Global Spinning Machinery Market Size, Share, Growth Analysis By Machine Type (Ring Spinning Machine, Rotor/Open-End Spinning Machine, Air-Jet Spinning Machine, Vortex/Compact Spinning Machine, Others), By Fiber Type (Synthetic Fibers, Natural Fibers, Recycled/Regenerated Fibers), By Automation Level (Semi-Automatic, Manual, Automatic), By Application (Apparel & Fashion, Home & Household Textiles, Technical & Industrial Textiles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 175639

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

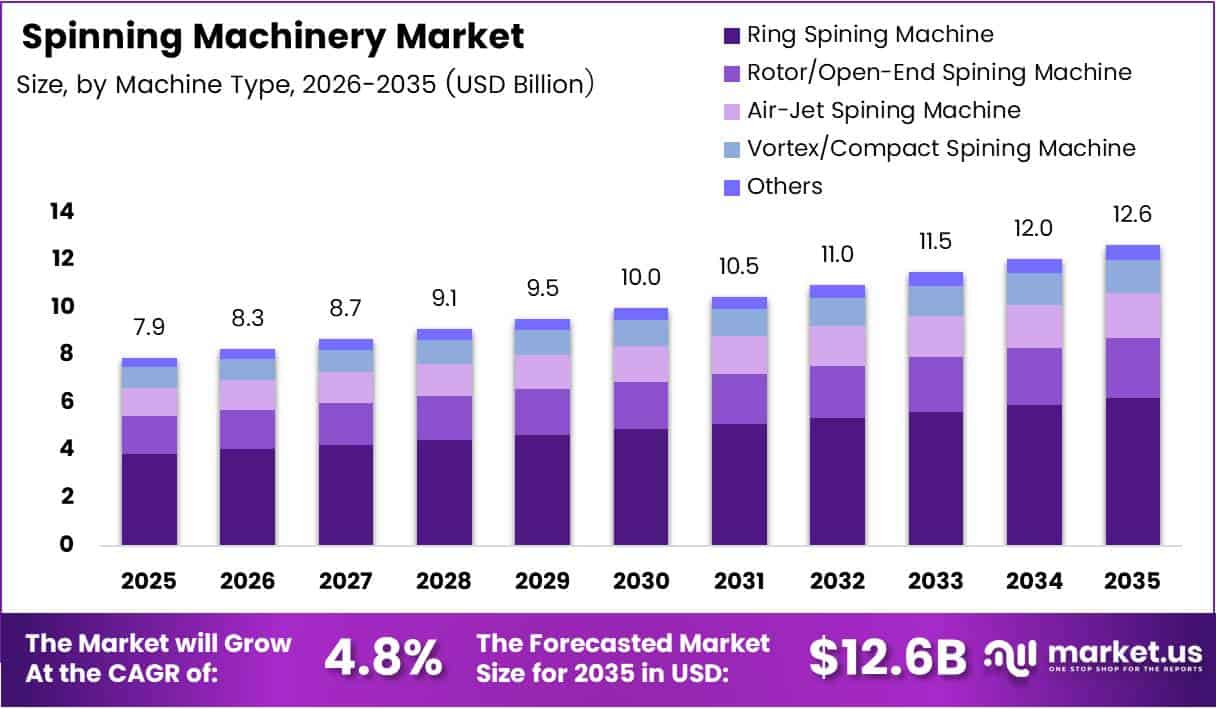

Global Spinning Machinery Market size is expected to be worth around USD 12.6 Billion by 2035 from USD 7.98 Billion in 2025, growing at a CAGR of 4.8% during the forecast period 2026 to 2035.

Spinning machinery transforms raw textile fibers into yarn through mechanical processes. These systems include ring spinning frames, rotor machines, and air-jet units that serve apparel, home textile, and industrial fabric manufacturers. Modern spinning equipment integrates automation technologies to enhance production efficiency and yarn consistency.

The market experiences steady expansion driven by capacity additions in integrated textile plants. Manufacturers upgrade aging infrastructure to meet export quality standards and operational efficiency requirements. Additionally, automation adoption addresses skilled labor shortages while improving production consistency across spinning operations.

