RNA Based Therapeutic Market By Type (RNA Interference (RNAi) technologies, RNA Antisense, Purification, Labeling, and Inhibition), By Application (Genetic Disorders, Oncology, Metabolic Disorders, Infectious Diseases, and Auto-immune Disorders), By End-user (Research Institutes, Hospitals & Clinics), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151331

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

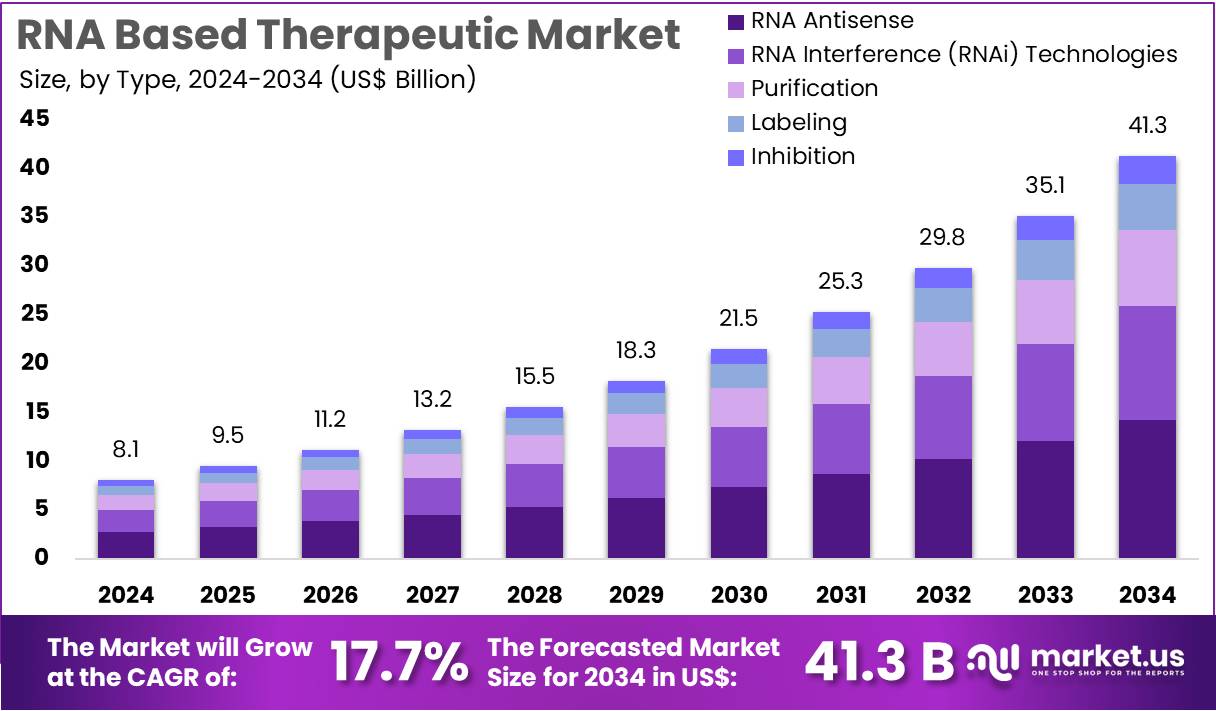

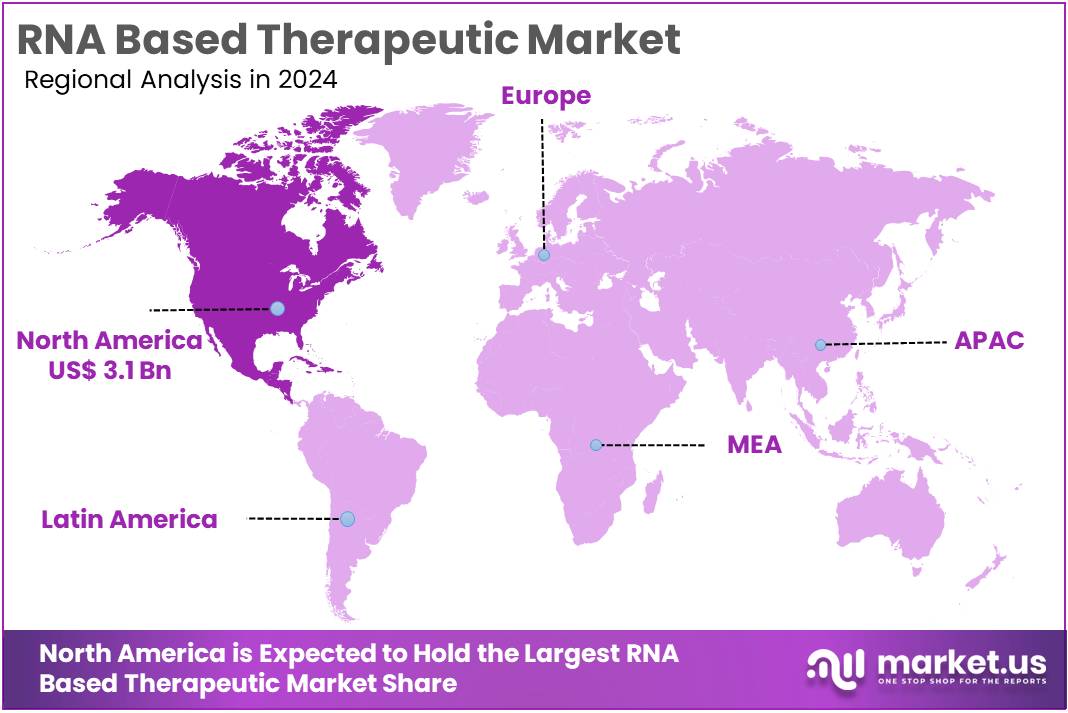

The RNA Based Therapeutic Market Size is expected to be worth around US$ 41.3 billion by 2034 from US$ 8.1 billion in 2024, growing at a CAGR of 17.7% during the forecast period 2025 to 2034. North America held a dominant market position, capturing more than a 37.8% share and holds US$ 3.1 Billion market value for the year.

Growing interest in personalized medicine and advancements in genetic research are driving the rapid expansion of the RNA-based therapeutic market. RNA-based therapies, including messenger RNA (mRNA) and small interfering RNA (siRNA) therapies, offer innovative treatment options for a wide range of conditions, including genetic disorders, cancers, and viral infections.

