Global Refrigerated Display Cases Market Size, Share, Growth Analysis By Type (Remote, Plug-In, Semi Plug-In), By Material (Glass, Stainless Steel, Plastic), By Design (Vertical, Horizontal, Hybrid), By End-User (Food Service Sector (Quick Service Restaurants, Bakeries, Hotels), Retail Food & Beverage Sector (Fuel Station Stores, Hypermarkets & Supermarkets, Discount Stores, Others)) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2026-2035

- Published date: Jan 2026

- Report ID: 173815

- Number of Pages: 286

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

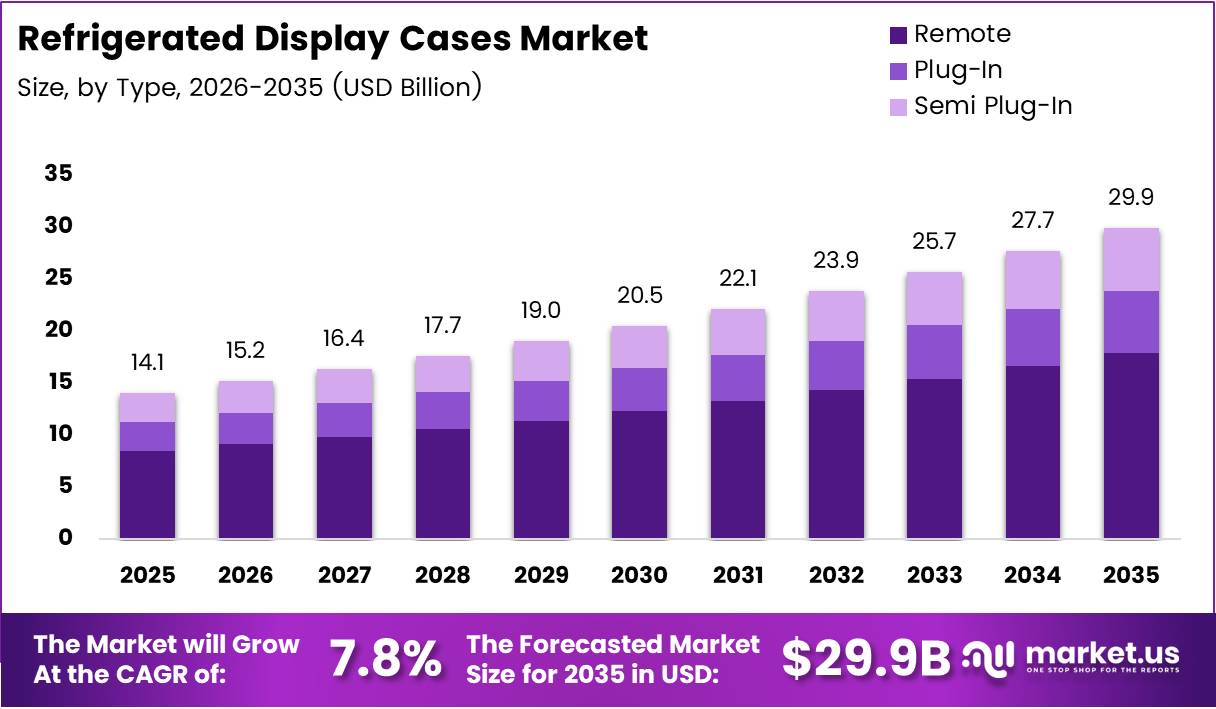

Global Refrigerated Display Cases Market size is expected to be worth around USD 29.9 Billion by 2035 from USD 14.1 Billion in 2025, growing at a CAGR of 7.8% during the forecast period 2026 to 2035.

The refrigerated display cases market encompasses specialized commercial refrigeration equipment designed to preserve and showcase perishable food products while maintaining optimal temperatures. These units serve critical merchandising functions across retail food, beverage, and foodservice establishments. They combine refrigeration technology with visual merchandising capabilities to enhance product visibility.

Currently, the market demonstrates robust expansion driven by organized retail proliferation and evolving consumer preferences. Urbanization patterns coupled with growing disposable incomes fuel demand for chilled and frozen convenience foods. This transformation creates sustained requirements for advanced display refrigeration infrastructure across multiple retail formats.

Moreover, stringent food safety regulations mandate temperature-controlled merchandising environments. Compliance requirements push retailers and foodservice operators toward modernized refrigeration investments. The regulatory landscape strengthens market fundamentals while ensuring consumer protection and product quality maintenance throughout the distribution chain.

