Global Restaurant Takeout Market Size, Share, Growth Analysis By Payment Method (Digital Wallets, Debit Cards, Cash, Credit Cards), By Food Delivery (Mobile Applications, Websites), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 170259

- Number of Pages: 342

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

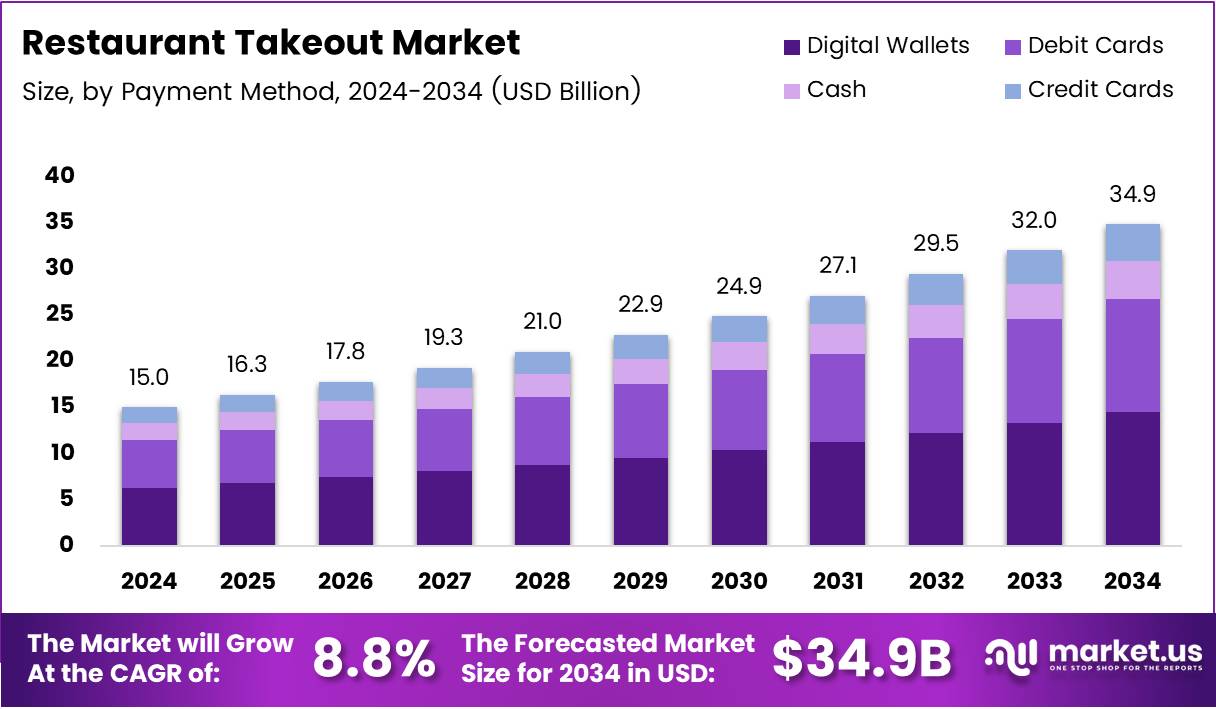

The Global Restaurant Takeout Market size is expected to reach around USD 34.9 Billion by 2034 from USD 15.0 Billion in 2024, growing at a CAGR of 8.8% during the forecast period from 2025 to 2034. This expansion reflects fundamental shifts in consumer dining preferences driven by urbanization and digital transformation.

The restaurant takeout market encompasses prepared meals ordered from restaurants for off-premises consumption. Subsequently, it includes services delivered through various channels such as mobile applications, websites, and traditional phone ordering systems. Modern takeout operations leverage cloud kitchens and delivery-only formats to optimize operational efficiency.

Urban lifestyles continue accelerating demand for convenient meal solutions across metropolitan areas globally. Moreover, busy professionals and dual-income households increasingly depend on takeout services for daily sustenance. Digital ordering platforms have revolutionized how consumers access diverse cuisines without dining in traditional restaurant settings.

Mobile technology integration has transformed the takeout landscape by simplifying order placement and payment processing. Furthermore, artificial intelligence enhances demand forecasting while automated kitchen systems improve preparation speed and accuracy. These technological advancements enable restaurants to serve larger customer bases with improved consistency.

Government regulations around food safety and delivery standards shape operational frameworks for takeout providers nationwide. Additionally, health departments enforce stringent packaging and temperature control requirements to ensure meal quality during transit. Compliance with these standards remains critical for maintaining consumer trust and brand reputation.

