Global Rocket And Missile Market Size, Share Analysis Report By Product (Missiles (Cruise Missiles, Ballistic Missiles, Interceptor Missiles), Rocket Artilleries, Torpedoes), By Speed (Sub-sonic, Super-sonic, Hyper-sonic), By Launch Mode (Surface to Surface, Surface to Air, Air to Air, Air to Surface), By Guidance Mechanism (Guided, Un-Guided), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: May 2025

- Report ID: 148409

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

- Rockets And Missiles Market Size

- Key Takeaways

- Analysts’ Viewpoint

- US Market Expansion

- North America Growth

- By Product Analysis

- By Speed Analysis

- By Launch Mode Analysis

- By Guidance Mechanism Analysis

- Key Market Segments

- Driver

- Restraint

- Opportunity

- Challenge

- Growth Factors

- Emerging Trends

- Business Benefits

- Key Player Analysis

- Recent Developments

- Report Scope

Rockets And Missiles Market Size

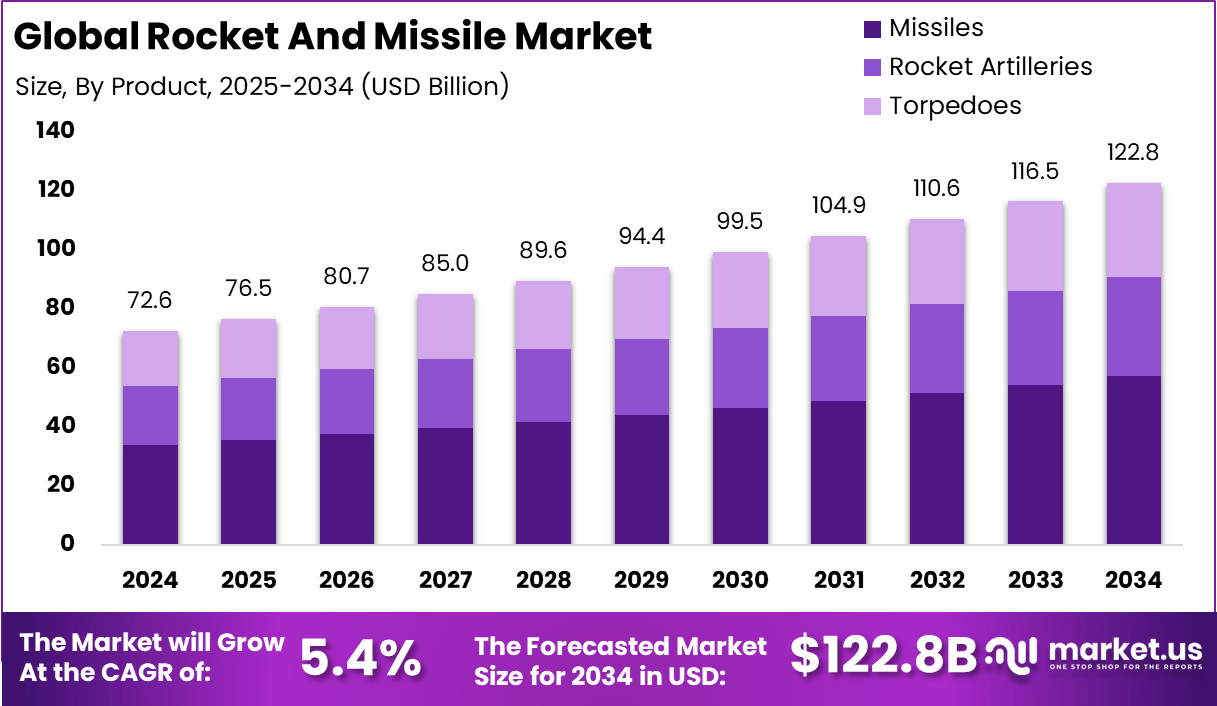

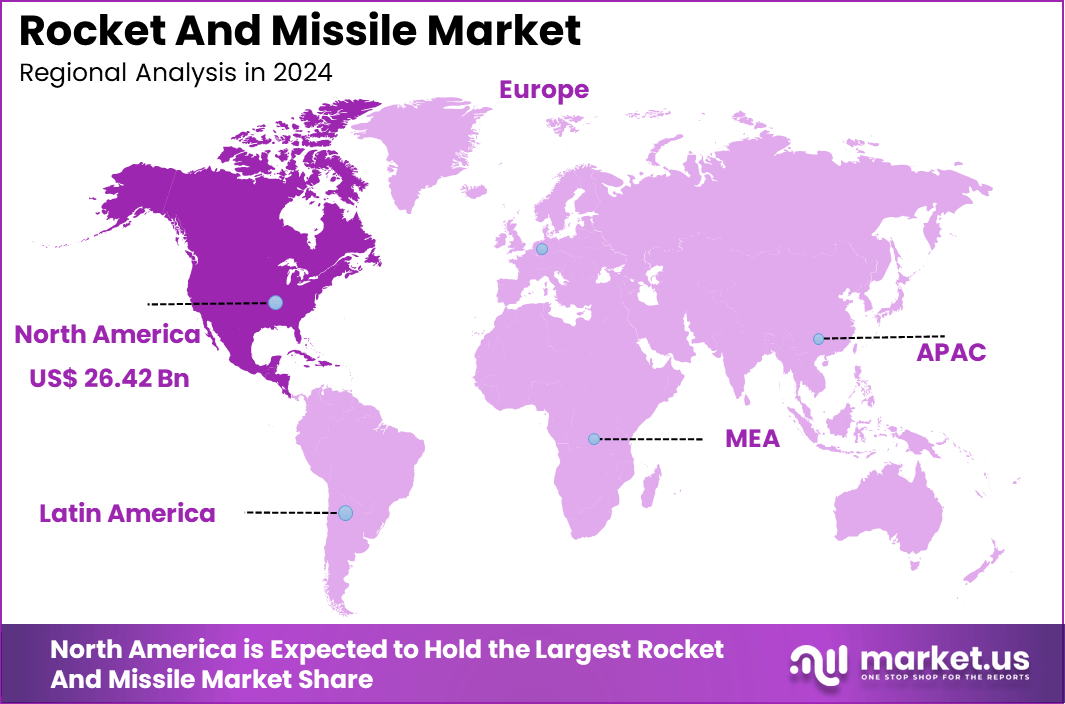

The Global Rocket And Missile Market size is expected to be worth around USD 122.8 Billion By 2034, from USD 72.6 billion in 2024, growing at a CAGR of 5.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 36.4% share, holding USD 26.42 Billion revenue.

Rockets and missiles are integral components of modern defense and aerospace systems. A rocket is a self-propelled vehicle that moves by expelling exhaust in the opposite direction, operating on Newton’s third law of motion. Rockets are used for various purposes, including launching satellites, space exploration, and as weapons in military applications. Missiles, on the other hand, are guided weapons designed to deliver explosive payloads with high precision.

The global rocket and missile market is experiencing substantial growth, driven by increasing defense budgets, technological advancements, and rising geopolitical tensions. Key driving factors for the rocket and missile market include the increasing need for advanced defense systems to counter emerging threats, the proliferation of missile technology, and the emphasis on indigenous development of missile defense systems.

The evolving nature of warfare, characterized by the use of unmanned systems and cyber warfare, necessitates the development of sophisticated missile technologies. Additionally, the integration of artificial intelligence and machine learning in missile guidance systems is enhancing the precision and effectiveness of these weapons.

Demand analysis indicates a significant increase in the procurement of missiles and rockets by various countries to strengthen their defense capabilities. The Asia-Pacific region, in particular, is witnessing a surge in demand due to regional security concerns and territorial disputes. The emphasis on self-reliance in defense production, especially in countries like India, is further propelling the demand for domestically developed missile systems.

