Global Quantum Cloud Computing Market Size, Share, Industry Analysis Report By Offering (Software, Services), By Technology (Trapped Ions, Quantum Annealing, Superconducting Qubits, Others), By Application (Optimization, Simulation and Modeling, Sampling, Encryption, Others), By Industry Vertical (Aerospace & Defense, BFSI, Healthcare, Automotive, Energy & Power, Chemical, Government, Others), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 161437

- Number of Pages: 333

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Cloud Computing Statistics

- Analysts’ Viewpoint

- Role of Generative AI

- U.S. Market Size

- Offering Analysis

- Technology Analysis

- Application Analysis

- Industry Vertical Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

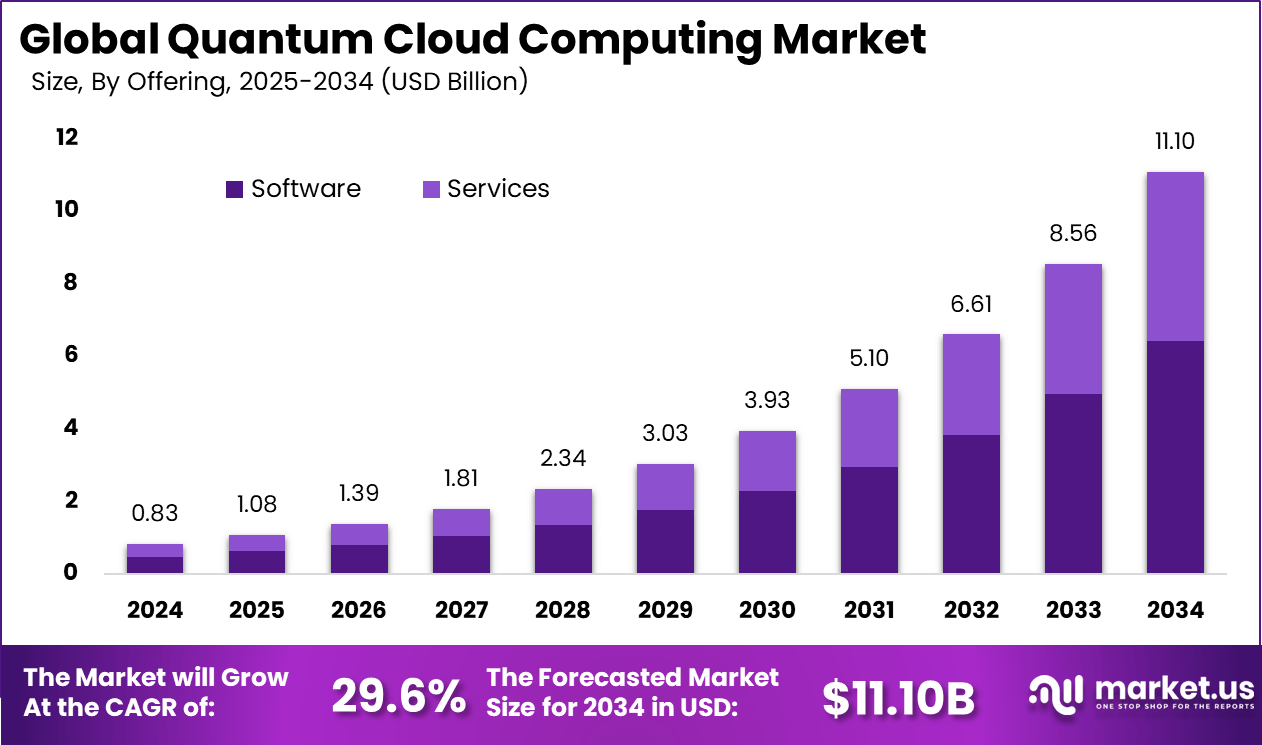

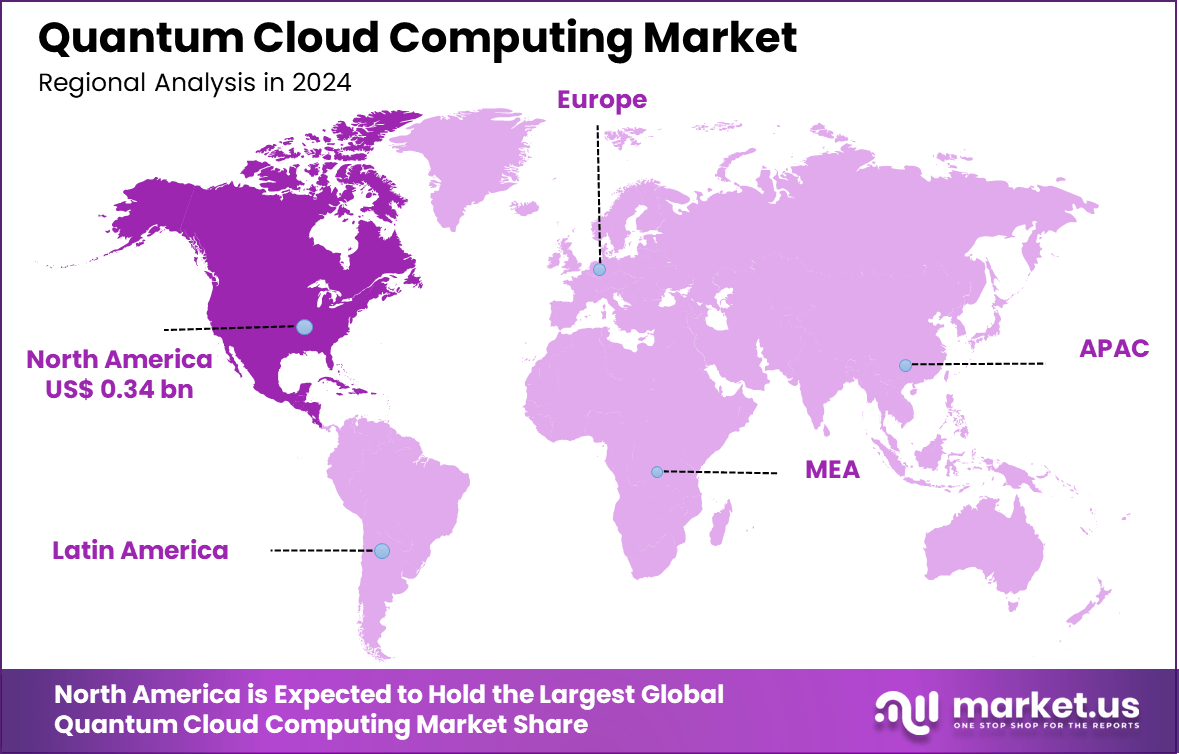

The Global Quantum Cloud Computing Market size is expected to be worth around USD 11.10 Billion by 2034, from USD 0.83 Billion in 2024, growing at a CAGR of 29.6% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 42% share, holding USD 0.34 Billion in revenue.

The quantum cloud computing market focuses on delivering quantum processing power through cloud-based platforms rather than on-premise systems. Because quantum hardware is expensive and still developing, cloud access allows researchers, developers, and enterprises to experiment with quantum algorithms, simulate workloads, and test applications without owning the hardware. Interest is growing across sectors such as finance, logistics, pharmaceuticals, cybersecurity, and materials research.

Among the key driving forces are the urgent need for faster computing to solve complex problems, advancements in quantum hardware, and the growing maturity of quantum algorithms. For example, businesses increasingly recognize quantum cloud computing as a solution to computationally intensive tasks such as cryptography and materials simulation.

The growing availability of scalable quantum processors through cloud platforms has contributed to this, with estimates showing that over 70% of enterprises cite scalability and flexibility as critical factors in adopting quantum cloud computing solutions.

