Global Solid Perfume Market By Ingredient Type (Natural and Synthetic), By Fragrance Type (Single Fragrance and Mixed Fragrance), By End User (Male, Female, and Unisex), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies And Drugstores, Specialty Stores, Retail Cosmetic Stores, Online Stores, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175020

- Number of Pages: 349

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

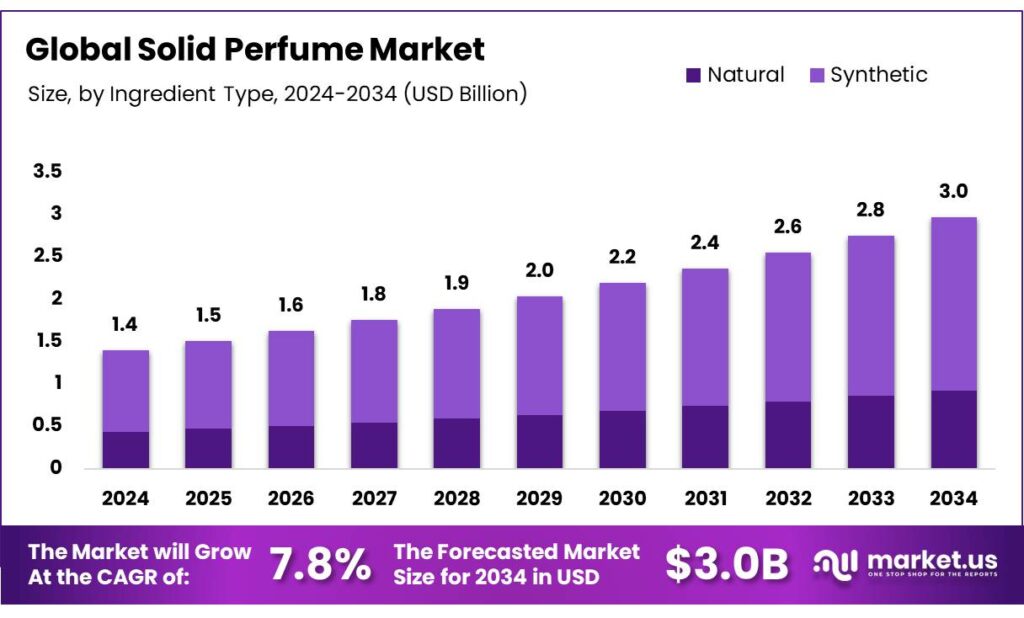

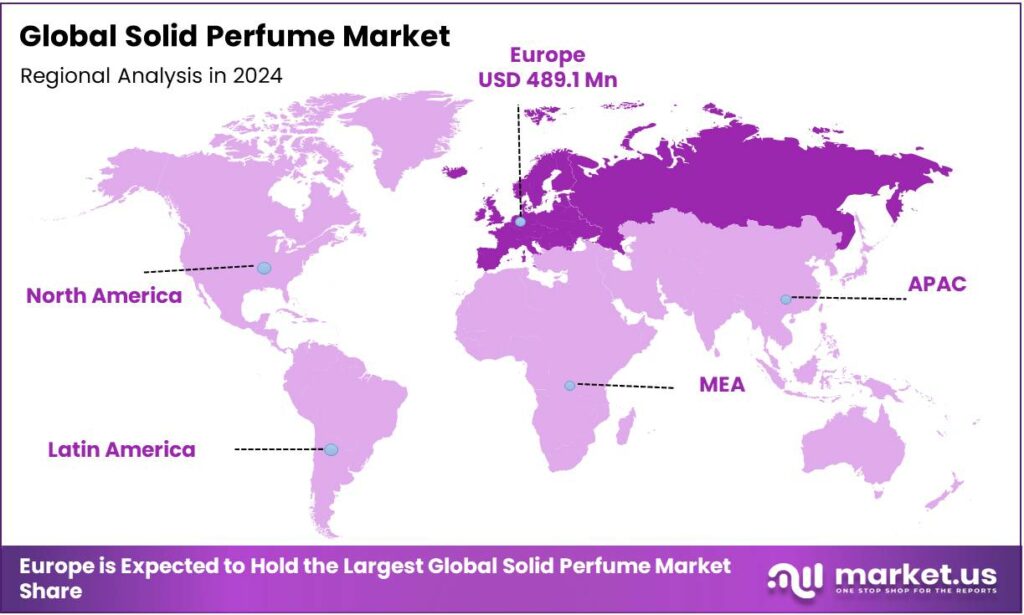

Global Solid Perfume Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.4 Billion in 2024, growing at a CAGR of 7.8% during the forecast period from 2025 to 2034. In 2024 Europe held a dominant market position, capturing more than a 46.2% share, holding USD 0.4 Billion in revenue.

Solid perfume is a fragrant balm or wax, often alcohol-free, that melts onto skin for a subtle, enduring scent, made by blending fragrance oils with natural bases such as beeswax, butters, or carrier oils, like coconut and jojoba. The market has experienced a notable shift in consumer preferences, driven by the increasing demand for convenience, portability, and sustainability.