For instance, In August 2023, Raytheon Technologies secured a significant contract valued at USD 124.3 million from the U.S. Navy, aimed at advancing the tactical efficiency of its missile systems. Under this agreement, the company is set to deliver 42 maritime strike Tomahawk seeker suites, designed to substantially enhance the targeting precision and operational flexibility of Tomahawk missiles in maritime environments.

The adoption of advanced technologies in missile systems is on the rise. Innovations such as the Solid Fuel Ducted Ramjet (SFDR) propulsion system are enhancing the speed and range of missiles. The integration of AI in missile guidance systems allows for real-time decision-making and improved target accuracy. These technological advancements are crucial for developing next-generation missile systems capable of addressing modern warfare challenges.

The primary reasons for adopting these advanced technologies include the need for enhanced precision, extended range, and improved survivability of missile systems. The incorporation of AI and machine learning enables missiles to adapt to dynamic combat environments, increasing their effectiveness against sophisticated defense systems.

Key Takeaways

- The Global Rocket and Missile Market is projected to reach USD 122.8 billion by 2034, rising from USD 72.6 billion in 2024, with a steady CAGR of 5.4% from 2025 to 2034.

- In 2024, North America dominated the market, securing over 36.4% share and generating USD 26.42 billion in revenue, driven by strong defense budgets and space programs.

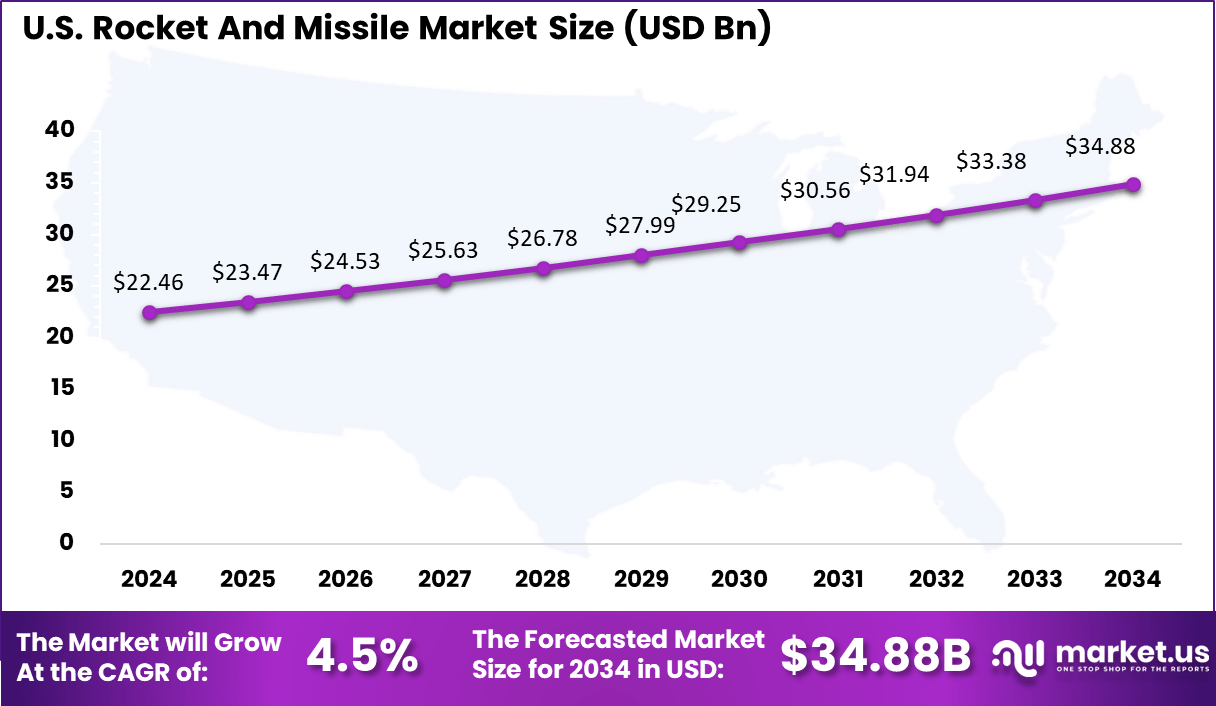

- The U.S. alone accounted for USD 22.46 billion in 2024, and is expected to grow from USD 2.47 billion in 2025 to USD 34.88 billion by 2034, reflecting a CAGR of 4.5%, underpinned by investments in advanced warfare systems and missile defense.

