Global Residual Solvents Market Size, Share Analysis Report By Technology (Gas Chromatography, Liquid Chromatography, Spectroscopy, Others), By Type (Class 1, Class 2, Class 3), By Application (Pharmaceuticals, Food and Beverage, Cosmetics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153862

- Number of Pages: 283

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

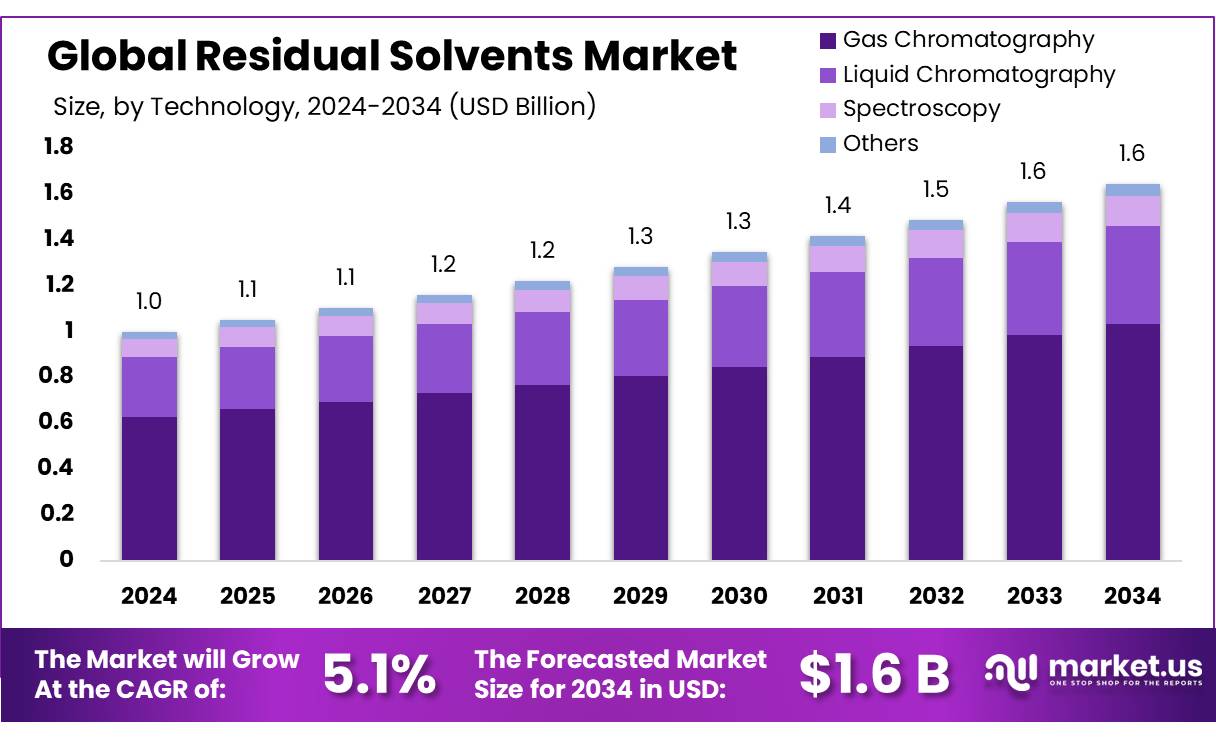

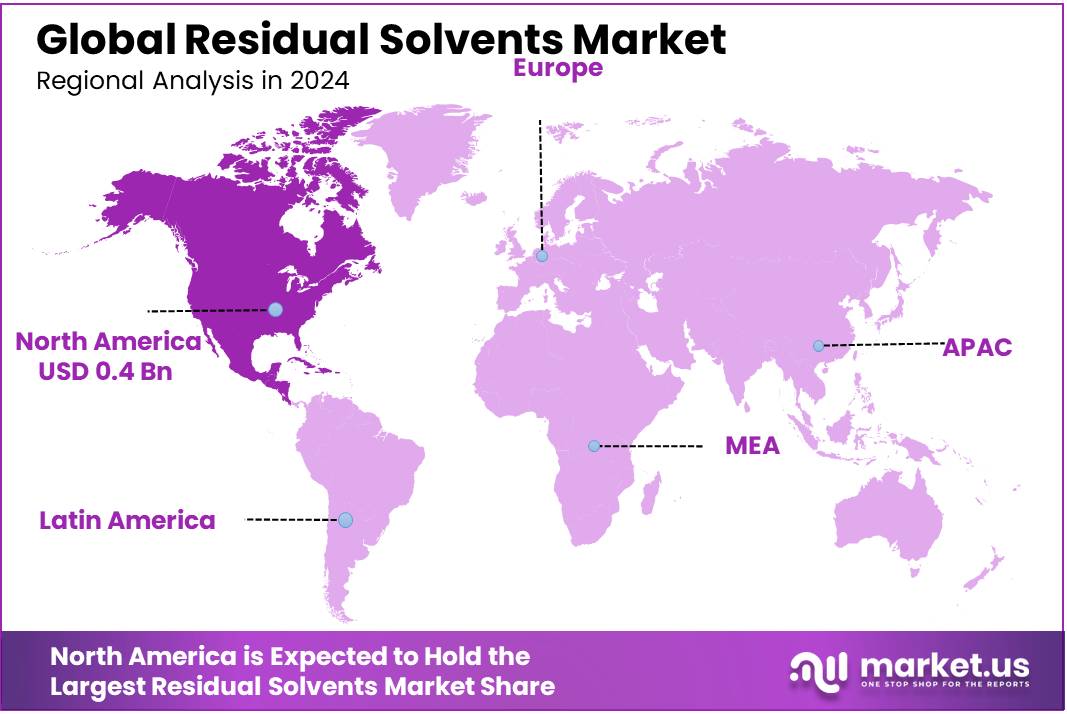

The Global Residual Solvents Market size is expected to be worth around USD 1.6 Billion by 2034, from USD 1.0 Billion in 2024, growing at a CAGR of 5.1% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 46.9% share, holding USD 0.4 Billion revenue.

Residual solvents concentrates are chemical formulations containing trace amounts of solvents used during the manufacturing of active pharmaceutical ingredients (APIs), excipients, or drug products. These solvents are typically removed during the production process; however, their residual presence can pose safety concerns, potentially affecting product stability and patient health. Consequently, stringent regulatory guidelines, such as those from the International Conference on Harmonisation (ICH), classify residual solvents into three classes based on their toxicity and environmental impact, necessitating rigorous testing and control measures.

In India, the chemical industry is a significant contributor to the economy, producing over 80,000 different chemical products. As of 2022, it accounted for approximately 7% of the country’s GDP and employed around five million people. The industry encompasses a diverse range of sectors, including bulk chemicals, specialty chemicals, agrochemicals, petrochemicals, polymers, and fertilizers. This diversification underscores the integral role of residual solvents concentrates in maintaining product purity and safety across various applications.

The Central Pollution Control Board (CPCB) in India has issued guidelines for the pharmaceutical industry to minimize solvent losses and ensure environmental compliance. According to these guidelines, the total cumulative losses of solvents should not exceed 5% of the solvent on an annual basis from storage inventory. These measures aim to reduce environmental impact and promote sustainable practices within the industry.

Government initiatives such as the Production Linked Incentive (PLI) Scheme for Active Pharmaceutical Ingredients (APIs) and the Scheme for Promotion of Bulk Drug Parks aim to boost domestic manufacturing and reduce reliance on imports. The PLI Scheme has an allocation of INR 6,940 crores, with INR 4,600 crores earmarked for agri and allied products, including pharmaceuticals . These initiatives are expected to enhance the quality control measures, including the management of residual solvents, in pharmaceutical manufacturing.

