Global Robotics Club Insurance Market By Coverage Type (General Liability, Property Insurance, Accident Insurance, Equipment Insurance, Professional Liability, Others), By End-User (Schools, Colleges & Universities, Community Clubs, Private Organizations, Others), By Distribution Channel (Direct, Brokers, Online Platforms, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Feb. 2026

- Report ID: 176412

- Number of Pages: 217

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- By Coverage Type

- By End User

- By Distribution Channel

- Emerging Trends

- Growth Factors

- Opportunity Analysis

- Challenge Analysis

- Key Market Segments

- Regional Analysis

- Driver Impacts Analysis

- Restraints Impact Analysis

- Investment Opportunities

- Competitive Analysis

- Recent Developments

- Report Scope

Report Overview

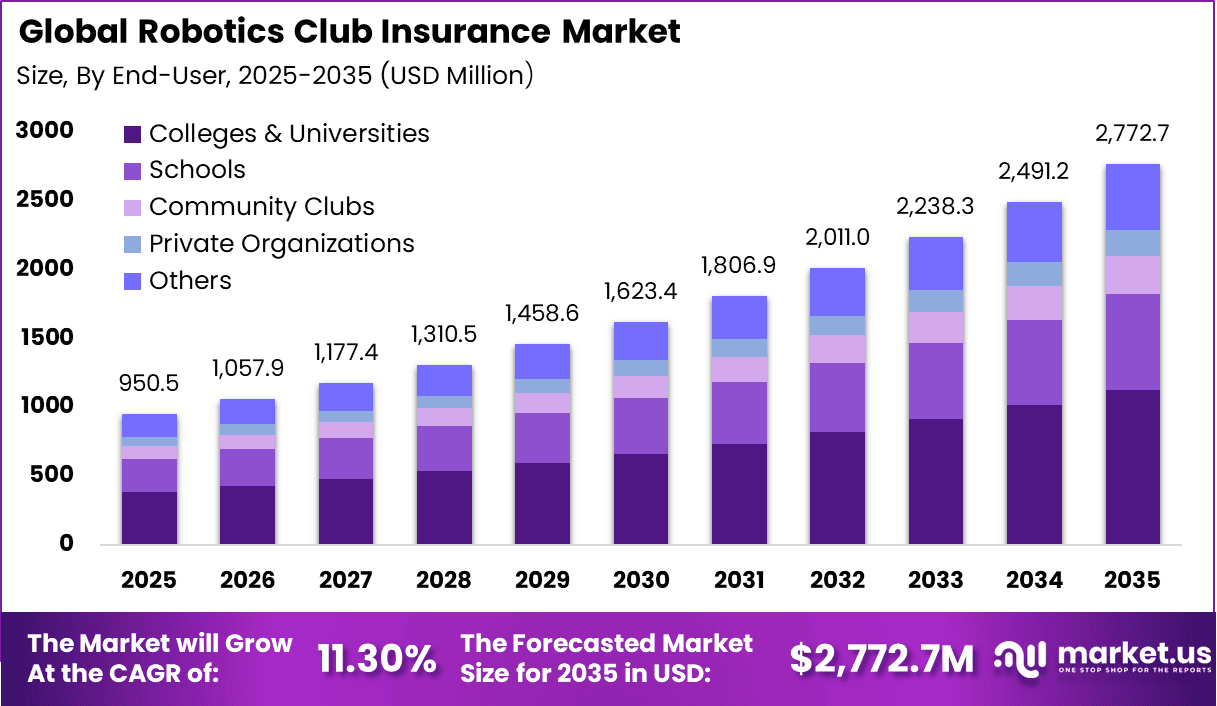

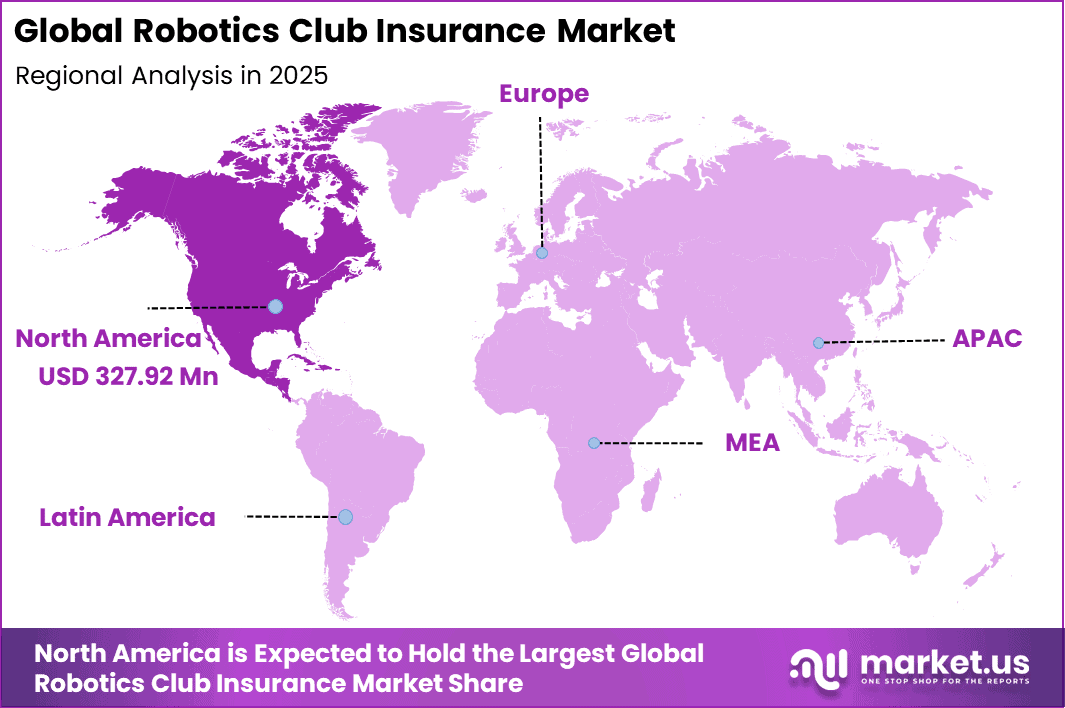

The Global Robotics Club Insurance Market generated USD 950.5 million in 2025 and is predicted to register growth from USD 1,057.9 million in 2026 to about USD 2,772.7 million by 2035, recording a CAGR of 11.30% throughout the forecast span. In 2025, North America held a dominan market position, capturing more than a 34.5% share, holding USD 327.92 Million revenue.

The robotics club insurance market focuses on specialised coverage designed to protect individuals and organisations involved in robotics education, competitions, workshops, and hobbyist activities. These insurance solutions address risks such as accidental injury, property damage, equipment loss, and third-party liability that can arise during robot construction, testing, and demonstrations.

Robotics clubs operate in diverse settings ranging from schools and universities to community centres and maker spaces, each with distinct exposures related to tools, machinery, and participant interaction. As robotics activities grow across educational, recreational, and competitive domains, the demand for risk protection tailored to this environment is strengthening.

A primary driver of the robotics club insurance market is the increasing popularity of robotics education and competitive events. Schools, colleges, and community groups are expanding robotics programmes to support STEM learning and hands-on technical skill development. Robotics competitions often involve dynamic activities and public demonstrations, which elevate exposure to accidental injury and property damage.

Demand for robotics club insurance is driven by educational institutions seeking structured risk management. Schools and colleges often require insurance coverage before approving club activities. This ensures protection for students, faculty, and the institution. As robotics clubs become more formalized, insurance adoption increases.

Top Market Takeaways

- By coverage type, general liability accounts for 38.8% of the market, covering claims for injuries, property damage, or accidents during club meetings, builds, and tournaments.

- By end-user, colleges & universities represent 40.7% share, driven by extracurricular robotics programs needing insurance for campus events, competitions, and student-led innovations.

