Global Social Tourism Market Size, Share, Growth Analysis By Tour Type (Socio-Educational Tours, Socio-Cultural Tours, Socio-Recreational Tours, Socio-Adventure Tours, Others), By Booking Channel (Phone Booking, Online Booking, In Person Booking), By Tourist Type (Domestic Tourist, International Tourist), By Age Group (25–45 Years, 46–65 Years, Above 66 Years), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 167327

- Number of Pages: 239

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

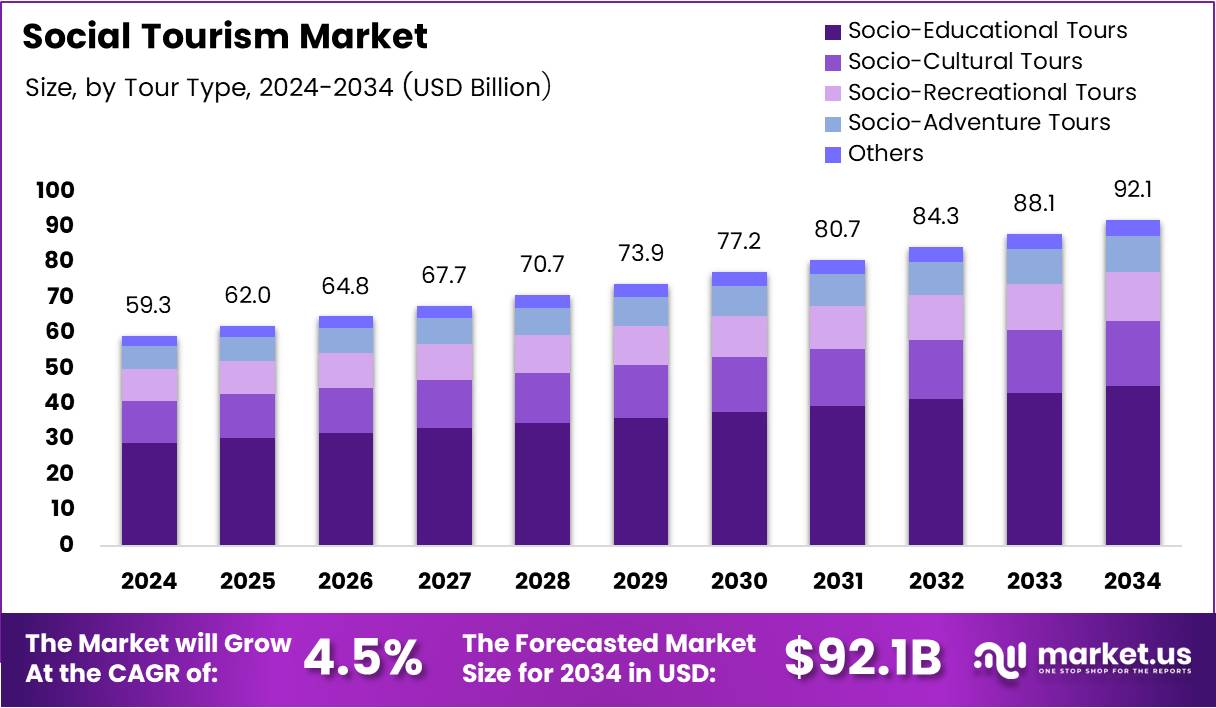

The Global Social Tourism Market size is expected to be worth around USD 92.1 Billion by 2034, from USD 59.3 Billion in 2024, growing at a CAGR of 4.5% during the forecast period from 2025 to 2034.

Social tourism refers to travel experiences designed to ensure accessibility for low-income families, senior citizens, students, and differently-abled individuals by offering subsidized packages and inclusive travel programs. It aims to promote cultural exchange, equitable leisure opportunities, and community engagement while supporting sustainable tourism models that benefit local societies and strengthen social welfare systems.

The Social Tourism Market reflects an expanding global industry focused on inclusive travel infrastructure, socially responsible tourism services, and community-based engagement programs. Moreover, demand continues to rise as travelers seek affordable, ethical, and socially impactful tourism options that enhance cultural learning while generating revenue and sustainable development within host regions.