- The Missiles segment led globally, capturing more than 46.6% share in 2024, reflecting rising demand for precision strike capabilities and defense deterrence strategies.

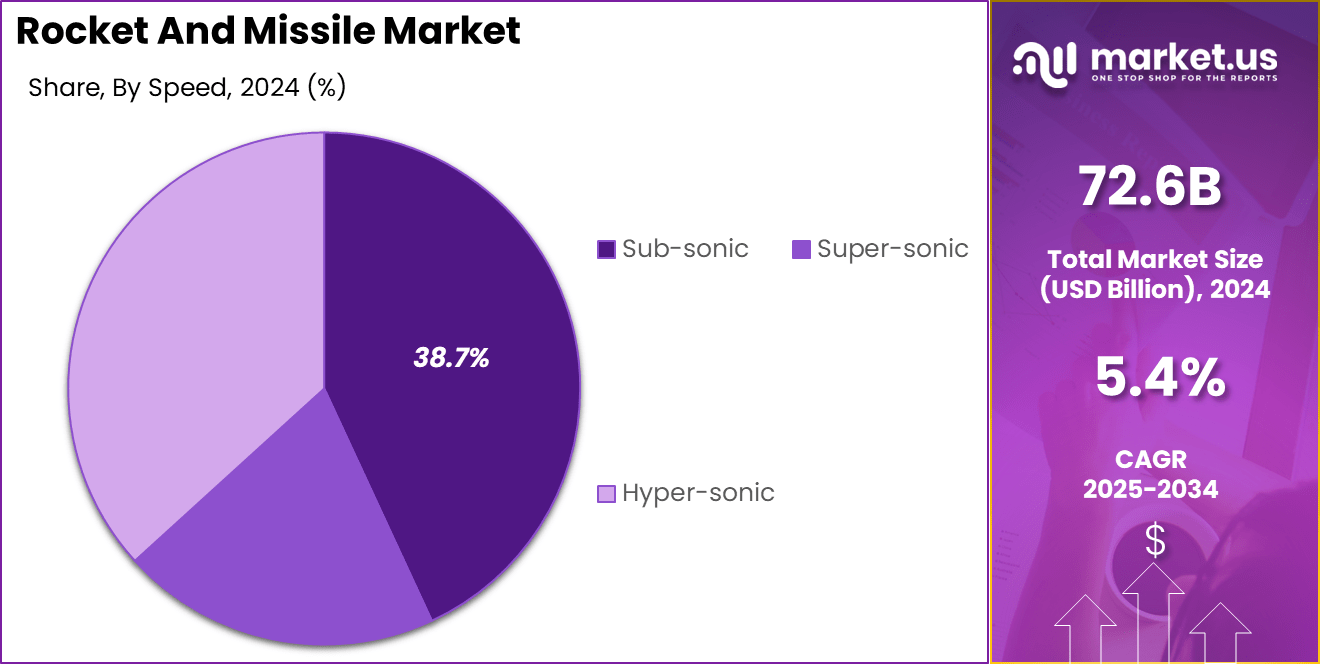

- Subsonic systems held 38.7% share in 2024, dominating due to their cost-efficiency, versatility, and widespread application across short- to medium-range missions.

- The Surface-to-Air segment secured over 35.5% of the global share in 2024, backed by growing air defense programs and cross-border threat management needs.

- In 2024, Guided systems commanded a significant 54.6% share, driven by technological advancements in targeting, tracking, and command-and-control functionalities across modern combat systems.

Analysts’ Viewpoint

Investment opportunities in the rocket and missile market are abundant, driven by the continuous demand for advanced defense systems. Companies specializing in missile technology, propulsion systems, and guidance technologies are attracting significant investments. The focus on indigenous defense production in emerging economies presents lucrative opportunities for local manufacturers and technology providers.

