Global Subscription Experience Platforms Market Size, Share, Industry Analysis Report By Deployment Model (Cloud-Based, On-Premise), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Application (E-Commerce, Media & Content, SaaS, Others), By Industry Vertical (Retail & Ecommerce, IT & Technology, FMCG, Media & Entertainment, Telecom, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165041

- Number of Pages: 227

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Customer Behavior and Retention

- Technology and Trends

- Role of Generative AI

- Investment and Business Benefits

- U.S. Market Size

- Deployment Model Analysis

- Organization Size Analysis

- Application Analysis

- Industry Vertical Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

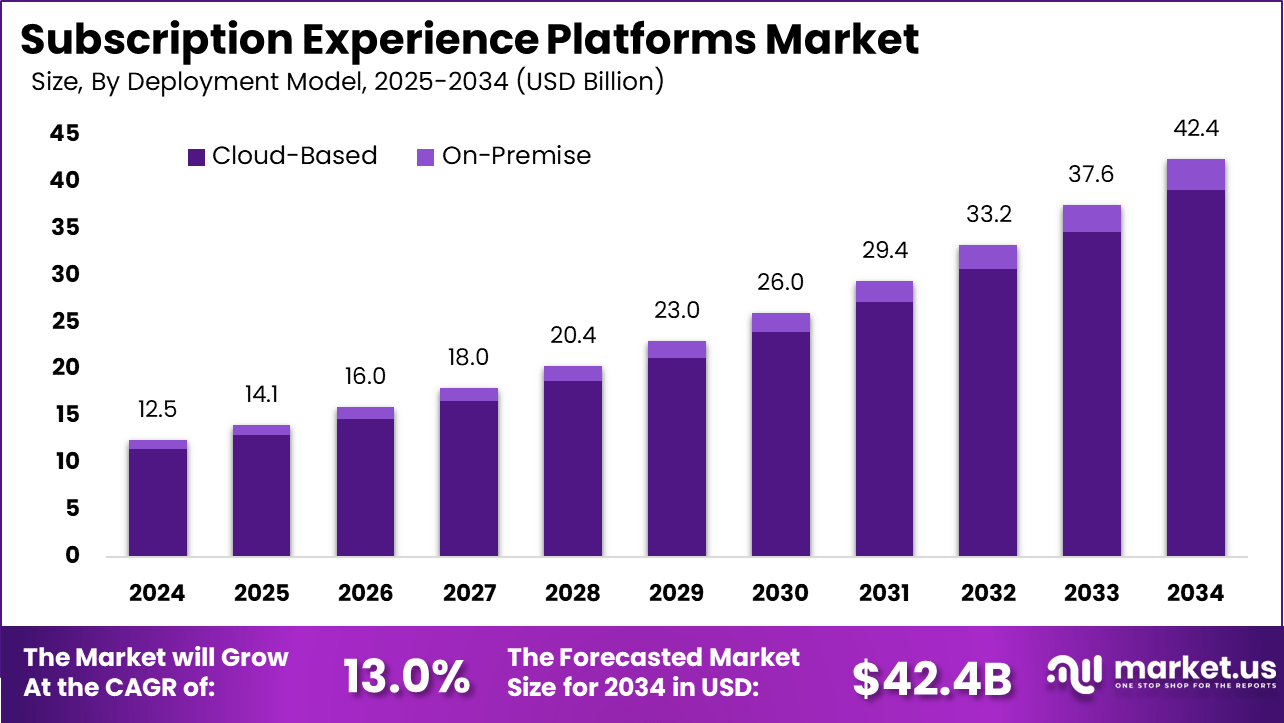

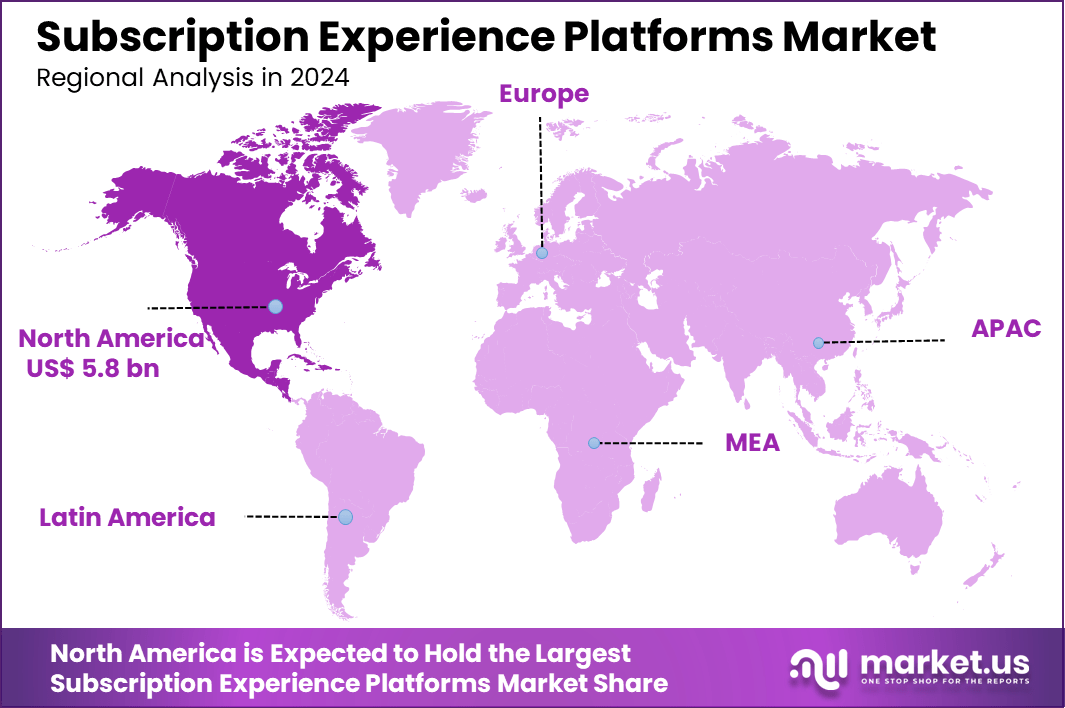

The Global Subscription Experience Platforms Market size is expected to be worth around USD 42.4 billion by 2034, from USD 12.5 billion in 2024, growing at a CAGR of 13.0% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 46.4% share, holding USD 5.8 billion in revenue.

Subscription Experience Platforms are specialized software systems designed to manage and enhance the entire lifecycle of subscription services. They provide businesses with tools to streamline subscription management, recurring billing, customer engagement, and detailed analytics. These platforms facilitate personalized and seamless experiences for subscribers by automating payment processes, managing subscription tiers, handling upgrades and cancellations, and delivering tailored communications.

