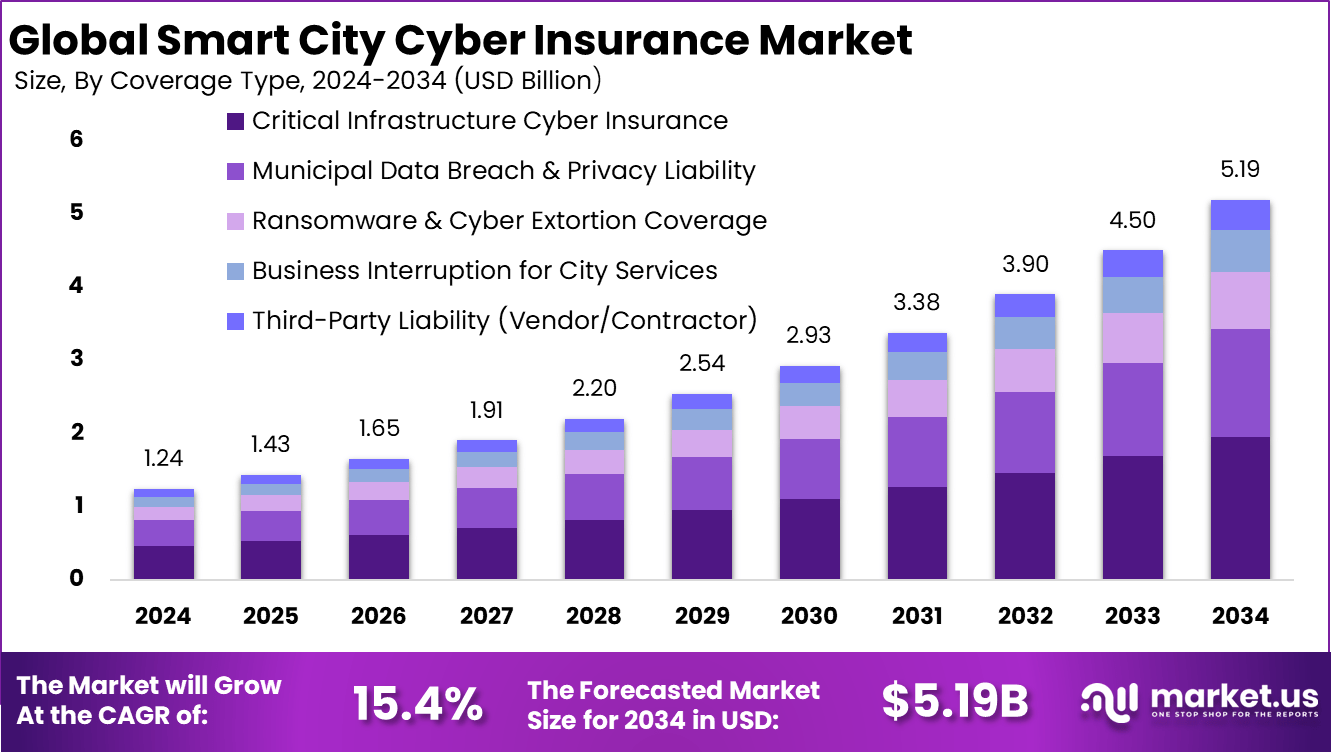

Global Smart City Cyber Insurance Market Size, Share and Analysis Report By Coverage Type (Critical Infrastructure Cyber Insurance, Municipal Data Breach & Privacy Liability, Ransomware & Cyber Extortion Coverage, Business Interruption for City Services, Third-Party Liability (Vendor/Contractor), By Insured Entity (Municipal Governments & Agencies, Public Utility Operators, Smart Infrastructure Vendors/Operators, Public Transit Authorities), By Technology Application (Smart Grid & Energy Systems, Intelligent Transportation Systems, Public Safety & Surveillance Networks, Smart Water & Waste Management), By Policy Duration (Annual Policies, Multi-Year/Project-Based Policies), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Dec. 2025

