Global Single Use Packaging Market Size, Share, Growth Analysis By Material Type (Paper and Paper Board, Plastic, Glass, Others), By Product Type (Bags & pouches, Films & wraps, Boxes & cartons, Bottles & jars, Others), By End-User (Food, Beverage, Personal Care, Pharmaceutical, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 154274

- Number of Pages: 297

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

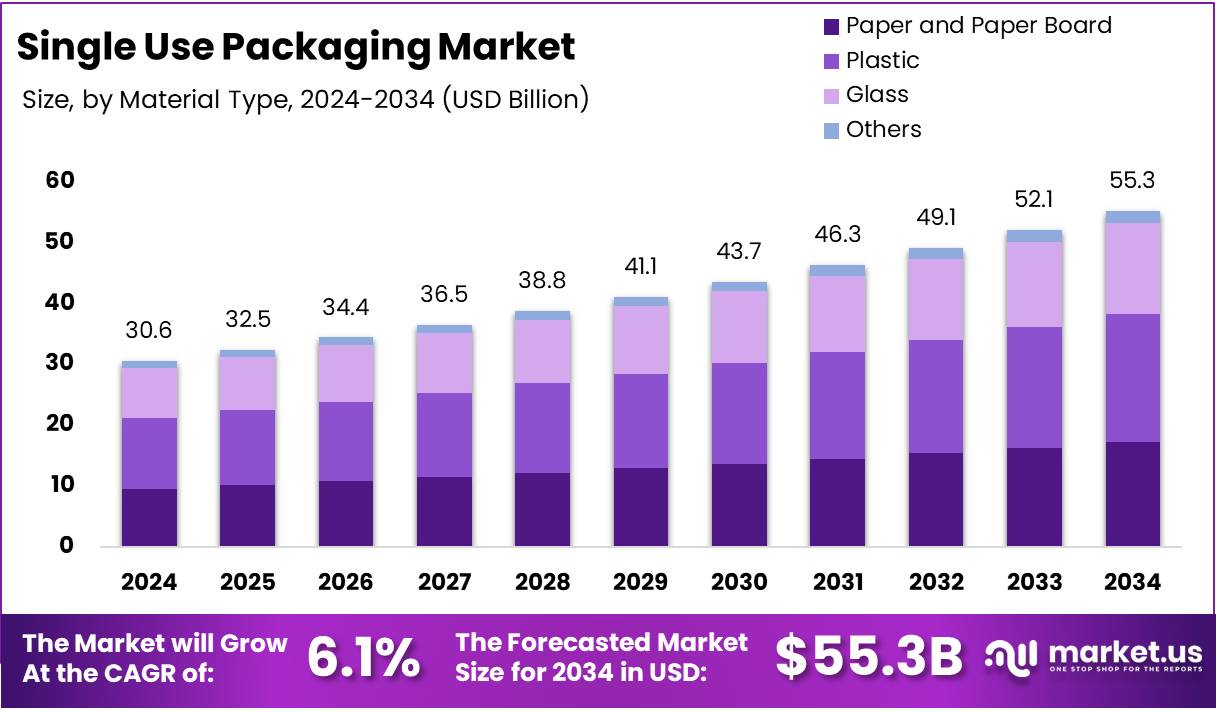

The Global Single Use Packaging Market size is expected to be worth around USD 55.3 Billion by 2034, from USD 30.6 Billion in 2024, growing at a CAGR of 6.1% during the forecast period from 2025 to 2034.

The Single Use Packaging market refers to the industry involved in the production and distribution of packaging products designed for one-time use. These include plastic bags, sachets, wrappers, containers, and other disposable items. Businesses across food, beverage, healthcare, and personal care sectors heavily rely on these products for hygiene and convenience.

Increasing urbanization and fast-paced lifestyles continue to drive demand for single use packaging. Consumers seek easy-to-carry and ready-to-dispose options. As a result, industries are shifting toward lightweight, cost-effective materials that support mass consumption. Moreover, e-commerce expansion boosts demand for individual-use packaging formats globally.