Top driving factors for the adoption of Subscription Experience Platforms include the shift in consumer behavior towards access-based consumption, where customers prefer paying for services regularly rather than owning products outright. Businesses benefit from predictable revenue streams generated by subscriptions, fostering financial stability. The demand for personalization is another major driver, with 43% of consumers willing to pay more for experiences tailored to their needs.

The demand for Subscription Experience Platforms is rising rapidly due to digital transformation and the expansion of subscription-based models across industries. The integration of AI and machine learning enables personalized recommendations, predictive analytics, and churn control. These technologies help companies refine pricing, improve customer segmentation, and offer flexible plans such as freemium, usage-based, and tiered models.

For instance, in October 2025, Braintree, a PayPal company headquartered in Chicago, supports merchants across 200+ markets, driving over 25 billion transactions annually. PayPal’s strategic shift to margin growth through Braintree’s omnichannel payment integrations covers a significant market share in the U.S. subscription payments ecosystem.

Key Takeaway

- In 2024, the Cloud-Based segment led with a 92.3% share, driven by the scalability, flexibility, and integration capabilities of SaaS-based subscription solutions.

- The Small & Medium Enterprises (SMEs) segment captured 64.5%, reflecting growing adoption of digital platforms to enhance customer retention and subscription lifecycle management.

