Global SaaS Data Management Market Size, Share and Analysis Report By Component (Software/Solutions, Services), By Service Type (Software-as-a-Service, Platform-as-a-Service, Infrastructure-as-a-Service), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare and Life Sciences, Retail and E-commerce, Manufacturing, Government and Public Sector, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 178319

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Drivers Impact Analysis

- Restraint Impact Analysis

- By Component: Software/Solutions

- By Service Type: Software-as-a-Service

- By Deployment Mode: Public Cloud

- By Organization Size: Large Enterprises

- By End-User Industry: BFSI

- Regional Overview: North America

- Emerging Trend Analysis

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

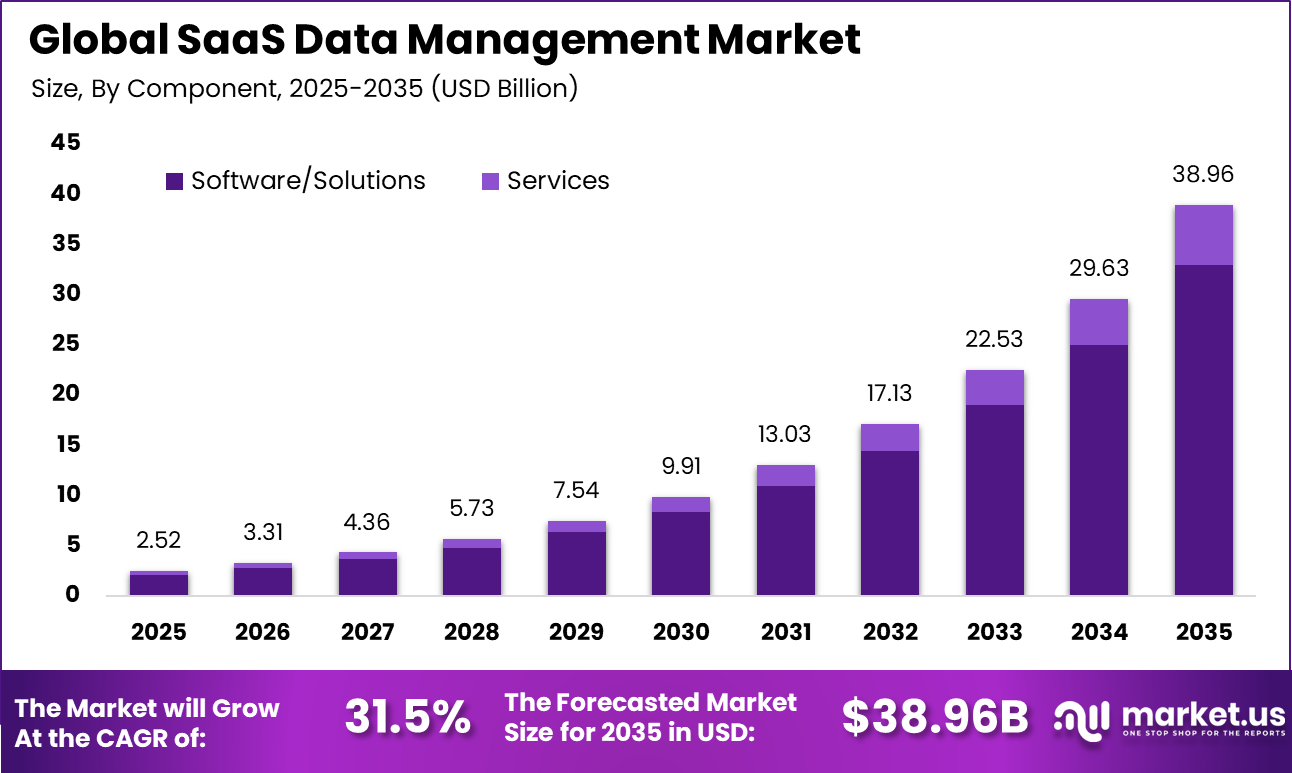

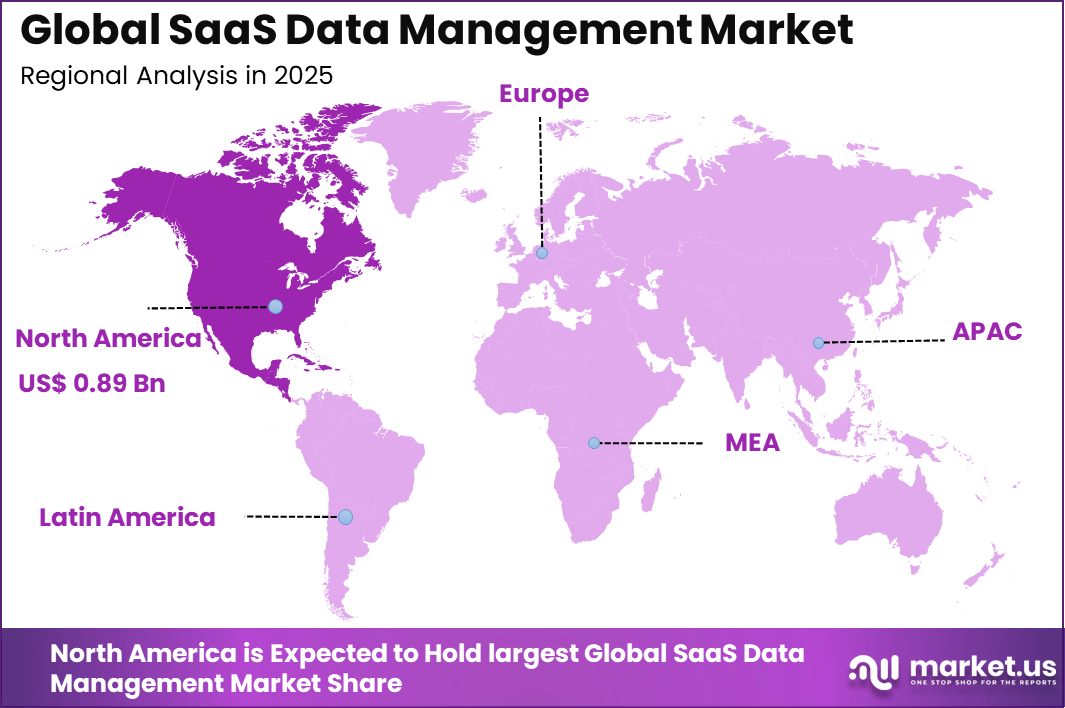

The Global SaaS Data Management Market size is expected to be worth around USD 38.96 billion by 2035, from USD 2.52 billion in 2025, growing at a CAGR of 31.5% during the forecast period from 2025 to 2035. North America held a dominant market position, capturing more than a 35.63% share, holding USD 0.89 billion in revenue.

The SaaS data management market refers to cloud delivered platforms and services that help organisations collect, store, organise, and govern their data assets through software delivered as a service. These solutions enable centralised control of data without the need for extensive on-premises infrastructure, making them accessible to organisations of varying size and maturity. The market includes tools for data integration, cleansing, quality control, and governance that are hosted and managed by third party providers.

