Global Same Day Delivery Market By Service Type (Domestic, International), By Application (Retail, Documents & Letters, E-Commerce, Manufacturing, Healthcare, Other Applications), By End User (B2B, B2C, C2C), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Feb. 2024

- Report ID: 32321

- Number of Pages: 386

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

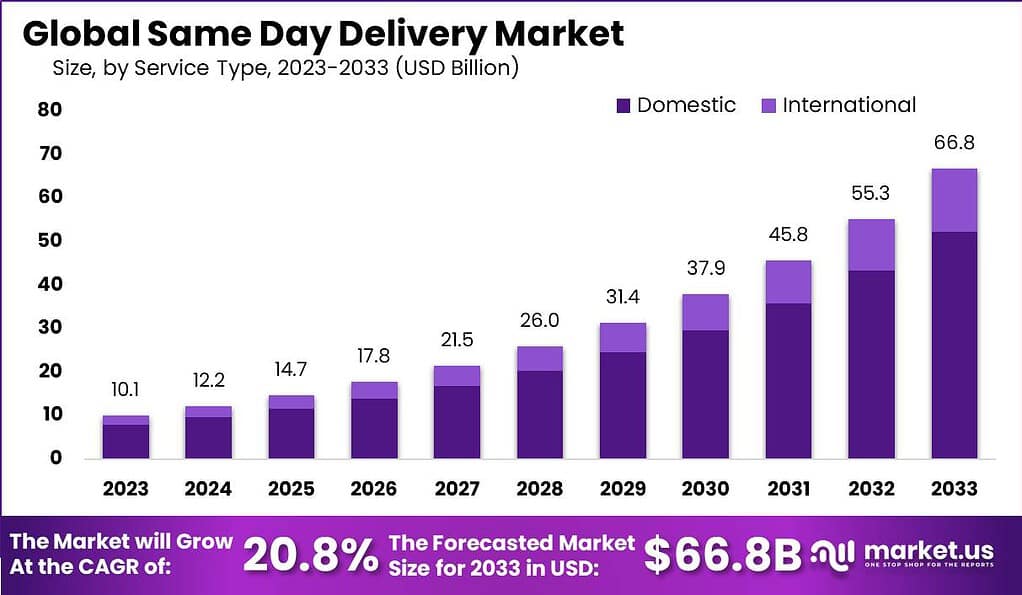

The Global Same Day Delivery Market is projected to expand from USD 10.1 Billion in 2023 to USD 66.8 Billion by 2033, exhibiting a remarkable CAGR of 20.8% during the forecast period from 2024 to 2033.

Same day delivery refers to the practice of delivering products to customers on the same day they place an order. It has gained significant popularity in recent years, driven by the increasing demand for fast and convenient delivery options. As e-commerce has grown, consumer expectations for faster delivery times have increased, leading to the rise of same day delivery options.

The same day delivery market is expected to continue growing as consumer expectations for convenience and speed persist. It is expanding as both businesses and consumers seek faster and more reliable delivery solutions. This growth is driven by advancements in logistics technology, urbanization, and the growing expectation for immediate product access. The Same Day Delivery market includes courier companies, postal services, and online retailers, all competing to provide the fastest and most efficient service.

In the landscape of same-day delivery startups, the year 2021 marked a significant milestone, with venture capital investments nearly doubling to almost $10 billion, compared to the previous year. This surge in funding underscores the burgeoning demand and investor confidence in the sector. Among the beneficiaries, Gopuff, DoorDash, and Instacart emerged as top-funded entities, securing $1.2 billion, $620 million, and $265 million, respectively.

DoorDash, trading under the symbol DASH, saw its share price reach $59.01 as of February 10, 2024. The company’s strategic maneuvers in 2023, which included raising $2.3 billion in funding and forging partnerships with major retailers like Walmart and CVS, significantly expanded its delivery network. These efforts have bolstered DoorDash’s market valuation to $38.8 billion, evidencing the robust investor confidence and the company’s pivotal role in redefining the delivery landscape.

