Global Sporting Goods Market Size, Share, Growth Analysis By Product Type (Equipment, Apparel, Shoes), By Sales Channel (Specialty Stores, Supermarkets, Online Stores, Independent Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 163151

- Number of Pages: 295

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

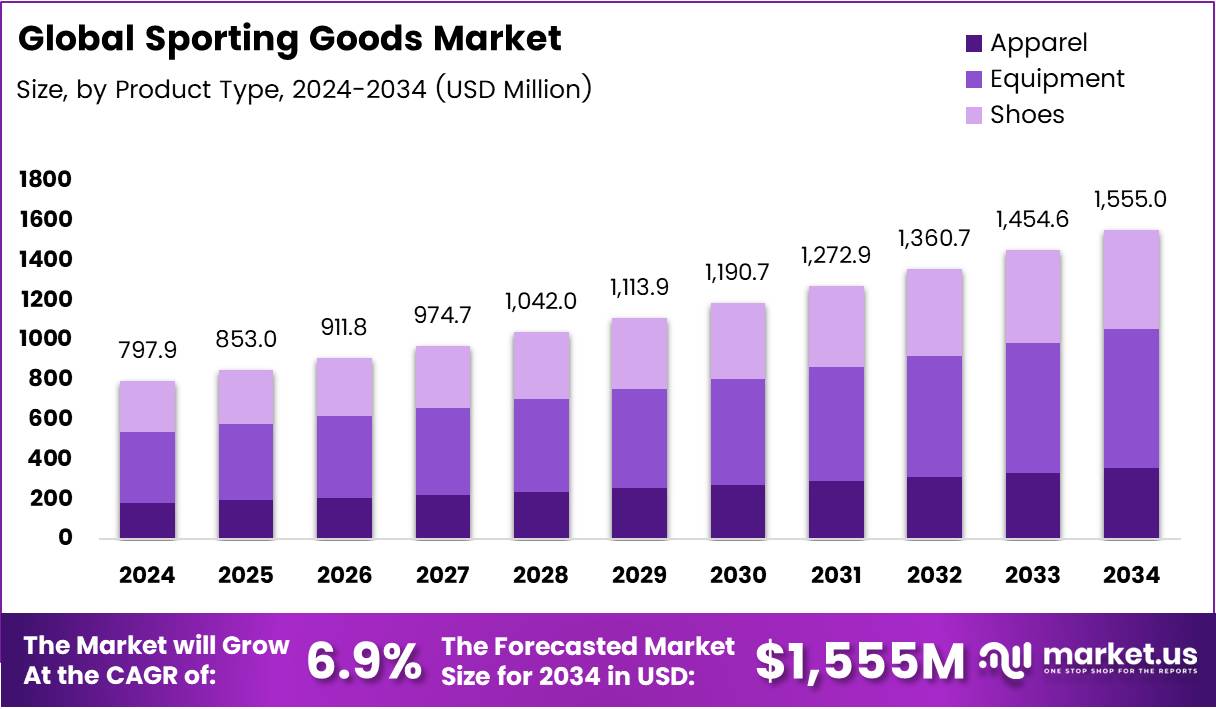

The Global Sporting Goods Market size is expected to be worth around USD 1,555.0 Million by 2034, from USD 797.9 Million in 2024, growing at a CAGR of 6.9% during the forecast period from 2025 to 2034.

The sporting goods market represents a dynamic segment within the global retail landscape, encompassing equipment, apparel, and accessories for sports and fitness activities. It caters to both professional athletes and recreational consumers, driven by growing health consciousness and active lifestyle trends. Moreover, technology integration and material innovation are reshaping product development.

Furthermore, the market’s evolution is supported by digital transformation, expanding online retail channels, and personalized consumer experiences. Brands are increasingly leveraging data analytics to optimize inventory and forecast demand. As fitness becomes a mainstream lifestyle choice, the sporting goods market continues to gain significant traction across both developed and emerging economies.

Additionally, government initiatives promoting physical education and sports infrastructure are creating new growth avenues. Many regions are investing in community sports programs and national fitness campaigns. These policies not only encourage participation but also stimulate product demand, enhancing the long-term sustainability of the sporting goods industry.

At the same time, increasing investments in eco-friendly manufacturing and recycling regulations are transforming market practices. Companies are adopting sustainable materials and transparent supply chains to align with environmental standards. Such regulatory frameworks are fostering consumer trust while positioning sustainability as a central growth driver in the sporting goods sector.