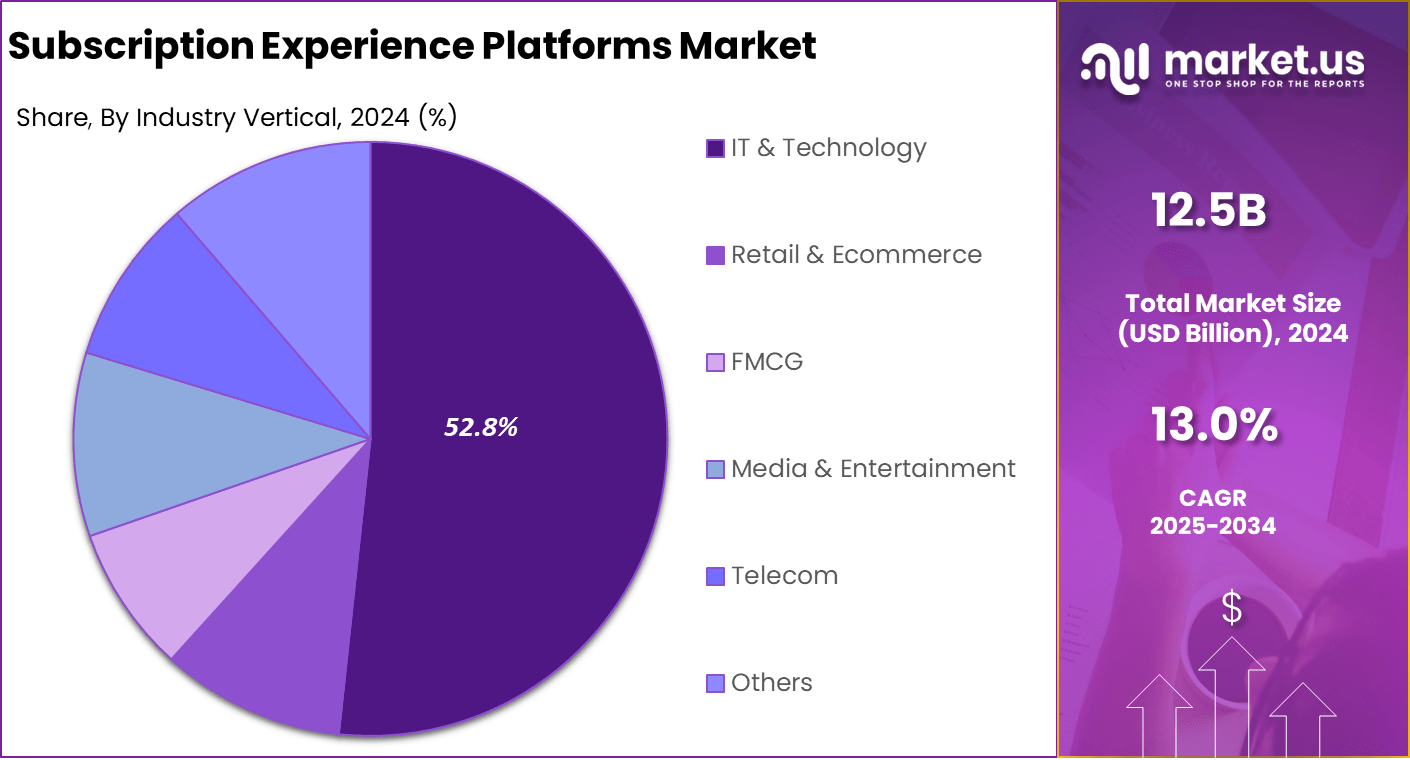

- The SaaS segment held a strong 52.8% share, emphasizing the market’s shift toward software-driven automation and data-driven personalization.

- The IT & Technology segment accounted for 51.7%, showcasing early adoption of subscription experience tools to streamline service delivery and analytics.