Analysts observe strong market growth driven by increased awareness of responsible tourism, wider adoption of social travel programs, and collaborative initiatives between public and private organizations. Additionally, inclusive tourism platforms are encouraging cross-cultural learning and strengthening community livelihood opportunities, creating a stable foundation for long-term market expansion.

Furthermore, investment in accessible tourism infrastructure—including budget accommodations and community participation initiatives—continues to accelerate. As governments prioritize inclusivity in travel, strategic funding supports new public facilities, transportation access, and rural tourism development programs that allow underserved demographics to experience structured and meaningful travel opportunities.

In addition, regulatory reforms promoting responsible tourism, cultural preservation, and environmental safeguards are creating favorable business environments. Policies encouraging sustainability, ethical travel practices, and social equity are compelling companies to innovate while ensuring inclusivity, safety, and high-quality services for travelers across various socioeconomic backgrounds.

Simultaneously, technology adoption—such as digital booking platforms and awareness programs—supports the Social Tourism Market by increasing visibility and simplifying affordable travel planning. Community-based tourism cooperatives and NGO-led travel initiatives are also expanding their outreach to encourage greater participation from marginalized groups and develop diversified income streams for rural communities.

According to the Ministry of Tourism, India welcomed 9.24 million foreign tourist arrivals in 2023, reflecting a 43.5% rise from 6.44 million in 2022, while foreign exchange earnings reached approximately Rs 2.3 lakh crore, marking a 65% increase from the previous year. These metrics reinforce strong demand momentum and policy-driven tourism acceleration.

Key Takeaways

- Global Social Tourism Market expected to reach USD 92.1 Billion by 2034, up from USD 59.3 Billion in 2024, growing at 4.5% CAGR (2025–2034).

- Socio-Educational Tours lead with 32.1% share as the dominant tour type segment.

