Global Rx-to-OTC Switches Market By Product Type (Internal use drugs, External use drugs) By Therapeutic Area (Allergy, Pain, Gastrointestinal, Dermatological) By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Food, Drug & Mass Merchandisers (FDMMs), Convenience stores) Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Nov 2025

- Report ID: 165984

- Number of Pages: 220

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

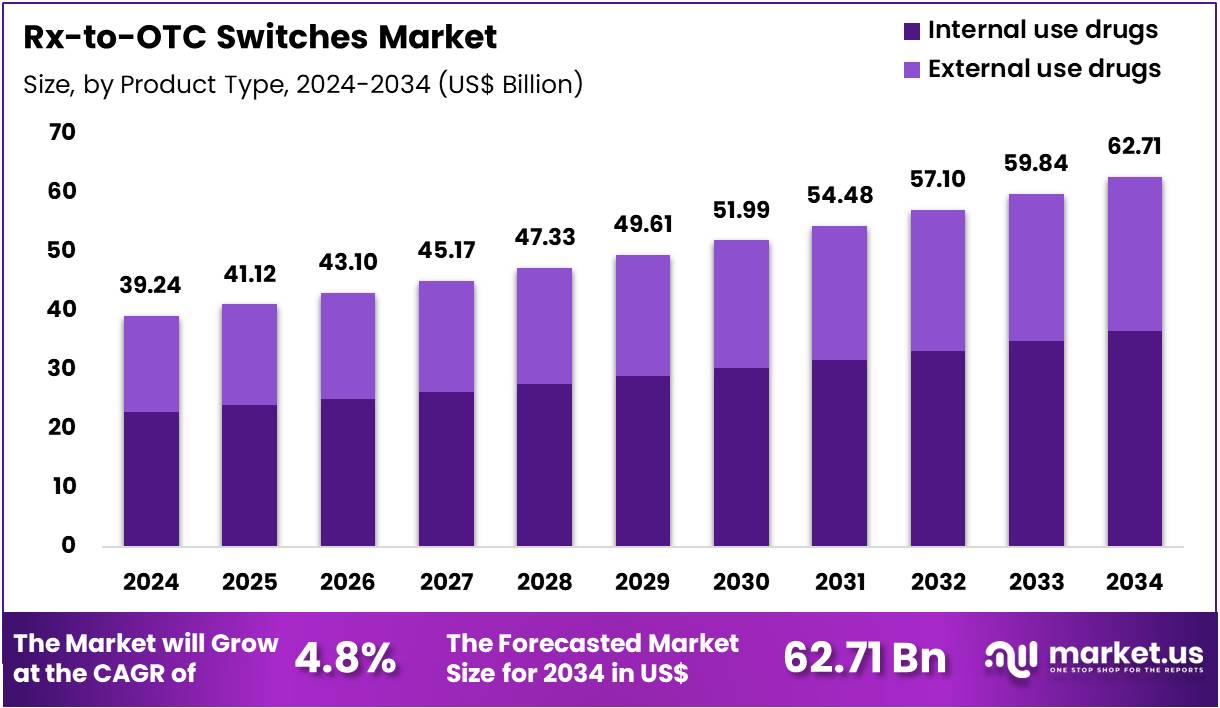

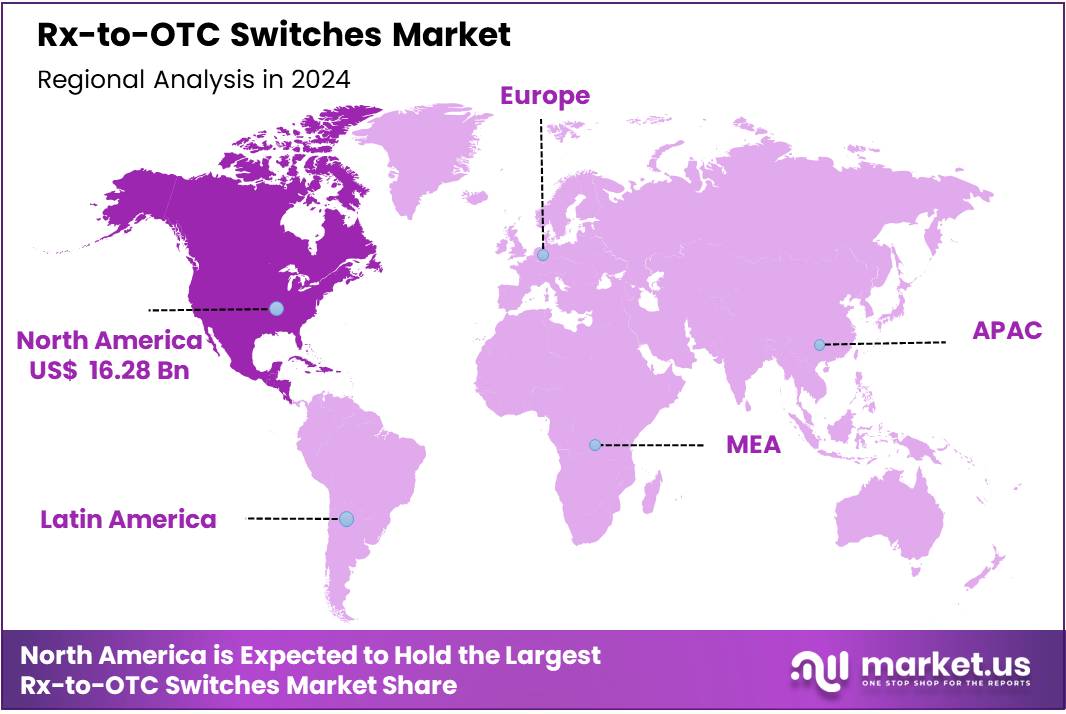

Global Rx-to-OTC Switches Market size is expected to be worth around US$ 62.71 Billion by 2034 from US$ 39.24 Billion in 2024, growing at a CAGR of 4.8% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 41.5% share with a revenue of US$ 16.28 Billion.

The Rx-to-OTC switches market is experiencing steady expansion as global health systems encourage wider use of self-care and non-prescription medicines. This shift is being supported by strong policy initiatives from organizations such as the World Health Organization (WHO), which identifies self-care as an essential component of universal health coverage. These policy directions have encouraged governments to integrate responsible self-medication into national health strategies. As a result, the environment for transitioning suitable prescription medicines to OTC status has become more favorable.

Rising consumer interest in self-care is playing a central role in this growth. Increased health literacy, easy access to digital health information, and a preference for convenient treatment options are motivating people to manage common, self-diagnosable conditions independently. Global medical associations support the safe use of registered OTC products, reinforcing trust in non-prescription medicines. This growing acceptance strengthens the case for more prescription medicines to be switched to OTC status.

