Global Silicon Carbide Fibers Market Size, Share, And Enhanced Productivity By Form (Continuous, Woven, Others), By Usage (Composites, Non-composites), By Substrate (Carbon-Carbon Composites, Ceramic Matrix Composites, Metal Matrix Composites), By Application (Aerospace and Defense, Energy and Power, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176461

- Number of Pages: 265

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

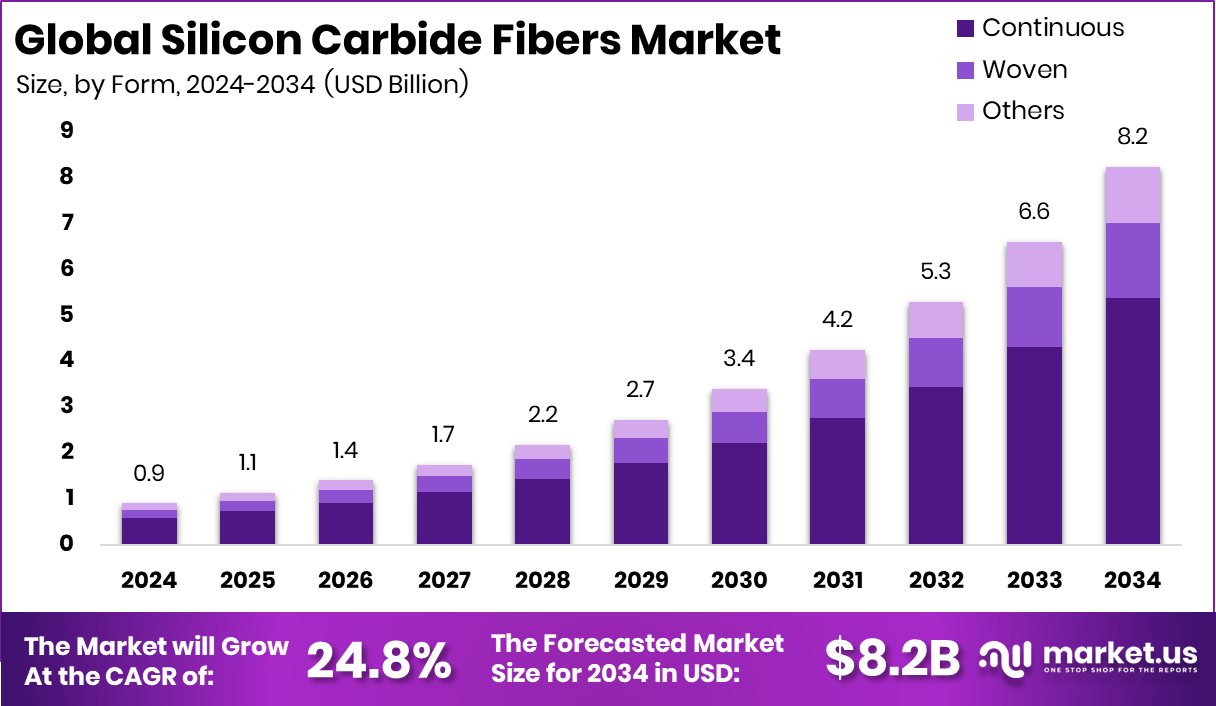

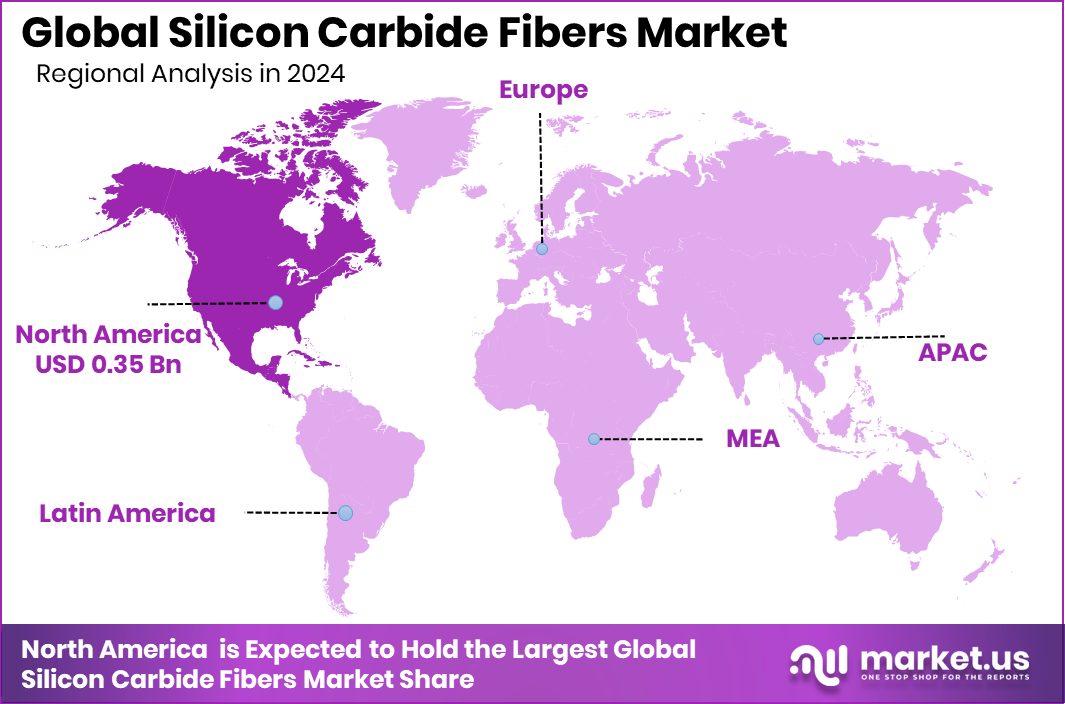

The Global Silicon Carbide Fibers Market is expected to be worth around USD 8.2 billion by 2034, up from USD 0.9 billion in 2024, and is projected to grow at a CAGR of 24.8% from 2025 to 2034. The region of North America accounted for 38.9%, worth nearly USD 0.35 Bn.

Silicon carbide fibers are high-strength, heat-resistant fibers made from silicon carbide, known for their ability to perform in extreme temperatures. These fibers are used in demanding environments such as turbine engines, high-temperature insulation, and structural composites where durability and thermal stability are critical. Their lightweight profile and excellent oxidation resistance make them suitable for advanced aerospace and energy applications.

The Silicon Carbide Fibers Market covers materials supplied in forms such as continuous fibers, woven formats, and specialty variants used across composites, non-composites, carbon-carbon substrates, ceramic matrix composites, and metal matrix systems. Key applications include aerospace and defense, energy and power, and other industrial areas requiring reliable performance under high thermal loads.

