Global Standard Modulus Carbon Fiber Market Size, Share, And Industry Analysis Report By Product Type (Continuous, Long, Short), By Application (Composites, Non-composites), By End-use (Aerospace And Defense, Wind Energy, Automotive, Sporting Goods, Construction, Pipes And Tanks, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171790

- Number of Pages: 383

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

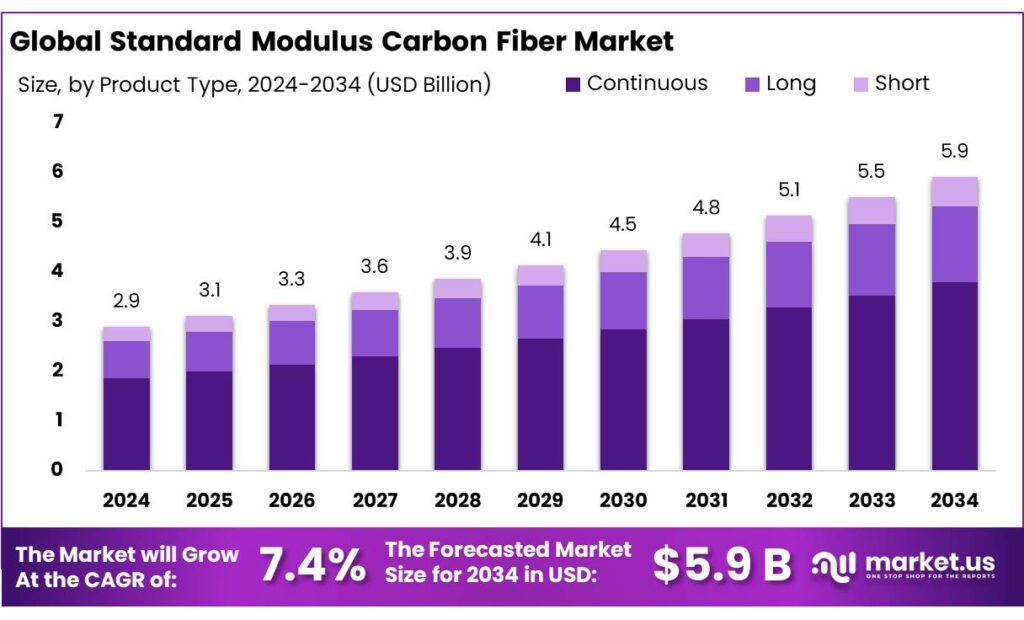

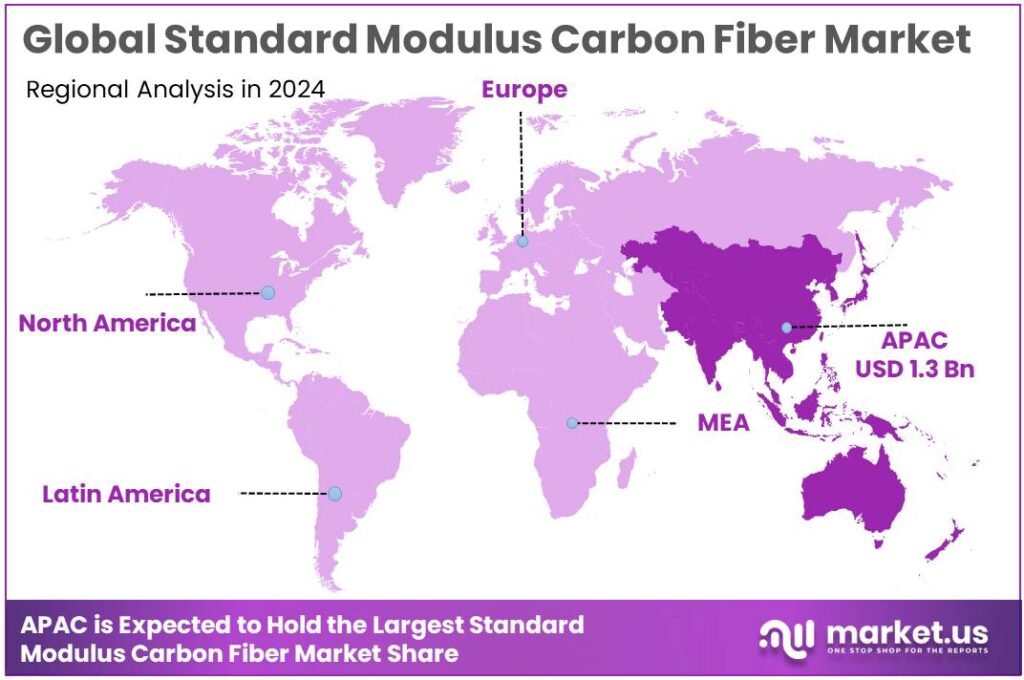

The Global Standard Modulus Carbon Fiber Market size is expected to be worth around USD 5.9 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 7.4% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 47.9% share, holding USD 1.3 Billion in revenue.

Standard modulus (SM) carbon fiber is the workhorse grade used when buyers need high strength-to-weight and reliable processing economics, without paying for intermediate/high-modulus fibers. In industrial terms, SM fiber typically sits around a tensile modulus of about 230–250 GPa (often referenced as 33–34 Msi), which balances stiffness, toughness, and cost efficiency for structural composite parts in transportation, energy, and general industrial equipment.

From an industry scenario standpoint, the carbon-fiber ecosystem is shifting from being predominantly aerospace-led to a more diversified demand stack that includes wind, pressure vessels, and mobility. Trade media tracking fiber supply and end-use adoption notes that global carbon fiber demand has grown to roughly 150,000 tonnes and is widely projected to scale materially this decade, with scenarios pointing toward around 450,000 tonnes per year by 2030 as energy-transition and industrial applications broaden. This growth matters for SM grades because many “volume” composite programs (large blades, tanks, industrial structures) optimize around strength-per-cost rather than ultra-high stiffness.

