Global Quantum Photonics Market Size, Share, Industry Analysis Report By Component (Systems, Services (Managed Services, Professional Services)), By Application (Quantum Communication, Quantum Computing, Quantum Sensing & Metrology (Atomic Clocks, Quantum Dot Photodetector, Quantum LiDar, PAR (Photosynthetically Active Radiation) Quantum Sensors)),By End-use Industry (Space Research, Government & Defense, Telecommunication, Healthcare & Pharmaceutical, Transportation & Logistics, Environment, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Nov. 2025

- Report ID: 165773

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

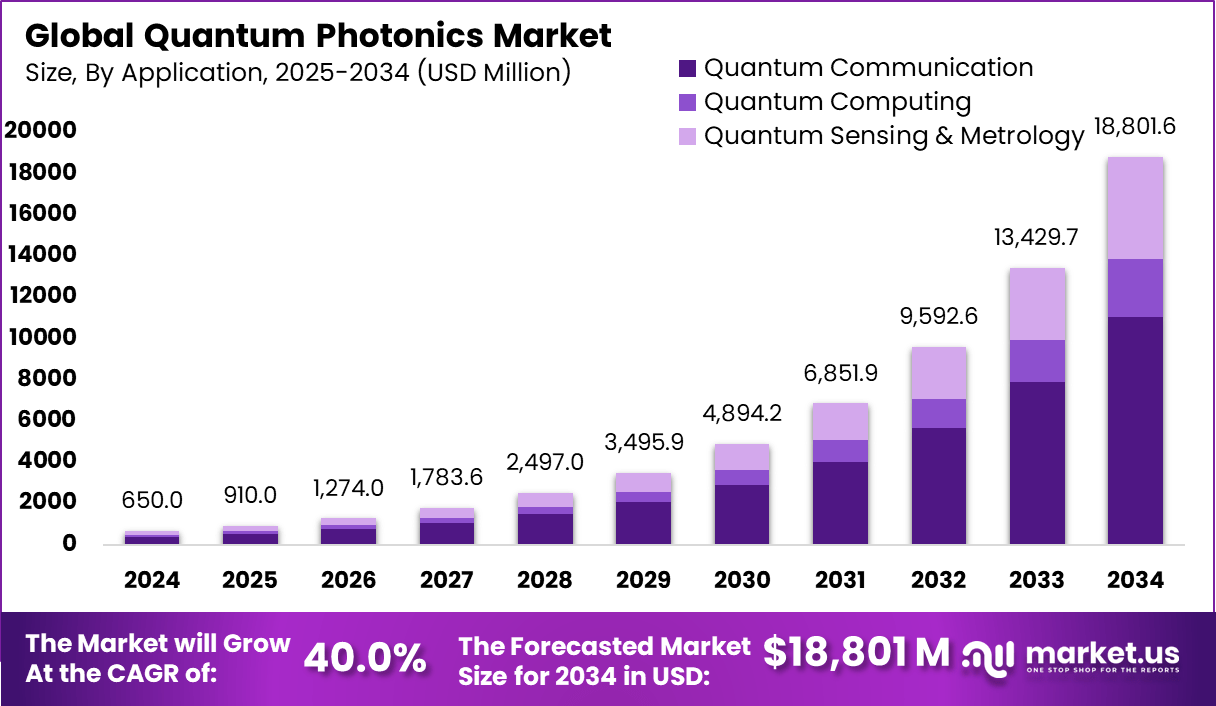

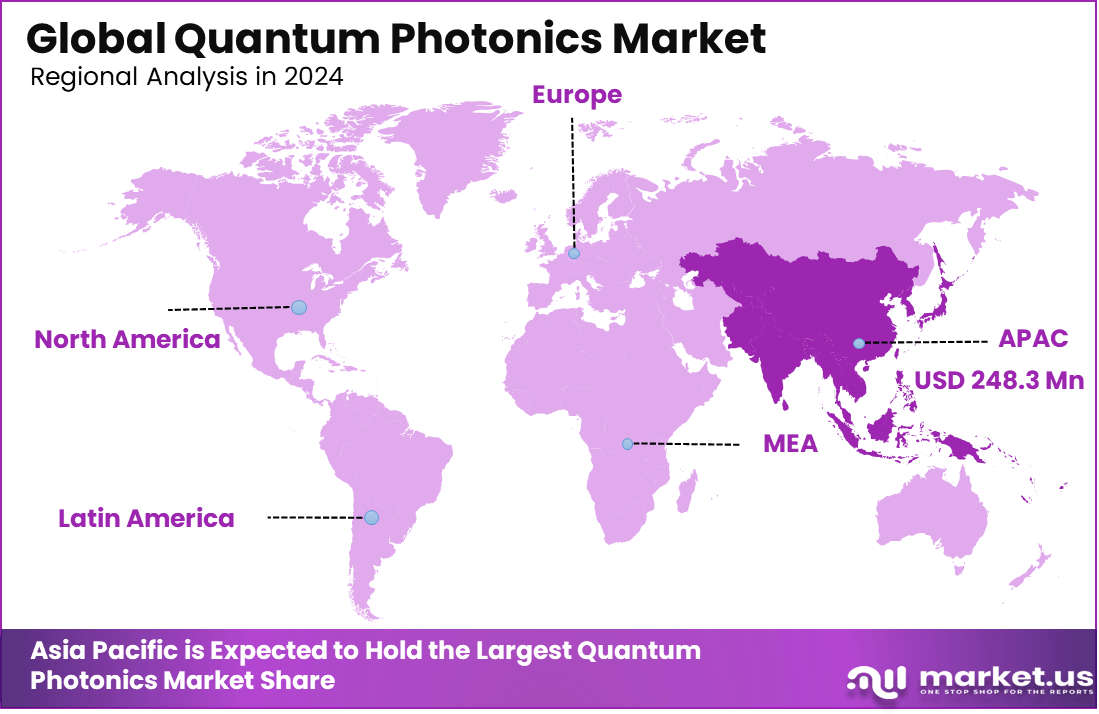

The Global Quantum Photonics Market generated USD 650 Million in 2024 and is predicted to register growth to about USD 18,801.6 million by 2034, recording a CAGR of 40% throughout the forecast span. In 2024, Asia Pacific held a dominan market position, capturing more than a 38.2% share, holding USD 248.3 Million revenue.

The quantum photonics market has been expanding as industries and research institutions invest in technologies that use quantum states of light for computation, communication and sensing. The market is moving from early research into practical development as quantum components, integrated photonic circuits and single photon sources gain maturity. Growth reflects rising interest in secure communication systems and advanced quantum information processing.

The growth of the market can be attributed to increasing demand for ultra secure data transmission and improved computational performance using quantum light based systems. Industries are adopting quantum photonics to overcome limitations of classical communication channels and to support next generation encryption standards. Advancements in integrated photonics, quantum dot technologies and precision manufacturing have strengthened the reliability of quantum devices.

Key technologies driving adoption include integrated photonic chips, single photon detectors, entangled photon sources and photonic quantum gates. Improvements in waveguide fabrication, silicon photonics and chip scale quantum circuits allow more complex quantum functions to be performed on compact devices. Hybrid photonic architectures and cryogenic detection systems further expand the capabilities of quantum platforms.

There are investment opportunities in integrated quantum photonic chips, quantum light sources, detectors, cryogenic systems and quantum secure communication networks. Growth potential exists in developing portable quantum sensing devices and scalable photonic processors. Emerging markets that aim to strengthen quantum infrastructure also present attractive opportunities for specialised component manufacturers and software developers.