Businesses operating in the rocket and missile market benefit from the growing demand for advanced defense systems. The development and production of cutting-edge missile technologies offer companies a competitive edge and the potential for substantial revenue growth. The focus on self-reliance and local production is opening new opportunities for domestic businesses in defense manufacturing and supply chains.

The regulatory environment for the rocket and missile market is stringent, governed by international treaties and national regulations to prevent the proliferation of missile technology. Agreements such as the Missile Technology Control Regime (MTCR) aim to restrict the spread of missile systems capable of delivering weapons of mass destruction.

US Market Expansion

The U.S. Rocket and Missile Market has been valued at approximately USD 22.46 billion in 2024, reflecting its strategic importance in defense modernization, space exploration, and advanced warfare systems.

This market is expected to register stable growth over the next decade, with projections indicating a rise from USD 2.47 billion in 2025 to around USD 34.88 billion by 2034, expanding at a compound annual growth rate (CAGR) of 4.5% during the forecast period of 2025 to 2034.

The projected expansion of the market is closely tied to rising geopolitical tensions, increased defense spending, and consistent demand for technologically advanced missile and rocket systems. There has also been notable investment in hypersonic missile programs and reusable launch vehicles, which is creating significant traction across both military and commercial domains.

North America Growth

In 2024, North America held a dominant market position, capturing more than a 34.4% share of the global rocket and missile market, with an estimated revenue of around USD 26.42 billion. This extraordinary lead is primarily driven by the United States’ unmatched military spending, deep-rooted defense innovation, and continuous government-backed investments in advanced missile systems.

The region’s dominance is also reinforced by its strategic defense priorities and increasing military readiness across NATO and Indo-Pacific partnerships. Recent procurement contracts, modernization of the U.S. nuclear triad, and consistent satellite launch missions contribute to North America’s comprehensive influence over this sector.

In addition, growing partnerships with commercial space companies are blurring the lines between civil and military rocket technologies – further strengthening regional leadership. The high frequency of cross-sector investments and robust support for innovation are placing North America at the center of the global rocket and missile landscape, positioning it as the benchmark for operational scale, technical expertise, and sustained market growth.

By Product Analysis

In 2024, the Missiles segment held a dominant position in the global Rocket and Missile Market, capturing more than a 46.6% share. This leadership is attributed to the increasing demand for advanced missile systems, driven by evolving security threats and the need for precision strike capabilities.

The prominence of the Missiles segment is further reinforced by substantial investments in research and development, leading to the introduction of next-generation missile technologies. For instance, the U.S. Navy’s successful test of the Solid Fuel Integral Rocket Ramjet (SFIRR) missile exemplifies advancements in propulsion systems, enhancing range and maneuverability. Such innovations underscore the strategic importance of missiles in modern defense arsenals.

Moreover, geopolitical tensions and regional conflicts have prompted nations to bolster their missile capabilities. Countries like Australia have announced significant investments in missile procurement and local manufacturing to address emerging threats and ensure self-reliance in defense production. These initiatives highlight the global emphasis on strengthening missile forces to maintain strategic deterrence.

By Speed Analysis

In 2024, the Subsonic segment held a dominant position in the global Rocket and Missile Market, capturing more than a 38.7% share. This leadership is attributed to the widespread adoption of subsonic missiles, such as cruise missiles, which are known for their precision, cost-effectiveness, and versatility in various combat scenarios.

Subsonic missiles, operating at speeds below Mach 1, offer strategic advantages in modern warfare. Their slower speed allows for more precise navigation and targeting, making them ideal for missions requiring high accuracy. Additionally, subsonic missiles are generally more affordable to produce and maintain compared to their supersonic and hypersonic counterparts, making them a cost-effective choice for many defense forces.

The versatility of subsonic missiles has led to their extensive use in various military operations. They can be launched from multiple platforms, including ships, submarines, aircraft, and ground-based systems, providing flexibility in deployment. Furthermore, their ability to fly at low altitudes and follow terrain contours makes them less detectable by radar, enhancing their effectiveness in penetrating enemy defenses.