Key driving factors are anchored in lightweighting economics and renewable buildout. Wind is a direct pull-through market for carbon fiber because it enables longer blades and higher capacity factors. The IEA reports total installed wind capacity of about 1,015 GW in 2023, highlighting how quickly turbine fleets are scaling globally. In parallel, IRENA reports total wind capacity reaching about 1,133 GW by end-2024, reinforcing the continued equipment pipeline that supports composite demand across blades and nacelle components.

Capacity expansion announcements from major producers reinforce that growth picture. For example, Toray has communicated multiple investments aimed at increasing “regular tow” carbon fiber output across sites in the U.S., Korea, and France. In Europe, Toray also announced an increase at its Abidos, France site from 5,000 to 6,000 metric tons per year. In the U.S., Toray Composite Materials America announced a facility expansion in Spartanburg, South Carolina expected to add 3,000 metric tons per year of capacity starting in 2025, explicitly tied to “clean energy solutions” demand such as pressure vessels.

Government and trusted-institution initiatives also support future industrialization by lowering process cost and building domestic capability. In the U.S., the Department of Energy backed the Institute for Advanced Composites Manufacturing Innovation (IACMI) with a $70 million award at launch, explicitly targeting scale-up and manufacturing innovation—an enabling condition for higher-volume SM carbon fiber adoption beyond premium aerospace use cases. DOE programs have also funded composites workforce pathways with awards such as $1 million for an IACMI-led advanced composites career pathways effort, addressing a practical constraint: trained technicians for layup, resin infusion, and automated processing.

Key Takeaways

- Standard Modulus Carbon Fiber Market size is expected to be worth around USD 5.9 Billion by 2034, from USD 2.9 Billion in 2024, growing at a CAGR of 7.4%.

- Continuous held a dominant market position, capturing more than a 64.7% share.

- Composites held a dominant market position, capturing more than a 79.9% share.

