Global Super Absorbent Polymers Market By Type (Bio-Based SAP, Sodium Polyacrylate, Polyacrylamide Based, and Others), By Application (Personal Hygiene Products, Agriculture And Horticulture, Medical, Industrial, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160337

- Number of Pages: 204

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overviews

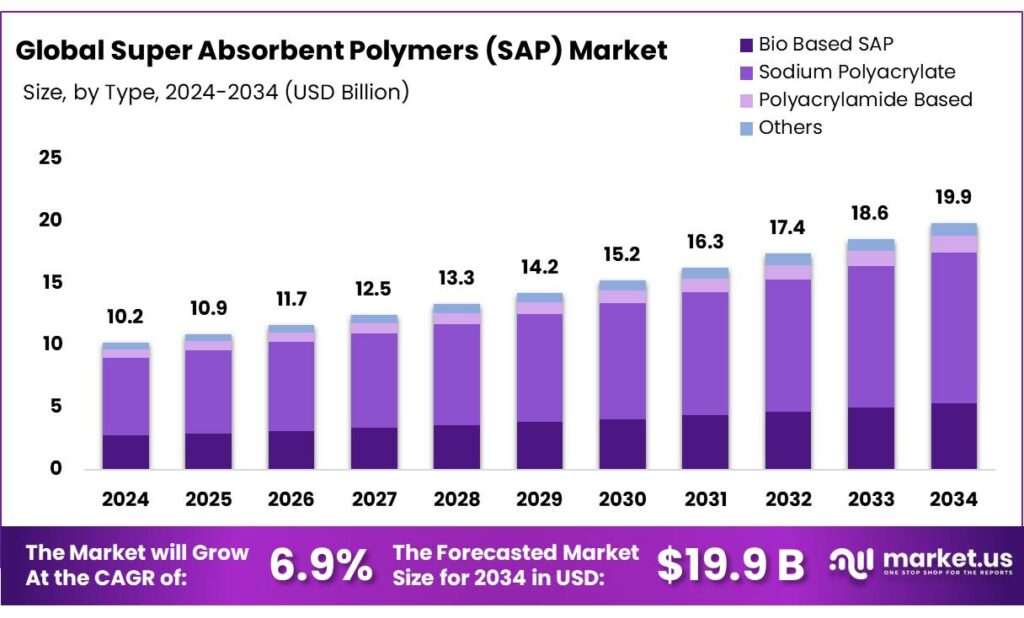

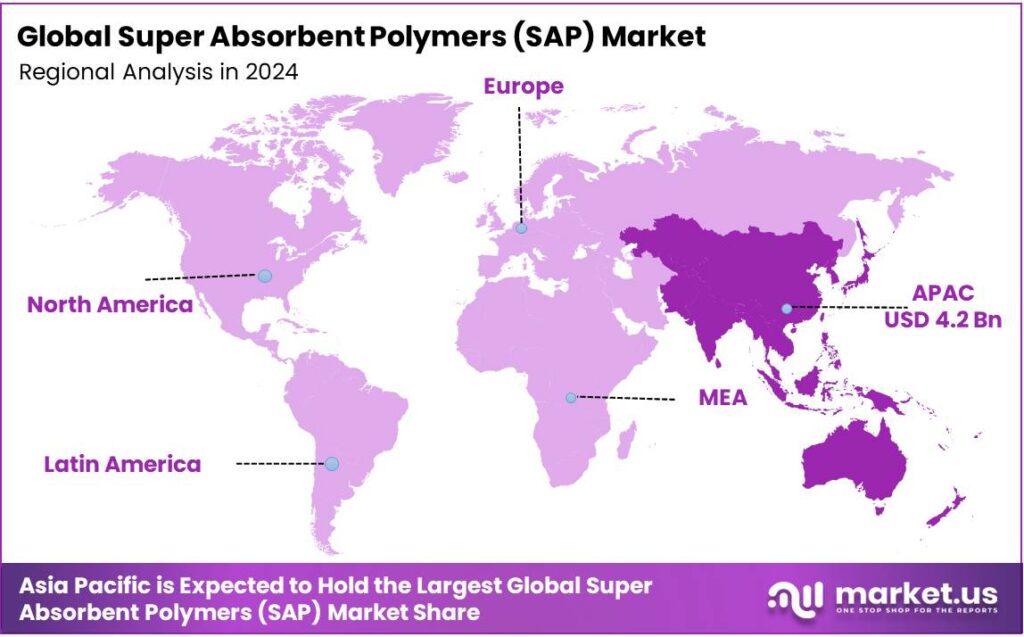

The Global Super Absorbent Polymers (SAP) Market size is expected to be worth around USD 19.9 Billion by 2034, from USD 10.2 Billion in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034. In 2024 Asia-Pacific held a dominant market position, capturing more than a 41.2% share, holding USD 4.2 Billion in revenue.

