Global Rice Derivative Market Size, Share and Report Analysis By Ingredient Type (Rice Starch, Rice Bran, Rice Germ, Rice Oil, Rice Protein, Rice Fats, Rice Flour, Ready To Use Powder, Liquid Rice Blend, Others), By Nature (Organic, Synthetic), By Form (Powder, Liquid), By Application (Animal Feed, Pharmaceutical, Food And Beverage, Cosmetics And Personal Care, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 176165

- Number of Pages: 271

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

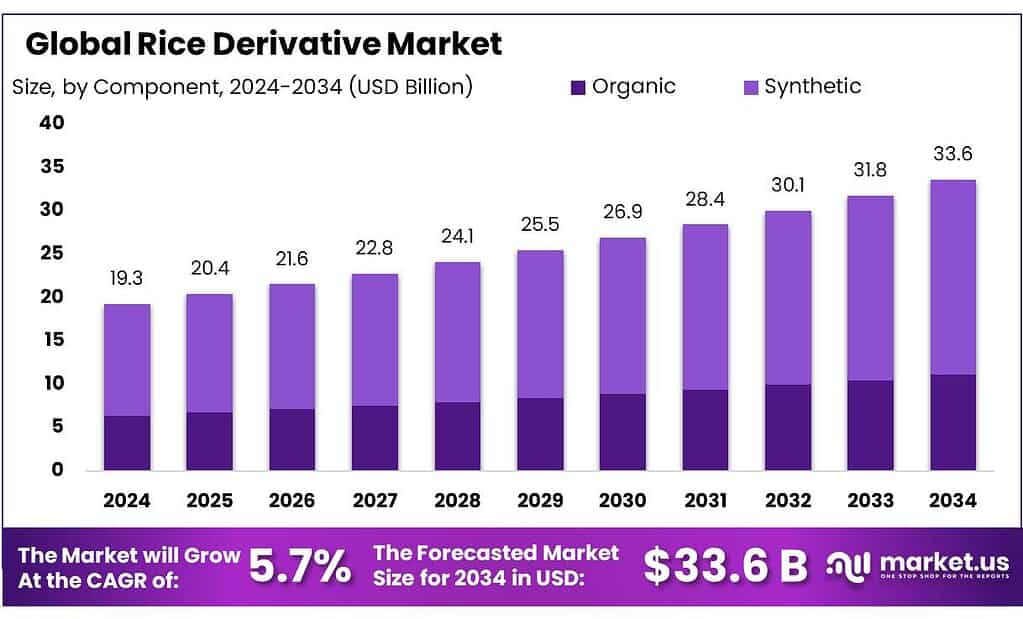

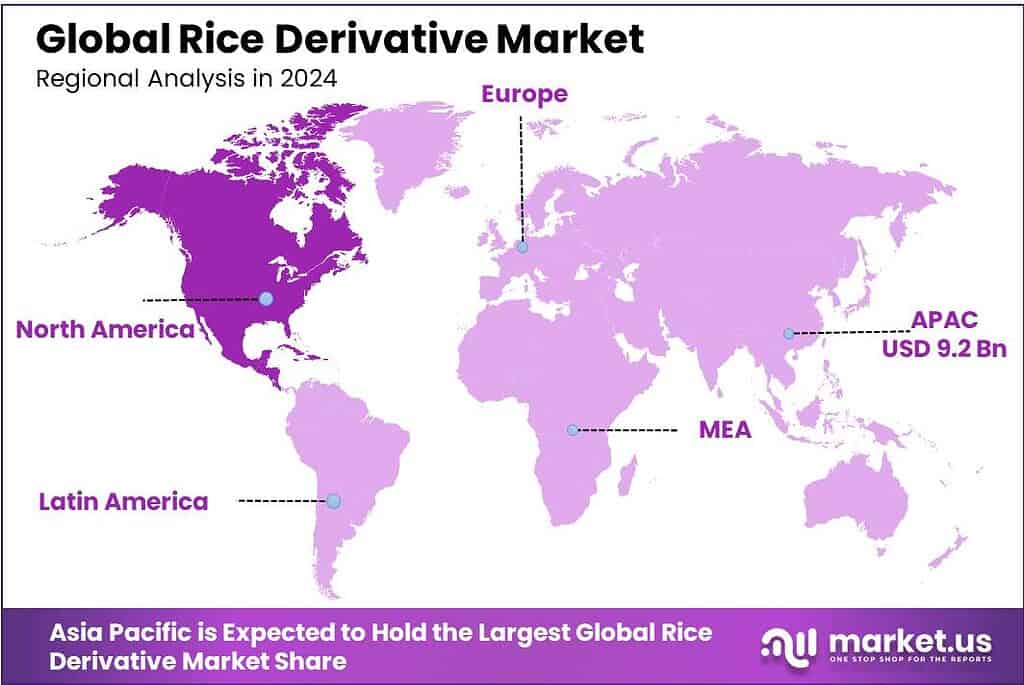

Global Rice Derivative Market size is expected to be worth around USD 33.6 Billion by 2034, from USD 19.3 Billion in 2024, growing at a CAGR of 5.7% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 48.1% share, holding USD 9.2 Billion in revenue.

Rice derivatives sit downstream of one of the world’s biggest food staples. In 2024/25, global rice production was estimated around 541.3 million metric tons (milled basis) and total use was projected to reach about 535.8 million tons, which keeps the ingredient pipeline large enough for steady industrial scaling.

- FAO’s latest outlook put world rice production for 2024/25 at ~543.3 million tonnes, while USDA FAS data shows ~541.3 million metric tons for 2024/2025—two closely aligned benchmarks that signal a large, stable raw-material pool for derivative processors.