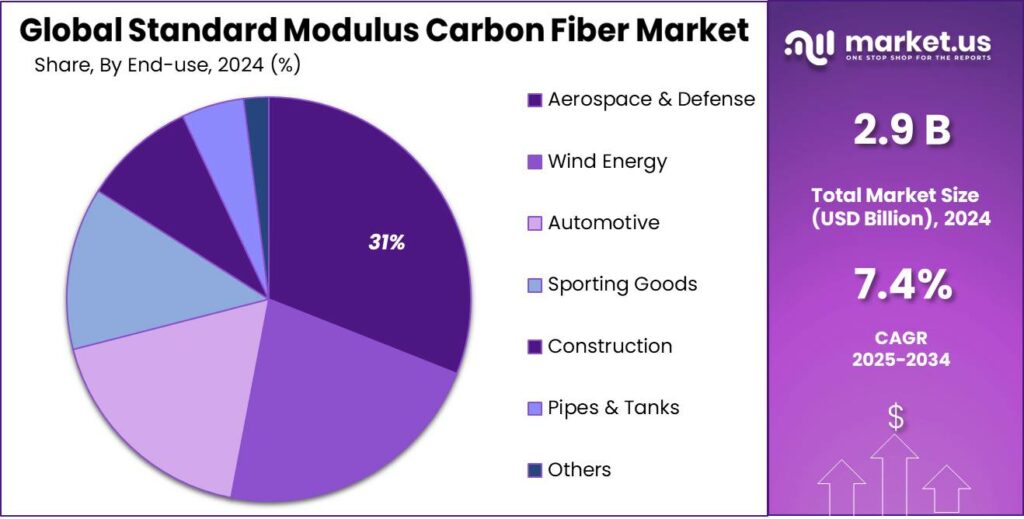

- Aerospace & Defense held a dominant market position, capturing more than a 31.2% share.

- Asia Pacific (APAC) region emerged as the most significant contributor to the global standard modulus carbon fiber market, commanding a dominant 47.9% share and generating approximately USD 1.3 billion in revenue.

By Product Type Analysis

Continuous carbon fiber leads the market with a strong 64.7% share, driven by its consistent strength and reliability

In 2024, Continuous held a dominant market position, capturing more than a 64.7% share in the standard modulus carbon fiber market, supported by its wide use in applications where uniform strength, durability, and performance stability are required. Continuous carbon fiber was largely preferred in aerospace components, wind energy structures, pressure vessels, and high-performance automotive parts, as it allows load to be distributed evenly over long lengths without interruption. The dominance of this segment was also reinforced by its suitability for advanced manufacturing processes such as filament winding, pultrusion, and automated fiber placement, which are increasingly adopted to improve production efficiency and reduce material waste.

By Application Analysis

Composites dominate with a commanding 79.9% share, supported by broad industrial acceptance

In 2024, Composites held a dominant market position, capturing more than a 79.9% share in the standard modulus carbon fiber market, mainly due to their extensive use across structural and performance-driven applications. Carbon fiber composites were widely adopted in automotive components, aerospace structures, wind turbine blades, sporting goods, and industrial equipment, as they offer a strong balance of strength, stiffness, and weight reduction.

This trend remained steady in 2025, supported by growing production of electric vehicles and rising demand for durable lightweight materials in renewable energy projects. The ease of integrating standard modulus carbon fiber into resin systems and established composite manufacturing processes further reinforced the dominance of this application segment across global end-use industries.

By End-use Analysis

Aerospace & Defense leads with a solid 31.2% share, driven by demand for lightweight strength

In 2024, Aerospace & Defense held a dominant market position, capturing more than a 31.2% share in the standard modulus carbon fiber market, supported by its critical role in aircraft structures, military equipment, and space-related components. Standard modulus carbon fiber was widely used in fuselage panels, wing structures, interior components, and defense-grade systems where weight reduction and high structural strength are essential.

In 2025, continued investment in next-generation aircraft, unmanned systems, and space programs sustained consumption, as carbon fiber enabled longer service life and improved operational efficiency. The material’s reliability under high stress and its ability to meet strict safety standards remained key factors reinforcing its leading position in this end-use segment.