Next, companies are focusing on innovation to meet rising environmental concerns. Biodegradable and recyclable alternatives are gaining attention. Market players are investing in R&D to create more sustainable single-use solutions. This shift not only appeals to eco-conscious consumers but also aligns with changing global regulations.

Additionally, growth opportunities are visible across developing economies. Countries in Asia-Pacific and Latin America are witnessing a rapid rise in packaged food and pharmaceutical usage. This is accelerating demand for single-use formats. Local players are increasingly tapping into this trend to expand their market presence.

Simultaneously, governments are introducing supportive policies and public-private partnerships. Funding for sustainable packaging projects is rising. For instance, multiple countries are investing in circular economy models to promote recyclable packaging. Such steps provide a stable regulatory environment for market participants.

However, tightening environmental norms are reshaping the industry. Regulations around plastic use are growing stricter. The European Union, for example, enforces bans on several single-use plastic items. This regulatory pressure is pushing firms to rethink packaging design and invest in greener solutions.

Despite these challenges, demand remains steady. Key sectors such as food delivery, personal care, and pharmaceuticals rely on one-time-use formats. With health and hygiene taking priority post-COVID, industries are unlikely to shift completely from disposable solutions in the near term.

According to a survey by Our World in Data, over 380 million tons of plastics are produced globally every year, with nearly 50% used for single-use purposes. Furthermore, based on UNEP’s survey, about 85% of global respondents support banning single-use plastics under a global treaty—highlighting increasing consumer pressure.

Key Takeaways

- The Global Single Use Packaging Market is projected to reach USD YYYYY by 2034, growing from USD 30.6 Billion in 2024 at a CAGR of 6.1% from 2025 to 2034.

- In 2024, Paper and Paper Board led the market by material type with a 31.3% share, driven by demand for sustainable packaging.

- Bags & Pouches dominated the product type segment in 2024 with a 34.8% share, owing to their convenience and adaptability.