Regulatory developments also contribute significantly to market expansion. In the United States, the Food and Drug Administration (FDA) has updated and modernized its non-prescription drug framework, including the introduction of the Additional Conditions for Nonprescription Use (ACNU) pathway. This pathway allows for the switch of more complex drugs when supported by digital tools or other measures that guide safe self-selection. European regulators, including the European Medicines Agency and national authorities, have also issued clearer guidelines for switch procedures. These improvements reduce regulatory uncertainty and encourage pharmaceutical companies to invest in switch applications.

Growing pressure on health systems provides another strong incentive for these transitions. Self-care and OTC medicines help reduce the burden on healthcare facilities by shifting the management of minor ailments away from clinics. This leads to better use of healthcare resources and lower treatment costs, especially in regions with limited clinical capacity. Pharmacists also play a key role by guiding patients in selecting suitable OTC products, which further enhances the safety and effectiveness of self-medication practices.

Additional momentum comes from digital innovation and real-world evidence. Digital tools support patient education and responsible use, while real-world data helps regulators assess safety and effectiveness during the switch process. Demographic factors, including ageing populations and increasing prevalence of lifestyle-related conditions, also align with greater use of OTC products.

Commercial strategies by pharmaceutical companies further strengthen market growth, as firms seek to extend product life cycles and build strong consumer health brands. Emerging markets in Asia and Latin America are also contributing to expansion due to rising incomes and evolving regulatory frameworks. Taken together, these factors support sustained growth in the Rx-to-OTC switches market and a positive outlook for future developments.

Key Takeaways

- Market Size: Global Rx-to-OTC Switches Market size is expected to be worth around US$ 62.71 Billion by 2034 from US$ 39.24 Billion in 2024.

- Market Growth: The market growing at a CAGR of 4.8% during the forecast period from 2025 to 2034.