Key Market Segments

By Product Type

- Continuous

- Long

- Short

By Application

- Composites

- Non-composites

By End-use

- Aerospace & Defense

- Wind Energy

- Automotive

- Sporting Goods

- Construction

- Pipes & Tanks

- Others

Emerging Trends

Lower-Carbon Carbon Fiber Becomes the New Benchmark

A clear latest trend in standard modulus carbon fiber is the shift from “just performance” to performance plus a cleaner footprint. Buyers in mobility, energy, and industrial equipment still want lightweight strength, but they are now asking tougher questions about raw materials, manufacturing energy, and end-of-life impacts. That change is pushing producers to work on renewable, non-food feedstocks, cleaner processing routes, and better documentation of carbon impact, so carbon fiber can scale without the sustainability backlash that often hits plastics and composites.

A good marker of this trend is public funding aimed at changing how carbon fiber is made. The U.S. Department of Energy announced up to $11.3 million for projects to advance “cost-competitive, high-performance” carbon fiber from renewable, non-food-based feedstocks such as agricultural residues and woody biomass. The point is not just greener inputs, but cost reduction and wider adoption in fuel-efficient vehicles and renewable energy components. When a national energy agency funds renewable precursor work, it’s a signal that the supply chain is being shaped intentionally—not left to chance.

At the same time, industrial growth is steering carbon fiber toward applications that must scale responsibly. Hydrogen is a strong example: the International Energy Agency reports global hydrogen demand reached more than 97 Mt in 2023 and could reach almost 100 Mt in 2024. As hydrogen expands, more high-pressure storage tanks and transport systems are needed, and these frequently rely on carbon fiber composites. That pushes producers to add capacity, but also raises the sustainability bar because the volumes can get large.

Policy targets in Europe reinforce the same direction. The European Commission states that the REPowerEU Strategy set the aim of producing 10 million tonnes and importing 10 million tonnes of renewable hydrogen by 2030. Even if the path to those numbers is uneven, the policy intent pushes investment into hydrogen supply chains—then straight into composite storage, distribution, and related equipment. More equipment means more carbon fiber, and more carbon fiber means stronger scrutiny of how it is produced.

Capacity plans show how “industrial decarbonization use-cases” are shaping strategy. Toray Composite Materials America announced a facility expansion in Spartanburg, South Carolina expected to add 3,000 metric tons per year of carbon fiber capacity starting in 2025, explicitly tied to demand in pressure-vessel applications for clean energy solutions. Industry reporting also notes Toray’s investments aim to lift group regular-tow capacity by over 20% to 35,000 metric tons beginning in 2025.

Drivers

Lightweighting to Cut Energy Use Is the Biggest Driver

One major reason standard modulus carbon fiber keeps gaining ground is simple: lighter parts need less energy to move. In transport, that shows up as better fuel economy or longer EV range, without redesigning the whole powertrain. The U.S. Department of Energy explains that a 10% reduction in vehicle weight can deliver about a 6%–8% improvement in fuel economy, because less energy is required to accelerate a lighter vehicle.

That efficiency effect scales fast when it spreads across fleets. DOE also estimates that using lightweight components and high-efficiency engines enabled by advanced materials in one quarter of the U.S. fleet could save more than 5 billion gallons of fuel annually by 2030. That kind of “system-level” saving is why carbon fiber—especially standard modulus grades that balance performance and cost—keeps moving from niche to industrial mainstream.

Industry capacity moves show producers are responding to this pull from energy and mobility markets. Toray Composite Materials America announced a 30,000 square foot expansion at Spartanburg, South Carolina, expected to add 3,000 metric tons per year of carbon fiber capacity starting in 2025, highlighting demand tied to “clean energy solutions” and pressure-vessel applications. In Europe, Toray also announced an Abidos, France expansion from 5,000 to 6,000 metric tons per year, with production expected to start in 2025—again focused on regular-tow carbon fibers used heavily in industrial applications.

