Global Robotic Refueling System Market Size, Share, Growth Analysis By Component (Hardware, Software), By Fuel Pumped (Gasoline, Natural Gas, Petrochemicals, Others), By Payload Carrying Capacity (Up to 50 Kg, 50–100 Kg, 100–150 Kg), By Industry Vertical (Aerospace, Mining, Automotive, Oil & Gas, Military & Defense, Warehouse & Logistics, Construction, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Feb 2026

- Report ID: 128845

- Number of Pages: 329

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

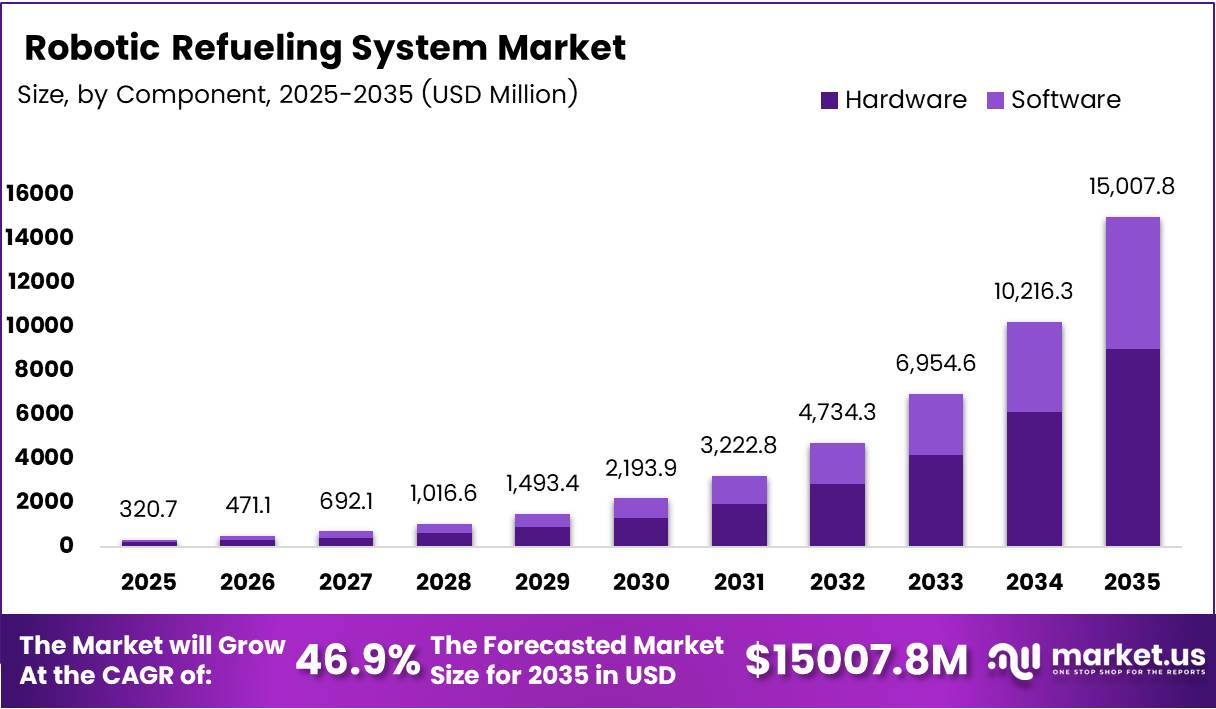

Global Robotic Refueling System Market size is expected to be worth around USD 15,007.8 Million by 2035 from USD 218.3 Million in 2025, growing at a CAGR of 46.90% during the forecast period 2026 to 2035.

Robotic refueling systems automate the delivery of fuel to vehicles, aircraft, ships, and industrial equipment without human intervention. These systems combine robotic arms, fuel dispensing units, vehicle positioning technology, and control software to handle refueling tasks precisely and safely. Their value lies not just in speed but in eliminating human exposure to hazardous fueling environments.