For instance, in February 2025, SEALSQ announced plans to make cloud-based quantum computing more accessible and affordable. The company introduced innovations aimed at simplifying quantum computing for businesses and researchers by offering more cost-effective solutions and reducing the complexity associated with quantum technologies.

Key Takeaway

- 58% share was taken by the software segment in 2024, showing its importance as the core layer driving quantum services.

- 40% share was held by superconducting qubits, reflecting their maturity and strong role in commercial adoption.

- 28% share came from optimization applications, underlining demand for solving complex computational problems.

- 21% share was captured by the BFSI sector, highlighting its early move toward quantum-enabled risk modeling and fraud detection.

- The U.S. market showed rapid growth momentum, supported by strong CAGR trends and government-backed initiatives.

- 42% share was secured by North America, positioning it as the leading hub for quantum cloud computing adoption and innovation.

Cloud Computing Statistics

- AWS leads with 32%, followed by Microsoft Azure at 21% and Google Cloud at 12%, showing clear dominance of top providers.

- 96% of companies use the public cloud, while 84% also deploy private cloud, proving hybrid cloud is the standard strategy.

- By 2025, global data volumes will reach 200 zettabytes, creating unprecedented demand for scalable infrastructure.

- 82% of decision-makers highlight cost control as the biggest cloud management challenge.

- 94% of businesses report stronger security after cloud migration, boosting trust in adoption.

- Spending on SaaS will approach USD 300 billion by 2025, securing its lead in enterprise IT spending.

- Infrastructure services are expected to expand by 25%, and platform services by 22% in 2025.

- By 2025, 51% of IT budgets will shift from traditional tools to cloud-based solutions.

- 75% of enterprises are focusing on cloud-native application development to modernize operations.

- 92% of companies are expected to embrace multi-cloud strategies, ensuring flexibility and reducing vendor lock-in.

Analysts’ Viewpoint

Demand for quantum cloud computing is accelerating across multiple sectors such as autonomous vehicles, healthcare, biotechnology, and pharmaceuticals. Quantum-powered optimization enhances vehicle navigation and traffic management, while healthcare leverages quantum simulations for faster drug discovery and personalized treatments.

Investment in this sector remains strong, with venture capital funding for startups in quantum software and cloud integration growing over 25% annually. The defense sector continues to be a significant investor, driven by security priorities. Companies leverage quantum cloud computing for solving complex optimization problems, speeding molecular simulations, and handling large-scale data, resulting in cost reductions close to 30% and shortened R&D cycles.

Growth is supported by improvements in qubit stability and error correction, though talent shortages persist, with around 76% of firms citing it as a key hurdle. Efforts in education and improved development tools aim to bridge this gap. Economic trends and global competitive dynamics continue to influence quantum cloud computing’s trajectory and market opportunities.

Role of Generative AI

Generative AI plays an important role in quantum cloud computing by enhancing the efficiency and capabilities of quantum algorithms. Quantum-enhanced generative models use principles like superposition and entanglement to handle large, complex data sets more effectively than classical models.

For example, quantum generative adversarial networks (QGANs) and quantum Boltzmann machines optimize data generation processes, creating more accurate and diverse samples. This capability supports real-time data processing and analysis within the cloud, improving AI application performance on quantum platforms. It is estimated that spending on cloud computing driven by generative AI increased by nearly 22% in recent years, showing the growing importance of this technology synergy.

Additionally, AI-driven quantum algorithms help optimize quantum circuits, making quantum systems more scalable and practical. This optimization reduces errors and enhances performance, accelerating research and development in areas like drug discovery and cryptography. The combination of generative AI with quantum computing also shortens training times and improves the quality of synthetic data, which is crucial for research fields including healthcare and finance.