Adoption of SaaS based data management supports broader enterprise initiatives to improve data accessibility, reduce operational complexity, and enhance decision making. SaaS data management platforms are designed to be scalable and flexible, allowing organisations to adjust capacity in line with evolving business needs. These solutions often provide subscription based pricing and regular updates, which reduces the need for in-house maintenance and system upgrades.

SaaS data management platforms are designed to be scalable and flexible, allowing organisations to adjust capacity in line with evolving business needs. These solutions often provide subscription based pricing and regular updates, which reduces the need for in-house maintenance and system upgrades. The shift to cloud centric operations has accelerated interest in SaaS based approaches as firms seek to minimise capital expenditure while maximising data utility.

According to Zylo, organizations spend an average of $55.7 million each year on SaaS applications, reflecting the scale at which software subscriptions now operate within enterprises. On average, companies manage around 305 SaaS applications, indicating a broad and complex digital ecosystem. The total number of applications declined marginally by 0.07% year over year, suggesting that portfolio expansion has stabilized rather than continuing to grow unchecked.

Despite relatively flat application counts, overall SaaS spending rose by 8% year over year, highlighting cost escalation across existing tools and contracts. Budget pressure is becoming more visible, as 61% of organizations reported that they were forced to reduce projects or delay initiatives due to unexpected SaaS cost increases. At the same time, investment patterns are shifting, with spending on AI-native SaaS applications surging by 108% year over year, signaling a strong pivot toward intelligent, automation-driven software platforms.