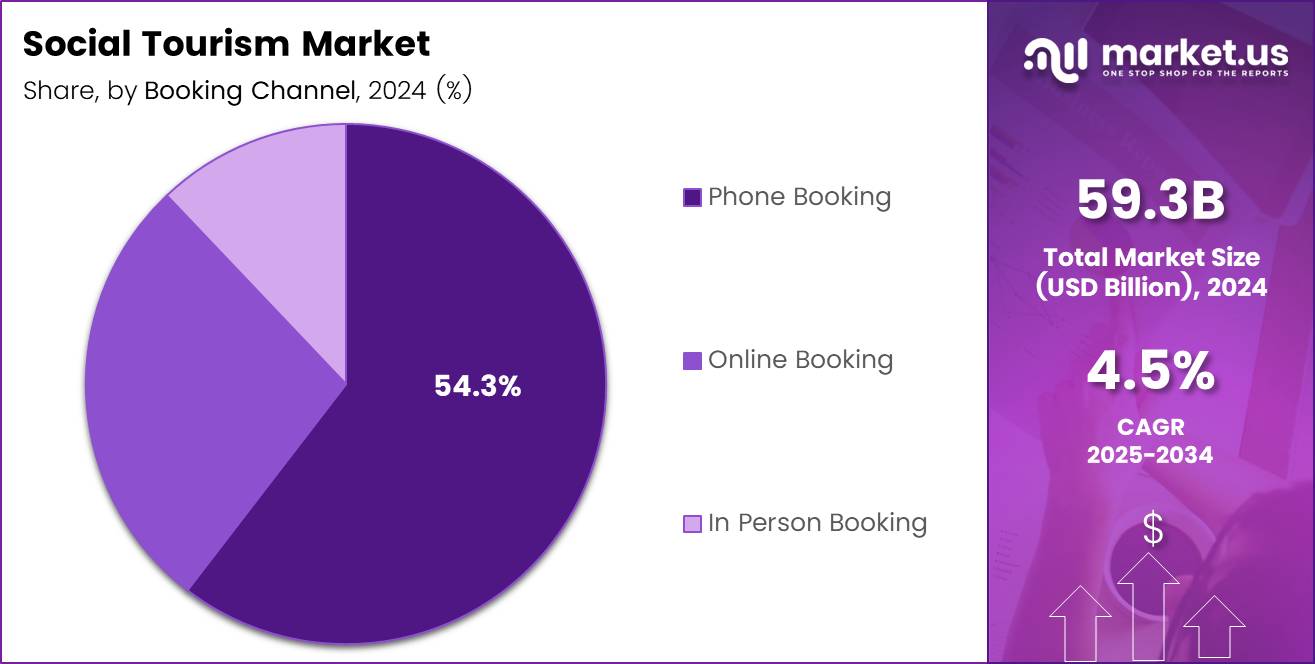

- Phone Booking holds 54.3% share, making it the leading booking channel.

- Domestic Tourists account for 67.9% share, dominating tourist type participation.

- 25–45 age group represents 49.2% share, ranking as the largest age-based segment.

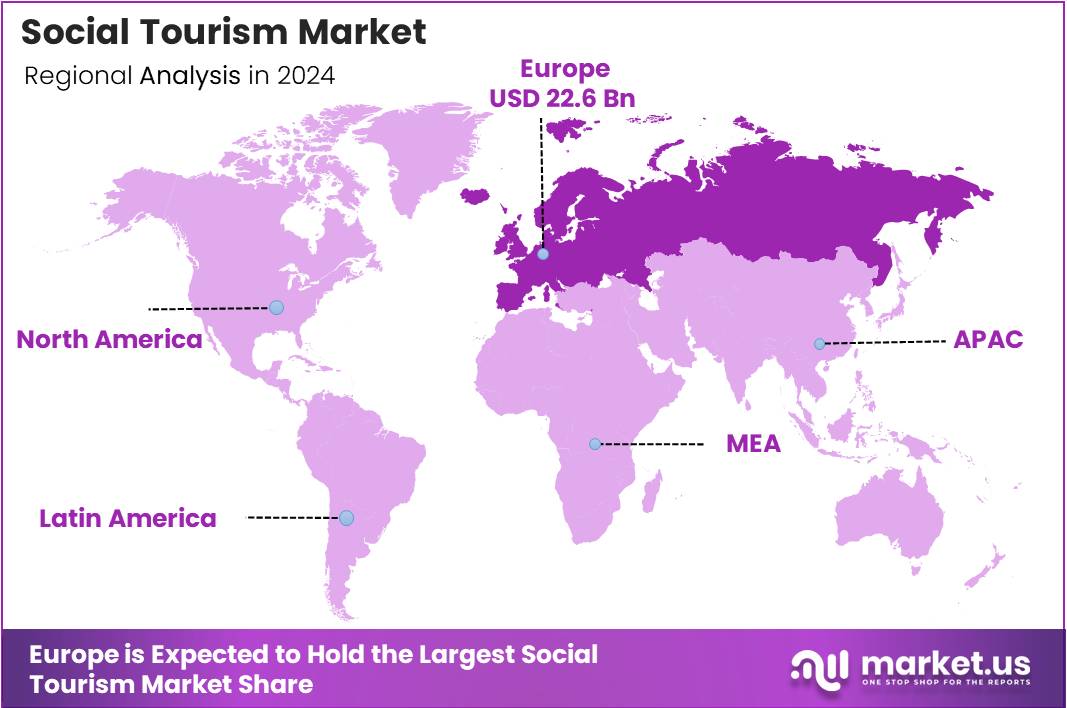

- Europe leads regionally with a 38.2% market share valued at USD 22.6 Billion.

By Tour Type Analysis

Socio-Educational Tours dominate with 32.1% due to their structured learning experiences and accessibility for diverse social groups.

In 2024, Socio-Educational Tours held a dominant market position in the By Main Segment Analysis segment of Social Tourism Market, with a 32.1% share. These tours focus on educational exposure, cultural exchange programs, and learning-based travel, boosting participation from institutions and families seeking meaningful travel.

Socio-Cultural Tours continued to grow as travellers embraced heritage experiences and community integration. These tours highlight local traditions, festivals, and customs, allowing travellers to explore authentic cultural practices while contributing to cultural preservation and deeper social awareness.

