Global Small Molecule API Market Analysis By Type (Synthetic/Chemical APIs, Biological APIs), By Application (Commercial, Clinical), By Manufacturing (In-house, Outsourced), By Therapeutic Area (Cardiovascular Diseases, Oncology, CNS & Neurology, Orthopedic, Endocrinology, Gastroenterology, Nephrology, Ophthalmology, Others), By End-User (Pharmaceutical Companies, Biotechnology Companies, CDMOs, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160354

- Number of Pages: 376

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

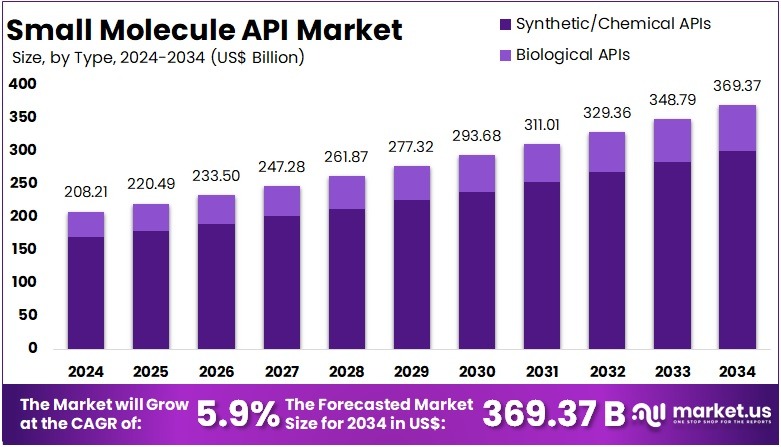

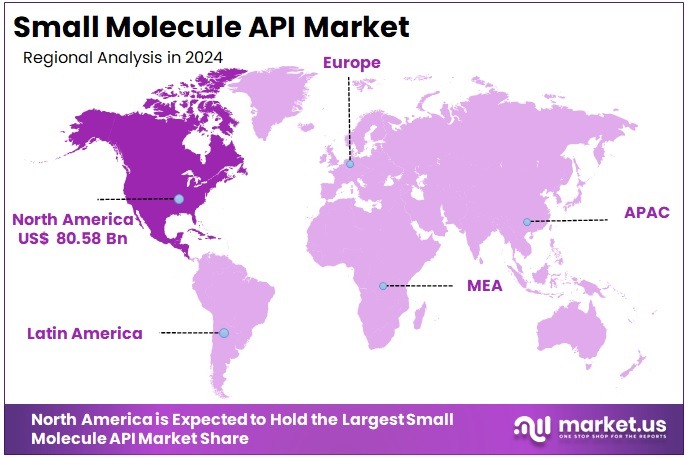

The Global Small Molecule API Market size is expected to be worth around US$ 369.37 Billion by 2034, from US$ 208.21 Billion in 2024, growing at a CAGR of 5.9% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 38.7% share and holding US$ 80.57 billion market value for the year.

A Small Molecule Active Pharmaceutical Ingredient (API) is the core chemical substance in a drug that delivers its therapeutic effect. These APIs are defined by low molecular weight and clear chemical structures, which allow easy entry into cells. They are commonly administered in oral forms such as tablets and capsules. According to industry studies, small molecule APIs are widely used in therapeutic areas including oncology, cardiovascular disorders, infectious diseases, and central nervous system conditions. Examples include aspirin, statins, and antibiotics.

The global small molecule API market has gained momentum due to the rising demand for generic medicines and the growing burden of chronic illnesses. For instance, cardiovascular diseases, diabetes, and cancer continue to account for a large share of treatment demand. At the same time, patent expirations of blockbuster drugs are opening opportunities for generic small molecule APIs. Pharmaceutical firms increasingly outsource production to contract manufacturing organizations (CMOs) to achieve cost efficiency and regulatory compliance, a trend that continues to expand.

The World Health Organization (WHO) updated its Model List of Essential Medicines in September 2025. The new list recommends 523 medicines for adults and 374 for children. A majority are oral small molecules addressing widespread conditions such as hypertension, diabetes, and cancer. When medicines are added or their indications broadened, national formularies often follow suit. This raises tender volumes for finished drugs and, in turn, for their compliant APIs. The 2025 update signals a sustained baseline demand across low-, middle-, and high-income regions.