- In 2023, Gen-Z usage of perfumes reached 83%, up by 5% from 2022, driven by shift in lifestyles, such as tourist travel.

- According to an analysis, 44% of individual’s worldwide use fragrance daily, with highest usage levels in the Latin America and Middle East and Africa regions. However, the usage of solid perfume is more concentrated in Europe.

In addition, the market is expanding due to the cost-effectiveness of solid perfumes, which are typically more affordable than liquid counterparts. Despite facing competition from conventional perfumes, solid fragrances are gaining traction through their unique advantages, such as enduring scents and minimal packaging waste.

Key Takeaways

- The global solid perfume market was valued at USD 1.4 billion in 2024.

- The global solid perfume market is projected to grow at a CAGR of 7.8% and is estimated to reach USD 3.0 billion by 2034.

- On the basis of types of ingredients, synthetic ingredients dominated the market, constituting 68.8% of the total market share.

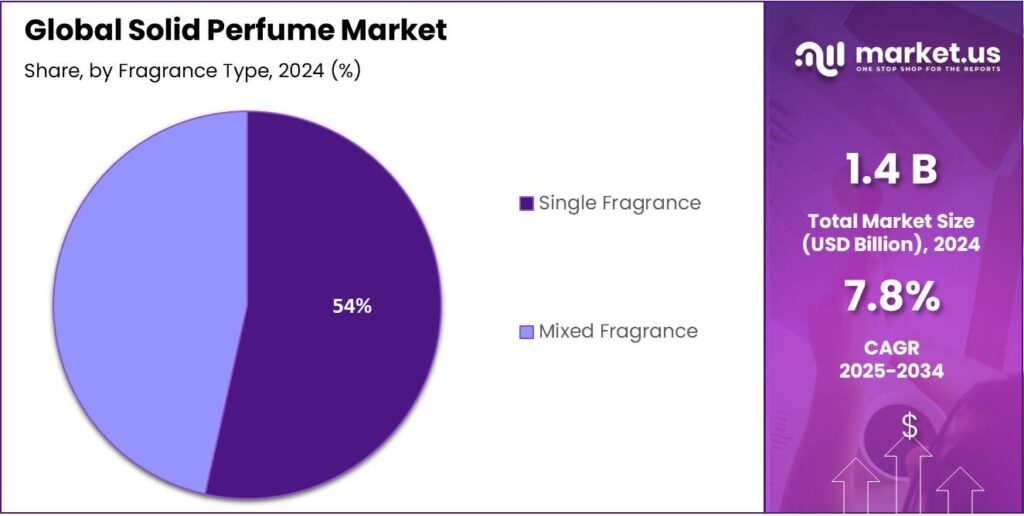

- Based on the fragrance type, mixed fragrance dominated the market, with a substantial market share of around 53.5%.