Aviation, military, oil and gas, and warehouse logistics sectors drive adoption of these automated fueling systems. Each vertical faces mounting pressure to reduce downtime, cut labor costs, and meet stricter safety compliance standards. Robotic refueling directly addresses all three priorities, which explains why operators across these industries are accelerating procurement decisions.

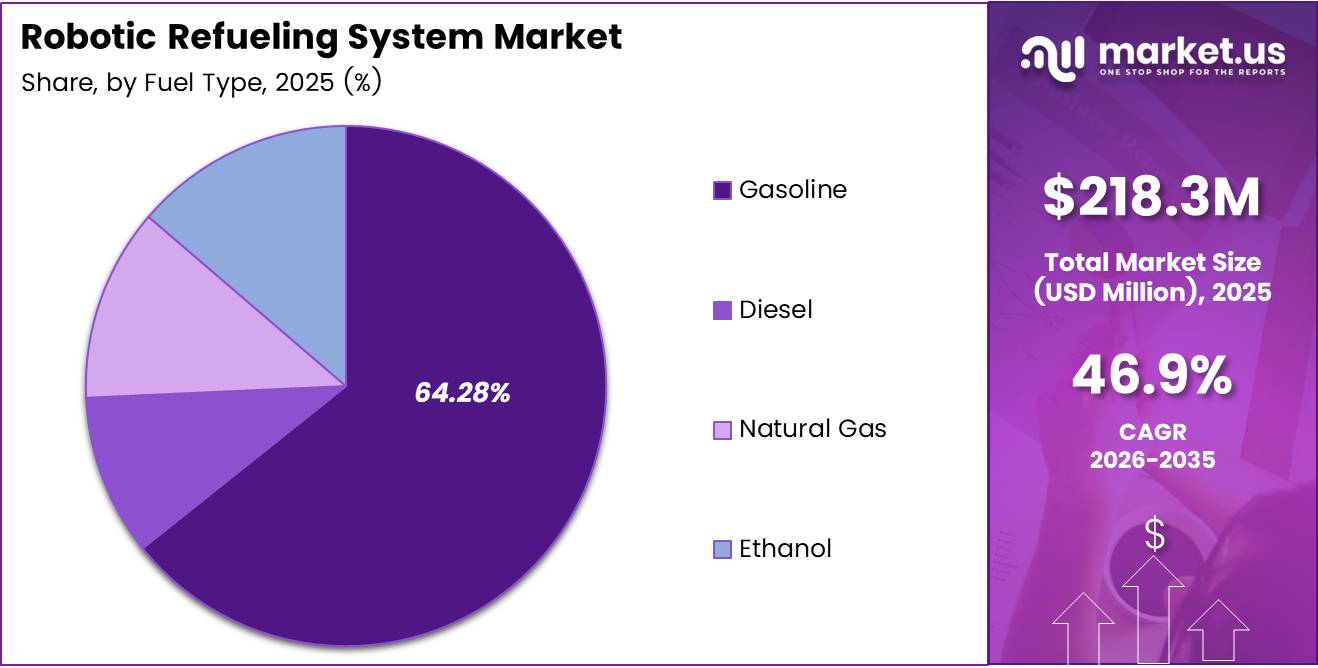

Hardware leads the market, commanding 58.73% share across components including robotic arms, vehicle positioning systems, and fuel dispensing units. Meanwhile, gasoline-based refueling accounts for 64.28% of fuel-type deployment, reflecting the current dominance of conventional fuel infrastructure even as alternative fuels enter the picture.

Government investment in military fueling automation is a structural force shaping this market. Defense departments across North America and Europe are funding autonomous refueling programs for forward operating bases and naval vessels. This institutional demand creates a procurement pipeline that commercial vendors can anchor their product roadmaps around.

According to the International Federation of Robotics (IFR), 542,076 industrial robots were installed globally in factories in 2024 — more than double the installations of a decade earlier. This baseline surge in industrial robotics capability directly lowers the integration cost of robotic refueling systems, since core hardware and control technology are increasingly commoditized.