- Report ID: 172353

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Quick Market Facts

- U.S. Market Size

- Coverage Type Analysis

- Insured Entity Analysis

- Technology Application Analysis

- Policy Duration Analysis

- Emerging Trend Analysis

- Investment and Business Benefits

- Key Market Segments

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

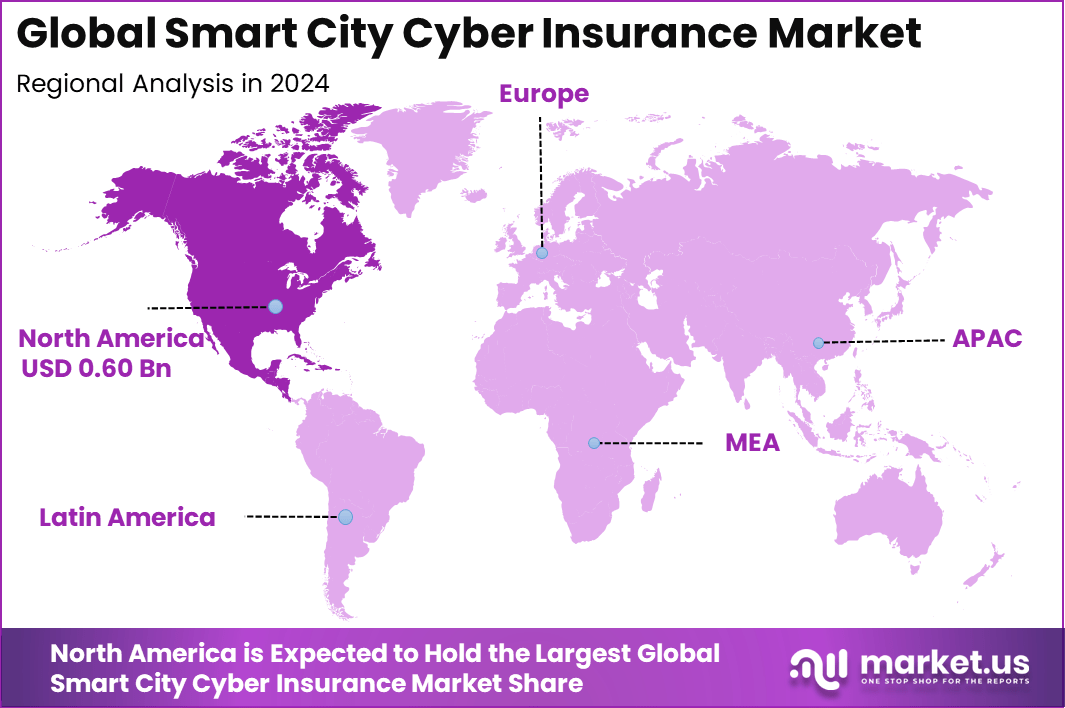

The Global Smart City Cyber Insurance Market size is expected to be worth around USD 5.19 billion by 2034, from USD 1.43 billion in 2025, growing at a CAGR of 15.4% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 48.7% share, holding USD 0.60 billion in revenue.

The Smart City Cyber Insurance Market focuses on insurance solutions designed to protect smart city infrastructure from cyber risks. Smart cities rely on connected systems such as traffic management, smart grids, surveillance, and public service platforms, which increases exposure to cyber threats. Cyber insurance provides financial protection against data breaches, system outages, ransomware, and operational disruptions. This market supports governments and urban operators in managing digital risk across interconnected city ecosystems.

Demand for smart city cyber insurance is driven by the rising frequency and sophistication of cyberattacks on public infrastructure. City authorities and municipal bodies face increasing pressure to safeguard sensitive data and ensure uninterrupted public services. Cyber incidents can disrupt transportation, utilities, and emergency systems, creating significant financial and reputational risks. Insurance coverage is therefore being considered as part of broader risk management strategies.

For instance, in April 2025, Travelers introduced Cyber Risk Services across all cyber policies, adding always-on threat monitoring, predictive alerts, and recovery support for smart city operators. After acquiring Corvus for advanced tech, this enhances resilience against ransomware that could cripple urban systems. Business leaders tell me these tools cut recovery costs by up to 30% in real-world tests.

The adoption of cyber insurance in smart cities is supported by technologies such as Internet of Things networks, cloud platforms, and centralized data management systems. These technologies enable advanced city services but also expand the digital attack surface. Cyber risk assessment tools help insurers evaluate exposure across complex urban systems. Improved monitoring and analytics support more accurate policy structuring.

Artificial intelligence and data analytics are also influencing insurance adoption. These tools help assess threat patterns and potential loss scenarios in connected city environments. Secure data sharing between city operators and insurers improves underwriting accuracy. Technology integration strengthens the alignment between cybersecurity controls and insurance coverage.