Additionally, technological innovations reshape market dynamics through energy-efficient solutions. Natural refrigerants and smart monitoring systems gain traction as sustainability concerns intensify. These developments align with corporate environmental commitments while reducing operational expenditures for end users seeking competitive advantages.

The foodservice sector emerges as a dominant growth contributor, particularly through quick service restaurants and bakery operations. These establishments require versatile display formats that balance product preservation with consumer appeal. Simultaneously, retail food and beverage channels expand their refrigerated merchandising footprints across hypermarkets and convenience outlets.

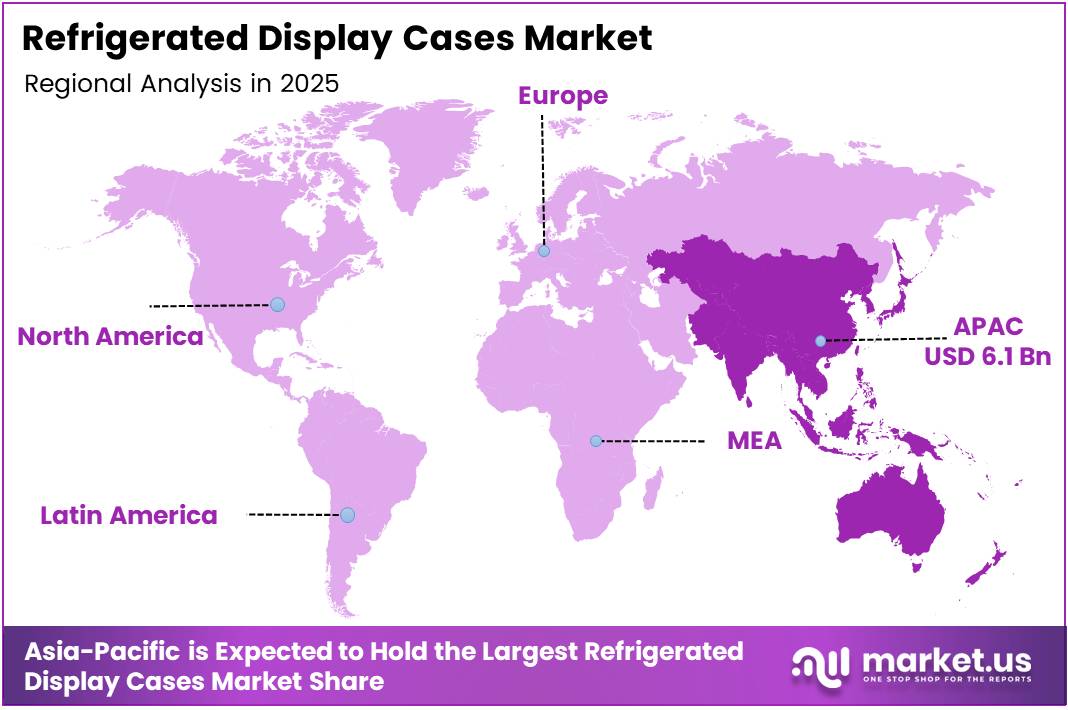

Asia-Pacific leads global market expansion with 43.8% share, valued at USD 6.1 Billion. Rapid supermarket penetration in emerging economies drives regional growth momentum. Government initiatives supporting cold chain infrastructure further accelerate adoption rates across developing markets in the region.

Investment flows toward retrofitting existing retail infrastructure with eco-friendly refrigeration systems. Energy efficiency mandates and utility cost pressures encourage replacement cycles for legacy equipment. This retrofit opportunity presents substantial revenue potential for manufacturers offering innovative display case solutions with improved performance metrics.

Key Takeaways

- Global Refrigerated Display Cases Market projected to reach USD 29.9 Billion by 2035 from USD 14.1 Billion in 2025 at 7.8% CAGR

