Global Rosin Resin Market Size, Share, And Industry Analysis Report By Product Type (Rosin Esters, Rosin Acids, Hydrogenated Rosin Resins, Dimerized Rosin Resins, Modified Rosin Resins), By Source (Gum Rosin, Tall Oil Rosin, Wood Rosin), By Application (Adhesives, Paints and Varnishes, Rubbers, Paper Sizing, Printing Inks), By End Use (Packaging, Construction, Automotive, Electronics), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: February 2026

- Report ID: 176951

- Number of Pages: 199

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

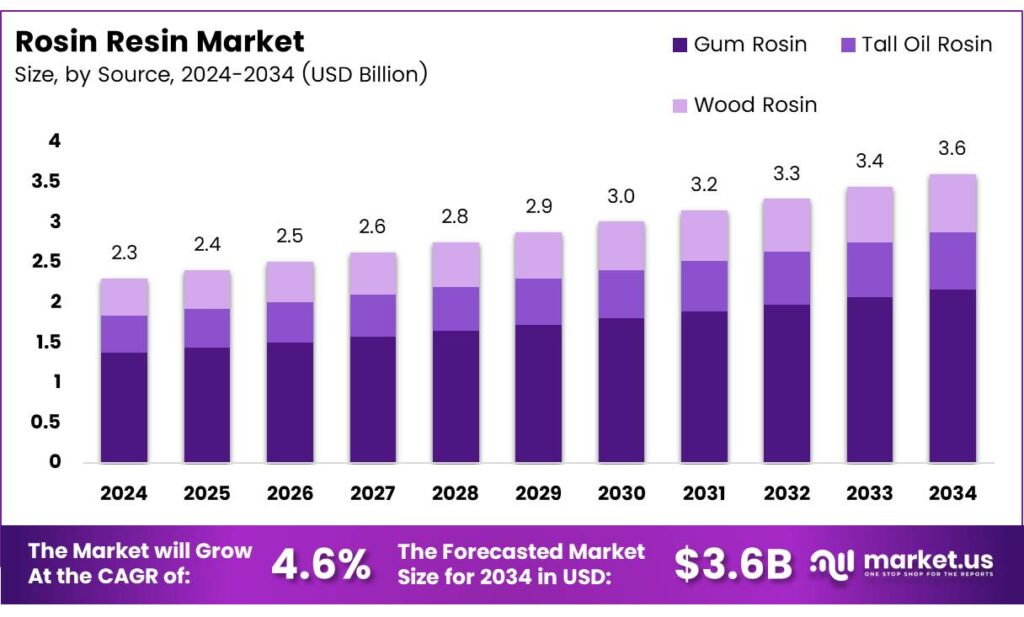

The Global Rosin Resin Market size is expected to be worth around USD 3.6 billion by 2034, from USD 2.3 billion in 2024, growing at a CAGR of 4.6% during the forecast period from 2025 to 2034.

The Rosin Resin Market represents a traditional yet evolving segment of the global chemicals industry, widely used in adhesives, inks, coatings, rubber, and paper applications. The market benefits from rising demand for bio-based tackifiers, as rosin resins provide natural viscosity, strong adhesion, and compatibility with multiple industrial formulations.

The market advances steadily as manufacturers shift toward sustainable sourcing and renewable raw materials. Growing environmental concerns encourage industries to replace petroleum-based resins with bio-origin alternatives. Consequently, rosin resins gain importance across packaging, personal care, and printing sectors, supporting broader green chemistry transitions.

- Global rosin production remains stable at about 1.2 million tons annually, driven mainly by gum rosin at 60% and tall oil rosin at 35%. Wood rosin has become negligible, reflecting a clear shift toward plantation-based sources and pulp-industry by-products. Rosin also maintains strong supply consistency due to its high 95 wt.% resin acid content.

Rosin composition varies widely across pine species, emphasizing diverse sourcing characteristics. Chinese Pinus massoniana typically contains 39% abietic and related diterpene acids, while Brazilian Pinus elliottii features 37% abietic acids with 27% other components. Indonesian Pinus merkusii offers a higher share of 36% other acids, and Russian Pinus sylvestris presents a balanced profile with 35% abietic acid.

Furthermore, global opportunities expand as consumer goods producers adopt eco-friendly adhesives and coating agents. Increasing interest in waterborne formulations, hot-melt applications, and biodegradable bonding solutions boosts rosin resin integration. This shift aligns with tightening regulations that restrict VOC emissions and encourage natural resin adoption in industrial manufacturing.

