Global Space Utilization Sensors Market Size, Share and Growth Report By Sensor Type (Infrared Sensors, Ultrasonic Sensors, Image-based Sensors, Pressure Sensors, Others), By Application (Offices, Educational Institutions, Healthcare Facilities, Retail, Airports, Others), By Connectivity (Wired, Wireless), By End-User (Commercial, Residential, Industrial), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 171440

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Quick Market Facts

- U.S. Market Size

- Sensor Type Analysis

- Application Analysis

- Connectivity Analysis

- End-User Analysis

- AI-Led Growth Outlook

- Emerging Trends

- Growth Factors

- Value Chain Overview

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

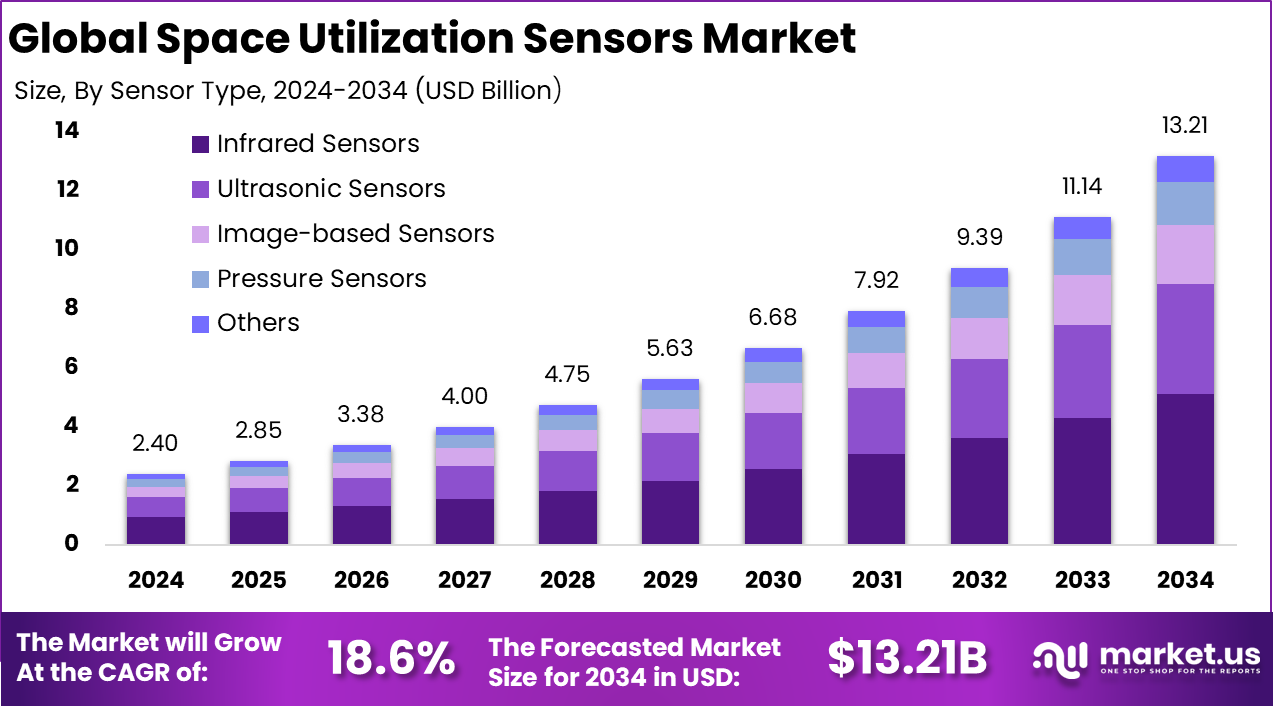

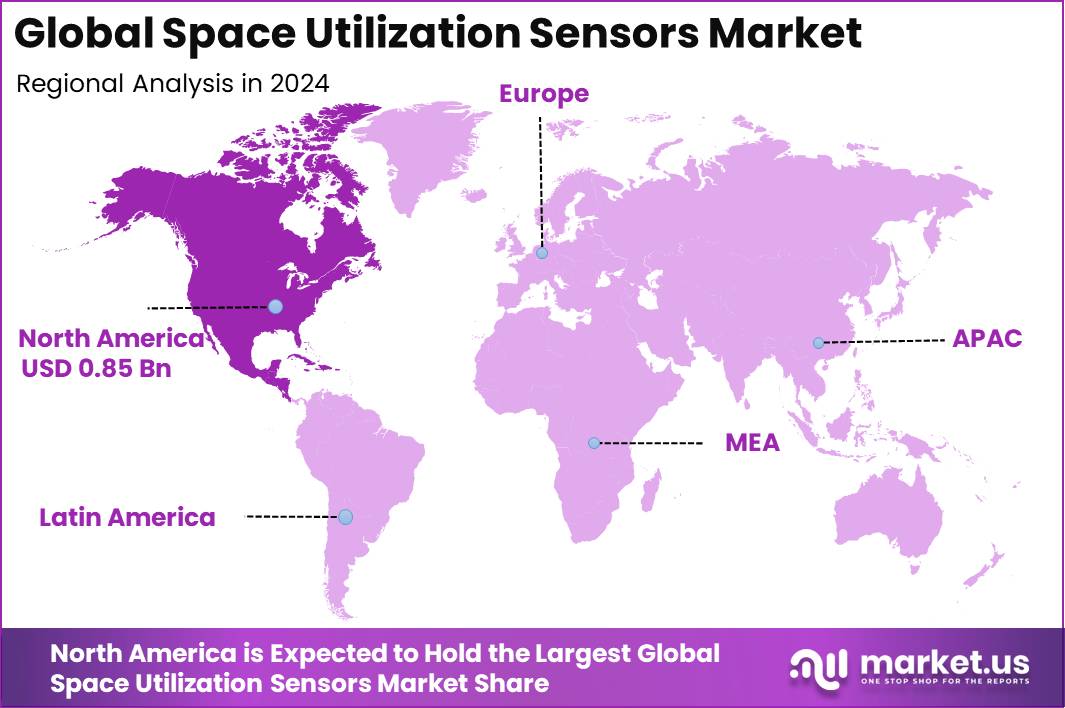

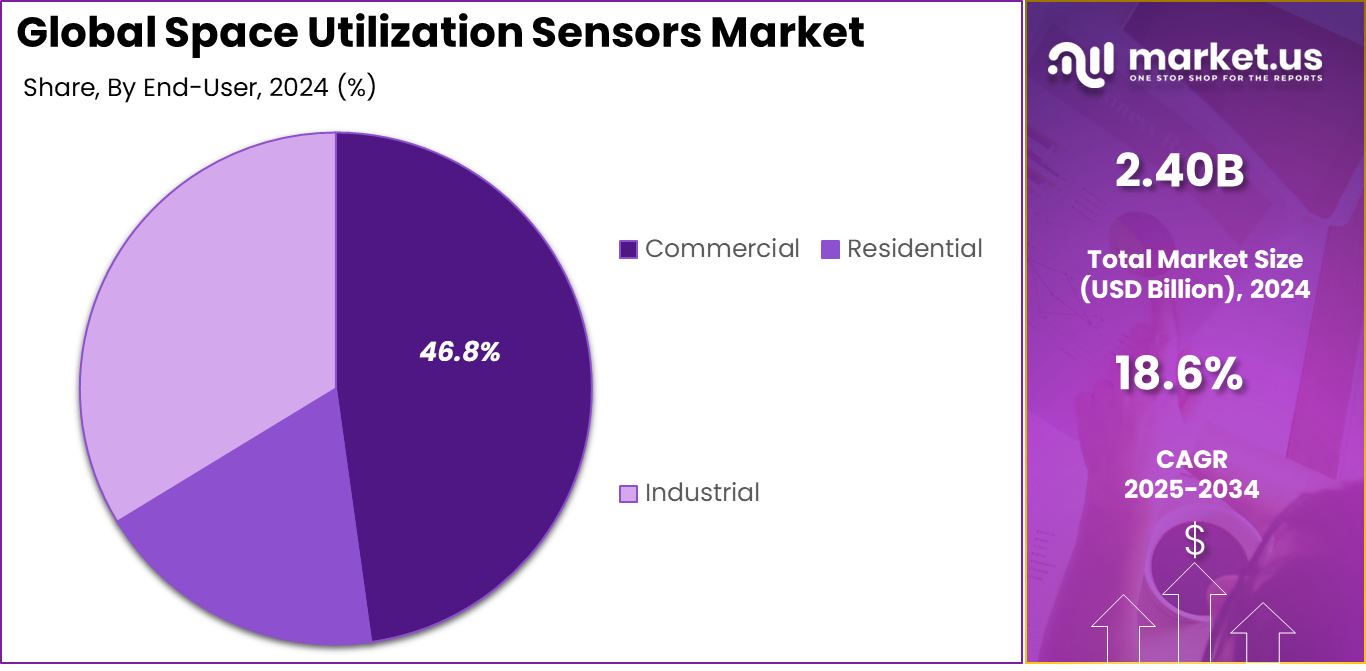

The Global Space Utilization Sensors Market size is expected to be worth around USD 13.21 billion by 2034, from USD 2.40 billion in 2024, growing at a CAGR of 18.6% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 35.7% share, holding USD 0.85 billion in revenue.