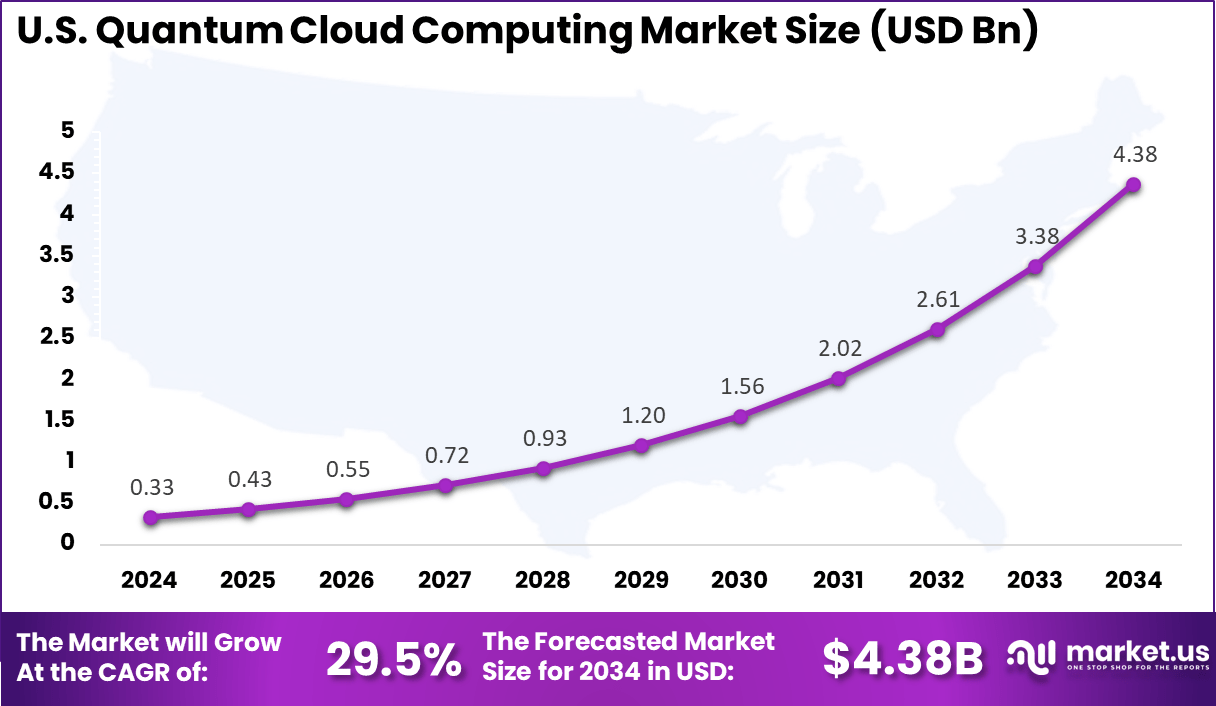

U.S. Market Size

The market for Quantum Cloud Computing within the U.S. is growing tremendously and is currently valued at USD 0.33 million, the market has a projected CAGR of 29.5%. The market is growing tremendously due to strong government support, significant investments in quantum research, and a robust technology infrastructure. Leading tech companies and startups are actively developing quantum cloud platforms, accelerating innovation.

The U.S. industry’s focus on cybersecurity, healthcare, and financial services drives demand for advanced quantum computing solutions. Additionally, the skilled workforce and collaboration between academia, government, and the private sector foster rapid adoption and commercialization of quantum cloud technologies across various industries.

For instance, in February 2025, Amazon Web Services (AWS) unveiled the Ocelot chip, a breakthrough in quantum cloud computing that reinforces the U.S.’s dominance in this rapidly growing field. The Ocelot chip is designed to significantly reduce the costs of implementing quantum error correction by up to 90%, making quantum computing more accessible and efficient.

In 2024, North America held a dominant market position in the Global Quantum Cloud Computing Market, capturing more than a 42% share, holding USD 0.34 million in revenue. This dominance is due to its advanced technological infrastructure and strong government initiatives supporting quantum research.

The region boasts leading technology companies and innovative startups actively developing quantum cloud platforms. Significant investments in quantum computing, combined with collaborations between academic institutions and industry, have accelerated development. Additionally, high demand from sectors like healthcare, finance, and defense seeking quantum solutions further reinforced its leadership in this market.