According to an industry report, in the first quarter of 2025, U.S. e-commerce sales for sporting goods, hobby, musical instruments, and books grew by 4.4%, compared to 0.7% growth in 2024. Similarly, in 2023, the EU’s trade in sporting goods with the rest of the world was valued at €18.3 billion, including €7.7 billion in exports and €10.6 billion in imports. These figures highlight steady international demand and cross-border trade potential.

Key Takeaways

- In April 2024, JD Sports Fashion plc entered into a binding agreement to acquire Hibbett, Inc. for about US$1.08 billion, expanding its footprint across the U.S. sports retail landscape and strengthening its omnichannel capabilities in athletic apparel and footwear.

- In April 2024, adidas launched its 2024 Athlete Pack collection featuring 49 footwear designs across 41 sports, reflecting the brand’s focus on innovation and inclusivity ahead of global sporting events, with retail availability from 18 April.

- In June 2024, Stack Athletics introduced its Summer 2024 14-piece apparel collection crafted specifically for pickleball enthusiasts, aiming to blend performance-driven fabrics with lifestyle-oriented designs catering to the sport’s rapidly growing community.

- In July 2024, DICK’S Sporting Goods, Inc. announced an exclusive partnership with Team USA and the LA28 Olympic and Paralympic Games, naming the company as the Official Sporting Goods Retail Provider to enhance its association with elite athletic excellence and community engagement.

By Product Type Analysis

Equipment dominates with 44.9% due to its widespread use in training and professional sports activities.

In 2024, Equipment held a dominant market position in the By Product Type segment of the Sporting Goods Market, with a 44.9% share. The growth is driven by the increasing adoption of advanced sporting tools and gear among athletes and fitness enthusiasts. Additionally, the rising number of sports tournaments and fitness events worldwide fuels equipment demand.

Apparel continues to gain traction owing to growing health consciousness and the rising popularity of athleisure fashion. Consumers are increasingly opting for comfortable and performance-oriented clothing that supports active lifestyles. Moreover, innovations in moisture-wicking fabrics and sustainable materials are further enhancing the appeal of sports apparel.

Shoes represent a vital part of the market as sports footwear evolves with technological innovations. Enhanced cushioning, grip, and durability are key factors driving customer preference. The trend of using sports shoes for casual wear is also expanding the market’s reach, supported by brand endorsements and stylish designs appealing to a wide consumer base.

