Global Refined Copper Market By Source (Concentrates, Scrap and Solvent Extraction and Electrowinning (SX-EW)), By Refining Process (Pyrometallurgical and Hydrometallurgical), By Application (Wire Rods, Plate, Sheet & Strip, Tubes, Bars & Sections and Others), By End-use (Construction, Consumer Goods and Equipment, Power grids, Transport, Heavy Engineering and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2023-2032

- Published date: Oct 2023

- Report ID: 34942

- Number of Pages: 226

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

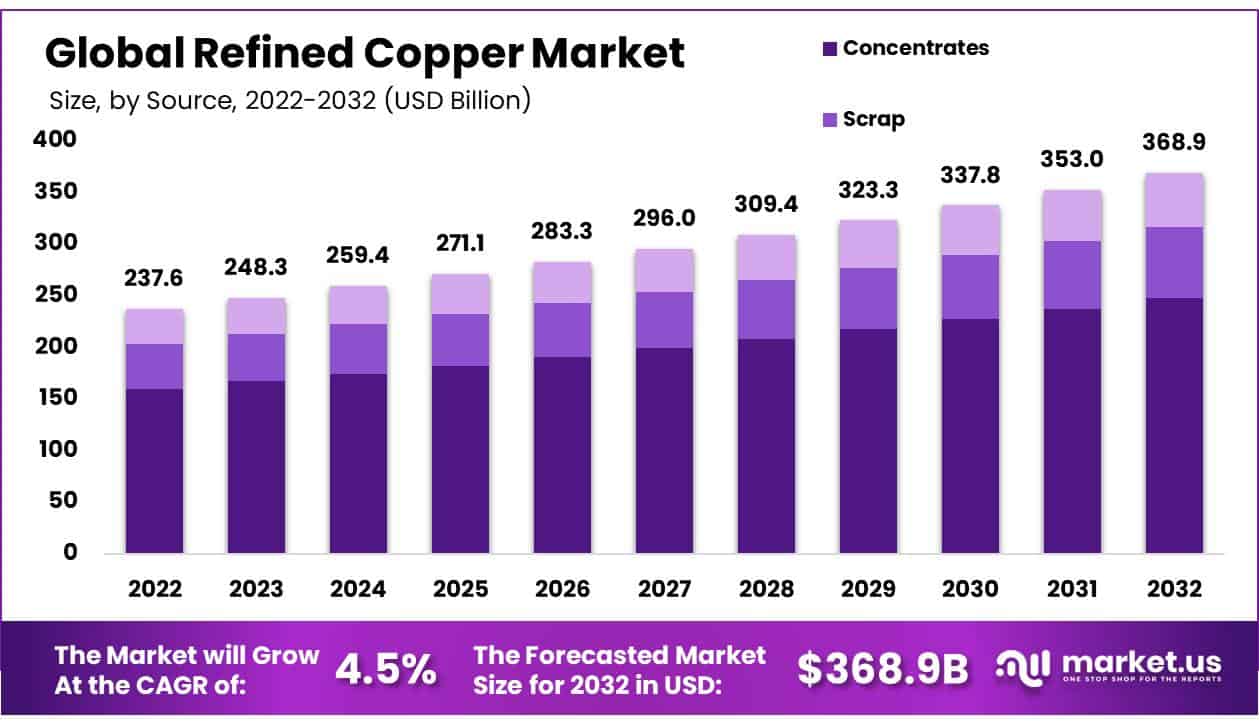

In 2022, the global refined copper market was valued at USD 237.6 billion, and it is projected to reach USD 368.9 billion by 2032 Between 2023 and 2032, this market is estimated to register the highest CAGR of 4.5%.

Introduction

Refined copper, commonly known as “the red metal,” occupies a pivotal and indispensable role across various sectors within the global economy. It represents a high-purity manifestation of copper, meticulously obtained through a refining process designed to eliminate impurities, consequently augmenting its electrical conductivity and malleability.

This refining process culminates in achieving copper purity levels of up to 99.99%, a universally recognized standard for the highest-grade copper. Copper’s exceptional attributes, including its superior electrical and thermal conductivity, ductility, and resistance to corrosion, render it a ubiquitous presence in numerous industries.