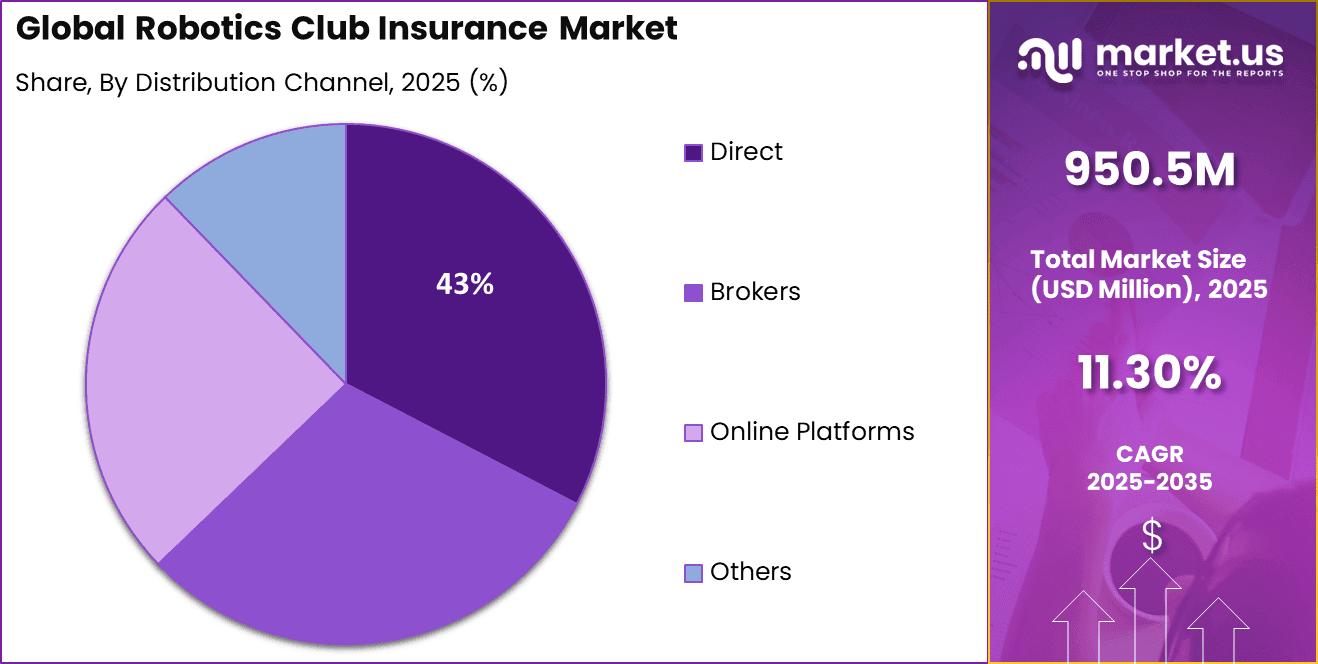

- By distribution channel, direct sales hold 43.2%, enabling educational institutions to obtain policies efficiently through insurers’ platforms tailored for clubs and academic teams.

