The Global Stored Grain Insecticides Market Size, Share, And Enhanced Productivity By Product Type (Organophosphates, Pyrethroids, Fumigants , Bio-insecticides, Insect Growth Regulators, Synergized Combination Products, Others), By Formulation (Liquid Concentrate, Dust and Dry Flowables, Aerosol/Fogging Agents, Tablets and Pellets, Suspension Concentrate, Micro-encapsulated), By Mode of Action (Contact Neurotoxins, Systemic Actives, Fumigant Gases, Juvenile Hormone Analogs (IGRs)), By Application (On-farm Storage, Off-farm Commercial Elevators, Export Shipments, Integrated Logistics and Transit, Seed Storage/Seed Banks, Emergency Rescue Treatments), By Distribution Channel (Direct-to-Farm Sales, Ag Retailers and Cooperatives, Grain Elevator Service Providers, Online Ag Input Platforms), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178540

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Formulation Analysis

- By Mode of Action Analysis

- By Application Analysis

- By Distribution Channel Analysis

- Key Market Segments

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

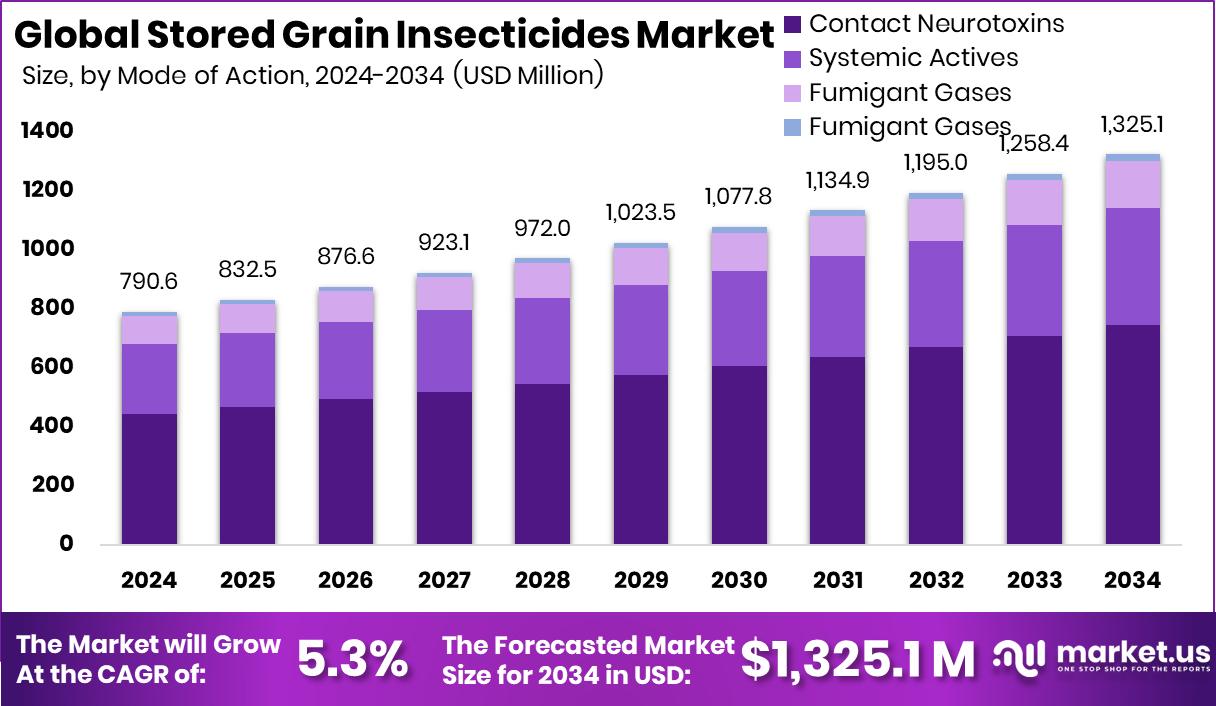

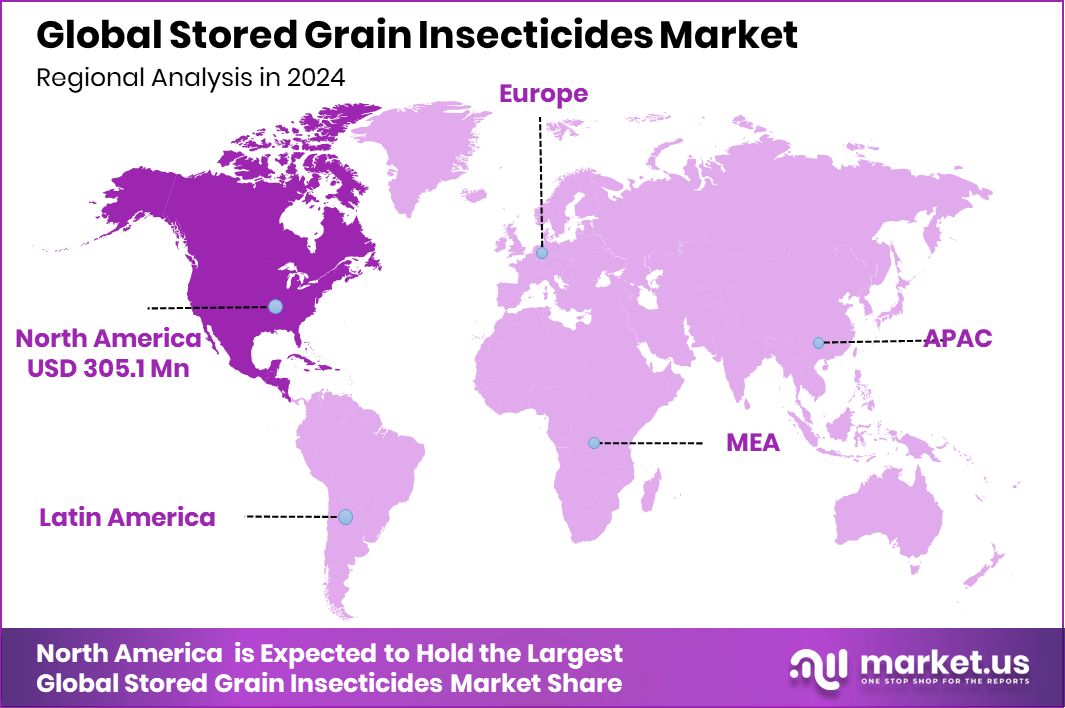

The Global Stored Grain Insecticides Market is expected to be worth around USD 1,325.1 million by 2034, up from USD 790.6 million in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034. Strong storage infrastructure supported North America’s 38.6% USD 305.1 Mn growth.