Remarkably, approximately 60 percent of the world’s refined copper production finds application in the production of electrical conductors, encompassing a wide spectrum of cables and wires. Notable sectors reliant on copper encompass construction, Consumer Goods and Equipment, the power industry, transportation, and heavy engineering.

Furthermore, copper stands as a fundamental material behind the advancement of renewable energy, prominently featured in the construction of solar panels and wind farms. Its pivotal role extends to the realm of transport electrification, where it is integral to the production of batteries, wiring, electric motors, and the development of charging infrastructure.

As the global economy progresses toward 2050 and the imperative of achieving Net-Zero Emissions, investments in copper-intensive technologies are anticipated to surge, notably in response to the targets set for meeting sustainability objectives and the ongoing industrialization of developing nations.

Consequently, per capita copper consumption is poised to experience a significant upswing between 2024 and 2035.

Key Takeaways:

- In 2022, the global refined copper market was valued at US$ 237.6 Billion.

- By source, the concentrates source held a major market share of 67.3% in 2022.

- By refining process, the pyrometallurgical segment dominated the global market with 80.6% market share in 2022.

- By application, in 2022, copper wire rods held a significant revenue share of 61.1%.

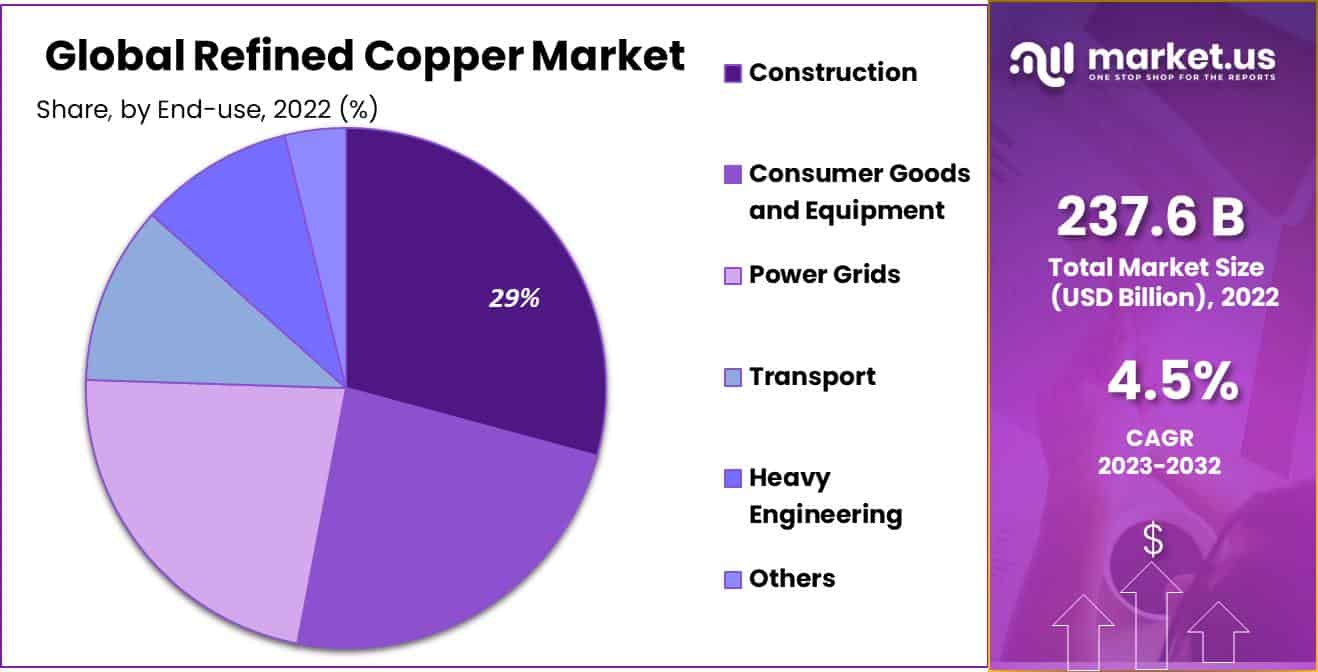

- By end-use, the construction industry has dominated the market in 2022 with 29.2% market share.