Key Takeaways

- Residual Solvents Market size is expected to be worth around USD 1.6 Billion by 2034, from USD 1.0 Billion in 2024, growing at a CAGR of 5.1%.

- Gas Chromatography held a dominant market position in the residual solvents market by technology, capturing more than a 62.9% share.

- Class 3 held a dominant market position in the residual solvents market by type, capturing more than a 58.2% share.

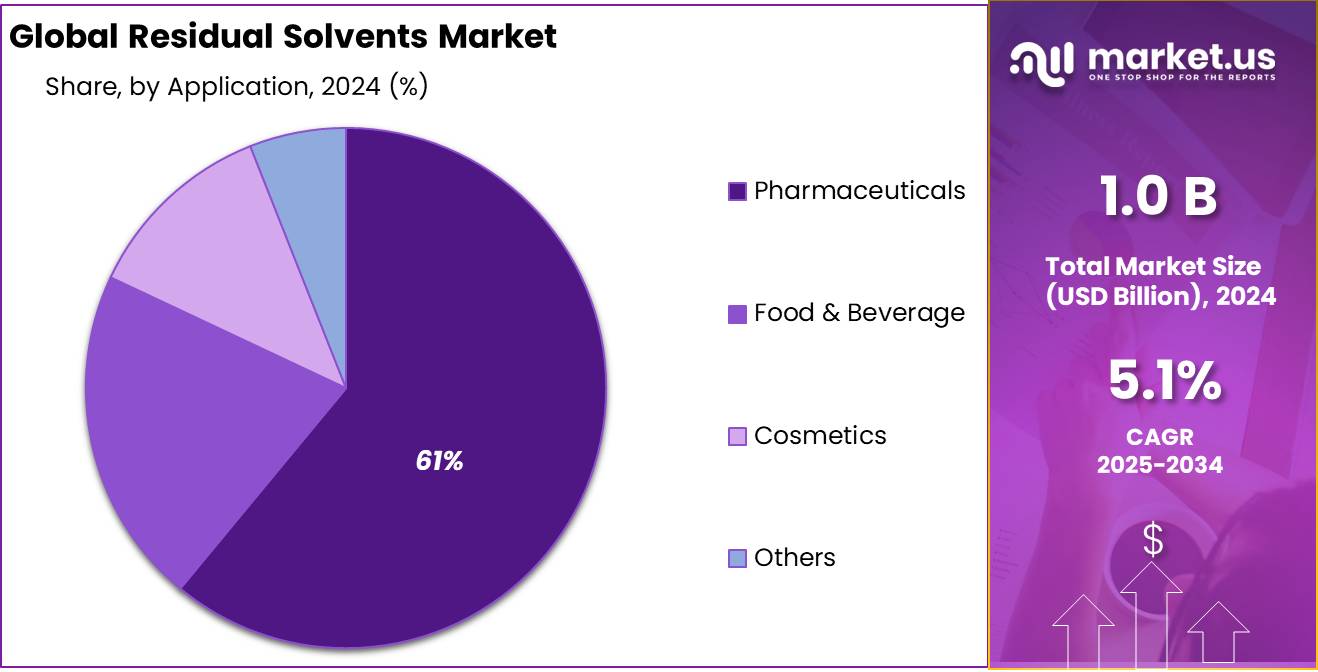

- Pharmaceuticals held a dominant market position in the residual solvents market by application, capturing more than a 61.3% share.

- North America secured a commanding position in the residual solvents market by region, accounting for approximately 46.9% of total market value, equivalent to around USD 0.4 billion.

By Technology Analysis

Gas Chromatography leads with 62.9% share due to its high accuracy and reliability.