Growth in this market is supported by strong investment across energy and semiconductor ecosystems. Coherent’s silicon carbide semiconductor business, completing $1 billion in investments from DENSO and Mitsubishi Electric, reflects rising confidence in high-performance materials. Additional momentum comes from U.S. initiatives such as the $750 million Commerce support for a North Carolina chips company and large-scale grid and energy storage funding worldwide.

Demand continues to expand as energy technologies evolve. Funding such as £130 million for Highview, Rs 800 crore for Apraava Energy, $1.3 billion raised by Nuveen, $1 billion Series C for Base Power, €450 million for Belgium’s power grid, and financing for a 100-MW Victorian battery project all signal opportunities for heat-resistant materials like silicon carbide fibers in next-generation power, storage, and grid infrastructure.

Key Takeaways

- The Global Silicon Carbide Fibers Market is expected to be worth around USD 8.2 billion by 2034, up from USD 0.9 billion in 2024, and is projected to grow at a CAGR of 24.8% from 2025 to 2034.

- Continuous forms dominate the Silicon Carbide Fibers Market with a strong 65.2% share globally.

- Composites lead market usage in Silicon Carbide Fibers, accounting for a significant 78.1% adoption rate.

- Carbon-carbon composites remain the primary substrate, capturing 47.7% share in silicon carbide fiber demand.