Key Takeaway

- Critical infrastructure cyber insurance led coverage types with a 37.6% share, reflecting rising concern over cyber risks targeting smart city utilities, transport, and public services.

- Municipal governments and agencies dominated insured entities at 58.3%, driven by increasing digitalization of city operations and exposure to ransomware and system outages.

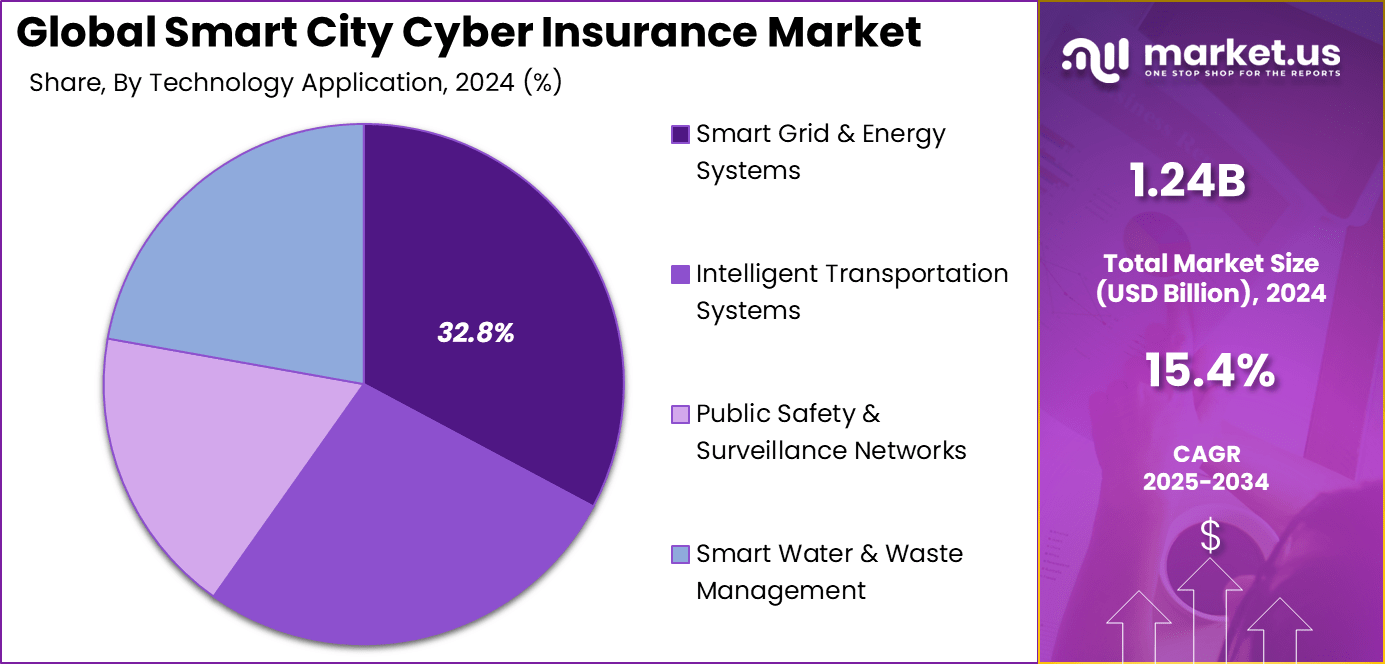

- Smart grid and energy systems accounted for 32.8% of technology applications, as power networks remain among the most cyber-sensitive smart city assets.

- Annual policies represented 79.4%, highlighting preference for predictable, recurring coverage aligned with municipal budgeting cycles.

- North America held a leading 48.7% share, supported by advanced smart city deployments, higher cyber risk awareness, and mature insurance frameworks.