On the policy/industrial side, biofuel blending targets have created a measurable pull for surplus grain and broken rice: India’s national ethanol blending program targets 20% blending by 2025, and public disclosures show scale-up activity—India reported 33.06 LMT of rice sold to ethanol distilleries during 2025.

- Reuters also reported the Food Corporation of India allocated 5.2 million metric tons of rice for ethanol in 2024/25, alongside a reported 19.8% blending achievement in a recent month—illustrating how grain-to-ethanol can directly influence downstream demand for rice-derived inputs and co-products.

Government actions are also shaping the industrial scenario, particularly in biofuels and grain management. India’s ethanol blending program sets a national target of 20% ethanol blending with petrol by 2025, which has encouraged more feedstock pathways beyond sugarcane.

In parallel, trade policy changes can quickly move derivative flows; for example, reporting in March 2025 highlighted India authorizing exports of 100% broken rice, with a domestic surplus cited at 67.6 million tons and an industry expectation of roughly 2 million tons of broken rice exports in 2025.

Key Takeaways

- Rice Derivative Market size is expected to be worth around USD 33.6 Billion by 2034, from USD 19.3 Billion in 2024, growing at a CAGR of 5.7%.

- Rice Starch held a dominant market position, capturing more than a 23.4% share.

- Synthetic held a dominant market position, capturing more than a 67.9% share.

