Global Scarves And Shawls Market Size, Share, Growth Analysis By Material (Wool, Silk, Cotton, Others), By Product (Scarves, Shawls), By End-user (Women, Men), By Distribution Channel (Offline Stores, Online Stores), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 174453

- Number of Pages: 230

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

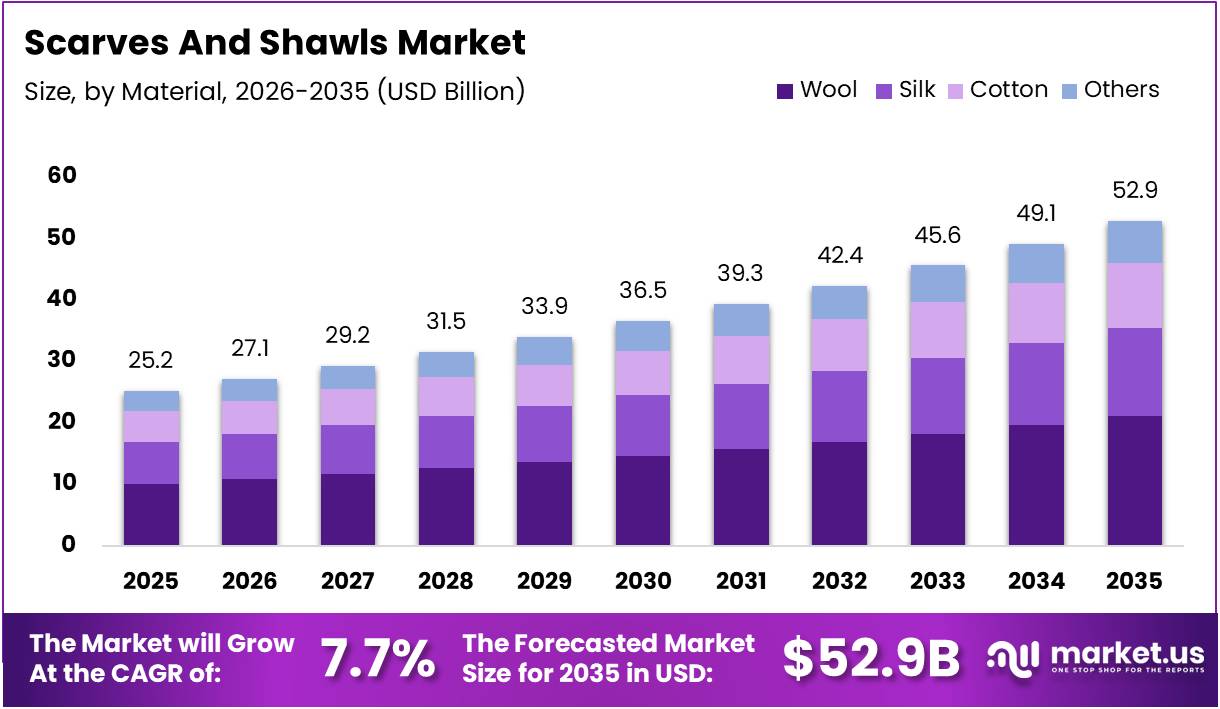

The Global Scarves And Shawls Market size is expected to be worth around USD 52.9 Billion by 2035, from USD 25.2 Billion in 2025, growing at a CAGR of 7.7% during the forecast period from 2026 to 2035.

The scarves and shawls market represents a dynamic segment within the global fashion accessories industry. This market encompasses diverse product categories including winter scarves, silk shawls, cotton wraps, and luxury pashminas. Growing consumer awareness regarding fashion trends drives sustained demand. Manufacturers continually innovate with sustainable materials and versatile designs. The market serves both functional and aesthetic purposes across demographics.

Market growth accelerates through expanding e-commerce channels and rising disposable incomes globally. Urban consumers increasingly prioritize fashion accessories that complement multiple outfits. Emerging markets demonstrate robust potential as middle-class populations expand. Digital marketing strategies effectively reach younger demographics who value personalized styling. Cross-border trade facilitates access to premium international brands, thereby broadening consumer choices significantly.