Government incentive programs accelerate investments in domestic yarn production facilities. These initiatives reduce import dependence and strengthen regional textile supply chains. Consequently, spinning machinery suppliers benefit from sustained demand across emerging manufacturing economies seeking production modernization.

According to Textile Technicals, a typical ring spinning unit with 20,000 spindles requires approximately 2 megawatts (MW) of connected electrical power. This power requirement highlights the energy intensity of spinning operations and drives demand for energy-efficient machinery solutions that reduce operational costs.

Moreover, Rieter demonstrates significant progress in energy optimization. In October 2025, Rieter reported advancing its strategy while expecting regulatory approvals for the Barmag Division acquisition in the fourth quarter of 2025. This strategic move strengthens Rieter’s position across natural and manmade fiber spinning systems.

According to Rieter, energy consumption in ring spinning systems targets a 15% reduction by 2025 compared with 2021 technology levels. These efficiency improvements address rising energy costs and environmental sustainability requirements. Therefore, spinning machinery manufacturers prioritize innovative designs that deliver lower power consumption per kilogram of yarn produced.

Digital monitoring platforms transform spinning mill operations through real-time visibility. According to Metal Spun, smart sensors and IoT-based energy monitoring systems in spinning mills show 10-20% energy savings versus manual operations. These technologies optimize machine loads and drive configurations to minimize electricity consumption throughout production cycles.

Key Takeaways

- Global Spinning Machinery Market valued at USD 7.98 Billion in 2025, projected to reach USD 12.6 Billion by 2035 at 4.8% CAGR