The success of mRNA vaccines, particularly in response to the COVID-19 pandemic, has significantly raised awareness of RNA-based technologies, further fueling their adoption in various therapeutic areas. These therapies offer precision treatment by targeting specific genetic sequences, enabling highly effective and tailored interventions with reduced side effects. The market benefits from continuous research and development, with new RNA-based treatments for rare and complex diseases progressing through clinical trials.

Increasing investments in RNA technology, as well as advancements in delivery systems, are opening new opportunities for market growth. In November 2024, Maravai LifeSciences, Inc. announced plans to acquire Officinae Bio’s DNA and RNA business. This acquisition will expand Maravai and TriLink BioTechnologies’ capabilities in supporting the development of novel nucleic acid therapies, strengthening their position in the global life sciences market. As more RNA-based therapies advance through the pipeline, the market is poised for significant growth, driven by ongoing innovation and increasing demand for targeted treatments.

Key Takeaways

- In 2024, the market for RNA based therapeutic generated a revenue of US$ 8.1 billion, with a CAGR of 17.7%, and is expected to reach US$ 41.3 billion by the year 2034.

- The type segment is divided into RNA interference (RNAi) technologies, RNA antisense, purification, labelling, and inhibition, with RNA antisense taking the lead in 2023 with a market share of 34.5%.

