The Disposable Holds the Significant Share in Type Segment in Surgical Stapling Device Market.

Based on type, the Disposable segment dominates the surgical stapling device market with a 70% market share. Various surgical procedures, such as gastrointestinal, thoracic, and gynecologic surgery, require disposable surgical stapling instruments. These tools are a crucial component of the surgical stapling industry because they are made for single use and are destroyed after a single treatment. The rise in surgical operations, the prevalence of chronic diseases, and the desire for minimally invasive procedures are some of the factors propelling the disposable segment of the surgical stapling device market.

End-User Analysis

The Hospitals Hold the Significant Share of the End-User Segment in the Surgical Stapling Device Market.

Based on end-user, the Hospital segment dominates the surgical stapling device market with a 45% market share. In some surgical disciplines like general surgery, gynecology, as well as thoracic surgery staplers may be used for this surgery. Hospitals may also need a variety of stapling tools, from basic versions for everyday producers to more sophisticated tools for intricate surgery.

Key Market Segments

Based on Product

- Powered Stapling Device

- Manual Stapling Device

Based on Type

- Disposable

- Reusable

Based on End-User

- Hospitals

- Ambulatory Surgical Centers

- Other End-Users

Growth Opportunity

Rising Prevalence of Chronic Conditions, The Opportunity for Surgical Stapling Devices Market.

The demand for surgical treatment has grown as a result of the increasing incidence of chronic conditions like gastrointestinal problems, cancer, and obesity among others. Owing to its widespread use in many surgical procedures, this increased the demand for surgical stapling equipment. The technological development in this field of surgery has produced more sophisticated surgical staplers that are more accurate as well as precise. Owing to its expanded use in surgical operations the market has grown.

Increasing preference for minimally invasive producers due to their reduced invasive as well as reduced tissue stress. Surgical stapling devices have become more widely used as a result of the trends toward minimally invasive procedures. Their market demand has increased as a result of this. This healthcare industry, particularly the market for surgical stapling devices, has increased healthcare costs in both developed as well as developing nations.

Future predictions indicate that this pattern will persist, spurring market expansion. Increased access to healthcare services, including surgical operations, is the result of the expansion of the healthcare infrastructure in emerging nations. In turn, this has increased demand for surgical stapling tools, fueling market expansion.

Latest Trends

More Mergers and Acquisitions Occurring in The Surgical Stapling Devices Market.

New technologies such as powered surgical stapler, which requires less force to use are becoming more and more common. Other developments include the production of surgical staplers using 3D printing technology as well as the incorporation of AL also machine learning to enhance surgical results. Minimally invasive procedures are becoming more popular because they need fewer incisions, cause less discomfort and scars, and have quicker recovery times.

To meet this demand, surgical stapling equipment is being improved to be more ergonomic, user-friendly, and effective. To assure optimal tissue alignment, precise staple creation, and minimal tissue stress, surgical stapling devices are being designed with an increased focus on patient safety. By doing so, the possibility of complications like bleeding and infection following surgery is reduced.

As businesses seek to diversify their product lines and acquire a competitive edge, more mergers and acquisitions are occurring in the surgical stapling devices market. In emerging economies like India as well as China, where is a rising number of surgical producers owing to an increase in the prevalence of chronic diseases, the market for surgical stapling devices is also growing to meet the rising demand, businesses are strengthening their presence in this region by collaborating with regional distributors also healthcare providers.

Regional Analysis

North America Accounted for the Largest Revenue Share in Surgical Stapling Devices Market in 2022.

North America is estimated to be the most lucrative market in the surgical stapling devices market, with the largest market share of 41%. Owing to the high prevalence of chronic conditions including cancer as well as obesity in North America, surgical stapling device have historically enjoyed the biggest market share, the main market in the area is the United States, followed by Canada. Major players like Medtronic, Johnson & Johnson, and B. Braun are present in the market, which defines it.