Super absorbent polymers (SAPs) are materials that can absorb and retain large amounts of liquids, becoming a gel-like substance and locking the liquid in place. Their ability to absorb and hold water stems from their unique molecular structure, which forms a three-dimensional network of polymer chains that uncoil and expand when exposed to liquid.

They are typically made from sodium polyacrylate and are used in products like diapers, feminine hygiene products, and as water-retaining agents in agriculture. These personal hygiene products are the major driver of the superabsorbent polymer market. These polymers are made from the petrochemical feedstock such as methoxyethyl methacrylate, ethylene glycol dimethacrylate, acrylic acid, and vinyl acetate.

As regulatory complications regarding petrochemicals increase, it might become a significant challenge for the industry. As these regulatory pressures increase, there is a constant focus on bio-based superabsorbent polymers. Additionally, polymers are extensively used in the agriculture industry, particularly in arid and semi-arid regions.

Key Takeaways

- The global superabsorbent polymers (SAP) market was valued at USD 10.2 billion in 2024.

- The global super absorbent polymers (SAP) market is projected to grow at a CAGR of 6.9% and is estimated to reach USD 19.9 billion by 2034.

- Based on the types of super absorbent polymers, sodium polyacrylate dominated the market in 2024, comprising about 61.2% share of the total global market.

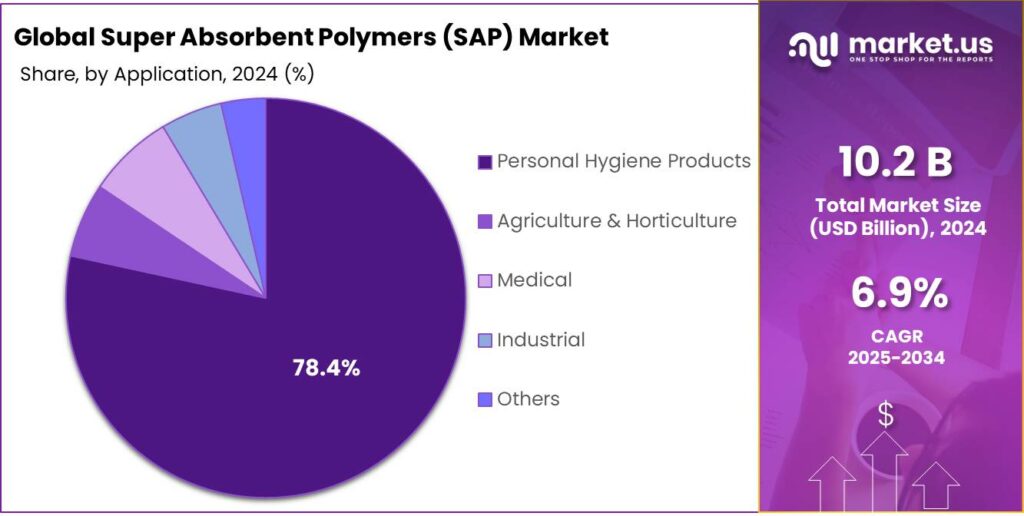

- Among the applications of super absorbent polymers, the personal hygiene products dominated the market in 2024, accounting for around 78.4% of the market share.

- Asia Pacific was the largest market for super absorbent polymers (SAP) in 2024, accounting for around 41.2% of the total global consumption.

Type Analysis

Sodium Polyacrylate Dominated the Super Absorbent Polymers (SAP) Market.