- Asia-Pacific dominates with 43.8% market share, valued at USD 6.1 Billion

- Remote type segment leads with 57.8% share in type analysis

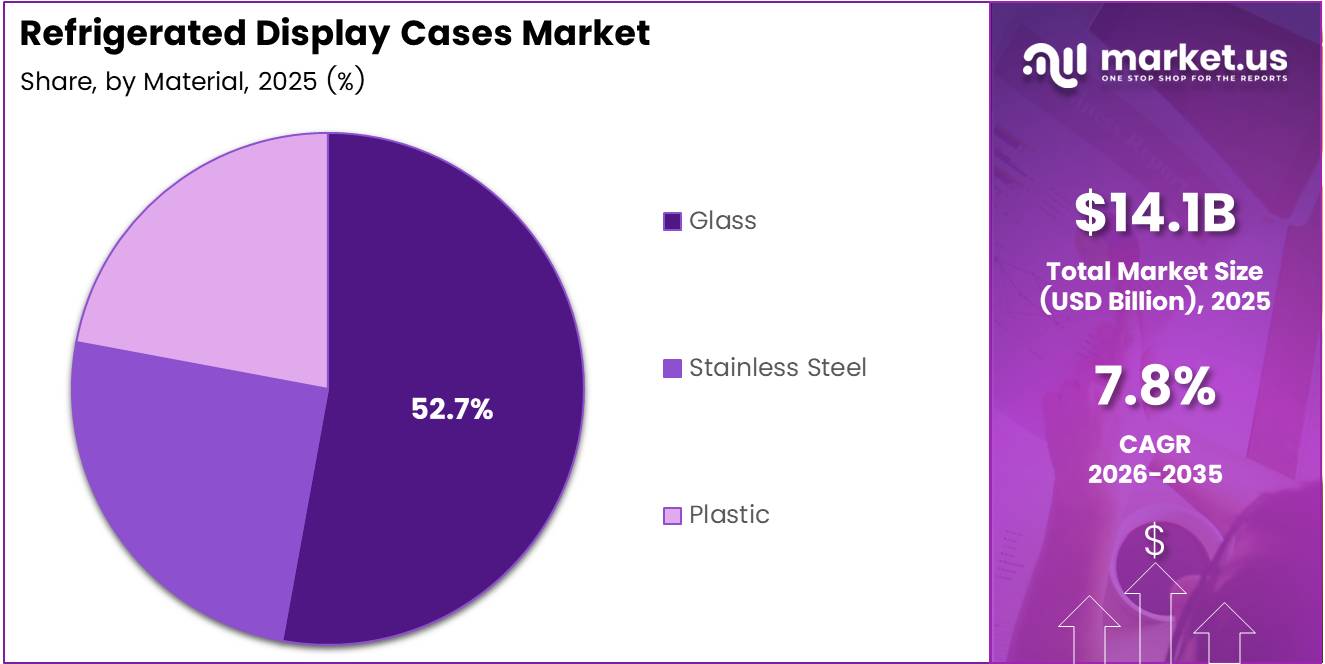

- Glass material holds 52.7% market position in material segment

- Vertical design commands 69.6% share in design configuration

- Food Service Sector accounts for 69.3% in end-user segment

Type Analysis

Remote type refrigerated display cases dominate with 57.8% due to their superior energy efficiency and centralized refrigeration management.

In 2025, Remote type held a dominant market position in the By Type segment of Refrigerated Display Cases Market, with 57.8% share. Remote systems separate condensing units from display cases, reducing heat emission in retail spaces. This configuration enhances customer comfort while lowering air conditioning costs. Large-format retailers prefer remote systems for their scalability across extensive store layouts.

Plug-In display cases offer flexibility and ease of installation for smaller retail operations. These self-contained units require minimal infrastructure investment and can be relocated as needed. Independent grocers and convenience stores favor plug-in models for their quick deployment capabilities. The segment serves markets where space constraints or temporary installations prevail.

Semi Plug-In systems bridge the gap between fully remote and standalone configurations. They provide partial centralization benefits while maintaining installation simplicity. This hybrid approach appeals to mid-sized retailers seeking operational efficiency without extensive infrastructure modifications. The segment addresses specific market niches requiring balanced performance and investment considerations.

Material Analysis

Glass material dominates with 52.7% due to its superior product visibility and premium merchandising appeal.

In 2025, Glass held a dominant market position in the By Material segment of Refrigerated Display Cases Market, with 52.7% share. Glass construction delivers unobstructed product visibility that drives impulse purchases and enhances brand presentation. Modern frameless designs further amplify aesthetic appeal in premium retail environments. Energy-efficient low-E glass technology reduces condensation while maintaining thermal performance standards.

Stainless Steel materials provide exceptional durability and hygiene benefits for commercial refrigeration applications. This material withstands frequent cleaning protocols and resists corrosion in demanding foodservice environments. Professional kitchens and back-of-house operations prioritize stainless steel for its longevity and sanitation properties. The material supports regulatory compliance in health-sensitive applications.