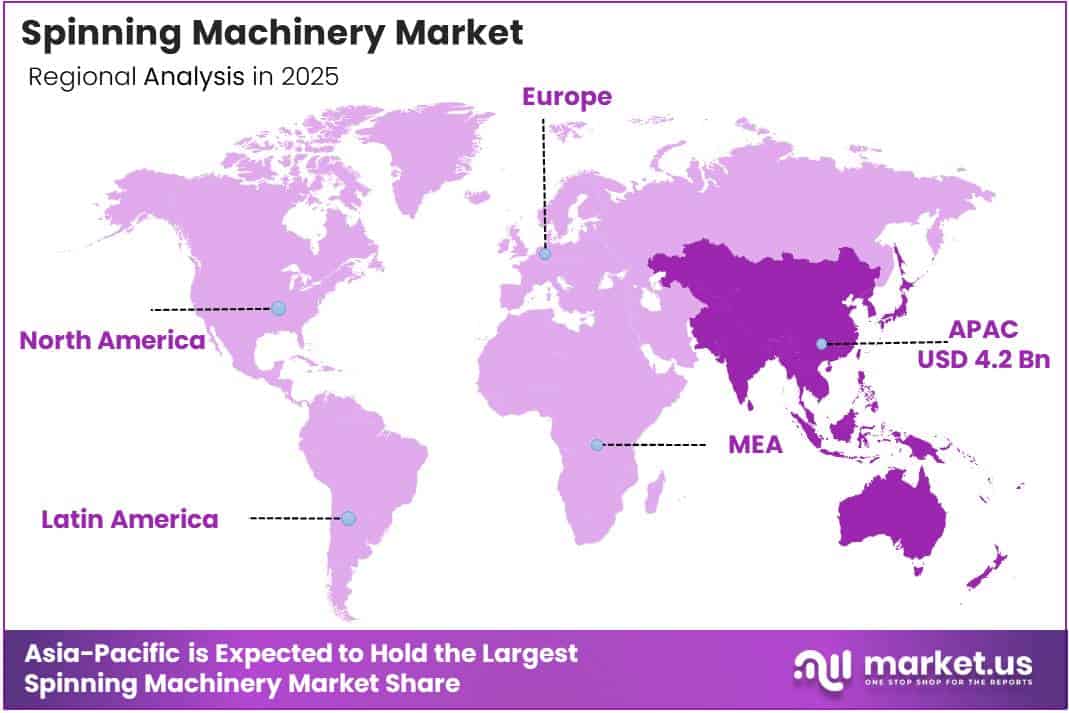

- Asia-Pacific dominates with 52.83% market share, valued at USD 4.2 Billion

- Ring Spinning Machines lead By Machine Type segment with 46.78% share

- Synthetic Fibers segment holds 61.83% dominance in By Fiber Type category

- Semi-Automatic machinery captures 48.34% share in By Automation Level segment

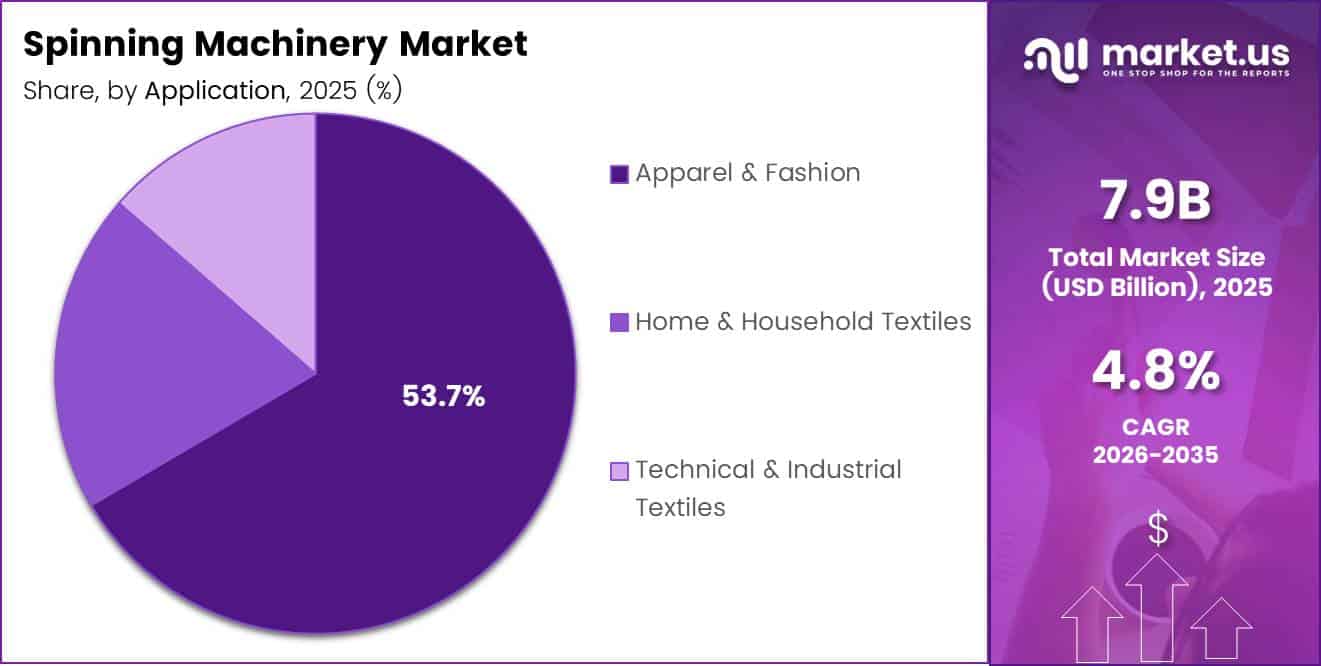

- Apparel & Fashion applications account for 53.72% market share

Machine Type Analysis

Ring Spinning Machine dominates with 46.78% due to proven reliability and versatile yarn production capabilities.

In 2025, Ring Spinning Machine held a dominant market position in the By Machine Type segment of Spinning Machinery Market, with a 46.78% share. These machines produce high-quality yarn suitable for diverse textile applications. Moreover, ring spinning technology offers flexibility across fiber types and yarn counts, making it the preferred choice for integrated textile manufacturers worldwide.

Rotor/Open-End Spinning Machine serves producers requiring high-speed yarn production with lower labor inputs. These systems deliver coarser yarn grades at significantly faster production rates compared to ring spinning. However, rotor spinning finds primary application in home textiles and industrial fabrics where yarn quality specifications are less stringent than apparel requirements.

