Global Salts And Flavored Salts Market Size, Share, And Enhanced Productivity By Product Type (Table Salt, Seasoned Salt and Flavored Salt (Truffle Salt, Garlic Salt, Lime and Lemon Salt, Smoked Salt, Jalapeño Salt, Others)), By Source (Mineral, Rock, Naturally Harvested, Others),By Distribution Channel (Supermarket and Hypermarket, Convenience and Grocery Stores, Online Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174225

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

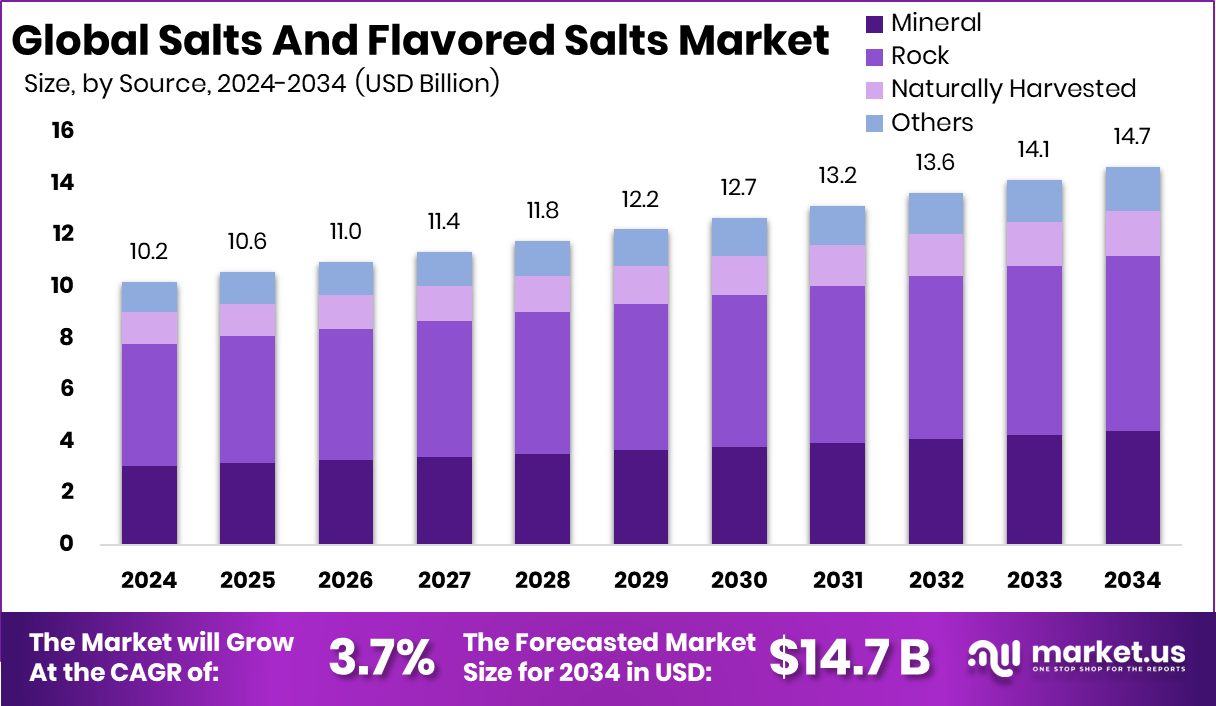

The Global Salts And Flavored Salts Market is expected to be worth around USD 14.7 billion by 2034, up from USD 10.2 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034. Salts and Flavored Salts Market in North America reached 34.20%, USD 3.4 Bn.

Salts and flavored salts are basic food ingredients used to enhance taste, balance flavors, and support food preservation. Regular salt is widely used in daily cooking, while flavored salts combine salt with herbs, spices, or natural seasonings to add depth and variety. These products are used at home, in restaurants, and in packaged foods because they improve taste without complex preparation.

The salts and flavored salts market covers the production, processing, and sale of these products across retail and foodservice channels. It reflects how consumers buy everyday salt as well as premium flavored options for cooking convenience. The market is closely linked to eating habits, packaged food growth, and changing taste preferences.

One key growth factor is the shift toward clean-label and alternative food products. Startups developing mycelium-based foods highlight this trend. MyForest Foods raised USD 15 million in a Series A-2 round, while Matr Foods secured USD 23 million to scale clean-label mycelium meat. These products still rely on salt and seasoning to deliver taste, supporting steady demand.

Demand is rising as consumers cook more at home and seek simple ways to improve flavor. Flavored salts offer easy seasoning without extra sauces or additives. They fit well with plant-based and protein-alternative foods that need balanced seasoning to appeal to consumers.