By Launch Mode Analysis

In 2024, the Surface-to-Air segment held a dominant position in the global Rocket and Missile Market, capturing more than a 35.5% share. This leadership is attributed to the increasing demand for advanced air defense systems to counter evolving aerial threats, including unmanned aerial vehicles (UAVs), cruise missiles, and ballistic missiles.

The proliferation of these threats has necessitated the development and deployment of sophisticated surface-to-air missile (SAM) systems by various nations to protect critical infrastructure and maintain airspace sovereignty. The prominence of the Surface-to-Air segment is further reinforced by substantial investments in research and development, leading to the introduction of next-generation missile technologies.

For instance, the U.S. Department of Defense has announced the procurement of National Advanced Surface-to-Air Missile Systems (NASAMS) to enhance its air defense capabilities. Similarly, Australia’s $7 billion investment in upgrading its missile defenses underscores the strategic importance of SAM systems in modern warfare.

Moreover, the integration of advanced technologies such as artificial intelligence and network-centric warfare capabilities has enhanced the effectiveness of SAM systems. These advancements enable real-time threat detection, tracking, and interception, thereby improving response times and accuracy. The adoption of such technologies has been pivotal in maintaining the operational superiority of surface-to-air missile systems in the face of increasingly sophisticated aerial threats.

By Guidance Mechanism Analysis

In 2024, the Guided segment held a dominant position in the global Rocket and Missile Market, capturing more than a 54.6% share. This leadership is attributed to the increasing demand for precision-guided munitions, driven by the need for enhanced accuracy, reduced collateral damage, and improved operational efficiency in modern warfare.

Guided missiles, equipped with advanced navigation systems such as GPS, inertial navigation, and laser guidance, offer superior target engagement capabilities compared to their unguided counterparts. The prominence of the Guided segment is further reinforced by substantial investments in research and development, leading to the introduction of next-generation missile technologies.

For instance, the integration of artificial intelligence and machine learning algorithms has enhanced the real-time decision-making capabilities of guided missiles, enabling them to adapt to dynamic battlefield conditions. Additionally, the development of hypersonic guided missiles has expanded the operational reach and effectiveness of modern missile systems.

The rise in asymmetric warfare and regional tensions has led countries to strengthen their defense with precision-guided weapons. Nations such as the United States, China, and India have notably increased their defense budgets to acquire advanced guided missile systems, aiming to ensure strategic dominance and deterrence. This highlights the growing importance of guided missiles in today’s military planning.

Key Market Segments

By Product

- Missiles

- Cruise Missiles

- Ballistic Missiles

- Interceptor Missiles

- Rocket Artilleries

- Torpedoes

By Speed

- Sub-sonic

- Super-sonic

- Hyper-sonic

By Launch Mode

- Surface to Surface

- Surface to Air

- Air to Air

- Air to Surface

By Guidance Mechanism

- Guided

- Un-Guided

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver

Escalating Geopolitical Tensions and Defense Modernization

The global rocket and missile market is witnessing substantial growth, primarily driven by escalating geopolitical tensions and the imperative for defense modernization. Nations worldwide are increasingly investing in advanced missile systems to bolster their defense capabilities in response to regional conflicts and evolving security threats.

For instance, Australia’s commitment of A$74 billion to acquire long-range strike missiles underscores the urgency to enhance strategic deterrence amid rising tensions in the Indo-Pacific region. Similarly, the United States has allocated significant funds towards the development of next-generation intercontinental ballistic missiles, such as the LGM-35 Sentinel, to maintain its strategic edge.

This surge in defense spending is not confined to traditional military powers. Emerging economies are also prioritizing the development and procurement of sophisticated missile technologies to assert their strategic autonomy and respond to regional security dynamics. The emphasis on modernizing missile arsenals reflects a broader trend of nations seeking to enhance their deterrence capabilities through precision-guided munitions and advanced delivery systems.