- In 2022, Asia Pacific dominated the market with the highest revenue share of 70.4%.

- There’s a growing emphasis on recycling and the circular economy in the copper industry. As the world seeks to reduce waste and resource consumption, recycled copper is gaining importance, and recycling technologies are improving efficiency which is positively influencing the refined copper market.

- Copper has traditionally played a crucial role in vehicle electrical systems, and its significance is set to grow with the automotive industry’s transition toward fully electric vehicles, driven by a commitment to environmental sustainability. To align with these sustainability goals, automakers are exploring more eco-friendly options, and the adoption of refined copper emerges as a promising solution.

- Key players include Codelco, Rio Tinto, Glencore, BHP Group Limited, Southern Copper Corporation, Freeport-McMoRan Grupo Mexico., and others.

Actual Numbers Might Vary in the Final Report

Driving Factors

Rapid growth in the consumer goods and equipment industry is propelling the market revenue growth of refined copper

The rapid expansion of the consumer goods and equipment industry stands as a significant driver bolstering the refined copper market. This sector heavily relies on copper for diverse applications, encompassing the production of consumer electronics, household appliances, and industrial machinery.

As the demand for these products steadily ascends in response to amplified consumer preferences, the requirement for copper, esteemed for its exceptional electrical conductivity and robustness, experiences a concurrent increase.

The ubiquity of electronic devices, spanning from smartphones to home appliances, underscores the pivotal role played by copper within this industry. Moreover, the proliferation of manufacturing industrial machinery and equipment further augments the demand for refined copper.

Consequently, the burgeoning consumer goods and equipment industry emerges as a pivotal contributor to the refined copper market, exerting a substantial impact on its overall demand dynamics and fostering stability within the sector.

Restraining Factors

Fluctuation in refined copper prices would hamper the revenue growth in the forecast years

Copper stands as one of the world’s foremost traded commodities, with trading behavior often rooted in sentiment and expectations rather than immediate supply and demand fundamentals.

This is primarily due to the inherent time delay in the release of data pertaining to actual supply and demand dynamics. Given the active participation of copper traders through platforms like the LME, price movements can at times diverge significantly from the underlying market fundamentals.

Copper price dynamics are intricate with economic indicators, financial market news, and capital flows. Significantly, these price movements demonstrate a strong and enduring correlation with the overall performance of the global economy, notably in relation to the Global Purchasing Managers’ Index (PMI).

This is due to the pivotal role played by manufacturing activity, a central driver of metal demand, in directly shaping copper prices. Consequently, copper exhibits a remarkable level of responsiveness to shifts in economic sentiment and fluctuations in industrial activity on a global scale.

Growth Opportunities

The global shift towards renewable energy sources represents a significant opportunity for the refined copper market

The rapid growth in the renewable energy sector across the globe presents a substantial growth opportunity in the upcoming years. Renewable technologies such as wind and solar widely rely on refined copper for enhanced energy transmission and utilization.

Renewable energy system utilizes relatively 12 times more refined copper than the traditional energy system. For instance, in the solar power system around 5.5 tons per megawatt, of refined copper is used.

Thus, a rise in the installation of solar power plants across the globe would have a positive influence on the global market.

Furthermore, in a global landscape where the emphasis on sustainable and low-carbon energy solutions as a means to combat climate change continues to intensify, there is a notable surge in demand for technologies reliant on copper.

Moreover, the evolution of smart grid systems, strategically engineered to augment the efficiency and reliability of electrical distribution, pivots on the exceptional conductivity and data transmission capabilities offered by copper.

These advancements in grid technology are pivotal in effectively accommodating the fluctuations in energy generation that are inherent to renewable sources.

Latest Trends

Green and Sustainable Copper Production: Green and sustainable copper production focuses on environmentally responsible mining and refining methods that prioritize conservation and minimize ecological harm.

This approach includes adopting energy-efficient technologies, using renewable energy, implementing effective water management, reducing waste through responsible tailings management and recycling, and safeguarding local ecosystems impacted by mining.