Key Takeaways

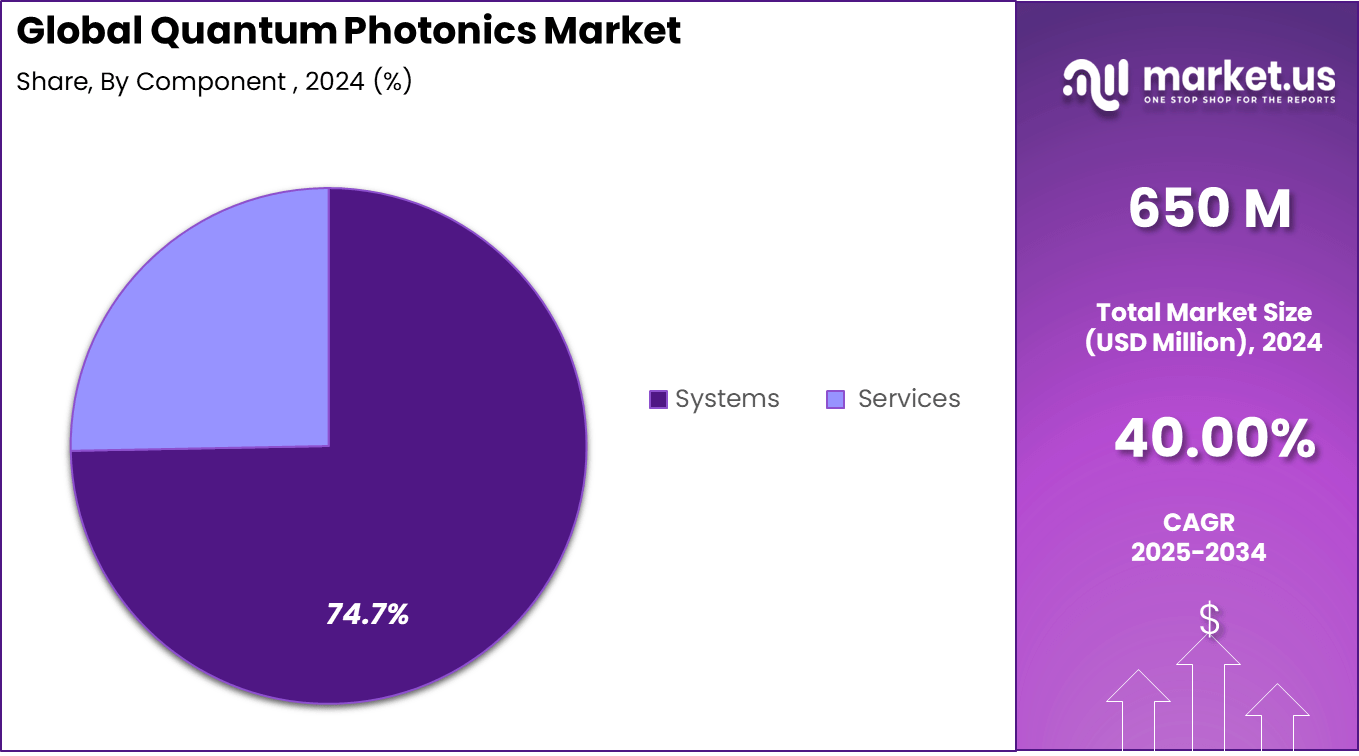

- Systems dominated the component segment with a 74.7% share, reflecting the strong demand for integrated quantum hardware used in communication, sensing, and computing ecosystems.

- Quantum Communication led the application landscape with 58.8%, driven by the rise of secure communication technologies such as QKD and government-backed security initiatives.

- The Government and Defense sector accounted for 37.4%, highlighting heavy investment in national security, intelligence, and advanced encryption capabilities.

- Asia Pacific held a significant 38.2% share, supported by aggressive quantum research initiatives across leading economies.