Growth opportunities emerge as service providers penetrate tier-II and tier-III cities through app-based platforms. Meanwhile, sustainable packaging innovations address environmental concerns while maintaining food integrity during delivery. Health-focused menus featuring customizable and diet-specific options attract wellness-conscious consumers seeking nutritious alternatives.

According to USDA ERS, food-away-from-home expenditures accounted for 58.9% of total food expenditures in 2024, demonstrating significant consumer spending patterns. Research from Food on Demand indicates that nearly 75% of all restaurant traffic now happens off-premises through takeout, drive-thru, or delivery channels.

The National Restaurant Association reports that 47% of adults pick up takeout at least once weekly, while 42% use drive-thru services and 37% order delivery weekly, highlighting widespread adoption across different service formats.

Key Takeaways

- Global Restaurant Takeout Market projected to reach USD 34.9 Billion by 2034 from USD 15.0 Billion in 2024

- Market expected to grow at a CAGR of 8.8% during the forecast period 2025-2034.

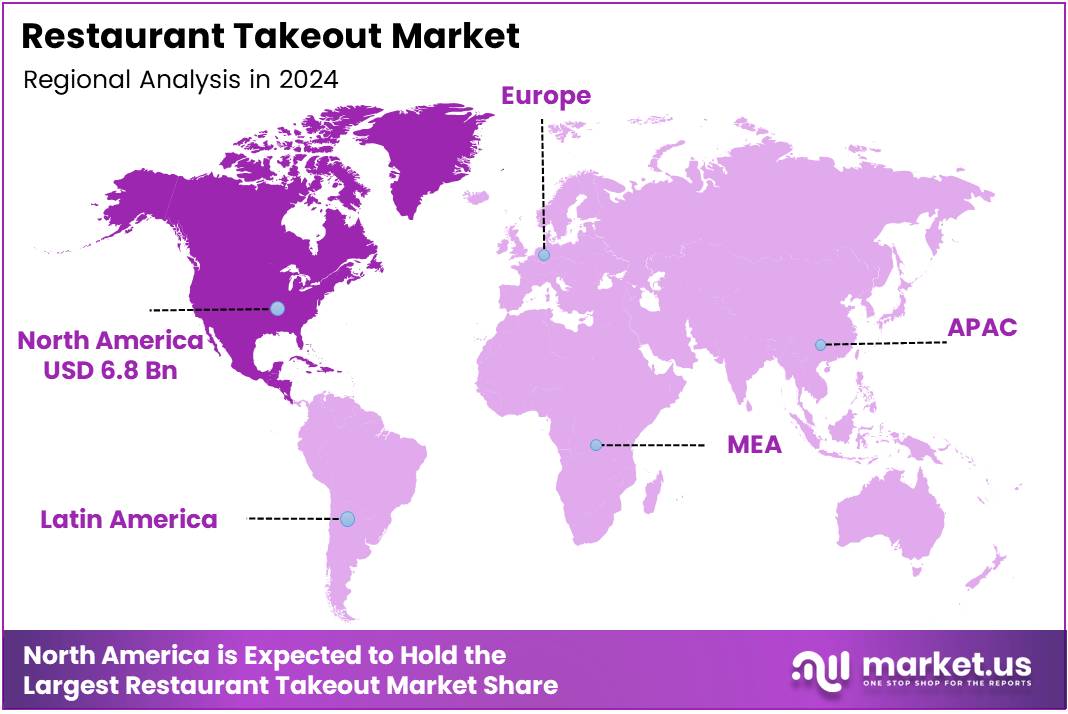

- North America dominates with 45.9% market share, valued at USD 6.8 Billion.

- Digital Wallets segment leads payment methods with 39.7% market share.