Opportunities emerge from sustainability-focused product development and ethical manufacturing practices. Eco-conscious consumers seek organic fabrics and fair-trade certified accessories. Customization services gain traction as personalization becomes paramount. Seasonal collections generate recurring revenue streams for established brands. Collaborations with fashion influencers amplify brand visibility, particularly among millennial and Gen-Z shoppers seeking trendy accessories.

Government initiatives promoting textile manufacturing strengthen domestic production capabilities in key regions. Trade policies influence import-export dynamics, affecting pricing strategies across markets. Regulatory standards regarding fabric quality and labeling ensure consumer protection. Tax incentives for sustainable manufacturing encourage industry-wide adoption of green technologies. Compliance frameworks maintain product safety standards, building consumer trust effectively.

Consumer preferences reveal critical insights into purchasing behavior and product expectations. According to research, 48% of female participants reported wearing a headscarf frequently or always when going out, highlighting substantial usage patterns. Furthermore, customers highly value scarves that are cool and lightweight (50%), soft and cozy (25%), and high quality (25%), indicating strong preference for comfort and material integrity. These statistics underscore the importance of fabric innovation and quality assurance in product development strategies.

Market dynamics continue evolving as brands balance traditional craftsmanship with contemporary design aesthetics. Innovation in moisture-wicking fabrics and temperature-regulating materials addresses functional consumer needs. Strategic positioning within premium and mass-market segments enables comprehensive market penetration, ensuring sustained competitive advantage.

Key Takeaways

- The Global Scarves And Shawls Market is projected to reach USD 52.9 Billion by 2035 from USD 25.2 Billion in 2025, growing at a CAGR of 7.7%.

- Wool dominates the market by material with a 39.6% share in 2025.