Key Takeaway

- In 2025, the Software and Solutions segment accounted for 84.6% of the Global SaaS Data Management Market, reflecting strong demand for integrated data governance, backup, and analytics platforms.

- The Software-as-a-Service model captured 62.3% share, supported by rising preference for subscription-based delivery and lower upfront infrastructure requirements.

- The Public Cloud segment held 58.7% share, driven by scalable storage, flexible deployment, and cost-efficient data processing capabilities.

- Large Enterprises represented 67.4% of the market, as they manage complex data environments and require advanced compliance and security frameworks.

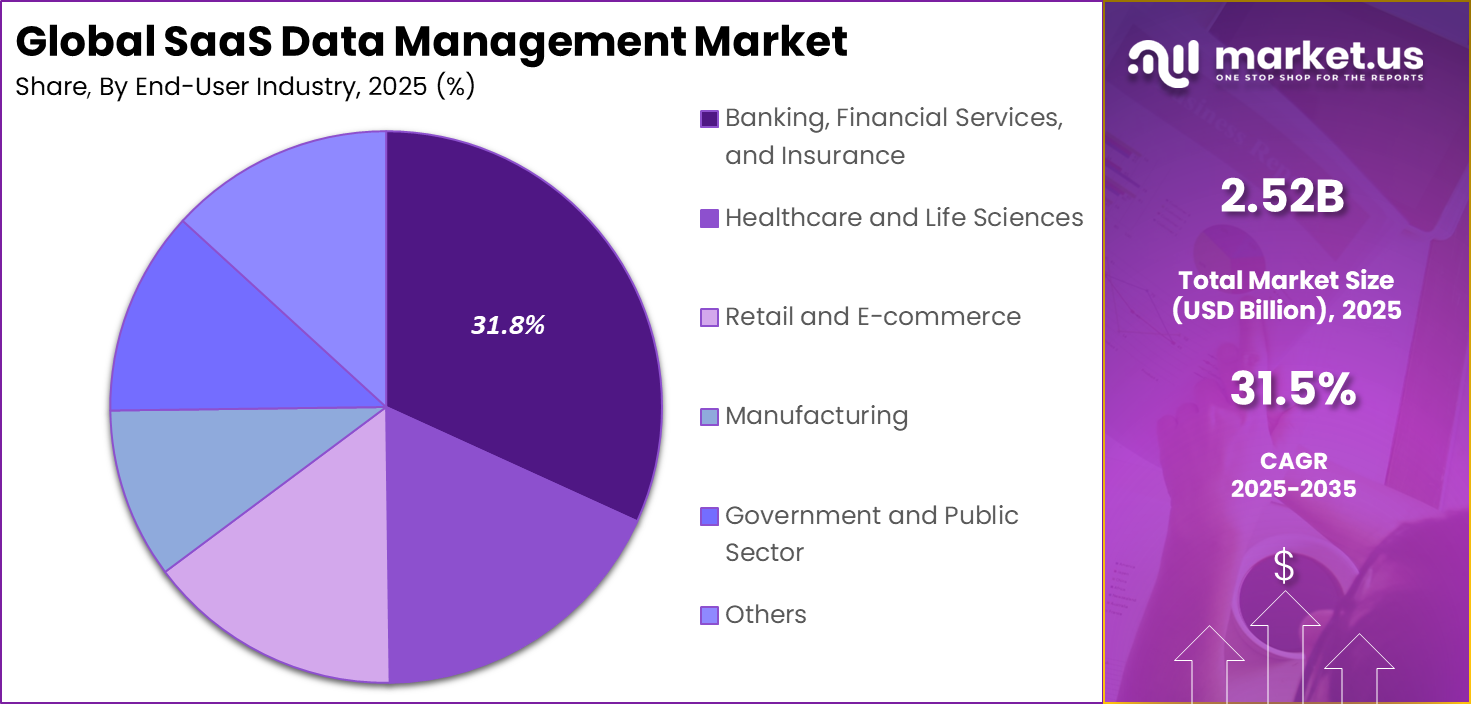

- The Banking, Financial Services, and Insurance sector accounted for 31.8%, supported by regulatory mandates, risk management needs, and real-time data analytics adoption.