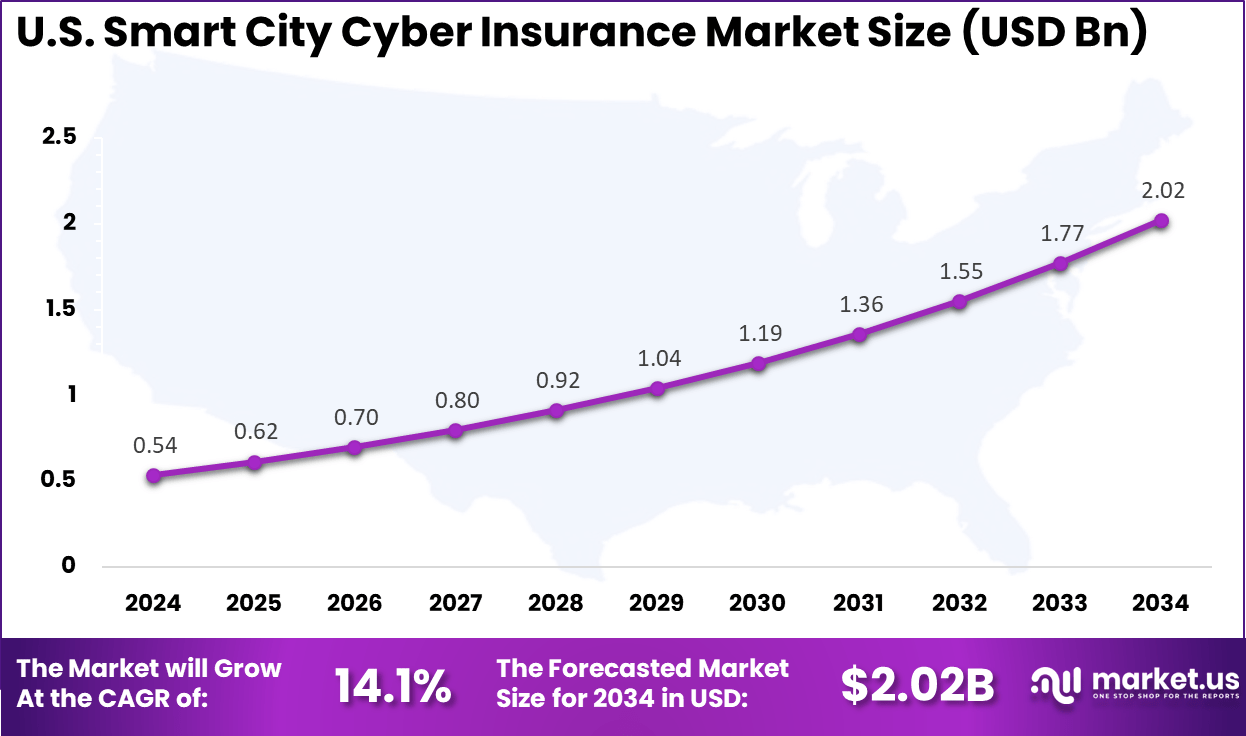

- The U.S. market reached USD 0.54 billion in 2024 and is expanding at a 14.1% CAGR, driven by growing cyber threats to urban infrastructure and increased adoption of specialized cyber insurance products.

Quick Market Facts

Adoption Rates by Sector and Organization Size 2025

- 78% of regional and local governments carry standalone cyber insurance policies, up from 61% in 2023.

- Large enterprises and smart city developers show adoption levels between 70% and 80%.

- Only 17% of small businesses in the public supply chain carry cyber insurance.

- Small businesses account for 46% of all reported breaches in 2025.

- Healthcare leads sector adoption with an 82% coverage rate.

Usage and Coverage Statistics

- 68.3% of policies are standalone cyber insurance products.

- 81% of active policies include data recovery coverage.

- Ransomware represents 41% to 44% of all insurance claims.

- Incident response clauses are triggered in 73% of claims.

- Large claim frequency declined by 30% in early 2025.

- Ransomware loss severity increased by 17%, averaging USD 1.18 million per incident.

U.S. Market Size

The United States reached USD 0.54 Billion with a CAGR of 14.1%, reflecting steady expansion. Growth is driven by increased cyber incidents and infrastructure digitization. Municipal entities continue to strengthen risk protection strategies. Cyber insurance supports financial resilience. Market growth momentum remains positive.

For instance, in September 2025, The Hartford Financial Services Group, Inc. expanded CyberChoice First Response via the ICON platform, providing small businesses with ransomware income protection, breach costs, and 24/7 U.S. hotline access. Strengthens U.S. dominance in accessible cyber insurance for smart city vendors and operators.

North America accounts for 48.7%, supported by widespread smart city initiatives and digital infrastructure. Cities in the region invest heavily in connected systems. Cyber risk awareness is relatively high among public authorities. Insurance adoption reflects proactive risk management. The region remains a key market.