Regulatory approvals further refresh market pipelines. In 2024, the U.S. FDA approved 50 new drugs, while the European Medicines Agency recommended 114 medicines, including 46 new active substances. These approvals introduce new API categories, driving process development and creating multi-year supply opportunities. Early 2025 FDA updates also confirm a steady cadence of approvals, supported by dashboards that give manufacturers visibility for capacity planning. This steady flow of first-in-class and follow-on molecules secures ongoing relevance for small molecule APIs.

Demand Trends and Policy Impact

Cancer incidence remains a significant demand driver for oncology APIs. According to the WHO’s International Agency for Research on Cancer, there were 20 million new cancer cases in 2022. This figure is projected to reach more than 35 million by 2050. The rise is linked to ageing populations and lifestyle risk factors. Oral and targeted small molecules, used in adjuvant, metastatic, and maintenance therapies, will remain critical. As a result, oncology APIs are expected to anchor procurement budgets for decades.

Supply security is another factor reshaping the market. For example, the European Commission proposed a Critical Medicines Act in March 2025. The Union List of critical medicines, updated in December 2024, now includes over 270 substances. The act aims to diversify sources, cut single-country dependencies, and accelerate funding for strategic projects. This regulatory shift encourages EU buyers to place longer contracts with qualified suppliers and expand the number of approved manufacturing sites.

Operational shortage management also drives API demand. The FDA Drug Shortages program issues measures such as extended-use guidance and targeted compounding recommendations. In February 2025, the FDA resolved the shortage of semaglutide injections after two years of elevated demand. This case demonstrates how sudden spikes can propagate upstream to API producers before stabilizing as new capacity comes online. Similar patterns are expected across other critical APIs.

Domestic manufacturing incentives further expand capacity. For instance, India’s Department of Pharmaceuticals continues its Production Linked Incentive schemes through 2024–2025. These programs co-finance upgrades for plants producing key starting materials, intermediates, and APIs. The addition of new GMP-compliant facilities increases the number of audited sources available globally. Buyers benefit from improved resilience and competitive pricing, while local industries gain scale. This dynamic ensures that mature small molecule APIs remain cost-effective and widely available.

In summary, the market is supported by essential medicine updates, new drug approvals, and long-term oncology demand. It is further reinforced by policy initiatives, shortage management strategies, and domestic incentives. Together, these forces ensure stable growth in small molecule API consumption, benefiting manufacturers that focus on compliance, redundancy, and efficient process innovation.

Key Takeaways

- The global small molecule API market is projected to reach US$ 369.37 billion by 2034, up from US$ 208.21 billion in 2024.

- The market is anticipated to expand at a CAGR of 5.9% between 2025 and 2034, highlighting consistent and sustainable industry growth.

- In 2024, synthetic/chemical APIs dominated the type segment, accounting for over 81.3% of the global small molecule API market share.

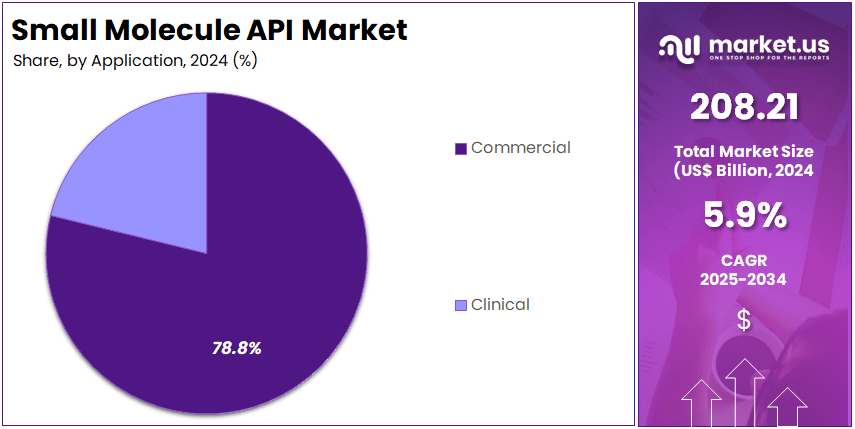

- The commercial applications category led the market in 2024, capturing more than 78.8% of the total small molecule API applications segment share.