According to IFR, the total global stock of operational industrial robots reached approximately 4,664,000 units in 2024, a 9% increase from the prior year. This expanding base of deployed robotics infrastructure signals that enterprises across sectors are now experienced robot operators — reducing the adoption friction that previously slowed specialized solutions like robotic refueling from gaining traction.

Key Takeaways

- The Global Robotic Refueling System Market is valued at USD 218.3 Million in 2025 and is forecast to reach USD 15,007.8 Million by 2035 at a CAGR of 46.90%.

- By Component, Hardware dominates with a 58.73% market share in 2025.

- By Fuel Pumped, Gasoline leads with a 64.28% share, reflecting conventional fuel infrastructure dominance.

- By Payload Carrying Capacity, the 50–100 Kg segment holds 40.61% share, indicating preference for mid-range robotic capability.

- By Industry Vertical, Aerospace leads with 38.94% share, driven by aviation safety and turnaround efficiency demands.

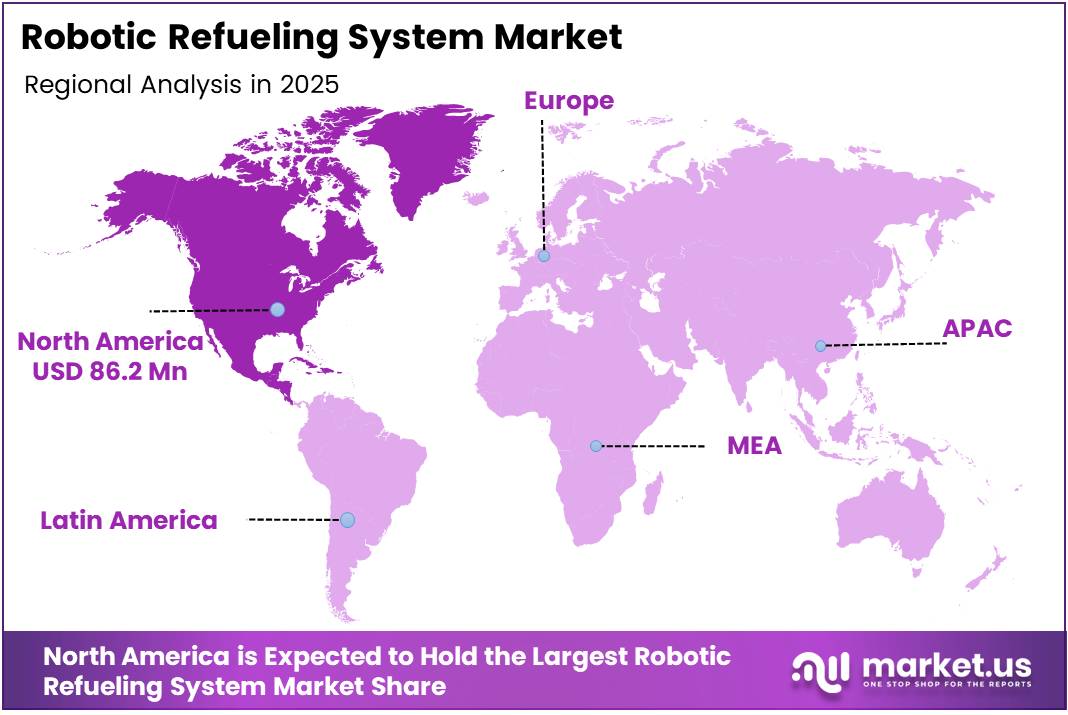

- North America dominates regionally with a 39.50% share, valued at USD 86.2 Million in 2025.

Component Analysis

Hardware dominates with 58.73% due to high-cost physical infrastructure requirements.

In 2025, Hardware held a dominant market position in the By Component segment of the Robotic Refueling System Market, with a 58.73% share. Physical components — robotic arms, positioning systems, and dispensing units — represent the irreplaceable core of any refueling installation. No software investment delivers value without this foundational hardware layer, which locks in high per-unit contract values for hardware vendors.