Stored grain insecticides are chemical or biological products used to protect harvested grains from insects during storage. After crops like wheat, rice, and corn are harvested, they often remain in silos, warehouses, or storage bags for weeks or months. During this period, insects such as weevils, beetles, and moths can cause serious losses in both quantity and quality. Stored grain insecticides help prevent infestation, control active pests, and maintain grain standards required for food processing and export trade.

The Stored Grain Insecticides Market includes the production, distribution, and sale of these protection products across different product types, formulations, and applications. It covers solutions ranging from organophosphates and fumigants to bio-insecticides and insect growth regulators. These products are supplied through direct farm sales, retailers, elevator operators, and digital platforms to support on-farm storage, commercial facilities, and transit systems.

One major growth factor is the rising focus on reducing post-harvest losses. Governments and research institutions are investing in safer and more sustainable pest control. For example, a SOM researcher received a $2.8 million grant to study pesticide exposure impacts, highlighting the push toward safer solutions. At the same time, SOLASTA Bio raised $14 million, and IBI Ag secured $10 million in Series A funding to advance bioinsecticide innovation.

Demand is supported by increasing grain production and global trade, where quality compliance is essential. Opportunities are expanding in biological and peptide-based alternatives, supported by funding such as California’s $3 million agricultural grant and continued investment into sustainable crop protection technologies.