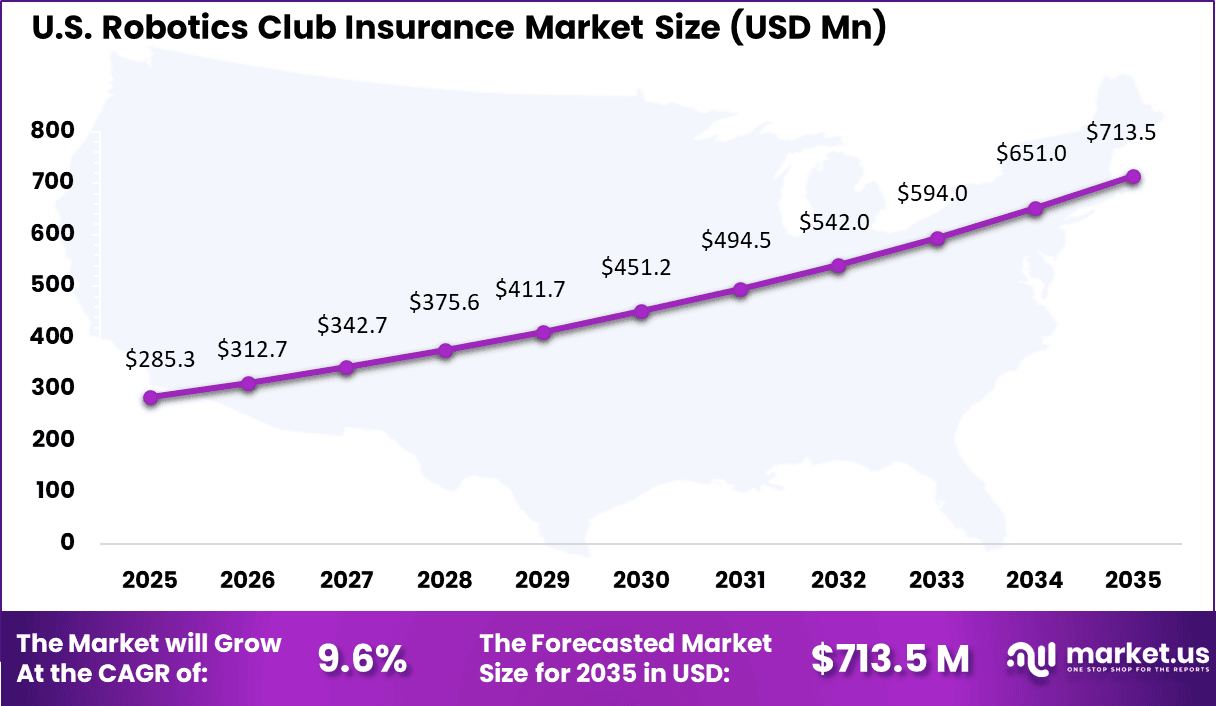

- By region, North America leads with 34.5% of the global market, where the U.S. is valued at USD 285.29 million with a projected CAGR of 9.6%, supported by growing STEM initiatives and risk awareness in higher education.

By Coverage Type

General liability coverage represents 38.8% of the robotics club insurance landscape, as it addresses the most frequent risk exposures linked to student led technical activities. Robotics clubs regularly conduct hands on workshops, testing sessions, and live demonstrations, which increase the likelihood of bodily injury or third party property damage.

Coverage is therefore treated as a foundational requirement rather than optional protection. The growing use of mechanical components, electrical systems, and autonomous functions has further strengthened demand for general liability policies.

Educational institutions and club administrators increasingly view this coverage as essential for safeguarding students, faculty supervisors, and visitors. This risk profile supports consistent uptake across academic robotics programs.

By End User

Colleges and universities account for 40.7% of total end user adoption, reflecting their central role in sponsoring and overseeing robotics clubs. These institutions typically host multiple student organizations, competitions, and research driven activities under a single campus environment. Insurance coverage is required to align with institutional safety standards and governance frameworks.

Academic institutions also face higher accountability related to student welfare and facility usage. As robotics clubs expand beyond classroom settings into intercollegiate competitions and public showcases, insurance coverage becomes a standard administrative requirement. This supports steady demand from higher education entities.

By Distribution Channel

Direct distribution channels hold a 43% share, supported by increased preference for streamlined and digital insurance purchasing. Colleges and club coordinators often seek fast policy issuance with clear coverage terms, which direct channels are well positioned to deliver. This approach reduces administrative complexity and accelerates approval cycles.

The direct model also allows institutions to align coverage features with specific club activities and equipment usage. Improved online underwriting tools help insurers assess risk based on participation size and activity type. This has improved trust in direct purchasing among academic buyers.

Emerging Trends

The Robotics Club Insurance market is witnessing a clear shift toward specialized, activity-based coverage models. Insurance policies are increasingly being structured around hands-on robotics activities such as competitions, drone testing, autonomous vehicle trials, and hardware prototyping.

This trend is being driven by rising participation of student-led clubs in interschool and international robotics events, where liability requirements are clearly defined by organizers. As a result, coverage related to equipment damage, third-party injury, and event participation is becoming more tailored, with limits aligned to higher-risk experimentation environments and supervised lab settings.

Another emerging trend is the growing demand for flexible, short-term insurance policies rather than annual contracts. Robotics clubs often operate on academic calendars, with peak activity during competitions and project exhibitions. Insurance products are therefore being adapted to cover 6 to 9 months of active use instead of full-year exposure.

This shift improves affordability for educational institutions while ensuring compliance with school safety policies and venue requirements. Digital policy issuance and simplified onboarding are also gaining traction, supporting faster coverage activation for time-bound events.

Growth Factors

The primary growth factor for the Robotics Club Insurance market is the rapid expansion of robotics education across schools, colleges, and community innovation centers. Robotics clubs are increasingly viewed as core learning platforms that combine coding, electronics, and mechanical engineering.