For instance, in November 2024, Oak Ridge National Laboratory (ORNL), a leader in advanced computing and quantum research, expanded its quantum cloud computing services by integrating IQM Resonance, a quantum processor, into its offerings. This addition strengthens North America’s dominance in the quantum computing space, particularly in the quantum cloud sector.

Offering Analysis

In 2024, the Software segment held a dominant market position, capturing a 58% share of the global quantum cloud computing market. This dominance is due to the crucial role that software plays in making quantum computing accessible and usable. Software platforms provide essential tools for developing, simulating, and running quantum algorithms remotely, eliminating the need for expensive hardware ownership.

Moreover, quantum software includes simulators and emulators, which help users prepare quantum tasks before running them on real hardware, improving accuracy and reducing costs. These platforms also facilitate collaboration across locations and support security features that build trust in quantum cloud services, sustaining the software segment’s leading role.

For Instance, In September 2025, Cisco introduced new software that enables easier connection to quantum computing through cloud platforms. The goal is to simplify access to quantum resources and expand their practical use across industries, underscoring the rising role of software in quantum cloud computing.

Technology Analysis

In 2024, the Superconducting Qubits segment held a dominant market position, capturing a 40% share of the global quantum cloud computing market. This technology is favored due to its maturity and scalability compared to other qubit types. Superconducting qubits operate using ultra-cold circuits, offering good control, stability, and measurement accuracy, allowing significant advancements in practical quantum computing.

Advancements in cryogenic systems and microwave control have further improved their performance for cloud implementations. Their ability to integrate with classical electronic components makes superconducting qubits highly suitable for delivering stable, scalable quantum cloud services, solidifying their leadership in quantum technology.

For instance, In April 2025, Fujitsu and RIKEN unveiled a 256-qubit superconducting quantum computer in Japan. It has four times more qubits than the previous model and supports more advanced error correction. The system uses a scalable 3D architecture and improved cooling, all within the same refrigeration unit.

Application Analysis

In 2024, the Optimization segment held a dominant market position, capturing a 28% share of the global quantum cloud computing market. Optimization benefits from quantum computing’s ability to analyze multiple potential solutions simultaneously, which classical computers cannot easily accomplish. This makes quantum cloud services valuable for complex problems like supply chain management, financial portfolio balancing, and logistics planning.

Additionally, optimization applications extend to enhancing machine learning workflows by accelerating model training and improving predictions. Widespread business interest in these practical quantum advantages boosts demand for optimization-focused quantum cloud solutions, driving growth in this segment.

For Instance, In February 2025, AWS introduced new quantum cloud computing tools to accelerate drug lead optimization. By using quantum-based molecular simulations in the cloud, researchers can more accurately predict chemical interactions, speeding up drug discovery while reducing time and costs.

Industry Vertical Analysis

In 2024, the BFSI segment held a dominant market position, capturing a 21% share of the global quantum cloud computing market. The banking, financial services, and insurance sector benefits from quantum cloud computing’s speed and strong data processing capabilities to tackle challenges like fraud detection, risk analysis, and rapid trading.

This sector’s focus on security and regulatory compliance further accelerates the adoption of quantum cloud solutions that offer advanced encryption and data protection. The flexibility of cloud platforms allows BFSI firms to scale computing resources on demand, ensuring efficient handling of fluctuating workloads and maintaining their leadership in quantum cloud adoption.

For Instance, in September 2025, HSBC demonstrated the world’s first-known quantum-enabled algorithmic trading in collaboration with IBM. This trial used a combination of quantum and classical computing resources to optimize bond trading in the European corporate bond market. The experiment achieved up to a 34% improvement in predicting the probability of winning customer inquiries compared to classical methods alone.

Emerging Trends

One rising trend in quantum cloud computing is the increasing adoption of hybrid quantum-classical approaches, where cloud platforms enable seamless integration of quantum processors with classical computers. This trend helps overcome limitations of current quantum hardware and increases accessibility.