It also involves strict adherence to environmental regulations and transparent reporting of environmental impacts, all aimed at meeting global copper demand while reducing the industry’s ecological footprint for a greener future.

Infrastructure Investment: Infrastructure investment involves substantial financial commitments from governments or private entities to enhance a country’s physical and social infrastructure.

This includes projects like transportation networks, urban infrastructure, energy systems, telecommunications, and water management.

These investments boost economic growth, create jobs, improve connectivity, enhance environmental sustainability, and provide better access to essential services, contributing significantly to overall regional or national development and quality of life.

This rapidly growing infrastructure investment is propelling the demand for refined copper.

By Source Analysis

The concentrates segment held the largest market share in 2022 due to the abundance availability of copper ores

Based on source, the market for refined copper is segmented into concentrates, scrap and solvent extraction, and electrowinning (SX-EW). Among these, the concentrates segment was the most lucrative in the global refined copper market, with a market share of 67.3% in 2022, and it is estimated to project a CAGR of 5.1%.

Concentrates are a key source of refined copper and originate from mining operations. Copper ore extracted from mines is initially in the form of concentrates, which contain varying levels of copper content. These concentrates undergo a complex refining process, including smelting and refining, to extract the copper metal.

This method is instrumental in producing high-purity copper suitable for a wide range of industrial applications. The availability and quality of copper concentrates from mines play a crucial role in determining the overall supply of refined copper.

By Refining Process Analysis

The pyrometallurgical refining process held a significant market share owing to strong adaptability of raw materials, low energy consumption, high efficiency and high metal recovery rate.

By refining process, the global refined copper can be further categorized into pyrometallurgical and hydrometallurgical. The pyrometallurgical refining process dominated the market with a significant share of 80.6% in 2022.

Pyrometallurgical methods entail the application of elevated temperatures and chemical reactions for the extraction of copper from its ores and concentrates, primarily involving copper sulfides and sometimes high-grade oxides.

The utilization of high temperatures offers several advantages, including rapid chemical reaction rates, some reactions that are unable to perform at low temperatures become spontaneous at higher temperatures, and the transformation of minerals into a liquid state, facilitating the separation of the metal from the residue.

Depending on the specific copper minerals and the equipment employed, the pyrometallurgical recovery process may encompass up to four distinct stages: roasting, smelting, converting, and fire refining, each serving a vital role in achieving refined copper production.

By Application Analysis

The wire rods dominated the global market due to extensive use in electrical and telecommunications applications

By application, the market is further segmented into, wire rods, plates, sheets & strips, tubes, bars & sections, and others. The wire rods dominated the refined copper market with a noteworthy revenue share of 61.1%.

Copper wire rod production involves a continuous process encompassing melting, casting, and drawing, typically conducted within facilities dedicated to processing refined copper. The primary material employed in this phase is predominantly copper cathodes, although higher-quality copper scrap may also find utility.

Wire rod represents an intermediate product crucial in the manufacturing of both single and multiple wires, essential components in the construction of conducting strands within various cable and electric cable applications, such as enameled cables, automotive wiring, and power cords.

The persistent global population growth, urbanization trends, and the proliferation of electronic devices continue to drive the demand for dependable and efficient electrical infrastructure. Copper’s remarkable electrical conductivity and reliability render wire rods the preferred choice for critical applications in this domain.

Furthermore, ongoing technological advancements, particularly in high-performance electronics and renewable energy systems, contribute to the sustained demand for copper wire rods, reinforcing their dominant stature within the refined copper market.

By End-use Analysis

The construction sector held a significant market share due to copper’s indispensable role in the modern construction industry

Based on end-use, the market can be further categorized as, construction, consumer goods and equipment, power grids, transport, heavy engineering, and others. In 2022, the construction sector held a substantial market share of 29.2%.

Copper is widely favored for its exceptional characteristics such as electrical conductivity, corrosion resistance, and durability, making it an essential component in electrical wiring systems, plumbing infrastructure, and architectural applications.

In electrical installations, copper ensures the efficient transmission of electricity and power, critical for lighting, heating, and various electrical systems within residential, commercial, and industrial structures.