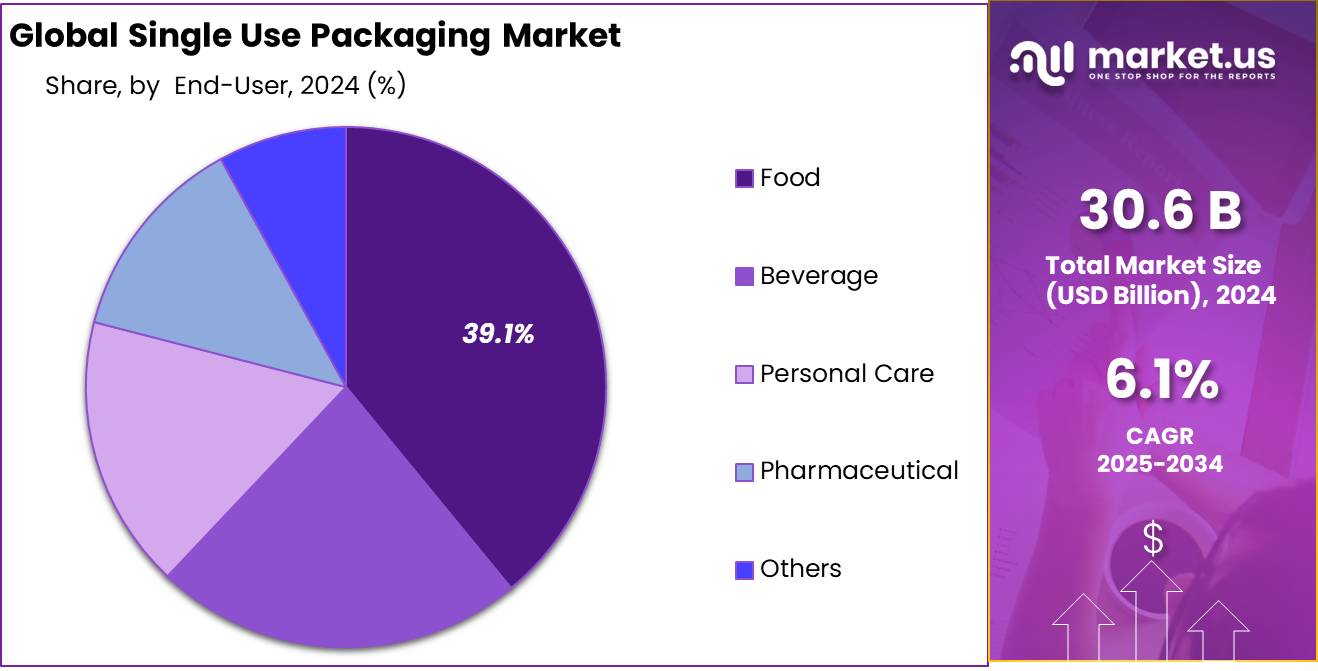

- The Food end-user segment accounted for the highest share at 39.1% in 2024, supported by trends in ready-to-eat and takeaway foods.

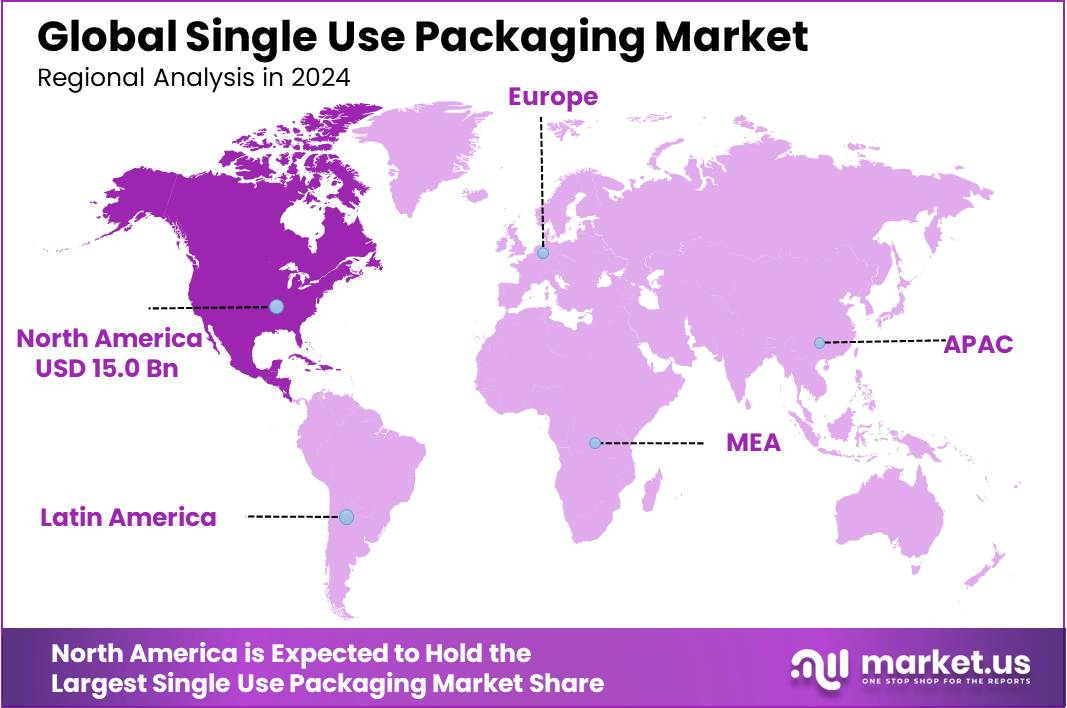

- North America was the leading region in 2024, capturing a 49.3% share valued at USD 15.0 Billion, due to strong demand across food, e-commerce, and pharma sectors.

Material Type Analysis

Paper and Paper Board leads with 31.3% due to its eco-friendly nature and recyclability.

In 2024, Paper and Paper Board held a dominant market position in By Material Type Analysis segment of the Single Use Packaging Market, with a 31.3% share. This segment benefitted from growing consumer demand for biodegradable and sustainable packaging options, especially in food and beverage sectors.

