Global Smart Warehousing Market By Component (Hardware, Software, Services), By Deployment (Cloud, On-Premises), By Technology (IoT, Robotics and Automation, AI and Analytics, Networking and Communication, AR and VR, Others), By Application (Inventory Management, Order Fulfillment, Asset Tracking, Others), By Warehouse Size (Small, Medium, Large), By Vertical (Retail & E-commerce, Manufacturing, Transportation & Logistics, Food & Beverages, Healthcare, Energy and Utilities, Agriculture, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2024-2033

- Published date: July 2024

- Report ID: 113020

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

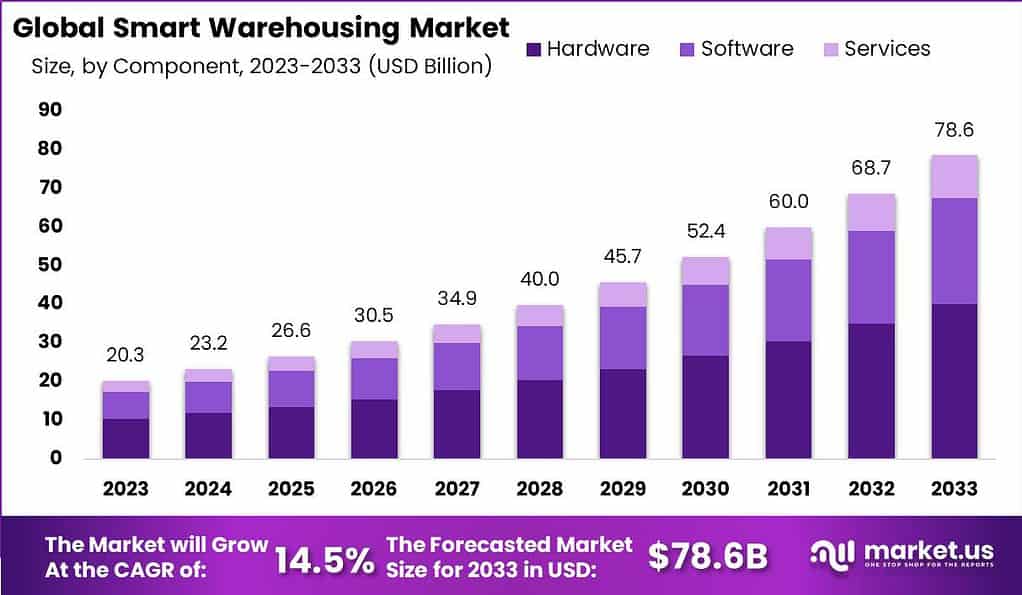

The Global Smart Warehousing Market size is expected to be worth around USD 78.6 Billion by 2033, from USD 20.3 Billion in 2023, growing at a CAGR of 14.5% during the forecast period from 2024 to 2033.

The Smart Warehousing Market is undergoing significant transformation, driven by advancements in technology and evolving industry demands. This market is expected to see considerable growth due to factors such as the increasing adoption of Internet of Things (IoT) devices, automation technologies, and the need for efficient inventory management and logistics. These technologies enable warehouses to operate more efficiently, reducing costs and improving accuracy in inventory control and order fulfillment.

One of the key growth factors driving the smart warehousing market is the increasing demand for efficient and streamlined warehouse operations. With the rise of e-commerce and the need for faster order fulfillment, companies are seeking innovative solutions to optimize their warehouse processes. Smart warehousing technologies, such as robotics, Internet of Things (IoT) devices, and artificial intelligence (AI), enable real-time tracking, inventory management, and automated workflows, leading to enhanced operational efficiency and cost savings.

Moreover, the growing focus on sustainability and environmental consciousness presents an opportunity for smart warehousing. Technologies like energy-efficient lighting systems, automated climate control, and green building practices can help reduce energy consumption and minimize the carbon footprint of warehouses, aligning with the global sustainability agenda.

However, the market faces challenges including the high initial investment required for setting up smart warehouses and the need for skilled personnel to manage and maintain advanced technologies. Additionally, cybersecurity concerns pose a significant challenge as the integration of digital systems increases the risk of data breaches and cyber attacks.