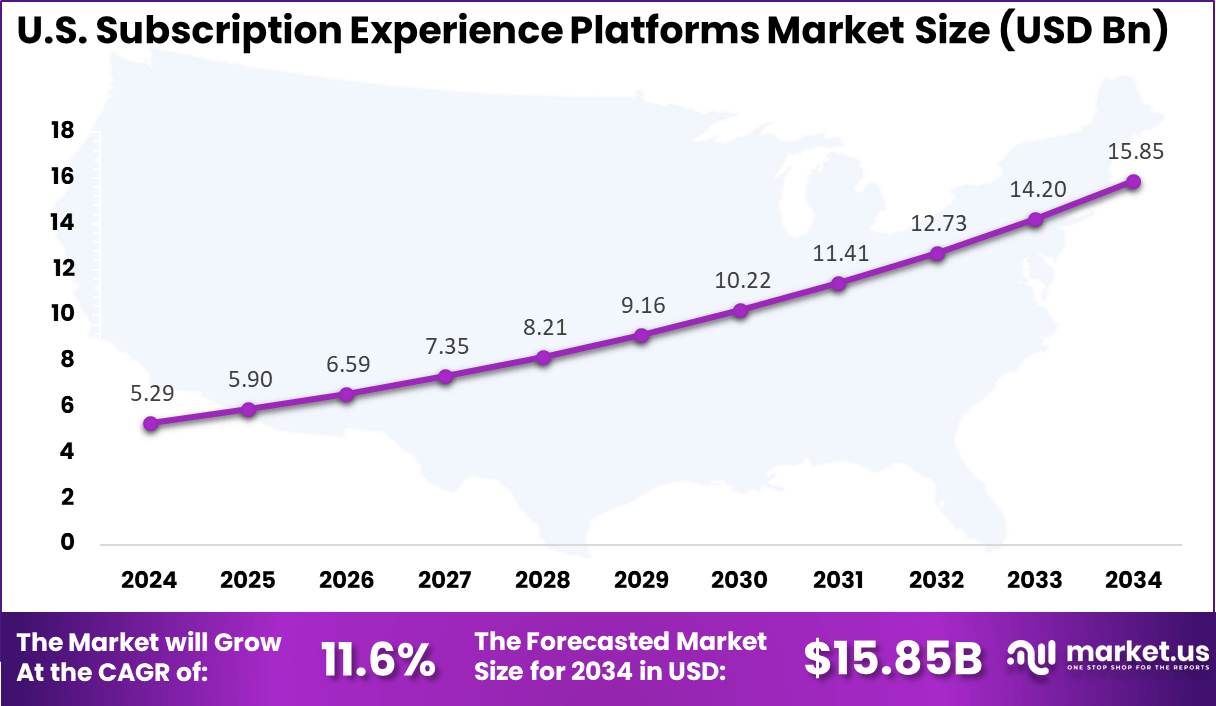

- The US market was valued at USD 5.29 billion in 2024 and is expanding at a robust CAGR of 11.6%, underscoring sustained demand for customer-centric subscription solutions.

- North America dominated with more than 46.4% share, supported by mature digital ecosystems and strong enterprise focus on customer experience optimization.

Customer Behavior and Retention

- Primary reasons for subscribing: Most consumers subscribe for convenience and enjoyment, rather than cost savings. This shows that perceived value and ease of use are more important than pricing in influencing subscription choices.

- Churn rates: The median churn rate across industries is 4.1%. The Digital Media and Entertainment sector records the highest churn at 6.9%, while the software industry reports the lowest at 3.5%, reflecting better customer loyalty and product integration.

- Personalization: About 28% of customers consider a personalized experience the most important reason for continuing their subscription. Personalization remains a strong driver of retention and satisfaction.

- Cancellations: In 2024, around 50% of consumers canceled at least one subscription within six months. The main reasons were reducing expenses, losing interest, or facing price increases. Offering discounts or lower-cost tiers can help businesses retain more users.

- User retention: Retention levels for mobile apps remain low, with only 25.3% of users active on day one and just 5.7% by day thirty. This highlights the importance of sustained engagement strategies and better onboarding experiences.

Technology and Trends

- AI and automation: Artificial intelligence is increasingly being used to personalize offers, predict churn, and manage billing. About 83% of subscription businesses have already invested or plan to invest in AI-driven capabilities.