Moreover, multi-cloud and hybrid cloud strategies are growing, with businesses combining different cloud services to prevent vendor lock-in and enhance flexibility. By 2025, more than 50% of enterprises planned to use such hybrid models for their quantum and classical computing needs, driven by the demand for optimized performance and cost-efficiency.

Another key trend is the advancement in AI-powered quantum computing, which leverages AI to fine-tune quantum algorithms and hardware. This trend improves system reliability and error correction, contributing to the practical deployment of quantum computing on cloud platforms. Security enhancements using AI-driven predictive models are also gaining traction.

Growth Factors

The growth of quantum cloud computing is strongly supported by technological improvements in qubit stability and error correction techniques, which increase the reliability of quantum processors. Cloud computing platforms provide broader access to quantum technology without the high costs of owning quantum hardware, enabling startups and researchers to innovate faster.

More than 60% of quantum computing projects worldwide now rely on cloud-based access, highlighting cloud infrastructure as a critical enabler of market growth. Investment in foundational quantum software and algorithms also fuels growth. By enabling practical applications such as optimization, simulation, and machine learning, the cloud-based quantum ecosystem attracts diverse industries, including finance, healthcare, and telecommunications.

Additionally, collaborations between public and private sectors contribute to rapid development and deployment cycles. These growth factors collectively create a supportive environment for quantum cloud computing to expand its reach and capabilities.

Key Market Segments

By Offering

- Software

- Services

By Technology

- Trapped Ions

- Quantum Annealing

- Superconducting Qubits

- Others

By Application

- Optimization

- Simulation and Modeling

- Sampling

- Encryption

- Others

By Industry Vertical

- Aerospace & Defense

- BFSI

- Healthcare

- Automotive

- Energy & Power

- Chemical

- Government

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Drivers

Growing Demand for High-Performance Computing

One of the primary drivers for quantum cloud computing is the increasing need for high-performance computing solutions across sectors like healthcare, finance, and logistics. These industries regularly handle complex problems and large datasets that traditional computers struggle to process efficiently.

Quantum cloud computing enables remote access to powerful quantum processors, which speed up computations such as drug simulations, fraud detection, and supply chain optimizations. This driver reflects the greater reliance on data-driven decision-making and the search for technological advantages in competitive markets.

For instance, in June 2025, OVHcloud announced the deployment of the Pasqal Orion Beta quantum processing unit on its cloud platform, expanding access to quantum emulators and processors. This move directly supports growing demand for high-performance computing by making advanced quantum resources available via the cloud, enabling businesses and researchers to tackle complex problems without owning costly hardware.

Restraint

Challenges in Scalability and Error Correction

A key restraint limiting wider adoption is the current difficulty in scaling quantum hardware and controlling errors during computation. Quantum bits, or qubits, are highly sensitive and prone to errors caused by environmental noise or imperfect control, making it hard to run long and complex quantum algorithms reliably.

Error correction is crucial but requires adding many physical qubits for each logical qubit, increasing hardware complexity and cost. This limitation restricts the size of usable quantum circuits today and constrains the range of problems quantum cloud platforms can practically address.

For instance, In August 2025, researchers at Northwestern University identified a new “double-sided” attack called QubitVise targeting cloud-based quantum systems. The study showed that attackers could interfere with other users’ computations on shared quantum hardware, exposing security gaps caused by multi-tenant setups and hardware limits. The findings underscored ongoing challenges with isolation, error correction, and trust in quantum cloud platforms.

Opportunities

Expansion of Quantum-as-a-Service (QaaS)

Quantum-as-a-Service (QaaS) is a growing opportunity because it gives organizations the chance to experiment with quantum computing on flexible and affordable terms. Without the need for upfront hardware purchases, smaller firms and research institutions can access quantum power through cloud platforms, which helps democratize the technology.