The opportunity lies in pairing salts with new food formats and lifestyle shifts. Even broader economic stories, such as living on a USD 45,000 salary in Washington, D.C., highlight budget-conscious cooking at home. Affordable seasoning solutions like salts remain essential, creating long-term opportunities across everyday and specialty food use.

Key Takeaways

- The Global Salts And Flavored Salts Market is expected to be worth around USD 14.7 billion by 2034, up from USD 10.2 billion in 2024, and is projected to grow at a CAGR of 3.7% from 2025 to 2034.

- In the Salts and Flavored Salts Market, table salt dominates product type, holding 83.2% share.

- Rock salt leads the source in the Salts and Flavored Salts Market, accounting for 46.4% share.

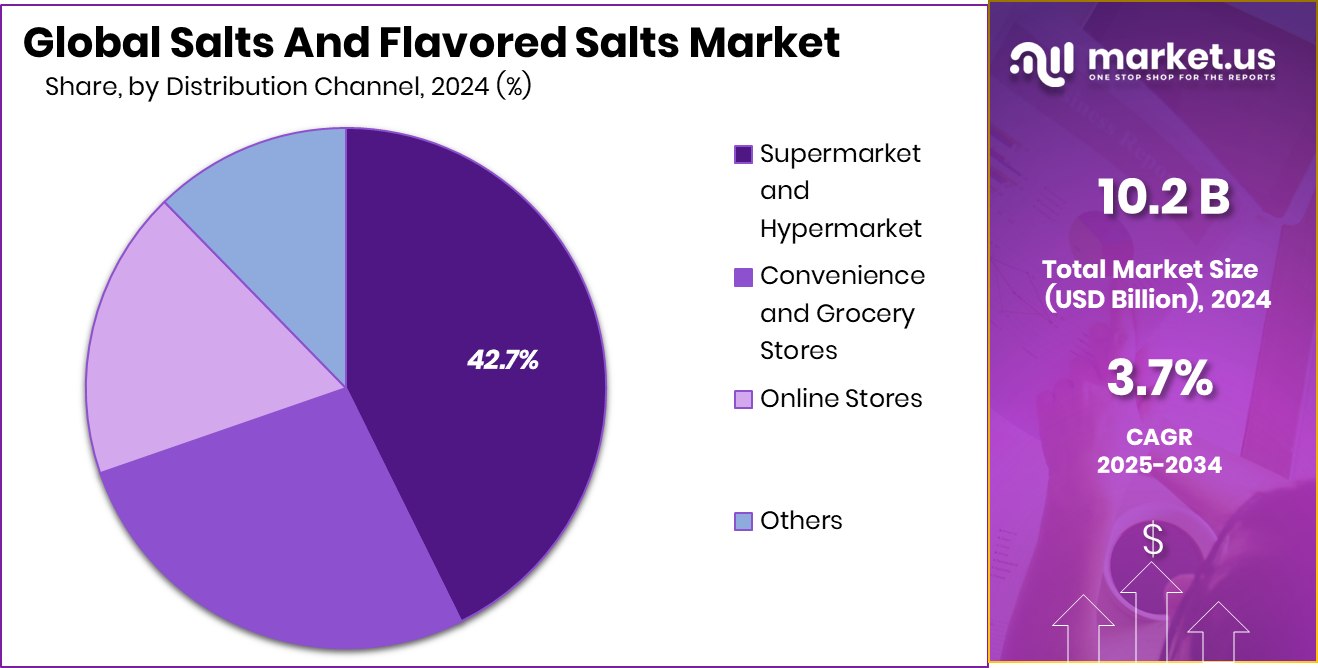

- Supermarket and hypermarket channels dominate the salts and flavored salts market distribution, capturing 42.7% of sales share.

- North America region generated USD 3.4 Bn with 34.20% market share Salts Flavored.

By Product Type Analysis

In the Salts and Flavored Salts Market, Table Salt leads by product type, holding 83.2% share.

In 2024, the Salts and Flavored Salts Market was largely shaped by the dominance of Table Salt, which accounted for 83.2% of total product-type demand. This strong share reflects table salt’s everyday use across households, foodservice outlets, and packaged food manufacturing. Its affordability, long shelf life, and universal role in cooking continue to support steady volumes.

In emerging urban markets, table salt remains a staple purchase, even as consumers explore specialty and flavored options. Food processors also rely heavily on refined table salt for consistency in taste, texture, and preservation. Despite rising interest in gourmet salts, table salt’s wide acceptance, stable pricing, and integration into daily diets ensured it retained its leading position within the overall salts and flavored salts landscape throughout the year.