For instance, in September 2025, Liberty Mutual Insurance Company launched the Liberty Cyber Resolution suite, offering flexible global first/third-party cyber coverage, including quantum computing, generative AI, and executive personal losses. Tailored for diverse industries, it bolsters North American leadership in protecting smart city digital ecosystems.

Coverage Type Analysis

In 2024, Critical infrastructure cyber insurance accounts for 37.6%, showing its importance in protecting essential smart city systems. This coverage focuses on risks linked to power grids, transportation networks, water systems, and public communication platforms. Smart cities depend heavily on connected infrastructure, which increases exposure to cyber threats. Insurance coverage helps manage financial losses from system failures. Protection of public services remains a top priority.

Demand for this coverage is driven by rising cyber incidents targeting infrastructure assets. Municipal authorities seek insurance to strengthen resilience and recovery planning. Policies support incident response and restoration efforts. Coverage also helps meet regulatory and governance expectations. This sustains steady adoption.

For Instance, in October 2025, AXA XL launched a new cyber solution for construction firms in Europe, Asia, and Australia. This endorsement boosts protection for digital tools like building models and drones, key in smart city builds. It covers breaches in infrastructure software, fitting the needs of critical systems in urban projects.

Insured Entity Analysis

In 2024, Municipal governments and agencies hold 58.3%, making them the primary insured entities. These bodies manage large-scale smart city projects and digital public services. Cyber insurance helps protect budgets against unexpected cyber losses. Coverage supports continuity of essential services. Public accountability increases the need for protection.

Adoption is driven by increasing digitization of city operations. Municipal entities face growing pressure to manage cyber risk responsibly. Insurance supports risk transfer and financial stability. It also complements cybersecurity investments. This reinforces demand among public agencies.

For instance, in April 2025, Chubb partnered with SentinelOne to speed cyber insurance for small public entities. It uses security reports for quick quotes, aiding municipalities with tight budgets. This helps local governments handle data risks from public services in smart environments.

Technology Application Analysis

In 2024, Smart grid and energy systems represent 32.8%, highlighting their exposure to cyber risks. These systems rely on connected sensors, control software, and data networks. Cyber incidents can disrupt power distribution and monitoring. Insurance coverage helps mitigate financial and operational impact. Energy security is critical for smart cities.

Growth in this application is driven by expansion of digital energy infrastructure. Utilities and city authorities seek protection for automated energy systems. Insurance supports recovery from outages and cyber events. Coverage also aligns with infrastructure modernization efforts. This supports continued adoption.

For Instance, in October 2024, Allianz expanded cyber offerings with tech for active risk management. This targets vulnerabilities in energy networks like smart grids. Partnerships bring monitoring to prevent disruptions in urban power distribution.

Policy Duration Analysis

In 2024, Annual policies account for 79.4%, reflecting preference for predictable coverage periods. Year-long policies allow continuous protection for evolving cyber risks. Municipal budgets are often planned on an annual cycle. This aligns well with annual insurance contracts. Stability in coverage is important for public entities.

Adoption of annual policies is driven by ease of renewal and policy management. Insured entities can reassess coverage each year based on risk exposure. Annual policies also simplify compliance and reporting. Insurers and buyers prefer structured review cycles. This supports long-term policy usage.

For Instance, in April 2025, Travelers added services to all cyber liability policies for ongoing monitoring. These annual enhancements help with threat alerts and recovery, suiting cities’ yearly budgets. It lowers attack risks for standard policy terms in smart projects.

Emerging Trend Analysis

The Smart City Cyber Insurance Market is experiencing increased adoption of risk scoring and predictive analytics tools that assess cyber risk exposure across connected urban infrastructure. These technologies analyze historical incident data, device vulnerabilities, and network configurations to provide insurers with deeper insight into potential losses.

As a result, policy pricing and coverage terms are becoming more tailored to actual risk profiles rather than broad assumptions. This shift is driving more precise underwriting and stronger alignment between risk and premium. Another emerging trend is the integration of automated incident response services with cyber insurance offerings.

Insurers are partnering with cybersecurity solution providers to deliver real-time threat detection and rapid response support as part of policy benefits. This integration strengthens resilience by enabling insured entities to contain and mitigate breaches quickly. Demand for bundled protection and response solutions is rising as city operators seek to manage both risk transfer and operational continuity.