Restraint

High Development Costs and Budgetary Constraints

Despite the robust demand, the rocket and missile market faces significant restraints due to the high costs associated with research, development, and production of advanced missile systems. The complexity of integrating cutting-edge technologies into missile platforms necessitates substantial investment, often leading to budget overruns and project delays.

A pertinent example is the LGM-35 Sentinel program in the United States, which has experienced a cost escalation from an estimated $95.3 billion to over $140.9 billion, accompanied by schedule delays. These financial challenges are further compounded by budgetary constraints faced by governments, especially in the wake of economic pressures from global events.

Allocating substantial funds to missile development programs can strain national budgets, leading to difficult decisions regarding defense spending priorities. Additionally, smaller nations or those with limited defense budgets may find it challenging to invest in high-cost missile systems, potentially limiting market expansion in certain regions.

Opportunity

Expansion into Emerging Markets and Indigenous Development

The rocket and missile market presents significant opportunities through expansion into emerging markets and the development of indigenous missile capabilities. Countries like India are actively investing in domestic missile development programs to reduce reliance on foreign suppliers and enhance self-reliance in defense technologies.

India’s focus on indigenous development is exemplified by its efforts to produce advanced missile systems, such as the BrahMos and Akash, through collaborations between government agencies and private sector firms. This trend towards indigenous development not only opens new markets for missile technologies but also fosters innovation and technological advancement within these countries.

Furthermore, as emerging economies prioritize defense modernization, there is an increasing demand for cost-effective and adaptable missile systems that can be integrated into existing defense infrastructures. Manufacturers that can offer scalable solutions tailored to the specific needs of these markets are well-positioned to capitalize on this opportunity, thereby driving growth and diversification in the global rocket and missile market.

Challenge

Stringent Regulatory Frameworks and Export Controls

A significant challenge confronting the rocket and missile market is the stringent regulatory frameworks and export controls governing the proliferation of missile technologies. International agreements, such as the Missile Technology Control Regime (MTCR), impose strict guidelines on the export of missile-related technologies to prevent the spread of weapons of mass destruction.

These regulations can limit market access for manufacturers and complicate international collaborations. Navigating these complex regulatory landscapes requires substantial compliance efforts and can lead to delays in the approval and delivery of missile systems. Additionally, geopolitical considerations and shifting alliances can influence export policies, creating an unpredictable environment for manufacturers and buyers alike.

Companies must invest in robust compliance mechanisms and maintain flexibility to adapt to changing regulatory conditions. Failure to effectively manage these challenges can result in lost business opportunities and hinder the global expansion of missile technologies.

Growth Factors

The growth is primarily driven by escalating geopolitical tensions, increased defense budgets, and the modernization of military arsenals. Countries worldwide are investing in advanced missile systems to enhance their defense capabilities, leading to a surge in demand for both rockets and missiles. Additionally, the rise in asymmetric warfare and the need for precision strike capabilities have further propelled market expansion.

Technological advancements, such as the development of hypersonic missiles and improved propulsion systems, have also contributed significantly to market growth. The integration of artificial intelligence (AI) and machine learning in guidance systems has enhanced the accuracy and efficiency of these weapons, making them more appealing to defense forces.

Emerging Trends

One notable trend in the rocket and missile market is the development of environmentally sustainable propulsion systems. There is a growing emphasis on reducing the environmental impact of missile launches by exploring alternative fuels and propulsion methods that minimize emissions. This shift not only aligns with global environmental goals but also addresses the increasing regulatory pressures related to defense-related environmental concerns.

Another significant trend is the miniaturization of missile components, which allows for the deployment of smaller, more agile missile systems without compromising performance. This miniaturization facilitates the integration of missile systems into a wider range of platforms, including unmanned aerial vehicles and smaller naval vessels, thereby expanding their operational versatility.

Business Benefits

Investing in the rocket and missile market offers substantial business advantages, particularly for companies involved in defense manufacturing and technology development. The increasing global demand for advanced missile systems ensures a steady stream of contracts and revenue opportunities for industry players.