The space utilization sensors market refers to the segment of the global sensor industry focused on devices that measure occupancy, movement, and usage patterns within physical environments such as offices, educational institutions, healthcare facilities, and public spaces. These sensors gather data that facility managers and building automation systems use to optimize space usage, reduce operational costs, and improve user convenience.

The market has witnessed a rise in demand as organizations prioritize efficient use of real estate and enhanced workplace management. Adoption is supported by the integration of these sensors into wider smart building and occupancy analytics platforms. The space utilization sensors market is driven by a growing emphasis on optimizing real estate usage and minimizing operational costs for commercial and public infrastructure.

Organizations are increasingly leveraging data-driven insights to enhance workplace efficiency and employee experience. This has resulted in increased demand for robust sensor solutions that provide accurate occupancy and usage metrics. Another driving factor is the integration of these sensors into smart building and facility management systems.

Companies and institutions are adopting automation technologies that integrate occupancy data to control lighting, heating, ventilation, and air conditioning (HVAC) systems, reducing energy consumption and supporting sustainability goals. Demand is also influenced by regulatory pressures in some regions to improve energy efficiency in buildings.

For instance, in February 2025, Schneider Electric SE launched the SpaceLogic Touchscreen Room Controller, an edge-AI device that fine-tunes comfort and energy via occupancy detection. It promises ongoing updates through 2025 for better well-being and savings, showing how sensor innovation keeps buildings efficient.

Key Takeaway

- Infrared sensors led the space utilization sensors market with a 38.7% share, supported by reliable occupancy detection and cost-effective deployment across buildings.

- Offices and healthcare facilities together accounted for 40.6%, reflecting strong demand for real-time space monitoring to improve efficiency, safety, and compliance.

- Wired connectivity dominated with 58.9%, as organizations favored stable data transmission and long-term reliability in fixed commercial environments.

- Commercial end users represented 46.8%, driven by adoption across offices, hospitals, retail spaces, and large facilities.

- North America held a 35.7% share, supported by early adoption of smart building technologies and workplace optimization initiatives.