By Source Analysis

In the Salts and Flavored Salts Market, Rock Salt dominates the source category with a 46.4% share.

In 2024, the market also showed a clear preference by Source, with Rock Salt holding a 46.4% share, reflecting growing consumer trust in naturally mined salt products. Rock salt benefits from its perceived purity and minimal processing, which aligns with clean-label and traditional food preferences. Many consumers associate rock salt with essential minerals and a more natural origin, supporting its use in both household cooking and food processing.

In developing regions, rock salt remains widely used due to local availability and cost advantages. At the same time, manufacturers value rock salt as a base material for refining and flavor infusion. These factors together strengthened rock salt’s role as the leading source segment within the salts and flavored salts market.

By Distribution Channel Analysis

In the Salts and Flavored Salts Market, Supermarkets and hypermarkets lead distribution, capturing 42.7% market share.

In 2024, Supermarkets and Hypermarkets emerged as the leading Distribution Channel, capturing 42.7% of total sales in the Salts and Flavored Salts Market. Large-format retail stores continue to attract consumers by offering a wide product variety, competitive pricing, and convenient one-stop shopping. Shoppers prefer these outlets for comparing brands, pack sizes, and salt variants, including table, rock, and flavored salts.

Promotional discounts and bulk packaging further drive higher volumes through this channel. For manufacturers, supermarkets and hypermarkets provide strong visibility and shelf presence, supporting brand recognition and impulse purchases. As urban retail infrastructure expands and organized retail penetration increases, this channel remains critical for sustaining large-scale sales and consumer reach.

Key Market Segments

By Product Type

- Table Salt

- Seasoned Salt and Flavored Salt

- Truffle Salt

- Garlic Salt

- Lime and Lemon Salt

- Smoked Salt

- Jalapeño Salt

- Others

By Source

- Mineral

- Rock

- Naturally Harvested

- Others

By Distribution Channel

- Supermarket and Hypermarket

- Convenience and Grocery Stores

- Online Stores

- Others

Driving Factors

Premium Artisanal Salts Drive Flavor Innovation Growth

One strong driving factor in the Salts and Flavored Salts Market is the rising demand for premium and artisanal salt products. Consumers are actively looking for natural, handcrafted, and origin-specific salts that add character to everyday cooking. This shift supports small and mid-scale producers focused on quality rather than volume.

A clear example is Anglesey Sea Salt, which secured £1.2m in expansion funding to increase production capacity and meet growing demand. This investment reflects confidence in premium salt consumption across home cooking and foodservice. Chefs and home cooks value texture, mineral content, and subtle flavor differences, pushing growth beyond basic table salt. As food culture becomes more experience-driven, premium salts act as affordable indulgences, supporting steady market expansion.

Restraining Factors

Health Concerns Around Sodium Intake: Limit Consumption

A major restraining factor for the Salts and Flavored Salts Market is increasing awareness of health risks linked to high sodium intake. Consumers are becoming more cautious about daily salt consumption due to concerns around blood pressure and long-term wellness. This awareness often leads to reduced usage rather than switching to new salt varieties. Even flavored salts, while offering taste variety, still contain sodium, which limits their use among health-focused buyers.

Food brands and households are under pressure to control portion sizes, which directly affects volume growth. Regulatory guidelines and dietary advice further reinforce moderation. As a result, while salt remains essential, growth is naturally constrained by the need to balance flavor with responsible consumption, slowing aggressive expansion in mature markets.

Growth Opportunity

Home Cooking Habits Create New Seasoning Demand

A key growth opportunity in the Salts and Flavored Salts Market comes from rising home cooking and meal customization. Consumers want simple ingredients that help them recreate restaurant-style flavors without complex recipes. Flavored salts meet this need by combining salt with herbs, spices, or natural aromas in a single step. They offer convenience, consistency, and control over taste intensity. This trend opens opportunities for new blends tailored to regional cuisines, grilling, baking, or plant-based dishes.

As households experiment more with food, salts evolve from basic staples into flavor tools. This creates room for differentiated products that fit daily cooking routines while remaining affordable and easy to use.

Latest Trends

Natural Flavors And Clean Labels Shape Market Trends

One of the latest trends shaping the Salts and Flavored Salts Market is the shift toward clean-label and naturally flavored products. Consumers prefer salts made with recognizable ingredients and minimal processing. Artificial additives are increasingly avoided, especially in flavored variants. Producers are responding by highlighting sourcing, mineral content, and simple ingredient lists.