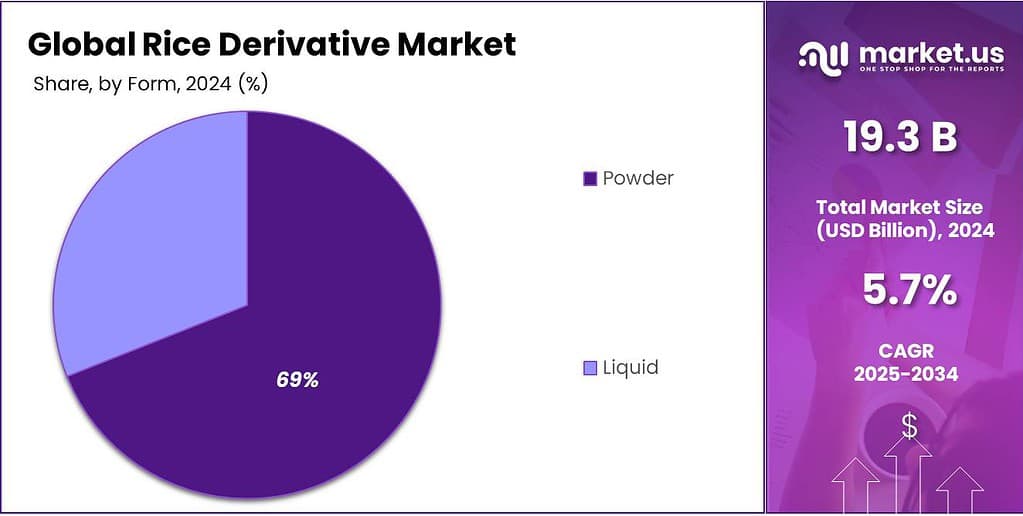

- Powder Correction held a dominant market position, capturing more than a 69.6% share.

- Food & Beverage held a dominant market position, capturing more than a 39.2% share.

- Asia Pacific holding 48.1% of the market and reaching USD 9.2 Bn.

By Ingredient Type Analysis

Rice Starch leads the category with a strong 23.4% share in 2024, supported by rising clean-label demand and wider food-processing use.

In 2024, Rice Starch held a dominant market position, capturing more than a 23.4% share, reflecting its growing relevance across food, beverage, and personal-care formulations. Manufacturers increasingly rely on rice starch because of its smooth texture, neutral taste, and allergy-friendly profile, which makes it suitable for baby foods, bakery fillings, snacks, and ready-to-eat meals.

The year saw steady uptake from clean-label product lines, where rice starch replaced chemically modified starches, helping brands meet stricter consumer expectations. Its use also expanded in coating systems for confectionery and plant-based products, where stable viscosity and transparency were key performance advantages.

By Nature Analysis

Synthetic category leads the rice derivative market with a strong 67.9% share in 2024, driven by consistent performance and large-scale industrial use.

In 2024, Synthetic held a dominant market position, capturing more than a 67.9% share, mainly because manufacturers rely on consistent quality, stable functionality, and predictable supply when formulating large-volume food and non-food products.

Synthetic variants of rice derivatives—particularly modified starches and processed rice-based ingredients—are widely used in packaged foods, bakery mixes, instant meals, confectionery coatings, and industrial applications where uniformity matters more than natural positioning. Their ability to deliver higher viscosity stability, improved shelf life, and better heat or freeze–thaw tolerance has kept them preferred among large processors that work with tight production standards.

By Form Analysis

Powder form leads the rice derivative market with a strong 69.6% share in 2024, supported by its versatility and wide industrial acceptance.

In 2024, Powder Correction held a dominant market position, capturing more than a 69.6% share, mainly because the powdered form of rice derivatives is easier to handle, mix, store, and transport across different industries.

Food processors prefer powder due to its long shelf life, stable flow characteristics, and quick solubility in both hot and cold applications. It is widely used in bakery mixes, instant foods, snacks, beverages, and nutraceutical formulations, where controlled dosing and consistent performance are essential. The year also saw an increase in powdered rice starch, rice flour, and rice protein utilization as brands focused on clean-label formulations and allergen-friendly ingredient systems.

By Application Analysis

Food & Beverage leads the rice derivative market with a solid 39.2% share in 2024, driven by rising clean-label and formulation needs.

In 2024, Food & Beverage held a dominant market position, capturing more than a 39.2% share, reflecting the strong dependence of global food manufacturers on rice-based ingredients for texture, stability, and nutritional enhancement. Rice starch, flour, syrup, protein, and bran-based components were widely used across bakery products, ready-to-eat meals, beverages, baby foods, snacks, and plant-based alternatives.

