Global Sales Tech Market Size, Share Analysis Report By Type (Customer Relationship Management (CRM), Prospecting and Lead Generation, Sales Automation, Sales Reporting and Management, Project Management, Others), By Application (Medium-sized Enterprises, Large Enterprises), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150671

- Number of Pages: 322

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

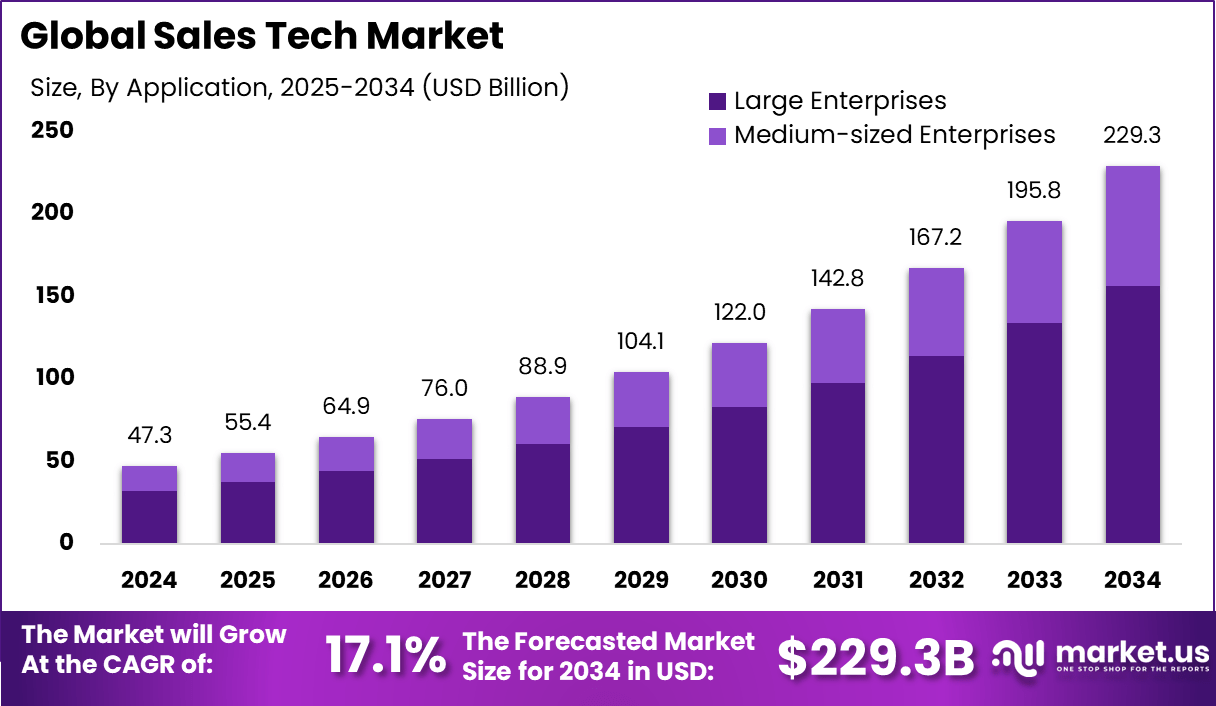

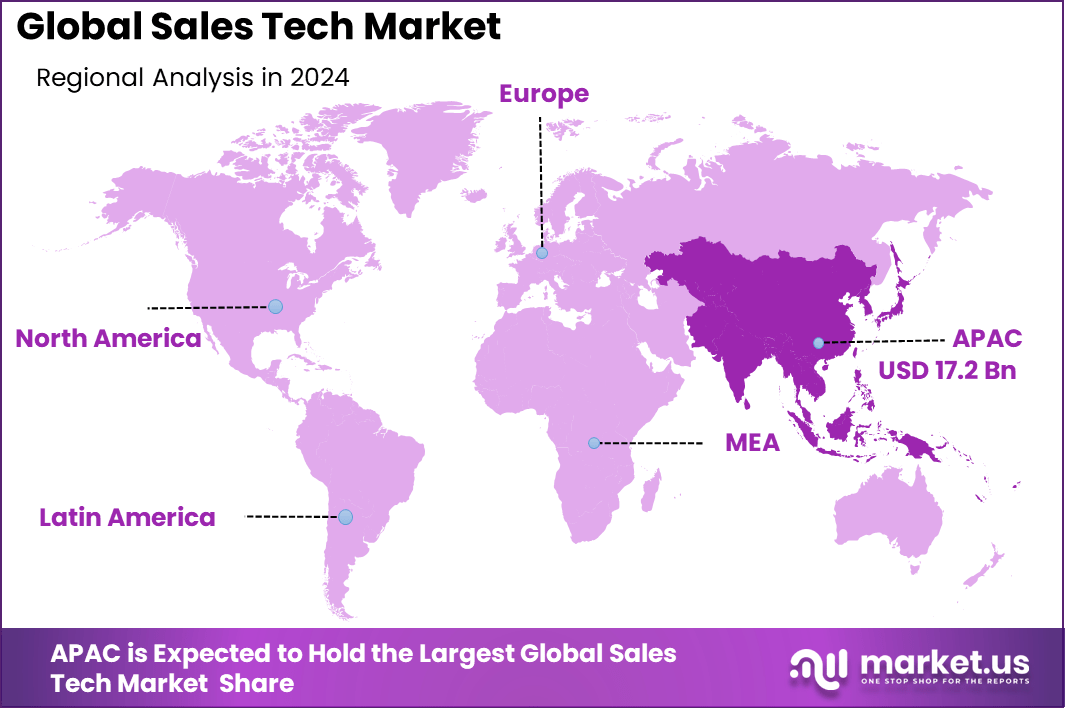

The Global Sales Tech Market size is expected to be worth around USD 229.3 Billion By 2034, from USD 47.3 billion in 2024, growing at a CAGR of 17.1% during the forecast period from 2025 to 2034. In 2024, APAC held a dominant market position, capturing more than a 36.4% share, holding USD 17.2 Billion revenue.

The Sales Technology (Sales Tech) Market is undergoing a significant expansion as companies increasingly adopt digital tools to streamline revenue generation. This market encompasses diverse solutions – such as sales intelligence, analytics, enablement, and acceleration platforms – designed to enhance sales productivity, optimize workflows, and drive customer engagement.

One Top Driving Factor behind this growth is the transition to virtual and hybrid selling models. Sales teams are leveraging AI-enabled tools, real-time analytics, and mobile accessibility to adapt to remote interactions and digital-first buyer behaviors. This transformation reflects the need to maintain engagement and consistency across geographically dispersed markets.

The market is witnessing an Increasing Adoption of Technologies such as machine learning, natural language processing, and augmented analytics. These technologies empower predictive forecasting, automated pipeline management, and actionable insights. Embedded AI within tools identifies cross-sell and upsell opportunities, while augmented analytics automate reporting and discovery of sales trends, delivering rapid ROI.