Instacart, maintaining its status as a private entity, raised $265 million in funding over the same period. Its collaborations with leading grocery chains such as Kroger and Costco have been pivotal in cementing its position as a key player in the same-day grocery delivery segment. These strategic partnerships, coupled with its consistent performance, have propelled Instacart’s funding value to $39 billion, underscoring its substantial impact on the grocery delivery market.

GoPuff, another significant player, secured $1 billion in funding in 2023, reflecting its ambitious expansion strategy. The company’s diversification into alcohol, convenience items, and prepared meals delivery services has broadened its market reach. Despite being a private company, GoPuff’s funding value stands at $8.9 billion, indicating a strong investor belief in its business model and growth trajectory.

Key Takeaways

- Market Growth Projection: The Same Day Delivery Market is projected to expand significantly, with a projected expansion from USD 10.1 Billion in 2023 to USD 66.8 Billion by 2033, exhibiting a remarkable CAGR of 20.8% during the forecast period from 2024 to 2033.

- Service Type Analysis: In 2023, the Domestic Segment held a dominant market position in the Same Day Delivery Market, capturing more than a 78.3% share.

- Application Outlook: In 2023, the Retail Segment held a dominant market position in the Same Day Delivery Market, capturing more than a 27.2% share.

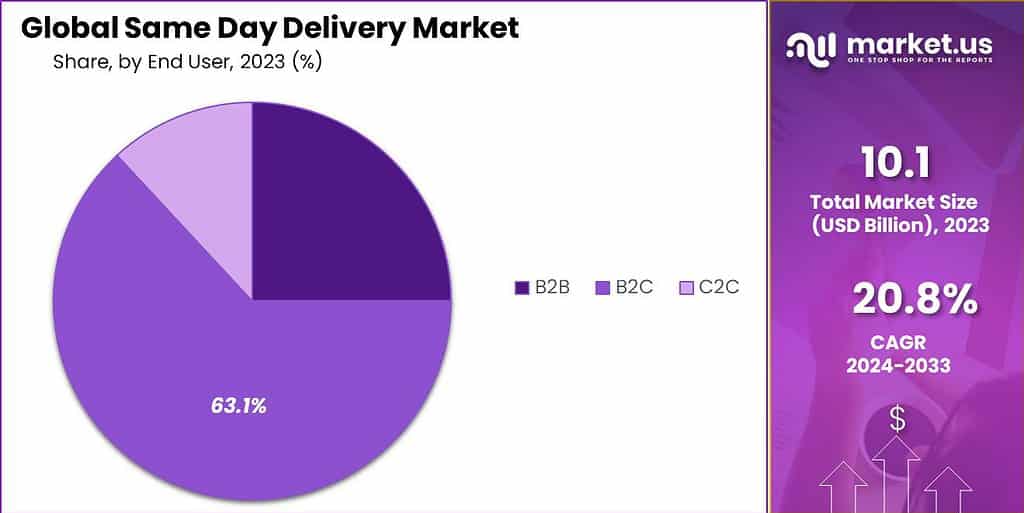

- End User Insights: In 2023, the B2C (Business to Consumer) Segment held a dominant market position in the Same Day Delivery Market, capturing more than a 63.1% share.

- Driving Factors: The market’s growth is driven by several factors, including the increasing consumer demand for convenience, the rapid growth of e-commerce, urbanization, and advancements in technology such as route optimization algorithms and real-time tracking systems.

- Challenges: Challenges in the Same Day Delivery Market include scaling up operations while maintaining efficiency, standing out in a highly competitive market, meeting high customer expectations, and addressing sustainability and environmental impact concerns.

- Key Players: The market is mostly controlled by a few big and medium-sized companies, including DHL, FedEx Corporation, United Parcel Service, Amazon.com Inc., and others.