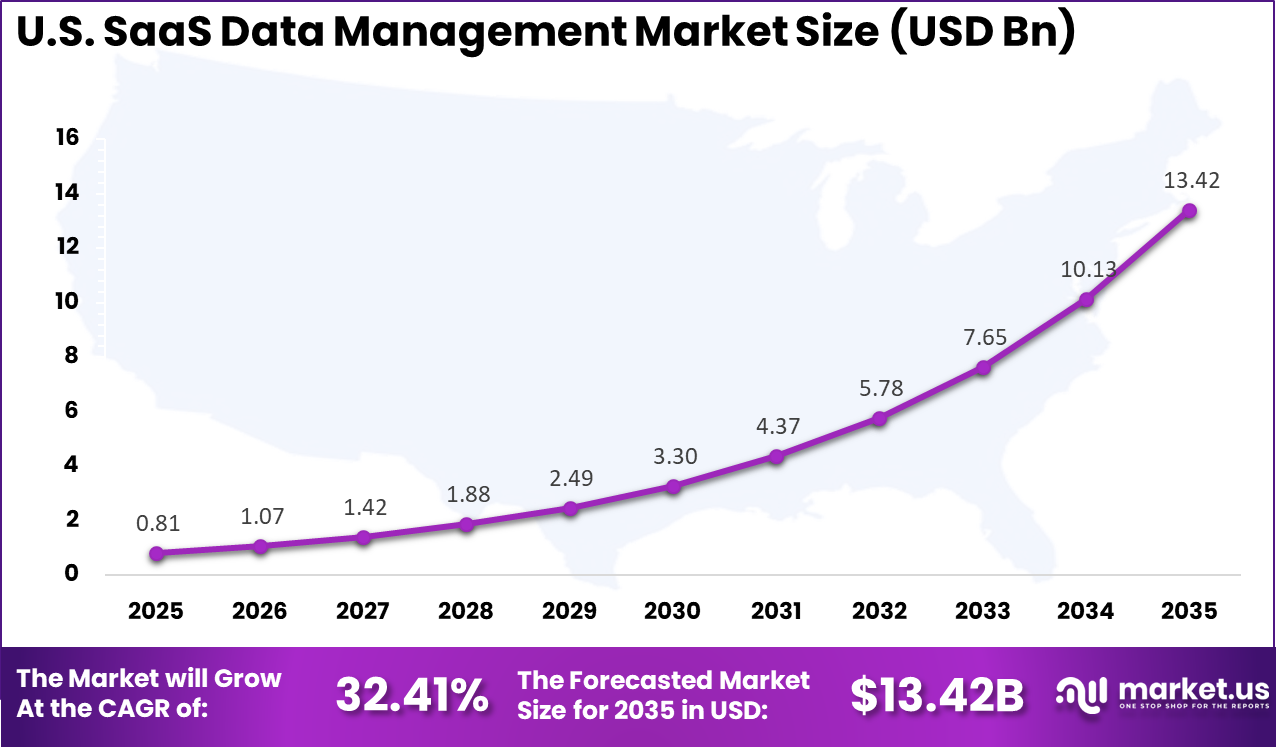

- The U.S. SaaS Data Management Market was valued at USD 0.81 billion in 2025, expanding at a CAGR of 32.41%, reflecting accelerated cloud modernization across enterprises.

- North America maintained a leading position with over 35.63% of the global market share in 2025, supported by advanced digital infrastructure and early adoption of cloud-based data solutions.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rapid enterprise migration to cloud-native SaaS environments +8.1% North America, Europe Short to medium term Increasing volume and complexity of structured and unstructured data +7.0% Global Medium term Rising demand for centralized governance across distributed SaaS applications +6.2% North America, Europe Medium term Expansion of AI and analytics workloads requiring clean data pipelines +5.4% Global Medium term Regulatory compliance and data residency requirements +4.8% Europe, North America Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Integration challenges across multi-cloud SaaS ecosystems -4.9% Global Short to medium term High migration and data transformation costs -4.2% Emerging Markets Medium term Data security and privacy concerns in shared cloud environments -3.6% Europe, North America Medium term Limited skilled workforce in cloud data architecture -3.0% Global Medium term Vendor lock-in risks and platform dependency -2.6% Global Medium to long term By Component: Software/Solutions

Software and solutions account for 84.6% of the SaaS data management market, reflecting the core role of centralized platforms in handling structured and unstructured enterprise data. Organizations increasingly depend on integrated tools that provide data storage, governance, integration, and analytics within a single environment. These solutions enable automation of data workflows and reduce reliance on manual data handling processes.