Key Takeaways

- The Global Rosin Resin Market is projected to reach USD 3.6 billion by 2034, growing from USD 2.3 billion in 2024, at a CAGR of 4.6% during the forecast period 2025–2034.

- Rosin Esters lead the product type segment with a dominant share of 43.8% in 2025.

- Gum Rosin dominates the source segment, accounting for 53.7% of the market in 2025.

- The Adhesives segment holds the highest application share at 39.5% due to rising demand from packaging and construction.

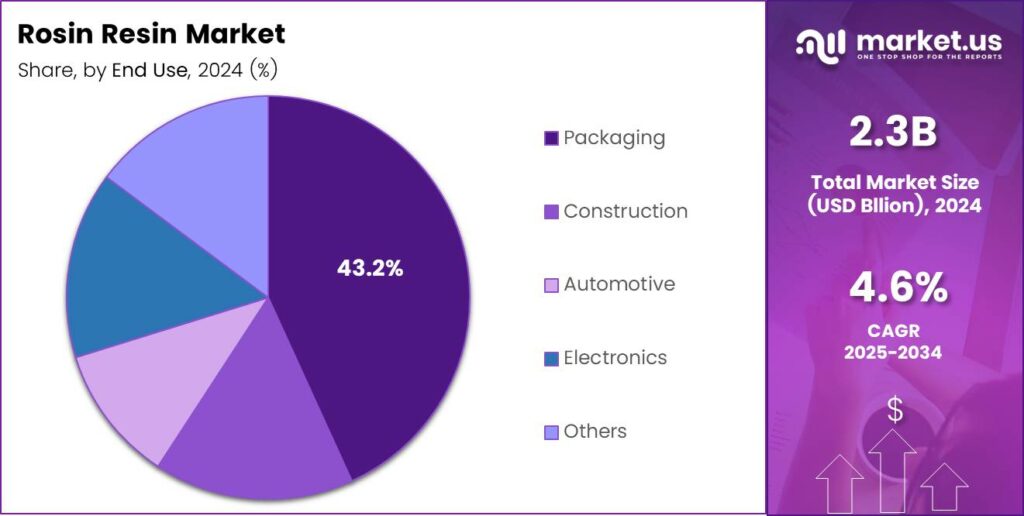

- Packaging remains the leading end-use segment with a significant 43.2% share in 2025.

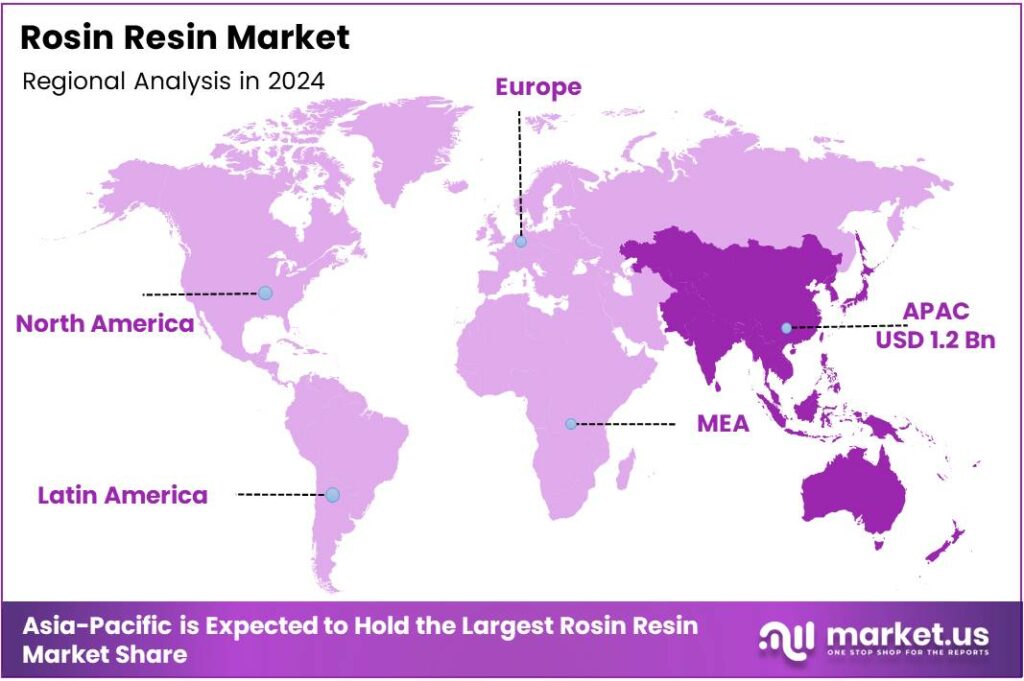

- Asia Pacific dominates the global market with a substantial 51.9% share, valued at approximately USD 1.2 billion.

