Global Specialty Polymers Market By Product Type (Specialty Elastomers, Specialty Thermoplastics, Specialty Thermosets, and Others), By Source (Synthetic, and Natural), By End-Use (Transport, Building And Construction, Medical And Healthcare, Electrical And Electronics, Textile, Food And Beverage, Cosmetics And Personal Care, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175024

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

Global Specialty Polymers Market size is expected to be worth around USD 80.2 Billion by 2034, from USD 48.3 Billion in 2024, growing at a CAGR of 5.2% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 42.3% share, holding USD 75.7 Billion in revenue.

Specialty polymers are high-performance materials engineered to provide specific, advanced properties for niche or demanding applications. Unlike commodity polymers, such as standard polyethylene used for grocery bags, specialty polymers are often produced in smaller volumes and tailored for extreme environments.

- According to the U.S. Department of Energy, a 10% reduction in vehicle weight yields a 6%–8% improvement in fuel economy. As the regulations revolving around fuel efficiency grow more stringent, there will be a consistent demand for lightweight materials in the automotive sector.

The specialty polymers market is characterized by advanced materials designed to meet high-performance requirements across diverse industries, including transportation, healthcare, electronics, and aerospace. The transport sector is the largest consumer, with polymers playing a crucial role in enhancing vehicle performance, fuel efficiency, and safety. The aerospace and automotive industries rely on specialty polymers for components such as lightweight body panels, engine parts, and high-performance coatings.

- According to an analysis, the chemical and refining industries, which include polymer production, accounted for 59% of U.S. manufacturing greenhouse gas emissions in 2021. Similarly, in the EU, manufacturing processes alone were responsible for 58% of the plastics value chain’s climate impact in 2022.

While other sectors, such as healthcare and electronics, utilize specialty polymers, their adoption is less widespread due to specific application needs or regulatory complexities. Geopolitical tensions, such as supply chain disruptions, have added challenges, particularly in raw material sourcing. Furthermore, the rise of biopolymers and smart polymers offers new opportunities, driven by increasing demand for sustainable and adaptive materials. The specialty polymers are integral to technological innovation across various industries.

- China’s Ministry of Industry and Information Technology (MIIT) has mandated an average annual increase of over 5% in petrochemical added value for the 2025–2026 period, specifically targeting breakthroughs in high-end polyolefin and electronic chemicals.

Key Takeaways

- The global specialty polymers market was valued at USD 48.3 billion in 2024.

- The global specialty polymers market is projected to grow at a CAGR of 5.2% and is estimated to reach USD 80.2 billion by 2034.

- Based on the specialty polymers type, anionic Specialty Polymers dominated the market, with 44.2% of the total global market.

- On the basis of the source of the Specialty Polymers systems, the synthetic Specialty Polymers held a major share of the market, around 78.4%.

- Among the applications, the home care & detergents sector emerged as a major segment in the specialty polymers market, with a substantial market share of 36.8%.

- In 2024, the Asia Pacific was the most dominant region in the specialty polymers market, accounting for 42.3% of the total global consumption.

Specialty Polymers Type Analysis

Specialty Thermoplastics Polymers Held a Major Share in the Market.

The specialty polymers market is segmented based on the specialty polymers types into specialty elastomers, specialty thermoplastics, specialty thermosets, and others. The specialty thermoplastics polymers dominated the market, comprising 33.2% of the market share. Thermoplastics can be melted and reprocessed multiple times, making them highly adaptable to various manufacturing methods, such as injection molding and extrusion. This reusability reduces production costs and supports mass production.

Additionally, thermoplastics offer excellent mechanical properties, including strength, durability, and impact resistance, which are crucial for applications in automotive, aerospace, and electronics. In contrast, specialty elastomers, while offering flexibility and resilience, require more complex curing processes, and thermosets, once cured, cannot be reprocessed, limiting their flexibility in manufacturing. These factors make thermoplastics a preferred choice in many industries.

Source Analysis

Synthetic Specialty Polymers Emerged as a Leading Segment in the Market.

On the basis of source, the specialty polymers market is segmented into synthetic, and natural Approximately 84.1% of the specialty polymers market revenue is generated by synthetic polymers, primarily due to their superior control over material properties, consistency, and scalability. Synthetic polymers can be engineered to meet precise performance requirements, which makes them more versatile across a wide range of industries.