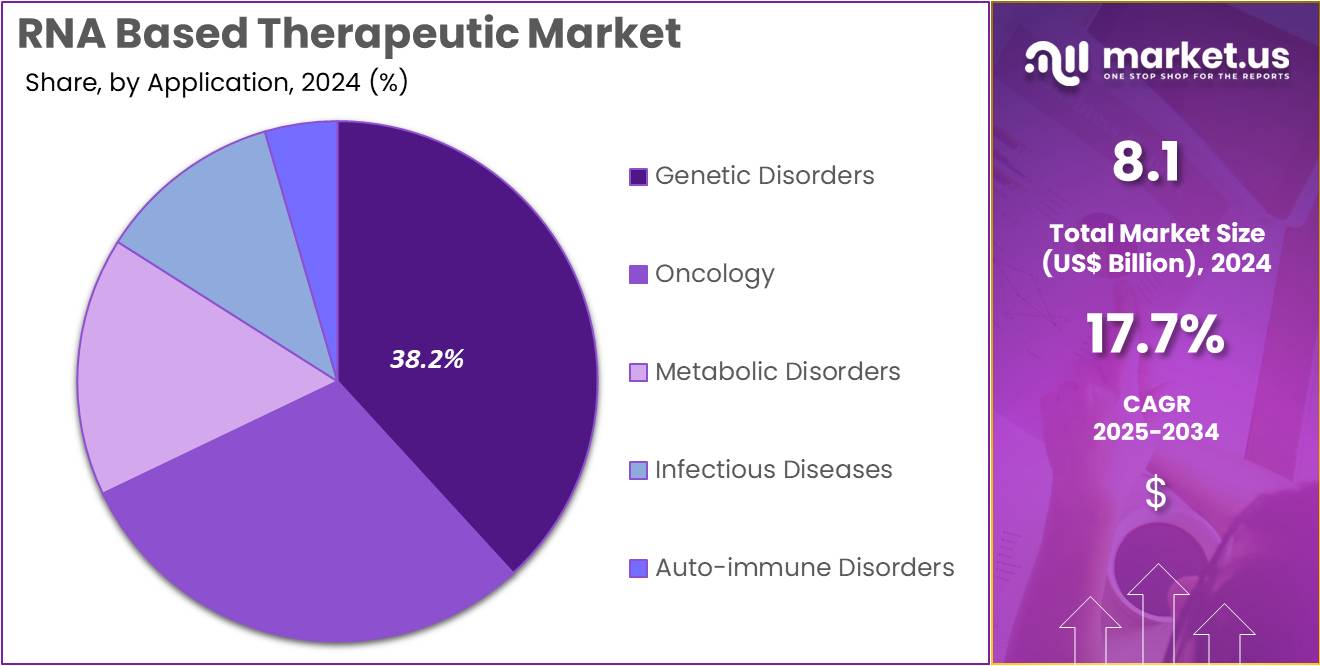

- Considering application, the market is divided into genetic disorders, oncology, metabolic disorders, infectious diseases, and auto-immune disorders. Among these, genetic disorders held a significant share of 38.2%.

- Furthermore, concerning the end-user segment, research institutes sector stands out as the dominant player, holding the largest revenue share of 45.8% in the RNA based therapeutic market.

- North America led the market by securing a market share of 37.8% in 2023.

Type Analysis

RNA antisense is expected to dominate the RNA-based therapeutic market, comprising 34.5% of the market share. This approach, which involves using synthetic RNA molecules to bind to and silence target messenger RNA (mRNA), has shown promising results in treating various genetic and viral diseases. The growing success of antisense therapies in clinical trials, particularly in diseases like spinal muscular atrophy and Duchenne muscular dystrophy, is projected to drive significant growth in this segment.

Antisense RNA therapies are anticipated to be a key tool in precision medicine, as they allow for highly targeted and specific gene silencing, which minimizes off-target effects. As regulatory agencies continue to approve antisense-based treatments, this segment is likely to expand, with more companies investing in developing antisense therapeutics for a wide range of disorders.

Application Analysis

Genetic disorders are expected to be the largest application segment in the RNA-based therapeutic market, accounting for 38.2% of the market share. The increasing prevalence of genetic disorders, coupled with the advancements in RNA-based therapies, is anticipated to drive the growth of this segment. RNA therapies, particularly RNA antisense and RNAi technologies, offer promising solutions to treat a range of genetic disorders, including rare and previously untreatable conditions.

The development of targeted therapies that can correct genetic defects at the mRNA level is projected to revolutionize the treatment landscape for these disorders. With a growing focus on gene editing and personalized medicine, the demand for RNA-based therapeutics in genetic disorders is likely to rise, further bolstering this segment’s market share.