Socio-Recreational Tours gained momentum as travellers increasingly sought leisure-focused travel in safe and friendly environments. This segment promotes relaxation, entertainment activities, and family-centred travel, motivating participants to unwind while establishing healthier and socially supportive connections.

Socio-Adventure Tours appealed strongly to thrill-seeking travellers who prioritize outdoor sports, trekking, and physically engaging activities. Participants are motivated by excitement and group adventure experiences while also strengthening social bonding and emotional resilience through shared group challenges.

Others remained a niche but stable category, offering personalized and special-interest tour experiences. This sub-segment supports travellers with hobbies or unique preferences such as wellness retreats, community volunteering, or rural exchange activities, adding diversity to the social tourism portfolio.

By Booking Channel Analysis

Phone Booking dominates with 54.3% due to high trust and personalized assistance in arranging social group travel.

In 2024, Phone Booking held a dominant market position in the By Main Segment Analysis segment of Social Tourism Market, with a 54.3% share. Travellers preferred direct conversation and human support, especially when planning group trips, discounts, and customized itineraries.

Online Booking continued expanding steadily as advanced platforms improved price comparison, itinerary planning, and instant confirmation services. Tech-savvy travellers increasingly chose digital booking due to convenience and access to detailed travel information from home or mobile devices.

In Person Booking remained relevant among travellers who value face-to-face consultation for group arrangements and safety concerns. Physical travel agencies benefit from personal trust, printed confirmations, and consultative travel planning, especially for senior travellers and large educational groups.

By Tourist Type Analysis

Domestic Tourist dominates with 67.9% as most travellers prefer affordable and easily accessible social travel experiences in their home country.

In 2024, Domestic Tourist held a dominant market position in the By Main Segment Analysis segment of Social Tourism Market, with a 67.9% share. Familiarity with language, cultural comfort, and lower travel costs increased participation in nationwide social tourism programs.

International Tourist participation grew gradually as more travellers sought global cultural and recreational experiences. This sub-segment benefits from academic exchange programs, cross-border cultural tours, and global adventure travel, enhancing international understanding and social diversity.

By Age Group Analysis

25-45 Years dominate with 49.2% due to higher spending capacity and increased interest in skill-building and leisure-based group travel.

In 2024, 25-45 Years held a dominant market position in the By Main Segment Analysis segment of Social Tourism Market, with a 49.2% share. This age group participates actively in educational, recreational, and adventure travel to achieve both personal and social development.

Travellers aged 46-65 Years increasingly engaged in cultural and recreational tourism to explore new destinations while maintaining wellness. They prefer comfortable itineraries, heritage experiences, and safe leisure opportunities that promote relaxation and social connection.

Above 66 Years exhibited a steady yet stable share driven by wellness retreats, heritage travel, and assisted tourism programs. This segment values comfortable mobility, group companionship, and safe cultural discovery while contributing to age-friendly tourism growth.

Key Market Segments

By Tour Type

- Socio-Educational Tours

- Socio-Cultural Tours

- Socio-Recreational Tours

- Socio-Adventure Tours

- Others

By Booking Channel

- Phone Booking

- Online Booking

- In Person Booking

By Tourist Type

- Domestic Tourist

- International Tourist

By Age Group

- 25–45 Years

- 46–65 Years

- Above 66 Years

Drivers

Government-Sponsored Travel Subsidies to Promote Social Inclusion Drives Market Growth

The social tourism market is gaining strong traction as governments around the world introduce travel subsidies to support disadvantaged groups. These programs aim to reduce inequality by making leisure and cultural travel affordable for low-income families, students, senior citizens, and people with disabilities. Such initiatives help boost travel participation and encourage tourism spending across regions.

Another key driver is the rising demand for accessible tourism among seniors and low-income groups. As aging populations grow, more individuals are seeking barrier-free travel experiences that offer comfort, safety, and affordability. Travel companies are adapting with wheelchair-friendly accommodations, discounted tour packages, and specialized transportation services.