On the basis of the types of super absorbent polymers, the market is segmented into bio-based SAP, sodium polyacrylate, polyacrylamide-based, and others. Sodium polyacrylate dominated the market in 2024 with a market share of 61.2%. Sodium polyacrylate is the most widely used type of super absorbent polymer due to its superior absorbency, cost-effectiveness, and stability compared to bio-based SAPs or polyacrylamide-based SAPs. It can absorb and retain large amounts of water, up to 300 times its weight, making it highly efficient for applications such as diapers and agriculture.

Additionally, sodium polyacrylate is relatively easy to produce on a large scale with consistent quality. In contrast, bio-based SAPs often face challenges such as lower absorbency, higher production costs, and limited availability of raw materials. Polyacrylamide SAPs can have toxicity concerns due to residual acrylamide monomers, making sodium polyacrylate a safer and more practical choice for widespread use.

Application Analysis

Personal Hygiene Products Emerged as a Leading Segment in the Super Absorbent Polymers (SAP) Market.

Based on the applications of super absorbent polymers, the market is divided into personal hygiene products, agriculture & horticulture, medical, industrial, and others. Personal hygiene products dominated the market in 2024 with a market share of 78.4%. Personal hygiene applications dominate the use of super absorbent polymers, as they require high absorbency and reliability in everyday products such as diapers, sanitary pads, and adult incontinence items.

These products depend heavily on SAPs to provide comfort, leakage protection, and moisture control, making SAPs essential for their effectiveness. Compared to agriculture or industrial uses, the demand for hygiene products is more consistent and widespread due to global population growth and rising awareness of personal care. Medical applications, while important, are more specialized and limited in scale, and agriculture or horticulture uses of SAPs, though growing, often face challenges like cost and application methods.

Key Market Segments

By Type

- Bio-Based SAP

- Sodium Polyacrylate

- Polyacrylamide Based

- Others

By Application

- Personal Hygiene Products

- Baby diapers

- Adult incontinence products

- Feminine hygiene products

- Agriculture & Horticulture

- Medical

- Industrial

- Others

Drivers

Demand for Personal Hygiene Products Drives the Super Absorbent Polymers Market.

The growing demand for personal hygiene products is a key driver of the superabsorbent polymers market. SAPs are essential components in products such as baby diapers, adult incontinence products, and feminine hygiene items due to their ability to absorb and retain large amounts of liquid relative to their mass.

- For instance, a typical baby diaper can hold up to 30 times its weight in fluid, largely because of the presence of SAP. With the global birth rate remaining high in regions such as Sub-Saharan Africa and South Asia, the need for disposable diapers continues to rise.

Similarly, aging populations in countries such as Japan, Germany, and Italy have led to an increased demand for adult incontinence products. According to the World Health Organization, the population aged 60 years and older is expected to double by 2050, significantly boosting consumption of hygiene-related SAP products. In 2023, almost a third of Japan’s population was over 65, an estimated 36.23 million individuals. Furthermore, rising awareness of menstrual hygiene in developing countries is fueling the adoption of sanitary pads, further supporting the SAP market growth.

- For instance, according to a 2024 study by the National Family Health Survey in India, almost 76.15% of women reported exclusive use of hygienic period products during menstruation.

Restraints

Regulatory Pressure Might Hamper the Growth of the Super Absorbent Polymers Market.

Regulatory pressure poses a potential challenge to the growth of the superabsorbent polymers market, particularly due to environmental and health concerns associated with conventional, petroleum-based SAPs. Common non-renewable fossil fuel-derived raw materials for SAP production include methoxyethyl methacrylate, hydroxyethyl methacrylate, ethylene glycol dimethacrylate, methoxydiethoxyethyl methacrylate, acrylic acid, vinyl acetate, and N-(2-hydroxypropyl) methacrylamide. These are used in the manufacturing of the SAPs, such as sodium polyacrylate and polyacrylamide-based.

Additionally, these polymers are not readily biodegradable and can persist in landfills for hundreds of years, raising concerns about their long-term ecological impact. As awareness grows, governments and environmental agencies are implementing stricter regulations on the use of non-degradable plastics in consumer products.

For instance, the European Union’s Single-Use Plastics Directive targets a reduction in plastic waste, which can indirectly affect SAP-based products such as disposable diapers and sanitary pads. Furthermore, chemical safety regulations such as REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) require detailed safety assessments of substances used in manufacturing SAPs, increasing compliance costs for producers.