End-User Analysis

Research institutes are projected to remain the dominant end-user in the RNA-based therapeutic market, holding 45.8% of the market share. These institutions are at the forefront of developing and advancing RNA-based technologies, including RNAi and antisense therapies. Research institutes play a critical role in the discovery and testing of new RNA-based therapeutics, driving innovation in the field.

The continued investment in genomic and molecular research, supported by government and private funding, will likely fuel the growth of this segment. As the understanding of RNA biology improves, research institutes are expected to expand their use of RNA-based technologies for therapeutic applications, disease modeling, and drug discovery. This growth is further supported by collaborations between academic researchers, pharmaceutical companies, and biotech firms, accelerating the development of RNA-based treatments.

Key Market Segments

By Type

- RNA Interference (RNAi) technologies

- RNA Antisense

- Purification

- Labeling

- Inhibition

By Application

- Genetic Disorders

- Oncology

- Metabolic Disorders

- Infectious Diseases

- Auto-immune Disorders

By End-user

- Research Institutes

- Hospitals & Clinics

Drivers

Growing Number of RNA-Based Drugs in Clinical Development is Driving the Market

The rapid expansion of the pipeline for RNA-based therapeutics, encompassing messenger RNA (mRNA) vaccines, small interfering RNA (siRNA), antisense oligonucleotides (ASOs), and microRNAs (miRNAs), is a primary driver for the market. These novel modalities offer unprecedented precision in targeting disease at the genetic level, promising breakthrough treatments for previously untreatable conditions, including rare genetic disorders, infectious diseases, and various cancers.

The US Food and Drug Administration (FDA) continues to receive a growing number of Investigational New Drug (IND) applications for RNA-based therapies; for example, the FDA’s Center for Biologics Evaluation and Research (CBER) has noted a significant increase in gene and cell therapy INDs, which includes many RNA-based modalities, from 2022 to 2024. This robust and diversifying pipeline, with an increasing number of candidates advancing to late-stage clinical trials and receiving regulatory approvals, directly fuels demand for the specialized research, development, and manufacturing capabilities in this innovative field.

Restraints

Challenges in Delivery and Stability of RNA Molecules are Restraining the Market

The RNA based therapeutic market faces significant restraint due to persistent challenges related to the efficient delivery and inherent instability of RNA molecules in vivo. Naked RNA molecules are susceptible to degradation by ubiquitous nucleases in the body and struggle to cross cell membranes to reach their intracellular targets, necessitating complex delivery systems such as lipid nanoparticles (LNPs) or viral vectors.

A 2024 review published in Nature Reviews Drug Discovery highlighted that overcoming challenges in RNA delivery remains a critical hurdle for unlocking the full potential of these therapeutics, particularly for systemic administration. The development and optimization of these delivery technologies add significant complexity and cost to the manufacturing process, impacting scalability and broad applicability, thus impeding the market’s rapid expansion.

Opportunities

Advancements in Delivery Technologies and Gene Editing Integration Create Growth Opportunities

Ongoing advancements in RNA delivery technologies, particularly the evolution of more stable and targeted lipid nanoparticles (LNPs), and the increasing integration of RNA-based approaches with gene editing technologies like CRISPR, present significant growth opportunities in the market. Innovations are focused on improving the specificity, efficacy, and safety profile of RNA delivery, enabling broader therapeutic applications and reducing off-target effects. For example, a 2024 study published in Science showcased novel LNP formulations capable of delivering mRNA more efficiently to specific cell types beyond the liver.

Furthermore, the use of guide RNAs in CRISPR-Cas9 systems highlights the symbiotic relationship between RNA and gene editing, opening new avenues for precise genetic modulation. These technological leaps are overcoming key biological barriers, making RNA therapeutics more viable for a wider range of diseases.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic factors significantly influence the RNA based therapeutic market, primarily through their impact on global healthcare expenditure, government funding for pandemic preparedness, and venture capital investment in biotechnology. Periods of robust economic growth often translate into increased national healthcare budgets and greater private sector investment in cutting-edge biotechnologies, facilitating the high-cost research and development characteristic of RNA therapeutics.

The global pharmaceutical R&D spending continued its upward trend, reaching significant levels in 2023-2024, as reported by various industry overviews, supporting this highly innovative field. Conversely, economic downturns or persistent high inflation can lead to tighter budgets, potentially slowing the pace of clinical trials or increasing scrutiny over reimbursement for novel, often expensive, RNA-based drugs.