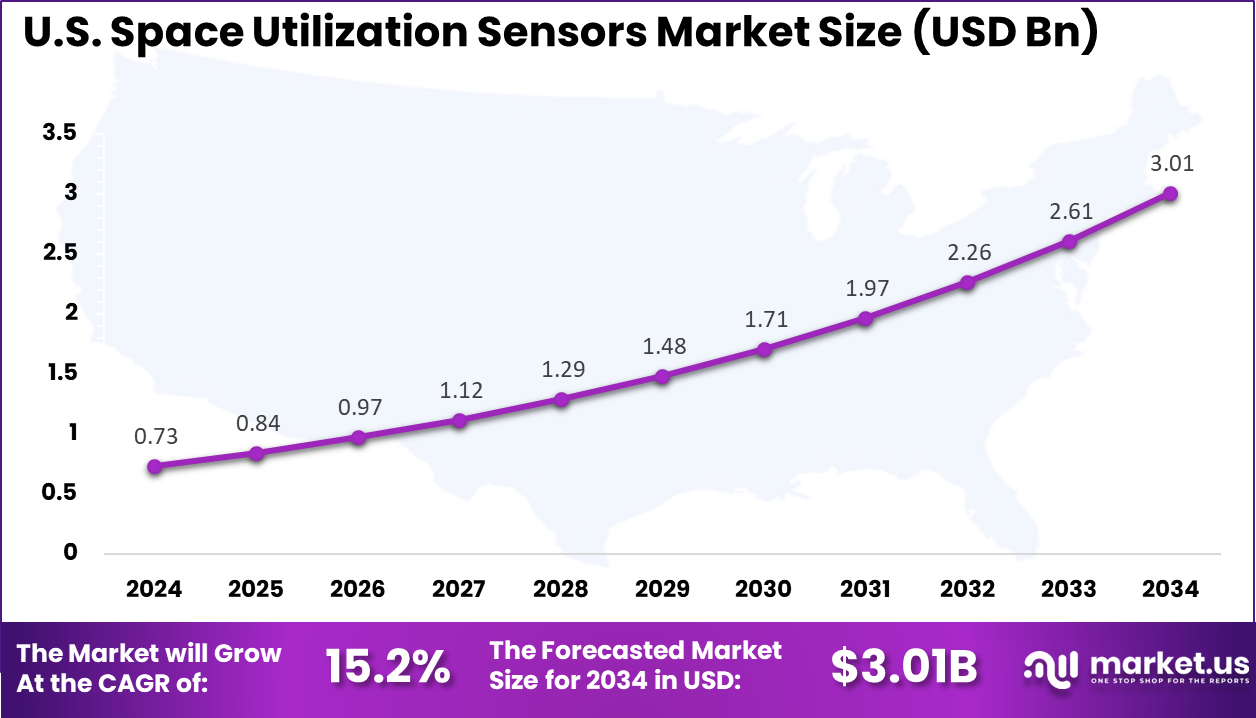

- The U.S. market reached USD 0.73 billion in 2024 and is expanding at a 15.2% CAGR, driven by rising demand for data-driven space planning and operational efficiency.

Quick Market Facts

- Global office utilization remains structurally low, operating at only 30% to 50% of capacity in mid 2025, well below pre pandemic norms despite gradual recovery trends.

- Clear regional variation is visible, with APAC leading at 47%, followed by the UK at 44%, while North America lags at 36%, even after a notable 9.5 point year over year increase.

- Smart occupancy sensing is delivering measurable efficiency gains, with data driven space optimization enabling 30% to 40% cost savings across real estate and facilities operations.

- PIR based room sensors provide 90% to 95% accuracy but show limitations when occupants remain stationary, making desk level sensing a necessary enhancement.

- Integrated systems combining booking data with PIR sensing achieve around 81.56% accuracy, rising above 96% when unoccupied time is included, as validated by 2025 research.

- High volume entry sensors installed over doorways reach up to 98% accuracy in large open areas, supporting reliable people counting at scale.

- Usage patterns vary significantly at the team level, with some groups occupying space 65% to 75% of the time, while others use the same facilities only 20% to 30%, highlighting inefficiencies in fixed space allocation.

U.S. Market Size

The market for Space Utilization Sensors within the U.S. is growing tremendously and is currently valued at USD 0.73 billion, the market has a projected CAGR of 15.2%. The market is growing due to the rising demand for smart buildings that optimize office and commercial spaces amid hybrid work trends.

Building owners turn to these sensors for real-time occupancy data, slashing energy costs on lighting and HVAC in empty areas. Healthcare facilities also adopt them to manage patient flows safely. Tech advances in infrared and wired systems boost reliability, while regulations push energy efficiency in urban developments.

For instance, in September 2024, Honeywell International Inc. collaborated with Cisco Systems, Inc. (San Jose, California, USA) on an AI-powered solution integrating Cisco Spaces occupancy data with Honeywell Forge Sustainability+ for Buildings. The partnership delivers real-time insights into building utilization and energy efficiency, reinforcing U.S. dominance through advanced sensor integration across HVAC and lighting systems.

In 2024, North America held a dominant market position in the Global Space Utilization Sensors Market, capturing more than a 35.7% share, holding USD 0.85 billion in revenue. This lead comes from early adoption of smart building tech in the U.S. and Canada, where offices and commercial sites prioritize occupancy tracking for hybrid work setups.

Strict energy codes drive the use of sensors to cut waste on lights and air in empty spaces. Healthcare facilities add demand by monitoring patient areas for better flow. Advanced infrastructure supports seamless integration of infrared and wired systems.

For instance, in March 2025, Johnson Controls International plc launched the NSW8000 Series Wireless Network Sensor, providing real-time monitoring of temperature, humidity, occupancy, and optional CO2 levels for enhanced air quality and space utilization. This innovation strengthens North America’s leadership in space utilization sensors by enabling secure, long-range connectivity and minimal maintenance in smart buildings.