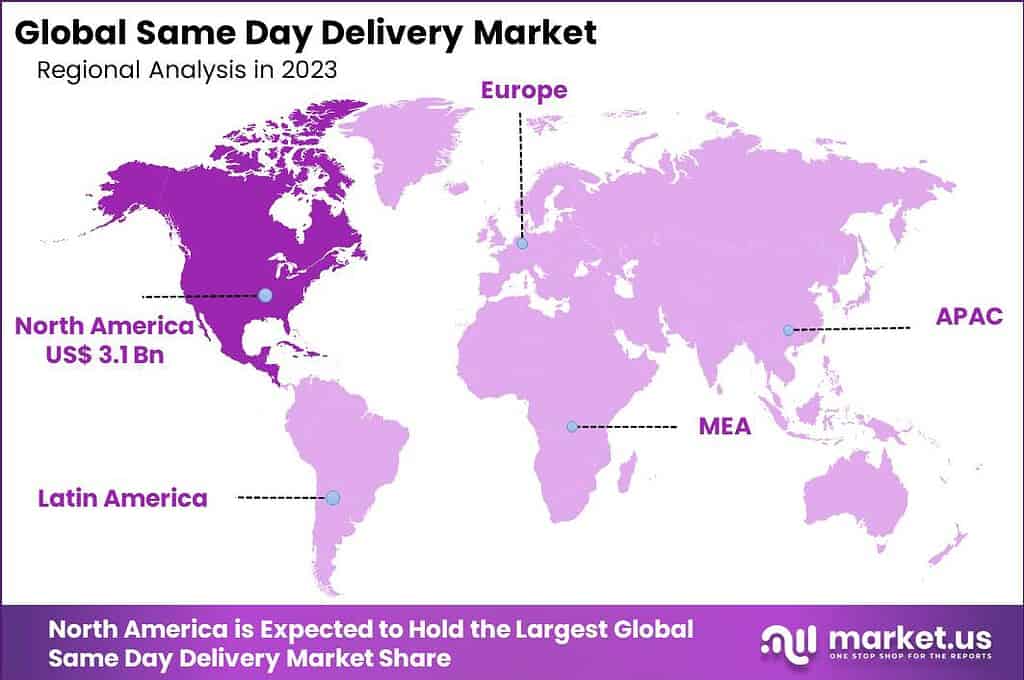

- Regional Analysis: In 2023, North America emerged as a powerhouse in the Same Day Delivery sector, commanding an impressive 31.5% market share.

Service Type Analysis

In 2023, the Domestic Segment held a dominant market position in the Same Day Delivery Market, capturing more than a 78.3% share. This substantial portion of the market can be attributed to the increasing consumer demand for rapid, efficient delivery services within their own countries. Factors driving this segment include the rise of e-commerce platforms, advancements in logistics and transportation technologies, and the growing expectation for quick turnarounds on orders.

Businesses are leveraging these trends to provide faster delivery options, aiming to enhance customer satisfaction and retention. The segment’s growth is further bolstered by the integration of sophisticated tracking systems and last-mile delivery solutions, which ensure timely and reliable delivery of goods. Despite its current dominance, the Domestic Segment continues to evolve, influenced by changing consumer behaviors and the continual push for more efficient delivery models.

On the other hand, the International Segment, while smaller, presents significant growth opportunities. As globalization increases and businesses expand their reach, the need for efficient cross-border delivery solutions is becoming more pronounced. Companies in this segment are focusing on overcoming challenges such as customs clearance, international logistics complexities, and varying delivery standards across countries.

Technological advancements and strategic partnerships are key to enhancing the efficiency and reliability of international deliveries. As businesses continue to tap into global markets, the International Segment is expected to witness substantial growth, driven by the expanding online retail sector, improvements in transportation infrastructure, and the increasing reliability of international delivery services. While it currently holds a smaller share of the market, its potential for expansion and innovation is considerable, marking it as a vital area for future development in the Same Day Delivery Market.

Application Outlook

In 2023, the Retail Segment held a dominant market position in the Same Day Delivery Market, capturing more than a 27.2% share. This dominance is primarily driven by the retail industry’s rapid transformation, where immediacy in product delivery has become a crucial competitive edge.

Retailers are increasingly adopting same-day delivery to meet customer expectations for fast and convenient shopping experiences. This segment’s growth is further propelled by technological advancements in logistics and the widespread use of smartphones, enabling easy access to online shopping platforms.

The Documents & Letters Segment also plays a significant role, particularly in the business and legal sectors, where the prompt delivery of critical documents is essential. Though it doesn’t match the Retail Segment’s size, its importance remains high due to the ongoing need for reliable and fast document transfer.