Geopolitical factors, such as international trade agreements, intellectual property protections, and the stability of global supply chains for specialized nucleotides, enzymes, and lipid components, are also crucial. Disruptions caused by geopolitical tensions, as seen in 2024 with various trade and logistics issues, can increase costs and delay the delivery of critical raw materials and manufacturing equipment, impacting production timelines and costs for RNA therapeutics.

However, the transformative potential of RNA-based medicines to address urgent medical needs, especially in infectious diseases and oncology, ensures continued strategic investment and development, providing a strong foundation for the market’s long-term growth even amidst economic and political volatility.

Current US tariff policies can directly impact the RNA based therapeutic market by altering the cost of imported specialized nucleotides, enzymes, lipid components for nanoparticles, and advanced bioprocessing equipment crucial for RNA drug manufacturing. Given the complex and globally sourced nature of these high-tech components, tariffs imposed on key imports can significantly increase the operational costs for US-based pharmaceutical and biotechnology companies.

The US International Trade Commission (USITC) reported that US imports of key biotechnology components and reagents, including those used in RNA synthesis and purification, reached substantial values in 2023, indicating a broad exposure to potential tariff impacts. Such tariffs would directly raise manufacturing expenses, which could translate to higher prices for RNA therapeutics or reduced profit margins for developers, potentially affecting patient access or the financial viability of commercialization.

Conversely, these tariff policies can act as a powerful incentive for pharmaceutical companies to invest in expanding or establishing domestic manufacturing capabilities for RNA drug components and finished products within the US. This strategic shift towards localized production aims to create a more secure and resilient supply chain for critical RNA-based medicines, reducing dependence on potentially volatile international sources and enhancing national biopharmaceutical preparedness, despite the immediate challenges of increased initial investment and compliance costs.

Latest Trends

Increased Focus on Infectious Disease Preparedness and Pandemic Response is a Recent Trend

A prominent recent trend in the RNA based therapeutic market is the heightened and sustained focus on leveraging mRNA technology for infectious disease preparedness and rapid pandemic response. The success of mRNA vaccines during the COVID-19 pandemic has demonstrated their speed of development, flexibility, and efficacy in combating emerging pathogens. This has led to substantial government and private sector investment in establishing platforms for rapid mRNA vaccine and therapeutic development for future outbreaks.

The Biomedical Advanced Research and Development Authority (BARDA), a component of the US Department of Health and Human Services, announced in April 2024 new investments to expand domestic manufacturing capacity for mRNA vaccines as part of the Project NextGen initiative, aiming to accelerate the development of next-generation vaccines. This strategic emphasis ensures continued innovation and expansion of mRNA capabilities beyond COVID-19, addressing a critical global health priority.

Regional Analysis

North America is leading the RNA Based Therapeutic Market

North America dominated the market with the highest revenue share of 37.8% owing to a surge in research and development, expedited regulatory approvals, and substantial investments from major pharmaceutical companies. The US Food and Drug Administration (FDA) has actively approved a variety of RNA-based therapies, including messenger RNA (mRNA) vaccines and RNA interference (RNAi) therapeutics, with at least 21 such therapies approved as of April 2024.

This regulatory support fosters innovation and accelerates the market entry of new treatments. Companies at the forefront of this field reported significant revenues; Pfizer, a major player in mRNA technology, generated US$ 3.4 billion in Comirnaty (COVID-19 vaccine) revenue in Q4 2024. Moderna, another leader in mRNA therapeutics, reported US$ 3.1 billion in Spikevax sales for the full year 2024.

Furthermore, Alnylam Pharmaceuticals, a key developer of RNAi therapeutics, achieved global net product revenues of US$ 1.646 billion for the full year 2024 for its portfolio of approved RNAi medicines, demonstrating a 33% growth compared to 2023. These financial successes and ongoing regulatory milestones underscore the dynamic expansion of RNA-based medicine in the region.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing government support for biotechnology and pharmaceutical innovation, a rising prevalence of diseases addressable by these advanced therapies, and expanding manufacturing capabilities. China, for instance, has significantly increased its total expenditure on research and experimental development (R&D), which exceeded CNY 3.6 trillion (approximately US$ 0.5 trillion) in 2024, with a strong focus on biopharma and innovative drugs.

