Global Slickline Logging Services Market Size, Share, And Enhanced Productivity By Hole Type (Open Hole, Cased Hole), By Location of Deployment (Onshore, Offshore), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173844

- Number of Pages: 317

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

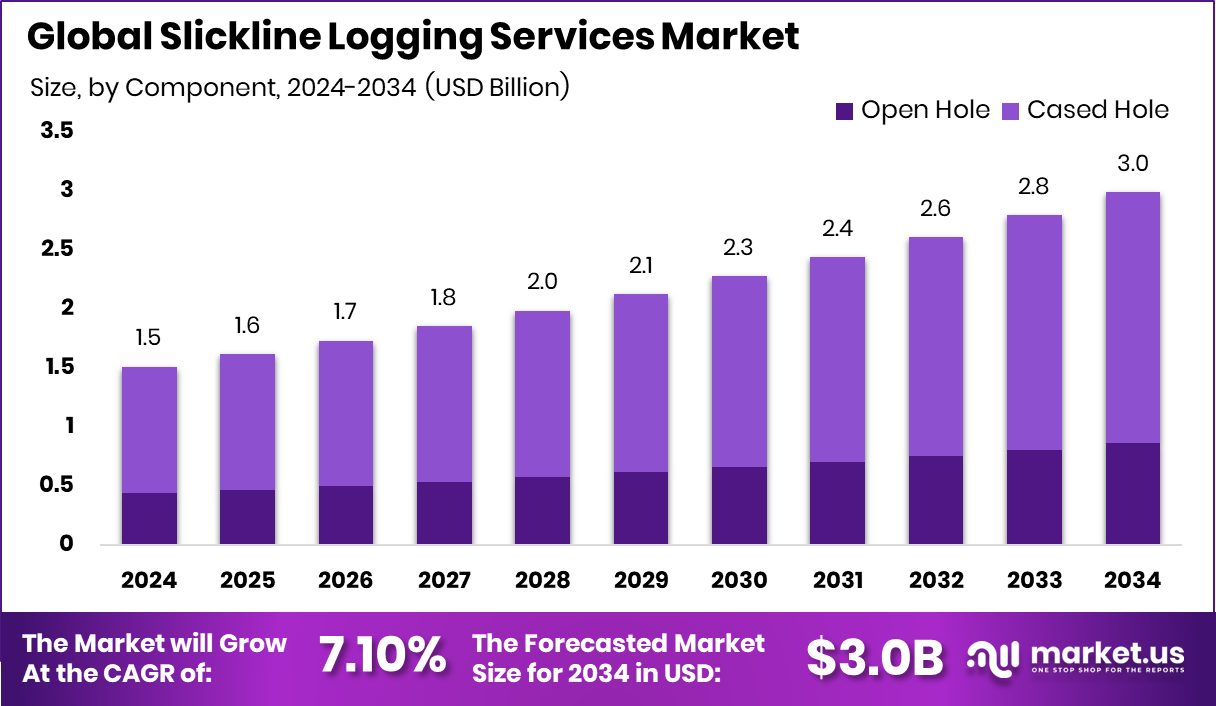

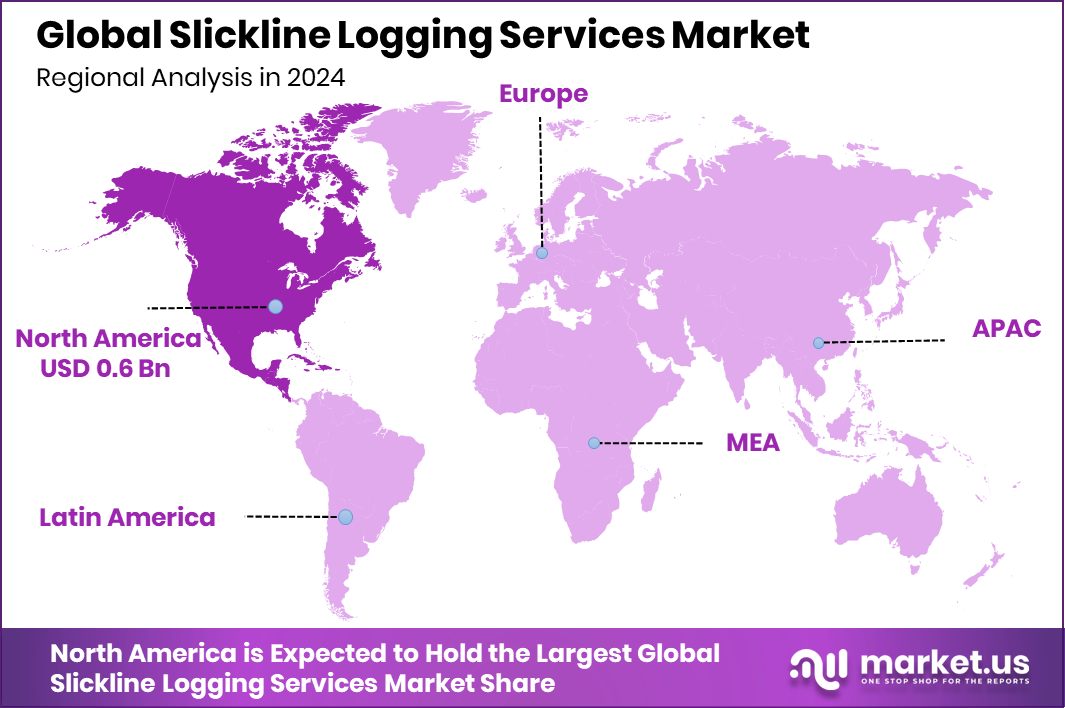

The Global Slickline Logging Services Market is expected to be worth around USD 3.0 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 7.10% from 2025 to 2034. In North America, the Slickline Logging Market reached USD 0.6 Bn, capturing 42.4% share.

Slickline logging services are well-intervention operations that use a thin steel wire to lower tools into an oil or gas well. These services help operators measure pressure and temperature, check well integrity, set or retrieve downhole devices, and support routine maintenance. Slickline work is valued for being fast, precise, and cost-effective, especially when wells need diagnostics without heavy equipment or production shutdowns.

The Slickline Logging Services Market represents the commercial ecosystem that delivers these wireline-based interventions across producing wells. It supports oil and gas operators throughout a well’s productive life, from early monitoring to late-stage integrity checks. The market focuses on operational efficiency, safety, and extending asset life, particularly in mature and onshore fields where frequent intervention is required.

Growth factors are closely tied to rising operational and infrastructure spending pressures. In the UK, rising defence spending has exposed a £2 trillion infrastructure funding gap, pushing governments and energy operators to maximise existing assets rather than build new ones. Slickline services fit this need by enabling low-cost well optimisation and integrity assurance without major capital expansion.

Demand is also influenced by security and energy resilience concerns. UK forces are reported to face a £28 billion funding shortfall, increasing pressure to secure domestic energy systems. This environment supports steady demand for slickline logging to maintain reliable production from existing wells under tighter budgets.

Opportunities emerge as capital discipline spreads globally. Even private investment faces strain, highlighted by KKR confronting a €449 million earnings gap from a major deal. This reinforces operator preference for efficient, intervention-based solutions like slickline logging that deliver measurable results with controlled spending.

Key Takeaways

- The Global Slickline Logging Services Market is expected to be worth around USD 3.0 billion by 2034, up from USD 1.5 billion in 2024, and is projected to grow at a CAGR of 7.10% from 2025 to 2034.

- In the Slickline Logging Services Market, cased hole operations dominated with a 71.6% share, driven by intervention.