Software carries the highest long-term margin potential within the component stack. Once installed, software platforms generate recurring licensing and upgrade revenues that hardware cannot replicate. Vendors building proprietary control and analytics software alongside hardware sales are effectively creating a captive customer base, since switching costs rise sharply after software integration.

Vehicle Positioning System serves as the entry point for precision fueling operations. Without accurate positioning, robotic arms cannot align with fuel inlets reliably. This makes positioning technology a non-negotiable specification in procurement, and suppliers offering proprietary positioning solutions gain a technical lock-in advantage over competitors using generic components.

Control System coordinates all operational sequences across the refueling cycle. Its reliability directly determines system uptime — a metric that aviation and defense clients weight heavily in vendor selection. Buyers in these verticals accept premium pricing for proven control architecture, making this sub-segment a margin-protective category.

Robotic Arm differentiates vendors through reach, payload tolerance, and environmental durability. In harsh refueling environments — military bases, offshore platforms, and cold-weather airfields — arm specifications become the primary selection criterion. Suppliers with arms certified for extreme-condition use carry a clear competitive edge in regulated procurement processes.

Fuel Dispensing System handles the final, highest-risk stage of the refueling sequence. Precision, leak prevention, and compatibility with multiple fuel types determine its commercial value. As alternative fuels enter the market, dispensing systems capable of handling hydrogen or compressed natural gas become a differentiation point that early movers can patent-protect.

Control Software translates hardware commands into safe, repeatable refueling sequences. Its architecture determines how quickly operators can adapt to new vehicle types or fuel specifications without hardware modifications. Flexible control software reduces total cost of ownership and shortens system recertification cycles — a meaningful advantage in heavily regulated sectors.

Navigation and Mapping Software enables autonomous system movement within complex refueling environments such as airport aprons or fuel depots. Accurate spatial mapping reduces collision risk and improves cycle time. As airport layouts and military staging areas grow more complex, navigation software becomes a critical differentiator rather than a commodity feature.

Safety and Monitoring Software provides real-time alerts, shutdown protocols, and audit trails that satisfy regulatory compliance requirements. Aviation and defense clients treat safety software as a procurement prerequisite, not an optional upgrade. Vendors who integrate safety monitoring natively into their platforms reduce customer compliance costs and accelerate purchase approvals.

Data Analytics and Reporting Software converts refueling event data into operational intelligence. Fuel consumption patterns, cycle time benchmarks, and predictive maintenance signals all emerge from analytics layers. Operators who adopt analytics-enabled systems gain measurable efficiency improvements — creating a feedback loop that reinforces long-term platform loyalty.

Integration Software connects robotic refueling systems with existing enterprise infrastructure, including fleet management, ERP, and maintenance platforms. Its role is often underestimated at point of purchase but becomes critical during deployment. Vendors offering pre-built integration connectors for major enterprise systems shorten implementation timelines and reduce post-sale service friction.

Fuel Pumped Analysis

Gasoline dominates with 64.28% due to existing conventional fuel infrastructure scale.

In 2025, Gasoline held a dominant market position in the By Fuel Pumped segment of the Robotic Refueling System Market, with a 64.28% share. The sheer volume of gasoline-dependent vehicles, aircraft, and equipment in operation creates the largest addressable installation base for robotic refueling systems today. This dominance reflects current infrastructure reality, not a long-term ceiling — alternative fuels will reshape this breakdown as fleets transition.

Natural Gas refueling automation serves a fleet operator segment that prioritizes cost and emissions reduction simultaneously. Compressed natural gas stations require precise handling protocols that favor robotic automation over manual processes. As commercial trucking fleets accelerate CNG adoption, automated refueling infrastructure for natural gas becomes a procurement priority rather than an experimental category. In May 2024, Autofuel showcased its robotic refueling system at the UNITI Expo in Stuttgart, highlighting the commercial momentum in non-gasoline automated fueling solutions.

Petrochemicals refueling automation addresses industrial and offshore environments where manual fueling carries high safety risk. Robotic dispensing systems for petrochemical fuels reduce human exposure to volatile compounds and enable refueling in environments where regulatory restrictions on human activity are tightening. This positions petrochemical automation as a compliance-driven purchase rather than a purely efficiency-driven one.