Participation rates in STEM clubs have increased steadily, with some education boards reporting engagement growth of over 30% in technical extracurricular programs. This expansion directly increases exposure to physical equipment, shared workspaces, and public demonstrations, which strengthens the need for structured insurance coverage.

Another key growth driver is rising institutional accountability and risk management awareness. Educational institutions are under stronger pressure to formalize safety protocols and liability protection for student activities. Robotics clubs often use high-value components, sharp tools, and powered machinery, increasing the risk of accidental damage or injury.

Insurance is therefore being adopted not as an optional safeguard but as a compliance requirement. This shift is further supported by event organizers and sponsors who mandate proof of insurance before allowing participation, reinforcing consistent demand for robotics club insurance solutions.

Opportunity Analysis

A significant opportunity in the robotics club insurance market lies in developing modular policy options that align with specific activities and member profiles. Flexible coverage that addresses event liability, equipment protection, participant injury, and volunteer indemnity separately can improve relevance and affordability. Such modular designs allow clubs to select protections that match their operational needs.

Another opportunity is partnership with educational institutions and competitive league organisers. Collaboration with school districts, universities, and robotics competition bodies to promote insurance literacy and offer group-based programmes can increase adoption rates. These partnerships can include risk assessment support and safety training resources that complement insurance coverage.

Challenge Analysis

A core challenge for the robotics club insurance market is balancing comprehensive coverage with cost constraints. Many clubs operate on limited budgets supported by membership fees, sponsorships, and fundraising. Premium affordability becomes critical, especially for clubs with substantial equipment assets or extensive hands-on activities. Designing policies that deliver meaningful protection without prohibitive cost remains a complex actuarial task.

Another challenge involves ensuring effective safety practices across varied operational environments. Insurers often require documented safety protocols and supervision standards as part of underwriting. Supporting diverse clubs in adopting and maintaining consistent safety measures requires education, monitoring, and engagement that can strain limited organisational resources.

Key Market Segments

By Coverage Type

- General Liability

- Property Insurance

- Accident Insurance

- Equipment Insurance

- Professional Liability

- Others

By End-User

- Schools

- Colleges & Universities

- Community Clubs

- Private Organizations

- Others

By Distribution Channel

- Direct

- Brokers

- Online Platforms

- Others

Regional Analysis

North America holds a 34.5% share of the robotics club insurance market due to the strong presence of school, college, and community-based robotics programs. Insurance demand is supported by higher participation in STEM activities, frequent competitions, and the use of shared facilities such as schools, labs, and community centers that require liability coverage.

The United States market is valued at USD 285.29 Mn and is expanding at a CAGR of 9.6%, driven by widespread robotics education initiatives and competitive robotics leagues. Insurance uptake is influenced by school district requirements, grant compliance, and the growing use of advanced robotics kits and electronic components with higher replacement costs.

Growth is further supported by increased awareness of liability exposure during travel, competitions, and hands-on training sessions, leading clubs to formalize insurance as part of standard risk management practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Impacts Analysis

Key Driver Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Rising participation in school and community robotics programs +3.1% North America, Europe Short to medium term Growth of STEM education initiatives and competitions +2.6% North America, Asia Pacific Medium term Increased liability exposure from robotics equipment and events +2.2% Global Short term Higher involvement of sponsors and educational institutions +1.9% North America, Europe Medium term Expansion of after-school and private robotics clubs +1.5% Asia Pacific, Latin America Medium to long term Restraints Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Budget constraints among small clubs and schools −2.1% Global Short to medium term Limited insurance awareness among volunteer-led organizations −1.8% Asia Pacific, Latin America Medium term Perceived low risk for non-competitive robotics activities −1.5% Global Medium term Complexity of coverage for equipment damage and liability −1.3% Global Medium term Inconsistent safety and insurance requirements across regions −1.0% Emerging Markets Long term Investment Opportunities

Investment opportunities in the robotics club insurance market are emerging as schools, universities, and community groups expand hands on robotics programs and competitions. Demand is growing for insurance that covers equipment damage, student injuries, and liability during workshops, testing sessions, and public demonstrations.

