Global Supercritical Fluids Market By Fluid Type (Supercritical CO2, Supercritical Water, Supercritical Methanol, Supercritical Ethanol, and Others), By Application (Pharmaceuticals, Food And Beverages, Chemicals, Polymers And Plastics, Textiles, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2026

- Report ID: 177708

- Number of Pages: 256

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

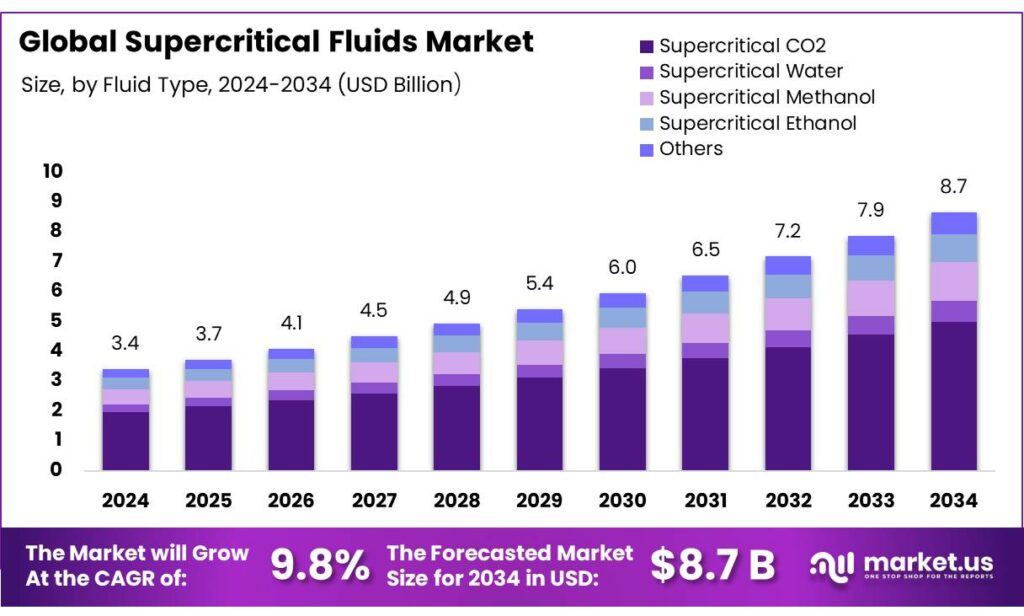

The Global Supercritical Fluids Market is expected to be worth around USD 8.7 Billion by 2034, up from USD 3.4 Billion in 2024, and is projected to grow at a CAGR of 9.8% from 2025 to 2034. The North America segment maintained 46.8%, supporting a Psychedelic Mushrooms value of USD 0.7 Bn.

A supercritical fluid (SCF) is a substance maintained at a temperature and pressure above its critical point, where the distinct liquid and gas phases merge into a single homogeneous state. In this state, the fluid possesses unique physical properties, the density of a liquid but the viscosity and diffusivity of a gas. The market is driven by advancements in sustainable, non-toxic, and efficient technologies across multiple sectors, with a notable focus on food and beverages.

In particular, supercritical CO₂ is the most widely used solvent due to its ability to extract bioactive compounds without leaving harmful residues, making it ideal for clean-label products. The food sector’s growing demand for natural ingredients and healthier processing methods is a key factor propelling supercritical fluid adoption.

Similarly, supercritical fluid technologies are gaining traction in pharmaceutical, chemical, and waste management industries, where they offer eco-friendly alternatives to traditional processes. Moreover, regulatory pressures favoring cleaner, safer production methods further support market expansion, particularly in North America and Europe. However, high upfront costs, technical complexity, and supply chain vulnerabilities, particularly in raw materials, pose ongoing challenges.

Key Takeaways

- The global supercritical fluids market was valued at USD 3.4 billion in 2024.

- The global supercritical fluids market is projected to grow at a CAGR of 9.8% and is estimated to reach USD 8.7 billion by 2034.

- Based on the types of supercritical fluids, supercritical carbon dioxide dominated the market, with a substantial market share of around 57.8%.