- Product Type Analysis: Internal-use drugs accounted for an estimated 58.3% share of the global market in 2024

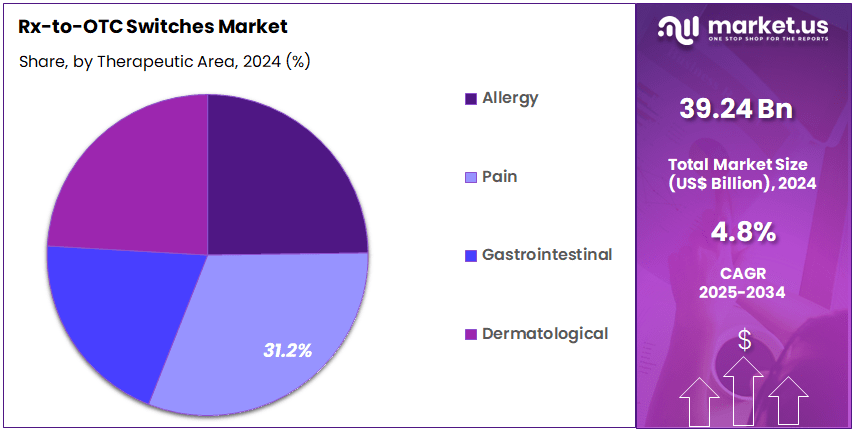

- Therapeutic Area Analysis: Pain management products constituted the dominant segment, accounting for an estimated 31.2% market share in 2024.

- Distribution Channel Analysis: Retail pharmacies and drug stores accounted for 34.1% of the global market share in 2024.

- Regional Analysis: In 2024, North America led the market, achieving over 41.5% share with a revenue of US$ 16.28 Billion.

Product Type Analysis

The market has been segmented by product type into internal-use drugs and external-use drugs. Internal-use drugs accounted for an estimated 58.3% share of the global market in 2024, and this dominance can be attributed to the broader therapeutic coverage and higher consumer demand for self-managed treatment options.

The shift of widely used medications such as antihistamines, gastrointestinal agents, analgesics, and smoking-cessation products from prescription status to OTC has contributed to stronger uptake. The expansion of self-care practices and growing patient preference for oral dosage forms have further reinforced the position of internal-use drugs. Strong regulatory support for switching high-volume prescription categories continues to enhance market penetration.

External-use drugs constituted the remaining share of the market in 2024. Their adoption has been supported by increasing demand for topical analgesics, dermatological preparations, and wound-care formulations. These products have benefited from the rising incidence of minor injuries, skin conditions, and musculoskeletal disorders that can be managed without physician consultation.

Growth in this segment has also been driven by the introduction of improved formulations, including fast-acting gels and sprays, which enhance user convenience. Although smaller in comparison, the external-use segment is expected to register steady expansion as consumer awareness of preventive and symptomatic care increases globally.

Therapeutic Area Analysis

The therapeutic area segmentation of the Rx-to-OTC switches market is defined by strong consumer demand, favorable regulatory pathways, and increasing awareness of self-care solutions. Pain management products constituted the dominant segment, accounting for an estimated 31.2% market share in 2024. This leadership position has been supported by the high prevalence of acute and chronic pain conditions and the consistent reclassification of analgesics to over-the-counter status. Expanded accessibility and broad clinical acceptance further strengthened this segment’s performance.

The allergy segment exhibited steady expansion, driven by the increasing incidence of allergic rhinitis and environmental sensitivities. The availability of antihistamines and nasal corticosteroids in OTC formats supported wider adoption and improved consumer convenience. Gastrointestinal (GI) products formed another key segment, with growth supported by rising cases of acid reflux, indigestion, and lifestyle-related digestive disorders. Switches of proton pump inhibitors and H2 blockers contributed significantly to category penetration.

Dermatological products showed sustained demand, particularly for anti-fungal, acne, and corticosteroid-based treatments. The transition of multiple topical therapies to OTC status increased accessibility for routine skin conditions and supported segment growth. Overall, therapeutic diversification continued to enhance market penetration, reinforcing the shift toward patient-driven self-medication practices.

Distribution Channel Analysis

The distribution landscape of the Rx-to-OTC switches market has been shaped by strong reliance on established pharmaceutical retail networks and expanding access through diversified channels. Retail pharmacies and drug stores accounted for 34.1% of the global market share in 2024, and their dominance has been supported by broad product availability, strong consumer trust, and the presence of trained pharmacists who guide purchasing decisions. This segment has continued to benefit from high footfall, particularly for self-medication categories such as analgesics, antihistamines, and gastrointestinal products.