- Based on the distribution channel, specialty stores led the market, comprising 35.7% of the total market.

- Among the end users, female users held a major share in the solid perfume market, 45.6% of the market share.

- In 2024, Europe was the most dominant region in the solid perfume market, accounting for 34.2% of the total global consumption.

Ingredient Type Analysis

Synthetic Ingredients Are a Prominent Segment in the Solid Perfume Market.

The solid perfume market is segmented based on ingredient types into natural and synthetic. The synthetic ingredients led the solid perfume market, comprising 68.8% of the market share, primarily due to their cost-effectiveness, consistency, and ease of production. Synthetic ingredients are often less expensive and more readily available than natural ingredients, allowing manufacturers to produce perfumes at a lower cost and in larger quantities.

Additionally, synthetic fragrances offer a wider variety of scent profiles, enabling brands to create unique and consistent fragrances that can be reproduced with precision. In contrast, natural solid perfumes often rely on limited, seasonal, and more expensive ingredients, making them harder to produce at scale.

Fragrance Type Analysis

Mixed Fragrance Solid Perfume Dominated the Market.

On the basis of fragrance type, the market is segmented into single fragrance and mixed fragrance. The mixed fragrance perfume dominated the market, comprising 53.5% of the market share, as it offers a more complex and dynamic scent experience that appeals to a broader range of preferences. Combining multiple fragrance notes creates a more sophisticated and long-term aroma, allowing for a richer, more personalized experience.

Consumers often prefer mixed fragrances as they can evoke a range of moods and are perceived as more versatile for different occasions. Additionally, mixed perfumes can balance lighter and heavier notes, making them more appealing for everyday use. Furthermore, the variety in scent profiles helps brands cater to diverse tastes, increasing their market reach.

End User Analysis

Solid Perfume Mostly Utilized by Female Consumers.

Based on the end users, the market is divided into male, female, and unisex. The female consumers dominated the market, with a notable market share of 45.6%, due to several cultural and behavioral factors. Conventionally, women have been more inclined to use perfumes as part of their daily beauty and grooming routines, with fragrance often seen as a key component of femininity and personal expression.

Additionally, solid perfumes often feature a wider range of floral, fruity, or sweet scents, which tend to be more popular among female consumers. While the market for men’s and unisex solid perfumes is growing, female consumers continue to represent the largest share, driven by long-established preferences for fragrance and beauty products.

Distribution Channel Analysis

Specialty Stores Held a Major Share of the Solid Perfume Market.

Among the distribution channels, 35.7% of the total global consumption of solid perfume is sold through specialty stores, due to the niche, artisanal nature of the product. Specialty stores often focus on high-quality, unique, or eco-friendly offerings, positioning solid perfumes as premium or handcrafted items that align with consumers’ demand for personal and sustainable luxury. These stores can provide a curated shopping experience, where consumers can explore exclusive scents and receive personalized recommendations.

In contrast, supermarkets and larger retail chains tend to prioritize mass-market products, while pharmacies and drugstores focus on health and wellness items. Similarly, the online stores may lack the tactile experience of smelling or testing a perfume, which is a key factor in fragrance purchasing decisions.

Key Market Segments

By Ingredient Type

- Natural

- Synthetic

By Fragrance Type

- Single Fragrance

- Mixed Fragrance

By End User

- Male

- Female

- Unisex

By Distribution Channel

- Supermarkets/Hypermarkets

- Pharmacies & Drugstores

- Specialty Stores

- Retail Cosmetic Stores

- Online Stores

- Others

Drivers

Demand for Convenience and Portability Drives the Solid Perfume Market.

The solid perfume market has witnessed a notable surge in demand driven by increasing consumer preference for convenience and portability. Solid perfumes, which are compact and portable, appeal particularly to individuals with fast-paced lifestyles, such as travelers or busy professionals. Their spill-proof nature makes them an attractive alternative to traditional liquid perfumes, which can be cumbersome during travel.