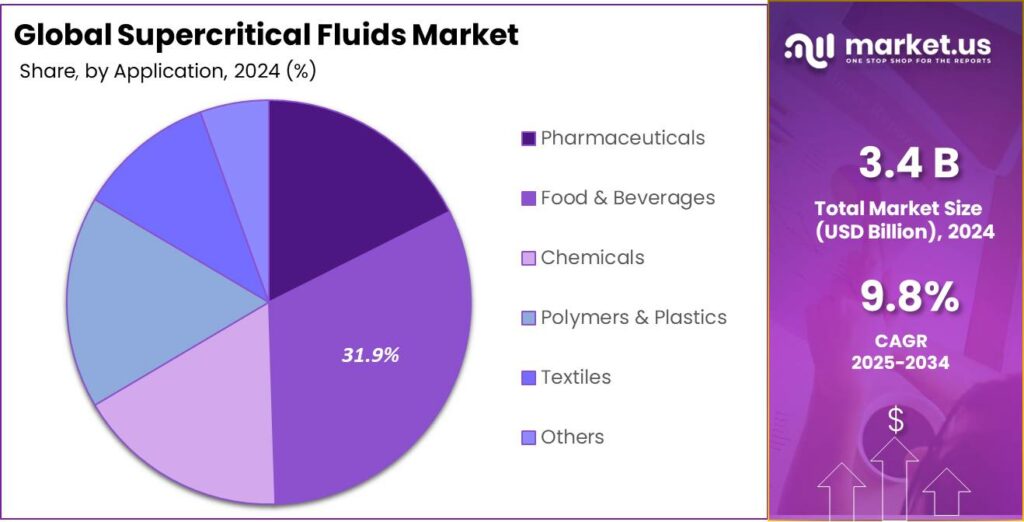

- Among the applications of supercritical fluids, the food & beverages sector held a major share in the market, 31.9% of the market share.

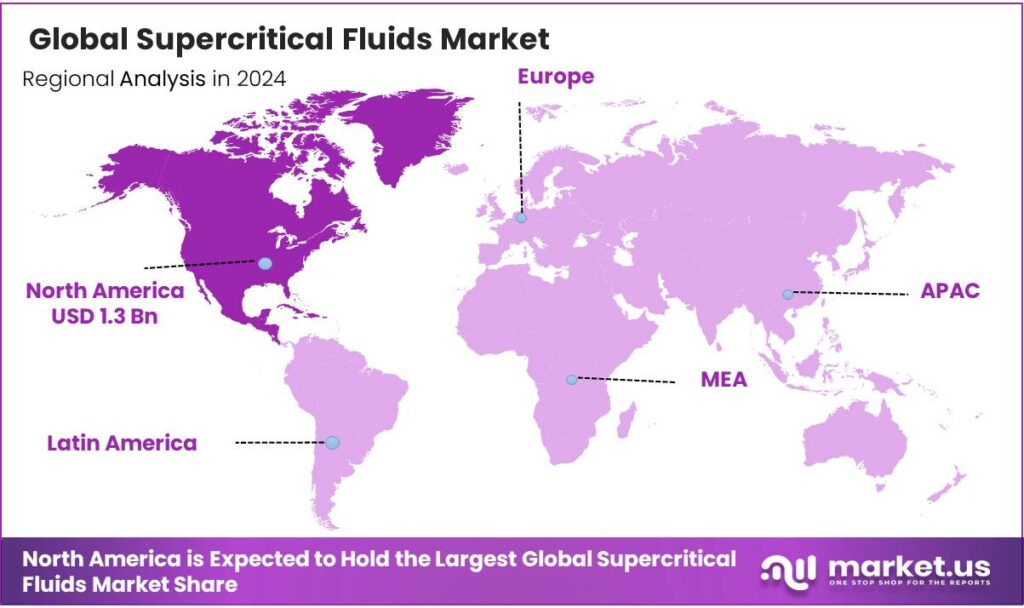

- In 2024, North America was the most dominant region in the supercritical fluids market, accounting for around 36.8% of the total global consumption.

Fluid Type Analysis

Supercritical Carbon Dioxide is a Prominent Segment in the Market.

The supercritical fluids market is segmented based on type into supercritical CO2, supercritical water, supercritical methanol, supercritical ethanol, and others. The supercritical carbon dioxide dominated the market, comprising around 57.8% of the market share, due to its low critical point (31.1⁰C and 73.8 bar). It is non-toxic, non-flammable, chemically inert, and relatively inexpensive, making it a safer and more cost-effective choice compared to supercritical water or alcohols.

Additionally, CO₂’s critical temperature and pressure are relatively easy to achieve with existing equipment, which enhances its practical use in industries such as food processing, pharmaceuticals, and cosmetics. Similarly, CO₂ is highly tunable, allowing for selective solubility of compounds, which is crucial for applications such as extraction and chromatography.

Application Analysis

The Supercritical Fluids Are Mostly Utilized in the Food & Beverages Sector.

Based on the applications of supercritical fluids, the market is divided into pharmaceuticals, food & beverages, chemicals, polymers & plastics, textiles, and others. The food & beverages sector dominated the market, with a market share of 31.9%, due to the sector’s strong demand for clean, non-toxic, and efficient processing methods.

In particular, supercritical CO₂ is ideal for extracting flavors, fragrances, essential oils, and other bioactive compounds from natural materials without leaving harmful residues, which is particularly important in food processing, where consumer preferences for clean-label and natural products are growing. Additionally, the food and beverage sector benefits from the ability of supercritical fluids to operate at relatively low temperatures, preserving the quality of sensitive compounds such as vitamins and antioxidants.