- B2B dominance: The B2B segment accounted for over 55% of the subscription economy in 2024, supported by the growth of software-as-a-service (SaaS) and other cloud-based solutions that rely on recurring revenue models.

- Payment integration: Smooth and secure payment systems are essential for global expansion. The median sign-up decline rate is 11%, often caused by failed payments. Better payment integration improves conversions and renewals.

- Bundling: Companies are increasingly combining multiple services such as streaming, fitness, and productivity under a single subscription plan. This approach increases customer value and helps lower churn by keeping users engaged across several services.

Role of Generative AI

Generative AI is making subscription experience platforms smarter by personalizing user interactions and improving customer satisfaction. Around 65% of AI users are younger generations who actively engage with technology, making AI personalization crucial. These platforms use AI to predict what subscribers want next, reducing the chances of cancellations by addressing issues before they occur.

This leads to better customer retention and higher lifetime value, as companies can offer more relevant and valuable experiences. Beyond personalization, generative AI automates pricing and billing processes to make subscriptions smoother for users and more profitable for businesses.

Over 60% of new service companies now use AI-driven features that adjust pricing based on customer behavior and market changes. This automation handles routine tasks while dynamically optimizing offers, helping companies grow their subscriber base more efficiently through tailored, flexible plans that meet evolving customer needs.

Investment and Business Benefits

Investment opportunities in the Subscription Experience Platform space are abundant as more companies embrace recurring revenue models. Investors are drawn by the technology’s potential to transform traditional business frameworks and unlock new monetization strategies across SaaS, media streaming, e-commerce, and even alternative investments.

Growing demand for platforms that offer compliance features, flexible integrations, and AI-powered personalization creates attractive areas for capital deployment. Additionally, cloud-based platforms with advanced security protocols and automation capabilities represent promising innovations addressing market needs for scalability and data protection.

Business benefits of Subscription Experience Platforms span operational, financial, and customer-centric domains. Organizations see improved productivity as manual subscription and billing tasks are automated, freeing resources for growth initiatives. The centralized collection of customer data supports more accurate revenue forecasting, helps optimize marketing efforts, and lowers churn through proactive engagement.

Customers enjoy flexibility in subscription management, including modifying plans and accessing support around the clock, which boosts retention. Enhanced security features also protect sensitive data, reducing risks associated with breaches and regulatory non-compliance.

U.S. Market Size

The market for Subscription Experience Platforms within the U.S. is growing tremendously and is currently valued at USD 5.29 billion, the market has a projected CAGR of 11.6%. This growth is driven by increasing consumer demand for personalized, flexible subscription services that cater to individual preferences and lifestyles.

Businesses are leveraging advanced technologies such as AI and cloud computing to enhance customer experiences, automate billing, and optimize subscription management. Additionally, high digital penetration, widespread adoption of smartphones, and a strong e-commerce ecosystem in the U.S. are fueling the demand for subscription platforms.

In 2024, North America held a dominant market position in the Global Subscription Experience Platforms Market, capturing more than a 46.4% share, holding USD 5.8 billion in revenue. This strong position is attributable to the region’s advanced digital infrastructure, widespread consumer acceptance of subscription and recurring billing models, and the presence of numerous leading platform providers.

The ongoing digital transformation across various sectors, such as retail, telecommunications, and financial services, has driven investments in customer-centric technologies to improve engagement and retention. Moreover, North America’s leadership benefits from the rapid adoption of emerging technologies like AI, IoT, and cloud computing, which enhance personalized customer experiences and operational efficiency.

Major companies in the region continuously innovate and expand their subscription offerings, strengthening the market’s growth and making North America a global hub for subscription platform advancements. This blend of technological integration and strong enterprise involvement supports sustained market dominance.

For instance, in October 2025, Zuora partnered strategically with Nuvei to power global subscription payments, enhancing enterprise recurring revenue support at scale. This integration boosts payments infrastructure to accelerate growth in North America and globally, reflecting Zuora’s strong leadership in subscription monetization across key markets.

