Global QR Code Payments Market By Component (Software & Solutions, Services), By Payment Type (Peer-to-Peer, Consumer-to-Business, Business-to-Business), By Transaction Channel (In-store, Online, Mobile App), By End-User (Merchants, Consumers, Financial Institutions),By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2035

- Published date: Jan. 2026

- Report ID: 175164

- Number of Pages: 310

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Top Market Takeaways

- Drivers Impact Analysis

- Restraint Impact Analysis

- Investor Type Impact Matrix

- Technology Enablement Analysis

- Component Analysis

- Payment Type Analysis

- Transaction Channel Analysis

- End-User Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Regional Analysis

- Driver Analysis

- Restraint Analysis

- Opportunity Analysis

- Challenge Analysis

- Competitive Analysis

- Future Outlook

- Recent Developments

- Report Scope

Report Overview

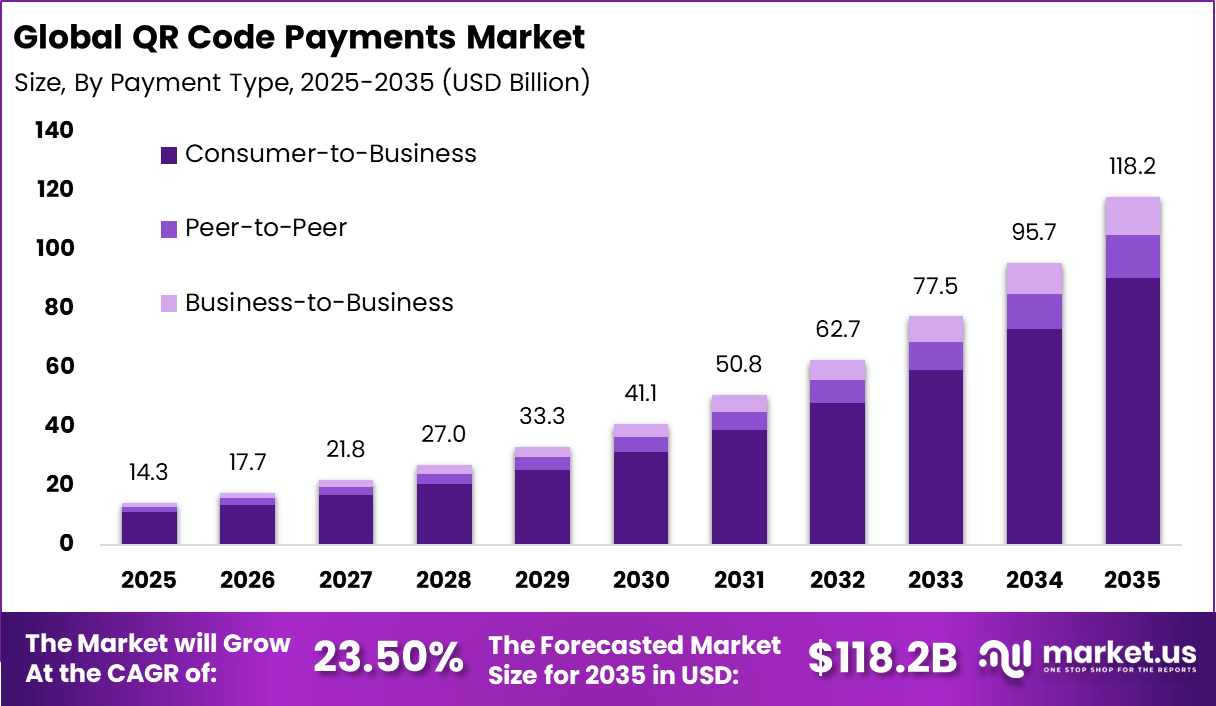

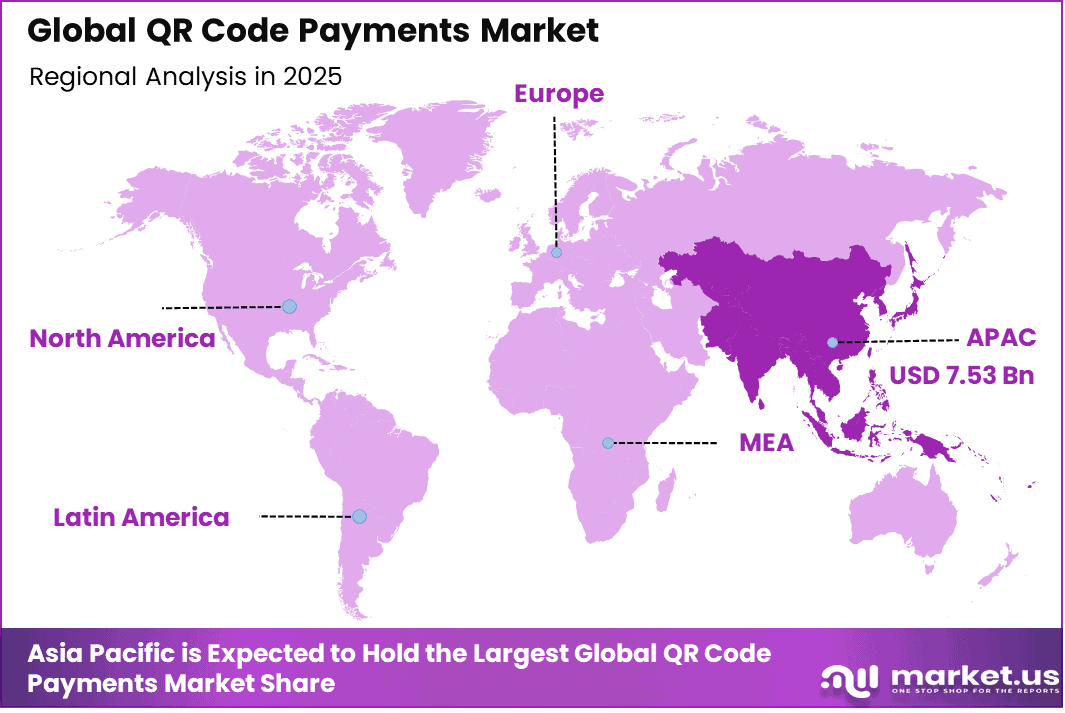

The Global QR Code Payments Market generated USD 14.3 billion in 2025 and is predicted to register growth from USD 17.7 billion in 2026 to about USD 118.2 billion by 2035, recording a CAGR of 23.50% throughout the forecast span. In 2025, Asia Pacific held a dominan market position, capturing more than a 52.6% share, holding USD 7.53 Billion revenue.

The QR code payments market refers to the systems and services that allow customers to make payments by scanning quick response (QR) codes with a smartphone or other device. QR code payments use a two-dimensional barcode that can link directly to a payment instruction or digital wallet, enabling fast and simple transactions.

These payments can be initiated in stores, in apps, on websites, or between individuals. QR code payments are widely used in retail, transportation, hospitality, and digital commerce where ease of use and low cost are important for merchants and customers.