While supercritical fluid technology is applicable in other industries, the food sector’s stringent regulations for safety and purity, combined with the growing consumer shift towards natural ingredients, drive higher adoption compared to pharmaceuticals, chemicals, or textiles.

Key Market Segments

By Fluid Type

- Supercritical CO2

- Supercritical Water

- Supercritical Methanol

- Supercritical Ethanol

- Others

By Application

- Pharmaceuticals

- Food & Beverages

- Chemicals

- Polymers & Plastics

- Textiles

- Others

Drivers

Regulatory Pressure for Solvent Reduction Drives the Supercritical Fluids Market.

Regulatory pressure for solvent reduction is a significant driver of the supercritical fluids market, particularly in industries such as pharmaceuticals, food processing, and environmental applications. Regulatory bodies, including the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA), have enforced stringent standards to limit the use of volatile organic compounds (VOCs) and other hazardous solvents.

These regulations, such as the EPA’s Clean Air Act and ECHA’s REACH regulation, mandate the reduction of solvent emissions due to their environmental and health risks. For instance, the U.S. EPA’s National Volatile Organic Compound Emission Standards for consumer and commercial products have driven industries to adopt safer, more sustainable solvents such as CO₂ in supercritical fluid processing.

Similarly, in the pharmaceutical industry, the U.S. Food and Drug Administration (FDA) has increasingly encouraged the use of supercritical fluids in drug formulation due to their non-toxic and non-flammable properties.

Moreover, the European Union’s Solvent Emissions Directive (SED) further exemplifies such pressures, requiring the reduction of solvent use in manufacturing processes. These regulations create a favorable environment for supercritical fluid technologies, which offer a cleaner alternative to traditional solvent-based methods, driving their adoption across multiple sectors.

Restraints

High Upfront Costs Along with Technical Complexity Might Dampen the Demand for Supercritical Fluids.

The high upfront costs and technical complexity of supercritical fluid systems present significant challenges for market adoption, especially for small and medium-sized enterprises. Supercritical fluid technologies require expensive equipment such as high-pressure pumps, specialized reactors, and safety systems capable of withstanding extreme temperatures and pressures. According to the U.S. Department of Energy (DOE), the capital investment for supercritical CO₂ systems can exceed several hundred thousand dollars, a cost barrier for businesses with limited capital.

Furthermore, the technical complexity of supercritical fluid processes, including precise control of temperature and pressure, demands specialized knowledge and skilled personnel. The operational intricacies involved in maintaining the desired supercritical conditions require expertise in thermodynamics and fluid dynamics. This limits the widespread implementation of supercritical fluid technology, particularly in industries with less technical infrastructure.

In addition, challenges related to system maintenance, troubleshooting, and scalability are frequently cited. For instance, a study published in the journal Industrial & Engineering Chemistry Research highlights the technical difficulties faced when scaling up supercritical fluid processes for large-scale manufacturing, which further increases operational costs and complexity.

Opportunity

Demand for Clean-Label Ingredients Creates Opportunities in the Supercritical Fluids Market.

The growing demand for clean-label ingredients, particularly in the pharmaceutical and food industries, presents a notable opportunity for the supercritical fluids market. Clean-label products, characterized by minimal processing and the absence of synthetic chemicals, are increasingly sought after by consumers concerned about food safety and transparency.

In the food industry, the European Food Safety Authority (EFSA) has supported the use of supercritical CO₂ as a solvent in food extraction processes, noting its ability to extract bioactive compounds such as essential oils, antioxidants, and flavors without leaving harmful residues.

For instance, supercritical CO₂ is increasingly used for the decaffeination of coffee, where it preserves the natural taste and aroma of the beans while meeting clean-label requirements. The supercritical fluid techniques are effective for producing clean-label products in food and nutraceuticals, supporting the trend toward healthier and more sustainable ingredient sourcing.

Trends

Growth in Applications of Supercritical Fluids in the Waste Management Industry.

The use of supercritical fluids in waste management is emerging as a significant trend due to their effectiveness in treating hazardous waste and recycling materials in an environmentally sustainable manner. Supercritical fluid technology has been identified as an alternative to traditional methods such as incineration or landfilling, which are often associated with high emissions and environmental risks.

In waste-to-energy applications, the supercritical fluid-assisted extraction techniques for removing toxic solvents from industrial waste are often used. For instance, supercritical CO₂ is capable of selectively extracting contaminants, such as heavy metals or organic pollutants, from waste streams with minimal energy input compared to traditional thermal methods.

Additionally, supercritical fluid technology has been proposed for managing oil spills. Supercritical fluids can be employed to separate oil from water, aiding in the cleanup process without using toxic dispersants. This process aligns with environmental standards and sustainability goals set by regulatory agencies such as the European Commission’s Waste Framework Directive, which promotes the recycling and recovery of waste materials through innovative technologies such as supercritical fluids.