Their neutral taste, allergen-friendly nature, and ability to improve mouthfeel and shelf life made them preferred choices for reformulation efforts, especially in gluten-free and clean-label product lines. The year also saw higher inclusion of rice derivatives in functional beverages and fortified foods as brands sought natural carriers for nutrients and flavor systems.

Key Market Segments

By Ingredient Type

- Rice Starch

- Rice Bran

- Rice Germ

- Rice Oil

- Rice Protein

- Rice Fats

- Rice Flour

- Ready To Use Powder

- Liquid Rice Blend

- Others

By Nature

- Organic

- Synthetic

By Form

- Powder

- Liquid

By Application

- Animal Feed

- Pharmaceutical

- Food & Beverage

- Cosmetics & Personal Care

- Others

Emerging Trends

Rise of clean-label and plant-based demand is shaping rice derivative trends

One of the most defining trends in the rice derivative landscape today is the growing consumer preference for clean-label, plant-based, and hypoallergenic ingredients, and this shift is directly influencing how the industry innovates and grows. Simple, recognisable ingredients are no longer marketing buzzwords — they are becoming the foundation of product development in food, beverages, and even personal care, pushing producers to rethink rice derivatives not just as functional components, but as visible, trusted ingredients that meet evolving consumer expectations.

The clean-label and plant-based trend is also tied to broader dietary and health drivers. As people become more health conscious, demand for ingredients that are perceived as wholesome and native to traditional diets has continued to rise. For instance, rice protein and rice starch are increasingly viewed not merely as functional additives but as nutritional contributors — rice protein is often used in plant-based nutrition products because it offers a hypoallergenic alternative for people avoiding soy or dairy proteins.

Governments and regulatory bodies have also played a role in reinforcing this trend indirectly by clarifying standards around ingredient labelling and food additive approval. In the U.S., for example, rice protein isolates have received Generally Recognized as Safe (GRAS) status for use in infant nutrition, which not only affirms safety but encourages broader use in sensitive food categories where clean-label or allergen-free positioning matters most to consumers. This regulatory clarity reduces barriers for manufacturers considering rice-based ingredients in specialised applications.

Beyond packaged foods, the clean-label movement stretches into personal care and cosmetics, where simpler ingredient lists are increasingly preferred. Rice derivatives — especially rice starch and rice bran oil — are finding new roles in formulations that market sustainability, plant origins, and gentle performance. This broadened application elevates rice derivatives beyond traditional food roles into holistic ingredient platforms that appeal to consumers across everyday categories.

Drivers

Government-led rice fortification is a major demand driver for rice derivatives

One of the strongest driving forces for rice derivatives is the steady expansion of government-backed nutrition programs, especially rice fortification. When public systems choose fortified staples, they create large, predictable demand for the “ingredient layer” behind the grain—fortified kernels, premixes, carriers, stabilizers, and processing aids that are often produced using rice derivatives. In practical terms, this shifts rice derivatives from being “optional formulation ingredients” to being part of an essential nutrition supply chain.

The policy runway also looks long enough for manufacturers to invest with confidence. In October 2024, the Cabinet approved continuation of the universal fortified rice supply under government welfare schemes from July 2024 to December 2028. A multi-year continuation matters for industry because it reduces uncertainty: processors can plan capacity, procurement, and quality upgrades knowing there is a stable offtake environment for fortified-rice inputs and related rice-derivative ingredients.

The health rationale behind this demand driver is backed by national-level nutrition statistics. As referenced in Government of India releases, NFHS-5 (2019–21) shows anaemia remains widespread, including 57.0% among women and 67.1% among children (6–59 months). These figures help explain why fortification remains a priority: when a country targets micronutrient delivery at population scale, rice becomes a practical vehicle, and the supporting ingredient ecosystem—where rice derivatives are frequently used—grows alongside it.

