Global Radiation Shielding Glass Market By Type(Lead Glass, Lead-Free Glass), By Radiation Type(X-Ray Shielding, Gamma Ray Shielding, Neutron Shielding), By Application(Medical, Research and Laboratory, Nuclear Energy, Industrial), By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024–2033

- Published date: Feb 2024

- Report ID: 34676

- Number of Pages: 240

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

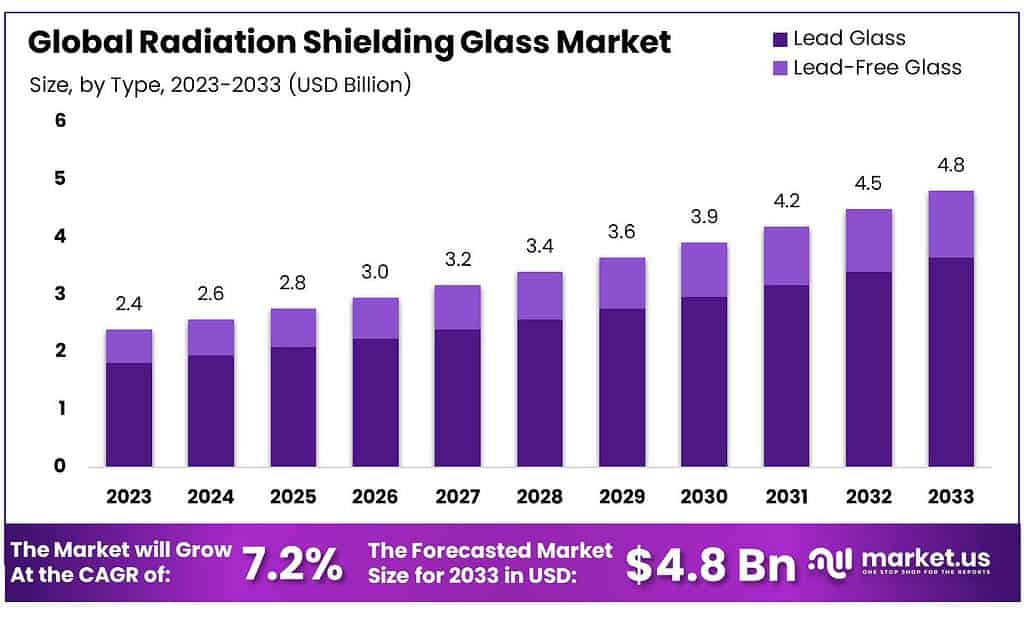

The global Radiation Shielding Glass Market size is expected to be worth around USD 4.8 billion by 2033, from USD 2.4 billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2023 to 2033.

Radiation shielding glass refers to specialized glass designed to protect ionizing radiation, including X-rays and gamma rays. This type of glass is employed in various applications where it is crucial to create a protective barrier, allowing for safe observation and operation in environments where radiation exposure is a concern.

The primary purpose of radiation shielding glass is to attenuate or reduce the transmission of harmful ionizing radiation while still maintaining transparency for visible light. It is engineered to offer a balance between clarity and radiation protection, making it suitable for applications in medical facilities, nuclear power plants, laboratories, and other environments where radiation-emitting equipment or materials are present.

Key Takeaways

- Market Growth: Expected market worth of USD 4.8 billion by 2033, with a CAGR of 7.2% from 2023 to 2033.

- Lead Glass Dominance: Held over 75.8% market share in 2023, preferred for its radiation attenuation properties and reliability.