Key Takeaways

- The Global Stored Grain Insecticides Market is expected to be worth around USD 1,325.1 million by 2034, up from USD 790.6 million in 2024, and is projected to grow at a CAGR of 5.3% from 2025 to 2034.

- In the Stored Grain Insecticides Market, Organophosphates account for 43.7% share globally across major regions.

- Within the Stored Grain Insecticides Market, Liquid Concentrate formulations hold 47.9% share among product segments.

- Contact Neurotoxins dominate the Stored Grain Insecticides Market with 56.3% share due to rapid action.

- On-farm Storage applications represent 49.1% of the Stored Grain Insecticides Market, driven by rising infestations.

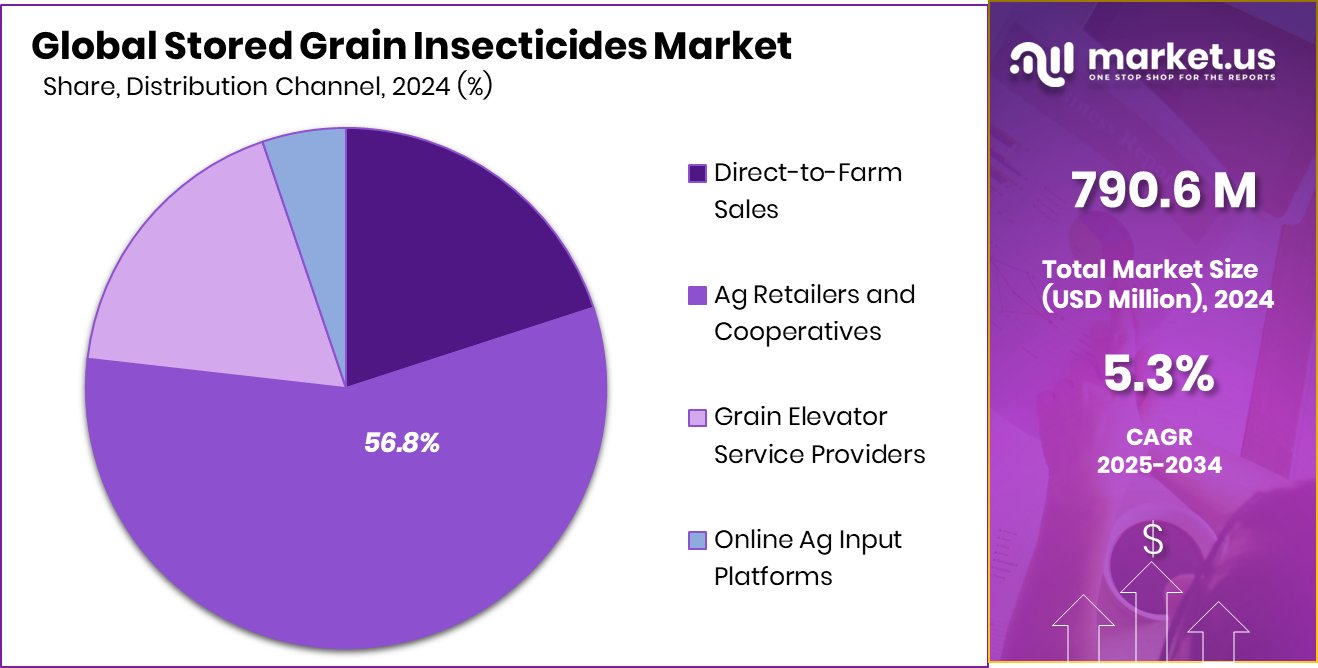

- Ag Retailers and Cooperatives lead distribution in the Stored Grain Insecticides Market with 56.8% share.

- North America generated USD 305.1 Mn in market revenue.

By Product Type Analysis

Stored Grain Insecticides Market sees Organophosphates leading with 43.7% share.