Air-Jet Spinning Machine represents advanced technology offering exceptional productivity through pneumatic yarn formation processes. These machines eliminate traditional spindle and traveler components, reducing maintenance requirements. Additionally, air-jet systems produce unique yarn characteristics suited for technical textile applications where specific performance properties are essential.

Vortex/Compact Spinning Machine delivers enhanced yarn quality through improved fiber alignment and twist insertion mechanisms. These specialized systems produce yarn with superior strength and reduced hairiness. Furthermore, compact spinning technology addresses premium apparel segments where fabric appearance and performance justify investment in advanced spinning equipment.

Fiber Type Analysis

Synthetic Fibers dominates with 61.83% due to abundant availability, consistent properties, and growing polyester textile demand.

In 2025, Synthetic Fibers held a dominant market position in the By Fiber Type segment of Spinning Machinery Market, with a 61.83% share. Polyester and nylon fibers drive this segment through consistent quality and competitive pricing. Consequently, synthetic fiber spinning supports mass-market apparel production and technical textile manufacturing where performance characteristics outweigh natural fiber preferences.

Natural Fibers maintain significant market presence through cotton and wool yarn production for traditional textile applications. These fibers deliver comfort properties and aesthetic characteristics valued in premium apparel segments. However, natural fiber spinning requires specialized machinery configurations to handle variable fiber properties and moisture management requirements throughout production processes.

Recycled/Regenerated Fibers represent growing segment driven by sustainability initiatives and circular economy principles in textile manufacturing. These materials include mechanically recycled polyester and chemically regenerated cellulosic fibers. Moreover, spinning machinery manufacturers adapt equipment specifications to accommodate recycled fiber characteristics, supporting environmental responsibility goals while maintaining yarn quality standards.

Automation Level Analysis

Semi-Automatic machinery dominates with 48.34% due to balanced investment requirements and operational flexibility for diverse production environments.

In 2025, Semi-Automatic machinery held a dominant market position in the By Automation Level segment of Spinning Machinery Market, with a 48.34% share. These systems combine automated core functions with manual supervision capabilities. Therefore, semi-automatic equipment serves manufacturers transitioning from conventional operations while managing capital expenditure constraints in emerging textile economies.

Manual spinning machinery continues serving small-scale producers and specialty yarn manufacturers requiring flexible production capabilities. These conventional systems demand higher labor inputs but offer lower initial investment thresholds. However, manual operations face increasing pressure from labor cost escalation and quality consistency requirements in export-oriented textile production.

Automatic spinning systems deliver maximum productivity through fully integrated digital controls and minimal human intervention requirements. These advanced installations optimize yarn quality consistency and operational efficiency. Additionally, automatic machinery addresses skilled labor shortages while enabling predictive maintenance capabilities that reduce unplanned downtime across high-volume spinning operations.

Application Analysis

Apparel & Fashion dominates with 53.72% due to continuous global demand for clothing textiles and fashion industry consumption patterns.

In 2025, Apparel & Fashion held a dominant market position in the By Application segment of Spinning Machinery Market, with a 53.72% share. This segment encompasses yarn production for woven and knitted garments across all market tiers. Consequently, apparel manufacturers drive spinning machinery demand through capacity expansions supporting fast-fashion business models and seasonal collection requirements.

Home & Household Textiles generate substantial spinning machinery demand through bed linens, upholstery fabrics, and decorative textile production. These applications require specific yarn characteristics balancing durability with aesthetic properties. Moreover, home textile manufacturers invest in spinning equipment producing coarser yarn counts suitable for heavier fabric constructions used in residential and commercial interior applications.

Technical & Industrial Textiles represent specialized segment requiring advanced yarn properties for automotive, medical, geotextile, and protective fabric applications. These products demand precise yarn specifications including high tensile strength and dimensional stability. Therefore, technical textile producers select spinning machinery capable of processing specialized fiber blends while maintaining stringent quality control standards throughout production operations.