- In 2024, in-house manufacturing held dominance, securing a 59.7% share of the total small molecule API manufacturing segment worldwide.

- Oncology emerged as the leading therapeutic area segment in 2024, with a 33.1% share of the global small molecule API market.

- Pharmaceutical companies represented the largest end-user group in 2024, accounting for over 45.8% of the global small molecule API market share.

- North America dominated regional markets in 2024, holding a 38.7% share valued at approximately US$ 80.57 billion during the year.

Type Analysis

In 2024, the Synthetic/Chemical APIs Section held a dominant market position in the Type Segment of the Small Molecule API Market, and captured more than a 81.3% share. This leading position was explained by the widespread use of synthetic routes in drug production. Synthetic APIs are recognized as cost-effective and reliable. They are also supported by established manufacturing technologies. High demand across oncology, cardiovascular, and infectious disease therapies further strengthened the growth of this section within the market.

The Biological APIs Section accounted for a smaller share but demonstrated steady expansion. The rising demand for advanced therapies was identified as the key driver for this growth. Increased research in biotechnology and innovations in recombinant and fermentation methods have supported this shift. The section also benefited from a growing number of regulatory approvals for biopharmaceuticals and biosimilars. This is encouraging stronger adoption of biologically derived molecules across several therapeutic applications in both developed and emerging markets.

Market dynamics indicated that synthetic APIs will remain the leading category in the short term. However, biological APIs were reported to be growing at a faster pace. This acceleration is expected due to continued innovation in biologics, alongside rising investments in biotechnology-based research. The biological segment is also likely to benefit from personalized medicine and targeted therapies. As a result, this category is projected to contribute significantly to the overall market structure during the forecast period, even as synthetic APIs retain dominance.

Application Analysis

In 2024, the Commercial Section held a dominant market position in the Application Segment of the Small Molecule API Market, and captured more than a 78.8% share. This dominance was supported by the strong demand for generic medicines and the large-scale use of APIs in mass-market therapies. Widespread application in oncology, cardiovascular, and metabolic disorders further contributed to its share. The ability to ensure reliable production at reduced costs strengthened the commercial segment’s overall growth.

The Clinical Section, although comparatively smaller, demonstrated strong growth potential within the market. Rising investments in drug discovery activities and clinical research programs boosted its demand. The increasing number of clinical trials and the emergence of innovative therapies supported this expansion. Partnerships between pharmaceutical companies and contract research organizations played a key role in the development of APIs for specialized therapies. This segment has been shaped by the growing importance of precision medicine and rare disease treatments.

The Commercial Section is expected to remain the leading application area over the coming years due to its scale advantages and established supply chains. Meanwhile, the Clinical Section is projected to register a higher growth rate. This is primarily driven by innovation in therapeutic approaches and the supportive regulatory environment for novel drugs. Together, these two segments highlight the balance of established demand and new opportunities. The market structure thus reflects both volume-driven stability and innovation-led expansion in small molecule APIs.

Manufacturing Analysis

In 2024, the In-house Section held a dominant market position in the Manufacturing Segment of the Small Molecule API Market, and captured more than a 59.7% share. This strong lead was explained by better quality control, higher protection of intellectual property, and tighter supply chain efficiency. Many pharmaceutical companies preferred in-house production, especially for high-value and complex APIs. The approach also allowed faster adjustments to demand changes and ensured strict compliance with global regulatory frameworks.

The In-house model was seen as a critical element for large players in the pharmaceutical industry. It enabled them to maintain independence from third-party manufacturers and protect sensitive formulations. In addition, in-house manufacturing helped reduce risks linked with supply disruptions and external dependencies. Companies continued to expand internal facilities to strengthen overall flexibility. This consistent investment supported the segment’s dominance and confirmed its role as the preferred choice for established organizations worldwide.