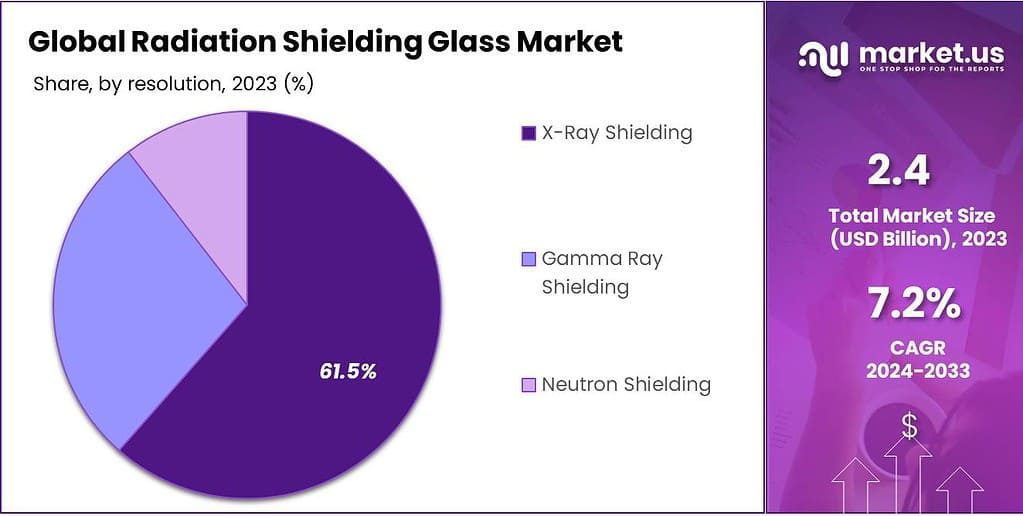

- X-Ray Shielding Prominence: Secured 61.5% market share in 2023, widely used in medical facilities for safety during diagnostic procedures.

- Medical Sector Dominance: Medical applications led with over 68.6% market share in 2023, crucial for safety in healthcare environments.

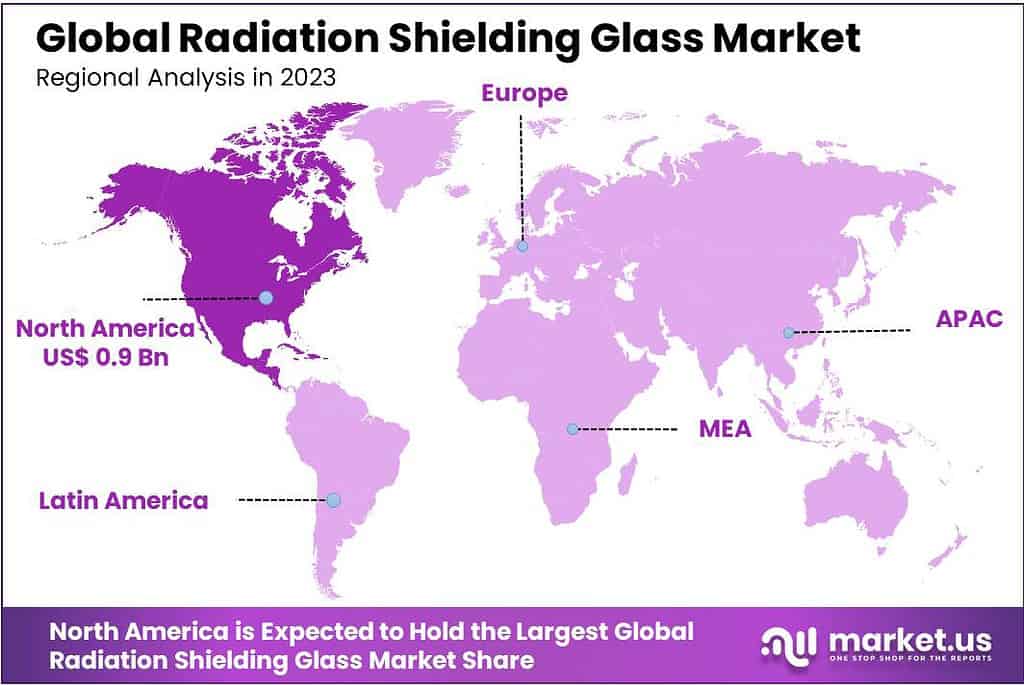

- Regional Analysis: North America, led by the United States, dominates the market, driven by advanced healthcare infrastructure.

By Type

In 2023, Lead Glass stood out as the top contender in the radiation shielding glass market, securing a commanding market position with an impressive share of over 75.8%. This type of glass emerged as the preferred choice for radiation shielding applications, highlighting its widespread acceptance and reliability in the industry.

Lead Glass, renowned for its excellent radiation attenuation properties, played a pivotal role in ensuring safety in environments where protection from ionizing radiation is crucial. Its dominance in 2023 showcased the strong preference for this traditional yet effective material in the radiation shielding glass market.

On the other hand, Lead-Free Glass, while present in the market, held a smaller market share in comparison. Some segments may opt for lead-free alternatives due to environmental and safety considerations. However, the significant majority still leaned towards the established and proven capabilities of Lead Glass.