Plastic components offer cost-effective solutions for budget-conscious retail operations. Lightweight construction simplifies transportation and installation processes across various venue types. The material serves entry-level market segments and temporary merchandising applications. However, durability limitations restrict plastic’s adoption in high-traffic commercial environments requiring extended service life.

Design Analysis

Vertical design dominates with 69.6% due to its space efficiency and optimal eye-level product placement.

In 2025, Vertical design held a dominant market position in the By Design segment of Refrigerated Display Cases Market, with 69.6% share. Vertical configurations maximize merchandising space within limited retail footprints. Multiple shelving levels accommodate diverse product assortments while maintaining accessibility. Supermarkets and convenience stores deploy vertical cases along perimeter walls to optimize floor space utilization.

Horizontal display cases excel in impulse purchase categories like frozen desserts and chilled beverages. Top-loading or sliding glass door designs facilitate high-volume customer access in high-traffic zones. These units typically position near checkout areas to maximize conversion rates. The horizontal format suits grab-and-go retail concepts prevalent in fuel stations and quick service restaurants.

Hybrid designs combine vertical and horizontal elements to address complex merchandising requirements. These versatile configurations accommodate varied product dimensions and temperature zones within single units. Specialty food retailers leverage hybrid systems to create distinctive shopping experiences. The design flexibility supports premium positioning strategies and differentiated store layouts.

End-User Analysis

Food Service Sector dominates with 69.3% due to rapid expansion of quick service restaurants and bakery operations.

In 2025, Food Service Sector held a dominant market position in the By End-User segment of Refrigerated Display Cases Market, with 69.3% share. Quick Service Restaurants drive substantial demand through their beverage and dessert merchandising requirements. These establishments prioritize customer-facing display cases that combine preservation with visual appeal. Compact footprints and easy maintenance align with fast-paced operational demands.

Bakeries require specialized display refrigeration for pastries, cakes, and temperature-sensitive baked goods. Humidity-controlled environments prevent product deterioration while maintaining presentation quality. Glass-fronted cases with interior lighting enhance product attractiveness and support premium pricing strategies. This segment values customizable configurations that reflect brand identity.

Hotels utilize refrigerated displays across multiple touchpoints including breakfast buffets, lobby shops, and catering operations. Versatile units accommodate diverse food categories while meeting stringent food safety standards. The hospitality sector emphasizes aesthetic integration with interior design themes. Reliability and quiet operation become critical selection criteria.

Retail Food & Beverage Sector encompasses diverse channel formats with varying refrigeration needs. Fuel Station Stores require compact, high-efficiency units for impulse beverage and snack sales. Limited space availability drives demand for multifunctional display cases with minimal energy consumption.

Hypermarkets & Supermarkets represent the largest retail channel with extensive refrigerated merchandising requirements. These outlets deploy varied case configurations across departments including dairy, deli, beverages, and frozen foods. Centralized refrigeration systems support large-scale operations while maintaining consistent temperature control throughout expansive retail spaces.

Discount Stores prioritize cost-effective refrigeration solutions that balance performance with budget constraints. These retailers seek durable equipment with straightforward maintenance requirements. Value-oriented positioning influences equipment selection toward proven technologies rather than premium innovations.

Others category includes specialty food stores, pharmacies, and non-traditional retail formats adopting refrigerated merchandising. This segment demonstrates growing diversity in display case applications across evolving retail landscapes. Emerging channel formats create incremental demand opportunities beyond conventional retail and foodservice sectors.

Key Market Segments

By Type

- Remote

- Plug-In

- Semi Plug-In

By Material

- Glass

- Stainless Steel

- Plastic

By Design

- Vertical

- Horizontal

- Hybrid

By End-User

- Food Service Sector

- Quick Service Restaurants

- Bakeries

- Hotels

- Retail Food & Beverage Sector

- Fuel Station Stores

- Hypermarkets & Supermarkets

- Discount Stores

- Others

Drivers

Expansion of Organized Retail Chains Demanding Standardized Chilled Merchandising Infrastructure Drives Market Growth

Organized retail proliferation across emerging markets creates substantial demand for commercial refrigeration equipment. Modern supermarket chains require consistent display standards that maintain brand identity across multiple locations. Standardization drives bulk procurement opportunities for refrigerated display case manufacturers.

Consequently, rising consumption of fresh and ready-to-eat food categories reshapes retail refrigeration requirements. Urban consumers increasingly prioritize convenience and quality in chilled food purchases. This behavioral shift compels retailers to expand their refrigerated merchandising footprints significantly.