Additionally, cultural exchange and volunteer travel programs are expanding, encouraging young travelers to participate in social service activities while exploring new regions. These programs promote meaningful travel and foster cross-cultural understanding.

Many countries are now integrating social tourism into national welfare policies, linking travel benefits with social protection schemes. These welfare-based travel models help boost domestic tourism while improving the quality of life for vulnerable populations.

Restraints

Limited Funding Allocation for Subsidized Travel Programs Restrains Market Expansion

Despite strong growth potential, the social tourism market faces the challenge of limited financial support. Subsidized travel programs depend heavily on government budgets, which can fluctuate based on economic priorities. When funding is reduced, fewer individuals can benefit from affordable travel opportunities, restricting the market’s reach.

Another significant restraint is the lack of accessibility infrastructure in remote and rural destinations. Many social tourism programs focus on unexplored and nature-rich regions, but these areas often lack accessible transportation, disability-friendly facilities, and well-developed tourist services. As a result, travelers with special needs may find it difficult to explore such destinations comfortably.

The gap in infrastructure also prevents travel service providers from scaling their offerings. Without adequate development, remote locations may struggle to attract social tourism investments or maintain regular visitor flow. This infrastructure limitation slows market expansion and restricts the ability of social tourism to reach its full social and economic potential.

Growth Factors

Development of Eco-Social Tourism Packages in Underexplored Regions Offers Market Growth Opportunities

The global social tourism market is opening new growth avenues with the increasing creation of eco-friendly social tourism packages in unexplored regions. These offerings allow travelers to engage with nature responsibly while contributing to local community development and preservation.

Partnerships between NGOs and travel service providers are also emerging as valuable opportunities. Through collaborative initiatives, organizations can support vulnerable travelers with financial aid, travel guidance, and accessibility support. This approach enhances inclusivity and helps expand the market reach of social tourism programs.

Digital booking platforms tailored for social tourism are another promising opportunity. By simplifying pricing, accessibility information, and subsidy verification processes, these platforms make travel planning easier for low-income and special-needs travelers. As adoption increases, they can improve market visibility and participation.

Additionally, cross-border social tourism initiatives within regional blocs such as the EU or ASEAN are gaining momentum. These programs promote low-cost mobility between neighboring countries, encouraging cultural exchange and regional travel growth.

Emerging Trends

Increased Preference for Community-Based Accommodation Experiences Influences Social Tourism Trends

Social tourism is witnessing strong trends as travelers increasingly prefer community-based accommodation experiences such as homestays and local guesthouses. These options offer meaningful interaction with residents and help support local economies.

Another emerging trend is the rise of multigenerational social travel programs. Families are increasingly choosing group trips that include children, parents, and grandparents, creating demand for accessible itineraries, family-friendly accommodations, and affordable package pricing.

Tourism providers are also adopting social impact assessment metrics to evaluate how travel programs benefit host communities. This trend reflects a shift toward responsible and measurable social contribution in tourism services.

Moreover, global travel campaigns focusing on cultural immersion and social responsibility are gaining popularity. Marketing content now highlights authentic experiences such as local craft workshops, community festivals, and volunteer activities. This shift encourages travelers to seek purpose-driven journeys rather than purely recreational trips.

Regional Analysis

Europe Dominates the Social Tourism Market with a Market Share of 38.2%, Valued at USD 22.6 Billion

Europe leads the global social tourism market, driven by extensive government initiatives promoting subsidized travel for low-income groups, students, and senior citizens. The region holds a commanding 38.2% market share, valued at USD 22.6 Billion, supported by strong public policies encouraging inclusive leisure and cultural mobility. High participation in community-based tourism programs and well-established travel infrastructure continue to reinforce Europe’s dominant position.

North America Social Tourism Market Trends

North America shows steady expansion in the social tourism market, supported by rising emphasis on community travel, volunteer tourism, and accessible travel programs for underserved groups. Increasing funding for educational trips and senior travel assistance is contributing significantly to market growth. The region also benefits from a strong network of cultural and recreational attractions encouraging domestic social tourism participation.