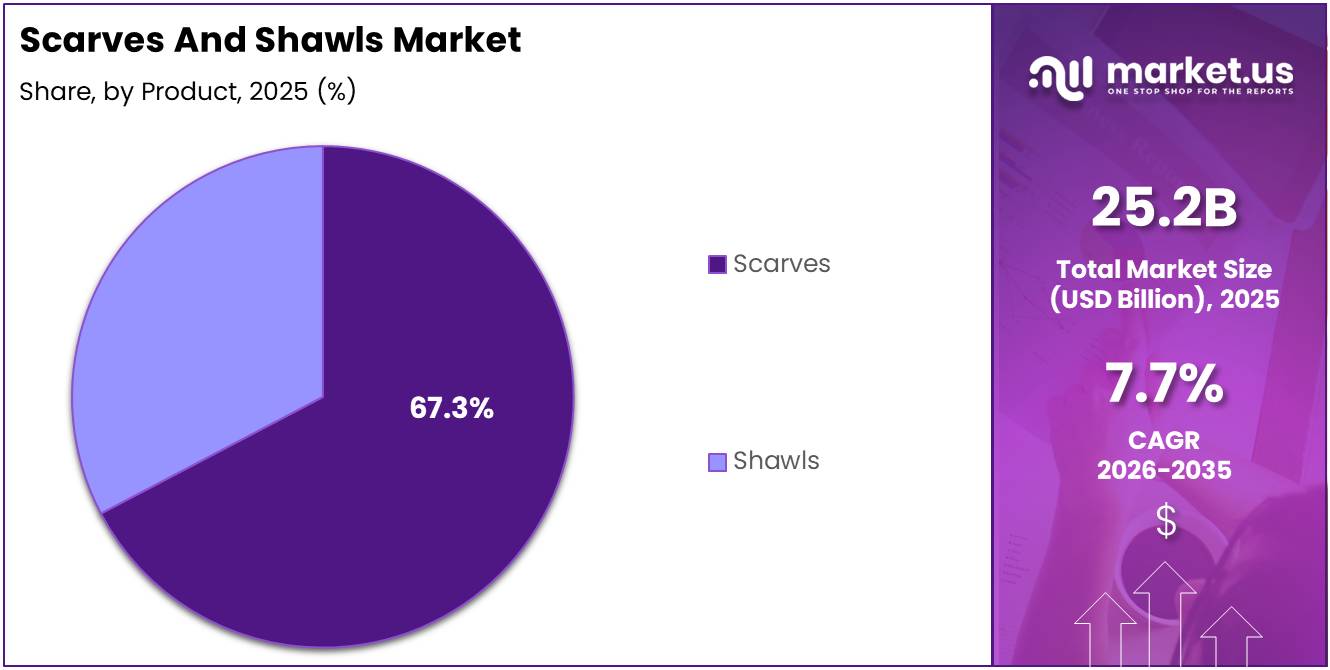

- Scarves lead the product segment with a 67.3% share in 2025.

- Women are the largest end-user segment, accounting for 69.9% in 2025.

- Offline Stores are the primary distribution channel with a 61.7% share in 2025.

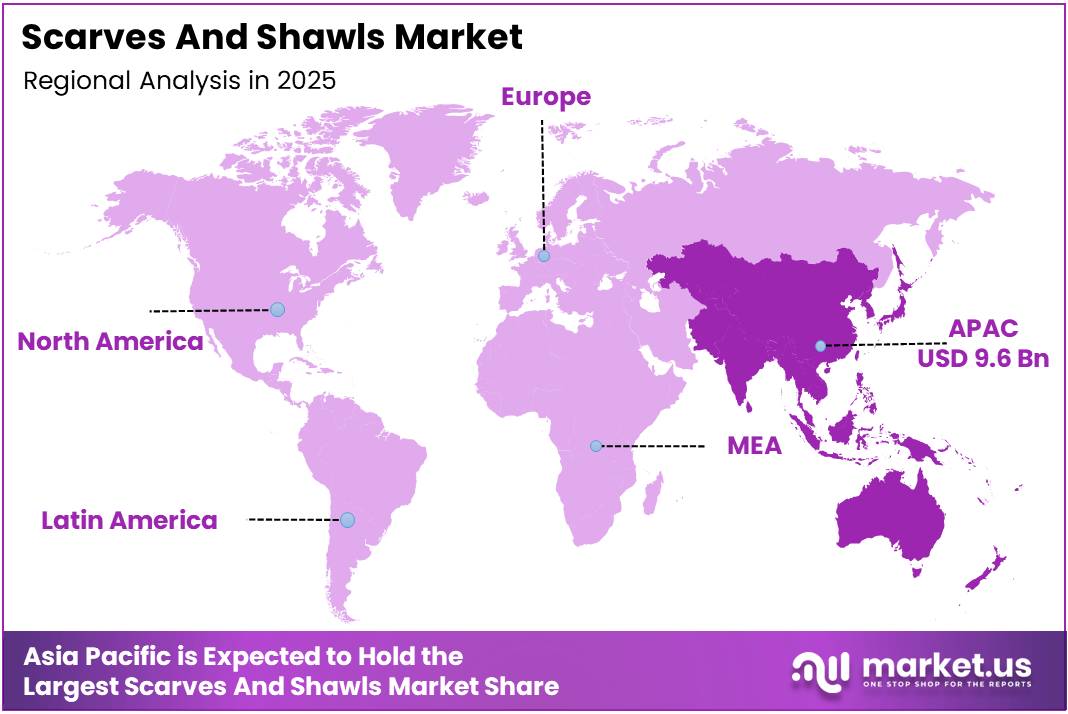

- Asia Pacific is the largest regional market, holding 38.4% share valued at USD 9.6 Billion.

By Material Analysis

Wool dominates with 39.6% due to its superior warmth retention and versatile styling options.

In 2025, Wool held a dominant market position in the By Material Analysis segment of Scarves And Shawls Market, with a 39.6% share. Wool’s exceptional insulation properties make it the preferred choice for cold weather accessories. The natural fiber offers breathability while maintaining warmth, appealing to consumers seeking comfort and functionality.