E-Commerce is another robust segment, closely intertwined with retail, experiencing exponential growth. As online shopping becomes more prevalent, e-commerce platforms are continuously seeking efficient delivery solutions to enhance customer satisfaction and loyalty. The increasing preference for online shopping, coupled with the demand for quick delivery, is likely to drive substantial growth in this segment.

The Manufacturing Segment, though more niche, is crucial for the just-in-time delivery model, where components and materials are delivered exactly when needed in the production process, reducing inventory costs and increasing efficiency.

Healthcare is an emerging segment within the Same Day Delivery Market, particularly vital for the timely delivery of medical supplies and specimens, which can be critical for patient care. The urgency and sensitivity of healthcare items necessitate reliable and swift delivery services. Other Applications encompass a broad range of sectors, including but not limited to, automotive, agriculture, and construction, where the timely delivery of goods can significantly impact operations.

End User Insights

In 2023, the B2C (Business to Consumer) Segment held a dominant market position in the Same Day Delivery Market, capturing more than a 63.1% share. This significant lead is primarily attributed to the surge in online retail and e-commerce, where consumers increasingly expect fast, reliable delivery directly to their doorstep.

The rise of digital platforms, coupled with the consumer’s growing preference for immediate gratification when shopping online, has propelled the B2C segment forward. Retail giants and small businesses alike are investing in same-day delivery capabilities to enhance customer satisfaction and remain competitive in the market. The convenience and speed offered by same-day delivery services are not just luxuries but expected standards in today’s fast-paced consumer environment.

The B2B (Business to Business) Segment, while smaller in comparison, is nonetheless crucial, particularly in industries where time-sensitive deliveries can greatly impact operations. This includes sectors like manufacturing, where the timely delivery of parts and materials is essential for maintaining production schedules. The B2B segment is characterized by its focus on reliability and efficiency, as businesses increasingly rely on just-in-time delivery to minimize inventory costs and maximize productivity.

Lastly, the C2C (Consumer to Consumer) Segment, though the smallest, is growing due to the rise in online marketplaces and platforms that facilitate peer-to-peer selling and trading. This segment benefits from the increasing trend of consumers selling directly to each other, requiring efficient delivery services to bridge the geographical gap. The C2C market is particularly diverse, encompassing everything from second-hand goods to homemade crafts, all requiring swift and reliable delivery options to satisfy customer expectations.

Key Market Segments

By Service Type

- Domestic

- International

By Application

- Retail

- Documents & Letters

- E-Commerce

- Manufacturing

- Healthcare

- Other Applications

By End User

- B2B

- B2C

- C2C

Driving Factors

- Consumer Demand for Convenience: The increasing demand for convenience and instant gratification is a major driving factor in the same day delivery market. Consumers expect fast and efficient delivery services to meet their immediate needs and enhance their shopping experience.

- E-commerce Growth: The rapid growth of e-commerce has fueled the demand for same day delivery. As more consumers shift towards online shopping, retailers and e-commerce platforms are striving to offer faster delivery options to remain competitive in the market.

- Urbanization and Population Density: The concentration of population in urban areas and the ongoing trend of urbanization contribute to the growth of same day delivery. Higher population density allows for more efficient delivery routes and shorter distances, making same day delivery more feasible and cost-effective.

- Advancements in Technology: Technological advancements have significantly improved the efficiency and effectiveness of same day delivery services. Innovations such as route optimization algorithms, real-time tracking systems, and automated warehouse management systems streamline logistics operations, enabling faster and more accurate deliveries.

Restraining Factors

- Logistics Infrastructure Challenges: Setting up and maintaining an efficient logistics infrastructure for same day delivery can be a significant challenge. Companies need to invest in warehousing facilities, transportation networks, and last-mile delivery capabilities to ensure timely and reliable deliveries, which can be capital-intensive and complex.

- Cost and Profitability: Implementing same day delivery services can be costly for companies. The need for faster delivery often involves higher operational expenses, including labor, transportation, and inventory management. Balancing these costs while maintaining profitability can be a constraint for businesses, especially for smaller players in the market.

