Global Regulatory Data Management Market Size, Share, Growth Analysis By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Compliance Systems, Financial Transaction Systems, Cloud Infrastructures, Data Storage, Transfer and Processing Systems, Identity Management Systems, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare and Life Sciences, IT and Telecommunications, Energy and Utilities, Retail and E-commerce, Manufacturing, Government and Public Sector, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2035

- Published date: Feb 2026

- Report ID: 178412

- Number of Pages: 205

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Effective Takeaways

- By Component

- By Deployment Mode

- By Organization Size

- By Application

- By End-User Industry

- Key Market Segments

- Regional Analysis

- US Market Size

- Driving Factors

- Restraint factors

- Growth Opportunities

- Trending factors

- Competitive Analysis

- Future Predictions

- Recent Developments

- Report Scope

Report Overview

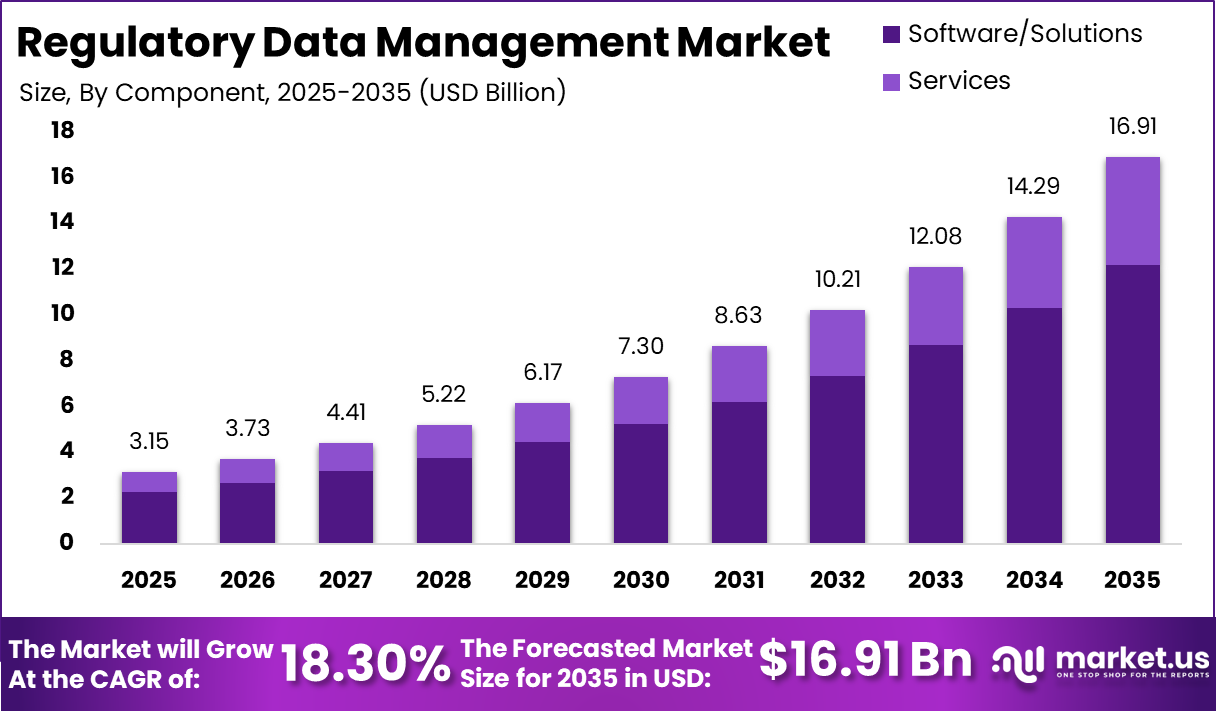

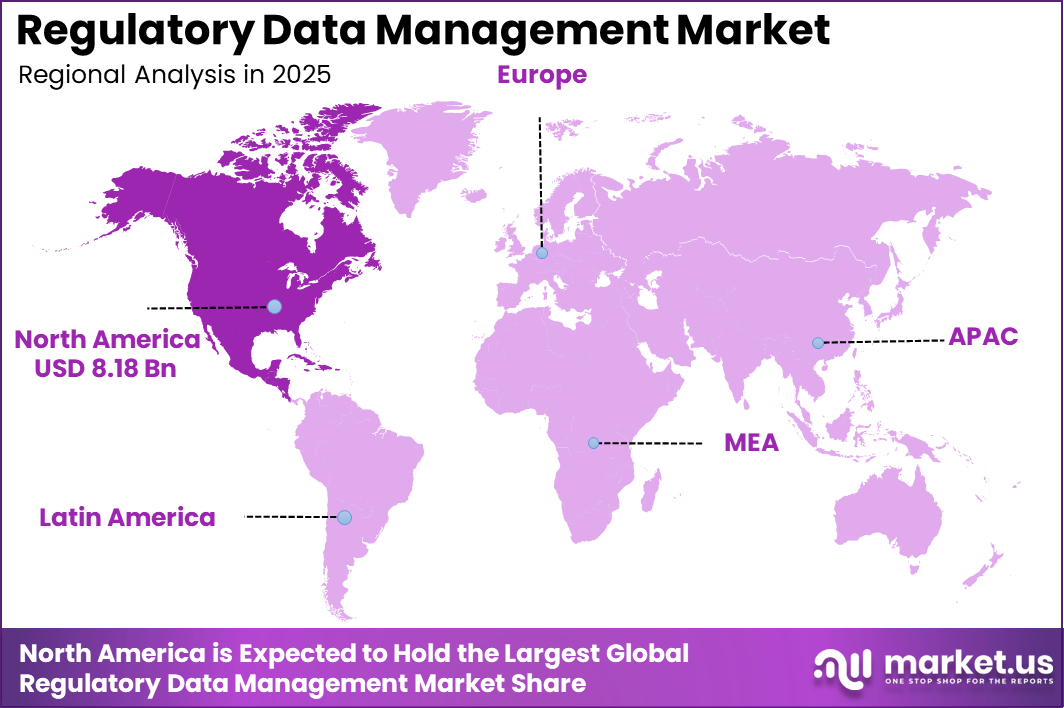

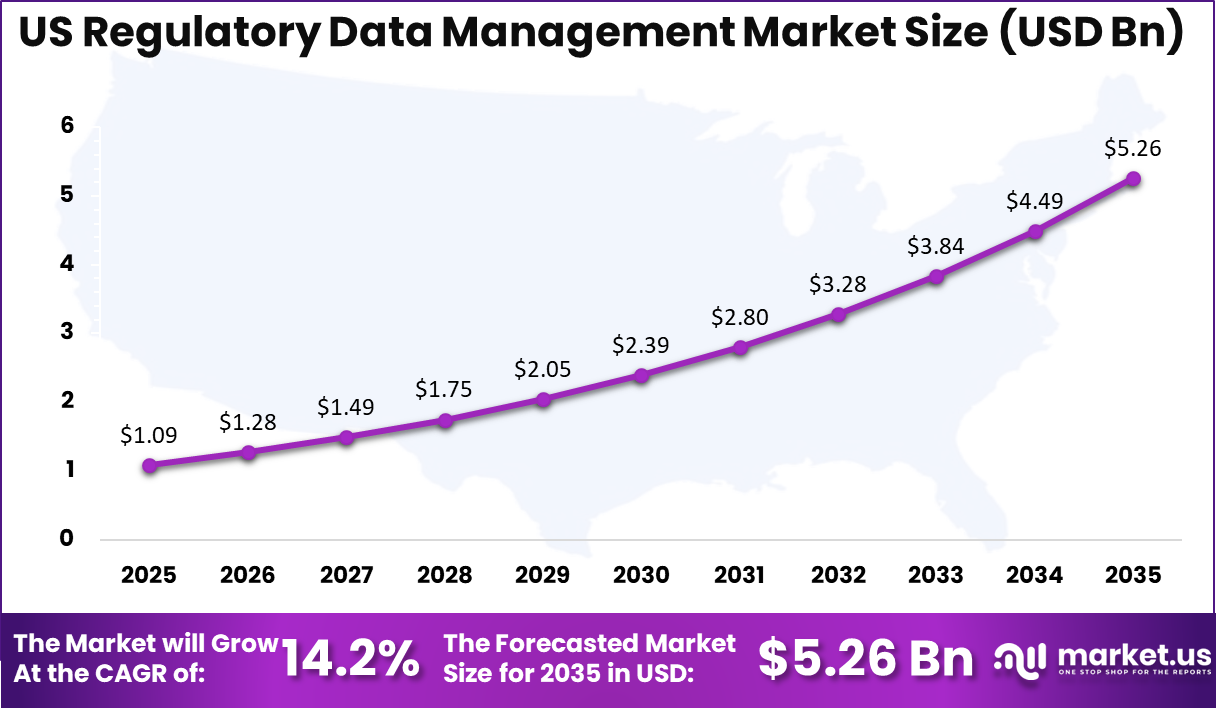

The Regulatory Data Management Market is valued at USD 3.15 billion in 2025 and is projected to reach USD 16.91 billion by 2035, expanding at an 18.30% CAGR over the period. North America accounts for 38.5% share in the provided dataset. Within the region, the US market is valued at USD 1.09 billion in 2025 and is projected to reach USD 5.26 billion by 2035 at a 17.04% CAGR.