Furthermore, mandatory food safety temperature compliance regulations enforce strict standards across supermarkets and quick service restaurants. Regulatory frameworks mandate continuous temperature monitoring and documentation capabilities. Non-compliance risks include penalties, product recalls, and reputational damage that drive investment in certified refrigeration systems.

Additionally, growth of frozen dessert, dairy, and beverage merchandising requires multi-zone display formats. Product diversification necessitates flexible refrigeration solutions accommodating varied temperature requirements. Retailers seek modular systems that adapt to changing category mixes and seasonal merchandising strategies.

Restraints

High Capital Investment and Installation Costs for Multi-Deck Systems Restrain Market Expansion

High capital investment requirements for multi-deck and glass-door refrigeration systems create barriers for small retailers. Initial equipment costs combined with installation expenses strain budgets of independent operators. This financial constraint limits market penetration in price-sensitive segments and developing regions.

Moreover, escalating commercial electricity tariffs increase lifecycle operating expenses significantly. Energy consumption represents the largest ongoing cost component for refrigerated display case operators. Rising utility rates compress profit margins and extend payback periods for refrigeration investments.

Additionally, specialized maintenance requirements demand trained technician availability and ongoing service contracts. Technical complexity of modern refrigeration systems increases dependency on manufacturer support networks. Limited service infrastructure in remote markets restricts adoption rates and creates operational risks for potential buyers.

Furthermore, space constraints in urban retail locations limit deployment opportunities for larger display case configurations. High real estate costs encourage retailers to prioritize revenue-generating floor space over refrigeration footprints. This spatial limitation particularly affects vertical market segments in densely populated metropolitan areas.

Growth Factors

Retrofit Demand for Energy-Efficient Natural Refrigerant Display Systems Creates Growth Opportunities

Retrofit demand for energy-efficient natural refrigerant display systems presents substantial growth opportunities in existing retail infrastructure. Environmental regulations phasing out synthetic refrigerants drive replacement cycles ahead of normal equipment lifecycles. This accelerated obsolescence creates incremental market demand beyond organic growth projections.

Meanwhile, rapid supermarket and convenience store penetration in Tier-II and Tier-III cities expands addressable market boundaries. Rising disposable incomes in secondary urban centers support modern retail format adoption. Infrastructure development in these regions creates greenfield opportunities for refrigeration equipment suppliers.

Similarly, adoption of modular plug-and-play display cases for pop-up retail and quick-format stores addresses emerging channel requirements. Temporary retail concepts and experiential marketing activations need flexible refrigeration solutions. This niche segment values portability and rapid deployment capabilities over traditional performance metrics.

Furthermore, demand for customized branded refrigerated displays by FMCG and beverage manufacturers creates co-branding opportunities. Brand owners increasingly sponsor refrigeration equipment featuring proprietary designs and logos. This marketing-driven investment supplements traditional retailer capital expenditure and expands total market value.

Emerging Trends

Shift Toward Natural Refrigerant Display Case Platforms Transforms Market Dynamics

The shift toward CO₂ and hydrocarbon-based natural refrigerant display case platforms accelerates as environmental regulations tighten. These substances offer negligible global warming potential compared to traditional hydrofluorocarbon refrigerants. Regulatory mandates and corporate sustainability commitments drive adoption despite higher initial system costs.

Concurrently, rising integration of smart temperature monitoring and IoT-enabled case management systems enhances operational efficiency. Connected refrigeration platforms enable predictive maintenance and real-time performance optimization. Data analytics capabilities reduce energy consumption and minimize food spoilage through precise temperature control.

Additionally, increased preference for frameless glass and LED-lit premium merchandising designs elevates aesthetic standards. Modern consumers respond positively to visually appealing display environments that enhance shopping experiences. Retailers invest in premium case designs to differentiate their offerings and justify premium product pricing.

Moreover, growing deployment of remote condensing and centralized refrigeration display architectures improves system efficiency. Centralized systems reduce redundant components and enable waste heat recovery for space heating applications. This architectural approach delivers superior energy performance and lower total cost of ownership.

Regional Analysis

Asia-Pacific Dominates the Refrigerated Display Cases Market with a Market Share of 43.8%, Valued at USD 6.1 Billion

Asia-Pacific commands the refrigerated display cases market with 43.8% share, valued at USD 6.1 Billion. Rapid urbanization and expanding middle-class populations drive organized retail growth across the region. Countries like China and India witness accelerated supermarket penetration creating substantial equipment demand. Government initiatives supporting cold chain infrastructure further strengthen market fundamentals.