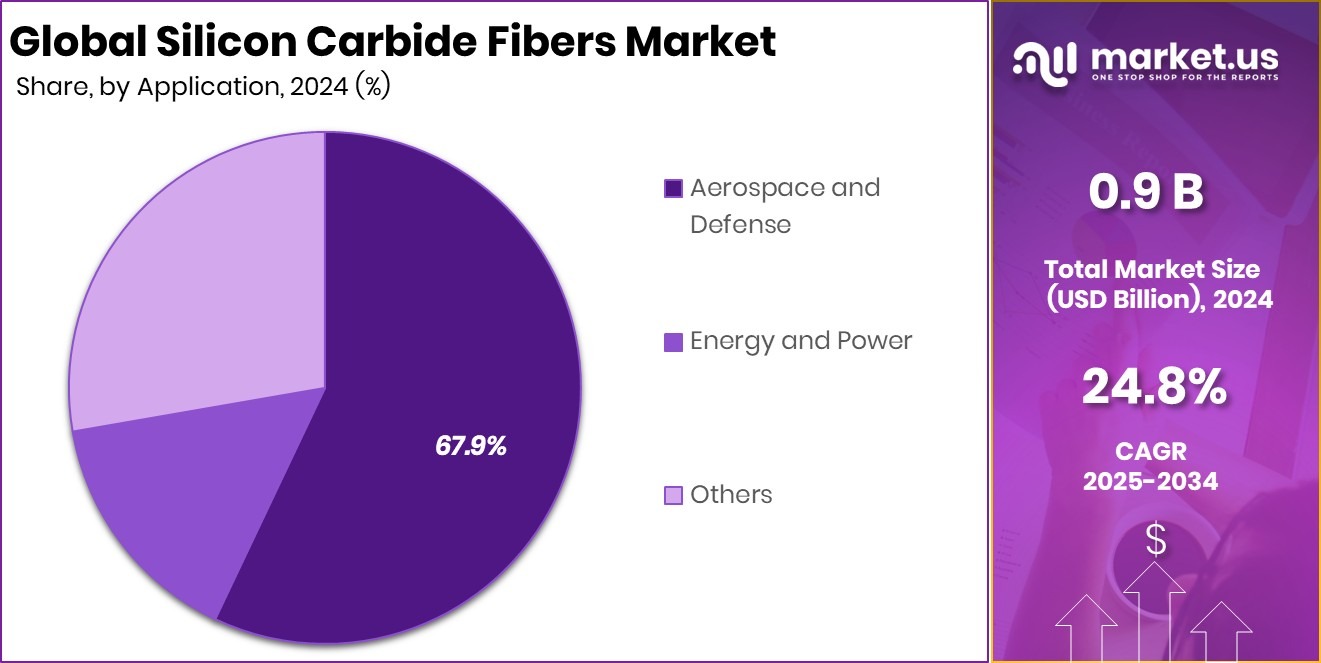

- Aerospace and defense applications drive growth, contributing a commanding 67.9% share of overall consumption.

- In 2024, North America dominated with 38.9%, reaching USD 0.35 Bn overall.

By Form Analysis

Continuous form dominates the Silicon Carbide Fibers Market with a strong 65.2% share.

In 2024, the Silicon Carbide Fibers Market saw Continuous fibers holding a dominant 65.2% share, driven by their exceptional thermal stability and mechanical strength. Industries increasingly prefer continuous SiC fibers for critical structural components, especially where long-term durability under extreme heat is required. Their ability to withstand temperatures beyond 1,400°C while maintaining stiffness makes them essential for next-gen aerospace engines and nuclear applications.

Continuous fibers also support lightweighting initiatives, offering higher efficiency in turbine performance and reduced fuel consumption. As governments and manufacturers move toward high-performance ceramic matrix composites, continuous SiC fibers continue to replace traditional metal alloys. This transition strengthens demand from defense aviation programs, next-gen propulsion systems, and advanced industrial heating technologies.

By Usage Analysis

Composites usage leads the Silicon Carbide Fibers Market, capturing an impressive 78.1% share.

In 2024, Composites accounted for a commanding 78.1% share of the Silicon Carbide Fibers Market, reflecting strong adoption across aerospace, defense, and energy sectors. SiC-reinforced composites are widely used for turbine blades, thermal protection systems, and high-temperature engine parts. Their lightweight profile, combined with superior oxidation resistance, enables aircraft manufacturers to design more efficient propulsion units that reduce emissions.

Growing investments in ceramic matrix composites (CMCs) by engine OEMs significantly push demand for SiC fibers. The material’s stability in corrosive and high-velocity environments also strengthens its usage in industrial gas turbines. As nations expand hypersonic programs and advanced propulsion research, composite-grade SiC fibers remain integral to next-generation thermal-structural material systems.

By Substrate Analysis

Carbon-carbon composites hold 47.7% in the Silicon Carbide Fibers Market substrate segment.