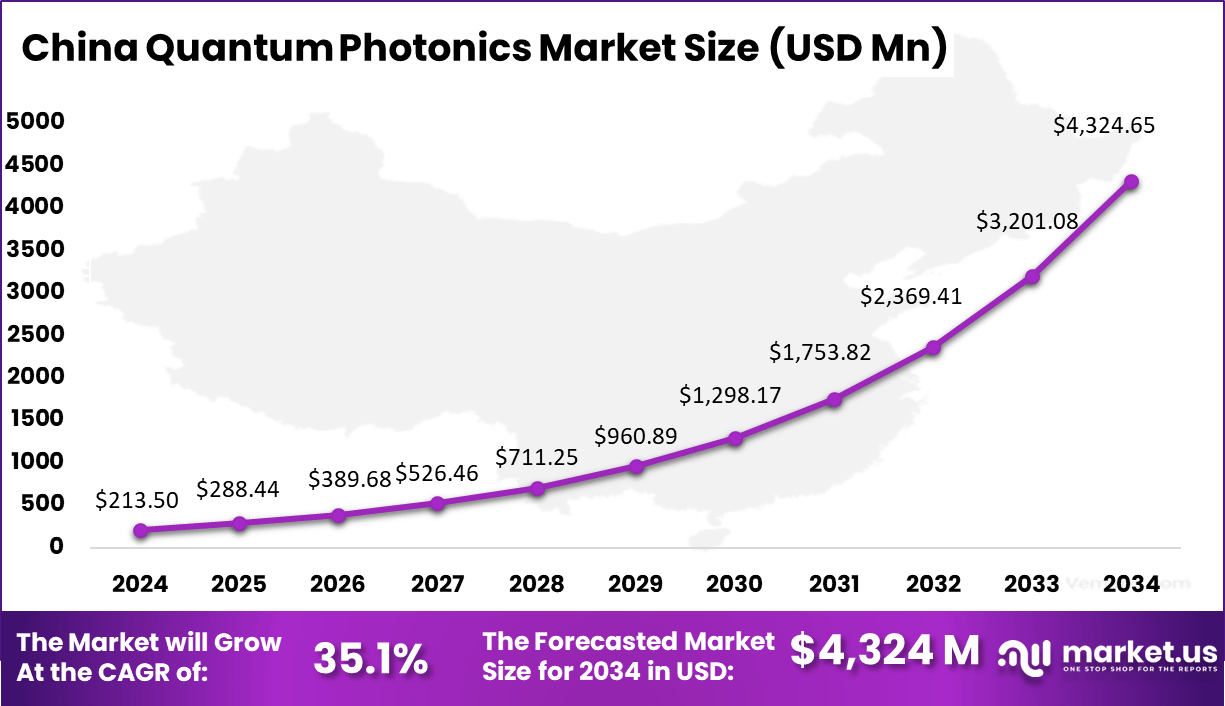

- China remained a major contributor, reaching USD 213.5 million in 2024 and growing at a strong 35.1% CAGR, reflecting substantial investment in quantum communication infrastructure and strategic defense programs.

China Market Size

China emerges as a key market within Asia Pacific, valued at approximately USD 213.5 million, with a remarkable CAGR of 35.1%. The country’s aggressive investments in quantum communication infrastructure and strategic prioritization of quantum technology development drive this expansion. China actively supports the commercialization of quantum photonic systems for government, defense, and emerging commercial applications.

China’s role as a technology leader in quantum photonics is strengthened by dedicated funding, talent development, and partnerships between public and private sectors, ensuring fast-tracked innovation and market growth.

Asia Pacific holds a dominant 38.2% share in the quantum photonics market, reflecting accelerated technological development and strong government support for quantum research. The region benefits from rapidly expanding innovation ecosystems and significant investments aimed at quantum communication and computing technologies.

Its broad adoption of quantum photonics systems aligns with growing industrial and defense applications. The Asia Pacific market’s growth is underpinned by government initiatives, burgeoning research institutions, and supply chain enhancements that foster rapid development and commercial use of quantum photonics technologies.