Government initiatives strengthen the same driver by pushing cost and supply improvements. The U.S. DOE announced up to $11.3 million for projects to advance carbon fiber made from renewable, non-food feedstocks. The goal is to make high-performance carbon fiber more cost-competitive so it can be used more widely in fuel-efficient vehicles and renewable-energy components.

Restraints

Recycling and End-of-Life Challenges Limit Broader Adoption

In practical terms, this means that a large fraction of carbon fiber composite waste — sometimes estimated at about 30% of production — ends up in landfills or underutilized waste streams because it is hard to recover and reuse with quality comparable to virgin material. For industries that could use standard modulus carbon fiber to reduce vehicle weight, improve efficiency, or cut energy use in equipment, this end-of-life challenge adds a hidden cost and environmental burden that can dampen enthusiasm for adoption in large, cost-sensitive markets.

To give a sense of scale, recycled carbon fiber markets are still small relative to overall carbon fiber use: one estimate places the value of recycled carbon fiber at around USD 304.95 million in 2024, even though demand for carbon fiber materials overall is many billions of dollars. That gap reflects not only the performance limitations of recycled fiber but also the high cost and technical difficulty of recycling processes that preserve fiber strength and integrity.

Government and policy efforts are beginning to recognize this constraint, especially because environmental authorities are increasingly concerned about the waste burden from composite materials. For example, the European Union (EU) has introduced policies aimed at reducing carbon fiber waste and encouraging reuse, which signals regulatory pressure on manufacturers to address sustainability across the product lifecycle. However, achieving closed-loop recycling — where reclaimed fibers can meaningfully replace virgin material — remains a work in progress in many regions.

From an industrial point of view, companies that make heavy use of composites, such as aerospace and wind energy producers, are aware that managing end-of-life carbon fiber waste will become increasingly critical over the next decade. Accumulating waste — estimated to involve tens of thousands of tonnes annually — not only creates environmental headaches but also exposes manufacturers to potential future costs if regulatory regimes tighten.

Opportunity

Hydrogen Pressure Vessels Create a Clear Growth Lane

A major growth opportunity for standard modulus carbon fiber is the fast build-out of the hydrogen economy, especially high-pressure storage tanks used in fuel-cell vehicles, tube trailers, and stationary storage. Hydrogen may sound “future-facing,” but it is already a large industrial market: the International Energy Agency reports global hydrogen demand reached more than 97 million tonnes (Mt) in 2023 and could reach almost 100 Mt in 2024. As that demand gradually shifts toward cleaner production and new end uses, storage and transport hardware becomes the practical bottleneck—and that hardware is where carbon fiber is hard to replace.

Europe is a good example of how policy can translate into equipment demand. The EU hydrogen strategy points to a target of 40 GW of renewable hydrogen electrolysers by 2030, linked to 10 million tonnes of renewable hydrogen production. The European Commission also states REPowerEU aims to produce 10 million tonnes and import 10 million tonnes of renewable hydrogen by 2030. If even a portion of these targets materialize, the system will need more compression, storage, and distribution assets—exactly the areas where composite pressure vessels and lightweight containment are most valuable.

In the United States, the policy signal is similarly direct. DOE’s Hydrogen Shot sets an ambition to cut the cost of clean hydrogen by 80% to $1 per kilogram in 1 decade. Lower fuel cost matters because it makes fleets more willing to adopt fuel-cell trucks, buses, and material-handling vehicles—segments that rely heavily on high-pressure tanks. On the infrastructure side, DOE’s Alternative Fuels Data Center reports 54 open retail hydrogen stations in the U.S. as of 2024, with 20+ more in planning or construction. Each station and each vehicle rollout increases demand for dependable, lightweight storage solutions upstream and downstream.

Pressure vessels need high strength and fatigue resistance, but they also need predictable cost at scale. That is why producers are expanding “regular tow” capacity aimed at industrial markets. Toray Composite Materials America, for instance, announced a 30,000 sq. ft. expansion in Spartanburg, South Carolina that is expected to add 3,000 metric tons per year of carbon fiber capacity starting in 2025, explicitly to support pressure-vessel applications like hydrogen tanks. In Europe, Toray announced its Abidos, France site will increase from 5,000 to 6,000 metric tons per year, with production expected to start in 2025.