In 2024, Carbon–Carbon Composites represented 47.7% of the Silicon Carbide Fibers Market by substrate type, supported by their essential role in ultra-high-temperature applications. Combining SiC fibers with carbon-carbon substrates enhances oxidation resistance and overall mechanical performance, making them ideal for rocket nozzles, re-entry vehicle parts, and thermal protection systems. These hybrid materials are engineered to survive intense thermal shocks while preserving structural integrity.

Defense research programs increasingly adopt SiC-enhanced C/C composites for hypersonic glide vehicles and next-level propulsion systems. In industrial sectors, these materials also find use in high-temperature furnaces and semiconductor processing. The integration of SiC fibers significantly improves the lifespan and operational capability of C/C substrates across advanced engineering fields.

By Application Analysis

Aerospace and defense applications drive the Silicon Carbide Fibers Market with 67.9% share.

In 2024, the Aerospace and Defense segment dominated the Silicon Carbide Fibers Market with a notable 67.9% share, as global focus on lightweight, heat-resistant materials continues to rise. Aircraft engine manufacturers increasingly rely on SiC-based composites to enhance fuel efficiency, reduce engine weight, and improve thermal operating limits.

Defense programs, particularly in the U.S., Europe, and Asia, are integrating SiC fibers into missile systems, thermal shields, and hypersonic vehicle structures. The fibers’ ability to operate in extreme temperatures makes them indispensable for next-generation propulsion and high-speed aeronautics. Growing investments in space exploration and reusable launch systems also expand demand, positioning SiC fibers as a foundational material in advanced aerospace engineering.

Key Market Segments

By Form

- Continuous

- Woven

- Others

By Usage

- Composites

- Non-composites

By Substrate

- Carbon-Carbon Composites

- Ceramic Matrix Composites

- Metal Matrix Composites

By Application

- Aerospace and Defense

- Energy and Power

- Others

Driving Factors

Rising demand for high-temperature composite materials

Growing interest in high-temperature composite materials continues to strengthen the Silicon Carbide Fibers Market, especially as industries look for lightweight, durable, and thermally stable solutions. Demand grows further as manufacturers scale up ceramic matrix composites for aerospace engines, defense platforms, and industrial systems operating under extreme heat.

Recent funding helps accelerate this shift, including a firm raising £1.3 million to bring ceramic matrix composites to mass-market production and the AAMMC aerospace tech hub securing $50 million to expand advanced materials development. These investments support innovation in fiber reinforcement technologies, enabling wider adoption of SiC fibers where metal components cannot withstand long-term thermal stress or oxidation challenges.

Restraining Factors

High production costs limit scalability

Despite strong industry interest, high production costs remain a major restraint in scaling Silicon Carbide Fibers manufacturing. Producing fibers with consistent purity, crystal structure, and thermal performance demands specialized equipment and controlled processing environments, which limits large-scale affordability. Cost barriers increase further as companies attempt to transition from pilot production to broader commercialization.

Funding activity around advanced manufacturing highlights ongoing attempts to overcome these challenges, such as Holy Technologies raising €4.3 million to build an autonomous composites factory. While this investment supports future efficiency improvements, high initial cost structures still slow widespread adoption, especially among industries that require economical high-temperature material solutions for large-volume applications.

Growth Opportunity

Expanding applications in next-gen energy systems

Silicon carbide fibers continue to see expanding opportunities in next-generation energy systems, particularly applications involving extreme temperatures, structural reinforcement, and long operational lifetimes. These fibers support thermal-resistant components in advanced power units, hydrogen systems, turbine technologies, and high-capacity energy storage environments. Growing global investment in digital infrastructure and mobility further increases composite adoption.

New funding supports innovation momentum, including Composite securing $5.6 million in seed funding to automate processes and Bcomp raising CHF 36 million to advance eco-friendly composite materials for mobility applications. These developments reinforce broader opportunities for SiC fibers as industries shift toward efficient, lightweight, and thermally stable material solutions.

Latest Trends

Shift toward lightweight ceramic matrix composites

A notable trend shaping the Silicon Carbide Fibers Market is the transition toward lightweight ceramic matrix composites as industries push for higher performance with reduced weight. These materials enhance efficiency in aerospace, defense, energy, and high-temperature industrial environments by improving thermal limits and lowering fuel consumption.

Recent funding trends support this movement, with rocketry, high-temperature composites, and green-economy manufacturing receiving $62 million through the ITRP round. This investment highlights the growing interest in advanced thermal-structural materials capable of supporting next-generation propulsion systems and sustainable industrial solutions. As composite technologies evolve, Silicon Carbide Fibers remain central to the trend due to their unmatched heat resistance and mechanical stability.