Others in the fuel-type segment encompasses hydrogen, biofuels, and aviation-specific blends. These fuels represent the fastest-evolving portion of the segment, driven by decarbonization mandates in aviation and maritime sectors. Vendors who invest now in robotic dispensing compatibility for alternative fuels position themselves to capture first-mover share as these fuel types scale commercially.

Payload Carrying Capacity Analysis

50–100 Kg dominates with 40.61% due to balanced performance across major deployment environments.

In 2025, the 50–100 Kg payload segment held a dominant market position in the By Payload Carrying Capacity segment of the Robotic Refueling System Market, with a 40.61% share. This range offers the practical combination of sufficient arm strength for fuel hose and nozzle handling without the cost and footprint penalties associated with heavier-duty systems. Airport ground operations and automotive plant refueling both fall comfortably within this payload bracket.

Up to 50 Kg systems serve as the entry-level tier for operators deploying robotic refueling in space-constrained or cost-sensitive environments. Lighter systems carry lower acquisition costs and simpler installation requirements, making them accessible to smaller fleet operators or facilities running pilot programs before committing to full-scale deployment.

100–150 Kg systems address the high-end demand from military, heavy aviation, and offshore applications where fuel hose diameters, connector weight, and environmental resistance requirements exceed what lighter systems can handle reliably. This segment commands the highest per-unit price and represents the strategic priority for vendors serving defense and aerospace clients.

Industry Vertical Analysis

Aerospace dominates with 38.94% due to high safety standards and turnaround time pressure.

In 2025, Aerospace held a dominant market position in the By Industry Vertical segment of the Robotic Refueling System Market, with a 38.94% share. Aviation operators face two converging pressures: regulatory mandates for safer ground handling and commercial pressure to reduce aircraft turnaround times. Robotic refueling directly addresses both, which is why aerospace procurement leads all other verticals in contract volume and system complexity.

Mining operations use robotic refueling to service heavy equipment fleets in remote and hazardous terrain where human access is restricted or costly. Fuel consumption at mine sites is massive and continuous, making automation a clear cost-reduction tool. The remote deployment challenge also accelerates demand for ruggedized, low-maintenance refueling systems built for extended operation without on-site technical support.

Automotive manufacturing plants deploy robotic refueling to maintain production line continuity for internal combustion engine vehicles and test equipment. Precision and speed are the primary requirements in this setting. As automotive OEMs integrate more robotics into factory floors, refueling automation fits naturally into existing automation investment frameworks.

Oil and Gas facilities require robotic refueling solutions for equipment operating in explosion-risk zones where manual fueling violates safety regulations. This creates a compliance-driven purchase category where the question is not whether to automate but which certified system to procure. Vendors with explosion-proof certifications carry a structural advantage in this vertical.

Military and Defense represents the most technically demanding application, requiring systems that operate reliably in combat-adjacent environments, night conditions, and under time pressure. Defense procurement budgets are institutionally large and multi-year, making this vertical attractive to vendors who can meet certification requirements. Government investment in autonomous forward-area refueling programs signals a sustained demand runway through the forecast period.

Warehouse and Logistics facilities deploy robotic refueling to maintain forklift and autonomous guided vehicle fleets without interrupting warehouse operations. As e-commerce growth accelerates warehouse throughput requirements, any downtime from manual refueling becomes a measurable cost. Automated refueling during off-peak or inter-shift windows is becoming a standard efficiency benchmark in tier-one logistics networks.

Construction sites operate fuel-intensive equipment fleets across dispersed and often remote locations. Robotic refueling addresses the labor cost and safety risk of manual fueling in these settings. As construction firms adopt telematics and fleet management platforms, integration with automated refueling systems becomes a logical operational upgrade rather than a standalone capital decision.

Others within the industry vertical segment includes maritime, rail, and space-adjacent applications. Space in-orbit refueling represents the most technically speculative but potentially highest-value sub-category, attracting both private investment and government research funding as satellite longevity becomes a commercial priority.