Deployment Model Analysis

In 2024, the Cloud-Based segment held a dominant market position, capturing a 92.3% share of the Global Subscription Experience Platforms Market. This is mainly because cloud solutions make it easy to scale resources quickly to meet changing business demands. Companies do not have to invest heavily in hardware or infrastructure, saving on upfront costs. Cloud platforms handle maintenance, upgrades, and security, allowing businesses to focus more on growth and innovation with less operational hassle.

Additionally, cloud deployment offers improved accessibility and flexibility, letting users access applications from any location and device. The pay-as-you-go pricing model means companies pay only for what they use, making it cost-efficient. Its reliability is strengthened by providers’ extensive data networks that minimize downtime, giving businesses consistent performance and agility.

For Instance, in October 2025, Recurly released its Fall Update featuring AI-driven subscription growth tools, including Compass Assistant, a cloud-powered AI solution enabling businesses to automate subscriber lifecycle management efficiently. This reinforces Recurly’s role in cloud-based subscription experience management.

Organization Size Analysis

In 2024, the Small & Medium Enterprises (SMEs) segment held a dominant market position, capturing a 64.5% share of the Global Subscription Experience Platforms Market. These businesses often require affordable, scalable solutions that can grow with them without large IT investments. Subscription platforms help SMEs efficiently manage recurring revenue and customer relationships, crucial for their sustainability and competitive positioning.

The ease of cloud-based platform deployment suits SMEs well, enabling faster adoption without complex setups. This allows them to leverage modern technology and compete on a level playing field with bigger companies, improving their ability to innovate and respond quickly to market changes.

For instance, in October 2025, Chargebee was named a leader in Gartner’s Magic Quadrant for Recurring Billing Applications, highlighting its strong support for SMBs with scalable, cloud-native billing and subscription infrastructure. The acquisition of Inai boosted its AI-powered payments intelligence to assist SMEs in managing payments and reducing operational burdens.

Application Analysis

In 2024, The SaaS segment held a dominant market position, capturing a 52.8% share of the Global Subscription Experience Platforms Market. The platforms help SaaS providers automate billing, streamline customer onboarding, and reduce churn by improving user experience. This operational efficiency supports the growth of software companies by enabling them to focus on product development and customer engagement.

Integration capabilities of these platforms also add value, connecting billing with analytics, CRM, and support tools. This results in a more cohesive experience for both businesses and their end-users, which is vital in maintaining competitive advantage in the software subscription market.

For Instance, in April 2025, Paddle expanded its billing models with enhanced subscription retention tools and greater support for enterprise SaaS customers, including local payment methods and checkout recovery, enabling smoother SaaS subscription monetization.

Industry Vertical Analysis

In 2024, The IT & Technology segment held a dominant market position, capturing a 51.7% share of the Global Subscription Experience Platforms Market. This industry often deals with complex licensing and subscription scenarios, which the platforms handle effectively. They enable companies to customize offerings, track usage, and manage upgrades seamlessly to retain customers.

The sector’s rapid innovation pace also drives extensive use of these platforms to support digital transformation strategies. Subscription experience platforms are vital tools for technology companies to stay relevant by delivering continuous value and adapting quickly to customer needs.

For Instance, in October 2025, Chargebee innovated in AI-enhanced billing and usage-based pricing to serve IT & Technology companies’ complex monetization needs, reinforcing its position by powering revenue operations in dynamic tech environments.

Emerging Trends

Emerging trends in subscription experience platforms focus heavily on flexibility and user control. Around 67% of customers prefer paying based on usage, which motivates platforms to offer adaptable subscription options instead of one-size-fits-all plans.

Hybrid models are also growing, combining standard subscriptions with add-ons or one-time purchases, allowing users to customize their subscriptions in more meaningful ways. This increased freedom helps build deeper customer loyalty and makes subscriptions feel more like personal services.

Sustainability has also become a major factor shaping subscriptions. Consumers are increasingly looking for companies that provide eco-friendly options, such as sustainable packaging and carbon-neutral delivery. This shift is no longer niche, with many subscriptions now integrating environmental responsibility as a key part of their value.