Regulatory data management is becoming a core capability for organizations operating in highly regulated environments such as banking, insurance, healthcare, life sciences, energy, and large-scale digital platforms. As reporting obligations expand across data privacy, cybersecurity, financial controls, and industry-specific compliance, enterprises are prioritizing systems that standardize regulatory data, improve traceability, and reduce the operational burden of audits and recurring filings.

This demand is reinforced by increasing enforcement activity and the shift toward data-intensive supervision, where regulators expect faster, more consistent, and well-documented submissions. North America’s leadership reflects strong compliance maturity and continuous investments in data governance, while US adoption is being shaped by enterprise-wide efforts to reduce manual reporting, strengthen audit readiness, and improve the reliability of regulatory submissions across complex data environments.

Effective Takeaways

- In 2025, the Regulatory Data Management Market stands at USD 3.15 billion.

- An 18.30% CAGR indicates sustained high growth momentum through the forecast period.

- By 2035, the market is projected to expand to USD 16.91 billion.

- North America leads adoption with a 38.5% market share.

- North America recorded a market size of USD 8.18 billion in 2025.

- The US market is valued at USD 1.09 billion, reflecting strong enterprise compliance spend.

- US demand is expected to scale to USD 5.26 billion by 2035 as reporting and audit needs intensify.

- A 17.04% CAGR positions the US as a fast-growing core market within North America.

By Component

Software and solutions account for 72% share of the regulatory data management market, while services represent the remaining 28%. Software and solutions hold the dominant position because buyers prioritize repeatable compliance outcomes that can be embedded into daily data operations. Regulated organizations typically start by standardizing regulatory data models, mapping obligations to data elements, and setting validation rules that improve reporting consistency across business units.

Software layers that support lineage, audit trails, issue management, and workflow approvals are increasingly treated as core infrastructure because they reduce manual reconciliation and make evidence generation faster during audits.

This also explains why solution-led adoption is stronger in complex environments where data is distributed across multiple systems and teams. In practice, buyers evaluate platforms on how well they integrate with existing data stacks, enforce governance controls, and generate regulator-ready datasets with clear traceability.

Services remain essential but are used more selectively, often for implementation, data mapping, integration, and change management during rollouts. Many organizations prefer to build internal capability after initial deployment, using services for specialized tasks such as remediation, control redesign, or expansion into new regulatory domains. As a result, services grow alongside software, but software retains the larger share because it delivers ongoing compliance automation and measurable operational efficiency.