Plastic remains a widely used material in single use packaging, driven by its versatility and low production cost. However, regulatory pressures and environmental concerns continue to challenge its market presence.

Glass, although limited by weight and fragility, is used for premium packaging, especially in beverage and pharmaceutical segments. Its inert nature and perceived safety offer niche value.

The ‘Others’ category includes metal and hybrid materials, which hold marginal market positions. These are often chosen for specialized or industrial applications where durability is prioritized.

Product Type Analysis

Bags & Pouches dominate with 34.8% owing to their lightweight and flexible design.

In 2024, Bags & Pouches held a dominant market position in By Product Type Analysis segment of the Single Use Packaging Market, with a 34.8% share. Their convenience, portability, and efficient use of material make them ideal for modern retail and food service industries.

Films & Wraps are widely used for sealing, protecting, and extending the shelf life of products. They continue to find traction in grocery and frozen food categories, offering functional utility and tamper resistance.

Boxes & Cartons serve sectors that prioritize structural integrity and visual branding, such as personal care and pharmaceuticals. Their recyclability also supports eco-conscious branding.

Bottles & Jars are commonly adopted in liquid and semi-solid packaging. While not as flexible or lightweight as other forms, they are favored for safe and precise dispensing.

The Others segment includes trays, sachets, and specialty containers, which cater to niche packaging needs and often serve a supplementary role in the value chain.

End-User Analysis

Food segment leads with 39.1% driven by convenience and hygiene demands.

In 2024, Food held a dominant market position in By End-User Analysis segment of the Single Use Packaging Market, with a 39.1% share. Growth is attributed to the rising demand for ready-to-eat meals, takeaway formats, and online food deliveries, where hygiene and disposability are paramount.

The Beverage segment is also a major consumer of single-use packaging, particularly in bottled water, juices, and functional drinks. The need for portion control and portability enhances its relevance. Personal Care packaging includes single-use sachets and pouches for creams, shampoos, and wipes. These are favored in travel kits and trial-size offerings, aiding consumer sampling.

Pharmaceutical applications include sterile packaging for medicines, syringes, and diagnostic kits. Single-use designs reduce contamination risks and support patient safety. The Others category spans industrial and institutional applications where disposability improves sanitation or simplifies logistics.

Key Market Segments

By Material Type

- Paper and Paper Board

- Plastic

- Glass

- Others

By Product Type

- Bags & pouches

- Films & wraps

- Boxes & cartons

- Bottles & jars

- Others

By End-User

- Food

- Beverage

- Personal Care

- Pharmaceutical

- Others

Drivers

Rising Demand for Convenient Food and Beverage Consumption Drives Market Expansion

The Single Use Packaging market is witnessing notable growth, primarily driven by the rising demand for convenience in food and beverage consumption. Consumers today prefer ready-to-eat meals, portion packs, and on-the-go beverages due to their fast-paced lifestyles. This shift is pushing brands to adopt single use formats that are lightweight, easy to handle, and disposable—ultimately enhancing user convenience and food safety.

Alongside this, the rapid growth of e-commerce platforms and direct-to-consumer delivery models is reshaping how products are packaged. Single use packaging solutions are ideal for e-commerce because they ensure product protection, reduce shipping weight, and allow for safe and hygienic delivery of consumables. As online grocery and food delivery services continue to expand, demand for compact, tamper-proof packaging is surging across regions.

Moreover, the healthcare and pharmaceutical industry is increasingly relying on single use packaging for its sterility and safety. From pre-filled syringes to blister packs for tablets, these packaging formats help prevent contamination and ensure proper dosage, which is critical for patient safety. This adoption is also influenced by stricter regulatory standards and the growing importance of infection control.

Restraints

Rising Global Pressure to Ban Single-Use Plastics Restrains Market Expansion

Governments across the world are introducing strict regulations against single-use plastics, directly affecting the single-use packaging market. Many countries in Europe, Asia, and North America have either banned or imposed heavy taxes on disposable plastic items. This is pushing manufacturers to reduce reliance on plastic-based packaging and search for alternatives, which may not be as cost-effective or scalable. The growing environmental awareness among consumers is also reinforcing this trend, making it harder for plastic-based single-use packaging to maintain market share.