Growth Factors

Growth in subscription platforms is driven by the stability of recurring revenue and the ability to retain existing customers. Around 70% of revenue comes from current subscribers, making it essential to reduce churn and keep subscribers engaged. Improved mobile onboarding and digital wallet payments have made subscribing easier and more accessible, which supports consistent growth.

Additionally, AI-powered personalization further strengthens subscriber satisfaction and loyalty, directly increasing revenue per user. Improvements in technology also make subscription payments more reliable, cutting down on failed transactions and reducing friction during sign-up or renewal.

This ease of use helps maintain consistent subscriber numbers while giving companies valuable insights into customer behavior. The combination of steady revenue, technological advances, and data-driven personalization forms the foundation for sustainable growth in subscription platforms.

Key Market Segments

By Deployment Model

- Cloud-Based

- On-Premise

By Organization Size

- Small & Medium Enterprises (SMEs)

- Large Enterprises

By Application

- E-Commerce

- Media & Content

- SaaS

- Others

By Industry Vertical

- Retail & Ecommerce

- IT & Technology

- FMCG

- Media & Entertainment

- Telecom

- Others

Drivers

Growing Demand for Personalization

Consumers today increasingly expect services that cater specifically to their individual tastes and preferences. This demand has encouraged companies to adopt subscription experience platforms that can deliver personalized content and offers. By tailoring experiences to each user, businesses are able to enhance customer engagement, overall satisfaction, and loyalty, which directly contributes to business growth.

This emphasis on personalization also allows businesses to differentiate themselves from competitors by creating unique value propositions that resonate with users on a deeper level. Companies that effectively harness these platforms can generate stronger customer relationships and reduce churn. Personalization transforms how services are delivered, providing a more meaningful experience that helps transition simple transactions into ongoing customer connections.

For instance, In October 2025, Zuora upgraded its platform to offer personalized pricing and flexible subscription management. The update enables businesses to create custom bundles quickly, supports over 40 payment methods, and uses automation to improve customer engagement and operational efficiency.

Restraint

Complexity of Platform Integration

Although subscription experience platforms offer many benefits, integrating them with an organization’s existing IT systems can be complicated and resource-intensive. Many companies operate with legacy systems that were not designed to work seamlessly with modern cloud-based platforms. This integration process requires careful planning, technical expertise, and time, which can delay deployment and increase costs.

Without smooth integration, companies struggle to maintain unified data flows and consistent customer experiences, limiting the platform’s effectiveness. The complexity also creates operational challenges by disrupting current workflows and potentially causing data fragmentation. Businesses often need to supplement platform investments with additional developer support or customizations to bridge system gaps. This complexity can discourage some organizations from adopting or slow their transition, making integration one of the key barriers to growth for the subscription experience platform market.

For instance, in March 2025, Salesforce Subscription Management was noted for challenges related to integrating with outdated CRM systems at some client organizations. One mid-sized software company struggled with complex manual billing and renewal processes due to integration issues between Salesforce tools and legacy systems, leading to revenue leakage and higher churn rates. These integration difficulties slowed down business automation and increased operational costs.

Opportunities

Expansion into Niche Markets

There is a significant opportunity for growth in niche markets with subscription experience platforms. As the market matures, businesses explore specialized versions of these platforms to cater to specific industry needs or customer groups. For example, bespoke platforms for health and wellness, education, or entertainment can provide highly tailored services that appeal to targeted audiences.

This specialization allows businesses to deepen customer relationships and differentiate themselves from competitors in broader markets. Furthermore, technological advancements like AI, AR, and IoT are enabling these platforms to deliver more personalized and immersive experiences. Companies that leverage these technologies can create unique offerings that adapt to individual preferences in real-time.

For instance, In October 2025, Recurly introduced an AI-powered subscription growth engine named Recurly Compass to enhance customer retention through predictive analytics and automation. The platform enables personalized offers and localized payment options, helping businesses expand into niche markets while meeting compliance needs. It also supports global scalability with region-specific payment gateways and real-time subscriber insights.

Challenges

Managing Customer Churn and Fatigue

A major challenge for subscription experience platforms is managing high customer churn and fatigue. As subscription fatigue grows due to overwhelming choices and frequent engagement demands, many customers become less loyal or opt to cancel services altogether. This trend can significantly undermine revenue stability and slow down growth.