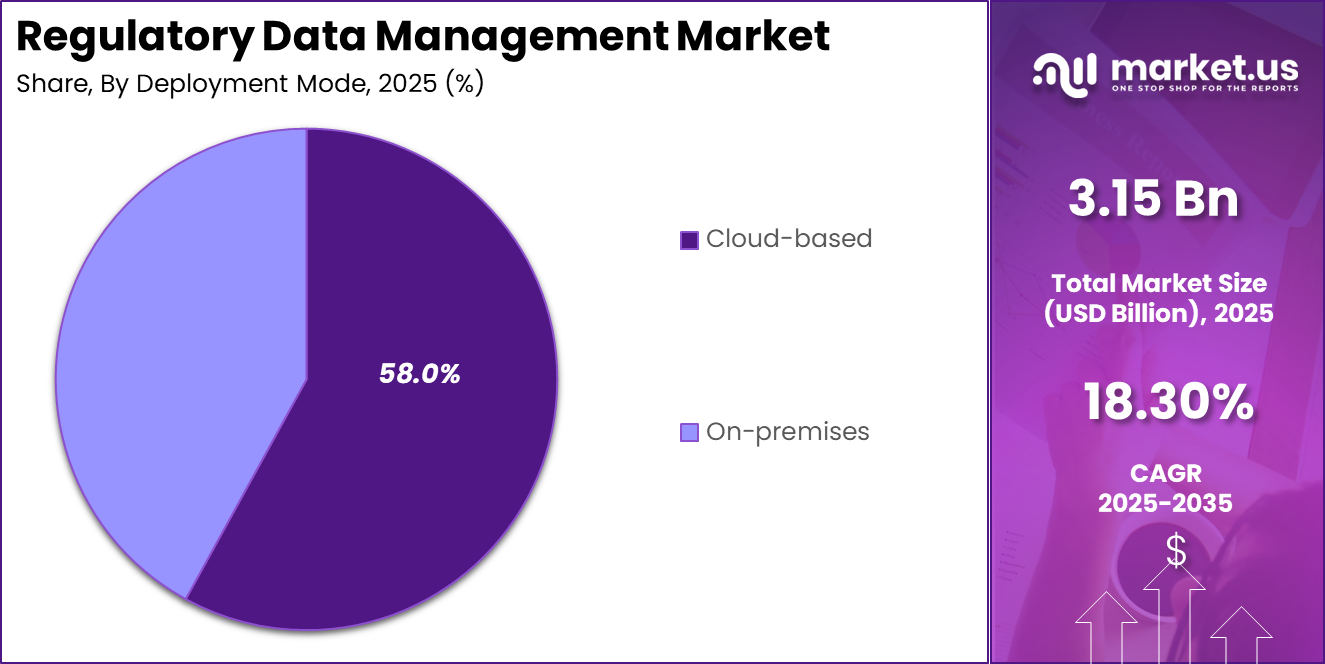

By Deployment Mode

Cloud-based deployments account for 58% share of the regulatory data management market, while on-premises models represent the remaining 42%. Cloud-based regulatory data management is gaining stronger adoption because it helps organizations scale compliance operations faster across regions, entities, and reporting cycles.

Many regulated firms are modernizing data estates and need a deployment model that supports frequent updates, rapid integration with cloud data platforms, and centralized governance across distributed teams. Cloud platforms also support faster onboarding of new business units and new reporting workflows, which is important when regulations change and deadlines are fixed.

For global organizations, cloud delivery improves collaboration between compliance, risk, IT, and audit teams by enabling consistent access controls, standardized data definitions, and shared evidence repositories. Buyers also value the ability to automate monitoring and validation, which helps reduce manual reconciliation and improves audit readiness.

On-premises deployments continue to be preferred in environments with strict data residency rules, legacy dependencies, or internal policies that require direct infrastructure control. Highly regulated sectors with complex legacy systems may also keep sensitive workloads on premises to align with internal security frameworks and long-established operational processes. As a result, cloud-based adoption is growing, but on-premises remains relevant where regulatory scrutiny, integration constraints, and risk tolerance favor tighter in-house control.

By Organization Size

Large enterprises account for 68% share of the regulatory data management market, while small and medium-sized enterprises represent the remaining 32%. Large enterprises dominate adoption because regulatory data management challenges scale sharply with organizational complexity. Multinational groups typically operate across multiple legal entities, product lines, and reporting regimes, which creates fragmented data ownership and inconsistent definitions across departments.

This increases the need for centralized platforms that can standardize regulatory taxonomies, enforce data quality rules, and maintain end-to-end lineage from source systems to reported outputs. Large enterprises also face more frequent audits and supervisory interactions, so they prioritize solutions that produce defensible evidence trails, automate issue remediation workflows, and reduce the time required to prepare recurring filings.

In many cases, these organizations are also modernizing data architectures, which increases the value of tools that integrate across hybrid environments and provide consistent governance controls at scale. SMEs adopt these solutions more selectively, often starting with narrower compliance scopes driven by specific reporting obligations, customer requirements, or industry audits.

Budget constraints and limited in-house compliance technology expertise can slow deployment, which shifts demand toward simpler implementations and managed service support. Even so, SME adoption is rising as regulations expand and digital operations grow, but large enterprises remain the primary spenders because the operational and regulatory risk exposure is higher and the ROI from automation is easier to justify.