Additionally, the manufacturing process for synthetic polymers allows for high reproducibility, ensuring uniformity in quality and performance. In contrast, natural and semisynthetic polymers, derived from renewable resources such as plant-based materials, often face variability in raw material quality, which can affect performance consistency. Additionally, the processing and modification of natural polymers can be more complex and less efficient compared to synthetic alternatives, limiting their widespread adoption.

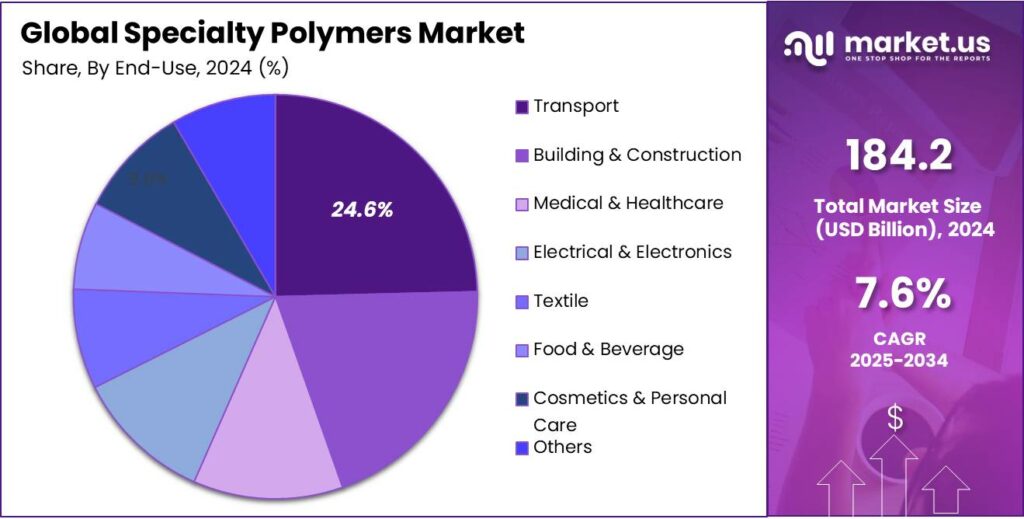

End-Use Analysis

The Transport Sector is a Prominent Segment in the Specialty Polymers Market.

The specialty polymers market is segmented on the end-use into transport, building & construction, medical & healthcare, electrical & electronics, textile, food & beverage, cosmetics & personal care, and others. The transport sector led the market, constituting 24.6% of the market share. Most specialty polymers are used in the transport sector as this industry demands high-performance materials for improving safety, efficiency, and sustainability.

Specialty polymers, such as lightweight composites, high-strength thermoplastics, and heat-resistant materials, are essential for reducing vehicle weight, improving fuel efficiency, and enhancing durability. In the transport sector, polymers are integral for applications such as engine components, body panels, and fuel systems, where performance under extreme conditions is critical.

While specialty polymers are used in other sectors such as healthcare, electronics, and construction, these industries often have less pressing requirements for the advanced properties offered by specialty polymers. The transport sector’s demand for innovation in energy efficiency and emissions reduction creates a more urgent and broad application of these materials.

Key Market Segments

By Specialty Polymers Type

- Specialty Elastomers

- Fluoroelastomers

- Fluorosilicone Rubber

- Liquid Silicone Rubber

- Natural Rubber

- Others

- Specialty Thermoplastics

- Polyolefins

- Polyimides

- Vinylic Polymer

- Polyphenyles

- Others

- Specialty Thermosets

- Epoxy

- Polyester

- Vinyl Ester

- Polyimides

- Others

- Others

By Source

- Synthetic

- Natural

By End-Use

- Transport

- Building & Construction

- Medical & Healthcare

- Electrical & Electronics

- Textile

- Food & Beverage

- Cosmetics & Personal Care

- Others

Drivers

The Automotive and Aerospace Industries Drive the Specialty Polymers Market.

Specialty polymers are integral to the automotive and aerospace industries due to their advanced material properties, including high thermal resistance, lightweight characteristics, and durability. These polymers are crucial for enhancing performance, safety, and fuel efficiency. For instance, in the automotive sector, polyamide-based materials used for under-the-hood applications in vehicles reduce weight and improve fuel efficiency.

Similarly, in aerospace, specialty polymers such as high-performance thermoplastics and thermosets are employed in components such as fuel tanks, seals, and wing flaps. The U.S. Federal Aviation Administration (FAA) highlights the use of polymer matrix composites in modern aircraft for weight reduction, which directly contributes to fuel efficiency and performance.