Silk represents a significant portion of the market, favored for its luxurious texture and elegant drape. This material attracts consumers seeking lightweight, sophisticated accessories for formal events and professional settings. Silk scarves and shawls offer exceptional color vibrancy and smooth finish, making them preferred choices for gift-giving and personal indulgence across various demographics.

Cotton offers affordability and breathability, making it ideal for everyday wear and transitional seasons. The material’s easy maintenance and hypoallergenic properties attract practical consumers. Cotton scarves and shawls provide comfortable options for casual styling while remaining budget-friendly for mass-market segments.

Others include synthetic blends, cashmere, and innovative materials catering to niche preferences. These alternatives address specific consumer needs such as vegan-friendly options, performance fabrics, and experimental textures. Though smaller in share, this segment drives innovation and diversification within the market landscape.

By Product Analysis

Scarves dominate with 67.3% due to their versatility in styling and year-round wearability.

In 2025, Scarves held a dominant market position in the By Product Analysis segment of Scarves And Shawls Market, with a 67.3% share. Scarves offer unmatched versatility, functioning as fashion statements, neck warmers, and head coverings across diverse occasions. Their compact size makes them convenient accessories for travel and daily commuting.

Shawls serve as statement pieces providing extensive coverage and dramatic styling opportunities. These larger garments are particularly popular for formal events, cultural celebrations, and evening wear. Shawls offer functional warmth while elevating outfit aesthetics with their draping capabilities. The product appeals to consumers seeking elegant solutions for layering during cooler temperatures.

By End-user Analysis

Women dominate with 69.9% due to higher fashion accessory consumption and diverse styling preferences.

In 2025, Women held a dominant market position in the By End-user Analysis segment of Scarves And Shawls Market, with a 69.9% share. Female consumers demonstrate significantly higher engagement with fashion accessories, viewing scarves and shawls as essential wardrobe components rather than mere functional items. Women’s fashion trends emphasize accessorizing, driving frequent purchases across multiple styles, colors, and materials.

Men represent a growing segment with increasing awareness of fashion accessories and personal styling. Male consumers primarily purchase scarves and shawls for functional warmth during winter months, though fashion-conscious men are gradually exploring these items as style statements. The segment shows potential for expansion as gender-neutral fashion trends gain momentum and men become more experimental with accessorizing.

By Distribution Channel Analysis

Offline Stores dominate with 61.7% due to tactile shopping experiences and immediate product availability.

In 2025, Offline Stores held a dominant market position in the By Distribution Channel Analysis segment of Scarves And Shawls Market, with a 61.7% share. Physical retail environments enable consumers to touch, feel, and examine fabric quality before purchasing, which remains crucial for textile accessories. Brick-and-mortar stores provide immediate gratification through instant product possession, eliminating shipping delays.

Online Stores are experiencing rapid growth driven by digital transformation and e-commerce convenience. Virtual shopping platforms offer extensive product variety, competitive pricing, and doorstep delivery that appeals to time-conscious consumers. Enhanced product photography, detailed descriptions, and customer reviews help bridge the tactile gap inherent in online shopping.

Key Market Segments

By Material

- Wool

- Silk

- Cotton

- Others

By Product

- Scarves

- Shawls

By End-user

- Women

- Men

By Distribution Channel

- Offline Stores

- Online Stores

Drivers

Rising Adoption of Fashion Accessories for Year-Round Styling Across Age Groups

The scarves and shawls market is experiencing strong growth driven by the increasing adoption of fashion accessories among diverse age demographics. Consumers are no longer viewing scarves and shawls as purely seasonal items but as essential year-round styling elements. Young adults, middle-aged professionals, and senior consumers alike are incorporating these accessories into their daily wardrobes to enhance personal style and express individuality.

Social media platforms and celebrity endorsements play a crucial role in driving market demand. Influencers and fashion icons regularly showcase creative styling techniques, inspiring millions of followers to experiment with scarves and shawls. Seasonal fashion cycles further accelerate purchasing patterns as brands launch new collections aligned with runway trends and cultural events.