- Last-Mile Delivery Complexity: The last leg of delivery, known as the last-mile, presents challenges due to factors such as traffic congestion, unpredictable customer availability, and the need for personalized delivery options. Overcoming these complexities and ensuring efficient last-mile delivery can be a restraining factor in the same day delivery market.

- Regulatory and Legal Considerations: The same day delivery market is subject to various regulatory and legal considerations, including labor laws, safety regulations, and compliance with delivery timeframes. Adhering to these regulations while providing fast and reliable delivery services can pose challenges for companies operating in this market.

Growth Opportunities

- Expansion into New Geographical Areas: There are significant growth opportunities for companies to expand their same day delivery services into new geographical areas. As e-commerce continues to grow globally, entering emerging markets and underserved regions can provide new avenues for growth in the same day delivery market.

- Collaboration and Partnerships: Collaborating with third-party logistics providers, retailers, or e-commerce platforms can create growth opportunities in the same day delivery market. Partnerships enable companies to leverage existing delivery networks, share resources, and reach a broader customer base, accelerating market penetration and growth.

- Integration of Technology and Automation: Embracing advanced technologies, such as artificial intelligence (AI), robotics, and autonomous vehicles, presents growth opportunities in the same day delivery market. Automation can streamline operations, increase efficiency, and reduce costs, enabling faster and more scalable delivery services.

- Customized Delivery Solutions: Offering customized delivery options, such as flexible time windows or personalized delivery preferences, can be a growth opportunity. Providing customers with the ability to choose their preferred delivery time and method enhances the overall customer experience and can differentiate a company’s same day delivery services in the market.

Challenges

- Scalability and Operational Efficiency: Scaling up same day delivery operations while maintaining operational efficiency can be a significant challenge. As order volumes increase, companies need to ensure that their logistics infrastructure, workforce, and technology can handle the growing demand without compromising on delivery speed and quality.

- Competitive Landscape: The same day delivery market is highly competitive, with numerous players vying for market share. Standing out among competitors and offering unique value propositions can be challenging. Companies need to differentiate themselves through exceptional service, innovative delivery options, and superior customer experiences.

- Customer Expectations and Service Level Agreements: Meeting the high expectations of customers in terms of delivery speed, accuracy, and service quality can be a challenge. Maintaining service level agreements and consistently delivering on time requires robust logistics management, effective communication, and proactive issue resolution.

- Sustainability and Environmental Impact: Same day delivery can have a significant environmental impact due to increased delivery frequency and associated carbon emissions. Balancing the need for fast delivery with sustainability considerations is a challenge for companies. Developing eco-friendly delivery solutions, such as electric vehicles or optimizing delivery routes, is crucial to address this challenge.

Regional Analysis

In 2023, North America emerged as a powerhouse in the Same Day Delivery sector, commanding an impressive 31.5% market share. This is largely due to the region’s advanced logistical network and the widespread consumer demand for immediate delivery, particularly in urban centers.

The demand for Same Day Delivery in North America was valued at US$ 3.1 billion in 2023 and is anticipated to grow significantly in the forecast period. The United States and Canada, with their high internet penetration rates and tech-savvy populations, have been instrumental in this growth, leveraging technologies like real-time tracking and automated dispatch systems.

Europe, on the other hand, presents a market driven by its commitment to sustainability and efficiency. European consumers, particularly in countries like Germany and the UK, are increasingly seeking quick yet environmentally conscious delivery options. This demand has spurred innovations in electric vehicle fleets and optimized route planning, catering to the region’s stringent regulatory standards and preference for green solutions.

In the Asia-Pacific region, rapid economic development and digital transformation are the key drivers. With burgeoning e-commerce platforms and a massive consumer base, countries like China, Japan, and South Korea are experiencing a boom in demand for same-day delivery services. The region’s market is further fueled by rising urbanization and improvements in last-mile delivery.

Latin America’s market is in a phase of accelerated growth, bolstered by the digital revolution and a young, tech-embracing demographic. While infrastructure challenges persist, the increasing internet and smartphone penetration rates are creating fertile ground for market expansion. Countries like Brazil and Mexico are at the forefront, with local and international players vying for a share in this growing market.