- The use of specialty polymer composites enables weight reductions of 20% to 40% compared to traditional metallic components. For instance, the Boeing 787 Dreamliner and Airbus A350 structures consist of 50% and 53% composite materials by weight, respectively.

These materials meet stringent regulatory standards for safety and environmental impact. Moreover, the European Union’s REACH regulations have further bolstered demand for non-toxic, high-performance polymers in these sectors. The specialty polymers drive innovation and operational efficiency, supporting the aerospace and automotive industries’ focus on sustainability and advanced manufacturing.

Restraints

High Investment in R&D Along with the Impact of Polymer Production on Environment Pose a Significant Challenge to the Specialty Polymers Market.

The high investment in research and development (R&D) and the environmental impact of polymer production are notable challenges for the specialty polymers market. R&D in specialty polymers is essential to develop materials that meet increasingly complex performance standards across industries, such as automotive, aerospace, and electronics. For instance, Rayonier Advanced Materials allocated US$33 million in 2024 toward biomaterials expansion and innovation systems.

However, the high costs of R&D, particularly for new polymer formulations, present significant barriers. The U.S. Department of Energy (DOE) identifies that polymer-based materials for automotive and aerospace applications require extensive testing to ensure they meet rigorous safety and durability standards. For instance, advanced polymers used in fuel-efficient vehicles must undergo long-term exposure tests for thermal stability, corrosion resistance, and mechanical strength.

Furthermore, the environmental impact of polymer production is a growing concern, which involves considerable energy consumption and generates significant greenhouse gas emissions, especially in the manufacture of petrochemical-based plastics. Similarly, the polymer industry’s reliance on non-renewable resources and the accumulation of polymer waste are critical issues.

- Global plastic production alone emits approximately 2.24 gigatons of CO2 equivalent annually.

Additionally, specialty polymers’ long degradation times contribute to environmental pollution, leading to regulatory pressures for improved recycling technologies and sustainable alternatives, such as bio-based polymers, which remain costly and underdeveloped.

Opportunity

Innovation in Biopolymers Creates Opportunities in the Specialty Polymers Market.

Innovation in biopolymers and smart specialty polymers presents significant opportunities for the specialty polymers market, driven by sustainability and performance enhancements across industries. Biopolymers, such as polylactic acid (PLA) and polyhydroxyalkanoates (PHA), are derived from renewable resources and have garnered attention due to their biodegradability and reduced environmental impact.

The European Commission’s Circular Economy Action Plan emphasizes the shift towards bioplastics, encouraging the development of materials that can reduce reliance on fossil fuels and mitigate plastic pollution. For instance, according to a report by the European Bioplastics Association, the global biobased plastics production capacity would double from 2.31 million tons in 2025 to about 4.69 million tons by 2030, reflecting rising demand and the emergence of ever more advanced applications and products. The advancements in biopolymers represent growing opportunities, supported by both regulatory incentives and technological innovation.

- Global bio-based plastics production capacity currently represents roughly 0.5% of the 431 million tons of plastics produced annually.

Trends

Adoption of Specialty Polymers in the Healthcare Industry.

The adoption of specialty polymers in the healthcare industry, particularly for medical devices and drug delivery systems, is a growing trend that enhances performance, safety, and patient outcomes. Specialty polymers such as polyetheretherketone (PEEK), Polylactic acid (PLA), and silicone are increasingly used in medical devices due to their biocompatibility, flexibility, and sterilization resistance. Materials such as PEEK and polyphenylsulfone (PPSU) are utilized in orthopedic implants and surgical instruments due to their ability to withstand over 1,000 autoclave sterilization cycles without mechanical degradation.

The U.S. Food and Drug Administration (FDA) has approved the use of PEEK in spinal implants, as it offers high mechanical strength, radiolucency (allowing X-ray visibility), and compatibility with bone tissue. Similarly, silicones are employed in medical devices such as catheters, implants, and wound dressings due to their inertness and hypoallergenic properties.

Similarly, in drug delivery, specialty polymers enable controlled, targeted release of pharmaceuticals, which improves treatment efficacy and patient compliance. The National Institutes of Health (NIH) has funded research on the use of poly (lactic-co-glycolic acid) (PLGA) for biodegradable drug delivery systems, noting its ability to encapsulate drugs and release them over extended periods. Additionally, the FDA has approved several polymer-based drug delivery systems, including those using polyethylene glycol (PEG) for cancer treatments, enhancing the precision of therapeutic applications.