Key Market Segments

By Component

- Hardware

- Vehicle Positioning System

- Control System

- Robotic Arm

- Fuel Dispensing System

- Others

- Software

- Control Software

- Navigation and Mapping Software

- Safety and Monitoring Software

- Data Analytics and Reporting Software

- Integration Software

By Fuel Pumped

- Gasoline

- Natural Gas

- Petrochemicals

- Others

By Payload Carrying Capacity

- Up to 50 Kg

- 50–100 Kg

- 100–150 Kg

By Industry Vertical

- Aerospace

- Mining

- Automotive

- Oil & Gas

- Military & Defense

- Warehouse & Logistics

- Construction

- Others

Drivers

Aviation Safety Mandates and Defense Fueling Investment Accelerate Robotic Refueling Adoption

Commercial aviation authorities and defense procurement agencies are pushing automated refueling higher on capital expenditure lists. Airlines face regulatory pressure to remove ground crew from high-risk fueling zones, while military planners fund autonomous fueling for forward-area operations. Both forces create structured, multi-year purchase pipelines rather than opportunistic single-system procurements.

According to the International Federation of Robotics (IFR), 74% of new industrial robot installations worldwide occurred in Asia in 2024, while Europe accounted for 16% and the Americas for 9%. This regional concentration of robotics capability means that Asian manufacturers building refueling system components benefit from deep local supply chains, giving them a cost advantage that Western integrators must strategically counter through specialization or proprietary software.

In August 2025, Integrated Solutions for Systems unveiled the HERO autonomous fueling robot at the AUVSI Pathfinder 2025 event, designed for automated helicopter refueling at forward arming and refueling points. This development confirms that military-grade autonomous refueling is moving from concept to deployable hardware — a signal that defense procurement timelines are shortening and vendor qualification windows are narrowing.

Restraints

High Capital Costs and Workforce Skill Gaps Slow Robotic Refueling System Deployment

Robotic refueling systems require substantial upfront investment across hardware, installation, and system integration. For small and mid-sized operators — regional airports, independent fleet operators, and smaller mining firms — this initial expenditure creates a payback period calculation that does not always clear internal investment thresholds, particularly when competing capital priorities exist.

Beyond acquisition cost, operators face a persistent shortage of technicians qualified to maintain and troubleshoot complex robotic refueling platforms. Unlike standard industrial robots, refueling systems combine mechanical, pneumatic, sensor, and software layers that require cross-disciplinary expertise. This skills gap increases dependence on vendor service contracts, which raises total cost of ownership and reduces the financial case for early adoption.

Together, these two constraints create a market access problem that disproportionately affects operators outside the aerospace and defense verticals. Vendors who address this through modular system design, remote diagnostics, and structured training programs will expand their addressable market faster than those who treat high-complexity installation as a feature rather than a barrier.

Growth Factors

Autonomous Vehicle Fueling Applications and Modular Airport Systems Unlock New Revenue Streams

Unmanned ground vehicles, autonomous delivery robots, and uncrewed naval vessels all require fuel or energy replenishment without human intervention. This creates a new product category — autonomous-to-autonomous refueling — where no human participates in either the vehicle or the fueling system operation. Vendors who engineer for this use case now position themselves ahead of a demand curve that the broader autonomous vehicle market is creating.

According to the International Federation of Robotics (IFR), worldwide sales of professional service robots rose by 30% in 2023, with over 205,000 units registered. This rate of expansion in non-manufacturing robotics confirms that buyers across multiple sectors have moved past proof-of-concept and into volume procurement — a pattern that directly benefits robotic refueling vendors targeting service-adjacent applications like airport ground support and logistics depot fueling.

In July 2025, Stratom was selected for a Phase I SBIR contract to develop an autonomous at-sea refueling system for uncrewed U.S. Navy surface vessels. This contract validates the commercial model for government-funded R&D partnerships, where technology providers receive non-dilutive funding to develop capability that then translates into proprietary product offerings for broader defense and commercial markets.