Climate-adaptive apparel demand is another significant driver, particularly in regions experiencing cold winters and transitional weather conditions. Consumers in temperate zones seek functional yet fashionable accessories that provide warmth without compromising style. This practical need, combined with aesthetic preferences, creates consistent demand across geographic markets.

Restraints

Seasonal Demand Fluctuations Affecting Consistent Product Consumption

The scarves and shawls market faces notable challenges from seasonal demand fluctuations that impact consistent sales throughout the year. Consumer purchasing behavior heavily concentrates during autumn and winter months when weather conditions drive practical need for warmth. This seasonality creates inventory management difficulties for retailers and manufacturers who struggle to maintain steady production schedules and revenue streams during off-peak periods.

Spring and summer months typically witness sharp declines in scarf and shawl purchases, forcing brands to offer significant discounts to clear inventory. This cyclical pattern reduces profit margins and complicates long-term business planning. Retailers often experience cash flow constraints during lean seasons, limiting their ability to invest in product development or marketing initiatives.

The availability of unorganized and unbranded products further complicates market dynamics. Local markets and street vendors offer low-cost alternatives that lack brand identity but appeal to price-sensitive consumers. These unbranded options make it challenging for established brands to differentiate their offerings based solely on quality or design.

Growth Factors

Expansion of Sustainable, Handcrafted, and Eco-Friendly Fabric Collections

The scarves and shawls market presents significant growth opportunities through the expansion of sustainable and eco-friendly product collections. Modern consumers increasingly prioritize environmental responsibility in purchasing decisions, creating demand for accessories made from organic cotton, recycled materials, and ethically sourced fibers. Brands that emphasize sustainability credentials and transparent supply chains can capture this growing conscious consumer segment.

Handcrafted and artisanal scarves offer another promising opportunity as consumers seek unique, authentic products with cultural significance. Traditional weaving techniques and hand-embroidered designs appeal to buyers looking for distinctive accessories that support local artisans and preserve heritage crafts. This premiumization trend allows brands to command higher price points while building emotional connections with customers.

E-commerce platforms enable direct-to-consumer brand expansion, eliminating intermediaries and improving profit margins. Online channels provide smaller brands access to global markets without substantial infrastructure investments. Digital marketing tools allow targeted campaigns that reach specific customer segments efficiently.

Customized and limited-edition collections generate excitement and urgency among fashion enthusiasts. Personalization options and exclusive releases create perceived scarcity that drives purchasing decisions and builds brand loyalty among style-conscious consumers.

Emerging Trends

Shift Toward Lightweight, Multi-Functional Scarves for All-Season Use

Current market trends reflect a notable shift toward lightweight, multi-functional scarves that serve purposes beyond traditional cold-weather protection. Consumers increasingly prefer versatile accessories that transition seamlessly across seasons and occasions. Breathable fabrics and adaptable designs allow scarves to function as fashion statements during warmer months while providing necessary warmth in cooler conditions.

Natural fiber preferences are strengthening as consumers recognize the superior qualities of wool, silk, and cashmere. These premium materials offer better temperature regulation, durability, and luxurious feel compared to synthetic alternatives. Health-conscious buyers appreciate natural fibers’ hypoallergenic properties and breathability, driving demand particularly in developed markets where quality consciousness prevails.

Gender-neutral and minimalist designs are reshaping product development. Contemporary consumers favor clean aesthetics and simple patterns that complement various wardrobe styles. Unisex options broaden market appeal and reflect inclusive fashion attitudes. Minimalist approaches emphasize timeless quality over temporary trends, encouraging sustainable consumption patterns.

Regional Analysis

Asia Pacific Dominates the Scarves and Shawls Market with a Market Share of 38.4%, Valued at USD 9.6 Billion

Asia Pacific leads the global scarves and shawls market with a commanding share of 38.4%, valued at USD 9.6 billion. The region’s dominance is driven by strong cultural traditions, robust manufacturing capabilities in countries like India and China, and a rapidly growing middle-class population with increasing fashion consciousness. Expanding e-commerce penetration and the presence of both traditional handcrafted products and modern accessories continue to fuel market growth.