Opportunities in the smart warehousing market are large. The growing e-commerce sector, for example, continuously demands faster and more efficient logistics solutions, which smart warehouses can provide. Moreover, advancements in AI and machine learning offer potential for further optimization of warehouse operations through predictive analytics and more sophisticated automation solutions

Key Takeaways

- The Smart Warehousing Market is projected to reach approximately USD 78.6 billion by 2033, with a remarkable CAGR of 14.5% from 2023, where it was valued at USD 20.3 billion. This growth highlights the increasing adoption of advanced technologies in warehouse operations.

- In 2023, hardware components held the majority market share at over 51%. These components are foundational in capturing real-time data and enabling automation.

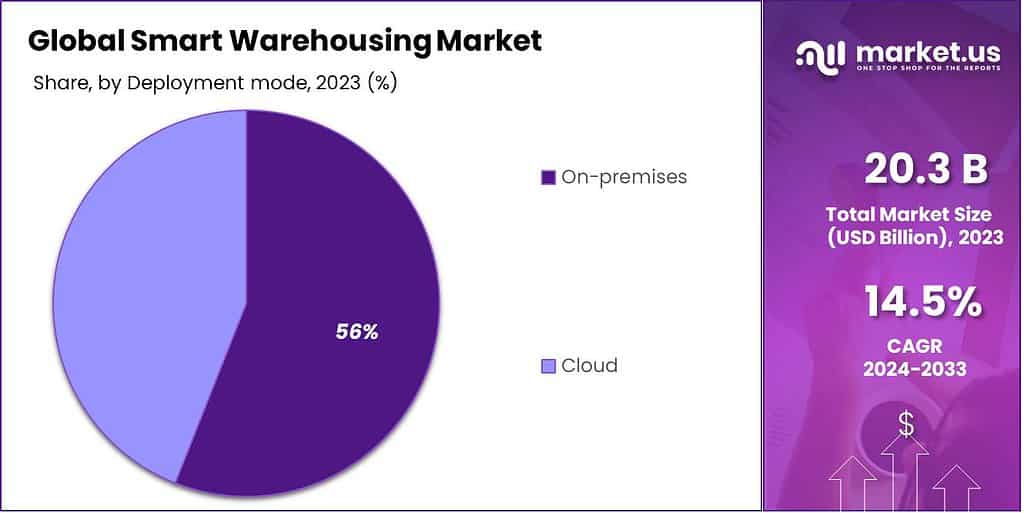

- On-premises solutions accounted for over 56% of the market in 2023, mainly due to enhanced control, customization, and reliability.

- Robotics and automation held more than 32% of the market share in 2023, offering efficiency gains and addressing labor shortages.

- The order fulfillment segment captured over 34% market share in 2023, driven by the need for rapid and accurate order processing, especially in e-commerce.

- Large warehouses held the largest market share at more than 48% in 2023, benefiting from advanced technologies to manage complex operations.

- Transportation & Logistics accounted for over 19.5% of the market share in 2023, as smart warehousing optimizes supply chain operations.