Key Market Segments

By Machine Type

- Ring Spinning Machine

- Rotor/Open-End Spinning Machine

- Air-Jet Spinning Machine

- Vortex/Compact Spinning Machine

- Others (Blow-room, Carding, Draw-frame, Comber, Winder)

By Fiber Type

- Synthetic Fibers

- Natural Fibers

- Recycled/Regenerated Fibers

By Automation Level

- Semi-Automatic

- Manual

- Automatic

By Application

- Apparel & Fashion

- Home & Household Textiles

- Technical & Industrial Textiles

Drivers

Rising Automation Adoption and Infrastructure Modernization Drive Market Expansion

Integrated textile plants accelerate capacity expansion programs to capture growing yarn demand from downstream manufacturers. These facilities install multiple spinning lines simultaneously to achieve economies of scale. Moreover, expansion projects incorporate latest machinery technologies that deliver improved productivity and reduced per-unit manufacturing costs compared to aging equipment.

Automation addresses critical skilled labor shortages affecting spinning operations across major textile producing regions. Modern spinning systems reduce dependence on manual intervention through digital controls and self-monitoring capabilities. In September 2025, Saurer unveiled next-generation spinning solutions at ITMA ASIA + CITME 2025, highlighting automated systems like Can-AGV Hunter S1 to boost efficiency and flexibility across spinning operations.

Export-oriented producers upgrade spinning infrastructure to meet international quality standards and customer specifications. Consistent yarn properties become essential competitive differentiators in global textile markets. Therefore, manufacturers replace conventional equipment with advanced spinning systems that minimize quality variations and production defects throughout extended production runs.

Restraints

High Capital Requirements and Cost Volatility Limit Market Adoption

Advanced spinning installations demand substantial capital expenditure that challenges small and medium textile manufacturers. Complete spinning lines require investments ranging from several million to tens of millions of dollars depending on capacity and automation levels. Consequently, many producers delay modernization projects due to financing constraints and limited access to affordable industrial credit facilities.

Extended payback periods complicate investment decisions when fiber and energy costs exhibit significant volatility. Spinning machinery investments typically require five to seven years for full cost recovery under stable operating conditions. However, fluctuating raw material prices and electricity tariffs extend these timelines, reducing investment attractiveness for risk-averse textile manufacturers.

Volatile energy costs directly impact spinning operation profitability since electricity represents major variable expense component. Power price fluctuations create uncertainty in production cost projections and margin calculations. Therefore, manufacturers hesitate committing to large-scale spinning capacity additions when energy market conditions remain unpredictable across key textile manufacturing regions.

Growth Factors

Technological Innovation and Policy Support Accelerate Market Development

Compact spinning systems gain adoption in space-constrained facilities seeking productivity improvements without major building expansions. These technologies integrate additional fiber alignment stages within conventional spinning frame footprints. Moreover, compact spinning delivers enhanced yarn quality characteristics that command premium pricing in high-value apparel and technical textile applications.

Government incentive schemes stimulate textile manufacturing investments through subsidies, tax benefits, and infrastructure support programs. These policies encourage domestic yarn production capacity additions that reduce import dependence. In May 2025, Rieter signed a definitive agreement to acquire Barmag from OC Oerlikon to strengthen its spinning machinery portfolio, with a transaction value of CHF 713 million.

Machinery compatibility with recycled and blended fibers becomes critical differentiator as sustainability pressures intensify across textile supply chains. Spinning equipment manufacturers develop adaptable systems processing variable fiber inputs while maintaining consistent yarn quality. Additionally, domestic yarn production expansion reduces regional import dependence, particularly in emerging economies building integrated textile manufacturing ecosystems to capture greater value chain participation.

Emerging Trends

Digital Technologies and Efficiency Innovations Transform Spinning Operations

Digital monitoring platforms integrate across spinning mills to provide real-time visibility into machine performance and production metrics. These systems enable predictive maintenance strategies that minimize unplanned downtime and optimize spare parts inventory management. Furthermore, data analytics identify process optimization opportunities that improve overall equipment effectiveness throughout spinning operations.