This driver is further strengthened by the global rice supply foundation, which makes large-scale ingredient conversion feasible. USDA’s Rice Outlook (January 2026) reports record global rice output around 541.3 million tons (milled basis) in 2024/25, with 2025/26 production closely tracking that level. Abundant supply helps mills and processors secure raw materials that are commonly converted into starches, flours, syrups, and functional ingredients used in fortification systems and packaged foods.

Restraints

Rice price volatility and supply instability act as a key restraining factor for the rice derivative industry

One of the biggest restraining forces on the rice derivative market comes from rice price volatility and unstable supply conditions, which ripple through the entire value chain from farmers to processors. Rice derivatives like starch, flour, bran, and syrup depend on reliable, affordable access to raw rice or by-products. When rice prices swing unpredictably or supply becomes uncertain, it directly increases the cost of inputs, squeezes margins, and makes long-term planning much harder for manufacturers.

Rice has historically been subject to wide price fluctuations, and despite improvements in global production, price volatility remains a central concern for both commodity markets and food processors. The Food and Agriculture Organization (FAO) of the United Nations regularly monitors rice prices through its Rice Price Index, which tracks export quotations from major origins. These measures show how sensitive rice prices can be to changing market conditions, weather, policy decisions, and supply imbalances in major producing regions.

Another dimension of supply instability comes from external shocks and climate-related disruptions, which can affect rice harvests in major producing countries. Weather variability, droughts, floods, and pest outbreaks can reduce yields or damage crops, tightening supply and creating price instability. When rice production drops unexpectedly, rice derivatives become more expensive to produce, and manufacturers may divert limited raw materials to food staples instead of value-added processing. This can slow down growth in derivative segments such as rice starch, which require consistent feedstock volumes to justify processing investments.

Governments and global market actors have tried to mitigate these risks. For example, the Agricultural Market Information System (AMIS) was created to improve transparency and coordination in staple commodity markets including rice, bringing together FAO, OECD, IFPRI, and other bodies to share data and reduce uncertainty. However, despite these efforts, rice price instability continues to pose constraints, as policy responses, export restrictions, or climatic events can still lead to unpredictable market conditions.

Opportunity

Surplus rice-to-ethanol programs create a high-volume growth opportunity for rice derivatives

A major growth opportunity for rice derivatives is the rising industrial use of surplus rice in ethanol production, especially when governments actively push fuel blending targets. This shift matters because it creates a new, large-scale outlet for broken rice and rice-based feedstocks that are otherwise priced mainly for food use. When ethanol demand rises, it can pull more rice into industrial processing, which supports wider utilization of rice derivatives and strengthens investment in handling, storage, and conversion infrastructure.

This is not a small pilot move; it signals that rice can become a practical balancing tool when stockpiles rise, helping the system convert surplus into energy value. The same Reuters report also notes India’s gasoline blending ambition of 20% ethanol blending by 2025/26, and mentions the blending level reaching 19.8% in a recent month.

The policy framework is also supportive at the procurement level, which reduces uncertainty for industrial buyers. A Press Information Bureau (PIB) release states ethanol distilleries can purchase rice for ethanol production at ₹2,250 per quintal, with a cap of 24 LMT under the OMSS(D) policy. For rice derivative stakeholders, such policy clarity can create a dependable industrial demand floor during surplus cycles, supporting capacity utilization for processors connected to milling byproducts and surplus-grade rice streams.

Progress on blending volumes adds further confidence that demand can remain high. A Parliamentary document hosted on Sansad indicates that during Ethanol Supply Year (ESY) 2024–25, more than 1,000 crore litres of ethanol had been blended, achieving an average blending of 19.24% ethanol in petrol. Numbers at this scale suggest the blending program is no longer early-stage; it is a mature, operational demand engine that can absorb multiple feedstocks, including rice, depending on availability and economics.