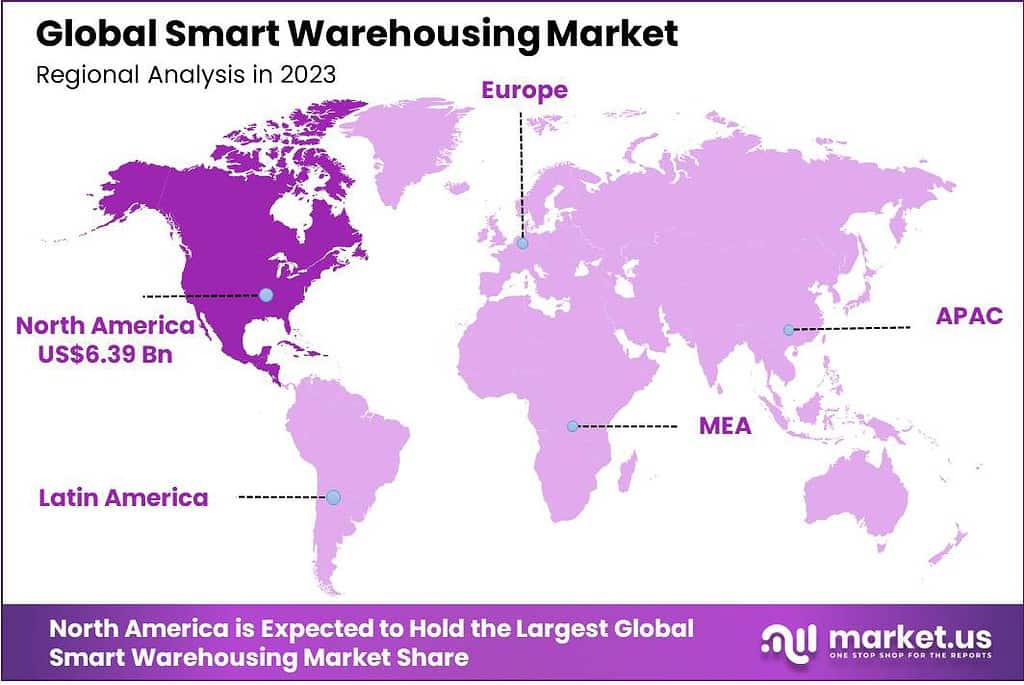

- In 2023, North America held a dominant market position in the Smart Warehousing market, capturing more than a 31.5% share.

Component Analysis

In 2023, the Hardware segment held a dominant position in the Smart Warehousing Market, capturing more than a 51% share. This substantial market share can primarily be attributed to the critical role that physical components, such as sensors, robots, and automated systems, play in the infrastructure of smart warehouses. These hardware elements are fundamental in transforming traditional warehouses into smart warehouses by enabling automation, enhancing data collection, and facilitating real-time monitoring and management of operations.

The leading position of the Hardware segment is further reinforced by the increasing demand for automation and efficiency in logistics and supply chain operations. Businesses are investing in sophisticated warehouse management systems that include conveyor belts, automated guided vehicles (AGVs), and picking robots to speed up operations and reduce human error. Moreover, the adoption of IoT devices and RFID systems for tracking inventory and assets in real-time contributes significantly to the growth of this segment.

For instance, Amazon.com Inc. made a significant announcement in June 2022, introducing its pioneering “fully autonomous” warehouse robot, Proteus. Designed to operate without physical constraints, Proteus ensures unrestricted movement in the presence of human workers. Its initial deployment will involve the autonomous movement of “GoCarts,” tall wheeled cages used for transporting packages within Amazon’s warehouses.

The growth of e-commerce and the rising need for faster delivery times also play a crucial role in driving the demand for advanced warehousing technologies. As companies strive to meet customer expectations for quick and accurate deliveries, the reliance on hardware that can optimize warehouse operations and increase throughput is expected to grow. This ongoing evolution towards more automated and efficient systems signifies a robust growth trajectory for the Hardware segment in the smart warehousing market, underpinning its leading position.

Deployment Analysis

In 2023, the On-Premises segment held a dominant market position in the Smart Warehousing Market, capturing more than a 56% share. This leadership is largely due to the high level of control and security that on-premises solutions offer to enterprises.

Many companies, particularly those with extensive and sensitive inventory, prefer on-premises deployment because it allows them to maintain complete control over their warehousing operations and data. This is crucial in industries where data privacy and operational security are paramount, such as pharmaceuticals, defense, and high-value retail.

Furthermore, on-premises solutions are favored for their ability to be customized to specific operational needs. Companies can tailor their warehousing systems extensively, integrating them seamlessly with existing IT infrastructures and machinery. This customization ensures that operations are optimized to the specific layout and workflows of a warehouse, which can lead to more efficient resource management and reduced operational costs.

Additionally, the initial hesitance towards cloud-based solutions, concerning reliability and data security, also contributes to the dominance of on-premises deployments. Despite the growing trust in cloud technologies, the on-premises model remains a staple in industries where uninterrupted operations are critical, and where companies are willing to invest significantly in maintaining proprietary systems to avoid potential downtime and external threats. This enduring preference underscores the ongoing significance of on-premises deployments in the smart warehousing sector.

Technology Analysis

In 2023, the Robotics and Automation segment held a dominant market position in the Smart Warehousing Market, capturing more than a 32% share. This prominence is driven by the significant efficiency gains and cost reductions that robotics and automation technologies offer to warehousing operations.

Automated guided vehicles (AGVs), robotic picking systems, and automated storage and retrieval systems (ASRS) are increasingly being implemented to handle repetitive tasks, reduce labor costs, and minimize errors. These technologies also enhance the scalability of operations, enabling warehouses to manage higher volumes of orders with greater accuracy and speed.