The Outsourced Section was observed as the secondary contributor to the overall market. Outsourcing was widely adopted by mid-sized and emerging pharmaceutical firms due to its lower costs and reduced need for heavy capital investment. Contract manufacturing organizations provided advanced process technologies and large-scale production support. This created opportunities for drug developers to focus on innovation while external partners managed production. Analysts suggested that outsourcing would continue to grow as companies aimed for faster launches, cost efficiency, and access to specialized expertise.

Therapeutic Area Analysis

In 2024, the Oncology Section held a dominant market position in the Therapeutic Area Segment of the Small Molecule API Market, and captured more than a 33.1% share. This growth was linked to the rising global cancer burden and the high adoption of advanced therapies. Strong demand for patent-protected drugs also supported this dominance. The Cardiovascular Diseases segment followed as the second-largest. Its position was driven by the prevalence of heart conditions and the steady need for therapeutic drugs.

The CNS and Neurology segment was identified as a key contributor. Its share increased due to a rising number of patients with neurological disorders such as epilepsy, Parkinson’s disease, and Alzheimer’s. Orthopedic APIs were also widely adopted. This was supported by the demand for pain management solutions and treatments for conditions such as osteoporosis and arthritis. The Endocrinology segment further expanded, as the increasing number of diabetes and thyroid cases drove steady requirements for small molecule APIs.

Gastroenterology APIs contributed significantly to market revenues. This was supported by the widespread occurrence of gastrointestinal diseases including GERD, ulcers, and bowel disorders. Nephrology was noted as a moderately growing segment. Its growth was based on rising kidney disease cases and consistent demand for supportive therapies. Ophthalmology remained niche yet promising, supported by demand for treatments for glaucoma and age-related eye disorders. The Others category, including dermatology, respiratory, and infectious diseases, provided balanced contributions and ensured overall market stability.

End-User Analysis

In 2024, the Pharmaceutical Companies section held a dominant market position in the End-User Segment of the Small Molecule API Market, and captured more than a 45.8% share. This dominance was linked to high production capacity, strong pipelines, and growing demand for branded therapies. Established distribution channels and investment in innovative drugs added to the strength of this segment. Expansion in chronic disease treatment areas also reinforced the leadership of pharmaceutical companies in driving API demand.

Biotechnology companies represented a strong contributor to the market share. Their focus remained on targeted therapies, cancer treatments, and rare disease research. Many of these companies engaged in collaborations with larger pharmaceutical firms, which improved their access to resources. Outsourcing to specialized manufacturers also supported their development strategies. The biotechnology segment showed consistent growth due to its role in early innovation, niche drug development, and adoption of small molecule APIs for advanced therapies.

Contract Development and Manufacturing Organizations (CDMOs) recorded rapid growth within the end-user landscape. This trend was supported by the increasing outsourcing activities of pharmaceutical and biotechnology firms. CDMOs provided cost benefits, technical knowledge, and scalability, making them preferred partners in API production. Global supply chain support and flexibility also strengthened their market role. Meanwhile, other end-users, including academic and research institutions, added modest contributions, often participating in early discovery initiatives and government-supported projects that encouraged further innovation.

Key Market Segments

By Type

- Synthetic/Chemical APIs

- Biological APIs

By Application

- Commercial

- Clinical

By Manufacturing

- In-house

- Outsourced

By Therapeutic Area

- Cardiovascular Diseases

- Oncology

- CNS & Neurology

- Orthopedic

- Endocrinology

- Gastroenterology

- Nephrology

- Ophthalmology

- Others

By End-User

- Pharmaceutical Companies

- Biotechnology Companies

- CDMOs

- Others

Drivers

Patent Expiries of Blockbuster Drugs

The expiry of patents for blockbuster small molecule drugs is acting as a strong market driver for the small molecule API segment. Once exclusivity ends, multiple manufacturers gain the opportunity to introduce affordable alternatives. This shift opens the market for generic active pharmaceutical ingredients, leading to higher production volumes. The increased competition benefits healthcare systems by reducing treatment costs, which further drives adoption. As a result, patent expiries are directly linked with the rising demand for cost-efficient generic APIs.

The loss of patent protection creates immediate opportunities for generic players to capture market share. Established pharmaceutical companies face revenue decline from their blockbuster products. In response, generic manufacturers focus on scaling up production capacity to meet the growing demand for APIs. This market dynamic accelerates the overall growth of the small molecule API sector. It also ensures that patients gain wider access to essential therapies at lower costs, thereby strengthening the role of generics in global healthcare.