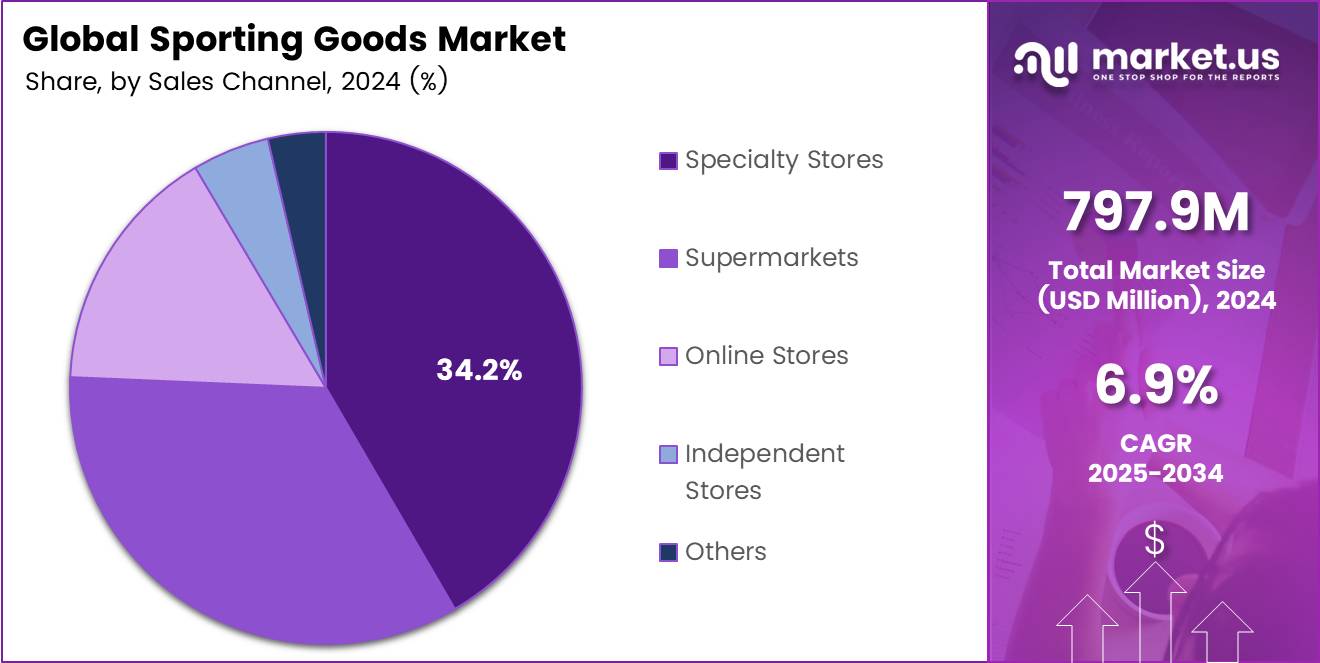

By Sales Channel Analysis

Specialty Stores dominate with 34.2% due to their personalized service and broad product variety.

In 2024, Specialty Stores held a dominant market position in the By Sales Channel segment of the Sporting Goods Market, with a 34.2% share. These outlets attract consumers seeking professional guidance and high-quality sports gear. Their tailored product offerings and in-store experiences strengthen customer loyalty and boost consistent sales growth.

Supermarkets are witnessing stable growth as they offer convenience and competitive pricing. Many consumers prefer purchasing sports goods along with their regular shopping, supported by strategic in-store promotions and easy accessibility. Expansion of supermarket chains in emerging regions is further improving product visibility and sales opportunities.

Online Stores are gaining momentum driven by e-commerce expansion and digital shopping convenience. The ability to compare prices, read reviews, and access a wider product range encourages consumers to shop online. Moreover, online discounts, fast delivery options, and easy return policies are reshaping buying behavior in the sporting goods sector.

Independent Stores continue to serve niche markets, offering personalized services and unique product selections. These outlets often focus on local sporting needs and foster community engagement. However, limited scale and online competition challenge their growth, prompting many to adopt hybrid sales models to sustain profitability.

Others segment includes department stores and direct sales, which collectively contribute to market expansion. These channels benefit from diversified customer bases and brand partnerships. Additionally, seasonal discounts and collaborations with sports events help maintain steady product demand throughout the year.

Key Market Segments

By Product Type

- Equipment

- Apparel

- Shoes

By Sales Channel

- Specialty Stores

- Supermarkets

- Online Stores

- Independent Stores

- Others

Drivers

Rising Global Focus on Health, Fitness, and Active Lifestyles Drives Market Growth

The sporting goods market is expanding as more people worldwide focus on maintaining healthy and active lifestyles. Rising awareness about the benefits of physical fitness and preventive healthcare has encouraged consumers to participate in sports and fitness activities, boosting demand for sports apparel, footwear, and equipment.

E-commerce platforms are also playing a vital role in driving this growth. Online stores offer easy access to a wide range of sporting goods, attractive discounts, and convenient delivery options, which help companies reach a broader audience.

In addition, the increasing number of international sports events and tournaments is fueling the market. Major events like the Olympics, FIFA World Cup, and marathons inspire individuals to engage in sports, further supporting product demand.

Technological advancements, such as smart and connected sports equipment, are also shaping the market. Devices with sensors and performance-tracking features are attracting tech-savvy consumers who want to improve their athletic performance and fitness routines.

Restraints

Fluctuations in Raw Material Prices Impacting Production Costs

The sporting goods market faces challenges due to fluctuating raw material prices, which directly affect manufacturing costs. Materials like rubber, leather, and synthetic fabrics often experience price volatility, making it difficult for producers to maintain stable pricing and profit margins.

Another key restraint is the limited access to sports infrastructure in developing regions. Lack of sports facilities, training centers, and awareness programs restricts consumer participation in physical activities, reducing the potential demand for sporting goods.

Moreover, seasonal demand variations impact sales consistency. Sporting goods such as outdoor equipment and winter sports gear see higher demand during specific seasons, creating revenue fluctuations throughout the year. This uneven sales pattern can challenge inventory management and financial planning for manufacturers and retailers.

Overall, these restraints limit the market’s growth potential, particularly in emerging economies where affordability and access remain key concerns.

Growth Factors

Emerging Demand for Sustainable and Eco-Friendly Sports Products Creates Growth Opportunities

The growing preference for sustainable and eco-friendly products presents new opportunities in the sporting goods market. Consumers are increasingly choosing brands that use recycled materials, biodegradable packaging, and environmentally responsible manufacturing practices.

Expanding into untapped rural and semi-urban areas also offers potential for growth. As incomes rise and awareness about fitness spreads, these regions are expected to become significant markets for affordable and durable sports goods.