By Application

Compliance systems account for 35% share of the regulatory data management market, while the remaining 65% is distributed across financial transaction systems, cloud infrastructures, data storage transfer and processing systems, identity management systems, and other use cases.

Compliance systems lead because they sit closest to day-to-day regulatory obligations and provide the most direct workflow automation for audits, attestations, policy controls, and reporting calendars. Regulated organizations often begin modernization here since compliance teams need a single source of truth for obligations mapping, evidence collection, approvals, and exception handling.

When these functions are managed through structured systems, organizations can reduce manual tracking across spreadsheets and emails, improve accountability through role-based workflows, and shorten the cycle time needed to prepare regulator-ready packages. This application area also benefits from clear ROI, since improvements can be measured through reduced remediation effort, faster audit response, and fewer repeat findings. The other application areas grow in parallel because regulatory requirements increasingly depend on the underlying data and technology stack.

Financial transaction systems require consistent reference data and reconciled reporting outputs, cloud infrastructures require governance and policy enforcement across environments, data storage and processing systems require lineage and retention discipline, and identity management systems support access controls and proof of segregation of duties. Even so, compliance systems retain the largest share because they orchestrate the overall compliance process and connect regulatory expectations to operational execution.

By End-User Industry

Banking, financial services, and insurance account for 32% share of the regulatory data management market, while the remaining 68% is distributed across healthcare and life sciences, IT and telecommunications, energy and utilities, retail and e-commerce, manufacturing, government and public sector, and other industries. BFSI leads adoption because regulatory reporting and supervisory scrutiny are continuous and data-intensive, covering areas such as risk, capital, liquidity, financial crime controls, consumer protection, and operational resilience.

Banks and insurers manage high volumes of sensitive customer and transaction data across complex product portfolios, which increases the need for strong data lineage, standardized definitions, and auditable evidence trails. Regulatory data management platforms help BFSI organizations reduce reconciliation effort between risk, finance, and compliance functions, improve data quality controls, and respond faster to regulator requests with repeatable reporting workflows.

The sector also tends to invest earlier in governance automation because the cost of non-compliance and remediation can be high, and audits often require detailed traceability from source systems to reported outcomes. Other industries are adopting rapidly as regulations expand beyond finance into privacy, cybersecurity, and sector-specific compliance.

Healthcare and life sciences need controlled data for patient safety and regulated documentation, IT and telecom face privacy and infrastructure security obligations, and energy utilities increasingly manage critical infrastructure and resilience reporting. Even so, BFSI retains the largest share because of the breadth, frequency, and complexity of regulatory obligations tied directly to enterprise data.

Key Market Segments

By Component

- Software/Solutions

- Services

By Deployment Mode

- Cloud-based

- On-premises

By Organization Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Compliance Systems

- Financial Transaction Systems

- Cloud Infrastructures

- Data Storage, Transfer, and Processing Systems

- Identity Management Systems

- Others

By End-User Industry

- Banking, Financial Services, and Insurance

- Healthcare and Life Sciences

- IT and Telecommunications

- Energy and Utilities

- Retail and E-commerce

- Manufacturing

- Government and Public Sector

- Others

Regional Analysis

North America accounts for 38.5% share in the provided dataset, with a 2025 regulatory data management market size of USD 8.18 billion. Within the region, North America remains the most mature region for regulatory data management adoption because regulated industries operate at scale and face frequent, high scrutiny examinations.

Large enterprises in banking, insurance, healthcare, and life sciences typically manage complex data estates spread across business units, products, and legacy platforms, which increases the need for standardized regulatory data definitions, lineage, and audit trails. The US market’s strong growth profile reflects ongoing pressure to reduce manual reporting, improve data quality controls, and support faster evidence generation during audits and supervisory reviews.

Adoption is also shaped by the need to demonstrate consistent governance across cloud and on-premises environments, while enabling repeatable workflows for recurring filings. As compliance functions push for defensible, traceable submissions, buyers in North America tend to prioritize solutions that improve documentation, strengthen accountability, and shorten the time required to prepare regulator-ready datasets.

US Market Size

The US market is valued at USD 1.09 billion in 2025 and is projected to reach USD 5.26 billion by 2035, expanding at a 17.04% CAGR. The US remains a high-priority market for regulatory data management because compliance expectations are both broad and enforcement-driven across financial services, healthcare, life sciences, and large digital enterprises.