Sensor Type Analysis

In 2024, the Infrared Sensors segment held a dominant market position, capturing a 38.7% share of the Global Space Utilization Sensors Market. They stand out for detecting heat and motion without physical contact, making them ideal for tracking occupancy in dynamic environments. Offices and healthcare settings favor them due to reliable performance across lighting conditions and low energy draw. This helps reduce unnecessary lighting and cooling, aligning with efficiency goals in modern buildings.

Their non-intrusive nature suits high-traffic areas where constant monitoring proves essential. Teams value the sensors’ durability and minimal false readings, which support data-driven space planning. Over time, this leads to better resource allocation and cost savings. Adoption grows as buildings prioritize smart features that enhance daily operations without disruption.

For Instance, in January 2025, Irisys rolled out upgraded infrared sensors for precise people counting in crowded spaces. These units detect body heat to track real-time occupancy without privacy issues. Building managers now use them to adjust lighting and air flow based on actual presence, cutting energy use in underoccupied areas.

Application Analysis

In 2024, the Offices- Healthcare Facilities segment held a dominant market position, capturing a 40.6% share of the Global Space Utilization Sensors Market. In offices, sensors map real-time desk and room usage to optimize layouts and improve employee satisfaction. Healthcare uses them for patient zones and lobbies to streamline movement and maintain hygiene standards amid varying crowds.

These applications benefit from precise data that informs staffing and maintenance schedules. Offices cut underused space, fostering hybrid work setups. Healthcare facilities ensure safer environments by spotting overcrowding early. Both sectors see gains in operational flow and energy management through such insights.

For instance, in March 2025, Johnson Controls launched the NSW8000 wireless sensor series for office and healthcare settings. It tracks occupancy alongside temperature and humidity to optimize room conditions. Healthcare teams value their role in managing patient flow, while offices use it for hybrid work planning.

Connectivity Analysis

In 2024, The Wired segment held a dominant market position, capturing a 58.9% share of the Global Space Utilization Sensors Market. It delivers consistent data transmission vital for large-scale installations needing uninterrupted feeds. This reliability supports instant decisions in critical spaces, integrating seamlessly with legacy infrastructure for straightforward upgrades.

No battery replacements mean lower upkeep costs over time. Wired systems handle high data volumes without interference, suiting environments with dense sensor networks. Building managers appreciate the stability that keeps utilization tracking accurate around the clock.

For Instance, in July 2025, Legrand expanded its wired occupancy sensor lineup for stable connectivity in large buildings. The sensors link directly to control panels for reliable data on room use. Installers prefer them in settings needing constant feeds without wireless interference issues.

End-User Analysis

In 2024, The Commercial segment held a dominant market position, capturing a 46.8% share of the Global Space Utilization Sensors Market. Offices, retail outlets, and public venues use sensors to monitor occupancy and automate lighting plus HVAC adjustments. This approach trims energy bills and aids in smarter facility planning based on actual patterns.

The segment thrives on the need for flexible spaces post-pandemic shifts. Sensors provide actionable data to reconfigure areas efficiently, boosting productivity. Commercial operators leverage this for competitive edges in tenant satisfaction and sustainability targets.

For Instance, in December 2025, Honeywell advanced its Space Sense platform for commercial real estate analytics. IoT sensors feed occupancy data to dashboards for space optimization. Commercial operators use insights to right-size floors and cut vacant area costs effectively.

AI-Led Growth Outlook

Artificial intelligence is expected to play a significant role in the evolution of space utilization sensor systems. AI algorithms can analyse complex occupancy and environmental patterns to predict utilisation trends and enable proactive space management. Machine learning models may enhance accuracy of occupancy prediction and support automated decision-making across building systems.

MDPIAI-enhanced analytics can also optimise energy use and forecast demand for space over time, supporting long-term planning and sustainability objectives. These capabilities are particularly valuable in large enterprises where dynamic space usage requires continuous monitoring and adaptation. The integration of AI with sensor data is likely to strengthen the market’s growth as organisations seek more intelligent, self-optimising infrastructure solutions.

Emerging Trends

In the space utilization sensors market, one significant trend is the adoption of IoT-enabled smart sensors that provide continuous visibility into how physical spaces are used. These sensors capture real time data on occupancy, movement patterns, and environmental conditions, enabling facility managers to optimise space assignments and enhance operational planning.