In addition, several multinational companies are committing to sustainable packaging goals, further restricting the growth of conventional single-use packaging. These corporate sustainability targets are promoting circular economy models, reusable packaging, and biodegradable materials. While good for the environment, this shift places added compliance costs and operational challenges on packaging producers who are dependent on fossil-based materials.

Another major restraint is the volatility in raw material prices, especially those derived from petrochemicals. The cost of polymers and resins key components in plastic packaging is influenced by global oil prices. Any fluctuation in crude oil markets directly impacts the production costs of single-use packaging. This uncertainty creates budgeting difficulties for manufacturers and disrupts supply chain planning.

Growth Factors

Development of Biodegradable and Compostable Packaging Solutions Drives Market Growth

The growing demand for eco-friendly packaging has opened up a major growth opportunity in the development of biodegradable and compostable packaging solutions. With governments implementing stricter regulations on plastic use and consumers becoming more conscious about sustainability, companies are investing in materials such as PLA, PHA, and plant-based fibers.

These alternatives offer similar functionality to traditional plastics but break down naturally, reducing environmental impact. This shift is especially promising for food, beverage, and personal care product packaging.

Another promising area is the integration of smart packaging technologies, which can enhance traceability and product authenticity. Technologies such as QR codes, RFID tags, and temperature sensors are being used to monitor product freshness, improve inventory management, and provide real-time tracking across the supply chain. These solutions are gaining traction in sectors like pharmaceuticals, perishable food items, and luxury goods, where traceability and quality assurance are critical.

Emerging Trends

Surge in Demand for Ready-to-Eat and Instant Food Products Boosts Market Momentum

In today’s fast-paced lifestyle, consumers are increasingly turning to ready-to-eat and instant food products. This trend is directly supporting the growth of the single use packaging market. People want food that’s quick to prepare and easy to carry, especially in urban areas. As a result, food companies are investing more in single use packaging to meet this rising demand efficiently.

Alongside convenience, sustainability has become a top priority. Brands are now using recyclable mono-materials to create eco-friendly single use packaging. These materials not only reduce waste but also make recycling much simpler.

For instance, using a single type of plastic or paper allows for cleaner recycling streams, which aligns with global sustainability commitments. This shift is drawing attention from both consumers and environmental bodies, further influencing market dynamics.

Another key trend is the rising popularity of minimalist and eco-conscious packaging design. Modern consumers are more aware of packaging waste and prefer products that use less material without compromising protection.

Clean, simple packaging appeals to environmentally conscious buyers and aligns with the aesthetic values of premium and health-focused brands. Companies are adapting by reducing packaging layers and printing with biodegradable inks.

Together, these factors are reshaping the single use packaging market. The focus is now on combining ease-of-use, sustainability, and appealing design making packaging not just functional, but a reflection of brand responsibility and modern lifestyle choices.

Regional Analysis

North America Dominates the Single Use Packaging Market with a Market Share of 49.3%, Valued at USD 15.0 Billion

In 2024, North America led the global single use packaging market, accounting for a dominant share of 49.3% and a market value of USD 15.0 billion. This leadership is driven by the widespread use of packaged and processed food, high e-commerce penetration, and strong demand from the pharmaceutical sector. Additionally, regulatory support for recyclable materials and efficient supply chains contribute to the region’s continued growth.

Europe Single Use Packaging Market Trends

Europe follows closely, characterized by its strong emphasis on sustainability and circular economy practices. The region is witnessing a steady transition towards eco-friendly mono-material packaging solutions and strict regulations against single-use plastics. Rising consumer awareness and environmental activism have been pivotal in reshaping packaging strategies across the continent.

Asia Pacific Single Use Packaging Market Trends

Asia Pacific is emerging as a high-growth region due to its expanding urban population, increasing disposable incomes, and booming online retail sector. Countries like China and India are witnessing a rise in demand for convenient and affordable packaging formats, particularly for food, beverages, and healthcare products. This region is also experiencing growing investments in sustainable packaging technologies.