Hospital pharmacies have maintained a stable position due to their controlled environments and structured dispensing practices. Their role has been reinforced by the growing shift of chronic prescription users toward OTC alternatives, where professional oversight is preferred. Online pharmacies have experienced rapid expansion as digital purchasing behavior strengthened, driven by convenience, price transparency, and home delivery services.

Food, Drug & Mass Merchandisers (FDMMs) have further contributed to market penetration by offering OTC products at competitive prices and integrating them into routine household shopping. Convenience stores have supported incremental growth by enabling quick, proximity-based access to essential OTC medicines, particularly in urban and transit-focused areas.

Key Market Segments

By Product Type

- Internal use drugs

- External use drugs

By Therapeutic Area

- Allergy

- Pain

- Gastrointestinal

- Dermatological

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Food, Drug & Mass Merchandisers (FDMMs)

- Convenience stores

- Retail Pharmacies/Drug Stores

Drivers

Consumer self-care and healthcare cost containment

The shift of medications from prescription (Rx) status to over-the-counter (OTC) status is driven significantly by the growing consumer demand for self-care and the need of healthcare systems to reduce costs. For example, OTC medicines allow consumers to treat common minor ailments without a physician visit, thereby reducing burden on healthcare providers and lowering system expenditures.Further, regulatory bodies acknowledge that for certain conditions the prescription status is “not necessary for the protection of the public health” if safety and efficacy are demonstrated in a self-treatment setting. Consequently, pharmaceutical companies are motivated to re-classify suitable Rx products to OTC in order to tap into self-medication markets, extend product life-cycle, and respond to payer and health system pressures for affordable care delivery.

Trends

Technological and regulatory enablers of next-generation switches

A notable trend in the Rx-to-OTC switch market is the increasing role of digital health, real-world evidence (RWE), and streamlined regulatory frameworks facilitating smoother transitions. Industry commentary points out that switches are now supported by data from consumer behaviour, self-selection studies, label-comprehension studies, and e-health tools.For instance, developments in self-diagnosis aids, smart packaging or digital guidance may help meet regulatory expectations for OTC usage safety. This evolution reflects the shift from simple Rx to OTC switches into “next-generation” switches where consumer behaviour, digital platforms and evidence-generation combine to accelerate adoption.

Restraints

Stringent regulatory and evidence demands

Although potential is significant, the Rx-to-OTC switch market is restrained by the high regulatory burden and the complexity of demonstrating safe consumer self-use. Regulatory agencies such as the U.S. Food & Drug Administration (FDA) require data packages that include not only efficacy and safety but also self-selection and label-comprehension studies to ensure that consumers can appropriately use the product without professional supervision.Moreover, the lack of harmonised regulatory frameworks across geographies increases cost and risk for pharmaceutical companies seeking global rollouts. As one review noted, the number of truly innovative switches (new to OTC active ingredient, new indication) remains quite low, signalling the difficulty of achieving substantial category breakthroughs.

Opportunities

Emerging markets and unmet needs for self-treatment

An important opportunity in the Rx-to-OTC switch space lies in emerging markets and in therapeutic categories where self-treatable conditions are under-served. For instance, in markets like India, self-care and OTC usage are increasingly recognised as means to reduce out-of-pocket expenditure and ease burdens on health infrastructure.Also, as demographics age and chronic conditions increase globally, consumers seek more manageable treatment options for minor or recurring conditions (e.g., allergies, heartburn, migraine) that may be amenable to OTC switches. Firms that can identify eligible Rx products, demonstrate consumer self-selection capabilities, and adapt the switch to local market dynamics stand to gain first-mover advantage in these geographies.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 41.5% share and holds US$ 16.28 Billion market value for the year. This leadership can be attributed to a mature healthcare system, strong consumer awareness, and favorable regulatory pathways.

The regional growth has been driven by a clear shift toward self-care. Consumers have shown a rising preference for convenient and cost-effective treatment options. This trend has supported the conversion of prescription drugs to over-the-counter status. Strong retail pharmacy networks have also played a key role. These channels have ensured widespread availability of OTC products across urban and rural areas.

Regulatory support has been another major factor. The presence of structured evaluation frameworks has enabled faster approvals for switches when safety and efficacy standards are met. This environment has encouraged manufacturers to introduce more non-prescription products.