The continued dominance of Lead Glass in the radiation shielding glass market is attributed to its well-established reputation, compliance with safety standards, and suitability for diverse applications. As the market evolves, Lead Glass remains at the forefront, emphasizing its reliability and effectiveness in providing essential radiation protection solutions.

By Radiation Type

In 2023, X-Ray Shielding asserted its dominance in the radiation shielding glass market, claiming a substantial market position with an impressive share of over 61.5%. This segment emerged as a leading choice for radiation shielding applications, underscoring its prevalent use and effectiveness in addressing X-ray exposure concerns.

X-ray shielding glass plays a pivotal role in various industries, particularly in medical facilities where X-ray imaging is a common diagnostic tool. Its dominance in 2023 reflects the widespread adoption of X-ray shielding solutions to ensure both patient and staff safety during medical procedures.

Gamma Ray Shielding, while a significant segment, held a comparatively smaller market share. The demand for gamma ray shielding glass is notable in industries such as nuclear power, industrial radiography, and certain medical applications. However, X-ray shielding maintained a prominent position due to its extensive use in everyday medical practices and diagnostic imaging.

Neutron Shielding, though essential in specific applications such as nuclear power plants and research facilities, represented a smaller share of the market. The specialized nature of neutron shielding requirements contributes to its relatively lower prevalence compared to X-ray shielding.

The dominance of X-ray shielding in 2023 is attributed to its versatile application across a range of industries, including healthcare, security, and industrial settings. The consistent need for effective X-ray protection in medical diagnostics, coupled with the established track record of X-ray shielding glass, solidifies its position as a preferred choice in the radiation shielding glass market.

By Application

In 2023, Medical applications took the lead in the radiation shielding glass market, securing a dominant market position with an impressive share of over 68.6%. This segment emerged as the primary driver of demand for radiation shielding glass, showcasing its crucial role in ensuring safety in medical environments where exposure to ionizing radiation is a concern.

The significant market share of Medical applications highlights the widespread use of radiation shielding glass in medical facilities, particularly in X-ray rooms and computed tomography (CT) scan areas. The need for transparent barriers that offer effective radiation protection for both patients and healthcare professionals contributed to the dominance of this segment.

Research and Laboratory applications, while essential, held a comparatively smaller market share. The demand for radiation shielding glass in research settings underscores its importance in protecting scientists and researchers working with various radiation sources.

Nuclear Energy applications represented another noteworthy segment, catering to the unique requirements of the nuclear power industry. The use of radiation shielding glass in nuclear power plants contributes to the safety of personnel and ensures the integrity of sensitive equipment.

Industrial applications, encompassing areas such as industrial radiography and manufacturing processes involving radiation sources, also contributed to the market. However, the dominance of Medical applications showcased the pivotal role of radiation-shielding glass in healthcare settings.

Market Key Segments

By Type

- Lead Glass

- Lead-Free Glass

By Radiation Type

- X-Ray Shielding

- Gamma Ray Shielding

- Neutron Shielding

By Application

- Medical

- Research and Laboratory

- Nuclear Energy

- Industrial

Drivers

Growing Demand in the Healthcare Sector:

The primary driver for the Radiation Shielding Glass Market is the increasing demand in the healthcare sector. The rise in medical imaging procedures, such as X-rays and CT scans, has led to a substantial need for effective radiation shielding solutions. Radiation shielding glass plays a pivotal role in providing a transparent yet protective barrier, ensuring the safety of both patients and healthcare professionals during diagnostic and therapeutic processes.

The growing prevalence of chronic diseases and the expanding global population contribute to the escalating demand for medical imaging services. As healthcare infrastructure continues to advance, especially in emerging economies, the requirement for radiation shielding glass is expected to witness a significant upsurge. The ability of this specialized glass to attenuate ionizing radiation while allowing for clear visibility positions it as an indispensable component in modern medical facilities.

Stringent Safety Regulations and Standards:

Stringent safety regulations and standards form another key driver for the Radiation Shielding Glass Market. Governments and regulatory bodies worldwide are imposing rigorous guidelines to safeguard individuals from the harmful effects of ionizing radiation. The implementation of these standards across various industries, including healthcare, research, and nuclear energy, necessitates the use of reliable radiation shielding solutions.