Investors can benefit from supporting simple, affordable policies tailored for educational and non profit environments, where budgets are limited but compliance needs are increasing. Digital onboarding and flexible coverage periods also present strong potential as clubs seek easy access to protection without complex administrative processes.

Investment Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Specialized education and event insurers High Medium North America, Europe Stable niche premium growth Large commercial insurers Medium Low to Medium Global Portfolio diversification Digital insurance platforms High Medium North America Efficient onboarding of small clubs Private equity firms Medium Medium North America, Europe Consolidation of niche insurance lines Venture capital investors Low to Medium High North America Selective interest via insurtech models Competitive Analysis

Global commercial insurers such as Allianz SE, AXA XL, and Chubb Limited hold strong positions in the robotics club insurance market. Their coverage typically includes general liability, equipment damage, event risk, and participant injury. These insurers apply underwriting models aligned with technology-driven educational activities. Strong risk assessment capabilities support schools, universities, and independent robotics clubs. Demand is driven by growing STEM programs and increased use of advanced robotics equipment.

Reinsurance and specialty capacity providers such as Munich Re Group, Swiss Re Group, and Lloyd’s of London play a key role in managing high-severity and emerging risks. Tokio Marine HCC and Sompo International support tailored policies for competitions and international events. These players strengthen market capacity through flexible coverage structures. Adoption is supported by rising participation in national and global robotics competitions.

Brokerage and specialty-focused insurers such as Marsh & McLennan Companies, Willis Towers Watson, and Beazley Group assist in program design and placement. Markel Corporation, Hiscox Ltd, and QBE Insurance Group support smaller clubs and educational institutions. Other insurers expand regional access and customization. This competitive landscape supports safe and scalable growth of robotics club activities worldwide.

Top Key Players in the Market

- Allianz SE

- AXA XL

- Chubb Limited

- Munich Re Group

- Zurich Insurance Group

- AIG (American International Group)

- Lloyd’s of London

- Swiss Re Group

- Tokio Marine HCC

- Sompo International

- Liberty Mutual Insurance

- Travelers Companies, Inc.

- Berkshire Hathaway Specialty Insurance

- Marsh & McLennan Companies

- Willis Towers Watson

- Beazley Group

- CNA Financial Corporation

- Markel Corporation

- Hiscox Ltd

- QBE Insurance Group

- Others

Recent Developments

- January 2026 – Zurich Insurance Group submitted an improved proposal to acquire 100% of Beazley Group, boosting specialty lines like potential robotics liability.

- May 2025 – Chubb Limited, Zurich Insurance Group, and National Indemnity launched a $100 million excess casualty facility, aiding robotics club event coverage.

Report Scope

Report Features Description Market Value (2025) USD 950.5 Million Forecast Revenue (2035) USD 2,772.7 Million CAGR(2025-2035) 11.30% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Coverage Type (General Liability, Property Insurance, Accident Insurance, Equipment Insurance, Professional Liability, Others), By End-User (Schools, Colleges & Universities, Community Clubs, Private Organizations, Others), By Distribution Channel (Direct, Brokers, Online Platforms, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Allianz SE, AXA XL, Chubb Limited, Munich Re Group, Zurich Insurance Group, AIG (American International Group), Lloyd’s of London, Swiss Re Group, Tokio Marine HCC, Sompo International, Liberty Mutual Insurance, Travelers Companies, Inc., Berkshire Hathaway Specialty Insurance, Marsh & McLennan Companies, Willis Towers Watson, Beazley Group, CNA Financial Corporation, Markel Corporation, Hiscox Ltd, QBE Insurance Group, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotics Club Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample

Robotics Club Insurance MarketPublished date: Feb. 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Allianz SE

- AXA XL

- Chubb Limited

- Munich Re Group

- Zurich Insurance Group

- AIG (American International Group)

- Lloyd’s of London

- Swiss Re Group

- Tokio Marine HCC

- Sompo International

- Liberty Mutual Insurance

- Travelers Companies, Inc.

- Berkshire Hathaway Specialty Insurance

- Marsh & McLennan Companies

- Willis Towers Watson

- Beazley Group

- CNA Financial Corporation

- Markel Corporation

- Hiscox Ltd

- QBE Insurance Group

- Others