By Component

In 2024, Systems dominate the quantum photonics market, holding a significant 74.7% share by component. These systems include integrated quantum photonic devices that combine single-photon sources, detectors, and quantum processors. Their advanced architecture enables ultra-secure quantum communication and high-precision quantum sensing.

The systems segment sees strong demand due to growing investments in quantum infrastructure, especially in government defense applications and research institutions that rely on these technologies for secure data transmission and advanced computational power.

Application

In 2024, Quantum communication leads the application segment with approximately 58.8% of the market share. This application uses quantum photonics to enable near-impenetrable encryption methods, such as quantum key distribution (QKD), which are increasingly vital in safeguarding sensitive data against cyber threats.

The communication sector benefits from quantum photonics because it ensures highly secure information transfer through entangled photons, reducing the risk of interception or hacking.With growing concerns over digital security, quantum communication is a strategic priority for governments and enterprises alike.

End-use Industry

In 2024, Government and defense sectors represent about 37.4% of the quantum photonics market’s end use. These industries invest heavily in quantum technologies for secure communications, surveillance, and advanced sensing applications. Quantum photonics provides the defense sector with cutting-edge capabilities such as encrypted communication links and sensitive detection systems for intelligence and battlefield applications.

The strategic importance of quantum photonics in national security drives continuous research funding and deployment initiatives. Governments seek to maintain technological superiority by deploying highly reliable quantum systems in defense infrastructure.

Key Market Segments

By Component

- Systems

- Services

- Managed Services

- Professional Services

By Application

- Quantum Communication

- Quantum Computing

- Quantum Sensing & Metrology

- Atomic Clocks

- Quantum Dot Photodetector

- Quantum LiDar

- PAR (Photosynthetically Active Radiation) Quantum Sensors

By End-use Industry

- Space Research

- Government & Defense

- Telecommunication

- Healthcare & Pharmaceutical

- Transportation & Logistics

- Environment

- Others

Driver Analysis

Investment in Quantum Computing

Investments in quantum computing research and national innovation initiatives are a major driver for the quantum photonics market. Governments and private companies are pouring funds into research and commercial projects that use photonic technologies to enable quantum processors. This broad funding is creating rapid momentum as both established firms and startups race to develop scalable, reliable new photonic systems for computing, communications, and sensing applications.

This wave of investment has particularly accelerated advancements in quantum communication networks and ultra-secure encryption for finance, defense, and healthcare. As real-world value becomes obvious, big players are expanding their footprints and forming more research-industry alliances. This ongoing momentum is expected to keep the market’s growth rate very high for several years.

Restraint Analysis

High Development Costs

One significant restraint for quantum photonics is the high cost of development and the complex fabrication processes required. The industry faces significant barriers, especially with the need for specialized materials and precise manufacturing techniques. These hurdles make it hard for new entrants to join the market and slow down the rollout of new products and solutions.

With expensive R&D, and limited supply chains for reliable, low-loss single-photon sources, it’s a tough environment for rapid commercialization. Many startups and smaller firms find it very difficult to compete, as much of the market is dominated by companies with deep pockets and advanced research infrastructure.

Opportunity Analysis

Secure Communication Demand

There is a big opportunity in the growing demand for ultra-secure communication across many sectors. Quantum photonics, especially quantum key distribution (QKD), is gaining strong attention from governments, financial institutions, and healthcare systems that want data protection methods immune to current hacking threats. Growth in these sectors is fueling demand for new quantum photonic systems designed just for secure communications.

Besides securing communications, research in quantum sensors and imaging is creating new healthcare diagnostics, environmental monitoring, and industrial applications. As photonic systems mature and adoption widens, companies that can deliver reliable, scalable solutions will be well positioned to benefit from the coming surge in demand for secure, quantum-enabled technologies.