Furthermore, this trend is reshaping industry competition by encouraging more companies to enter the API manufacturing landscape. Patent expiries stimulate demand not only for large-scale manufacturers but also for contract development and manufacturing organizations. These players aim to provide cost-competitive, high-quality alternatives. Consequently, the volume expansion in small molecule APIs is creating long-term growth opportunities. The consistent cycle of patent expiries ensures a steady pipeline of generic launches, reinforcing this factor as a primary driver of the market.

Restraints

Supply Chain Vulnerabilities in API Sourcing

The small molecule API market is constrained by its heavy reliance on India and China for production. These two geographies account for a major share of global active pharmaceutical ingredient (API) supply. Such concentration creates inherent risks in the value chain. Any disruption caused by export bans, regulatory shifts, or natural resource shortages in these regions may limit availability. This dependence restricts flexibility for global pharmaceutical companies and adds an element of uncertainty to their long-term sourcing strategies.

Geopolitical tensions and policy changes further intensify the vulnerability of API supply. Trade disputes, sudden export restrictions, or new compliance regulations in India or China can create immediate disruptions. Pharmaceutical manufacturers in other regions are often left exposed with limited alternatives. This overdependence raises the risk of supply bottlenecks and escalates operational challenges. As a result, global drug makers face constraints in meeting steady demand, especially for essential and life-saving medicines.

Another significant restraint lies in the pricing volatility linked to raw material availability. Shortages of key chemical intermediates or cost escalations in India and China ripple across global supply chains. Small molecule API prices become unstable, affecting production costs and profitability for pharmaceutical companies. This pricing uncertainty complicates strategic planning and contract negotiations. For smaller firms, it can even deter investment and innovation. Consequently, reliance on a few dominant suppliers continues to act as a structural weakness in the market.

Opportunities

Adoption of Green Chemistry and Sustainable Manufacturing

The adoption of green chemistry and sustainable manufacturing creates a strong opportunity in the small molecule API market. Companies are increasingly focusing on eco-friendly approaches such as solvent recovery, biocatalysis, and continuous flow chemistry. These methods not only reduce waste and emissions but also improve cost-efficiency in production. As regulatory pressures and sustainability goals intensify, API manufacturers can achieve compliance while enhancing process efficiency. This strategic alignment ensures long-term competitiveness and builds trust with regulatory authorities and healthcare stakeholders.

Sustainability-focused stakeholders and investors are showing growing interest in companies that prioritize eco-friendly practices. By implementing green chemistry, small molecule API manufacturers can attract investment from funds that are directed toward environmental, social, and governance (ESG) initiatives. This results in easier access to capital and collaborative partnerships, both of which are critical for scaling operations. In addition, positioning as a sustainable manufacturer enhances brand reputation, allowing companies to differentiate themselves in a highly competitive market.

The integration of sustainable manufacturing processes provides not only compliance benefits but also significant market opportunities. Healthcare and pharmaceutical companies are increasingly sourcing from suppliers with proven sustainable practices. This trend ensures strong demand for small molecule APIs produced under green chemistry frameworks. Furthermore, regulatory incentives and long-term cost savings act as enablers for adoption. Therefore, companies that adopt eco-friendly production methods can strengthen their market presence, secure strategic collaborations, and achieve sustainable growth in the evolving global pharmaceutical landscape.

Trends

Integration of Digital Technologies in Small Molecule API Manufacturing

The adoption of digital technologies in small molecule API manufacturing is transforming production practices. Advanced analytics and AI-driven process optimization are being used to streamline operations. These tools help monitor processes in real time and reduce variability. The application of digital twins allows virtual simulations of production systems. This enables predictive maintenance and supports quality assurance. As a result, manufacturers achieve higher efficiency, lower risks, and improved consistency in production outcomes.

Digitalization in API manufacturing is also lowering overall production costs. AI-based optimization enhances yields by identifying inefficiencies and reducing wastage. Advanced analytics tools ensure greater precision in process control, which reduces rework and resource consumption. The use of digital twins helps detect possible failures before they occur. This reduces downtime and maintenance costs. Together, these technologies support cost-effective manufacturing while maintaining compliance with stringent quality standards. This cost advantage positions companies competitively in a global market.