Moreover, copper’s malleability allows for intricate designs and ease of installation, further enhancing its appeal in construction projects. As urbanization and infrastructure development continue to surge globally, copper remains at the forefront of meeting the escalating demand for reliable and sustainable building materials.

Its enduring significance in construction, coupled with the increasing focus on energy efficiency and green building practices, solidifies the construction sector’s dominant position within the refined copper market.

Actual Numbers Might Vary in the Final Report

Market Key Segmentation

Based on Source

- Concentrates

- Scrap

- Solvent Extraction and Electrowinning (SX-EW)

Based on Refining Process

- Pyrometallurgical

- Hydrometallurgical

Based on Application

- Wire Rods

- Plate, Sheet & Strip

- Tubes

- Bars & Sections

- Others

Based on End-use

- Construction

- Consumer Goods and Equipment

- Power grids

- Transport

- Heavy Engineering

- Others

Geopolitics and Recession Impact Analysis

The refined copper market in 2022 came across a confluence of factors that contributed to a notable deceleration.

These included volatile demand dynamics in China, stringent monetary policies enacted by central banks, labor disruptions and social unrest in Latin America, potential supply risks from Russian metal sources, diminished copper stocks in exchange and warehousing facilities, the impetus for electrification in the transportation sector, and the introduction of new renewable energy capacity.

Throughout the year, refined copper prices exhibited substantial variability, ranging from USD 7,000 to USD 10,700 per metric ton. Notably, the peak in March was driven by geopolitical apprehensions and disruptions in South American mining operations.

Subsequently, a correction ensued, bringing copper prices down to USD 7,000 per metric ton by mid-year. This decline was ascribed to a combination of factors, including a fortified US dollar, diminished economic activity in China, and the implementation of interest rate hikes.

Nevertheless, the copper market subsequently witnessed a resurgence, with prices rebounding to a bracket of USD 8,000 to USD 8,900 per metric ton.

This resurgence was underpinned by a more accommodative stance from the Federal Reserve, the looming threat of labor strikes in Latin America, low copper inventories, and an optimistic outlook for the Chinese economy post-Communist Party Congress and the easing of COVID-related restrictions.

As of December 2022, total exchange stocks (LME, SHFE, and CME) were exceptionally low at 190 thousand metric tons, roughly unchanged from the previous year.

Concurrently, China’s bonded copper stocks experienced a substantial 71% reduction since the year’s commencement, reaching a decade-low of 55 thousand metric tons.

Regional Analysis

In 2022, Asia Pacific held a significant position in the global refined copper market, with in around 70.4%. The major contributors to revenue growth in the region are China and India. In the first half of 2023, Chinese apparent demand for refined copper saw a notable 9% increase, even amidst a global market surplus.

This growth is primarily attributed to China, responsible for 50% of the world’s copper demand, where the power and construction sectors continue to drive demand due to rapid industrialization, urbanization, and population expansion.

Copper plays a pivotal role in the burgeoning construction industry, extensively utilized in electrical systems, plumbing, and infrastructure development.

Simultaneously, the rising electric vehicle (EV) market and the transition towards renewable energy systems are poised to create new avenues of refined copper demand.

Additionally, burgeoning economies, notably India and ASEAN nations, are exhibiting robust demand growth, driven by increased investments in infrastructure, including power supply.

Furthermore, the EV market in the Asia Pacific, spearheaded by China, is to achieve a 24% compound annual growth rate (CAGR) by 2030, surpassing the global growth rate of 21%.

Forecasts anticipate Asia’s EV market, spearheaded by China, to achieve a 24% compound annual growth rate (CAGR) until 2030, surpassing the global growth rate of 21%.

Subsequently, Asia Pacific is estimated to expand its share of the global EV market from 51% in 2017 to 69% in 2030, exerting a positive influence on the refined copper market in the region.

Actual Numbers Might Vary in the Final Report

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- India

- Japan

- South Korea

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

Key Players Analysis

Key players in the global refined coppers market include Codelco, Rio Tinto, Glencore, BHP Group Limited, Southern Copper Corporation, Freeport-McMoRan and Grupo Mexico., and more. They are focusing on enhancing the refining process and adopting recycled sources for refined copper to cater to a global position in the market.