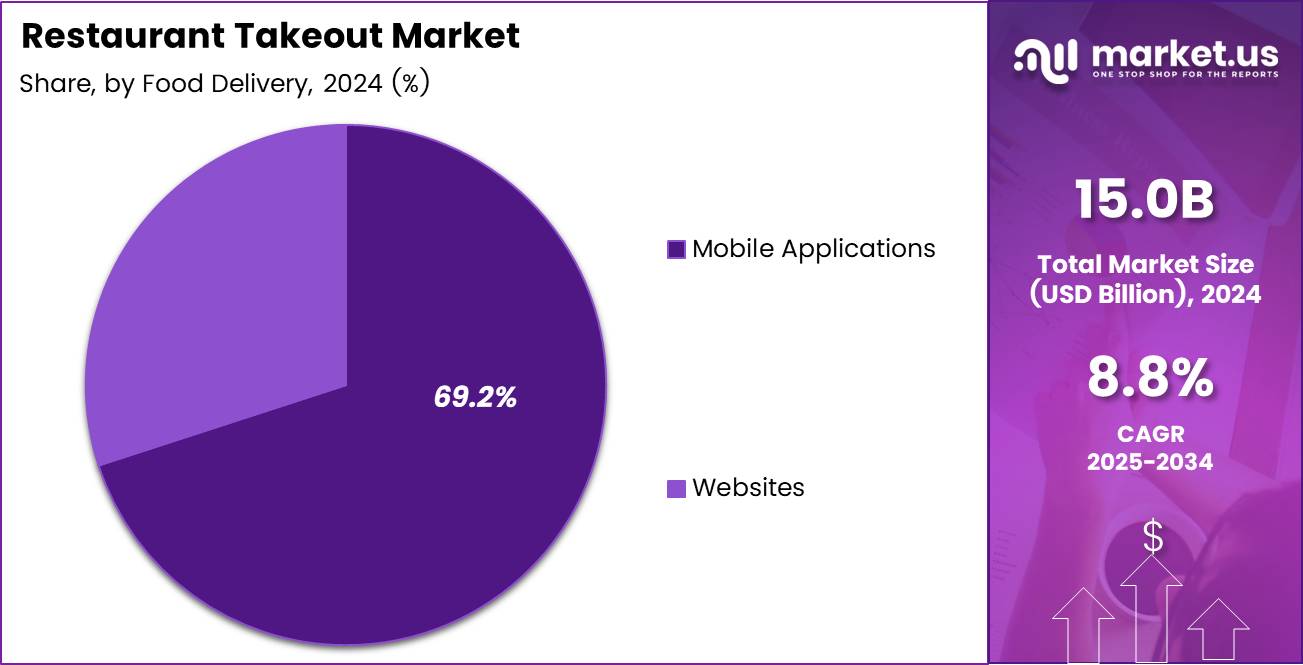

- Mobile Applications capture 69.2% share in food delivery channels.

- Food-away-from-home expenditures represent 58.9% of total food spending in 2024.

By Payment Method Analysis

Digital Wallets dominate with 39.7% due to seamless transaction experiences and enhanced security features.

In 2024, Digital Wallets held a dominant market position in the By Payment Method Analysis segment, capturing a 39.7% share. These platforms offer frictionless checkout experiences that reduce ordering time significantly. Additionally, they integrate loyalty rewards and promotional offers directly within payment interfaces. Enhanced encryption and tokenization technologies provide superior security compared to traditional payment methods, building consumer confidence.

Debit Cards represent a substantial payment segment within the restaurant takeout ecosystem. Subsequently, consumers prefer debit transactions for better budget control and immediate fund deduction. Many banking institutions offer cashback incentives specifically for food delivery purchases. This payment method appeals particularly to younger demographics who prioritize financial transparency.

Cash payments maintain relevance despite digital transformation trends across the takeout industry. Moreover, certain demographic segments and geographic regions continue preferring tangible currency transactions. Cash-on-delivery options accommodate consumers without banking access or digital payment infrastructure. However, contactless ordering trends gradually reduce cash transaction volumes.

Credit Cards facilitate higher-value orders and enable purchase flexibility for consumers. Furthermore, reward programs and travel points incentivize credit usage among frequent takeout customers. Premium credit cards often provide dining credits and exclusive restaurant partnerships. Nevertheless, processing fees impact restaurant margins compared to alternative payment methods.

By Food Delivery Analysis

Mobile Applications dominate with 69.2% due to superior user experiences and personalized recommendation engines.

In 2024, Mobile Applications held a dominant market position in the By Food Delivery Analysis segment, with a 69.2% share. These platforms provide intuitive interfaces optimized for smartphone navigation and quick order placement. Additionally, push notifications alert users about special offers, order status updates, and personalized menu suggestions. GPS integration enables real-time delivery tracking and accurate location-based restaurant discovery.

Websites serve as complementary channels for customers preferring desktop or laptop ordering experiences. Subsequently, they accommodate users in office environments or those wanting larger screen visibility for menu exploration. Website platforms typically mirror mobile functionality while offering expanded detailed views of menu items. Cross-device synchronization allows seamless transition between mobile and web ordering sessions for enhanced convenience.