In 2024, Gas Chromatography held a dominant market position in the residual solvents market by technology, capturing more than a 62.9% share. This leading position can be attributed to its strong ability to detect and quantify even trace amounts of volatile organic solvents in complex mixtures. The method is widely preferred across pharmaceutical, food, and chemical industries due to its precision, speed, and compliance with global testing standards. In 2025, the demand for gas chromatography is expected to remain high, supported by regulatory mandates and the continued need for quality assurance in drug and food production. Its compatibility with various detectors and automation systems further enhances its role as a standard tool for residual solvent analysis.

By Type Analysis

Class 3 Solvents dominate with 58.2% share due to lower toxicity and wider usage.

In 2024, Class 3 held a dominant market position in the residual solvents market by type, capturing more than a 58.2% share. These solvents are considered to have low toxic potential and are often used in pharmaceutical and food processing where minimal risk to human health is critical. Their acceptable daily intake levels are relatively higher, allowing manufacturers greater flexibility in formulations. By 2025, the continued reliance on Class 3 solvents is expected to sustain this dominance, especially in regions where regulatory frameworks permit their controlled use. Their widespread application, lower regulatory barriers, and ease of removal during processing have contributed to their strong market share.

By Application Analysis

Pharmaceuticals lead with 61.3% share due to strict quality control and solvent testing needs.

In 2024, Pharmaceuticals held a dominant market position in the residual solvents market by application, capturing more than a 61.3% share. This strong presence is driven by strict global regulations that mandate the monitoring and control of solvent residues in drug products. Regulatory agencies like the FDA and EMA require detailed documentation and compliance with permitted daily exposure limits, especially in active pharmaceutical ingredients (APIs) and finished dosage forms.

In 2025, the pharmaceutical sector is expected to maintain its leading role, supported by growing drug production, quality assurance practices, and rising demand for analytical testing. The need to ensure patient safety and product stability has made residual solvent analysis an essential step in pharmaceutical manufacturing.

Key Market Segments

By Technology

- Gas Chromatography

- Liquid Chromatography

- Spectroscopy

- Others

By Type

- Class 1

- Class 2

- Class 3

By Application

- Pharmaceuticals

- Food & Beverage

- Cosmetics

- Others

Emerging Trends

Adoption of Advanced Analytical Techniques for Residual Solvent Detection

A significant trend in the food industry is the increasing adoption of advanced analytical techniques to detect and quantify residual solvents in food products. As consumer awareness about food safety grows, manufacturers are investing in state-of-the-art technologies to ensure their products meet stringent safety standards.

This growth is primarily driven by the stringent regulatory requirements imposed by governmental and international bodies such as the United States Food and Drug Administration (FDA) and the European Medicines Agency (EMA), which mandate rigorous testing of food products to ensure they meet safety and efficacy standards.

Advanced techniques such as Gas Chromatography-Mass Spectrometry (GC-MS) and High-Performance Liquid Chromatography (HPLC) are becoming standard in food testing laboratories. These methods offer high sensitivity and specificity, allowing for the detection of trace amounts of solvents that could pose health risks. For instance, the FDA’s guidance on residual solvents in pharmaceuticals emphasizes the importance of using validated analytical methods to ensure product safety.

Moreover, the U.S. Food and Drug Administration (FDA) has launched initiatives to enhance the safety of food chemicals, including residual solvents. In May 2025, the FDA announced a new post-market chemical review program aimed at increasing transparency and ensuring the safety of chemicals in the food supply. This initiative includes updating lists of chemicals under review and expediting the review of substances that concern consumers, such as certain preservatives and additives.

Drivers

Stringent Regulatory Requirements and Safety Standards Driving Growth in Residual Solvents Management

The growing emphasis on safety regulations and standards in food manufacturing is a significant driver of the residual solvents market. Residual solvents, often used during food processing and packaging, must be minimized due to their potential risks to human health. As such, various global agencies have put stringent guidelines in place to ensure consumer safety.