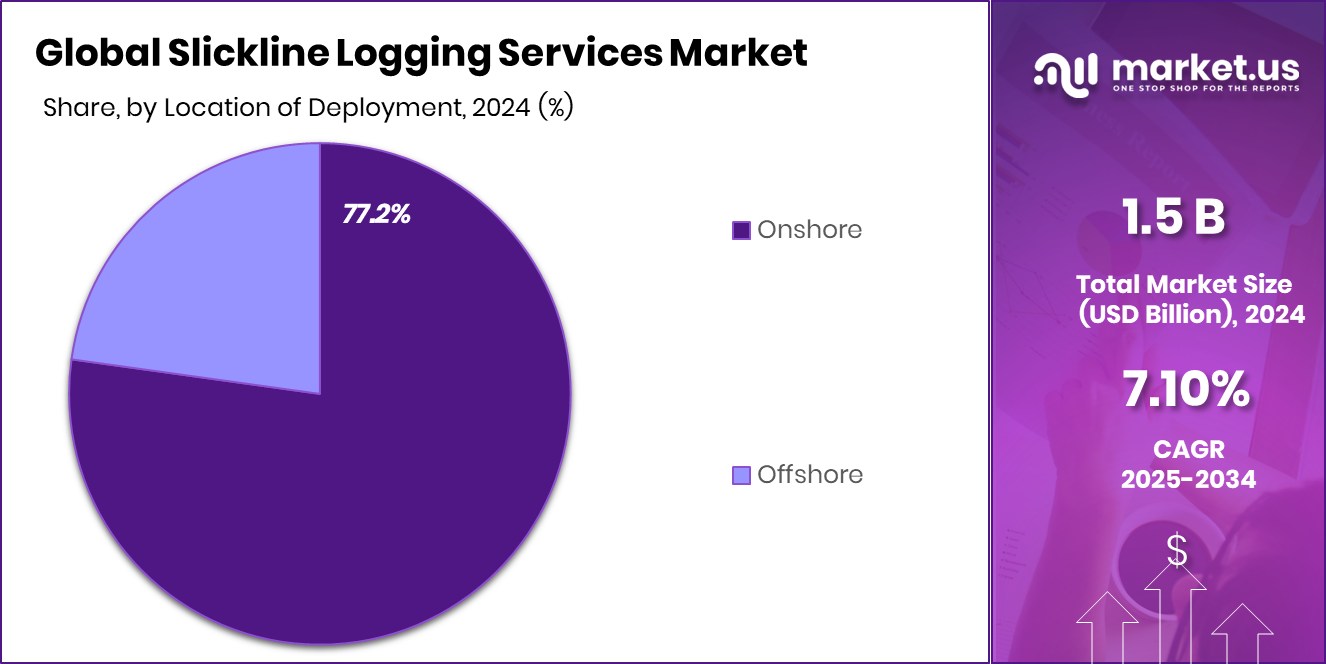

- In the Slickline Logging Services Market, onshore deployments led with 77.2% share, supported by mature fields.

- North America led the Slickline Logging Market with 42.4% share, reaching USD 0.6 Bn.

By Hole Type Analysis

Cased Hole dominates Slickline Logging Services Market with 71.6% share across wells.

In 2024, the Slickline Logging Services market by hole type, Cased Hole, continued to hold a dominant position with a 71.6% share of global service deployments. This strong preference is driven by the ongoing need for accurate well integrity evaluation, especially in mature fields where production optimisation and intervention planning are critical. Operators increasingly rely on cased-hole slickline logging to deliver high-resolution data on mechanical and reservoir conditions without the cost and complexity of open-hole campaigns.

Technological advancements such as real-time surface readouts, integrated memory tools, and advanced sensor packages have further enhanced service adoption. The cost-efficiency, rapid mobilisation, and safer operations when working in cased completions also underpin market growth. As unconventional plays decline and brownfield optimisation rises, cased-hole logging’s share is projected to remain robust through the mid-2020s.

By Location of Deployment Analysis

Onshore deployment leads the Slickline Logging Services Market with 77.2% adoption due to efficiency.

In 2024, the Slickline Logging Services market by location of deployment Onshore activities accounted for approximately 77.2% of total market revenue and service activity worldwide. The predominance of onshore operations is attributable to the extensive number of mature onshore basins in North America, the Middle East, and parts of Asia, where operators emphasise well integrity, production enhancement, and cost containment.

Onshore slickline logging supports frequent intervention cycles with shorter mobilisation times and lower logistical barriers than offshore. Additionally, the expansion of shale plays and tight reservoirs has stimulated demand for slickline services to monitor performance and guide stimulation programs. Regulatory emphasis on safe, low-impact operations in onshore environments further reinforces market preference. While offshore opportunities persist in deepwater and complex fields, onshore segments are expected to sustain the majority share and growth momentum through 2028.

Key Market Segments

By Hole Type

- Open Hole

- Cased Hole

By Location of Deployment

- Onshore

- Offshore

Driving Factors

Public Infrastructure Spending Drives Well Maintenance Demand

Public investment in infrastructure often increases pressure on energy systems to stay reliable and productive. When governments focus on fixing roads, utilities, and transport links, attention also turns to maintaining existing energy assets instead of building new ones. This supports slickline logging services, which help operators keep wells working safely at low cost.

In the UK, the government has linked funding access to proof of action, announcing £4.8 billion for major roads to tackle long-standing infrastructure issues. Such spending signals a broader push to protect and optimise existing assets. For energy operators, this environment favours fast, efficient well checks and maintenance. Slickline logging fits this need by allowing quick inspections and adjustments without heavy equipment, helping wells stay productive while capital is carefully controlled.

Restraining Factors

Limited Capital Allocation Slows Service Expansion Plans

A key restraint for the slickline logging services market is limited access to funding for expansion and modernisation. When public or private money is directed toward non-industrial priorities, fewer resources remain for upgrading field operations or adopting new tools. This can slow service availability in some regions.

For example, $1.6 million from the City of Austin was used to help The Hole in the Wall secure a 20-year lease, showing how funding is often allocated to community or cultural needs instead of industrial services. While such spending has social value, it highlights how energy service providers may face tighter budgets. As a result, some operators delay non-essential logging work, reducing short-term service demand despite long-term operational needs.