Radiation shielding glass, designed to comply with these stringent regulations, provides an effective means of achieving regulatory compliance. The glass is engineered to meet specific performance criteria, ensuring that it can effectively attenuate radiation without compromising visibility. As a result, industries and facilities that deal with ionizing radiation sources are compelled to adopt radiation shielding glass to adhere to the prescribed safety standards.

Restraints

High Initial Costs and Installation Challenges:

One of the significant restraints for the Radiation Shielding Glass Market is the high initial costs associated with procurement and installation. Radiation shielding glass is a specialized product that involves precise manufacturing processes and the integration of specific materials to meet stringent performance requirements. As a result, the production costs of high-quality radiation shielding glass are relatively elevated compared to conventional glass.

The initial investment required for the purchase and installation of radiation shielding glass can pose a financial challenge for some end-users, especially small healthcare facilities, research laboratories, or industrial setups with budget constraints. The higher costs may act as a deterrent for potential adopters, impacting the overall market growth.

Limited Awareness and Education on Radiation Shielding:

Another restraint faced by the Radiation Shielding Glass Market is the limited awareness and education on the importance of radiation shielding measures. In certain industries and applications, there may be a lack of understanding regarding the potential risks associated with ionizing radiation and the necessity of implementing effective shielding solutions.

End-users, particularly in smaller facilities or industries with less exposure to radiation safety guidelines, may not prioritize the adoption of radiation shielding glass due to a lack of awareness. The absence of comprehensive education and training programs on radiation safety can hinder market penetration, as decision-makers may not fully grasp the benefits and requirements of using specialized glass for radiation protection.

Opportunity

Advancements in Glass Manufacturing Technologies:

An opportunity for the Radiation Shielding Glass Market lies in advancements in glass manufacturing technologies. Ongoing innovations in glass production methods, including precision engineering, thin-film coatings, and advanced formulations, present avenues for improving the performance and cost-effectiveness of radiation shielding glass.

Manufacturers are exploring new techniques to enhance the attenuation properties of glass while maintaining optical clarity. Advanced manufacturing technologies allow for the production of thinner and lighter radiation-shielding glass without compromising efficacy. These developments contribute to overcoming the historical challenges associated with the weight and thickness of traditional lead-based glass solutions.

Increasing Adoption in Non-Medical Applications:

An expanding opportunity for the Radiation Shielding Glass Market lies in the increasing adoption of radiation-shielding glass in non-medical applications. While the healthcare sector has been a primary driver for the market, there is a growing recognition of the benefits of radiation-shielding glass in various non-medical settings.

Industries such as nuclear energy, research and laboratory facilities, and industrial applications are realizing the importance of implementing radiation shielding measures. As safety regulations become more stringent and awareness of radiation risks grows, there is a significant opportunity for radiation shielding glass to find increased use in these non-medical sectors.

Trends

Growing Focus on Sustainable and Lead-Free Solutions:

A notable trend in the Radiation Shielding Glass Market is the growing focus on sustainable and lead-free solutions. Traditionally, lead has been a key component in radiation-shielding glass due to its exceptional attenuation properties. However, environmental and health concerns associated with lead have led to an increased emphasis on developing lead-free alternatives.

Lead-free radiation shielding glass formulations are gaining traction, especially in regions where environmental regulations are stringent. Manufacturers are investing in research and development to create glass solutions that not only provide effective radiation shielding but also align with sustainability goals. These lead-free options cater to the rising demand for eco-friendly and health-conscious materials across various industries.

Integration of Smart Glass Technologies:

An emerging trend in the Radiation Shielding Glass Market is the integration of smart glass technologies. Smart glass, also known as switchable glass, can alter its transparency properties in response to external stimuli such as electrical voltage, heat, or light. This technology is being integrated into radiation shielding glass to enhance its functionality and usability in various applications.

The incorporation of smart glass technologies allows for dynamic control over the level of transparency, providing flexibility in adjusting visibility and privacy. In healthcare settings, for example, smart radiation shielding glass can be electronically controlled to become transparent during medical procedures and opaque for patient privacy at other times.

Regional Analysis

The hyaluronic acid market is anticipated to witness dominance in North America, specifically led by the United States, which holds the largest share. The region’s robust market position is fueled by factors such as high disposable income and an increasing awareness of aging-related concerns among the population. North America commands a substantial 38.4% share of the overall hyaluronic acid market.