Challenges

Scalability and Integration

Scalability and integration remain the biggest technical challenges in quantum photonics. Building large-scale quantum photonic systems that stay reliable and compatible with existing technology is a complex problem. The technology’s intricate needs for material purity and precise control mean systems are difficult to scale up for mass adoption.

Manufacturers are struggling with low yields, optical losses, and architectural limitations. Getting quantum photonics to work seamlessly inside today’s digital infrastructure is still years away, as developers continue to face obstacles with integration standards and engineering resources.

Key Players Analysis

ID Quantique, Menlo Systems, and Microchip Technology are shaping the quantum photonics market with strong capabilities in quantum-safe communication, precision lasers, and integrated photonic components. Their solutions support secure networks, sensing applications, and early-stage quantum computing systems.

NEC, NTT Technologies, and Nordic Quantum Computing Group add depth with advanced quantum research programs focused on photonic processing, coherent detection, and scalable architectures that strengthen future commercial deployment.

ORCA Computing, PsiQuantum, Quandela, and Quix Quantum are accelerating innovation with photonic quantum processors designed for high-speed computation and energy-efficient operation. Their platforms emphasize modularity and cloud accessibility, enabling broader experimentation and early commercial use. QuantumXchange, QuintessenceLabs, and QUSIDE expand adoption through quantum key distribution, entropy hardware, and photonic encryption tools that enhance cybersecurity demand.

Single Quantum, Thorlabs, Toshiba, TundraSystems, and Xanadu contribute to ecosystem growth with detectors, optical components, and full-stack photonic systems. Their technologies support quantum sensing, metrology, and communication infrastructure. Other emerging players are strengthening market expansion by focusing on integrated photonics, scalable fabrication, and improved noise performance.

Top Key Players in the Market

- ID Quantique

- Menlo Systems

- Microchip Technology

- NEC

- Nordic Quantum Computing Group

- NTT Technologies

- ORCA Computing

- PsiQuantum

- Quandela

- QuantumXchange

- QuintessenceLabs

- Quix Quantum

- QUSIDE

- Single Quantum

- Thorlabs

- Toshiba

- TundraSystems

- Xanadu

- Others

Recent Developments

- November 2025, ID Quantique, Attended the Optica Quantum Industry Summit in Bristol, showcasing its latest quantum networking solutions and reinforcing its role as a global leader in quantum-safe communications.

- September 2025, ORCA Computing, Released a blueprint for integrating photonic quantum processors with NVIDIA GPUs in data centers, marking a significant step toward practical quantum–classical hybrid computing for AI and machine learning.

Report Scope

Report Features Description Market Value (2024) USD 650 Mn Forecast Revenue (2034) USD 18,801.6 Mn CAGR(2025-2034) 40.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Systems, Services (Managed Services, Professional Services)),By Application (Quantum Communication, Quantum Computing, Quantum Sensing & Metrology (Atomic Clocks, Quantum Dot Photodetector, Quantum LiDar, PAR (Photosynthetically Active Radiation) Quantum Sensors)),By End-use Industry (Space Research, Government & Defense, Telecommunication, Healthcare & Pharmaceutical, Transportation & Logistics, Environment, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape ID Quantique, Menlo Systems, Microchip Technology, NEC, Nordic Quantum Computing Group, NTT Technologies, ORCA Computing, PsiQuantum, Quandela, QuantumXchange, QuintessenceLabs, Quix Quantum, QUSIDE, Single Quantum, Thorlabs, Toshiba, TundraSystems, Xanadu, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ID Quantique

- Menlo Systems

- Microchip Technology

- NEC

- Nordic Quantum Computing Group

- NTT Technologies

- ORCA Computing

- PsiQuantum

- Quandela

- QuantumXchange

- QuintessenceLabs

- Quix Quantum

- QUSIDE

- Single Quantum

- Thorlabs

- Toshiba

- TundraSystems

- Xanadu

- Others