Strong emphasis is placed on data visibility, compliance monitoring, and lifecycle management. As enterprises expand digital operations, comprehensive software platforms remain essential. Modern SaaS data management solutions also support real-time synchronization across distributed applications. Features such as metadata management, access control, and encryption strengthen security frameworks.

Automation capabilities reduce operational complexity and improve system reliability. Integration with analytics and reporting tools enhances strategic decision making. The scalability and flexibility of software solutions explain their significant share within the market.

For Instance, in February 2026, Snowflake Inc. launched PostgreSQL database-as-a-service in its AI Data Cloud. This move bolsters software capabilities for SaaS data management by blending transactional workloads with analytics in one spot. It helps enterprises handle live data alongside AI insights seamlessly, fueling growth in unified software solutions that simplify complex environments.

By Service Type: Software-as-a-Service

Software-as-a-Service represents 62.3% of the service segment, driven by demand for subscription-based and cloud-delivered platforms. Organizations prefer SaaS models due to lower upfront investment and simplified maintenance requirements. Continuous updates and centralized management improve operational efficiency. SaaS delivery allows enterprises to scale usage according to business growth. This model supports agility in fast-changing digital environments.

SaaS-based data management also reduces infrastructure burdens on internal IT teams. Service providers handle system upgrades, security patches, and performance optimization. This ensures consistent service availability and regulatory compliance. Businesses benefit from predictable pricing structures and faster deployment timelines. As digital transformation initiatives accelerate, SaaS remains the preferred service model.

For instance, in November 2025, SAP SE and Snowflake Inc. partnered on the SAP Snowflake solution extension for Business Data Cloud. This SaaS collaboration enables zero-copy data sharing, powering AI apps with rich business context. It accelerates innovation for users needing scalable, governed SaaS services to unify enterprise data without hassle.

By Deployment Mode: Public Cloud

Public cloud deployment accounts for 58.7% of the SaaS data management market. Organizations leverage public cloud infrastructure for its scalability, cost efficiency, and global accessibility. Public cloud environments enable centralized data storage across multiple geographic regions. This supports collaborative operations and real-time data sharing.

Cloud-based data management also enhances system resilience and disaster recovery capabilities. Public cloud platforms provide advanced security protocols and compliance certifications. Automated scaling ensures performance consistency during peak workloads.

Integration with analytics and artificial intelligence services further strengthens enterprise capabilities. The flexibility of public cloud infrastructure aligns with modern data-intensive business models. These operational advantages continue to drive strong adoption within this deployment segment.

For Instance, in March 2025, Google LLC extended Datastream for Salesforce Data Cloud extraction to BigQuery. This CDC service captures changes from Salesforce into public cloud destinations effortlessly. It simplifies merging SaaS data with operational sources, making public cloud deployments ideal for analytics and AI without integration pains.

By Organization Size: Large Enterprises

Large enterprises hold 67.4% of total market share in SaaS data management. These organizations manage complex data ecosystems across departments and regions. Centralized SaaS platforms help standardize governance policies and maintain consistent data quality. Enterprise-level adoption is supported by high data volumes and regulatory requirements.

Effective data oversight strengthens operational transparency and reporting accuracy. Large enterprises also require advanced analytics and real-time insights to support strategic planning. SaaS data management platforms provide scalable infrastructure for handling high transaction volumes.

Automation reduces system complexity and improves efficiency across global operations. Integration with enterprise resource planning and customer relationship management systems enhances performance visibility. The scale and technical maturity of large enterprises explain their dominant position.

For Instance, in September 2025, Workday, Inc. introduced Workday Data Cloud with zero-copy partnerships like Snowflake and Salesforce. Tailored for large firms, it unifies HR and finance data for AI insights without exports. Enterprises benefit from governed access in familiar tools, streamlining big-scale operations.