By Product Type Analysis

Rosin Esters dominate with 43.8% due to their strong demand across adhesives, coatings, and printing applications.

In 2025, Rosin Esters held a dominant market position in the ‘By Product Type’ Analysis segment of the Rosin Resin Market, with a 43.8% share. This segment leads because rosin esters offer excellent tackiness, stability, and compatibility with various polymers. Their widespread use in hot-melt adhesives and inks continues to push growth worldwide.

Rosin Acids remain an essential category due to their functional versatility across paints, rubbers, and emulsifiers. These acids help improve binding and emulsification properties, supporting their adoption in industrial production. Their ability to enhance polymer modification drives ongoing utilization in performance-driven applications.

Hydrogenated Rosin Resins gain traction as industries shift toward materials with better oxidation stability and lighter color. These resins support premium adhesive formulations and pressure-sensitive tapes. Their improved resistance to aging makes them highly suitable for long-term performance requirements across advanced applications.

Dimerized Rosin Resins serve niche applications requiring enhanced flexibility and mechanical stability. Their role in printing inks, coatings, and specialty adhesives continues to expand due to improved flow properties. Industries favor these resins for their stable viscosity characteristics during high-temperature processing stages.

Modified Rosin Resins find growing relevance due to their tailored performance features, including enhanced adhesion, flexibility, and softening points. These customized resins support evolving needs in packaging, construction, and automotive sectors. Their adaptability across formulations ensures steady market penetration.

By Source Analysis

Gum Rosin dominates with 53.7% owing to its natural availability and wide industrial acceptance.

In 2025, Gum Rosin held a dominant market position in the ‘By Source’ Analysis segment of the Rosin Resin Market, with a 53.7% share. This dominance results from abundant raw material availability and cost-effective extraction methods. Its use in adhesives, rubbers, and coatings continues to drive global demand.

Tall Oil Rosin remains an important segment, supported by its by-product nature from the kraft pulping process. It is widely used in inks, papermaking, and coatings due to its stability and sustainability profile. Industries value its favorable processing characteristics and consistent quality.

Wood Rosin contributes to specialty applications requiring specific performance benefits. Extracted through solvent processes, this rosin type supports adhesives, rubber compounds, and electronic materials. Its purity and controlled composition make it suitable for high-precision industrial uses.

By Application Analysis

Adhesives dominate with 39.5%, driven by strong demand in packaging, construction, and industrial bonding solutions.

In 2025, Adhesives held a dominant market position in the ‘By Application’ Analysis segment of the Rosin Resin Market, with a 39.5% share. Rosin’s natural tackiness and bonding capability make it ideal for hot-melt, pressure-sensitive, and solvent-based adhesive formulations across industries.

Paints and Varnishes remain a key segment, benefiting from rosin’s film-forming and gloss-enhancing properties. These materials help improve durability and surface finish in protective coatings. Their role in industrial and architectural applications continues to sustain market relevance.

Rubbers utilize rosin resins as tackifiers to improve elasticity and bonding strength. These additives enhance rubber compounding and processing efficiency. Their essential function in automotive rubber goods and tires supports consistent segment growth.

Paper Sizing applications rely heavily on rosin to improve water resistance and printability. The segment continues benefiting from the expanding packaging and printing industries. Its importance in improving fiber bonding and surface quality remains significant.

Printing Inks incorporate rosin resins to improve adhesion, color intensity, and drying behavior. Their compatibility with solvent-based and oil-based systems supports diverse ink formulations. This segment grows steadily with increasing demand for high-quality print products.

By End Use Analysis

Packaging dominates with 43.2%, supported by rising demand for strong, flexible, and cost-effective adhesive solutions.

In 2025, Packaging held a dominant market position in the ‘By End Use’ Analysis segment of the Rosin Resin Market, with a 43.2% share. This segment thrives due to growing consumption of hot-melt adhesives in boxes, labels, and sealing applications driven by e-commerce expansion.