Finally, the Middle East and Africa are showing promising signs of market evolution. With strategic investments in logistics and infrastructure, coupled with a burgeoning e-commerce sector, these regions are poised for significant growth. The UAE and South Africa, in particular, are leading the way, capitalizing on their strategic locations and improving delivery networks.

Note: Actual Numbers Might Vary In The Final Report

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Thailand

- Singapore

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Same Day Delivery market worldwide is mostly controlled by a few big and medium-sized companies, and they make up a large part of the total revenue in this market. These companies are mainly focusing on working together, buying or joining with others to stay competitive in the market. This shows that companies need to team up or make deals to do well in the market.

Top Company Profiles

- DHL

- FedEx Corporation

- United Parcel Service

- Amazon.com, Inc.

- TNT Express

- Aramex

- Maplebear Inc.

- Uber Technologies, Inc.

- Stuart Delivery

- Roadie Inc.

- GetSwift Technologies Ltd.

- PostNord AB

- Other Key Players

Recent Developments

- In July 2023, Amazon’s drone delivery, called Prime Air, got permission from the FAA to start delivering packages in Lockeford, California. This is a big step for Amazon’s plan to use drones for delivery, which could change how we get our packages.

- In March 2023, DoorDash launched DashPass, a subscription service that lets you get unlimited free deliveries from certain restaurants. DashPass has been a hit, helping DoorDash get more customers and making people order food more often.

Report Scope

Report Features Description Market Value (2023) USD 10.1 Billion Forecast Revenue (2033) USD 66.8 Billion CAGR (2024-2033) 20.8% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Service Type (Domestic, International), By Application (Retail, Documents & Letters, E-Commerce, Manufacturing, Healthcare, Other Applications), By End User (B2B, B2C, C2C) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, and Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, and Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape DHL, FedEx Corporation, United Parcel Service, Amazon.com Inc., TNT Express, Aramex, Maplebear Inc., Uber Technologies Inc., Stuart Delivery, Roadie Inc., GetSwift Technologies Ltd., PostNord AB, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is same-day delivery?Same-day delivery is a shipping model where a customer orders an item that can be delivered to their doorstep within 24 hours.

Is same-day delivery available everywhere?Same-day delivery availability varies based on location and the presence of logistics infrastructure in a particular area. It is more commonly offered in urban centers with well-established delivery networks.

How does same-day delivery impact businesses?Same-day delivery can positively impact businesses by increasing customer satisfaction, fostering brand loyalty, and boosting sales. However, it also comes with challenges related to operational efficiency and costs.

What are the benefits of same-day delivery?Same-day delivery offers a number of benefits for both businesses and consumers. For businesses, same-day delivery can help to improve customer satisfaction, increase sales, and reduce the risk of customer churn. For consumers, same-day delivery can save time and hassle, and it can provide peace of mind knowing that their order will arrive quickly.

Are there any limitations to same-day delivery?Same-day delivery may have limitations in remote or rural areas, where logistics infrastructure might not be as developed. Additionally, delivery time windows may be limited, and there could be restrictions on certain products' eligibility for same-day delivery.

What is the future of same-day delivery?The future of same-day delivery looks promising with ongoing technological advancements, such as drone delivery and autonomous vehicles. Additionally, the focus on sustainability and environmentally friendly delivery options will shape the industry's future.

Who are the key players involved The Same Day Delivery Market?The major players are DHL, FedEx Corporation, United Parcel Service, Amazon.com, Inc., TNT Express, Aramex, Maplebear Inc., Uber Technologies, Inc., Stuart Delivery, Roadie Inc., GetSwift Technologies Ltd., PostNord AB, Other Key Players

-

-

- DHL

- FedEx Corporation

- United Parcel Service

- Amazon.com, Inc.

- TNT Express

- Aramex

- Maplebear Inc.

- Uber Technologies, Inc.

- Stuart Delivery

- Roadie Inc.

- GetSwift Technologies Ltd.

- PostNord AB

- Other Key Players