Following closely is the European hyaluronic acid market, securing the second-largest market share. The growth in this region is attributed to a heightened emphasis on beauty awareness, rapid technological advancements, and the adoption of procedures with shortened surgical times. Within Europe, the German hyaluronic acid market stands out by holding the largest market share, while the UK’s market demonstrates the fastest growth.

The Asia-Pacific hyaluronic acid market is poised for significant expansion, driven by increasing medical needs in emerging markets, a growing awareness of minimally invasive techniques, and a rise in disposable income. Notably, the Chinese hyaluronic acid market claims the largest market share within the Asia-Pacific region, while the Indian market exhibits the fastest growth. This region is expected to register the highest growth rate throughout the forecast period.

Key Regions and Countries

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The Radiation Shielding Glass Market is characterized by the presence of key players contributing significantly to its growth and development. These companies are actively engaged in various strategies to enhance their market position, including mergers and acquisitions, product innovations, partnerships, and expansions.

Market Key Players

- SCHOTT AG

- Corning Incorporated

- Nippon Electric Glass Co., Ltd.

- Ray-Bar Engineering Corp.

- Kopp Glass, Inc.

- Nuclear Lead Co., Inc.

- Radiation Protection Products, Inc.

- Pilkington Group Limited

- Isolite Corporation

- British Glass

- Glaswerke Haller GmbH

- AGC Inc.

- Lead Glass Pro

- MarShield Custom Radiation Shielding Products

- Epurex Films GmbH

Recent Developments

- SCHOTT AG: Recently announced a new collaboration with a leading medical device manufacturer to develop radiation shielding components for advanced medical imaging equipment.

- Corning Incorporated: Launched a new radiation shielding glass product line with improved lead-free composition, targeting the growing demand for environmentally friendly solutions.

- Nippon Electric Glass Co., Ltd.: Invested in expanding its production capacity for radiation shielding glass to meet the increasing demand from the global healthcare sector.

Report Scope

Report Features Description Market Value (2022) US$ 2.4 Bn Forecast Revenue (2032) US$ 4.8 Bn CAGR (2023-2032) 7.2% Base Year for Estimation 2022 Historic Period 2016-2022 Forecast Period 2023-2032 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Type(Lead Glass, Lead-Free Glass), By Radiation Type(X-Ray Shielding, Gamma Ray Shielding, Neutron Shielding), By Application(Medical, Research and Laboratory, Nuclear Energy, Industrial) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape SCHOTT AG, Corning Incorporated, Nippon Electric Glass Co., Ltd., Ray-Bar Engineering Corp., Kopp Glass, Inc., Nuclear Lead Co., Inc., Radiation Protection Products, Inc., Pilkington Group Limited, Isolite Corporation, British Glass, Glaswerke Haller GmbH, AGC Inc., Lead Glass Pro, MarShield Custom Radiation Shielding Products, Epurex Films GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is the size of Radiation Shielding Glass Market?Radiation Shielding Glass Market size is expected to be worth around USD 35.3 billion by 2033, from USD 10.3 billion in 2023

What is the CAGR for the Radiation Shielding Glass Market?The Radiation Shielding Glass Market expected to grow at a CAGR of 7.2% during 2023-2032.Who are the key players in the Radiation Shielding Glass Market?SCHOTT AG, Corning Incorporated, Nippon Electric Glass Co., Ltd., Ray-Bar Engineering Corp., Kopp Glass, Inc., Nuclear Lead Co., Inc., Radiation Protection Products, Inc., Pilkington Group Limited , Isolite Corporation, British Glass, Glaswerke Haller GmbH, AGC Inc., Lead Glass Pro, MarShield Custom Radiation Shielding Products, Epurex Films GmbH

Radiation Shielding Glass MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample

Radiation Shielding Glass MarketPublished date: Feb 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- SCHOTT AG

- Corning Incorporated

- Nippon Electric Glass Co., Ltd.

- Ray-Bar Engineering Corp.

- Kopp Glass, Inc.

- Nuclear Lead Co., Inc.

- Radiation Protection Products, Inc.

- Pilkington Group Limited

- Isolite Corporation

- British Glass

- Glaswerke Haller GmbH

- AGC Inc.

- Lead Glass Pro

- MarShield Custom Radiation Shielding Products

- Epurex Films GmbH