QaaS supports use cases like encryption, optimization, simulation, and machine learning across multiple sectors. As software tools improve and platforms simplify access, demand for these services is accelerating globally.

For instance, In April 2025, NVIDIA launched a quantum cloud platform that connects quantum processors with AI supercomputers. This move supports the growing Quantum-as-a-Service model, giving users faster, flexible access to quantum resources. The platform enables hybrid quantum-classical applications and opens new use cases in sectors like materials science and pharmaceuticals.

Challenges

Talent Shortage and Skills Gap

A significant challenge holding back quantum cloud computing growth is the shortage of skilled professionals. Quantum computing is a complex field requiring knowledge in quantum physics, computer science, and software programming, which few professionals currently possess.

This talent gap slows the development and deployment of quantum applications, limits innovation, and stretches project timelines. Many organizations find it difficult to hire or train employees to fully utilize quantum cloud resources, creating bottlenecks.

For instance, In October 2025, security experts stressed the need to adopt post-quantum cryptography to address future cyber risks from quantum computing. However, a shortage of skilled professionals is slowing progress. The lack of quantum security and engineering talent is making it difficult for organizations to develop and deploy secure quantum applications in cloud environments.

Key Players Analysis

The Quantum Cloud Computing Market is led by major technology companies such as Google LLC, Microsoft Corporation, IBM Corporation, and Amazon Web Services Inc. (AWS). These firms provide cloud-based access to quantum processors, hybrid quantum-classical computing platforms, and developer toolkits.

Regional and telecom-oriented players including Baidu Inc. and Huawei Technologies Co., Ltd. are expanding quantum cloud capabilities in Asia. Their focus areas include quantum machine learning, encryption, and optimization services delivered through proprietary cloud ecosystems.

Specialized firms such as Quantum Computing Inc, Terra Quantum, Spinq, QpiCloud, and research institutions like CERN contribute through niche platforms, simulation environments, and quantum-as-a-service offerings. They support enterprises with application-specific solutions in cryptography, materials research, and high-performance computing.

Top Key Players in the Market

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services Inc. (AWS)

- Baidu. Inc

- Huawei Technologies Co., Ltd.

- Quantum Computing Inc

- Terra Quantum

- Spinq

- QpiCloud

- CERN

- Others

Recent Developments

- In July 2025, QuiX Quantum launched Bia™, a quantum cloud computing service designed to accelerate access to quantum solutions. Bia™ aims to simplify the deployment of quantum algorithms by providing a flexible and scalable cloud platform that integrates various quantum hardware backends and advanced software tools.

- In May 2025, L&T Cloudfiniti and QpiAI announced a strategic partnership to accelerate the deployment of scalable AI-quantum solutions across various industries. The collaboration aims to integrate quantum computing and artificial intelligence to solve complex challenges in sectors like healthcare, finance, and manufacturing.

Report Scope

Report Features Description Market Value (2024) USD 0.83 Bn Forecast Revenue (2034) USD 11.10 Bn CAGR(2025-2034) 29.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Offering (Software, Services), By Technology (Trapped Ions, Quantum Annealing, Superconducting Qubits, Others), By Application (Optimization, Simulation and Modeling, Sampling, Encryption, Others), By Industry Vertical (Aerospace & Defense, BFSI, Healthcare, Automotive, Energy & Power, Chemical, Government, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google LLC, Microsoft Corporation, IBM Corporation, Amazon Web Services Inc. (AWS), Baidu. Inc., Huawei Technologies Co., Ltd., Quantum Computing Inc., Terra Quantum, Spinq, QpiCloud, CERN, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Quantum Cloud Computing MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample

Quantum Cloud Computing MarketPublished date: Oct. 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Google LLC

- Microsoft Corporation

- IBM Corporation

- Amazon Web Services Inc. (AWS)

- Baidu. Inc

- Huawei Technologies Co., Ltd.

- Quantum Computing Inc

- Terra Quantum

- Spinq

- QpiCloud

- CERN

- Others