The drive towards faster delivery times in sectors like e-commerce and manufacturing has further fueled the adoption of robotics and automation. Companies are under constant pressure to expedite processes from inventory management to order fulfillment, making automation not just beneficial but essential. As consumer expectations for quick service continue to rise, the reliance on robotic solutions becomes increasingly critical, promoting continuous innovation and investment in this sector.

Moreover, the integration of AI with robotics and automation technologies is creating smarter systems capable of learning and adapting to new workflows. This integration allows for continuous improvement in operational efficiency, pushing the boundaries of what automated systems can handle and thus further solidifying the leadership position of the Robotics and Automation segment within the smart warehousing market.

Application Analysis

In 2023, the Order Fulfillment segment held a dominant market position in the Smart Warehousing Market, capturing more than a 34% share. This segment’s leadership stems from the critical role that efficient order fulfillment plays in customer satisfaction and operational efficiency.

As e-commerce continues to expand, the pressure on warehouses to process and ship orders quickly and accurately has intensified. Smart warehousing technologies tailored for order fulfillment, such as automated picking systems and intelligent sorting robots, significantly streamline these processes, reducing turnaround times and minimizing errors.

The adoption of advanced technologies in order fulfillment also addresses the increasing complexity of supply chains and customer demands for faster delivery services. Businesses are leveraging smart warehousing solutions to optimize every step of the fulfillment process – from receiving and storing goods to picking, packing, and shipping. This not only enhances operational efficiencies but also improves the overall customer experience by ensuring timely deliveries and reducing order inaccuracies.

Furthermore, as companies expand globally, they face diverse and fluctuating demand across different markets. Smart warehousing technologies provide the agility needed to adapt to these changes swiftly, allowing for real-time inventory adjustments and dynamic order processing.

This adaptability, coupled with the critical nature of fulfillment in logistics, positions the Order Fulfillment segment as a key driver of growth and innovation in the smart warehousing market. As businesses continue to prioritize speed and accuracy in their operations, this segment is expected to maintain its leading status and see continued investment and development.

Warehouse Size Analysis

In 2023, the Large segment held a dominant market position in the Smart Warehousing Market, capturing more than a 48% share. This dominance can be attributed to the significant advantages that large-scale operations gain from implementing smart warehousing technologies.

Large warehouses, typically utilized by major retailers, manufacturers, and logistics companies, have extensive inventories and complex operations that benefit immensely from automation and advanced data analytics. The integration of technologies such as IoT, AI, and robotics in these large facilities enhances operational efficiency by optimizing space utilization, reducing waste, and improving inventory management.

Additionally, the economies of scale in large warehouses allow for more substantial investments in cutting-edge technologies, which smaller operations might find cost-prohibitive. This investment capacity enables large warehouses to lead in adopting innovations that drive further efficiency, such as automated storage and retrieval systems (ASRS), advanced conveyor belts, and sophisticated management software that can handle complex logistics tasks more efficiently.

Moreover, the strategic importance of large warehouses in supply chain networks positions them as critical hubs for innovation in logistics practices. As the demand for faster and more reliable delivery services grows, large warehouses are increasingly leveraging smart technologies to stay competitive and meet customer expectations. This ongoing commitment to technological advancement ensures the continued dominance of the Large segment in the smart warehousing market, setting trends that shape the future of warehousing and distribution.

Vertical Analysis

In 2023, the Transportation & Logistics segment held a dominant market position in the Smart Warehousing Market, capturing more than a 19.5% share. This segment’s leadership is primarily due to the crucial role that efficient warehousing plays in the overall effectiveness of transportation and logistics operations.

As the backbone of supply chain management, transportation and logistics companies rely heavily on smart warehousing solutions to enhance operational efficiencies, reduce costs, and improve delivery times. Technologies such as real-time inventory management systems, automated sorting and picking equipment, and advanced tracking systems are integral in optimizing these processes.

The surge in global trade and e-commerce has further propelled the need for advanced warehousing solutions within this sector. Companies are increasingly adopting smart warehousing technologies to cope with the growing volume and complexity of goods movement. This includes the integration of IoT devices for seamless communication between different segments of the supply chain and the use of AI to predict demand patterns and optimize stock levels.

Moreover, the push for sustainability and reduced environmental impact in logistics operations is driving innovation in smart warehousing within this sector. Energy-efficient systems, waste reduction protocols, and improved resource management enabled by smart technologies not only lead to cost savings but also align with the global shift towards greener logistics practices.