By End-User Industry: BFSI

The Banking, Financial Services, and Insurance sector represents 31.8% of the market. Financial institutions manage sensitive and high-frequency transactional data that require secure storage and continuous monitoring. SaaS data management platforms ensure encryption, access control, and audit readiness.

These capabilities support compliance with strict regulatory frameworks. Real-time data processing strengthens fraud detection and risk management systems. Financial institutions also rely on data analytics for customer insights and product development. Centralized SaaS solutions enable seamless integration across digital banking platforms and payment systems.

Automated governance tools reduce operational risk and enhance transparency. Strong regulatory oversight continues to drive investment in secure and scalable data management platforms. The sector’s reliance on accurate and secure data supports its significant market share.

For Instance, in June 2025, Datadog, Inc. launched compliance-focused log retention for regulated industries like BFSI. Features like Archive Search help manage SaaS data securely with residency controls. BFSI firms optimize costs while meeting audit needs, spurring public cloud log management growth.

Regional Overview: North America

North America accounts for 35.63% of the global SaaS data management market. The region benefits from advanced cloud infrastructure and strong enterprise digital transformation initiatives. Organizations prioritize scalable data platforms to support analytics, artificial intelligence, and regulatory compliance. Continuous modernization of IT systems strengthens regional adoption rates.

Investment in secure and cloud-native technologies remains steady. For instance, in January 2026, Amazon Web Services expanded its dominance with Amazon DataZone updates, providing centralized data cataloging and automated access controls that streamline governance for multi-cloud SaaS deployments across North American enterprises.

The United States leads regional growth with a market value of USD 0.81 Bn and a CAGR of 32.41%. Enterprises across financial services, healthcare, retail, and technology sectors are accelerating SaaS adoption. Strong focus on data governance and cybersecurity further drives demand. Rapid innovation in cloud services supports sustained expansion. North America continues to represent a key region for SaaS data management advancement.

For instance, in February 2026, Microsoft Corporation enhanced U.S. dominance in SaaS data management by announcing expanded Fabric capabilities with advanced AI-driven data governance and real-time analytics across its Azure ecosystem, serving enterprise clients globally from Redmond, Washington.

Emerging Trend Analysis

A prominent emerging trend in the SaaS data management market is the integration of artificial intelligence and machine learning capabilities into core data functions to enhance automation, predictive insights, and operational efficiency.

Solutions are increasingly embedding intelligent analytics to support real-time data processing, anomaly detection, automated governance enforcement, and predictive trend analysis, which improves responsiveness to changing business conditions.

This trend is advancing the value proposition of SaaS data management by enabling deeper insights and reducing reliance on manual intervention for data quality and compliance tasks. Enhanced AI-driven features are reshaping expectations for how data is managed, accessed, and leveraged across enterprise workflows.

In addition, workflow-centric design is gaining traction, with vendors shifting focus from feature-heavy offerings to solutions that align more closely with how teams actually operate within business processes. Enterprises increasingly prioritize SaaS platforms that streamline data management tasks within established workflows rather than requiring extensive reconfiguration or specialized training.

Opportunity Analysis

A key opportunity in the SaaS data management market lies in leveraging enhanced real-time analytics and data visualization capabilities that support decision-making and operational optimization. By transforming raw data into actionable insights, SaaS platforms can accelerate strategic initiatives such as customer segmentation, churn analysis, and performance benchmarking.

These analytics features also support predictive modeling and trend forecasting, enabling organizations to anticipate future outcomes and proactively adjust operations. Growing demand for data-driven decision support presents a substantial opportunity for vendors to expand offerings that integrate advanced analytics within SaaS frameworks.

Moreover, expanding SaaS adoption across emerging markets and industry verticals presents further growth potential. Businesses in sectors such as healthcare, finance, retail, and logistics are increasingly embracing cloud-based data solutions to modernize operations, improve scalability, and enhance competitive positioning. Tailored SaaS data management solutions that address industry-specific regulatory requirements, scalability needs, and analytics demands can unlock new customer segments.