In 2024, the Stored Grain Insecticides Market saw Organophosphates holding a strong 43.7% share by product type. These products continue to be widely used because of their reliable knockdown effect against common storage pests such as weevils and beetles. Farmers and grain handlers prefer organophosphates due to their proven performance over decades and their ability to protect bulk grain during long storage cycles.

In many developing agricultural economies, these insecticides remain cost-effective compared to newer alternatives. Regulatory oversight has tightened in some regions, yet their affordability and broad-spectrum activity keep demand steady. As grain trade volumes expand globally, especially in wheat, maize, and rice, organophosphates remain a practical solution for maintaining grain quality during storage and transportation.

By Formulation Analysis

Stored Grain Insecticides Market shows Liquid Concentrate dominating at 47.9% globally.

In 2024, Liquid Concentrate formulations accounted for 47.9% of the Stored Grain Insecticides Market by formulation type. Liquid concentrates are widely favored because they are easy to dilute, apply, and distribute evenly across stored grain surfaces or storage structures. Their flexibility in dosage adjustment allows farmers and warehouse managers to tailor treatments based on infestation severity and storage duration.

Compared to dust or aerosol forms, liquid concentrates often provide better penetration and consistent coverage, particularly in large silos and bulk storage facilities. The growing use of mechanized spraying systems in commercial grain storage has further supported this segment. As storage infrastructure modernizes, especially in emerging agricultural regions, liquid concentrate formulations continue to lead due to convenience and operational efficiency.

By Mode of Action Analysis

Stored Grain Insecticides Market records Contact Neurotoxins capturing 56.3% share.

In 2024, Contact Neurotoxins dominated the Stored Grain Insecticides Market by mode of action with a 56.3% share. These insecticides work quickly by disrupting the nervous system of insects upon direct contact, making them highly effective for rapid infestation control. Storage operators value this fast-acting response because even minor pest outbreaks can lead to significant quality losses and financial damage.

Contact neurotoxins are particularly useful in managing adult insect populations in warehouses and silos. Their immediate impact reduces the risk of pest reproduction and secondary infestations. While integrated pest management practices are gaining attention, contact-based solutions remain essential in emergency treatments. Their consistent performance and quick results help maintain grain safety standards across domestic and export markets.

By Application Analysis

Stored Grain Insecticides Market highlights On-farm Storage accounting for 49.1%.

In 2024, On-farm Storage applications represented 49.1% of the Stored Grain Insecticides Market. Many farmers are increasingly investing in their own storage facilities to reduce post-harvest losses and gain better control over selling timelines. Protecting grain at the farm level has become crucial as climate variability and extended storage periods raise the risk of pest infestation.

On-farm storage insecticide use helps maintain grain quality before it reaches larger commercial warehouses or export terminals. Small and mid-sized farms especially rely on effective insect control to avoid quantity and quality losses that directly affect income. As governments in several agricultural nations promote improved rural storage infrastructure, demand for insecticides in on-farm settings continues to grow steadily.

By Distribution Channel Analysis

Stored Grain Insecticides Market notes Ag Retailers holding 56.8% distribution share

In 2024, Ag Retailers and Cooperatives led the Stored Grain Insecticides Market distribution channel with a 56.8% share. Farmers typically purchase insecticides through local agricultural retailers and cooperative societies because of accessibility, trusted relationships, and technical guidance. These channels often provide product recommendations, dosage advice, and after-sales support, which are critical for effective pest management.

In rural regions, cooperatives play an essential role in supplying inputs at competitive prices and ensuring timely availability during harvest seasons. Bulk procurement by cooperatives also helps reduce costs for individual farmers. As agricultural supply chains become more organized and service-oriented, ag retailers and cooperatives remain the primary link between manufacturers and end users in the stored grain protection market.