Construction applications utilize rosin resins in sealants, coatings, and bonding materials. Their contribution to enhancing adhesion and improving material stability supports demand. The rise of infrastructure projects continues to create opportunities for this segment.

Automotive end-users rely on rosin resins for adhesive tapes, coatings, and rubber components. Their ability to improve tack and durability supports their role in vehicle manufacturing. Increasing vehicle production reinforces the relevance of this segment.

Electronics incorporate rosin-based fluxes and bonding materials to ensure clean soldering and reliable connections. Their chemical stability and residue-control characteristics make them essential in circuit assembly processes. Growing consumer electronics output sustains demand.

Key Market Segments

By Product Type

- Rosin Esters

- Rosin Acids

- Hydrogenated Rosin Resins

- Dimerized Rosin Resins

- Modified Rosin Resins

By Source

- Gum Rosin

- Tall Oil Rosin

- Wood Rosin

By Application

- Adhesives

- Paints and Varnishes

- Rubbers

- Paper Sizing

- Printing Inks

- Others

By End Use

- Packaging

- Construction

- Automotive

- Electronics

- Others

Emerging Trends

Growing Popularity of Sustainable and Natural Resin-Based Products

A major trend shaping the Rosin Resin Market is the increasing preference for natural and sustainable chemicals. Consumers and industries are shifting away from petroleum-based materials due to environmental concerns, accelerating demand for pine-derived rosin resins.

- The bioeconomy is being framed as an industrial pathway to replace fossil-based materials at scale, and that direction is reinforced by public funding. The EU’s bioeconomy was described as having a value of €2.7 trillion in 2023 and employing more than 17 million people, which signals how big the bio-based materials agenda has become.

Another strong trend is the development of hydrogenated and polymerized rosin resins, which offer better performance in adhesives, inks, and coatings. These improved variants help companies meet rising requirements for durability, heat resistance, and long-term stability.

Drivers

Growing Demand for Adhesives and Coatings Accelerates Market Expansion

The Rosin Resin Market is witnessing steady growth as industries increasingly rely on adhesives for packaging, construction, and automotive applications. Rosin resins offer strong bonding and flexibility, making them useful across multiple sectors. The rising consumption of hot-melt adhesives, especially in e-commerce packaging, is boosting market demand.

- In the world, paper production was reported at 401 million tonnes, and global trade in wood and paper products included paper trade at about 104 million tonnes. In the United States, 64,897 wildfires were reported in 2024, and reported fires consumed 8,924,884 acres compared with 2,693,910 acres.

Additionally, the coatings industry uses rosin resin for improving gloss, durability, and surface protection. As manufacturing activity grows in developing economies, the need for performance-enhancing resins continues to rise. Many companies now prefer rosin-based materials because they come from natural pine trees, making them safer and more environmentally friendly.

Restraints

Price Volatility of Raw Materials Creates Market Limitations

One of the major restraints affecting the Rosin Resin Market is the inconsistent availability of pine resin, the primary raw material. Climatic challenges, deforestation issues, and seasonal variations directly impact production volumes, leading to unstable supply conditions. These fluctuations often cause price increases that affect manufacturers’ profitability.

- Additionally, competition from low-cost synthetic resins slows market growth. Some industries prefer petroleum-based alternatives due to their consistent quality and easier availability. The leading exporters of rosin were listed as China at USD 172M, Portugal at USD 167M, and Brazil at USD 154M.

Quality variations also pose concerns. Since rosin resin is sourced from natural trees, its composition often changes based on species, region, and extraction methods. This leads to inconsistencies in performance for industries that require standardized processing and high-precision materials.

Growth Factors

Rising Shift Toward Bio-Based Products Creates Strong Expansion Opportunities

The global move toward sustainable and bio-based chemicals presents major opportunities for the Rosin Resin Market. With increasing concern about environmental impact, many industries are replacing petroleum-based materials with natural alternatives. Rosin resin, being renewable and biodegradable, fits well into this transition.

Packaging companies, especially those focusing on recyclable and compostable solutions, are expected to drive demand. Rosin-based adhesives and coatings support eco-friendly packaging goals, making them highly attractive in Europe, North America, and emerging Asian markets.

Another major opportunity lies in the booming electric vehicle and electronics industry. Rosin resins are used in soldering fluxes, helping improve electrical connectivity and thermal performance. As electronics manufacturing accelerates, demand for rosin-based fluxes will expand.