Challenge Analysis

A significant challenge in the SaaS data management market is maintaining performance and scalability while managing growing volumes of diverse data types. As enterprises accumulate larger datasets from multiple sources, ensuring responsive performance for ingestion, storage, processing, and querying can strain SaaS infrastructures.

Organizations must balance resource allocation for optimal performance without disproportionately inflating operational costs. Effective scalability strategies remain a fundamental technical and financial challenge. Another persistent challenge involves the shortage of skilled professionals capable of designing, integrating, and managing advanced SaaS data environments.

Expertise in cloud architecture, data governance, and cybersecurity is critical for successful deployment and ongoing optimization, yet such skills are in high demand and limited supply. This talent gap can delay project timelines, increase dependency on external consultants, and elevate total cost of ownership. Bridging this skills deficit is essential for enterprises seeking to fully realize the strategic value of SaaS data management investments.

Key Market Segments

By Component

- Software/Solutions

- Services

By Service Type

- Software-as-a-Service

- Platform-as-a-Service

- Infrastructure-as-a-Service

By Deployment Mode

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By End-User Industry

- Banking, Financial Services, and Insurance

- Healthcare and Life Sciences

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

- Others

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Global cloud and platform providers such as Microsoft Corporation, Amazon Web Services, Inc., Google LLC, and Alibaba Cloud dominate the SaaS data management market. Their platforms offer scalable storage, integration, and analytics tools delivered through subscription models. Strong ecosystem integration and global infrastructure support enterprise adoption. Demand is driven by rapid digital transformation and multi-cloud deployment strategies.

Enterprise application and database vendors such as Oracle Corporation, SAP SE, Salesforce, Inc., Adobe Inc., Workday, Inc., and ServiceNow, Inc. integrate SaaS-based data management within business applications. Snowflake Inc. strengthens data warehousing and sharing capabilities. These vendors benefit from strong enterprise customer bases and API-driven architectures.

Observability and storage-focused providers such as Datadog, Inc., NetApp Inc., IBM Corporation, and ZoomInfo Technologies Inc. expand advanced monitoring, governance, and enrichment capabilities. These players emphasize automation, compliance, and performance optimization. Other vendors enhance competition and innovation, supporting sustained growth in SaaS data management solutions globally.

Top Key Players in the Market

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- Salesforce, Inc.

- Oracle Corporation

- SAP SE

- Adobe Inc.

- IBM Corporation

- Snowflake Inc.

- Datadog, Inc.

- Alibaba Cloud

- Workday, Inc.

- ServiceNow, Inc.

- ZoomInfo Technologies Inc.

- NetApp Inc.

- Others

Recent Developments

- In December 2025, Snowflake launched Polaris Catalog, an open-source Apache Iceberg catalog that boosts interoperability with AWS, Google Cloud, Azure, and Salesforce. This reinforces Snowflake’s role in SaaS data sharing, giving organizations flexible control over enterprise data without vendor lock-in.

- In August 2025, ServiceNow partnered with Datadog to embed real-time observability into its ITOM platform, automating incident workflows across SaaS environments. The combo tackles alert fatigue while improving uptime through AI-driven prioritization.

Report Scope

Report Features Description Market Value (2025) USD 2.5 Bn Forecast Revenue (2035) USD 38.9 Bn CAGR(2026-2035) 31.5% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Service Type (Software-as-a-Service, Platform-as-a-Service, Infrastructure-as-a-Service), By Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare and Life Sciences, Retail and E-commerce, Manufacturing, Government and Public Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Microsoft Corporation, Amazon Web Services, Inc., Google LLC, Salesforce, Inc., Oracle Corporation, SAP SE, Adobe Inc., IBM Corporation, Snowflake Inc., Datadog, Inc., Alibaba Cloud, Workday, Inc., ServiceNow, Inc., ZoomInfo Technologies Inc., NetApp Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  SaaS Data Management MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

SaaS Data Management MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Microsoft Corporation

- Amazon Web Services, Inc.

- Google LLC

- Salesforce, Inc.

- Oracle Corporation

- SAP SE

- Adobe Inc.

- IBM Corporation

- Snowflake Inc.

- Datadog, Inc.

- Alibaba Cloud

- Workday, Inc.

- ServiceNow, Inc.

- ZoomInfo Technologies Inc.

- NetApp Inc.

- Others