Investment and Business Benefits

Investment opportunities exist in specialized insurance products tailored for smart city use cases. Policies designed for utilities, transport systems, and public data platforms are gaining attention. Insurers that develop flexible coverage models aligned with city digital maturity can capture long-term value. Advisory services linked to cyber risk assessment also present growth potential.

There are also opportunities in partnerships between insurers, technology providers, and city administrators. Integrated solutions combining risk assessment, cybersecurity services, and insurance are increasingly relevant. Investors may focus on firms that offer scalable and adaptive cyber insurance frameworks. These investments support sustainable urban digitalization.

Smart city cyber insurance provides financial stability during cyber incidents. It reduces uncertainty by covering unexpected costs related to data breaches and system failures. This allows city authorities to plan budgets with greater confidence. Insurance also supports faster operational recovery after cyber disruptions.

Another business benefit is improved risk governance. Insurance requirements often encourage stronger cybersecurity practices and documentation. This leads to better coordination between technology teams and risk managers. Over time, insurance contributes to improved digital trust across city services.

Key Market Segments

By Coverage Type

- Critical Infrastructure Cyber Insurance

- Municipal Data Breach & Privacy Liability

- Ransomware & Cyber Extortion Coverage

- Business Interruption for City Services

- Third-Party Liability (Vendor/Contractor)

By Insured Entity

- Municipal Governments & Agencies

- Public Utility Operators

- Smart Infrastructure Vendors/Operators

- Public Transit Authorities

By Technology Application

- Smart Grid & Energy Systems

- Intelligent Transportation Systems

- Public Safety & Surveillance Networks

- Smart Water & Waste Management

By Policy Duration

- Annual Policies

- Multi-Year/Project-Based Policies

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

One primary driver of the market is the growing deployment of Internet of Things sensors, connected infrastructure, and data platforms within smart cities. As utilities, transportation, and public safety systems become increasingly digital, the volume of sensitive data and the number of networked endpoints expand accordingly. This expansion elevates cyber risk exposure and increases the potential financial impact of disruptions.

The need to safeguard critical services and maintain public trust is motivating city planners and administrators to adopt dedicated cyber insurance solutions. Another driver is regulatory emphasis on data protection and operational resilience. Government policies and industry standards are mandating stronger cybersecurity practices for public infrastructure and essential services.

Compliance with these requirements often involves demonstrating risk management strategies that include financial risk transfer mechanisms. Cyber insurance is being recognized as a complementary component of broader risk governance frameworks, encouraging adoption among municipal authorities and service providers.

Restraint Analysis

A key restraint for the market is the difficulty in accurately quantifying cyber risk across highly diverse smart city ecosystems. Urban technology environments include legacy systems, varied device manufacturers, and complex data flows that make risk assessment challenging. Insufficient historical loss data for city-scale cyber incidents limits actuarial precision and can lead to conservative pricing or restrictive coverage terms.

Another restraint arises from limited cyber risk awareness among smaller municipalities and public agencies with constrained resources. Understanding policy terms, exclusions, and coverage limitations requires technical and legal expertise that may not be readily available internally. These gaps in knowledge can lead to under-insurance or a reluctance to invest in robust cyber coverage.

Opportunity Analysis

There is significant opportunity in developing modular insurance products that align with specific smart city components such as traffic control systems, utility grids, and public Wi-Fi networks. Tailored coverage options can address distinct risk profiles associated with different infrastructure segments. This modularity enhances relevance for buyers by allowing them to purchase targeted protection that matches their unique risk landscape. Adoption of customized policies can foster greater market penetration.

Another opportunity exists in partnering with cybersecurity firms to offer preventive risk management services alongside traditional insurance. Bundling proactive security assessments, employee training programs, and continuous monitoring with financial protection creates value beyond indemnification alone. These combined offerings support resilience while reducing the likelihood of claims.

Challenge Analysis

A significant challenge for the market is the evolving nature of cyber threats targeting smart city technology. Attack vectors are continuously changing as adversaries innovate new methods to exploit connectivity, data streams, and cloud services. Keeping insurance coverage relevant in the face of shifting threat landscapes requires ongoing policy adjustments and agile underwriting models.

Another challenge is establishing standardization in policy language and coverage definitions across jurisdictions. Variations in regulatory frameworks, legal interpretations of cyber loss, and dispute resolution mechanisms affect how policies perform in practice. The lack of harmonized standards can lead to confusion, coverage gaps, and disputes during claim settlement.