North America Refrigerated Display Cases Market Trends

North America demonstrates mature market characteristics with focus on equipment replacement and energy efficiency upgrades. Stringent environmental regulations mandate transition to natural refrigerant systems across commercial refrigeration installations. The region leads in smart refrigeration technology adoption driven by labor cost pressures and operational efficiency requirements.

Europe Refrigerated Display Cases Market Trends

Europe emphasizes sustainability through aggressive F-gas phase-down regulations accelerating natural refrigerant adoption. The region’s established retail infrastructure creates substantial retrofit opportunities for eco-friendly display case technologies. Premium merchandising standards and design aesthetics influence equipment specifications across European markets.

Middle East and Africa Refrigerated Display Cases Market Trends

Middle East and Africa experience growing demand driven by retail modernization and hospitality sector expansion. Extreme ambient temperatures necessitate robust refrigeration solutions with superior insulation and cooling capacity. The region’s developing cold chain infrastructure presents long-term growth potential despite current market fragmentation.

Latin America Refrigerated Display Cases Market Trends

Latin America shows increasing adoption of modern retail formats in urban centers stimulating refrigeration equipment demand. Economic volatility influences purchasing decisions toward cost-effective solutions with proven reliability. Regional manufacturers gain market share through competitive pricing and localized service networks.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Refrigerated Display Cases Company Insights

Hussmann Corporation maintains strong market positioning through comprehensive product portfolios spanning multiple refrigeration categories. The company leverages extensive distribution networks and technical support infrastructure to serve large retail chains. Innovation focus on energy efficiency and natural refrigerants aligns with evolving regulatory requirements and customer sustainability priorities.

Carrier Commercial Refrigeration capitalizes on parent company’s global presence and technological capabilities in HVAC and refrigeration systems. The division offers integrated solutions combining refrigeration equipment with building management systems. Strategic emphasis on connected technologies and data analytics enhances customer value propositions in competitive markets.

Danfoss A/S demonstrates leadership in refrigeration controls and components that optimize display case performance. The company’s expertise in variable speed compressors and electronic expansion valves improves system efficiency. Strong research and development investments support continuous innovation in natural refrigerant technologies and digitalization.

Epta S.p.A. Refrigeration emphasizes design excellence and customization capabilities for premium retail environments. The company’s European heritage influences aesthetic sensibilities and quality standards across product lines. Expansion into emerging markets broadens geographic reach while maintaining brand positioning in sophisticated retail segments.

Key Players

- Hussmann Corporation

- Carrier Commercial Refrigeration

- Danfoss A/S

- Epta S.p.A. Refrigeration

- Haier Group

- Metalfrio Solutions S.A.

- AHT Cooling Systems GmbH

- Lennox International Inc.

- Liebherr Group

- Dover Corporation

Recent Developments

- In August 2024, TEFCOLD Group acquired Eureka, a German commercial cooling distributor, expanding its European market presence and distribution capabilities.

- In April 2024, TEFCOLD Group acquired Horeca Global Solutions, expanding operations in Spain and Portugal to strengthen regional market positioning.

- In February 2024, JSI Store Fixtures launched and shipped R290 propane-based refrigerated display units in the U.S. market, advancing natural refrigerant adoption.

- In February 2024, Axiom Cloud closed $5 Million in funding to grow AI refrigerant leak detection software deployment across commercial refrigeration installations.

Report Scope

Report Features Description Market Value (2025) USD 14.1 Billion Forecast Revenue (2035) USD 29.9 Billion CAGR (2026-2035) 7.8% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Remote, Plug-In, Semi Plug-In), By Material (Glass, Stainless Steel, Plastic), By Design (Vertical, Horizontal, Hybrid), By End-User (Food Service Sector (Quick Service Restaurants, Bakeries, Hotels), Retail Food & Beverage Sector (Fuel Station Stores, Hypermarkets & Supermarkets, Discount Stores, Others)) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Hussmann Corporation, Carrier Commercial Refrigeration, Danfoss A/S, Epta S.p.A. Refrigeration, Haier Group, Metalfrio Solutions S.A., AHT Cooling Systems GmbH, Lennox International Inc., Liebherr Group, Dover Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Refrigerated Display Cases MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Refrigerated Display Cases MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Hussmann Corporation

- Carrier Commercial Refrigeration

- Danfoss A/S

- Epta S.p.A. Refrigeration

- Haier Group

- Metalfrio Solutions S.A.

- AHT Cooling Systems GmbH

- Lennox International Inc.

- Liebherr Group

- Dover Corporation