Emerging Trends

AI-Powered Predictive Maintenance and Remote-Controlled Systems Reshape Robotic Refueling Operations

AI integration in robotic refueling platforms moves maintenance from reactive to predictive. Systems now monitor wear patterns, fuel flow anomalies, and sensor degradation in real time, flagging components for replacement before failure occurs. Operators who deploy AI-enabled refueling systems report measurable reductions in unplanned downtime — a metric that directly determines return on investment in high-throughput environments like commercial airports.

Remote-controlled refueling systems enable operations in environments previously inaccessible to automated equipment — arctic oil fields, active combat zones, and offshore platforms with restricted crew capacity. This capability expansion effectively opens new market segments that were structurally blocked before remote-operation technology matured. According to IFR data on robot density, South Korea operates approximately 1,012 robots per 10,000 manufacturing employees — the highest globally — demonstrating that intensive automation deployment is operationally sustainable at scale, which validates long-term confidence in deploying complex systems like remote refueling in demanding environments.

Airport ground support integration is accelerating as airlines and ground handlers seek to consolidate automation vendors. Robotic refueling systems that communicate natively with flight operations software, gate management platforms, and fuel management systems reduce the number of integration touchpoints operators must manage. Vendors offering pre-certified integration with major airport ground support ecosystems shorten procurement approval cycles and reduce implementation risk.

Regional Analysis

North America Dominates the Robotic Refueling System Market with a Market Share of 39.50%, Valued at USD 86.2 Million

North America commands 39.50% of the global market, valued at USD 86.2 Million in 2025. The region benefits from established aerospace procurement infrastructure, large defense budgets directing capital toward autonomous refueling programs, and a regulatory environment in aviation that prioritizes ground crew safety. These structural conditions make North America the highest-conversion market for robotic refueling vendors entering commercial scale.

Europe Robotic Refueling System Market Trends

Europe occupies the second-largest position in the global robotic refueling landscape, supported by stringent occupational safety regulations and active EU-funded automation initiatives. German and Scandinavian industrial operators lead regional adoption, particularly in automotive manufacturing and airport ground operations. Regulatory pressure on hazardous manual fuel handling creates a compliance-driven case for robotic systems that shortens internal approval processes for capital expenditure.

Asia Pacific Robotic Refueling System Market Trends

Asia Pacific holds the fastest-expanding regional position, anchored by China’s aggressive industrial automation investment and rapid commercial aviation fleet expansion across Southeast Asia. Airports in the region face capacity constraints that make every minute of turnaround time commercially valuable, creating strong economic logic for automated refueling deployment. Local robotics manufacturing capability keeps integration costs lower than in other regions, supporting faster rollout timelines.

Middle East and Africa Robotic Refueling System Market Trends

The Middle East drives regional activity through oil and gas sector investment in hazardous-environment automation and through Gulf state aviation infrastructure expansion. Major airports in the UAE and Saudi Arabia are actively modernizing ground support operations, creating procurement windows for advanced refueling systems. Africa’s market remains at an early stage, with mining sector operators presenting the most viable near-term adoption pathway.

Latin America Robotic Refueling System Market Trends

Latin America presents a developing-stage market where mining operations in Chile, Peru, and Brazil represent the highest-concentration demand source. Infrastructure limitations and currency volatility create budget constraints that favor modular, lower-cost system configurations over full-scale deployments. However, government-led mining modernization programs in the region are beginning to allocate capital toward automation, signaling a gradual market entry opportunity for cost-competitive vendors.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Company Insights

ABB Limited positions itself as a full-stack automation integrator, leveraging its global industrial robotics portfolio to offer refueling system solutions that connect seamlessly with existing factory and infrastructure automation. Its advantage lies in cross-selling robotic refueling into existing ABB-automated facilities, where integration costs and approval timelines are dramatically shorter. This embedded position across industrial verticals gives ABB a structural sales efficiency that pure-play refueling vendors cannot replicate.