In some regions, restrictions on landfill disposal and mandates for compostable or recyclable materials in hygiene products may force manufacturers to reformulate or invest in alternative bio-based SAPs, potentially slowing market growth.

Opportunity

Applications of Super Absorbent Polymers in the Agriculture Sector Create Opportunities in the Market.

The agricultural sector presents significant opportunities for the application of superabsorbent polymers, particularly in regions facing water scarcity and erratic rainfall. SAPs can absorb hundreds of times their weight in water and slowly release it to plant roots, improving water efficiency and reducing irrigation frequency. This is especially valuable in arid and semi-arid regions.

- According to the United Nations Convention to Combat Desertification (UNCCD), drylands cover 41% of the land surface, produce 44% of the crops, and contain over 2 billion people and half of the world’s livestock. In countries like India, where nearly 60% of agriculture depends on monsoon rains, SAPs have been used to improve crop yields during dry spells.

For instance, integrating SAPs into the soil for crops such as wheat, maize, and vegetables can lead to improved germination rates and better moisture retention. Additionally, these polymers help enhance fertilizer efficiency by reducing nutrient leaching. With growing concerns about sustainable farming and climate resilience, the adoption of SAPs in agriculture is poised to expand, offering new growth avenues in the SAP market.

Trends

Demand for Sustainable and Bio-Based Super Absorbent Polymers.

The rising demand for sustainable and bio-based super absorbent polymers is an emerging trend driven by environmental concerns and increasing awareness of plastic pollution. Traditional SAPs are primarily derived from petroleum-based products, which are non-biodegradable and contribute to long-term environmental waste. Researchers and manufacturers are shifting toward eco-friendly alternatives made from renewable resources.

For instance, in July 2024, ZymoChem, a leading biotech company dedicated to creating sustainable materials for everyday products, announced the launch of BAYSE, the scalable, 100% bio-based, and biodegradable super absorbent polymer (SAP).

Similarly, according to a study, application of cornstarch-based SAPs can improve tomato production in times of drought stress by retaining more water and nutrients in the active rooting zone and can reduce environmental pollution by reducing nitrogen runoff. In hygiene products like diapers and sanitary pads, consumers are increasingly seeking options labeled as biodegradable or eco-friendly, creating a growing niche for sustainable SAPs. Due to this, several companies are investing in bio-based SAP products.

- For instance, in June 2024, Nagase ChemteX Corporation, along with its parent company, Nagase & Co., Ltd., and LiveDo Corporation, agreed on the joint development of adult disposable diapers and incontinence products using a polymer developed by the NAGASE Group with a high biomass content and biodegradability.

Geopolitical Impact Analysis

Geopolitical Tensions Leading to Supply Chain Disruptions in the Super Absorbent Polymers (SAP) Market.

Geopolitical tensions can significantly impact the super absorbent polymers (SAP) market by disrupting supply chains and increasing raw material costs. Most SAP production, such as sodium polyacrylate SAP and polyacrylamide-based SAP, relies heavily on petrochemical feedstocks, which are often sourced from regions prone to political instability, such as the Middle East and Russia. For instance, due to the Ukraine-Russia conflict, the prices of petrochemical feedstock have surged enormously.

Similarly, an escalated conflict between Israel and Iran contributed to heightened volatility and increased investment uncertainty in global crude oil markets, impacting the prices of petrochemical feedstock. Conflicts or trade sanctions in these areas can lead to volatility in the prices of key inputs like acrylates and acrylic acid, essential components in SAP manufacturing.

For instance, trade conflicts between China and the United States have caused delays and increased costs in chemical imports, affecting production timelines, as China is the major manufacturing hub of these polymers. Furthermore, geopolitical tensions such as wars may lead to stricter export controls and tariffs, complicating the international trade of SAP products, which can disrupt industries relying on SAPs, including hygiene products and agriculture.

Regional Analysis

Asia Pacific is the Largest Market for Super Absorbent Polymers (SAP).

Asia Pacific held the major share of the global super absorbent polymers (SAP) market, valued at around US$4.2 billion, commanding an estimated 41.2% of the total revenue share. The region stands out as the largest market for superabsorbent polymers, driven by its vast population and expanding industrial sectors. Countries, such as China and India, which together account for over 37% of the world’s population, have seen increasing demand for SAP-based products such as diapers, adult incontinence products, and agricultural applications.