Regional Insights

APAC leads the standard modulus carbon fiber market with 47.90% share, valued at USD 1.3 Bn supported by robust regional demand

In 2024, the Asia Pacific (APAC) region emerged as the most significant contributor to the global standard modulus carbon fiber market, commanding a dominant 47.9% share and generating approximately USD 1.3 billion in revenue. This leadership was supported by sustained industrial growth across key economies such as China, Japan, and South Korea, where carbon fiber adoption was driven by expansion in automotive manufacturing, aerospace production, and renewable energy installations.

China, in particular, continued to underpin a large portion of regional demand through its extensive electric vehicle (EV) production and aggressive wind power capacity additions, reinforcing APAC’s importance as a hub for lightweight material applications. Regional manufacturers also benefited from cost-effective production capabilities and favorable government policies that promoted advanced material use in infrastructure and transportation projects.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Hexcel Corporation recorded close to USD 1.00 billion in 2024 revenue from carbon fiber and related composite products, accounting for about 9.4% market share. Its specialty in prepreg composites and deep relationships with aerospace OEMs support continued adoption in defense and advanced aircraft programs.

SGL Carbon SE generated around €1.026 billion revenue in 2024, reflecting its strong presence in carbon fiber and composite segments with an estimated ~10.4% market share. The company’s products serve industrial and mobility sectors, supported by global manufacturing sites and tailored pitch-based and continuous fiber solutions.

Mitsubishi Chemical Carbon Fiber & Composites achieved approximately USD 1.05 billion in carbon fiber related revenue in 2024, representing ~10.0% of the global market. The firm’s vertically integrated production from precursor to finished composite materials underpins its competitiveness in aerospace grade fibers and growing demand for lightweight structural components.

Top Key Players Outlook

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Carbon Fiber & Composites

- Hexcel Corporation

- SGL Carbon SE

- Synesqo

- Aksa Carbon

- Hyosung Advanced Materials

- Zhongfu Shenying Carbon Fiber Co., Ltd.

Recent Industry Developments

In 2024, Toray Industries, Inc. continued to reinforce its leadership in the standard modulus carbon fiber sector with a global presence and strong production footprint. The company produced an estimated 64,000 metric tons of carbon fiber capacity by March 2024, with planned expansions expected to increase this to 71,000 metric tons by 2025, highlighting strategic capacity growth in the United States, South Korea, and France to meet rising demand.

In 2024, Teijin Limited strengthened its role in the standard modulus carbon fiber sector by expanding its production and sustainable material initiatives under the Tenax™ brand, with group consolidated revenue near ¥1,032.8 billion (≈ USD 6.6 billion) for the fiscal year ending March 31, 2024, reflecting stable demand for high-performance fibers in aerospace, automotive, industrial and energy applications.

In 2025, Hexcel guided for further sales growth with expected revenue in the range of USD 1.95 billion to USD 2.05 billion, as aircraft production rates and composite adoption continued to recover, supporting market momentum.

Report Scope

Report Features Description Market Value (2024) USD 2.9 Bn Forecast Revenue (2034) USD 5.9 Bn CAGR (2025-2034) 7.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Continuous, Long, Short), By Application (Composites, Non-composites), By End-use (Aerospace And Defense, Wind Energy, Automotive, Sporting Goods, Construction, Pipes And Tanks, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Toray Industries, Inc., Teijin Limited, Mitsubishi Chemical Carbon Fiber & Composites, Hexcel Corporation, SGL Carbon SE, Synesqo, Aksa Carbon, Hyosung Advanced Materials, Zhongfu Shenying Carbon Fiber Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Standard Modulus Carbon Fiber MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Standard Modulus Carbon Fiber MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Carbon Fiber & Composites

- Hexcel Corporation

- SGL Carbon SE

- Synesqo

- Aksa Carbon

- Hyosung Advanced Materials

- Zhongfu Shenying Carbon Fiber Co., Ltd.