Customers often subscribe with good intentions but may lose interest if experiences are not continuously engaging or if they feel overwhelmed by too many options. Addressing this issue requires ongoing innovation in engagement strategies, such as offering flexible plans, personalized content, or easy pause-and-resume features.

Without these measures, businesses risk losing subscribers rapidly, impacting long-term profitability. Companies need to keep revisiting their value propositions and interaction models to retain customers in an increasingly competitive landscape. This ongoing effort remains a core challenge for the ecosystem of subscription platforms, making retention strategies crucial for sustainable growth.

For instance, In September 2025, PayPal introduced a subscriptions hub in its mobile app, allowing users to manage and update multiple subscriptions in one place. The feature aims to simplify subscription management and reduce churn caused by subscription fatigue. By enhancing convenience and offering incentives like cashback for linked services, PayPal seeks to strengthen user loyalty and retention.

Key Players Analysis

The market is anchored by platforms such as Zuora providing end-to-end subscription management covering billing, revenue recognition and customer lifecycle. Zuora’s platform underpins companies migrating to recurring-revenue models and aims to enhance the subscription experience through automation and data analytics. The value of a strong subscription experience is underscored by its ability to empower customers and reduce churn.

Next tier players like Recurly, Chargebee and Paddle focus on flexible pricing, global payment support and modular integrations. These platforms cater to digital-first businesses needing agile subscription flows and deeper customer insight. Their adoption has grown in line with the broader subscription economy, which is expanding due to increasing recurring revenue models across sectors.

Other providers such as Braintree, Stripe (though not listed) and niche platforms like Odoo or Pabbly serve smaller enterprises or specific verticals with streamlined tools for subscription sign-up, management and analytics. These diverse providers show the market’s fragmentation and the opportunity for new entrants offering simple, customer-centric subscription experiences.

Top Key Players in the Market

- Zuora

- Recurly

- Chargebee

- Salesforce Subscription Management

- Paddle

- Braintree

- PayPal

- Subscription Genius

- Paddle

- Odoo

- Pabbly

- Mangopay

- Recurr.io

- Softcatalyst

- Bill.com

- FloQast

- Resova

- Paddle

- Cleeng

- Others

Recent Developments

- In August 2025, Chargebee enhanced its mobile commerce capabilities with secure, customizable mobile checkouts and expanded tools for managing subscription lifecycles, including trials, renewals, and gift subscriptions. These refinements improve conversion rates and customer experience across subscription operations.

- In August 2025, Zuora introduced innovations to accelerate go-to-market agility with dynamic pricing and multi-org quoting support, enhance global billing compliance, and optimize payments with localized links, smart gateway routing, and upcoming network tokenization. Their new finance tools and AI-driven automation improve forecasting and personalized subscription journeys.

Report Scope

Report Features Description Market Value (2024) USD 12.5 Bn Forecast Revenue (2034) USD 42.4 Bn CAGR(2025-2034) 13.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Deployment Model (Cloud-Based, On-Premise), By Organization Size (Small & Medium Enterprises (SMEs), Large Enterprises), By Application (E-Commerce, Media & Content, SaaS, Others), By Industry Vertical (Retail & Ecommerce, IT & Technology, FMCG, Media & Entertainment, Telecom, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Zuora, Recurly, Chargebee, Salesforce Subscription Management, Paddle, Braintree, PayPalm, Subscription Genius, Paddle, Odoo, Pabbly, Mangopay, Recurr.io, Softcatalyst, Bill.com, FloQast, Resova, Paddle, Cleeng, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Subscription Experience Platforms MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample

Subscription Experience Platforms MarketPublished date: Nov. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Zuora

- Recurly

- Chargebee

- Salesforce Subscription Management

- Paddle

- Braintree

- PayPal

- Subscription Genius

- Paddle

- Odoo

- Pabbly

- Mangopay

- Recurr.io

- Softcatalyst

- Bill.com

- FloQast

- Resova

- Paddle

- Cleeng

- Others