- In December 2024, international visitor arrivals to the United States alone totaled 6,456,562, an increase of 9.5% from December 2023. Similarly, outbound travel departures from the United States by U.S. citizens totaled 10,007,357 in December 2024, an increase of 7.7% from December 2023. As these numbers grow, there is a demand for the products that are compact in size and easily portable, such as solid perfumes.

Additionally, the rise in sustainable consumer behavior has led to an increased interest in solid perfumes, as they are often packaged in eco-friendly materials, reducing waste. Similarly, in recent years, the increasing availability of solid perfume options in various fragrances and formats has contributed to their broader appeal, particularly among younger demographics.

Restraints

Competition from Conventional Perfumes Poses a Significant Challenge to the Solid Perfume Market.

The solid perfume market faces significant competition from conventional liquid perfumes, which remain the dominant choice for consumers worldwide. Liquid perfumes offer a wider variety of fragrances and are often perceived as more luxurious, primarily due to their sophisticated packaging. For instance, major fragrance brands such as Chanel, Dior, and Gucci continue to command a large share of the market with their liquid offerings.

While solid perfumes are gaining popularity for their portability, they often struggle to match the fragrance intensity and longevity of liquid perfumes. Additionally, the traditional perfume industry benefits from strong brand loyalty and established consumer trust, making it challenging for solid perfume brands to capture significant market share. Despite innovations in solid perfume formulas and packaging, these products must overcome the perception of being less luxurious and more temporary in comparison to their liquid counterparts.

Opportunity

Cost-Effectiveness of the Solid Perfumes Creates Opportunities in the Market.

The cost-effectiveness of solid perfumes presents a significant opportunity for growth within the market. Solid perfumes typically require fewer ingredients and less intricate manufacturing processes than liquid perfumes, making them more affordable for consumers and manufacturers. This price advantage appeals to budget-conscious consumers, particularly in regions with price-sensitive demographics.

For instance, solid perfumes often come in small, concentrated formats, allowing for long-term use despite their lower price point. Additionally, the compact size reduces the demand for expensive packaging, further lowering costs. Many solid perfume options are priced significantly lower than high-end liquid fragrances, making them an attractive alternative for those seeking quality scents without the premium price.

Trends

Shift Towards Alcohol-Free Perfumes.

The ongoing shift towards alcohol-free perfumes is a notable trend that has contributed to the growing popularity of solid perfumes. Alcohol-free fragrances, which are often found in solid form, are gaining traction due to their appeal to health-conscious consumers and consumers with sensitive skin. Unlike traditional liquid perfumes, which often contain alcohol that can cause irritation, solid perfumes use oils or wax-based carriers, offering a gentler option for customers.

The shift is particularly significant among younger customers who prioritize natural and organic products. For instance, in a case study, it was revealed that over 50% of consumers prefer natural and organic ingredients in personal hygiene and beauty products over synthetic products. Leveraging the trend, many brands have developed alcohol-free solid perfumes using ingredients such as shea butter, coconut oil, and essential oils, catering to consumers seeking cruelty-free, hypoallergenic, and sustainable alternatives.

Geopolitical Impact Analysis

Geopolitical Tensions Affecting the Consumer Behavior for the Adoption of Solid Perfumes.

The impact of current geopolitical tensions on the solid perfume market can be observed primarily in the supply chain disruptions and shifting consumer preferences. Geopolitical instability, particularly in regions such as Eastern Europe and parts of Asia, has resulted in logistical challenges, including delays in raw material procurement and increased shipping costs. Solid perfumes, which rely on ingredients such as essential oils, waxes, and natural compounds, experienced supply shortages due to the global supply chain issues.

For instance, the availability of certain exotic oils, such as rose or sandalwood, was affected, leading to price increases, supply shortages, and has impacted production timelines of solid perfumes. Additionally, trade restrictions, such as sanctions on key raw material suppliers or specific markets, have created hurdles for solid perfume manufacturers. Regulatory shifts in countries like Russia and China have necessitated changes in ingredient sourcing and product formulation to comply with local regulations, further complicating the supply chain.