According to Desku.io, the global sales ecosystem is undergoing a significant transformation, marked by a 10% projected growth fueled by the rapid expansion of digital sales channels and e-commerce platforms. Artificial Intelligence is set to redefine engagement norms, with 95% of customer interactions expected to be AI-driven by 2025, streamlining lead generation, personalization, and service delivery at scale.

Sales speed has become crucial, with early responders 35%-50% more likely to close deals. Around 90% of top sellers now use social platforms, and 80% of B2B deals involve several decision-makers, demanding more strategic outreach. Sales automation has surged by 71%, boosting both productivity and closure rates.

Based on Market.us insights, the Global B2B E-commerce Market is forecasted to reach approximately USD 1,02,013.4 Billion by 2034, rising from USD 21,222.6 Billion in 2024, at a robust 17% CAGR from 2025 onward. North America retained a leading market position in 2024, holding over 40% share and generating revenues of nearly USD 8,489 Billion, driven by mature digital infrastructures and early adoption of enterprise-level e-commerce solutions.

Key Reasons for Adopting Solutions include enhanced revenue efficiency, improved customer personalization, and stronger decision-making capabilities. Sales platforms reduce repetitive tasks, decrease time-to-close, and elevate customer experience through contextual, data-driven interactions. Integration with CRM systems ensures a unified view across sales and support functions, aligning teams around common objectives.

Key Takeaways

- The Global Sales Tech Market was valued at USD 47.3 Billion in 2024 and is projected to grow significantly to USD 229.3 Billion by 2034, registering a strong CAGR of 17.1% over the forecast period.