Key Market Segments

By Payment Method

- Digital Wallets

- Debit Cards

- Cash

- Credit Cards

By Food Delivery

- Mobile Applications

- Websites

Drivers

Accelerating Consumer Preference for Convenience-Oriented Meal Solutions Drives Market Expansion

Urban professionals increasingly prioritize time-saving meal options that eliminate cooking and cleanup responsibilities. Consequently, takeout services provide immediate access to restaurant-quality food without traditional dining time commitments. Fast-paced lifestyles leave minimal time for meal preparation, particularly among dual-income households and working parents.

Digital platforms have simplified ordering processes to just a few smartphone taps or clicks. Moreover, integrated payment systems and saved preferences reduce transaction friction significantly. Consumers appreciate the ability to browse multiple restaurant options simultaneously while comparing menus, prices, and customer reviews.

Expanding delivery radius and faster fulfillment times enhance convenience factors driving adoption rates. Additionally, subscription models and loyalty programs incentivize repeat purchases through discounts and exclusive benefits. Cloud kitchen proliferation increases cuisine variety available for takeout without corresponding restaurant infrastructure investments.

Restraints

Increasing Commission Fees from Third-Party Platforms Create Margin Pressure for Restaurants

Third-party delivery aggregators typically charge commission rates between twenty and thirty percent per order. Subsequently, these fees significantly erode restaurant profit margins, particularly for independent operators with lower volume. Small establishments struggle balancing platform visibility benefits against substantial commission costs impacting financial sustainability.

Quality degradation during transit remains a persistent challenge affecting customer satisfaction and repeat business. Moreover, temperature fluctuations compromise food taste, texture, and safety standards during delivery journeys. Packaging limitations fail to maintain optimal conditions for certain menu items, resulting in negative reviews and refund requests.

Restaurants face difficult decisions regarding menu pricing strategies to offset delivery platform costs. Additionally, raising prices risks losing price-sensitive customers to competitors offering better value propositions. Direct ordering systems require substantial technology investments that many smaller operators cannot afford independently.

Growth Factors

Penetration of Takeout Services in Emerging Markets Creates Substantial Growth Opportunities

Tier-II and tier-III cities represent untapped markets with growing smartphone penetration and disposable income. Subsequently, app-based platforms expand geographic coverage to capture these emerging consumer segments. Lower operational costs in smaller cities enable competitive pricing strategies that accelerate market entry and adoption.

Sustainable packaging innovations address environmental concerns while enhancing food quality preservation during delivery. Moreover, heat-retentive and leak-proof materials maintain meal integrity and temperature standards. Eco-friendly packaging resonates with environmentally conscious consumers willing to support responsible business practices.

Health-focused menu development targets wellness-oriented consumers seeking nutritious takeout alternatives. Additionally, customizable options accommodate dietary restrictions, allergies, and specific nutritional preferences. AI-driven demand forecasting optimizes inventory management and reduces food waste significantly. Kitchen automation technologies improve preparation consistency while reducing labor costs and human error.

Emerging Trends

Rapid Growth of Cloud Kitchens Transforms Restaurant Takeout Business Models

Cloud kitchens operate without traditional dining spaces, focusing exclusively on delivery and takeout fulfillment. Consequently, these facilities reduce overhead costs while enabling multiple brand operations from single locations. Shared kitchen infrastructure allows restaurants to test new concepts with minimal financial risk.

Consumer preference shifts toward eco-friendly and recyclable packaging materials accelerate sustainable practices adoption. Moreover, regulatory pressures and brand reputation concerns drive restaurants toward environmentally responsible packaging solutions. Compostable containers and biodegradable utensils become standard offerings across leading takeout providers.

Loyalty programs and subscription-based meal plans enhance customer retention and predictable revenue streams. Additionally, contactless ordering, pickup lockers, and curbside services minimize physical interactions while improving operational efficiency. These innovations address hygiene concerns while accommodating consumer preferences for minimal-contact transactions during health-conscious periods.

Regional Analysis

North America Dominates the Restaurant Takeout Market with a Market Share of 45.9%, Valued at USD 6.8 Billion

North America leads the global restaurant takeout market with a commanding 45.9% share, valued at USD 6.8 Billion. The region benefits from advanced digital infrastructure and high smartphone penetration rates. Subsequently, established delivery platforms and mature cloud kitchen ecosystems support robust market growth. Consumer familiarity with online ordering and cashless payments further accelerates adoption across demographic segments.