Technological integration is another major opportunity. Virtual Reality (VR) and Artificial Intelligence (AI) are being used in sports training, allowing athletes and fitness enthusiasts to monitor performance and improve skills through digital simulations and data-driven insights.

Furthermore, collaborations with fitness influencers and online communities help brands strengthen their digital presence. Social media marketing and influencer partnerships create stronger customer engagement and brand loyalty, especially among younger consumers.

Emerging Trends

Rise of Athleisure as a Lifestyle and Fashion Trend Fuels Market Expansion

Athleisure has become one of the most significant trends in the sporting goods market, blending comfort and style in everyday wear. Consumers now prefer apparel that serves both fitness and casual purposes, boosting demand for versatile sportswear.

Personalized and customizable sports gear is also trending. Many brands allow customers to design products with unique colors, names, and features, enhancing customer satisfaction and loyalty.

The rising popularity of home-based fitness equipment is another key trend. With busy lifestyles and remote work becoming more common, consumers are investing in home gyms and compact fitness tools to stay active without visiting gyms.

Lastly, wearable fitness technology such as smartwatches and performance trackers is gaining traction. These devices help users monitor their heart rate, calories burned, and workout progress, driving innovation and integration between sports equipment and digital health technology.

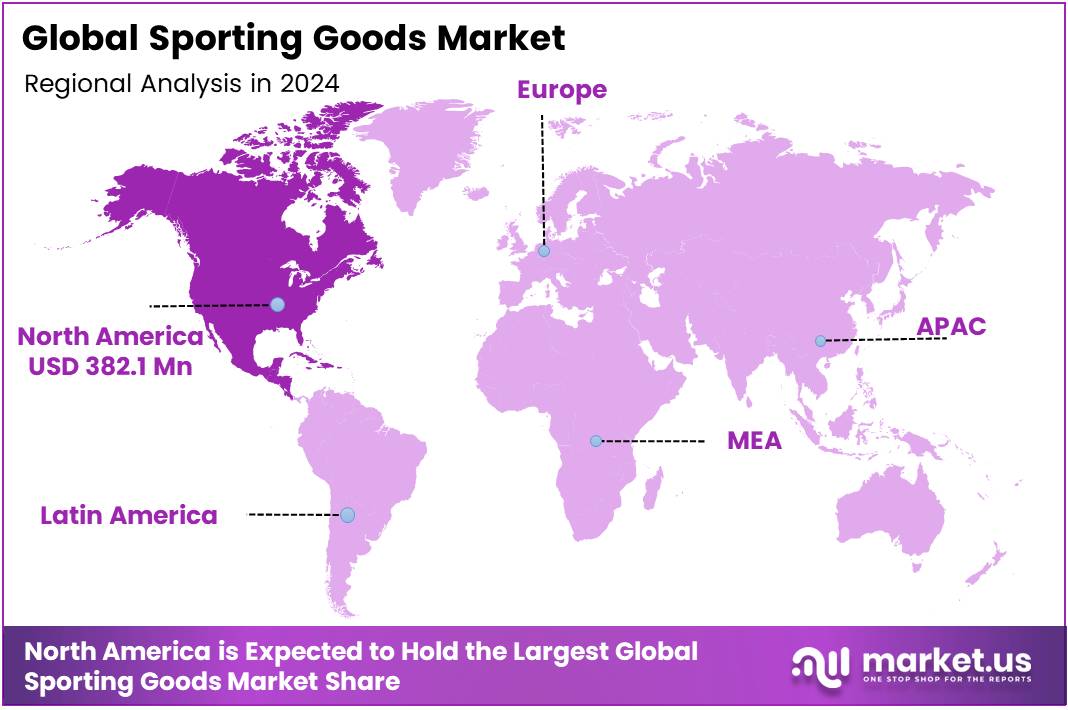

Regional Analysis

North America Dominates the Sporting Goods Market with a Market Share of 47.9%, Valued at USD 382.1 Million

North America holds the leading position in the global sporting goods market, accounting for a substantial 47.9% share and valued at USD 382.1 million in 2024. The region benefits from strong consumer participation in fitness and recreational activities, advanced retail infrastructure, and high brand penetration. Growing health awareness and government initiatives promoting physical well-being continue to propel product sales across categories such as outdoor gear, athletic apparel, and performance equipment.

Europe Sporting Goods Market Trends

Europe represents a mature market with a strong focus on sustainability and innovation in sportswear and equipment design. The region emphasizes eco-friendly materials and circular manufacturing processes, aligning with EU environmental policies. Additionally, rising popularity of community sports and wellness programs supports steady market expansion.