- Asia-Pacific (APAC) led the global market, securing more than 36.4% share and generating USD 17.2 Billion in revenue, driven by rapid enterprise digitalization and strong tech adoption across emerging economies.

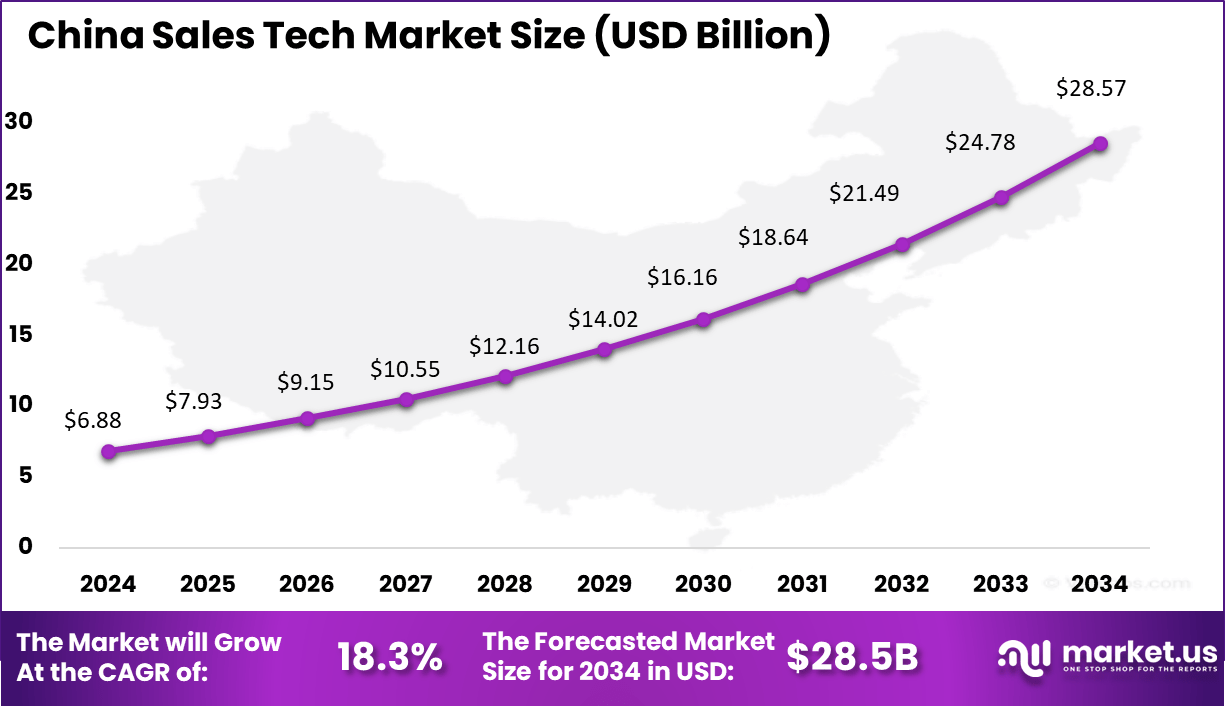

- Within APAC, China contributed USD 6.88 Billion in 2024 and is forecasted to expand at a robust CAGR of 18.3%, underpinned by growing SaaS adoption and automation in enterprise sales operations.

- Customer Relationship Management (CRM) solutions dominated the market by type, capturing a commanding 52.1% share, reflecting increasing reliance on CRM platforms to manage customer data and drive personalized sales strategies.

- Large Enterprises emerged as the leading application segment, accounting for 68.3% of the market, due to their higher capacity for tech investment and broader use of advanced sales analytics and automation tools.

China Market Expansion

The China Sales Tech Market is undergoing rapid expansion, fueled by widespread digitalization in enterprise sales operations and growing investments in AI-driven customer engagement tools. In 2024, the market value stood at approximately USD 6.88 Billion, reflecting the country’s strong push toward smarter, data-powered sales ecosystems.

By 2029, the market is expected to reach around USD 14.02 Billion, showcasing accelerated adoption across both large enterprises and agile startups. By 2034, the market is projected to grow further to approximately USD 28.57 Billion, advancing at a CAGR of 18.3% from 2025 to 2034.

In 2024, APAC held a dominant market position, capturing more than a 36.4% share, holding USD 17.2 Billion in revenue. The region’s leadership in the Sales Tech Market has been largely influenced by the rapid digitalization of sales ecosystems across countries like China, India, Japan, and South Korea.