Europe Restaurant Takeout Market Trends

Europe demonstrates steady growth driven by urbanization and busy professional lifestyles across major metropolitan areas. Moreover, diverse culinary traditions and multicultural populations create demand for varied cuisine options through takeout channels. Regulatory frameworks emphasizing food safety and sustainability shape operational standards for delivery providers.

Asia Pacific Restaurant Takeout Market Trends

Asia Pacific exhibits rapid expansion fueled by large population bases and increasing middle-class spending power. Additionally, mobile-first consumer behavior and affordable smartphone access drive digital ordering adoption rates. Dense urban centers with limited cooking facilities increase reliance on takeout services for daily meal requirements.

Middle East and Africa Restaurant Takeout Market Trends

Middle East and Africa show emerging potential as digital payment infrastructure and delivery networks expand. Subsequently, young demographics and rising disposable incomes support growing demand for convenient meal solutions. Investment in logistics and technology platforms gradually improves service quality and geographic coverage.

Latin America Restaurant Takeout Market Trends

Latin America experiences growth through increasing smartphone adoption and expanding e-commerce ecosystems. Moreover, urbanization trends and growing working populations drive demand for time-saving food solutions. Local restaurant chains increasingly partner with delivery aggregators to reach broader customer bases.

Key Restaurant Takeout Company Insights

The global restaurant takeout market features diverse players ranging from family dining establishments to fast-casual concepts. Denny’s operates extensive takeout services across its nationwide footprint, leveraging brand recognition and menu variety. Biscuitville focuses on southern-style breakfast and lunch offerings with emphasis on fresh, made-to-order takeout meals.

Bob Evans provides home-style comfort food through both dine-in and robust takeout operations targeting family demographics. The Original Pancake House specializes in breakfast and brunch takeout with premium ingredient quality and traditional recipes.

Village Inn combines family dining with takeout convenience through digital ordering platforms and curbside pickup. Perkins offers 24-hour takeout availability in many locations, serving diverse menu items from breakfast to dinner.

Huddle House operates primarily in smaller markets, providing accessible takeout options in underserved communities. Manchu Wok delivers Asian-inspired fast-casual takeout through mall locations and standalone restaurants.

HuHot Mongolian Grill adapts its customizable stir-fry concept for takeout packaging and delivery fulfillment. Fazoli’s specializes in fast-casual Italian cuisine with streamlined takeout processes and family meal bundles. Pappadeaux offers upscale seafood takeout, maintaining quality standards through specialized packaging and preparation methods.

Key Companies

- Denny’s

- Biscuitville

- Bob Evans

- The Original Pancake House

- Village Inn

- Perkins

- Huddle House

- Manchu Wok

- HuHot Mongolian Grill

- Fazoli’s

- Pappadeaux

Recent Developments

- In November 2024, Wonder announced its acquisition of Grubhub from Just Eat Takeaway for $650 million, consolidating delivery platform operations and expanding market presence significantly.

- In February 2025, Grubhub laid off around 500 employees following its acquisition by Wonder, streamlining operations to integrate with the new parent company structure.

- In May 2025, Wonder raised $600 million in new funding at a roughly $7 Billion valuation, demonstrating strong investor confidence in the food delivery sector.

- In May 2025, DoorDash announced an agreement to acquire Deliveroo valued at approximately £2.9 Billion (approximately $3.9 Billion), expanding international market coverage and operational capabilities.

- In May 2025, DoorDash announced the $1.2 Billion acquisition of SevenRooms, enhancing restaurant management technology and customer relationship capabilities across its platform ecosystem.

Report Scope

Report Features Description Market Value (2024) USD 15.0 Billion Forecast Revenue (2034) USD 34.9 Billion CAGR (2025-2034) 8.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Payment Method (Digital Wallets, Debit Cards, Cash, Credit Cards), By Food Delivery (Mobile Applications, Websites) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Denny’s, Biscuitville, Bob Evans, The Original Pancake House, Village Inn, Perkins, Huddle House, Manchu Wok, HuHot Mongolian Grill, Fazoli’s appadeaux Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Denny's

- Biscuitville

- Bob Evans

- The Original Pancake House

- Village Inn

- Perkins

- Huddle House

- Manchu Wok

- HuHot Mongolian Grill

- Fazoli's

- Pappadeaux