Similarly, consumer demand for affordable, locally produced products surged, as many individuals became more price-sensitive amid economic uncertainty. In contrast, the political climate heightened interest in sustainability and self-care, prompting many consumers to seek more eco-friendly and personal fragrance options. These developments are creating a more volatile market, requiring manufacturers to adapt by diversifying their supply chains and adjusting production practices.

Regional Analysis

Europe Held the Largest Share of the Global Solid Perfume Market.

In 2024, Europe dominated the global solid perfume market, holding about 34.2% of the total global consumption, driven by the strong consumer preference for luxury and sustainable products in the region. In countries such as Spain, France, Italy, and the UK, where fragrance culture is deeply embedded conventionally, consumers increasingly seek eco-friendly and innovative alternatives to traditional liquid perfumes. For instance, during the Renaissance era, the perfume manufacturing techniques evolved and developed in the region.

The growing demand for alcohol-free, cruelty-free, and vegan products in Europe further supports the dominance of solid perfumes, as these products align with the region’s wellness and environmental values. Additionally, European consumers are often more inclined to adopt compact, portable solutions due to busy lifestyles and a preference for products that are convenient for travel, as travelling is a popular recreational activity in the region. For instance, in 2024, EU residents aged 15 years and over made nearly 1.2 billion tourism trips with an average length of 5.0 overnight stays per trip. The cultural affinity for personal care, along with an awareness of environmental impact, positions Europe as a key driver of the solid perfume market’s growth.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The players in the solid perfume market emphasize product innovation, where brands introduce new scents, natural ingredients, and customizable options to cater to evolving consumer preferences. Additionally, as global consumers shift towards sustainable products, leveraging the trend, the companies prioritize eco-friendly packaging and cruelty-free formulations.

Similarly, several companies focus on expanding online presence through e-commerce platforms to reach global markets while offering convenience to consumers. Furthermore, they partner with influencers and collaborate with established brands to further boost the visibility of the product. These strategies collectively help solid perfume brands tap into diverse customer segments and strengthen their position in the market.

The Major Players in The Industry

- Aroamas

- Lush

- Pacifica

- L’Occitane

- Indah

- Sweet Anthem

- Bougie & Senteur

- Jean Niel

- Fury Bros

- Melange

- Longtake

- Diptyque

- Byredo

- Tom Ford

- Le Labo

- Zed Lifestyle Pvt. Ltd.

- Other Key Players

Key Development

- In January 2025, Korean fragrance brand Longtake, Amorepacific Group, released three gender-neutral solid perfumes formulated from upcycled oak sawdust.

- In November 2024, HYSSES, a brand revolving around aromatherapy, announced the launch of its collection of solid perfumes, featuring Osmanthus Jasmine, Elemi Camellia, and Palmarosa Jasmine.

Report Scope

Report Features Description Market Value (2024) USD 1.4 Bn Forecast Revenue (2034) USD 3.0 Bn CAGR (2025-2034) 7.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredient Type (Natural and Synthetic), By Fragrance Type (Single Fragrance and Mixed Fragrance), By End User (Male, Female, and Unisex), By Distribution Channel (Supermarkets/Hypermarkets, Pharmacies & Drugstores, Specialty Stores, Retail Cosmetic Stores, Online Stores, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape Aroamas, Lush, Pacifica, L’Occitane, Indah, Sweet Anthem, Bougie & Senteur, Jean Niel, Fury Bros, Melange, Longtake, Diptyque, Byredo, Tom Ford, Le Labo, Zed Lifestyle Pvt. Ltd., and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Aroamas

- Lush

- Pacifica

- L’Occitane

- Indah

- Sweet Anthem

- Bougie & Senteur

- Jean Niel

- Fury Bros

- Melange

- Longtake

- Diptyque

- Byredo

- Tom Ford

- Le Labo

- Zed Lifestyle Pvt. Ltd.

- Other Key Players