The market is anticipated to keep expanding as a result of factors such as the aging population, the rising demand for minimally invasive surgical procedures, and technological developments in surgical stapling equipment. Regulatory barriers, the high cost of surgical stapling devices, the availability of substitute surgical techniques, and other issues could provide problems for the market.

Asia Pacific is expected as Fastest Growing Region in Projected Period in Surgical Stapling Devices Market.

Asia Pacific is expected as fastest growing region in the forecast period in the surgical stapling devices market. The Asia Pacific region’s expanding medical tourism sector is anticipated to increase demand for surgical stapling equipment. Key businesses like Medtronic, Johnson & Johnson, and B. Braun Melsungen AG dominate the market share in this fiercely competitive industry.

Over the course of the forecast period, the Asia Pacific surgical stapling device market is anticipated to expand strongly due to factors like rising healthcare costs, rising demand for minimally invasive procedures, and an increase in the frequency of chronic diseases.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The superior quality of surgical staplers, technological advances, product approvals, and their use in numerous fields all drive the market for surgical staplers. The competitive environment comprises a review of a few well-known, internationally operating as well as locally based enterprises.

Market Key Players

- Covidien

- Ethicon US LLC

- Intuitive Surgical

- Cardica Inc

- Stryker

- Smith & Nephew

- CONMED Corporation

- CareFusion Corporation

- 3M Healthcare

- BioPro Inc

- Other Key Players

Recent Developments

- In March 2021, A new powered surgical stapler called the ECHELON+ Stapler with GST Reloads was introduced by Ethicon. It is intended to improve staple line security and decrease problems by compressing tissue more evenly and forming staples more effectively, especially in difficult circumstances.

- In December 2021, FDA approval for the 8 mm SureForm 30 Curved-Tip Stapler and reloads for use in general, gynecologic, thoracic, urologic, surgery, and pediatric surgery was granted to Intuitive Surgical Inc.

Report Scope

Report Features Description Market Value (2022) USD 4.3 Bn Forecast Revenue (2032) USD 9.4 Bn CAGR (2023-2032) 8.4% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Powered Stapling Device and Manual Stapling Device) By Type (Disposable, and Reusable) By End-User (Hospitals, Ambulatory Surgical Centres, and Other End-Users) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Covidien, Ethicon US LLC, Intuitive Surgical, Cardica Inc, Stryker, Smith & Nephew, CONMED Corporation, CareFusion Corporation, 3M Healthcare, BioPro Inc, and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

How big is the global market size of the surgical stapling devices industry?In 2022, the surgical stapling devices market accounted for USD 4.3 billion. It is projected to reach USD 9.4 billion by 2032.

What are the driving factors for the growth of the surgical stapling devices market?The increased use of minimally invasive surgical techniques and the rising number of surgical procedures are driving the growth of the surgical stapling devices market.

What are the different types of surgical stapling devices available in the market?The market offers powered stapling devices and manual stapling devices.

What are the types of stapling available in surgical stapling devices?Surgical stapling devices come in straight, curved, and circular stapling types.

What are the latest trends in the surgical stapling devices market?The market is witnessing trends such as product approvals, the introduction of innovative stapling technologies, and the development of advanced features to enhance surgical outcomes and patient safety.

What are the growth opportunities in the surgical stapling devices market?The rising prevalence of chronic conditions and the increasing preference for minimally invasive procedures create growth opportunities in the surgical stapling devices market.

Which companies are the key players in the surgical stapling devices market?The key players in the market include Covidien, Ethicon US LLC, Intuitive Surgical, Cardica Inc, Stryker, Smith & Nephew, CONMED Corporation, CareFusion Corporation, 3M Healthcare, BioPro Inc, and others.

Surgical Stapling Devices MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample

Surgical Stapling Devices MarketPublished date: Nov. 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Covidien

- Ethicon US LLC

- Intuitive Surgical

- Cardica Inc

- Stryker

- Smith & Nephew

- CONMED Corporation

- CareFusion Corporation

- 3M Healthcare

- BioPro Inc