The strategic importance of efficient warehousing in transportation and logistics ensures that this segment remains at the forefront of adopting and benefiting from smart warehousing innovations, maintaining its leadership position in the market.

Key Market Segments

By Component

- Hardware

- Software

- Services

By Deployment

- Cloud

- On-Premises

By Technology

- IoT

- Robotics and Automation

- AI and Analytics

- Networking and Communication

- AR and VR

- Others

By Application

- Inventory Management

- Order Fulfillment

- Asset Tracking

- Others

By Warehouse Size

- Small

- Medium

- Large

By Vertical

- Retail & E-commerce

- Manufacturing

- Transportation & Logistics

- Food & Beverages

- Healthcare

- Energy and Utilities

- Agriculture

- Others

Driver

Increasing Demand for Efficient Inventory Management

One of the primary drivers of the Global Smart Warehousing market is the increasing need for efficient inventory management systems. As businesses face growing pressures to optimize their supply chain and logistics operations, smart warehousing technologies offer solutions for real-time inventory tracking, predictive analytics for demand forecasting, and automated replenishment systems.

These capabilities significantly reduce errors, minimize costs associated with overstocking or stockouts, and improve overall operational efficiency. This trend is particularly pronounced in sectors such as e-commerce, retail, and manufacturing, where efficient inventory management directly impacts customer satisfaction and business profitability.

Restraint

High Initial Setup Costs

A major restraint in the Global Smart Warehousing market is the high initial setup costs associated with implementing smart warehousing solutions. Advanced technologies such as robotics, AI, IoT, and automation systems require significant capital investment, which can be a barrier, especially for small and medium-sized enterprises.

The cost associated with upgrading existing infrastructure to support these technologies and training employees to effectively utilize the new systems can also be substantial. This restraint can slow down the adoption rate of smart warehousing solutions among businesses with limited financial resources.

Opportunity

Integration of AI and IoT Technologies

A significant opportunity in the Global Smart Warehousing market lies in the integration of AI and IoT technologies. The convergence of these technologies has the potential to revolutionize warehouse operations by enhancing process automation, predictive maintenance, and real-time decision-making.

AI algorithms can analyze vast amounts of data from IoT sensors to optimize warehouse layout, inventory management, and supply chain logistics. This integration also opens up new possibilities for personalized and dynamic responses to changes in market demand, environmental conditions, and operational challenges, offering a competitive edge to businesses.

Challenge

Data Security and Privacy Concerns

A key challenge in the Global Smart Warehousing market is managing data security and privacy concerns. Smart warehousing systems rely heavily on the collection, processing, and storage of large amounts of data, some of which can be sensitive. Ensuring the security of this data against cyber threats and breaches is crucial.

Additionally, businesses must navigate complex regulatory environments regarding data privacy and protection. Failing to adequately address these concerns can result in significant legal, financial, and reputational risks for businesses, making data security and privacy a critical challenge in the adoption and implementation of smart warehousing technologies.

Regional Analysis

In 2023, North America held a dominant market position in the Smart Warehousing market, capturing more than a 31.5% share. This significant market presence is primarily due to the region’s rapid adoption of advanced technologies in logistics and supply chain management. The demand for Smart Warehousing in North America was valued at US$ 6.39 billion in 2023 and is anticipated to grow significantly in the forecast period.

North America, particularly the United States, has been at the forefront of integrating technologies such as robotics, AI, and IoT in warehousing operations. This trend is strongly supported by the presence of leading technology companies and startups that are continuously innovating in the smart warehousing space.

The region’s strong economic infrastructure and the presence of a large e-commerce market also contribute to this dominance. As e-commerce continues to grow, driven by consumer demand for faster and more efficient delivery services, warehouses in North America are increasingly turning to smart solutions to enhance operational efficiency and meet these demands. The high level of automation in warehousing in this region is not only a response to market demand but also a strategy to address labor shortages and reduce reliance on manual labor.

Furthermore, the investment in research and development in the field of smart warehousing is significant in North America. This investment fuels continuous improvements and innovations in warehousing technologies, keeping the region at the cutting edge of the smart warehousing market. Additionally, the established supply chain networks and the push towards digitization across various industries in this region provide a conducive environment for the growth of smart warehousing solutions.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Smart Warehousing market is highly competitive and consists of several key players that are actively contributing to the market growth. These companies are engaged in developing and offering a wide range of smart warehousing solutions, including hardware, software, and services.Key players in the market are continuously focusing on innovation, strategic partnerships, and mergers and acquisitions to strengthen their market presence and expand their product portfolios.