Key Players Analysis

AXA SA, Allianz SE, Zurich Insurance Group, Chubb, and American International Group lead the smart city cyber insurance market by underwriting cyber risks linked to connected urban infrastructure. Their coverage addresses data breaches, ransomware, operational disruption, and liability arising from smart grids, traffic systems, and public services. These insurers focus on advanced risk modeling, strong capital backing, and tailored policies for public sector entities.

Travelers Companies, Beazley, Munich Re, Swiss Re, and Liberty Mutual Insurance Company strengthen the market with reinsurance support, cyber risk advisory, and incident response services. Their offerings help municipalities assess exposure and improve resilience against cyber attacks. These providers emphasize actuarial expertise, threat intelligence, and claims management.

The Hartford Financial Services Group, Axis Capital Holdings, CNA Financial Corporation, Sompo Holdings, Tokio Marine Holdings, and other players expand the landscape with flexible cyber insurance products for regional and mid sized smart city projects. Their policies support compliance, risk transfer, and recovery planning. These companies focus on customization and cost effective coverage.

Top Key Players in the Market

- AXA SA

- Allianz SE

- Zurich Insurance Group, Ltd.

- Chubb, Ltd.

- American International Group, Inc. (AIG)

- Travelers Companies, Inc.

- Beazley plc

- Munich Re (Münchener Rückversicherungs-Gesellschaft AG)

- Swiss Re, Ltd.

- Liberty Mutual Insurance Company

- The Hartford Financial Services Group, Inc.

- Axis Capital Holdings, Ltd.

- CNA Financial Corporation

- Sompo Holdings, Inc.

- Tokio Marine Holdings, Inc.

- Others

Recent Developments

- In September 2025, Allianz Commercial released its Cyber Risk Trends 2025 report, flagging cyber incidents as the top global business risk due to AI-amplified threats, supply chain attacks, and privacy regs hitting smart city operators hard.

- In October 2025, AXA XL rolled out a specialized cyber insurance solution for construction firms across Europe, Asia, and Australia, targeting risks in smart infrastructure projects that power urban development. This move fills a critical gap as cities digitize their buildings and grids, where cyber vulnerabilities can halt operations costing millions. From my years tracking cyber markets, this positions AXA as a go-to for smart city builders facing interconnected IoT threats.

Report Scope

Report Features Description Market Value (2024) USD 1.2 Bn Forecast Revenue (2034) USD 5.1 Bn CAGR(2025-2034) 15.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (Critical Infrastructure Cyber Insurance, Municipal Data Breach & Privacy Liability, Ransomware & Cyber Extortion Coverage, Business Interruption for City Services, Third-Party Liability (Vendor/Contractor), By Insured Entity (Municipal Governments & Agencies, Public Utility Operators, Smart Infrastructure Vendors/Operators, Public Transit Authorities), By Technology Application (Smart Grid & Energy Systems, Intelligent Transportation Systems, Public Safety & Surveillance Networks, Smart Water & Waste Management), By Policy Duration (Annual Policies, Multi-Year/Project-Based Policies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape AXA SA, Allianz SE, Zurich Insurance Group, Ltd., Chubb, Ltd., American International Group, Inc. (AIG), Travelers Companies, Inc., Beazley plc, Munich Re (Münchener Rückversicherungs-Gesellschaft AG), Swiss Re, Ltd., Liberty Mutual Insurance Company, The Hartford Financial Services Group, Inc., Axis Capital Holdings, Ltd., CNA Financial Corporation, Sompo Holdings, Inc., Tokio Marine Holdings, Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Smart City Cyber Insurance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample

Smart City Cyber Insurance MarketPublished date: Dec. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- AXA SA

- Allianz SE

- Zurich Insurance Group, Ltd.

- Chubb, Ltd.

- American International Group, Inc. (AIG)

- Travelers Companies, Inc.

- Beazley plc

- Munich Re (Münchener Rückversicherungs-Gesellschaft AG)

- Swiss Re, Ltd.

- Liberty Mutual Insurance Company

- The Hartford Financial Services Group, Inc.

- Axis Capital Holdings, Ltd.

- CNA Financial Corporation

- Sompo Holdings, Inc.

- Tokio Marine Holdings, Inc.

- Others