Asia Pacific Sporting Goods Market Trends

Asia Pacific is witnessing rapid growth driven by expanding middle-class populations, urbanization, and rising disposable incomes. Countries such as China, Japan, and India are fostering sports culture through large-scale events and fitness initiatives. Moreover, the e-commerce boom across the region significantly enhances accessibility and affordability of sporting products.

Middle East and Africa Sporting Goods Market Trends

The Middle East and Africa market is evolving as governments invest in sports infrastructure and international sporting events. Growing interest in fitness clubs, youth sports, and adventure tourism has accelerated demand. Furthermore, the adoption of Western fitness trends and premium brand awareness contribute to positive market development.

Latin America Sporting Goods Market Trends

Latin America shows steady market progress supported by rising participation in football, cycling, and outdoor sports. Increasing health consciousness, coupled with government sports funding programs, fosters local industry expansion. Additionally, digital retail penetration and brand collaborations are enhancing product visibility and consumer engagement.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Sporting Goods Company Insights

Adidas AG is focused on performance-driven apparel and footwear, with growing emphasis on training, running, and lifestyle crossover products. The brand continues to lean into athlete partnerships and limited-edition drops to protect pricing power. At the same time, it is sharpening inventory control and channel discipline to recover margins in key regions such as North America and Europe.

Nike, Inc. continues to set the tone in the global sporting goods market through product innovation, digital engagement, and direct-to-consumer scaling. The company is expanding membership ecosystems and data-led personalization to drive repeat purchases across footwear, apparel, and connected fitness. Its strategy prioritizes premium positioning, speed-to-market, and tighter control of wholesale exposure to defend brand equity.

Under Armour, Inc. remains heavily associated with high-performance training and compression gear, while working to re-center its brand on core athletes rather than broad lifestyle fashion. The company is focusing on technical apparel, recovery-oriented materials, and sport-specific innovation in categories like running and gym performance. This repositioning aims to lift full-price sell-through and stabilize its North America business.

PUMA SE continues to benefit from its ability to blend sport performance with streetwear aesthetics, especially in football, running, and athleisure. The brand is targeting younger consumers with accessible pricing versus ultra-premium competitors, while using collaborations and sponsored athletes to stay culturally relevant. PUMA’s balanced regional footprint and focus on speed in product cycles support resilience in a competitive 2024 market environment.

Top Key Players in the Market

- Adidas AG

- Nike, Inc.

- Under Armour, Inc.

- PUMA SE

- AMER Sports

- Admiral Sportswear Limited

- Diadora S.p.A.

- Ellesse

- ODLO International AG

- Hummel International Sport & Leisure A/S

- Fila Holdings Corp.

Recent Developments

- In April 2024, JD Sports Fashion plc entered into a binding agreement to acquire Hibbett, Inc. for about US$1.08 billion, expanding its footprint across the U.S. sports retail landscape and strengthening its omnichannel capabilities in athletic apparel and footwear.

- In April 2024, adidas launched its “2024 Athlete Pack” collection featuring 49 footwear designs across 41 sports, reflecting the brand’s focus on innovation and inclusivity ahead of global sporting events, with retail availability from 18 April.

- In June 2024, Stack Athletics introduced its Summer 2024 14-piece apparel collection crafted specifically for pickleball enthusiasts, aiming to blend performance-driven fabrics with lifestyle-oriented designs catering to the sport’s rapidly growing community.

- In July 2024, DICK’S Sporting Goods, Inc. announced an exclusive partnership with Team USA and the LA28 Olympic and Paralympic Games, naming the company as the “Official Sporting Goods Retail Provider” to enhance its association with elite athletic excellence and community engagement.

Report Scope

Report Features Description Market Value (2024) USD 797.9 Million Forecast Revenue (2034) USD 1,555.0 Million CAGR (2025-2034) 6.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Equipment, Apparel, Shoes), By Sales Channel (Specialty Stores, Supermarkets, Online Stores, Independent Stores, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Adidas AG, Nike, Inc., Under Armour, Inc., PUMA SE, AMER Sports, Admiral Sportswear Limited, Diadora S.p.A., Ellesse, ODLO International AG, Hummel International Sport & Leisure A/S, Fila Holdings Corp. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Adidas AG

- Nike, Inc.

- Under Armour, Inc.

- PUMA SE

- AMER Sports

- Admiral Sportswear Limited

- Diadora S.p.A.

- Ellesse

- ODLO International AG

- Hummel International Sport & Leisure A/S

- Fila Holdings Corp.