Additionally, strategic partnerships and acquisitions are common tactics for market expansion, allowing companies to reach new markets and demographics. These key players and other industry participants collectively influence the refined copper market’s growth, supply, and demand dynamics.

Their continuous innovation, expansion, and market strategies contribute significantly to the industry’s development.

Market Key Players

- Codelco

- Rio Tinto

- Glencore

- BHP Group Limited

- Southern Copper Corporation

- Freeport-McMoRan

- Sumitomo Metal Mining Co., Ltd.

- Grupo Mexico

- JX Metals Corporation

- KGHM

- Zijin Mining Group Co., Ltd

- Anglo American

- Antofagasta plc

- Norilsk

- Jiangxi Copper Corporation

- Other Key Players

Recent Developments

- In August 2023, Corporación Nacional del Cobre de Chile (Codelco) and Anglo-American announced their intentions to collaborate in an effort to increase copper output and enhance productivity at their adjacent operations in Chile.

- In July 2023, Adani Enterprises announced that its copper-producing factory located in Gujarat’s Mundra region would commence operations in March 2024. The greenfield copper refinery project, with an estimated cost outlay of Rs 8,783 crore, boasts an annual production capacity of 1 million tonnes (MT). The endeavor is being undertaken by Adani Enterprises’ subsidiary, Kutch Copper Ltd (KCL), which is overseeing the construction of the greenfield copper refinery project for refined copper production in two distinct phases.

Report Scope

Report Features Description Market Value (2022) US$ 237.6 Bn Forecast Revenue (2032) US$ 368.9 Bn CAGR (2023-2032) 4.5 % Base Year for Estimation 2022 Historic Period 2020-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Source (Concentrates, Scrap and Solvent Extraction and Electrowinning (SX-EW)), By Refining Process (Pyrometallurgical and Hydrometallurgical), By Application (Wire Rods, Plate, Sheet & Strip, Tubes, Bars & Sections and Others), By End-use (Construction, Consumer Goods and Equipment, Power grids, Transport, Heavy Engineering and Others) Regional Analysis North America: The US and Canada; Europe: Germany, France, The UK, Italy, Spain, Russia & CIS, and the Rest of Europe; APAC: China, India, Japan, South Korea, ASEAN, and the Rest of APAC; Latin America: Brazil, Mexico, and Rest of Latin America; Middle East & Africa: GCC, South Africa, and Rest of Middle East & Africa. Competitive Landscape Codelco, Rio Tinto, Glencore, BHP Group Limited, Southern Copper Corporation, Freeport-McMoRan, Sumitomo Metal Mining Co., Ltd., Grupo Mexico, JX Metals Corporation, KGHM, Zijin Mining Group Co., Ltd, Anglo American, Antofagasta plc, Norilsk, Jiangxi Copper Corporation and Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the refined copper market size?refined copper market was valued at USD 237.6 billion, and it is projected to reach USD 368.9 billion by 2032 Between 2023 and 2032.

What is the CAGR for the Refined Copper Market?The Refined Copper Market is expected to grow at a CAGR of 4.5% during 2023-2032.Who are the key players in the Refined Copper Market?Codelco, Rio Tinto, Glencore, BHP Group Limited, Southern Copper Corporation, Freeport-McMoRan, Sumitomo Metal Mining Co., Ltd., Grupo Mexico, JX Metals Corporation, KGHM, Zijin Mining Group Co., Ltd, Anglo American, Antofagasta plc, Norilsk, Jiangxi Copper Corporation, Other Key Players.

-

-

- Codelco

- Rio Tinto

- Glencore

- BHP Group Limited

- Southern Copper Corporation

- Freeport-McMoRan

- Sumitomo Metal Mining Co., Ltd.

- Grupo Mexico

- JX Metals Corporation

- KGHM

- Zijin Mining Group Co., Ltd

- Anglo American

- Antofagasta plc

- Norilsk

- Jiangxi Copper Corporation

- Other Key Players