Organizations are investing in stronger data governance to ensure regulatory submissions are consistent, explainable, and backed by clear data lineage that can stand up to audits and supervisory reviews. Demand is also being reinforced by enterprise-wide modernization programs where data is distributed across multiple platforms, including cloud environments, legacy systems, and third-party sources.

In this setting, regulatory teams need trusted datasets that can be reused across recurring reporting cycles, while risk and audit functions require transparent controls and evidence trails. Buyers in the US are increasingly focused on reducing manual reconciliation work, improving data quality and validation, and shortening reporting timelines without weakening accountability.

As regulatory reporting becomes more data-intensive, investment is shifting toward systems that centralize critical regulatory data, automate governance workflows, and support rapid response to new rules, examinations, and internal compliance requests.

Regional Analysis and Coverage

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of Latin America

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driving Factors

Regulatory data management demand is being driven by the rapid expansion of data protection and digital risk obligations across countries and sectors. A practical trigger is the steady rise in privacy law coverage, where 179 of 240 analyzed jurisdictions already have data protection frameworks in place, and these laws cover more than 6.6 billion people, pushing multinational firms to standardize how regulatory data is defined, stored, and audited across geographies.

Financial services regulation is also raising the baseline for operational resilience and ICT risk evidence. In the EU, DORA started applying on January 17, 2025, which increases the need for structured registers, incident reporting readiness, and third-party oversight data that can be produced quickly under regulatory scrutiny. At the same time, cybersecurity spend is trending upward, and research expects information security spending to increase 12.5% in 2026, supporting more investment in access governance, audit trails, and control evidence.

Restraint factors

A key restraint is the complexity of aligning regulatory definitions to real enterprise data, especially when critical data is spread across legacy systems, cloud platforms, and third-party applications. Many firms struggle to create a consistent lineage from source systems to reported figures, which slows implementation and increases audit risk if evidence cannot be reproduced reliably.

Another restraint is the compliance burden created by third-party dependencies. Under DORA, regulators are sharpening expectations around ICT third-party risk management, and that expands the scope of data that must be captured across vendors, contracts, services, and incident histories.

This is reinforced by the EU move to directly supervise designated critical technology providers for the financial sector, signaling tighter oversight of concentration risk and operational resilience data. When regulated organizations must collect and maintain granular vendor and service mapping data, projects can stall due to ownership gaps, incomplete inventories, and the effort needed to keep registers current.

Growth Opportunities

Opportunities are emerging in automation and reusable compliance data models that reduce manual effort across recurring reporting cycles. As privacy obligations reach most of the world, organizations are increasingly motivated to build a common control and evidence layer that can serve multiple regulations, instead of maintaining separate reporting packs by country or regulator.

This creates room for platforms that can map obligations to data elements, enforce validation rules, and generate audit-ready evidence with minimal rework. Another opportunity is in risk data aggregation and reporting modernization within banking and insurance, where firms continue to align with BCBS 239-style expectations for timely, accurate risk information.

Even outside global systemically important banks, the same discipline is being adopted as an enterprise data governance approach, expanding the addressable need for standardized risk and regulatory datasets. Vendors that support faster reconciliation, lineage, and repeatable attestations across business units are positioned to benefit.

Trending factors

The regulatory data management market is trending toward continuous compliance, where monitoring and evidence generation are built into daily data operations rather than handled as a quarterly or annual reporting exercise. This trend is closely tied to growing cybersecurity investment, since stronger identity controls, logging, and risk reporting are easier to justify when security budgets expand, and regulators demand faster incident response evidence.

Another trend is the formalization of third-party oversight data, including vendor registers, dependency mapping, and resilience metrics, influenced by DORA and the designation of critical technology providers in the EU financial sector.

A parallel trend is the push toward standardized, cross-regulation reporting artifacts such as common taxonomies, reusable data quality rules, and control libraries that can be applied across privacy, operational resilience, and financial risk reporting. The result is a shift from document-heavy compliance to data-driven compliance, with stronger traceability and faster regulator-ready outputs.