In 2023, the U.S. Food and Drug Administration (FDA) reaffirmed its commitment to regulating residual solvents in food products, maintaining a zero-tolerance policy for substances that can negatively affect public health. These regulations are part of a broader effort by organizations like the European Food Safety Authority (EFSA) and the World Health Organization (WHO), who continue to set limits for solvent residues in food and beverages. The EFSA’s scientific opinion on solvent use in food emphasizes that acceptable levels must be maintained within highly specific thresholds. Failure to comply with these standards can lead to product recalls, severe reputational damage, and legal repercussions, driving the need for enhanced solvent control systems in food production.

Additionally, food manufacturers have started adopting more sophisticated testing techniques, including gas chromatography and high-performance liquid chromatography (HPLC), to detect trace amounts of solvents in finished goods. According to the U.S. Department of Agriculture (USDA), around 68% of food manufacturing companies implemented enhanced testing protocols in 2022 to comply with evolving regulations.

Government-backed initiatives also encourage the shift toward safer practices. In 2023, the U.S. Environmental Protection Agency (EPA) launched programs to reduce the use of harmful solvents in food processing, offering funding and technical support to companies that implement environmentally friendly practices.

Restraints

High Costs of Compliance and Testing for Residual Solvents

One of the major restraining factors for managing residual solvents in the food industry is the high cost of compliance and testing. As governments continue to enforce stricter regulations on the use of solvents in food processing, manufacturers are facing significant financial challenges. Implementing rigorous testing protocols, purchasing advanced equipment, and hiring specialized personnel to handle these tasks can be costly, especially for small to medium-sized food companies.

In the U.S., the Food and Drug Administration (FDA) and the U.S. Environmental Protection Agency (EPA) have mandated stringent testing standards for residual solvents in food products. For instance, food manufacturers must conduct regular testing for trace amounts of solvents using techniques such as gas chromatography and high-performance liquid chromatography (HPLC). These tests can cost thousands of dollars per sample, leading to an increase in overall operational costs. According to the USDA, approximately 56% of small food manufacturers reported that the costs of testing and compliance had a significant impact on their bottom line in 2022.

Moreover, food companies are also required to invest in training staff to ensure proper solvent management practices and to maintain ongoing certification for compliance. In Europe, the European Food Safety Authority (EFSA) has set guidelines for residual solvent levels that necessitate costly adaptations in food production lines to ensure products meet the required standards. The expense of installing new equipment, maintaining quality control, and regularly training staff creates an ongoing financial burden for companies.

Opportunity

Growing Demand for Organic and Clean Label Products

A significant growth opportunity in the residual solvents market is the increasing demand for organic and clean label products. Consumers are becoming more health-conscious and are looking for food products that are free from harmful chemicals, including residual solvents. This shift toward organic and clean label foods is driving food manufacturers to adopt safer and more sustainable practices in their production processes.

In 2023, the Organic Trade Association (OTA) reported that the U.S. organic food market reached a record USD 60 billion in sales, marking a 12.4% increase from the previous year. This growth in organic food demand is expected to continue as consumers increasingly prioritize transparency in food labeling and are willing to pay a premium for products that meet clean label standards. As a result, food companies are under pressure to reduce or eliminate residual solvents from their manufacturing processes to appeal to this growing market segment.

Government initiatives are also supporting this trend. In 2022, the U.S. Department of Agriculture (USDA) expanded its organic certification program to include more food categories, making it easier for producers to label their products as organic. This has further fueled consumer interest in organic foods, driving manufacturers to seek out alternative processing methods that minimize the use of solvents. Additionally, the European Union’s Green Deal and Farm to Fork Strategy, introduced in 2020, emphasize the need for sustainable food production, encouraging companies to adopt cleaner production techniques.

Regional Insights

North America dominates with 46.9% share and USD 0.4 billion market size, driven by strong industry and regulatory infrastructure.