Energy-efficient spindle and drive technologies reduce electricity consumption while maintaining or exceeding production output levels. Modern spinning frames incorporate variable frequency drives and optimized mechanical designs that lower power requirements per kilogram of yarn produced. According to Textile Technicals, energy use dropped from 39.5 kWh to 37.3 kWh during yarn production when comparing ring spinning frames with plastic versus metallic cylinder components.

Modular spinning line configurations provide flexible production planning capabilities that respond quickly to changing market demands. These systems allow phased capacity additions and product mix adjustments without complete production line shutdowns. Additionally, smart sensors enable real-time yarn defect detection through automated quality monitoring that identifies and removes substandard output before it reaches downstream processing stages.

Regional Analysis

Asia-Pacific Dominates the Spinning Machinery Market with a Market Share of 52.83%, Valued at USD 4.2 Billion

Asia-Pacific commands the global spinning machinery market through concentrated textile manufacturing in China, India, Bangladesh, and Vietnam. The region hosts integrated production ecosystems spanning fiber production through finished garment manufacturing. Moreover, government policies supporting textile industrialization and competitive labor costs drive sustained spinning capacity expansion across multiple countries. The region’s 52.83% market share, valued at USD 4.2 Billion, reflects its dominant position in global yarn production and ongoing infrastructure modernization programs.

North America Spinning Machinery Market Trends

North America maintains focused spinning machinery demand through technical textile production and specialized yarn manufacturing. The region emphasizes automation and advanced technologies that offset higher labor costs. Additionally, reshoring initiatives and nearshoring strategies drive selective capacity additions serving automotive, medical, and industrial textile applications requiring proximity to end-use markets.

Europe Spinning Machinery Market Trends

Europe focuses on high-value spinning applications including technical textiles and premium apparel yarns. The region prioritizes sustainability and energy efficiency in machinery selection decisions. Furthermore, European manufacturers invest in automation technologies that maintain competitiveness despite elevated operating costs compared to Asian production locations serving similar market segments.

Latin America Spinning Machinery Market Trends

Latin America experiences moderate spinning machinery demand concentrated in Brazil and Mexico serving regional apparel and home textile markets. The region benefits from trade agreements facilitating textile exports to North American markets. However, economic volatility and financing constraints limit large-scale capacity expansion projects across multiple countries throughout the region.

Middle East & Africa Spinning Machinery Market Trends

Middle East & Africa demonstrates growing spinning machinery adoption through cotton-producing nations developing integrated textile value chains. The region invests in modern spinning capacity to process domestic fiber production and reduce raw material exports. Additionally, government industrialization programs support textile manufacturing development as economic diversification strategy away from resource-dependent growth models.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

Rieter leads the global spinning machinery market through comprehensive product portfolios spanning blow-room through winding systems. The company delivers integrated spinning solutions combining mechanical equipment with digital automation platforms. Moreover, Rieter emphasizes energy efficiency and sustainability in machinery design, targeting 15% energy consumption reduction in ring spinning systems by 2025 compared with 2021 technology levels through optimized drives and mechanical configurations.

Saurer Intelligent Technology AG provides advanced spinning and twisting systems serving natural and synthetic fiber processing applications. The company focuses on automation technologies that enhance production efficiency and reduce manual intervention requirements. Additionally, Saurer develops modular equipment configurations enabling flexible production planning across varying yarn specifications and customer requirements in competitive textile markets.

Toyota Industries leverages automotive engineering expertise to deliver precision spinning machinery combining mechanical reliability with advanced control systems. The company serves Asian markets through its Kirloskar Toyota partnership providing localized support and service capabilities. Furthermore, Toyota Industries emphasizes quality consistency and operational efficiency in equipment design addressing export-oriented textile manufacturer requirements.

LMW Limited serves the Indian subcontinent and emerging markets with cost-effective spinning machinery solutions balancing performance capabilities with accessible pricing. The company provides comprehensive after-sales support including spare parts availability and technical service networks. Moreover, LMW develops equipment specifications aligned with regional power infrastructure and operator skill levels prevalent across developing textile manufacturing economies.