Key Market Segments

By Product Type

- Organophosphates

- Pyrethroids

- Fumigants

- Bio-insecticides

- Insect Growth Regulators

- Synergized Combination Products

- Others

By Formulation

- Liquid Concentrate

- Dust and Dry Flowables

- Aerosol/Fogging Agents

- Tablets and Pellets

- Suspension Concentrate

- Micro-encapsulated

By Mode of Action

- Contact Neurotoxins

- Systemic Actives

- Fumigant Gases

- Juvenile Hormone Analogs (IGRs)

By Application

- On-farm Storage

- Off-farm Commercial Elevators

- Export Shipments

- Integrated Logistics and Transit

- Seed Storage/Seed Banks

- Emergency Rescue Treatments

By Distribution Channel

- Direct-to-Farm Sales

- Ag Retailers and Cooperatives

- Grain Elevator Service Providers

- Online Ag Input Platforms

Driving Factors

Rising global grain storage capacity

Rising global grain storage capacity is a key driver in the Stored Grain Insecticides Market, as countries continue investing in better warehousing and silo infrastructure to reduce post-harvest losses. As more grain is stored for longer durations, the need for effective insect control naturally increases. In Ghana, Complete Farmer’s USD 2.5 M investment highlights how agritech platforms are strengthening supply chain transparency and storage efficiency, indirectly supporting demand for grain protection inputs.

Similarly, the Connecticut Department of Agriculture awarded nearly $1.5 million to projects building resilience across the middle of the food supply chain, reinforcing the importance of secure storage systems. As storage networks expand and modernize, the requirement for reliable insecticides to protect stored produce becomes increasingly critical.

Restraining Factors

Strict pesticide regulatory compliance requirements

Strict pesticide regulatory compliance requirements remain a major restraint for the Stored Grain Insecticides Market. Governments are tightening safety standards around chemical residues in stored food grains, increasing testing, documentation, and approval timelines for manufacturers and distributors. These compliance demands raise operational costs and may limit the availability of certain conventional chemistries.

At the same time, funding initiatives such as the next tranche offering up to €250,000 for tree nursery development show how public support is often directed toward sustainable and environmentally aligned agricultural projects. This shift reflects broader policy priorities favoring ecological balance and reduced chemical exposure. As environmental scrutiny grows, companies operating in stored grain protection must adapt formulations and processes to meet evolving legal and safety expectations.

Growth Opportunity

Expansion of bio-based insecticide adoption

Expansion of bio-based insecticide adoption presents strong opportunity within the Stored Grain Insecticides Market. Farmers and storage operators are increasingly seeking safer alternatives that maintain grain quality while meeting export standards. Financial backing for agricultural innovation further supports this shift. The IFA Fund’s commitment of $6 mn investment in agri firm Nu Genes signals growing interest in advanced agricultural technologies and improved crop resilience

. In addition, the Bezos Earth Fund pledged $17m to Colombia’s Future Seeds plant gene bank, reinforcing long-term investment in sustainable agriculture systems. Such funding strengthens research and development pipelines and encourages the introduction of biological and low-residue pest control options suited for stored grain environments.

Latest Trends

Shift toward eco-friendly fumigation solutions

A noticeable trend in the Stored Grain Insecticides Market is the shift toward eco-friendly fumigation solutions that balance effectiveness with environmental responsibility. Storage managers are increasingly evaluating products with lower toxicity profiles and improved safety for workers and surrounding communities. Global food security concerns are also shaping market direction.

For 2025, the FAO is seeking $1.9 billion to provide life-saving emergency agriculture assistance to 49 million people, highlighting the urgency of protecting food supplies from farm to storage. As food systems face climate pressures and supply disruptions, ensuring safe grain storage through responsible pest management solutions is becoming an essential priority across regions.

Regional Analysis

North America dominated the Stored Grain Insecticides Market with 38.6% share.

In 2024, North America emerged as the dominating region in the Stored Grain Insecticides Market, accounting for 38.6% of the total share and generating USD 305.1 Mn in revenue. The region’s leadership position is supported by its well-established grain storage infrastructure, large-scale commercial farming operations, and strict quality standards for stored crops. The presence of advanced silo systems and organized grain handling facilities has strengthened the demand for effective insect control solutions across the United States and Canada.