In 2024, North America secured a commanding position in the residual solvents market by region, accounting for approximately 46.9% of total market value, equivalent to around USD 0.4 billion. This dominant standing can be ascribed to the region’s extensive pharmaceutical and biotechnology sectors, which demand rigorous residual solvent testing to meet stringent regulatory standards. Agencies such as the U.S. Food and Drug Administration (FDA), United States Pharmacopeia (USP), and the International Council for Harmonisation (ICH) enforce comprehensive guidelines that compel manufacturers to conduct detailed solvent quantification and ensure patient safety.

Regional market dynamics are bolstered by high consumer awareness regarding product safety and purity, which drives demand for transparent testing protocols and validated analytical methodologies. Key growth enablers include the early adoption of automated and AI‑enhanced solvent analysis systems, enabling laboratories in North America to improve throughput, reduce turnaround time, and enhance detection sensitivity.

In addition, government-led quality assurance initiatives and pharmacopoeial updates—such as incorporation of ICH Q3C guidelines into USP chapter <467>—have elevated the importance of residual solvent control in manufacturing and quality systems. These regulatory enhancements have translated into consistent year‑on‑year analytical expenditure, thereby underpinning the USD 0.4 billion regional market figure in 2024 and reinforcing North America’s position as the most significant regional contributor within the global residual solvents landscape.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Agilent Technologies is a global leader in analytical instrumentation, providing innovative solutions for residual solvents analysis. The company offers a wide range of products, including Gas Chromatography-Mass Spectrometry (GC-MS) systems and high-performance liquid chromatography (HPLC) instruments. Agilent’s advanced technologies are designed to meet stringent regulatory standards and provide accurate, reliable results in residual solvent detection. With its extensive expertise and broad product portfolio, Agilent plays a crucial role in ensuring the safety and quality of food and pharmaceutical products.

Fuli Instruments is a renowned manufacturer of high-performance analytical equipment, focusing on providing solutions for residual solvent analysis. The company offers advanced gas chromatographs (GC) and other analytical instruments designed to deliver precise solvent detection. Fuli Instruments’ products are used extensively in the pharmaceutical, food, and chemical industries to ensure compliance with regulatory standards and improve product safety. The company’s commitment to innovation and customer satisfaction has established it as a key player in the residual solvents market.

Bruker is a leading player in the analytical instruments market, offering advanced solutions for residual solvent detection. The company’s portfolio includes state-of-the-art Gas Chromatography-Mass Spectrometry (GC-MS) systems and Fourier Transform Infrared (FTIR) spectroscopy. Bruker’s instruments are widely used in food, pharmaceutical, and environmental sectors for accurate, high-resolution analysis of residual solvents. Bruker’s cutting-edge technologies are designed to support compliance with global safety and quality regulations, playing a vital role in enhancing product integrity across industries.

Top Key Players Outlook

- Agilent Technology

- Beifenruili

- Bruker

- Fuli Instruments

- LECO

- PerkinElmer

- Shimadzu

- Techcomp

- Thermo Fisher Scientific

Recent Industry Developments

In the fourth quarter of 2024, Bruker reported revenues of $979.6 million, marking a 14.6% increase compared to the same period in 2023.

In 2024, Agilent reported total revenues of $6.79 billion to $6.87 billion, with a notable contribution from its Life Sciences and Applied Markets Group (LSAG), which generated $3.22 billion, accounting for approximately 47% of the company’s total revenue.

Report Scope

Report Features Description Market Value (2024) USD 1.0 Bn Forecast Revenue (2034) USD 1.6 Bn CAGR (2025-2034) 5.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Technology (Gas Chromatography, Liquid Chromatography, Spectroscopy, Others), By Type (Class 1, Class 2, Class 3), By Application (Pharmaceuticals, Food and Beverage, Cosmetics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Agilent Technology, Beifenruili, Bruker, Fuli Instruments, LECO, PerkinElmer, Shimadzu, Techcomp, Thermo Fisher Scientific Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Agilent Technology

- Beifenruili

- Bruker

- Fuli Instruments

- LECO

- PerkinElmer

- Shimadzu

- Techcomp

- Thermo Fisher Scientific