Scott Technology Ltd. focuses on specialized robotic end-effector design, which directly translates into precision fuel nozzle handling capability for aerospace and industrial clients. Its engineering-first positioning allows Scott to command premium pricing in technically demanding applications where standard industrial robots lack the dexterity required. This specialization creates a defensible niche, but also limits addressable market size compared to broader platform vendors.

AutoEnergy targets the commercial fueling station segment with robotic systems designed for high-cycle consumer and fleet vehicle refueling. Its market approach centers on reducing labor dependency at high-volume fuel retail locations, where shift-based staffing costs are a chronic margin pressure. AutoEnergy’s commercial focus differentiates it from aerospace-oriented competitors and positions it to capture a different buyer profile — fleet operators and fuel retail chains rather than government procurement offices.

Autofuel Aps builds its competitive strategy around multi-fuel compatibility, supporting both conventional and alternative fuel dispensing within the same robotic platform. This positions Autofuel advantageously as fleet operators manage mixed conventional and electric or hydrogen vehicles during the energy transition period. Operators selecting a single automated fueling platform for a transitioning fleet find Autofuel’s multi-fuel architecture significantly reduces future system replacement risk.

Key Players

- ABB Limited

- Scott Technology Ltd.

- AutoEnergy

- Autofuel Aps

- Rotec Engineering B.V

- Plug Power Inc.

- TATSUNO Corporation

- Mine Energy Group Pty Ltd.

- KUKA AG

- Adnoc Distribution

- Astroscale Japan Inc.

- Orbit Fab, Inc.

- Stratom, Inc.

- Others

Recent Developments

- October 2025 — Energy Robotics secured $13.5 million in Series A funding to accelerate commercial deployment of its autonomous inspection software platform for robots and drones in critical infrastructure sectors. This capital injection signals investor confidence in autonomous inspection as a companion technology to robotic refueling, where safety monitoring software increasingly determines system certification outcomes.

- August 2025 — Integrated Solutions for Systems (IS4S) unveiled the HERO (Helicopter Expedited Refueling Operations) autonomous fueling robot at the AUVSI Pathfinder 2025 event. The system targets automated aircraft refueling at forward arming and refueling points, confirming active military demand for deployable autonomous refueling platforms beyond fixed-base installations.

- January 2026 — Singapore-based Grab Holdings acquired Chinese AI robotics firm Infermove to strengthen delivery and autonomous robotics capabilities. Though not a direct refueling transaction, this acquisition reflects broader market consolidation around autonomous robotics platforms, indicating that strategic buyers across logistics and technology are moving to build comprehensive robotic operation portfolios.

Report Scope

Report Features Description Market Value (2025) USD 218.3 Million Forecast Revenue (2035) USD 15,007.8 Million CAGR (2026-2035) 46.90% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Hardware: Vehicle Positioning System, Control System, Robotic Arm, Fuel Dispensing System, Others; Software: Control Software, Navigation and Mapping Software, Safety and Monitoring Software, Data Analytics and Reporting Software, Integration Software), By Fuel Pumped (Gasoline, Natural Gas, Petrochemicals, Others), By Payload Carrying Capacity (Up to 50 Kg, 50–100 Kg, 100–150 Kg), By Industry Vertical (Aerospace, Mining, Automotive, Oil & Gas, Military & Defense, Warehouse & Logistics, Construction, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB Limited, Scott Technology Ltd., AutoEnergy, Autofuel Aps, Rotec Engineering B.V, Plug Power Inc., TATSUNO Corporation, Mine Energy Group Pty Ltd., KUKA AG, Adnoc Distribution, Astroscale Japan Inc., Orbit Fab Inc., Stratom Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Robotic Refueling System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Robotic Refueling System MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Scott Technology

- Fuelmatics AB

- Rotec Engineering B.V

- Neste

- Shaw development LLC

- PLUG POWER Inc.

- Aerobotix

- Airbus

- Boeing

- ABB Ltd.

- Simon Group Holding [SGH]

- Mine Energy Group

- Green Fueling Inc.

- Other Key Players