Europe represents a mature regional market, driven by strong regulatory compliance and structured grain warehousing systems. Asia Pacific shows steady expansion due to growing grain production and improving storage practices across developing economies. Meanwhile, the Middle East & Africa and Latin America are witnessing gradual adoption, supported by rising awareness about post-harvest loss prevention and the need for better grain protection across emerging agricultural markets.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Syngenta AG continues to hold a strong position in the global Stored Grain Insecticides Market through its broad crop protection portfolio and strong global distribution network. The company’s focus on research-driven chemistry and resistance management solutions supports its relevance in stored grain protection. Syngenta’s established relationships with large-scale grain producers and commercial storage operators strengthen its market reach. Its emphasis on product innovation and stewardship programs helps maintain compliance with evolving safety and environmental standards, particularly in regulated agricultural markets.

Corteva Agriscience remains a key participant, leveraging its integrated crop protection capabilities and farmer-focused approach. The company benefits from strong technical advisory support and field-level engagement, which enhances product adoption in grain-producing regions. Corteva’s investment in formulation improvements and application efficiency contributes to reliable insect control performance. Its structured supply chain and strong presence in North America and other major agricultural economies support steady participation in the stored grain segment.

UPL Limited plays a competitive role through its wide agrochemical portfolio and strong presence in emerging markets. The company’s cost-effective product offerings appeal to price-sensitive regions where post-harvest losses remain a concern. UPL’s global manufacturing footprint and distribution partnerships enable broad access to stored grain insecticide solutions, supporting consistent market visibility.

Top Key Players in the Market

- Syngenta AG

- Corteva Agriscience

- UPL Limited

- BASF SE

- Adama Agricultural Solutions Ltd.

- Nufarm Limited

- Envu GmbH

- Degesch America Inc.

- Douglas Products & Packaging Co., LLC

- FMC Corporation

Recent Developments

- In November 2025, Corteva Agriscience announced two new insect-control products designed to help farmers protect crops like wheat, rice, and corn from insect damage. Goltrevo™ is a broad-spectrum bioinsecticide based on a natural fungus that targets sap-feeding and chewing pests, while Varpelgo™ is a next-generation insecticide inspired by natural chemistry to combat chewing insects in row crops and vegetables. These products strengthen Corteva’s pest management portfolio with new tools for insect control.

- In September 2025, Syngenta AG completed the transfer of Actellic insecticide products, which are used to protect stored grain from pests, to Envu, a global environmental science company. This acquisition gives Envu full rights to several Actellic formulations used in stored grain protection, including liquid, smoke, and dust products. The sale supports broader pest control offerings with knockdown and residual effectiveness for growers and traders around the world.

Report Scope

Report Features Description Market Value (2024) USD 790.6 Million Forecast Revenue (2034) USD 1,325.1 Million CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Organophosphates, Pyrethroids, Fumigants, Bio-insecticides, Insect Growth Regulators, Synergized Combination Products, Others), By Formulation (Liquid Concentrate, Dust and Dry Flowables, Aerosol/Fogging Agents, Tablets and Pellets, Suspension Concentrate, Micro-encapsulated), By Mode of Action (Contact Neurotoxins, Systemic Actives, Fumigant Gases, Juvenile Hormone Analogs (IGRs)), By Application (On-farm Storage, Off-farm Commercial Elevators, Export Shipments, Integrated Logistics and Transit, Seed Storage/Seed Banks, Emergency Rescue Treatments), By Distribution Channel (Direct-to-Farm Sales, Ag Retailers and Cooperatives, Grain Elevator Service Providers, Online Ag Input Platforms) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Syngenta AG, Corteva Agriscience, UPL Limited, BASF SE, Adama Agricultural Solutions Ltd., Nufarm Limited, Envu GmbH, Degesch America Inc., Douglas Products & Packaging Co., LLC, FMC Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Stored Grain Insecticides MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Stored Grain Insecticides MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Syngenta AG

- Corteva Agriscience

- UPL Limited

- BASF SE

- Adama Agricultural Solutions Ltd.

- Nufarm Limited

- Envu GmbH

- Degesch America Inc.

- Douglas Products & Packaging Co., LLC

- FMC Corporation