Companies that can deliver innovative solutions and meet stringent defense requirements are well-positioned to secure long-term partnerships with governments and defense agencies. Furthermore, the collaborative nature of defense projects often leads to joint ventures and international partnerships, opening avenues for technology transfer and shared expertise.

Such collaborations not only enhance a company’s technological capabilities but also expand its market reach. Engaging in the rocket and missile sector allows businesses to contribute to national security objectives while achieving sustainable growth through diversified portfolios and global market presence.

Key Player Analysis

The global rocket and missile market is shaped by a diverse group of defense companies leading in engineering, innovation, and production scale. Lockheed Martin Corporation, Raytheon Technologies, and General Dynamics Corporation hold significant influence in the United States, driven by advanced missile defense systems and strategic contracts with defense ministries.

These firms actively invest in guided missile programs and long-range strike technologies. Their deep integration with government defense agendas continues to secure strong revenue streams and global partnerships across NATO-aligned countries.

In Europe, key players such as MBDA, Saab AB, Thales Group, KONGSBERG, and Nammo AS demonstrate robust capabilities across tactical missile systems, air defense solutions, and precision strike platforms. MBDA, a multinational consortium, delivers next-generation missiles such as the Meteor and Aster series.

Top Key Players in the Market

- Denel Dynamics

- General Dynamics Corporation

- ROKETSAN A.S.

- KONGSBERG

- Lockheed Martin Corporation

- MBDA

- MESKO

- Nammo AS

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Saab AB

- Thales Group

- Others

Recent Developments

- In January 2025, RTX (US) strengthened its position in the US defense industry by securing a USD 333 million contract from the US Navy. This deal focuses on the production of Standard Missile-6 (SM-6) Block IA missiles, a critical component of the Navy’s layered defense system. The SM-6 not only supports air defense but also contributes to anti-surface and terminal ballistic missile defense, making it a versatile asset in the US Navy’s growing arsenal.

- By October 2024, RTX (US) further expanded its government partnerships with a significant USD 676 million contract. This agreement ensures the continued production of the Tube-launched, Optically-tracked, Wire-guided (TOW) missile system for the US Army. As a proven anti-tank solution, the TOW system plays a vital role in combat vehicle lethality and remains integral to US ground-force operations, especially in asymmetric warfare.

- In a notable European advancement, Saab AB (Sweden) signed a USD 72.42 million contract in December 2024 with the Swedish Defense Materiel Administration. The objective is to modernize Sweden’s coastal anti-ship missile capability. This modernization drive reflects Sweden’s proactive approach to maritime defense amid growing tensions in the Baltic region.

- September 2024 proved a particularly active month. RTX (US) secured a contract modification from the US Air Force to produce Advanced Medium-Range Air-to-Air Missiles (AMRAAM) for both domestic and international buyers. The scope of work, running through December 2028, covers engineering support, spares, telemetry systems, and more, with operations based in Tucson, Arizona.

Report Scope

Report Features Description Market Value (2024) USD 72.6 Bn Forecast Revenue (2034) USD 122.8 Bn CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Product (Missiles (Cruise Missiles, Ballistic Missiles, Interceptor Missiles), Rocket Artilleries, Torpedoes), By Speed (Sub-sonic, Super-sonic, Hyper-sonic), By Launch Mode (Surface to Surface, Surface to Air, Air to Air, Air to Surface), By Guidance Mechanism (Guided, Un-Guided) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Denel Dynamics, General Dynamics Corporation, ROKETSAN A.S., KONGSBERG, Lockheed Martin Corporation, MBDA, MESKO, Nammo AS, Rafael Advanced Defense Systems Ltd., Raytheon Technologies Corporation, Saab AB, Thales Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Denel Dynamics

- General Dynamics Corporation

- ROKETSAN A.S.

- KONGSBERG

- Lockheed Martin Corporation

- MBDA

- MESKO

- Nammo AS

- Rafael Advanced Defense Systems Ltd.

- Raytheon Technologies Corporation

- Saab AB

- Thales Group

- Others