Geopolitical Impact Analysis

Geopolitical Tensions Cause Price Volatility in the Specialty Polymers Market.

The geopolitical tensions, particularly the trade and supply chain disruptions resulting from the conflict in Ukraine, U.S.-China relations, and other regional instabilities, have had a notable impact on the specialty polymers market. According to the U.S. Department of Commerce, sanctions and export restrictions have disrupted the supply of raw materials and intermediate chemicals used in polymer production.

For instance, the conflict in Ukraine has affected the supply of certain petrochemical feedstocks, which are critical for manufacturing polymers such as polyolefins and polyurethane. In addition, geopolitical tensions have led to an increased focus on supply chain diversification and nearshoring. This has spurred government initiatives aimed at bolstering domestic manufacturing capabilities, with the U.S. introducing programs under the CHIPS and Science Act to enhance resilience in key sectors, including advanced materials.

Furthermore, fluctuating energy prices, driven by geopolitical instability, impact the cost of polymer production. As energy prices rise, the cost of manufacturing specialty polymers increases, which may further strain global supply chains and lead to higher production costs.

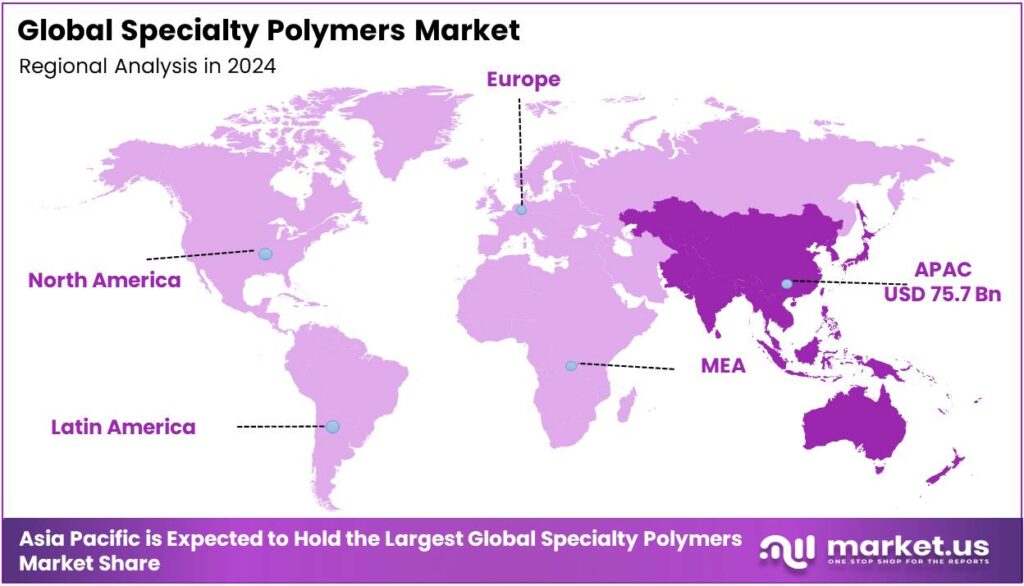

Regional Analysis

Asia-Pacific Held the Largest Share of the Global Specialty Polymers Market.

In 2024, the Asia-Pacific dominated the global specialty polymers market, holding about 41.1% of the total global consumption, driven by rapid industrialization, strong manufacturing capabilities, and technological advancements. The burgeoning automotive, electronics, and healthcare sectors in the region heavily rely on specialty polymers.

- China sold 9.5 million electric vehicles (EVs) in 2024, fueling demand for high-performance polymers in battery systems and thermal management. Similarly, in India, automobile production exceeded 22.9 million units in 2024, representing a critical volume driver.

- China produced nearly 140.7 million metric tons of plastic in 2024, accounting for roughly 34.5% of global materials production.

Additionally, the region’s dominance is attributed to its established petrochemical industry, particularly in China and India, where robust production capacities for polymer raw materials such as polyethylene and polypropylene are found. Moreover, the healthcare industry’s growth in Asia, particularly in countries such as Japan and India, has increased the demand for biocompatible and durable specialty polymers for medical devices and drug delivery systems.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Manufacturers of specialty polymers focus on several strategic activities to gain a competitive edge and enhance market share. They invest heavily in research and development (R&D) to innovate and develop advanced polymer formulations that meet the evolving needs of industries such as automotive, aerospace, and healthcare. Additionally, manufacturers focus on improving production processes to enhance efficiency, reduce costs, and ensure high-quality standards.