HAI ROBOTICS announced a significant partnership in January 2022, joining forces with Voyatzoglou Systems, a key player in intralogistics within Greece. The collaboration is geared towards implementing smart warehousing solutions throughout Greece and the broader Balkan region.

Top Key Players

- Honeywell International Inc.

- Siemens

- Zebra Technologies Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- KION Group AG

- Cognex Corporation

- ABB Ltd.

- Tecsys, Inc.

- Manhattan Associates

- PSI Logistics

- Reply

- Other key players

Recent Developments

- March 2023: Honeywell introduced the Honeywell Universal Robotics Controller (HURC) at ProMat 2023. This system aims to integrate various robotics and automation systems in distribution centers, enhancing interoperability and data exchange for better decision-making and efficiency in warehouse operations.

- January 2023: Siemens launched a new version of its Warehouse Management System (WMS), incorporating advanced AI algorithms to optimize inventory management and streamline warehouse operations. The updated system offers real-time data analytics and improved user interface for better operational control.

- February 2023: Zebra Technologies unveiled its latest RFID-enabled solution designed to enhance asset tracking and inventory management in warehouses. This solution aims to reduce errors and improve the efficiency of warehouse operations by providing real-time visibility into the status and location of assets.

- April 2023: IBM announced a collaboration with several logistics companies to integrate its AI-powered IBM Watson into warehouse management systems. This integration focuses on predictive analytics and automation to optimize warehouse processes and improve operational efficiency.

- June 2023: SAP SE launched an updated version of its Extended Warehouse Management (EWM) software, featuring new capabilities for automation and integration with IoT devices. The new features aim to improve inventory accuracy and operational efficiency in smart warehouses.

- September 2023: Cognex Corporation introduced new machine vision systems designed for smart warehouses, featuring advanced AI algorithms for improved accuracy in product identification and tracking. These systems aim to enhance automation and reduce operational errors in warehouses.

Report Scope

Report Features Description Market Value (2023) USD 20.3 Bn Forecast Revenue (2033) USD 78.6 Bn CAGR (2024-2033) 14.5% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware, Software, Services), By Deployment (Cloud, On-Premises), By Technology (IoT, Robotics and Automation, AI and Analytics, Networking and Communication, AR and VR, Others), By Application (Inventory Management, Order Fulfillment, Asset Tracking, Others), By Warehouse Size (Small, Medium, Large), By Vertical (Retail & E-commerce, Manufacturing, Transportation & Logistics, Food & Beverages, Healthcare, Energy and Utilities, Agriculture, Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Honeywell International Inc., Siemens, Zebra Technologies Corporation, IBM Corporation, Oracle Corporation, SAP SE, KION Group AG, Cognex Corporation, ABB Ltd., Tecsys Inc., Manhattan Associates, PSI Logistics, Reply, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Smart Warehouse?A smart warehouse refers to an advanced storage facility equipped with technologies like IoT, automation, and data analytics to optimize operational processes, enhance efficiency, and improve overall warehouse management.

How big is the smart warehousing market?The Global Smart Warehousing Market size is expected to be worth around USD 78.6 Billion by 2033, from USD 20.3 Billion in 2023, growing at a CAGR of 14.5% during the forecast period from 2024 to 2033.

Who are the key players in smart warehousing market?The major market players includes Honeywell International Inc., Siemens, Zebra Technologies Corporation, IBM Corporation, Oracle Corporation, SAP SE, KION Group AG, Cognex Corporation, ABB Ltd., Tecsys Inc., Manhattan Associates, PSI Logistics, Reply, Other key players

Which region accounted for the largest smart warehousing market share?North America dominated the market for smart warehousing and accounted for the largest revenue share (31.5% in 2023).

What factors are driving the growth of the Smart Warehousing Market?The market is propelled by the increasing adoption of automation, a demand for real-time tracking in supply chains, and a focus on cost reduction and operational efficiency in warehouse management.

-

-

- Honeywell International Inc.

- Siemens

- Zebra Technologies Corporation

- IBM Corporation

- Oracle Corporation

- SAP SE

- KION Group AG

- Cognex Corporation

- ABB Ltd.

- Tecsys, Inc.

- Manhattan Associates

- PSI Logistics

- Reply

- Other key players