The move toward connected sensor networks supports automated reporting and reduces dependence on manual surveys or periodic audits. Another trending development is the integration of sensor analytics with building management systems and workplace experience platforms.

Data from utilization sensors is increasingly fed into central dashboards that combine occupancy insights with energy usage, HVAC control, and room booking systems. This convergence creates a unified view of workplace dynamics and supports more responsive facility adjustments that improve user comfort and resource allocation.

Growth Factors

A key growth factor in the space utilization sensors market is the rising emphasis on workplace efficiency and cost optimisation. Organisations are seeking accurate data to understand how space is actually used so they can adjust layouts, reduce under-utilised areas, and make informed decisions about lease renewals or expansion plans. Sensors provide objective usage metrics that support strategic planning and operational budgeting.

Another important factor driving growth is the increasing adoption of hybrid work models. With employees splitting time between remote and onsite work, organisations require tools that can accurately track real time space usage and support flexible scheduling. Utilization sensors help align workplace resources with actual demand, making facilities more responsive to changing occupancy patterns.

Value Chain Overview

The value chain in the space utilization sensors market typically begins with component suppliers that provide sensing elements, microprocessors, and wireless communication modules. These are assembled by hardware manufacturers into complete sensor products that meet specific use-case requirements for occupancy detection and environmental monitoring. Software developers then create analytics platforms that aggregate and interpret sensor data.

Systems integrators and channel partners play a critical role in deploying and configuring solutions on site. After deployment, service providers support maintenance, software updates, and data management. End users, including corporate facility managers, real estate owners, and building administrators, derive value from actionable insights generated by the integrated system and contribute feedback for continuous improvement.

Key Market Segments

By Sensor Type

- Infrared Sensors

- Ultrasonic Sensors

- Image-based Sensors

- Pressure Sensors

- Others

By Application

- Offices

- Educational Institutions

- Healthcare Facilities

- Retail

- Airports

- Others

By Connectivity

- Wired

- Wireless

By End-User

- Commercial

- Residential

- Industrial

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Drivers

The primary driver of the space utilization sensors market is the increasing focus on efficient management of commercial and institutional spaces. Rising real estate costs are forcing organizations to closely monitor how offices, meeting rooms, and shared areas are used. Traditional space planning methods often rely on assumptions rather than actual usage data. Sensors provide accurate, real-time insights that support data-driven decisions.

Another important driver is the growing emphasis on operational efficiency and cost optimization. Organizations are under pressure to reduce unused or underutilized space. Space utilization sensors help identify inefficiencies that would otherwise remain hidden. This enables better planning, consolidation, and long-term savings.

For instance, in June 2025, Honeywell launched Connected Solutions, an AI platform integrating sensors for building management. It provides real-time occupancy data linked to cloud tools for space utilization tracking. Users monitor meeting areas and desks to cut waste effectively. The solution supports hybrid work by revealing empty zones. Operational efficiency improves through predictive insights.

Restraint

High initial deployment costs act as a major restraint in the space utilization sensors market. Installing sensors across large facilities requires investment in hardware, software platforms, and system integration. In many cases, organizations must also upgrade network infrastructure to support sensor connectivity. These costs can delay adoption decisions.

Integration challenges with existing building management systems also limit market growth. Older facilities may not support modern sensor technologies without additional modifications. The complexity of deployment increases implementation time and cost. This makes adoption more difficult for budget-constrained organizations.

For instance, in March 2025, Schneider Electric released a study on occupancy sensors, noting integration challenges with legacy systems. High upfront costs for sensors and building management links deter small firms. Skill shortages for calibration and maintenance add ongoing expenses. Compliance with regional data rules increases complexity. Mid-sized enterprises face barriers to full deployment.

Opportunities

The rise of hybrid work models presents a strong opportunity for the space utilization sensors market. Companies are redesigning workplaces to support flexible seating, shared desks, and collaborative zones. Sensors help organizations understand how often spaces are used and at what times. This insight supports smarter office redesign strategies.

Another opportunity lies in the growing adoption of smart building technologies. Space utilization sensors can be integrated with lighting, HVAC, and energy management systems. This enables automated adjustments based on real occupancy levels. Such integration improves energy efficiency and overall building performance.

For instance, in June 2025, Honeywell unveiled AI-powered Connected Solutions for predictive building operations. Sensors pair with platforms to analyze occupancy trends and automate energy adjustments. Maintenance needs drop through smart forecasts in offices and campuses. Scalable cloud setups target retrofits with real estate partners. Sustainability goals accelerate platform adoption.