Furthermore, they emphasize strategic partnerships with end-user industries for specific application demands. Moreover, many manufacturers are prioritizing sustainability by developing bio-based and recyclable polymers, which cater to increasing regulatory and environmental concerns. Similarly, the global expansion and supply chain diversification are essential strategies to mitigate geopolitical risks.

The Major Players in The Industry

- Arkema SA

- BASF SE

- Evonik Industries AG

- Covestro AG

- Solvay SA

- Dow Inc.

- SABIC

- Celanese Corporation

- Eastman Chemical Company

- Mitsubishi Chemical Group Corporation

- Toray Industries, Inc.

- Kuraray Co., Ltd.

- Ester Industries

- Syensqo

- Speciality Polymers Limited

- Other Key Players

Key Development

- In January 2026, Arkema announced that its Rilsan clear transparent polyamide production facility, situated on its Singapore platform in Jurong Island, is fully operational. This achievement reinforces Arkema’s leadership in high-performance polymers, making it the largest producer of transparent polyamides in Asia.

- In November 2025, Evonik announced the successful trial production of a second reactor at its Shanghai site, effectively doubling its capacity for long-chain polyamides (PA12) in Asia.

Report Scope

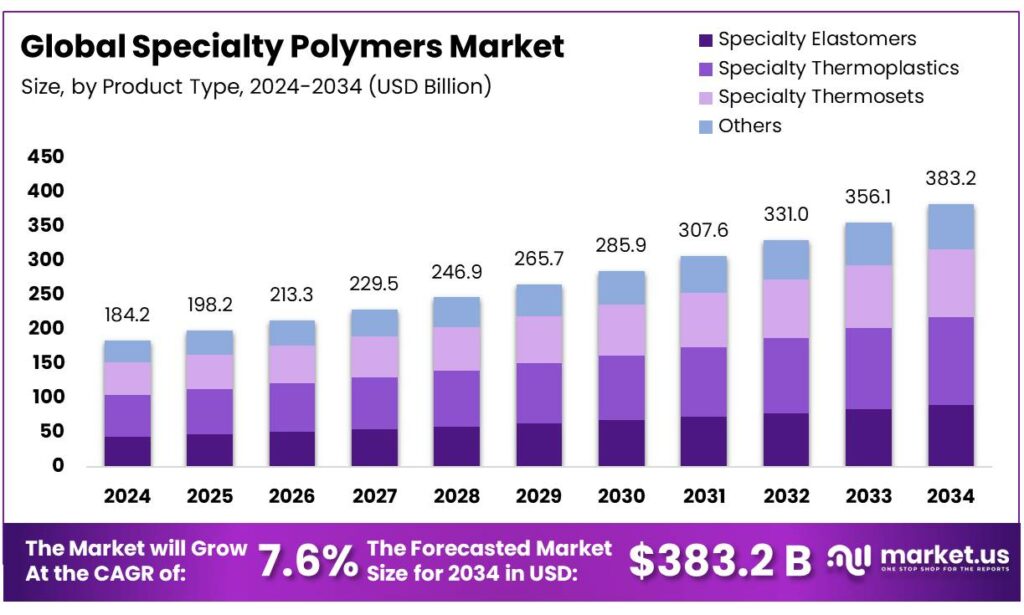

Report Features Description Market Value (2024) USD 184.2 Bn Forecast Revenue (2034) USD 383.2 Bn CAGR (2025-2034) 7.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Specialty Elastomers, Specialty Thermoplastics, Specialty Thermosets, and Others), By Source (Synthetic, Natural, and Semisynthetic), By End-Use (Transport, Building & Construction, Medical & Healthcare, Electrical & Electronics, Textile, Food & Beverage, Cosmetics & Personal Care, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Arkema, BASF SE, Evonik Industries AG, Covestro AG, Solvay SA, Dow Inc., SABIC, Celanese Corporation, Eastman Chemical Company, Mitsubishi Chemical Group Corporation, Toray Industries, Inc., Kuraray Co., Ltd., Ester Industries, Syensqo, Speciality Polymers Limited, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Arkema SA

- BASF SE

- Evonik Industries AG

- Covestro AG

- Solvay SA

- Dow Inc.

- SABIC

- Celanese Corporation

- Eastman Chemical Company

- Mitsubishi Chemical Group Corporation

- Toray Industries, Inc.

- Kuraray Co., Ltd.

- Ester Industries

- Syensqo

- Speciality Polymers Limited

- Other Key Players