The accelerated adoption of mobile-first sales platforms, CRM automation, and AI-driven analytics tools is transforming how businesses engage with customers. As businesses in APAC focus on expanding their online and omnichannel sales networks, technology platforms have become essential for scaling operations and customizing buyer journeys.

This dominance is further supported by the high penetration of e-commerce, the growing startup ecosystem, and strong government support for digital transformation. In emerging markets such as Southeast Asia and India, small and medium enterprises (SMEs) are increasingly investing in cloud-based sales enablement tools to compete with larger enterprises.

Moreover, local tech startups are offering affordable and localized Sales Tech solutions, creating widespread accessibility. The region’s growing digital talent pool and favorable demographic dividend are also contributing to a sustained demand for advanced sales technology, positioning APAC as a long-term growth engine in the global market.

By Type Analysis

In 2024, the Customer Relationship Management (CRM) segment held a dominant market position, capturing more than a 52.1% share in the global Sales Tech Market. This leadership can be attributed to the critical role CRM platforms play in helping organizations manage and analyze customer interactions throughout the entire sales lifecycle.

As businesses increasingly prioritize customer experience and data-driven decision-making, CRM systems are being widely adopted to centralize client information, personalize communication, and streamline follow-ups across various sales stages. The rising use of AI-powered CRM solutions, real-time data tracking, and cloud-based deployment models has further accelerated adoption across sectors.

Companies are leveraging predictive analytics and automation capabilities within CRMs to improve sales forecasting, reduce churn rates, and identify upselling opportunities. Additionally, the integration of CRM systems with communication tools, marketing platforms, and e-commerce ecosystems is enhancing cross-functional collaboration, allowing for more cohesive sales strategies.

Summary of Leading Segment – CRM

Key Drivers Details Market Maturity & Scale CRM accounts for over USD 53 billion in global spend, about 52.1% of Sales Tech solutions Enterprise Penetration 73.8% of CRM investment comes from companies with 1,000+ employees; North America leads with 42.4% of spending Leading Vendor Ecosystem Providers like Salesforce (~21.7% share), Microsoft, SAP, and Oracle anchor CRM with integrated sales, service, and marketing suites AI & Automation Innovation Emerging AI capabilities in CRM – autonomous agents, predictive analytics -enhance customer engagement and operational efficiency By Application Analysis

In 2024, the Large Enterprises segment held a dominant market position, capturing more than a 68.3% share in the global Sales Tech Market. This leadership is primarily driven by the scale and complexity of operations in large organizations, which demand advanced and integrated technology solutions to manage vast customer databases, multichannel sales pipelines, and geographically distributed teams.

These enterprises are investing heavily in enterprise-grade Sales Tech platforms that offer end-to-end automation, AI-powered analytics, and seamless CRM integrations to support complex decision-making and long-term strategic planning. Furthermore, large corporations often operate across multiple regions and sectors, requiring scalable solutions to maintain consistency and efficiency in their sales operations.

The need for real-time visibility into sales performance, customer engagement, and market trends has pushed large enterprises to adopt cloud-based sales enablement tools and predictive analytics solutions. Additionally, with increasing emphasis on data security, compliance, and business continuity, large enterprises are choosing well-established Sales Tech providers offering enterprise-level support and customization.

Summary of Leading Segment – Large Enterprises

Key Drivers Details Complex Sales Infrastructure Global teams and multi-channel pipelines require full-featured sales tech solutions like CRM and analytics High IT Budgets Large firms contribute over 73.8% of CRM spending and ~60% of total enterprise software investment Technology Integration Needs Demand for secure, scalable, and integrated platforms from Salesforce, Microsoft, SAP, etc. Digital Transformation Focus Strategic priority on automation, AI, and data-driven sales processes across business units Key Market Segments

By Type

- Customer Relationship Management (CRM)

- Prospecting and Lead Generation

- Sales Automation

- Sales Reporting and Management

- Project Management

- Others

By Application

- Medium-sized Enterprises

- Large Enterprises

Market Dynamics

Category Insight Summary Emerging Trend - AI‑powered sales tools – such as reinforcement‑learning agents, predictive lead scoring, and autonomous assistants – are accelerating. For example, SalesRLAgent applies reinforcement learning to boost lead conversion accuracy by 96.7%, outperforming standard LLM solutions.