Healthcare expenditure in the region has remained high. As a result, payers and patients have shown interest in reducing treatment costs. OTC alternatives have offered financial relief by lowering consultation visits. This shift has further strengthened market penetration.

Innovation in drug formulations has accelerated the transition rate. Extended-release formats and user-friendly delivery systems have improved consumer acceptance. These innovations have helped maintain the region’s competitive advantage.

Marketing strategies have also been effective. Clear labeling, strong brand recognition, and compliance-focused campaigns have increased consumer confidence. The steady rise in digital health platforms has added momentum. Online pharmacies and e-commerce channels have broadened product reach and supported continuous demand.

Overall, North America’s share has been reinforced by strong consumer trust, efficient regulatory processes, and the availability of advanced OTC products. Continued innovation and rising preference for self-management are expected to sustain the region’s leading position over the forecast period.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The competitive landscape is shaped by participants that maintain broad product portfolios, strong regulatory capabilities, and established distribution networks. Market growth has been supported by firms with robust R&D pipelines and proven success in navigating switch approvals. Strategic investments in consumer-oriented branding, post-marketing safety surveillance, and adherence to evolving regulatory guidelines have strengthened competitive positioning. Entities with advanced packaging, formulation expertise, and digital engagement channels have demonstrated higher adaptability.

Expansion into self-care categories, supported by targeted promotional activities, has further enhanced market reach. Competitors with global supply chain efficiency and consistent product availability have secured stronger market penetration. Long-term demand is expected to be influenced by organizations that integrate real-world evidence, maintain strong relationships with regulatory authorities, and invest in public education to support responsible self-medication, thereby enabling sustained leadership in the Rx-to-OTC switches market.

Market Key Players

- GlaxoSmithKline plc

- Sanofi S.A.

- Johnson & Johnson Services, Inc.

- AstraZeneca plc

- Merck KGaA

- Bayer AG

- Boehringer Ingelheim GmbH

- Bausch & Lomb Holdings Inc.

- Alcon Inc.

- Pfizer Inc.

- Galderma S.A.

- Arbor Pharmaceuticals LLC

- Perrigo Company plc

- Teva Pharmaceutical Industries Ltd.

- Other key players

Recent Developments

- GlaxoSmithKline plc (GSK) December 2018: GSK and Pfizer Inc. announced formation of a global Consumer Healthcare Joint Venture (GSK owns 68 %; Pfizer 32 %) combining their OTC portfolios, aimed at strengthening OTC leadership across pain, respiratory, vitamins and skin-health categories.

- Sanofi January 2025: Sanofi’s partner in ED self-care, Opella Therapeutics, disclosed that the Cialis® (tadalafil) usage trial in the U.S. had been accepted by the Food and Drug Administration (FDA), advancing its potential Rx-to-OTC switch for erectile dysfunction.

- Pfizer Inc. August 2019: Pfizer announced the closing of its JV with GSK to create the world’s largest OTC business (with GSK controlling), reinforcing Pfizer’s strategic shift toward innovative medicines and away from pure OTC, while still participating in the switch/consumer health ecosystem.

Report Scope

Report Features Description Market Value (2024) US$ 39.24 Billion Forecast Revenue (2034) US$ 62.71 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Internal use drugs, External use drugs) By Therapeutic Area (Allergy, Pain, Gastrointestinal, Dermatological) By Distribution Channel (Hospital Pharmacies, Online Pharmacies, Food, Drug & Mass Merchandisers (FDMMs), Convenience stores) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape GlaxoSmithKline plc, Sanofi S.A., Johnson & Johnson Services, Inc., AstraZeneca plc, Merck KGaA, Bayer AG, Boehringer Ingelheim GmbH, Bausch & Lomb Holdings Inc., Alcon Inc., Pfizer Inc., Galderma S.A., Arbor Pharmaceuticals LLC, Perrigo Company plc, Teva Pharmaceutical Industries Ltd., Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- GlaxoSmithKline plc

- Sanofi S.A.

- Johnson & Johnson Services, Inc.

- AstraZeneca plc

- Merck KGaA

- Bayer AG

- Boehringer Ingelheim GmbH

- Bausch & Lomb Holdings Inc.

- Alcon Inc.

- Pfizer Inc.

- Galderma S.A.

- Arbor Pharmaceuticals LLC

- Perrigo Company plc

- Teva Pharmaceutical Industries Ltd.

- Other key players