Rapid urbanization and rising disposable incomes in these countries have led to greater adoption of disposable hygiene products, fueling SAP consumption. In 2024, the nationwide per capita disposable income was 41,314 yuan. For instance, in India, the baby diaper market is growing as awareness and affordability improve, especially in urban and semi-urban areas. Additionally, the agricultural sector in the Asia Pacific benefits from SAPs, particularly in water-scarce regions such as parts of China and Southeast Asia, where SAPs help improve soil moisture retention. Moreover, local manufacturing hubs and supportive government initiatives aimed at enhancing healthcare and agriculture infrastructure further reinforce the Asia Pacific’s dominance in the SAP market.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The major global participants in the super absorbent polymers (SAP) market are BASF SE, LG Chem, Formosa Plastic Corporation, Sanyo Chemical Industries, Songwon, Evonik Industries AG, KAO Corporation, Nippon Shokubai, Sumitomo Seika Chemicals, Nippon Shokubai, SNF Holding Company, Acuro Organics, Zappa-Stewart, Chemtex Speciality, and Satellite Chemical.

These companies primarily focus on their R&D to improve the absorption ability of the polymers and on the development of bio-based polymers. Several leading players are focused on the expansion of manufacturing facilities to cater to the growing need for the product. Many companies are partnering with biotech companies for product development.

BASF focuses on developing SAPs with innovative properties, such as enhanced absorption, improved sustainability, and the ability to be used in thinner and lighter products.

LG Chem developed bio-balanced SAP using renewable, plant-based materials like vegetable oil, and is the first in Korea to receive ISCC PLUS certification for its entire process of producing SAP.

Nippon Shokubai is a leading Japanese chemical company, known for its unique catalyst technology, and is recognized as the most dominant company in the super absorbent polymers market.

The major players in the industry

- BASF SE

- LG Chem

- Formosa Plastic Corporation

- SANYO CHEMICAL INDUSTRIES, LTD.

- SONGWON

- Evonik Industries AG

- KAO Corporation

- Nippon Shokubai Co., Ltd.

- Sumitomo Seika Chemicals Co., Ltd.

- Nippon Shokubai Co., Ltd.

- SNF Holding Company

- Acuro Organics Ltd

- Zappa-Stewart

- Chemtex Speciality Limited

- Satellite Chemical

- Other Players

Key Developments

- In July 2024, Nippon Shokubai announced its expansion by building a manufacturing facility in Indonesia, Nippon Shokubai Indonesia (NSI), to produce superabsorbent polymers (SAP) with a capacity of 50,000 metric tons per year.

- In September 2022, Sanyo Chemical Industries announced that its wholly owned subsidiary, SDP Global Co., developed an eco-friendly superabsorbent polymer made using plant-based biomass as part of its raw materials and acquired the Biomass Mark certification by the Japan Organics Recycling Association.

Report Scope

Report Features Description Market Value (2024) US$10.2 Bn Forecast Revenue (2034) US$19.9 Bn CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Bio-Based SAP, Sodium Polyacrylate, Polyacrylamide Based, and Others), By Application (Personal Hygiene Products, Agriculture & Horticulture, Medical, Industrial, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, LG Chem, Formosa Plastic Corporation, Sanyo Chemical Industries, Songwon, Evonik Industries AG, KAO Corporation, Nippon Shokubai, Sumitomo Seika Chemicals, Nippon Shokubai, SNF Holding Company, Acuro Organics, Zappa-Stewart, Chemtex Speciality, Satellite Chemical, Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Super Absorbent Polymers MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample

Super Absorbent Polymers MarketPublished date: Oct 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- LG Chem

- Formosa Plastic Corporation

- SANYO CHEMICAL INDUSTRIES, LTD.

- SONGWON

- Evonik Industries AG

- KAO Corporation

- Nippon Shokubai Co., Ltd.

- Sumitomo Seika Chemicals Co., Ltd.

- Nippon Shokubai Co., Ltd.

- SNF Holding Company

- Acuro Organics Ltd

- Zappa-Stewart

- Chemtex Speciality Limited

- Satellite Chemical

- Other Players