Regional Analysis

North America held 38.9% share, valuing the Silicon Carbide Fibers Market at USD 0.35 Bn.

In the global Silicon Carbide Fibers Market, North America led the industry with a dominant 38.9% share, valued at USD 0.35 Bn, supported by strong aerospace and defense manufacturing activity across the U.S. and Canada. Demand in this region continues to benefit from widespread adoption of lightweight composite materials in next-generation engines and thermal-resistant components. Europe follows with steady growth driven by expanding aircraft component production and increasing integration of ceramic matrix composites in high-temperature applications.

In the Asia Pacific, market expansion is supported by rising production of advanced propulsion systems and growing defense modernization programs across China, Japan, and India. Meanwhile, the Middle East & Africa show gradual adoption as aerospace repair, maintenance, and industrial heat-processing sectors strengthen.

Latin America remains an emerging market with incremental uptake, primarily driven by industrial applications requiring high-temperature materials. Across all regions, the shift toward high-performance composite materials reinforces demand, with North America continuing to anchor global revenue due to its established manufacturing base and strong technological capabilities.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

NGS Advanced Fibers Co., Ltd. continued to play an essential role as a specialized producer of next-generation SiC fibers used in ceramic matrix composites. Its focus on improving fiber purity and thermal resistance supported broader adoption in aerospace propulsion components and advanced industrial systems requiring stable performance under extreme heat. NGS’s manufacturing expertise remained central to supply reliability, particularly as global demand for lightweight, high-strength composites increased.

Specialty Materials contributed significantly by offering tailored high-performance fibers engineered for defense and aerospace programs. The company’s emphasis on controlled crystallization and optimized fiber uniformity enabled consistent performance in demanding structural applications. Its technical engagement with component manufacturers helped accelerate the shift from traditional metal alloys toward advanced fiber-reinforced systems.

UBE Corporation maintained a stable position through its expanding portfolio of high-temperature materials and its capability to integrate SiC fibers into broader advanced-materials ecosystems. The company’s commitment to refining production processes and supporting composite-based applications strengthened its relevance as SiC fibers gained importance in next-generation engines, industrial furnaces, and thermal-protection components.

Top Key Players in the Market

- NGS Advanced Fibers Co., Ltd.

- Specialty Materials

- UBE Corporation

- American Elements

- Nanoshel LLC

- NINGXIA ANTELI CARBON MATERIAL CO. LTD

- Haydale Graphene Industries Pic

- Matech

- JS Ceramics GmbH

- SkySpring Nanomaterials, Inc.

Recent Developments

- In July 2024, Haydale signed an agreement with a Chinese tooling manufacturer to exclusively distribute its silicon carbide-reinforced tooling products in China. This deal expands market access for Haydale’s premium SiC and composite materials into the aerospace, automotive, and industrial sectors in China.

- In April 2024, UBE announced the launch of a new brand called U-BE-INFINITY™ for environmentally friendly products, which includes advanced materials and sustainable offerings across various product lines, including continuous inorganic fibers. This brand aims to highlight products that reduce environmental impact and support sustainability goals.

Report Scope

Report Features Description Market Value (2024) USD 0.9 Billion Forecast Revenue (2034) USD 8.2 Billion CAGR (2025-2034) 24.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Form (Continuous, Woven, Others), By Usage (Composites, Non-composites), By Substrate (Carbon-Carbon Composites, Ceramic Matrix Composites, Metal Matrix Composites), By Application (Aerospace and Defense, Energy and Power, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape NGS Advanced Fibers Co., Ltd., Specialty Materials, UBE Corporation, American Elements, Nanoshel LLC, NINGXIA ANTELI CARBON MATERIAL CO. LTD, Haydale Graphene Industries Pic, Matech, JS Ceramics GmbH, SkySpring Nanomaterials, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Silicon Carbide Fibers MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Silicon Carbide Fibers MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- NGS Advanced Fibers Co., Ltd.

- Specialty Materials

- UBE Corporation

- American Elements

- Nanoshel LLC

- NINGXIA ANTELI CARBON MATERIAL CO. LTD

- Haydale Graphene Industries Pic

- Matech

- JS Ceramics GmbH

- SkySpring Nanomaterials, Inc.