Challenges

Data privacy and employee trust remain key challenges in the space utilization sensors market. Employees may have concerns about being monitored in the workplace. If these concerns are not addressed, adoption can face resistance. Organizations must ensure transparency and clear communication about how data is collected and used.

Another challenge is ensuring data accuracy and reliability. Sensors must function consistently across different environments and layouts. Incorrect or incomplete data can lead to poor decision-making. Maintaining sensor performance over time is essential for long-term value.

For instance, in October 2025, Siemens Building X raised data security discussions in occupancy tracking deployments. Shared spaces spark fears over location info handling under varying rules. Cybersecurity entry points from sensors prompt caution. Legacy integrations need custom secure links. Global standards gaps complicate provider efforts.

Key Players Analysis

Competition in the space utilization sensors market is driven by sensor accuracy, ease of installation, and analytics quality. Vendors aim to differentiate through reliable hardware and intuitive software dashboards. Battery life and maintenance requirements also play an important role in customer selection. Buyers increasingly prefer solutions that require minimal disruption during installation.

Software capabilities are becoming a key area of competitive differentiation. Vendors that provide actionable insights rather than raw data gain stronger market traction. Integration with workplace management and smart building platforms adds further value. New entrants focus on wireless and low-power sensor solutions to compete with established providers.

Top Key Players in the Market

- Siemens AG

- Honeywell International Inc.

- Schneider Electric SE

- Bosch Security Systems

- Johnson Controls International plc

- Cisco Systems, Inc.

- Signify N.V. (formerly Philips Lighting)

- Legrand SA

- Crestron Electronics, Inc.

- Lutron Electronics Co., Inc.

- Delta Controls Inc.

- Enlighted, Inc. (a Siemens company)

- PointGrab Ltd.

- Irisys (InfraRed Integrated Systems Ltd.)

- HID Global Corporation

- Density Inc.

- Steinel GmbH

- Kaiterra

- OpenSensors Ltd.

- Ubisense Limited

- Others

Recent Developments

- In March 2025, Johnson Controls International plc launched the NSW8000 Series Wireless Network Sensors from its Milwaukee base. These units track temperature, humidity, occupancy, and even CO2 levels in real time. Building owners love the long-range wireless setup that cuts maintenance hassles while improving air quality and space use.

- In January 2025, Bosch Security Systems showcased AI-powered sensors at CES, blending MEMS with edge processing for always-on occupancy and motion detection in smart buildings. Their BHI360 chip enables seamless integration, pushing boundaries in real-time space analytics.

Report Scope

Report Features Description Market Value (2024) USD 2.4 Bn Forecast Revenue (2034) USD 13.2 Bn CAGR(2025-2034) 18.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Sensor Type (Infrared Sensors, Ultrasonic Sensors, Image-based Sensors, Pressure Sensors, Others), By Application (Offices, Educational Institutions, Healthcare Facilities, Retail, Airports, Others), By Connectivity (Wired, Wireless), By End-User (Commercial, Residential, Industrial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Siemens AG, Honeywell International Inc., Schneider Electric SE, Bosch Security Systems, Johnson Controls International plc, Cisco Systems, Inc., Signify N.V. (formerly Philips Lighting), Legrand SA, Crestron Electronics, Inc., Lutron Electronics Co., Inc., Delta Controls Inc., Enlighted, Inc. (a Siemens company), PointGrab Ltd., Irisys (InfraRed Integrated Systems Ltd.), HID Global Corporation, Density Inc., Steinel GmbH, Kaiterra, OpenSensors Ltd., Ubisense Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Space Utilization Sensors MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Space Utilization Sensors MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Siemens AG

- Honeywell International Inc.

- Schneider Electric SE

- Bosch Security Systems

- Johnson Controls International plc

- Cisco Systems, Inc.

- Signify N.V. (formerly Philips Lighting)

- Legrand SA

- Crestron Electronics, Inc.

- Lutron Electronics Co., Inc.

- Delta Controls Inc.

- Enlighted, Inc. (a Siemens company)

- PointGrab Ltd.

- Irisys (InfraRed Integrated Systems Ltd.)

- HID Global Corporation

- Density Inc.

- Steinel GmbH

- Kaiterra

- OpenSensors Ltd.

- Ubisense Limited

- Others