Regional Insights

Asia Pacific dominates the Rice Derivative Market with 48.1% share, valued at USD 9.2 Bn, supported by scale in rice production and processing

Asia Pacific leads the rice derivative market because it sits on the world’s largest rice production and consumption base, which naturally supports high, continuous demand for rice starch, flour, bran, syrup, and protein. With Asia Pacific holding 48.1% of the market and reaching USD 9.2 Bn, the region benefits from dense milling networks, strong procurement ecosystems, and large food-processing clusters that use rice-based ingredients for texture, stability, and cost control in packaged foods and beverages.

A key strength is the sheer availability of raw material. USDA’s Rice Outlook projects global rice production at 541.2 million tons (milled basis) for 2025/26, and highlights India at 152 million tons, reinforcing how much supply sits within Asia’s core production belt. This raw-material advantage helps the region keep rice-derivative production economical, especially for high-volume applications such as noodles, snacks, bakery mixes, infant foods, and ready-to-eat meals.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Cargill remains a major rice-derivative supplier through its global ingredients portfolio, including starches and sweeteners used in food processing. In its FY2024 annual report, the company highlights $160B in annual revenues and 160K+ employees. It also notes operations across 70 countries and selling into 125 markets, supporting broad sourcing and distribution for rice-based inputs.

Shafi Gluco Chem markets itself as a sweeteners and proteins manufacturer, aligning well with rice syrup and related derivative demand. Trade-tracking data indicates export turnover of $13.99M (with imports $4.35M) during October 2024 to September 2025, pointing to active cross-border sales for food-grade outputs in that period.

ABF’s presence in ingredients and food manufacturing gives it a strong position to supply starch and specialty ingredient demand tied to cereal-based processing. In its FY2024 reporting, ABF cites group revenue of £20.1bn and a footprint of 138,000 employees across 56 countries—scale that supports industrial sourcing, QA systems, and multinational customer servicing.

Top Key Players Outlook

- Cargill

- Kowa India

- Shafi Gluco Chem

- Paras Group

- Associated British Foods

- Agarwal Group of Industries

- Muerens Natural

- Asharam & Sons

- SACCHETTO

- RIBUS

Recent Industry Developments

In 2024–2025, Shafi Gluco Chem strengthened its presence in the rice derivative sector by focusing on naturally sourced rice-based sweeteners, syrups, starches, and protein ingredients used across food and beverage formulations. The company reported export turnover of around $13.99 million during Oct 2024 – Sep 2025, with additional international trade activity supporting its global footprint.

In 2024, Cargill’s role in the rice-derivative space was mainly visible through its food-ingredients offer—helping brands use rice-based inputs for texture, bulking, and label simplicity in processed foods. The company positions itself as a global “ingredients-to-customers” partner, and its scale supports steady supply for ingredient buyers: 2024 Company Data: Annual revenues: $160B | Employees: 160K+ | Operating footprint: 70 countries | Selling to: 125 markets.

Report Scope

Report Features Description Market Value (2024) USD 19.3 Bn Forecast Revenue (2034) USD 33.6 Bn CAGR (2025-2034) 5.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredient Type (Rice Starch, Rice Bran, Rice Germ, Rice Oil, Rice Protein, Rice Fats, Rice Flour, Ready To Use Powder, Liquid Rice Blend, Others), By Nature (Organic, Synthetic), By Form (Powder, Liquid), By Application (Animal Feed, Pharmaceutical, Food And Beverage, Cosmetics And Personal Care, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Cargill, Kowa India, Shafi Gluco Chem, Paras Group, Associated British Foods, Agarwal Group of Industries, Muerens Natural, Asharam & Sons, SACCHETTO, RIBUS Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Cargill

- Kowa India

- Shafi Gluco Chem

- Paras Group

- Associated British Foods

- Agarwal Group of Industries

- Muerens Natural

- Asharam & Sons

- SACCHETTO

- RIBUS