Asia Pacific Social Tourism Market Trends

The Asia Pacific region is witnessing rapid growth, driven by government-supported tourism schemes, youth travel subsidies, and expanding cultural exchange initiatives. Rising disposable incomes and improved transportation infrastructure are enabling broader participation in recreational and educational travel. Countries in this region are increasingly focusing on socially responsible tourism activities that support rural communities and local economies.

Middle East & Africa Social Tourism Market Trends

The Middle East & Africa market is developing gradually as social tourism programs become integrated into national tourism policies. Growth is supported by cultural heritage tourism expansion and new initiatives aimed at improving travel accessibility for residents and expatriates. Investments in community-based tourism and cultural preservation projects are fostering greater interest in social travel experiences across the region.

Latin America Social Tourism Market Trends

Latin America is strengthening its position in the social tourism sector through government-led travel programs intended for low-income families, students, and seniors. Rich cultural heritage and ecological destinations enhance participation in inclusive travel experiences. Collaborative programs between tourism ministries and social welfare departments are helping the region create a more accessible and community-oriented tourism environment.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Social Tourism Company Insights

The global Social Tourism Market in 2024 continues to expand as travel demand shifts toward community-based experiences and responsible tourism.

Intrepid remains a major driver of this trend, leveraging its established reputation in small-group and culturally immersive travel. The company’s growing focus on low-impact itineraries and partnerships with local communities positions it strongly among travelers prioritizing social and environmental value rather than purely leisure-centric trips.

Adventures has amplified its market presence by offering curated adventure-driven itineraries that appeal to younger and sustainability-focused demographics. Its strategic brand messaging around authentic exploration and impactful travel resonates well within social tourism segments, creating consistent repeat demand. Increasing investment in experiential travel and cross-cultural exchange programs further solidifies its competitive advantage.

Trenitalia supports the market through accessible rail-based tourism solutions that make socially responsible travel more affordable and connected across regions. By promoting low-carbon mobility and seamless public transport links to budget-friendly destinations, the railway operator enables broader participation in domestic and intra-European tourism. This accessibility enhances the inclusiveness that defines the core of social tourism.

SNCF plays a similar strategic role by integrating sustainable travel infrastructure with tourism initiatives that foster accessibility for youth, senior citizens, and low-income groups. Its continued expansion of discounted travel programs reflects a commitment to democratizing travel opportunities. Through rail-linked cultural routes and community-driven tourism collaborations, SNCF strengthens the position of socially supportive mobility as a major pillar within the global Social Tourism Market.

Top Key Players in the Market

- Intrepid

- Adventures

- Trenitalia

- SNCF

- Eurostar

- Renfe

- Explore Tours

- Exodus Travels

- Deutsch Bahn

- FlixTrain

- On-the-go Tours

Recent Developments

- In Sep 2024: Polish travel platform eSky announced plans to acquire the iconic Thomas Cook brand from China’s Fosun, aiming to expand its global footprint and strengthen its position in the European travel market.

- In Oct 2025: EaseMyTrip accelerated its 2.0 strategic roadmap by making four major acquisitions, boosting its integrated travel ecosystem with enhanced service offerings across tourism, hospitality, and mobility segments.

Report Scope

Report Features Description Market Value (2024) USD 59.3 Billion Forecast Revenue (2034) USD 92.1 Billion CAGR (2025-2034) 4.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Tour Type (Socio-Educational Tours, Socio-Cultural Tours, Socio-Recreational Tours, Socio-Adventure Tours, Others), By Booking Channel (Phone Booking, Online Booking, In Person Booking), By Tourist Type (Domestic Tourist, International Tourist), By Age Group (25–45 Years, 46–65 Years, Above 66 Years) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Intrepid, Adventures, Trenitalia, SNCF, Eurostar, Renfe, Explore Tours, Exodus Travels, Deutsch Bahn, FlixTrain, On-the-go Tours Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Intrepid

- Adventures

- Trenitalia

- SNCF

- Eurostar

- Renfe

- Explore Tours

- Exodus Travels

- Deutsch Bahn

- FlixTrain

- On-the-go Tours