Middle East and Africa Single Use Packaging Market Trends

The Middle East and Africa region is experiencing moderate growth, led by rising demand in the foodservice and beverage sectors. Although the market is still developing, initiatives to diversify economies and reduce environmental impact are gradually influencing packaging trends. The shift toward sustainable materials is gaining traction in urban centers.

Latin America Single Use Packaging Market Trends

In Latin America, market growth is supported by the increasing consumption of packaged goods and an evolving retail sector. While economic instability remains a challenge in some countries, manufacturers are adapting with low-cost and lightweight packaging formats. Government policies around plastic waste management are slowly impacting material preferences across the region.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Single Use Packaging Company Insights

In 2024, the global Single Use Packaging Market continues to see strategic expansion and innovation led by top industry players. Amcor plc remains a dominant force due to its strong focus on lightweight, recyclable packaging solutions, especially for food and healthcare products. The company’s push toward high-barrier mono-material formats aligns well with global sustainability efforts.

Constantia Flexibles has shown notable resilience by investing in fully recyclable packaging technologies, particularly for the pharmaceutical and consumer goods sectors. Its ongoing expansion in emerging markets also reinforces its global presence and diversified revenue stream.

Gerresheimer strengthens its market standing with specialized single-use packaging for medical and pharmaceutical applications. The company’s precision in plastic and glass product engineering continues to be a vital asset, especially with rising demand from the injectable drug segment.

Graphic Packaging International, LLC leverages its leadership in paper-based packaging to meet rising consumer and regulatory demands for eco-friendly formats. Its innovative folding carton solutions and focus on circular economy principles contribute significantly to the evolving sustainability narrative in single-use formats.

These players are collectively shaping the competitive dynamics of the single use packaging space through investments in eco-conscious materials, regional expansion, and product customization. The market’s forward momentum in 2024 is largely driven by the capabilities and direction set by these key contributors. Their strategic choices in material science, operational scalability, and regulatory compliance serve as critical benchmarks for the industry’s transition toward more sustainable yet functional packaging solutions.

Top Key Players in the Market

- Amcor plc

- Constantia Flexibles

- Gerresheimer

- Graphic Packaging International, LLC

- Huhtamaki

- Mondi

- PACCOR

- Plastipak Packaging

- ProAmpac

- Reynolds Consumer Products

Recent Developments

- In Jul 2025, Bambrew secured $10.3 million in funding to scale its operations and further develop its eco-friendly packaging alternatives as demand for sustainable solutions surges globally. The funds will support R&D and expansion into new markets.

- In Jul 2025, sustainable packaging startup Bambrew also raised ₹90 crore (~$10.8 million) to accelerate the production of biodegradable materials and strengthen its supply chain capabilities across India.

- In Apr 2025, Pack2Zero raised $5.7 million to drive innovation in reusable and compostable packaging. The investment aims to expand its product portfolio and enhance global distribution.

- In Dec 2024, Movopack secured $2.5 million in funding to grow its eco-friendly packaging offerings for e-commerce brands. The capital will be used to optimize operations and develop closed-loop logistics systems.

Report Scope

Report Features Description Market Value (2024) USD 30.6 Billion Forecast Revenue (2034) USD 55.3 Billion CAGR (2025-2034) 6.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Paper and Paper Board, Plastic, Glass, Others), By Product Type (Bags & pouches, Films & wraps, Boxes & cartons, Bottles & jars, Others), By End-User (Food, Beverage, Personal Care, Pharmaceutical, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Amcor plc, Constantia Flexibles, Gerresheimer, Graphic Packaging International, LLC, Huhtamaki, Mondi, PACCOR, Plastipak Packaging, ProAmpac, Reynolds Consumer Products Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Single Use Packaging MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Single Use Packaging MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Amcor plc

- Constantia Flexibles

- Gerresheimer

- Graphic Packaging International, LLC

- Huhtamaki

- Mondi

- PACCOR

- Plastipak Packaging

- ProAmpac

- Reynolds Consumer Products