Competitive Analysis

Competition in regulatory data management is shaped by three clear capability clusters: regulatory reporting infrastructure, enterprise GRC and data governance platforms, and regulated content plus regulatory intelligence providers. In the regulatory data management market, infrastructure and trade reporting, LSEG’s Regulatory Reporting Solutions positions strongly around multi-regime reporting coverage, such as MiFID II and EMIR, through an Approved Reporting Mechanism and related services. Bloomberg competes with its Regulatory Reporting Hub (RHUB), emphasizing end-to-end workflows from eligibility through reconciliation for global trade and transaction reporting.

On the enterprise platform side, IBM OpenPages targets regulatory compliance management through a centralized model for compliance risk visibility and structured obligation management. MetricStream competes in connected GRC by centralizing and automating compliance tasks, including control monitoring, audit tracking, and regulatory reporting workflows. Oracle’s financial services portfolio emphasizes accounting and regulatory compliance with a unified data approach designed to improve consistency across risk and finance reporting.

In regulated industries, Veeva and IQVIA compete where document control and regulatory lifecycle management are critical, with Veeva QualityDocs focused on controlled GxP content management and IQVIA SmartSolve RIM focused on end-to-end regulatory lifecycle automation. CUBE differentiates through automated regulatory intelligence and regulatory change management. Accenture adds competitive pressure through implementation, integration, and operating model transformation around regulatory change and risk reporting.

Top Key Players in the Market

- Refinitiv

- Bloomberg L.P.

- IBM Corporation

- Moody’s Analytics

- MetricStream

- Oracle Corporation

- SAP SE

- SAS Institute

- Wolters Kluwer N.V.

- Veeva Systems, Inc.

- Accenture plc

- Finastra

- Experian plc

- IQVIA Inc.

- CUBE Content Governance Global Limited

- Others

Future Predictions

Regulatory data management is expected to shift from periodic reporting to always-on controls that run continuously across data pipelines. With 179 of 240 jurisdictions now having data protection frameworks in place and coverage extending to more than 6.6 billion people, organizations are anticipated to standardize common privacy, retention, and consent datasets that can be reused across multiple regimes instead of building one-off reporting packs.

Security-driven governance is also expected to accelerate as cybersecurity budgets continue to expand, which typically increases investment in access controls, audit evidence, and data lineage needed for regulator-facing submissions. Research estimates information security spending is projected to increase 12.5% in 2026, reinforcing a stronger enterprise push toward defensible data controls and continuous monitoring.

Recent Developments

- CUBE Content Governance Global Limited acquired AI operational risk provider Acin in June 2025 to strengthen regulation to control traceability across compliance and operational risk workflows.

- IBM announced OpenPages 9.1.3 in January 2026, adding extensible AI and task-focused capabilities aimed at improving day-to-day GRC productivity.

- Wolters Kluwer signed an agreement in July 2025 to sell its Finance, Risk, and Regulatory Reporting unit to Regnology for an enterprise value of about €450 million, sharpening its portfolio focus.

Report Scope

Report Features Description Market Value (2025) USD 3.15 Billion Forecast Revenue (2035) USD 16.91 Billion CAGR(2025-2035) 18.30% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Component (Software/Solutions, Services), By Deployment Mode (Cloud-based, On-premises), By Organization Size (Large Enterprises, Small and Medium-sized Enterprises), By Application (Compliance Systems, Financial Transaction Systems, Cloud Infrastructures, Data Storage, Transfer and Processing Systems, Identity Management Systems, Others), By End-User Industry (Banking, Financial Services, and Insurance, Healthcare and Life Sciences, IT and Telecommunications, Energy and Utilities, Retail and E-commerce, Manufacturing, Government and Public Sector, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Refinitiv, Bloomberg L.P., IBM Corporation, Moody’s Analytics, MetricStream, Oracle Corporation, SAP SE, SAS Institute, Wolters Kluwer N.V., Veeva Systems, Inc., Accenture plc, Finastra, Experian plc, IQVIA Inc., CUBE Content Governance Global Limited, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Regulatory Data Management MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample

Regulatory Data Management MarketPublished date: Feb 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Refinitiv

- Bloomberg L.P.

- IBM Corporation

- Moody's Analytics

- MetricStream

- Oracle Corporation

- SAP SE

- SAS Institute

- Wolters Kluwer N.V.

- Veeva Systems, Inc.

- Accenture plc

- Finastra

- Experian plc

- IQVIA Inc.

- CUBE Content Governance Global Limited

- Others