- Additionally, virtual and omnichannel engagement are now baseline requirements. Digital selling across social, mobile, chat, and video platforms is now mainstream, with self-service tools, mobile enablement, and social selling forming core components of modern sales workflows.

Key Driver - Adoption of AI/ML and digital transformation across sales operations is fueling growth. Platforms with predictive analytics, real-time guidance, and automation are driving performance improvements – 68% of business leaders regard these tools as essential to their strategy.

- The shift to remote and hybrid work models has also intensified demand for cloud-native sales platforms, allowing distributed teams to collaborate and engage virtually with customers.

Market Restraint - High implementation costs and integration complexity represent significant barriers. Small- and mid-sized businesses face steep upfront investments and challenges when integrating new tools with legacy CRM, ERP, and communication systems.

- Additionally, need for skilled personnel to implement and manage AI‑enabled systems constrains adoption and increases operational expenses.

Market Opportunity - The market is expanding through revenue-tech convergence, integrating sales, marketing, and service platforms into unified ecosystems. This trend enables end-to-end funnel management, performance attribution, and unified analytics.

- Moreover, AI‑driven sales coaching and conversational intelligence – such as Salesforce’s Agentforce – shows promise. In real use cases, 84% of customer queries are managed by agents, freeing sellers to focus on relationship building.

Market Challenge - A key challenge is balancing AI automation with human trust. Overreliance on AI in client-facing activities risks diminishing authenticity; sales professionals still require human judgment, rapport, and ethical interaction.

- Another challenge is ensuring cross-platform interoperability. Complex ecosystems – spanning CRM, PRM, mobile tools, and analytics – require robust integration frameworks, APIs, and alignment across distributed teams.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Player Analysis

LinkedIn continues to refine Sales Navigator by deepening native integrations with CRMs such as HubSpot and Zoho. New widgets allow users to view full LinkedIn profile info directly within these tools, streamlining workflow and enhancing sales intelligence. Furthermore, LinkedIn’s promotion of cutting‑edge AI sales tools signals ongoing investment in automation and lead‑optimization features.

HubSpot remains focused on ecosystem expansion and AI‑driven efficiency. In 2025, it extended its Sales Hub via integrations like LinkedIn Sales Navigator and Google Analytics, enhancing pipeline transparency and data enrichment. The company also held its annual Sales Kickoff – an event highlighting competitive deal‑strategy and an AI‑centric product roadmap.

Freshworks persisted in extending its AI‑enabled CRM and customer‑interaction functions via its Sales Cloud. In 2025, it added conversational‑AI enhancements to its chat and calling modules, increasing automation and allowing reps to optimize response times and lead follow‑ups.

Top Key Players Covered

- Salesforce

- HubSpot

- Zoho

- ZoomInfo

- Outreach

- Freshwork

- ClickFunnels

- Pipedrive

- Sugar CRM

- Clari

- Mindtickle, Inc.

- Leadfeeder

- Others

Recent Developments

- In April 2025, HubSpot launched over 200 new features including AI tools such as Breeze AI and enhanced marketing and sales workspaces. It also rolled out a new credit-based pricing model for AI tools in May 2025, introducing monthly AI usage limits for Starter, Pro, and Enterprise tiers. These moves reflect HubSpot’s strong push into AI-powered sales tech to support automation and user engagement.

- During Zoholics 2025 in May, Zoho announced new updates to its CRM suite with guided selling, analytics, and advanced messaging. Additionally, Zoho launched Ulaa Enterprise, a privacy-focused browser for businesses, and Zoho Payments, marking its entry into the U.S. fintech sector. These launches signify Zoho’s broader ecosystem expansion to cover end-to-end business operations, including sales automation.

Report Scope

Report Features Description Market Value (2024) USD 47.3 Bn Forecast Revenue (2034) USD 229.3 Bn CAGR (2025-2034) 17.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Type (Customer Relationship Management (CRM), Prospecting and Lead Generation, Sales Automation, Sales Reporting and Management, Project Management, Others), By Application (Medium-sized Enterprises, Large Enterprises) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Salesforce, LinkedIn, HubSpot, Zoho, ZoomInfo, Outreach, Freshwork, ClickFunnels, Pipedrive, Sugar CRM, Clari, Mindtickle, Inc., Leadfeeder, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-