In Japan, the Japan Agency for Medical Research and Development (AMED) allocates substantial funding to advanced drug discovery and regenerative medicine, creating a fertile ground for RNA-based research. While specific regional revenue figures for all RNA-focused companies are not always publicly disaggregated, global players are directing attention to the Asia Pacific.

Moderna’s international sales, which include contributions from the Asia Pacific, were US$ 679 million in Q4 2024. This expanding research and development, coupled with a growing demand for effective treatments for various conditions, is anticipated to accelerate the adoption and development of RNA-based medicines across Asia Pacific.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the RNA-based therapeutics market employ various strategies to drive growth. They focus on expanding their product portfolios by developing novel therapies targeting a wide range of diseases, including genetic disorders, cancers, and infectious diseases. Companies invest in research and development to enhance the efficacy and safety profiles of their offerings.

Strategic partnerships with biotechnology firms, research institutions, and healthcare providers help accelerate innovation and facilitate the integration of new therapies into clinical practices. Additionally, players aim to strengthen their market presence by establishing manufacturing facilities and distribution networks in key regions, ensuring timely and efficient delivery of products to support the growing demand for RNA-based solutions.

Ionis Pharmaceuticals is a prominent player in the RNA-based therapeutics market. Headquartered in Carlsbad, California, Ionis specializes in discovering and developing RNA-targeted therapeutics. The company has three commercially approved medicines: Spinraza (nusinersen), Tegsedi (inotersen), and Waylivra (volanesorsen), and has four drugs in pivotal studies targeting diseases such as Huntington’s disease, amyotrophic lateral sclerosis (ALS), and cardiovascular conditions.

Ionis’s proprietary platform technology enhances the efficacy and safety profile of its therapeutics. The company’s strategic partnerships with major pharmaceutical entities further bolster its market presence and facilitate the advancement of its pipeline candidates. Ionis’s ability to consistently deliver results from its clinical trials has positioned it as a leader in the RNA space, contributing significantly to the overall growth of the market.

Top Key Players in the RNA Based Therapeutic Market

- Urban Therapeutics Inc

- Tekmira Pharmaceuticals Corp

- Silence Therapeutics PLC

- Pfizer

- Genzyme Corporation

- Dicerna Pharmaceuticals

- Benitec Biopharma Limited

- Alnylam Pharmaceuticals

Recent Developments

- In October 2024: Urban Therapeutics Inc. revealed its intention to lead advancements in RNA interference (RNAi)-based medicine. The company aims to develop innovative small interfering RNA (siRNA) “triggers” to enhance the efficacy and sustainability of RNAi-based therapeutics, broadening the potential applications of these medicines in the healthcare sector.

- In February 2024: UT Southwestern Medical Center collaborated with Pfizer to create RNA-enhanced delivery technology for gene therapy. This partnership, part of the Genetic Medicine Engineering Program at Dallas Medical Center, aims to improve the precision and effectiveness of RNA-based therapies for genetic disorders.

Report Scope

Report Features Description Market Value (2024) US$ 8.1 billion Forecast Revenue (2034) US$ 41.3 billion CAGR (2025-2034) 17.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type (RNA Interference (RNAi) technologies, RNA Antisense, Purification, Labeling, and Inhibition), By Application (Genetic Disorders, Oncology, Metabolic Disorders, Infectious Diseases, and Auto-immune Disorders), By End-user (Research Institutes, Hospitals & Clinics) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Urban Therapeutics Inc, Tekmira Pharmaceuticals Corp, Silence Therapeutics PLC, Pfizer, Genzyme Corporation, Dicerna Pharmaceuticals, Benitec Biopharma Limited, and Alnylam Pharmaceuticals. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  RNA Based Therapeutic MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

RNA Based Therapeutic MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Urban Therapeutics Inc

- Tekmira Pharmaceuticals Corp

- Silence Therapeutics PLC

- Pfizer

- Genzyme Corporation

- Dicerna Pharmaceuticals

- Benitec Biopharma Limited

- Alnylam Pharmaceuticals