Key Players

- Rieter

- Saurer Intelligent Technology AG

- Toyota Industries (Kirloskar Toyota)

- LMW Limited

- Trützschler Group SE

- Murata Machinery Ltd.

- Savio Macchine Tessili SpA

- Marzoli Machines Textile S.r.l.

- A.T.E. Pvt Ltd

- RIFA

- Jingwei Textile Machinery

- Other Key Players

Recent Developments

- September 2025 – Rieter showcased automated and digitized spinning solutions at ITMA ASIA + CITME 2025, including the OMEGAlap E 40 combing machine, NEO-BD precision winding machine, J 70 air-jet spinning machine, and energy-saving eNASA spindle. The company highlighted its strategy toward fully automated spinning mills featuring efficient bale transport, automated can transport, and fully automatic packaging systems to enhance operational efficiency.

- September 2025 – Saurer unveiled next-generation spinning and twisting solutions at ITMA ASIA + CITME 2025, highlighting the Zinser 51 ring-spinning machine with advanced Zpact FX drafting system and Autocoro 11 rotor station with Duo Sliver Feeding. The exhibition demonstrated automated systems including Can-AGV Hunter S1 to boost production efficiency and operational flexibility across integrated spinning operations.

- October 2025 – Egypt’s KTE signed a major contract at ITMA ASIA + CITME Singapore to adopt Saurer’s advanced ring-spinning and automation systems, including Autospeed roving frames and Zinser machines. The agreement incorporated BTS automation solutions designed to improve production throughput and reduce manual material handling requirements across spinning facility operations.

- May 2025 – Rieter signed a definitive agreement to acquire Barmag from OC Oerlikon to strengthen its spinning machinery portfolio across natural and manmade fiber systems. The strategic transaction valued at CHF 713 million expands Rieter’s capabilities in filament spinning technologies and broadens its customer base across synthetic fiber processing applications.

- October 2025 – Rieter reported significant progress in its strategic initiatives and confirmed expectations for regulatory approvals for the Barmag Division acquisition in the fourth quarter of 2025. The company provided investor updates on integration planning and anticipated synergies from combining complementary spinning technology portfolios across staple and filament yarn production systems.

- January 2024 – Rieter acquired Petit Spare Parts SAS, expanding its after-sales support network for spinning and textile machines across 25 service stations. The acquisition strengthened service capabilities enabling faster spare parts availability and technical support response times for spinning machinery customers throughout European and emerging markets.

- November 2024 – Rieter increased its stake in Prosino S.r.l., a ring component manufacturer, from 49% to 60%, strengthening its portfolio of high-quality ring spinning components. The expanded ownership provides greater control over critical component supply chains and enhances integration of advanced ring and traveler technologies into Rieter spinning systems.

Report Scope

Report Features Description Market Value (2025) USD 7.98 Billion Forecast Revenue (2035) USD 12.6 Billion CAGR (2026-2035) 4.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machine Type (Ring Spinning Machine, Rotor/Open-End Spinning Machine, Air-Jet Spinning Machine, Vortex/Compact Spinning Machine, Others), By Fiber Type (Synthetic Fibers, Natural Fibers, Recycled/Regenerated Fibers), By Automation Level (Semi-Automatic, Manual, Automatic), By Application (Apparel & Fashion, Home & Household Textiles, Technical & Industrial Textiles) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Rieter, Saurer Intelligent Technology AG, Toyota Industries (Kirloskar Toyota), LMW Limited, Trützschler Group SE, Murata Machinery Ltd., Savio Macchine Tessili SpA, Marzoli Machines Textile S.r.l., A.T.E. Pvt Ltd, RIFA, Jingwei Textile Machinery, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Rieter

- Saurer Intelligent Technology AG

- Toyota Industries (Kirloskar Toyota)

- LMW Limited

- Trützschler Group SE

- Murata Machinery Ltd.

- Savio Macchine Tessili SpA

- Marzoli Machines Textile S.r.l.

- A.T.E. Pvt Ltd

- RIFA

- Jingwei Textile Machinery

- Other Key Players