Texture-rich salts such as flakes or crystals are also gaining attention for finishing and presentation. This trend reflects broader food transparency expectations, where even basic seasonings must align with clean eating values. As a result, product storytelling, origin labeling, and natural flavor positioning are becoming central to how salts are marketed and perceived.

Regional Analysis

North America Salts And Flavored Salts Market held 34.20% share, USD 3.4 Bn.

The Salts and Flavored Salts Market shows clear regional variation in consumption patterns, retail structures, and product preferences. North America stands as the dominating region, holding 34.20% of the market and valued at USD 3.4 Bn, supported by high household penetration, strong packaged food consumption, and widespread availability through organized retail. Consumers in this region actively purchase table salt and flavored variants for home cooking and processed foods, reinforcing stable demand.

Europe follows with steady consumption driven by traditional culinary use and growing interest in specialty and flavored salts, particularly in mature food markets. Asia Pacific reflects volume-led demand, where salt remains a daily staple across households and foodservice, supported by population size and diverse cooking practices.

In the Middle East & Africa, usage is closely tied to traditional diets and preservation needs, with demand remaining consistent across household and commercial applications. Latin America shows balanced consumption, supported by home cooking habits and expanding retail access.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

K+S Aktiengesellschaft continues to play a structurally important role in the global salts and flavored salts market during 2024, supported by its long-standing expertise in salt extraction and processing. The company’s strength lies in its ability to serve multiple end-use segments, including food-grade salt, while maintaining consistent quality standards. Its operational focus on efficiency and reliable supply positions it well in markets where demand stability and product purity matter more than rapid product diversification. K+S’s presence across established markets helps reinforce steady volumes rather than speculative growth.

Akzo Nobel NV brings a different strategic angle to the salt landscape in 2024, shaped by its historical involvement in industrial and specialty salt activities. The company’s disciplined operational approach and emphasis on value-added applications influence how salt products are positioned within broader material portfolios. Rather than competing on volume alone, Akzo Nobel’s legacy supports controlled participation where consistency, process integration, and long-term customer relationships define performance.

Meanwhile, Tata Chemicals Limited remains a highly influential player, particularly due to its strong linkage with consumer salt usage. In 2024, Tata Chemicals benefits from deep household penetration and brand familiarity, supporting dependable demand across everyday salt categories. Its integrated operations and focus on food-grade salt allow it to balance affordability with scale, reinforcing its relevance in both domestic and international markets without relying on aggressive expansion narratives.

Top Key Players in the Market

- K+S Aktiengesellschaft

- Akzo Nobel NV

- Tata Chemicals Limited

- McCormick & Company Inc

- United Salt Corporation

- Ajinomoto Co. Inc

- Saltworks Inc

- INFOSA

- Cornish Sea Salt Co

- ITC Ltd

Recent Developments

- In July 2024, United Salt’s Houston area facilities were reported to be working on recovery efforts after the impact of Hurricane Beryl, focusing on restoring operations and ensuring a reliable supply of salt products. This reflects the company’s commitment to infrastructure resilience in the face of extreme weather events.

- In September 2024, Ajinomoto Co. Inc announced a new concept called “Electric Seasoning, a technology that uses light electrical stimulation to enhance the taste of low-salt foods. This development aims to help reduce salt in food while keeping flavor strong, working with research partners from The University of Tokyo and Ochanomizu University. The company plans further work with wearable devices linked to this technology.

Report Scope

Report Features Description Market Value (2024) USD 10.2 Billion Forecast Revenue (2034) USD 14.7 Billion CAGR (2025-2034) 3.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Table Salt, Seasoned Salt and Flavored Salt (Truffle Salt, Garlic Salt, Lime and Lemon Salt, Smoked Salt, Jalapeño Salt, Others)), By Source (Mineral, Rock, Naturally Harvested, Others),By Distribution Channel (Supermarket and Hypermarket, Convenience and Grocery Stores, Online Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape K+S Aktiengesellschaft, Akzo Nobel NV, Tata Chemicals Limited, McCormick & Company Inc, United Salt Corporation, Ajinomoto Co. Inc, Saltworks Inc, INFOSA, Cornish Sea Salt Co, ITC Ltd Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Salts And Flavored Salts MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Salts And Flavored Salts MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- K+S Aktiengesellschaft

- Akzo Nobel NV

- Tata Chemicals Limited

- McCormick & Company Inc

- United Salt Corporation

- Ajinomoto Co. Inc

- Saltworks Inc

- INFOSA

- Cornish Sea Salt Co

- ITC Ltd