Regional Analysis

Asia Pacific Dominates the Rosin Resin Market with a Market Share of 51.9%, Valued at USD 1.2 Billion

Asia Pacific leads the global Rosin Resin Market, holding a significant 51.9% share and generating approximately USD 1.2 billion in value. The region benefits from strong industrial expansion, rising adhesive and rubber production, and increasing consumption across packaging and electronics. Growing manufacturing capabilities and abundant raw material availability further reinforce the Asia Pacific’s dominant position.

North America shows steady growth in the Rosin Resin Market, driven by rising demand in printing inks, adhesives, and road marking applications. The region’s focus on high-performance and low-VOC materials supports consistent consumption. Additionally, technological advancements and robust infrastructure development continue to influence market expansion.

Europe’s market is characterized by sustainability-driven innovations and rising adoption of bio-based resin formulations. Regulatory emphasis on eco-friendly materials promotes wider usage across coatings, adhesives, and paper industries. Stable industrial production and strong R&D initiatives further support Europe’s ongoing market relevance.

Latin America’s Rosin Resin Market benefits from growing demand in automotive, packaging, and paper applications. Economic improvements and expanding manufacturing activities contribute to rising consumption. The region also sees increasing interest in sustainable resin formulations, supporting future market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2025, global rosin resin demand stays closely tied to packaging, labeling, hygiene, and construction activity, because these end uses consume large volumes of hot-melt and pressure-sensitive adhesives. Buyers are also more selective about softening point consistency, odor/color stability, and supply assurance, since adhesive performance is sensitive to batch variation.

Arakawa Chemical Industries is positioned as a specialty-focused supplier that benefits from value-added rosin derivatives where performance matters more than price alone. In 2025, its advantage typically shows in formulation know-how for tackifiers used in demanding adhesive and coating systems, helping customers improve tack and heat resistance.

BaoLin competes through scale and breadth across rosin and rosin-derivative lines, which supports a steady supply to high-throughput adhesive producers. Its role in 2025 is often strongest where buyers prioritize reliable volumes, standardized grades, and pragmatic cost control.

Eastman Chemical Company leverages deep polymers and additives expertise to serve customers looking for tighter specifications and global technical support. In 2025, the company is expected to win in applications requiring consistent performance across regions and strong compliance alignment for multinational brands.

Foreverest Resources is typically viewed as export-oriented and responsive to fast-moving adhesive and rubber compounding demand. In 2025, its growth is commonly supported by flexible sourcing and the ability to serve multiple rosin resin grades for different price-performance targets.

Top Key Players in the Market

- Arakawa Chemical Industries

- BaoLin

- Eastman Chemical Company

- Foreverest Resources

- Guilin Songquan Forest Chemical

- Hindustan Resins and Terpenes

- Harima Chemicals Group

- G.C. RUTTEMAN & Co.

- Lawter

- Resin Chemicals

Recent Developments

- In 2025, Eastman divested its adhesives and resins business, which included rosin-based products like rosins and dispersions, hydrocarbon resins (e.g., Eastman Impera), pure monomer resins, polyolefin polymers, and oleochemical/fatty-acid resins.

- In 2025, Foreverest specializes in bio-based chemicals from pine sources, including rosin resins and turpentine derivatives. Recent promotions and product insights. Introduced AE-Series modified rosin resins for natural preservation coatings and films to extend fruit shelf life and preserve flavor.

Report Scope

Report Features Description Market Value (2024) USD 2.3 Billion Forecast Revenue (2034) USD 3.6 Billion CAGR (2025-2034) 4.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Rosin Esters, Rosin Acids, Hydrogenated Rosin Resins, Dimerized Rosin Resins, Modified Rosin Resins), By Source (Gum Rosin, Tall Oil Rosin, Wood Rosin), By Application (Adhesives, Paints and Varnishes, Rubbers, Paper Sizing, Printing Inks, Others), By End Use (Packaging, Construction, Automotive, Electronics, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Arakawa Chemical Industries, BaoLin, Eastman Chemical Company, Foreverest Resources, Guilin Songquan Forest Chemical, Hindustan Resins and Terpenes, Harima Chemicals Group, G.C. RUTTEMAN & Co., Lawter, Resin Chemicals Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Arakawa Chemical Industries

- BaoLin

- Eastman Chemical Company

- Foreverest Resources

- Guilin Songquan Forest Chemical

- Hindustan Resins and Terpenes

- Harima Chemicals Group

- G.C. RUTTEMAN & Co.

- Lawter

- Resin Chemicals