The growing trend of digital integration is expected to reshape the competitive landscape. Companies adopting advanced technologies can accelerate product development and achieve faster time-to-market. Quality consistency builds stronger confidence among regulators and healthcare providers. Moreover, digitalization enhances scalability, making it easier to adapt to demand fluctuations. This shift reflects an industry-wide move toward intelligent, technology-driven manufacturing. Therefore, digital adoption is becoming a strategic necessity rather than an option in small molecule API production.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 38.7% share and holding US$ 80.57 billion market value for the year. According to industry data, the United States drives much of this growth due to its high medicine spending. Retail prescription drug spending in the U.S. reached approximately US$ 449.7 billion in 2023, reflecting an 11.4% year-over-year increase. This steady rise signals strong demand for small-molecule products and their APIs across multiple therapeutic areas.

Per-capita data further supports this strength. A study by OECD shows the U.S. spends significantly more per person on pharmaceuticals compared to the OECD average. This high per-capita spending creates a broad revenue base for small-molecule therapies. For example, overall health expenditure levels reinforce the extensive use of these drugs, which in turn ensures sustained demand for APIs. Such spending patterns position the U.S. as the central hub for API consumption within North America.

Canada also adds weight to the regional market. According to government estimates, prescription drug spending in Canada was slightly above CAD $41–42 billion in 2023. Medicines remain one of the largest and fastest-growing components of healthcare costs in the country. This increasing expenditure supports strong demand for small-molecule APIs, particularly in chronic care treatments. For instance, high reliance on prescription medicines in Canada ensures consistent API utilization across key therapeutic categories.

The disease burden in the Americas explains why demand remains high. Noncommunicable diseases such as cardiovascular disorders, diabetes, and cancer account for nearly 65% of all deaths in the region. Since these conditions are mainly treated with small-molecule drugs, API requirements remain substantial. For example, therapies in primary and long-term care rely heavily on small molecules, sustaining both prescription volumes and API consumption. This burden continues to anchor growth in the regional market.

Regulatory activity further reinforces North America’s leadership. The U.S. FDA approved 50 novel drugs in 2024, meeting or exceeding user-fee review goals in 94% of cases. Notably, 68% of these therapies were first approved in the U.S., accelerating local adoption and API demand. Moreover, FDA approvals of large numbers of generics, including first-time entries, expand patient access while supporting volume growth. This regulatory ecosystem creates an innovation-driven and volume-rich environment, securing North America’s dominance in the small-molecule API market.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The innovator-driven pharma companies such as Pfizer, Merck, AbbVie, Bristol-Myers Squibb, and Novartis retain strong internal capabilities in high-value small-molecule APIs. Their strengths lie in high-potency containment, advanced synthesis, and continuous manufacturing adoption. However, externalization is often selective, with capacity largely reserved for internal pipelines. Differentiation is anchored in quality systems, regulatory compliance, and process innovation. Outlook remains favorable, with demand growth expected in oncology, cardiovascular, and complex small molecules requiring advanced chemistries.

Large-cap pharma companies including Sanofi, AstraZeneca, GSK, and Gilead maintain a significant small-molecule base despite increasing biologics focus. Their positioning reflects hybrid models combining internal API networks with external partners. They leverage continuous processing, supplier governance, and regulatory expertise. Constraints arise from cost competitiveness and network optimization strategies. Nonetheless, internal base-load demand for legacy molecules provides stability. Outsourcing is driven by flexibility, risk management, and the growing need for high-potency APIs. Strategic collaborations with CMOs remain integral to balance capacity requirements.

Dedicated API-forward players and CDMOs such as Lonza, EuroAPI, and Siegfried demonstrate strong market presence. Their strengths lie in high-potency APIs, cytotoxics, continuous flow chemistry, and end-to-end development services. These players are highly differentiated through regulatory maturity and global inspection readiness. Premium pricing and capacity booking cycles present challenges, while commoditized APIs expose some to margin pressures. Despite these constraints, outlook remains positive, with incremental demand growth in oncology payloads and late-phase launches. Ongoing expansions and portfolio optimization strategies strengthen their competitive advantage.