North America Scarves and Shawls Market Trends

North America represents a mature market characterized by premium product preferences and strong seasonal demand during fall and winter. The region is witnessing a significant shift toward sustainable and ethically sourced materials, with consumers prioritizing organic fabrics and eco-friendly production practices. E-commerce platforms and social media marketing have become key channels for brand engagement and consumer purchasing decisions.

Europe Scarves and Shawls Market Trends

Europe showcases a sophisticated market with deep appreciation for luxury fashion accessories and heritage craftsmanship. The region demonstrates strong demand for designer scarves from established fashion houses, with consumers exhibiting growing interest in sustainable fashion and timeless designs that balance traditional elegance with contemporary styling trends.

Middle East and Africa Scarves and Shawls Market Trends

The Middle East and Africa region displays unique market dynamics driven by cultural and religious practices that emphasize modest dressing, particularly headscarves and shawls. The market benefits from increasing disposable incomes in Gulf countries and growing fashion awareness across urban centers. Premium and luxury segment products are gaining significant traction among affluent consumer groups in major metropolitan areas.

Latin America Scarves and Shawls Market Trends

Latin America presents an emerging market with rising consumer interest in fashion accessories influenced by both traditional textile heritage and global fashion trends. The region shows growing demand for affordable yet stylish products, with e-commerce platforms facilitating increased market access across diverse demographic segments.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Scarves And Shawls Company Insights

The global scarves and shawls market in 2025 continues to be shaped by luxury and heritage brands that balance craftsmanship with evolving consumer preferences.

Dolce & Gabbana remains a dominant force, leveraging its high-fashion appeal and seasonal collections to attract affluent consumers seeking statement accessories. Its focus on bold patterns and premium materials strengthens its positioning in luxury scarves and shawls globally, while occasional collaborations with artists and designers further enhance its brand visibility in niche fashion circles.

Himalayan Weavers, known for its traditional weaving techniques, has carved a niche by offering authentic handcrafted products. The brand benefits from growing demand for artisanal and sustainable fashion, appealing to consumers who value heritage craftsmanship and quality. Its regional expertise in wool and pashmina products reinforces its market relevance.

Elvang stands out for its emphasis on Scandinavian design and sustainable production. By integrating eco-friendly materials and minimalist aesthetics, the company attracts environmentally conscious consumers, especially in European and North American markets. Its strategy of combining comfort, design, and sustainability gives it a competitive edge.

Louis Vuitton leverages its global brand recognition and luxury positioning to maintain leadership in high-end scarves and shawls. Its collaborations and limited-edition collections create exclusivity, which continues to drive demand among luxury buyers. Strategic marketing and a focus on iconic designs ensure sustained brand visibility and consumer loyalty.

Top Key Players in the Market

- Dolce & Gabbana

- Himalayan Weavers

- Elvang

- Louis Vuitton

- Chanel

- Pashmina

- The Kashmir Company

- Shahkaar

- Prada

Recent Developments

- In May 2025, Chanel bolstered its luxury textiles footprint by acquiring an additional stake in Italian silk specialist Mantero Seta. This move enhanced Chanel’s access to premium silk, strengthening its range of high-end scarves and shawls for global markets.

- In April 2025, The Prada Group signed a definitive agreement to acquire Versace from Capri Holdings. This strategic consolidation in the luxury fashion market is expected to influence the scarves and shawls segment by combining iconic design aesthetics and expanding distribution channels.

Report Scope

Report Features Description Market Value (2025) USD 25.2 Billion Forecast Revenue (2035) USD 52.9 Billion CAGR (2026-2035) 7.7% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material (Wool, Silk, Cotton, Others), By Product (Scarves, Shawls), By End-user (Women, Men), By Distribution Channel (Offline Stores, Online Stores) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Dolce & Gabbana, Himalayan Weavers, Elvang, Louis Vuitton, Chanel, Pashmina, The Kashmir Company, Shahkaar, Prada Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Dolce & Gabbana

- Himalayan Weavers

- Elvang

- Louis Vuitton

- Chanel

- Pashmina

- The Kashmir Company

- Shahkaar

- Prada