Growth Opportunity

Local Spending Choices Create Efficient Service Opportunities

Growth opportunities for slickline logging services emerge when public spending priorities highlight efficiency gaps. When councils or authorities allocate funds to symbolic or short-term projects, operators become more focused on extracting maximum value from existing assets. A clear example is a council choosing to spend £50,000 on coronation-related costs instead of directing funds to food banks.

Such decisions reflect tighter overall budgets and stronger scrutiny of operational spending. In this environment, oil and gas operators prefer services that deliver clear results with minimal cost. Slickline logging offers exactly that by enabling targeted diagnostics and quick interventions. This creates opportunities for service providers that emphasise efficiency, fast turnaround, and measurable operational benefits.

Latest Trends

Workforce Restructuring Pushes Smarter Field Operations

A notable trend shaping the slickline logging services market is the shift toward leaner operations driven by workforce and budget restructuring. When public bodies reduce hiring or change employment models, industries respond by improving productivity with fewer resources. In the U.S., Des Moines cut open jobs to help fill a $17 million budget gap, reflecting broader cost-control measures.

Similar pressures affect energy operations, encouraging the use of services that require smaller crews and shorter deployment times. Slickline logging aligns well with this trend, as it supports efficient well intervention without large teams. The result is a growing preference for streamlined, low-disruption logging services that help operators do more with less.

Regional Analysis

Slickline Logging Market in North America held 42.4%, valued at USD 0.6 Bn.

In 2024, North America dominated the Slickline Logging Services Market, accounting for a 42.4% share and reaching USD 0.6 Bn, supported by steady well-intervention cycles and frequent diagnostic logging needs across producing basins. Europe maintained a stable demand profile, largely tied to compliance-focused well integrity programs and late-life asset management, where slickline logging remains a practical, lower-disruption option.

Asia Pacific continued to expand service uptake as operators emphasised cost control and faster turnaround in large onshore producing areas, keeping slickline work consistently active. Middle East & Africa sustained deployment through routine production optimisation and integrity monitoring in long-producing fields, where intervention activity is recurring and operationally essential.

Latin America showed ongoing service requirements linked to maintenance-driven interventions and operational reliability priorities, with slickline logging supporting regular checks and corrective actions. Overall, see-through diagnostics, quick mobilisation, and fit-for-purpose intervention workflows kept regional demand resilient, with North America leading due to its larger concentration of active wells and repeat logging activity.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SLB remains a benchmark player in the global Slickline Logging Services Market in 2024, supported by its deep technical expertise and integrated well-intervention capabilities. The company’s slickline services benefit from strong operational consistency, advanced tool reliability, and seamless alignment with broader well integrity and production workflows. SLB’s ability to deploy slickline logging across complex well environments strengthens its position among operators seeking precision and operational efficiency.

Halliburton continues to play a critical role in slickline logging by leveraging its strong field execution model and extensive operational footprint. In 2024, the company’s focus on practical, cost-conscious intervention solutions supports demand in mature and producing assets. Halliburton’s slickline offerings are closely tied to routine diagnostics, mechanical interventions, and production support, making it a preferred partner for repeat service engagements.

Baker Hughes maintains a competitive position through its emphasis on reliability, data accuracy, and well lifecycle integration. Its slickline logging services are widely applied for integrity verification and performance monitoring, particularly where operators prioritise safe and controlled interventions. In 2024, Baker Hughes benefits from aligning slickline operations with broader well optimisation objectives, reinforcing its relevance across both mature and active producing regions.

Top Key Players in the Market

- SLB

- Halliburton

- Baker Hughes

- Weatherford

- Expro Group

- Vallourec

- National Oilwell Varco

- Scientific Drilling

- Archer Ltd

- Nine Energy Service

Recent Developments

- In July 2024, Vallourec won a large contract from TotalEnergies to supply nearly 5,000 tonnes of OCTG (Oil Country Tubular Goods) products and services for the Kaminho deepwater project off Angola. This deal solidified its role as a provider of premium tubular solutions for complex well environments.

- In April 2024, Weatherford introduced a new HD Spitfire™ release tool as part of its wireline product line following the acquisition of Impact Selector International. This tool improves reliability during pump-down perforation operations, which supports slickline and related downhole intervention work.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 3.0 Billion CAGR (2025-2034) 7.10% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Hole Type (Open Hole, Cased Hole), By Location of Deployment (Onshore, Offshore) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SLB, Halliburton, Baker Hughes, Weatherford, Expro Group, Vallourec, National Oilwell Varco, Scientific Drilling, Archer Ltd, Nine Energy Service Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Slickline Logging Services MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Slickline Logging Services MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- SLB

- Halliburton

- Baker Hughes

- Weatherford

- Expro Group

- Vallourec

- National Oilwell Varco

- Scientific Drilling

- Archer Ltd

- Nine Energy Service