Generics-driven players like Teva, Dr. Reddy’s, and Cipla rely on integrated API operations to maintain cost competitiveness. Their portfolios include wide DMF coverage across regulated markets, supported by backward integration and efficient large-scale manufacturing. Advantages lie in affordability, regulatory responsiveness, and reliability in commodity molecules. Constraints involve price erosion, competitive intensity, and exposure to input costs. Outlook indicates stable volumes with selective expansion into higher-barrier APIs. Differentiation is expected to come from complex generics, specialty small molecules, and sustained regulatory compliance in key international markets.

Market Key Players

- Pfizer Inc.

- Merck & Co. Inc.

- AbbVie Inc.

- Bristol-Myers Squibb Company

- Novartis AG

- Sanofi S.A.

- AstraZeneca

- GSK plc. (GlaxoSmithKline)

- Gilead Sciences Inc.

- Lonza Group

- Teva Pharmaceuticals

- Dr. Reddy’s Laboratories Ltd.

- Cipla Inc.

- EuroAPI

- Siegfried Holding AG

Recent Developments

- In May 2024: Asymchem Laboratories of China signed a lease agreement to operate Pfizer’s former small-molecule API pilot plant located in Sandwich, Kent, United Kingdom. The facility included associated development laboratories. By August 2024, Asymchem officially inaugurated the site as its European small-molecule development and pilot manufacturing hub. The site began operations with approximately 70 staff members, many of whom were retained legacy employees from Pfizer, ensuring continuity of expertise and technical capability at the facility.

- In January 2024: Bristol Myers Squibb successfully completed the acquisition of Mirati Therapeutics, a U.S.-based biopharmaceutical company specializing in targeted oncology. This acquisition added significant small-molecule assets to BMS’s portfolio, including adagrasib (Krazati), a KRAS G12C inhibitor. The integration of Mirati’s pipeline strengthened Bristol Myers Squibb’s oncology segment and enhanced its position in precision cancer therapies. The move represented a strategic expansion of BMS’s small-molecule oncology capabilities and highlighted the increasing focus on targeted treatment solutions for cancer patients.

- In December 2023: The U.S. Food and Drug Administration (FDA) granted approval to Fabhalta® (iptacopan), an oral small-molecule Factor B inhibitor. This approval marked the first oral monotherapy treatment available for adults with paroxysmal nocturnal hemoglobinuria (PNH). The decision followed positive clinical outcomes from the APPLY-PNH and APPOINT-PNH studies, which demonstrated the drug’s efficacy. The approval of Fabhalta provided a significant advancement in PNH management, offering patients a convenient oral alternative to existing therapies, thereby improving treatment accessibility and adherence.

Report Scope

Report Features Description Market Value (2024) US$ 208.21 Billion Forecast Revenue (2034) US$ 369.37 Billion CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (Synthetic/Chemical APIs, Biological APIs), By Application (Commercial, Clinical), By Manufacturing (In-house, Outsourced), By Therapeutic Area (Cardiovascular Diseases, Oncology, CNS & Neurology, Orthopedic, Endocrinology, Gastroenterology, Nephrology, Ophthalmology, Others), By End-User (Pharmaceutical Companies, Biotechnology Companies, CDMOs, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Pfizer Inc., Merck & Co. Inc., AbbVie Inc., Bristol-Myers Squibb Company, Novartis AG, Sanofi S.A., AstraZeneca, GSK plc. (GlaxoSmithKline), Gilead Sciences Inc., Lonza Group, Teva Pharmaceuticals, Dr. Reddy’s Laboratories Ltd., Cipla Inc., EuroAPI, Siegfried Holding AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Pfizer Inc.

- Merck & Co. Inc.

- AbbVie Inc.

- Bristol-Myers Squibb Company

- Novartis AG

- Sanofi S.A.

- AstraZeneca

- GSK plc. (GlaxoSmithKline)

- Gilead Sciences Inc.

- Lonza Group

- Teva Pharmaceuticals

- Dr. Reddy’s Laboratories Ltd.

- Cipla Inc.

- EuroAPI

- Siegfried Holding AG