Geopolitical Impact Analysis

Geopolitical Tensions Are Impacting the Supercritical Fluids Market by Disrupting the Essential Supply Chains.

The geopolitical tensions are influencing the supercritical fluids market, particularly in terms of supply chain disruptions, access to raw materials, and technological collaborations. The ongoing conflicts and trade tensions between major economies, including the U.S. and China, have led to export restrictions on critical materials required for supercritical fluid systems, such as high-purity CO₂ and specialized metals for pressure vessels.

In addition, international sanctions, particularly against countries such as Russia, have affected the availability of certain chemical intermediates and high-grade solvents used in supercritical fluid processes. The disruptions in the global energy market, due to sanctions on Russian energy exports, have increased the costs of energy-intensive supercritical fluid processes.

Furthermore, geopolitical tensions are hindering cross-border collaborations on R&D projects in supercritical fluid technology. The European Commission’s Joint Research Centre has noted a slowdown in the adoption of supercritical fluid applications due to political uncertainties and regulatory shifts, particularly in sectors such as waste management and clean energy. These dynamics could limit the broader deployment of supercritical fluid technologies.

Regional Analysis

North America Held the Largest Share of the Global Supercritical Fluids Market.

In 2024, North America dominated the global supercritical fluids market, holding about 36.8% of the total global consumption, driven by strong regulatory frameworks and demand for sustainable manufacturing processes. The U.S. Environmental Protection Agency (EPA) has been a key driver, enforcing regulations that encourage the use of cleaner solvents in industries such as pharmaceuticals, food processing, and environmental remediation.

Specifically, the U.S. Food and Drug Administration (FDA) promotes supercritical fluid applications for drug formulation, highlighting their non-toxic and environmentally friendly characteristics in compliance with the Federal Food, Drug, and Cosmetic Act.

Additionally, the North American market is supported by substantial investments in clean technology, with initiatives such as the DOE’s Clean Energy Manufacturing Initiative, which promotes innovative and sustainable production methods. Consequently, the region remains at the forefront of supercritical fluid adoption, particularly in environmentally regulated sectors.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of supercritical fluids focus on heavy R&D investments to improve the efficiency and scalability of supercritical fluid systems, making them more cost-effective for industries such as pharmaceuticals, food processing, and waste management. This includes developing advanced technologies to reduce energy consumption and increase the reliability of supercritical fluid equipment.

Additionally, companies prioritize compliance with stringent environmental and safety regulations, ensuring that their products meet global standards, which builds trust in regulated industries. Similarly, manufacturers focus on forming partnerships with research institutions and government bodies to drive innovation and gain access to new applications.

The Major Players in The Industry

- BASF SE

- CO2 Solutions

- Thar Technologies

- Nova Extraction

- Applied Separations

- Supercritical Fluid Technologies (SFT)

- Vitalis Extraction Technology

- Chemtron Science Laboratories

- Naturmega

- Amar Equipment

- Aron Technologies

- Ocean Technologies

- Phasex Corporation

- Other Key Players

Key Development

- In October 2025, Naturmega officially inaugurated a pioneering supercritical fluid fractionation facility, the first of its kind in South America, specifically focused on omega-3 production. This facility enhances the purity, sustainability, and performance of omega-3 concentrates, marking the beginning of an era in lipid science with products such as EssentiOmega Nova, EssentiOmega Algae, and Ruby-O.

- In November 2024, Robertet announced the acquisition of Phasex Corporation, a leading innovator in supercritical CO2 extraction technology, based in the United States, providing innovative and environmentally friendly solutions for natural products, biopharmaceuticals, and polymers.

Report Scope

Report Features Description Market Value (2024) US$3.4 Bn Forecast Revenue (2034) US$8.7 Bn CAGR (2025-2034) 9.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fluid Type (Supercritical CO2, Supercritical Water, Supercritical Methanol, Supercritical Ethanol, and Others), By Application (Pharmaceuticals, Food & Beverages, Chemicals, Polymers & Plastics, Textiles, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, CO2 Solutions, Thar Technologies, Nova Extraction, Applied Separations, Supercritical Fluid Technologies (SFT), Vitalis Extraction Technology, Chemtron Science Laboratories, Amar Equipment, Aron Technologies, Ocean Technologies, Phasex Corporation, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Supercritical Fluids MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Supercritical Fluids MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- CO2 Solutions

- Thar Technologies

- Nova Extraction

- Applied Separations

- Supercritical Fluid Technologies (SFT)

- Vitalis Extraction Technology

- Chemtron Science Laboratories

- Naturmega

- Amar Equipment

- Aron Technologies

- Ocean Technologies

- Phasex Corporation

- Other Key Players