The main driving factors for the QR code payments market are the increasing adoption of smartphones and rising preference for contactless transactions. Consumers value payment methods that reduce physical contact and speed up checkout. Merchants benefit from systems that require minimal hardware investment because QR codes can be printed or displayed on screens without specialised terminals.

Improvements in mobile internet access and digital wallet use also encourage customers to adopt QR code based payments. In many regions, local payment networks and policies support QR code standards that enhance interoperability and convenience.

Demand analysis shows that interest in QR code payments continues to grow as both consumers and businesses prioritise fast, secure, and easy payment options. Small and medium sized merchants adopt QR code solutions as a low cost way to accept digital payments. Larger retailers and service providers integrate QR codes into loyalty programs and mobile apps to improve engagement.

Cross-border commerce and tourism support use of QR codes where travellers can pay in familiar ways without carrying cash. As digital payment habits strengthen and users seek simple payment experiences, investment in QR code payment tools and infrastructure is expected to remain strong, supporting wider adoption across sectors.

Top Market Takeaways

- By component, software and solutions captured 68.4% of the QR code payments market, driving platforms for generation, scanning, and secure transaction processing.

- By payment type, consumer-to-business dominated at 76.5%, facilitating everyday retail purchases via quick mobile scans.

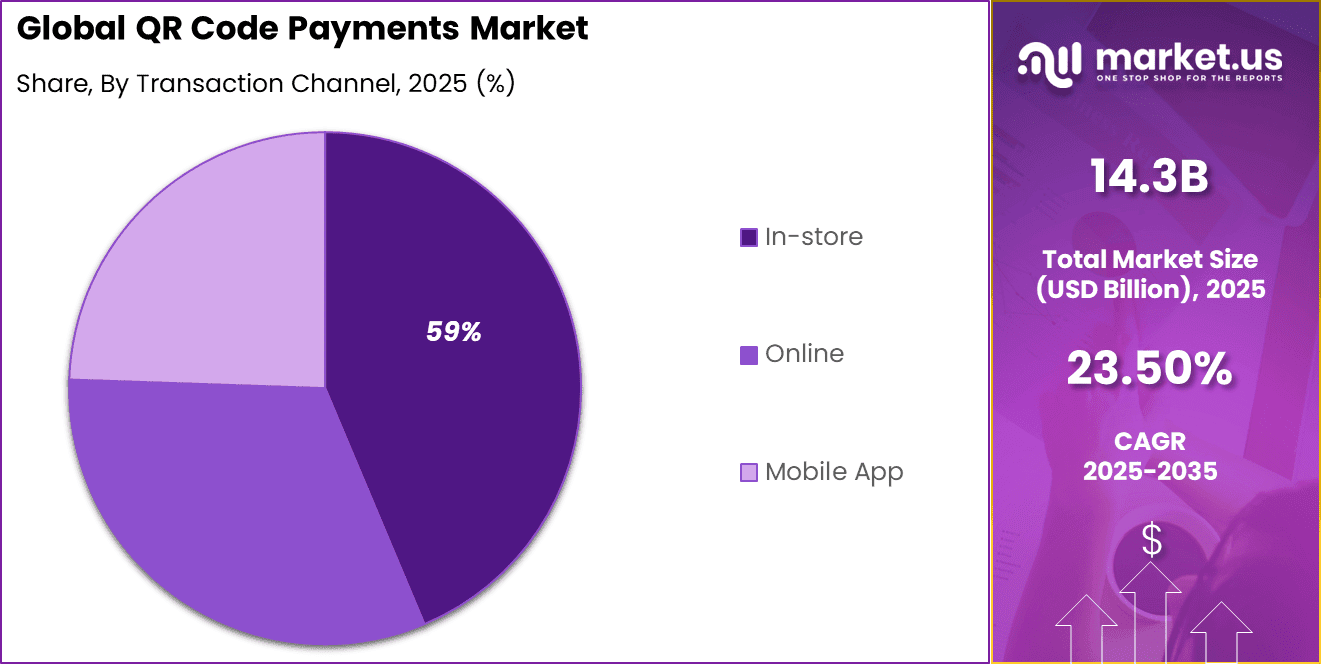

- By transaction channel, in-store payments led with 58.9%, popular for contactless checkouts in supermarkets and small shops.

- By end-user, merchants held 52.7%, adopting QR solutions for low-cost acceptance without expensive POS hardware.

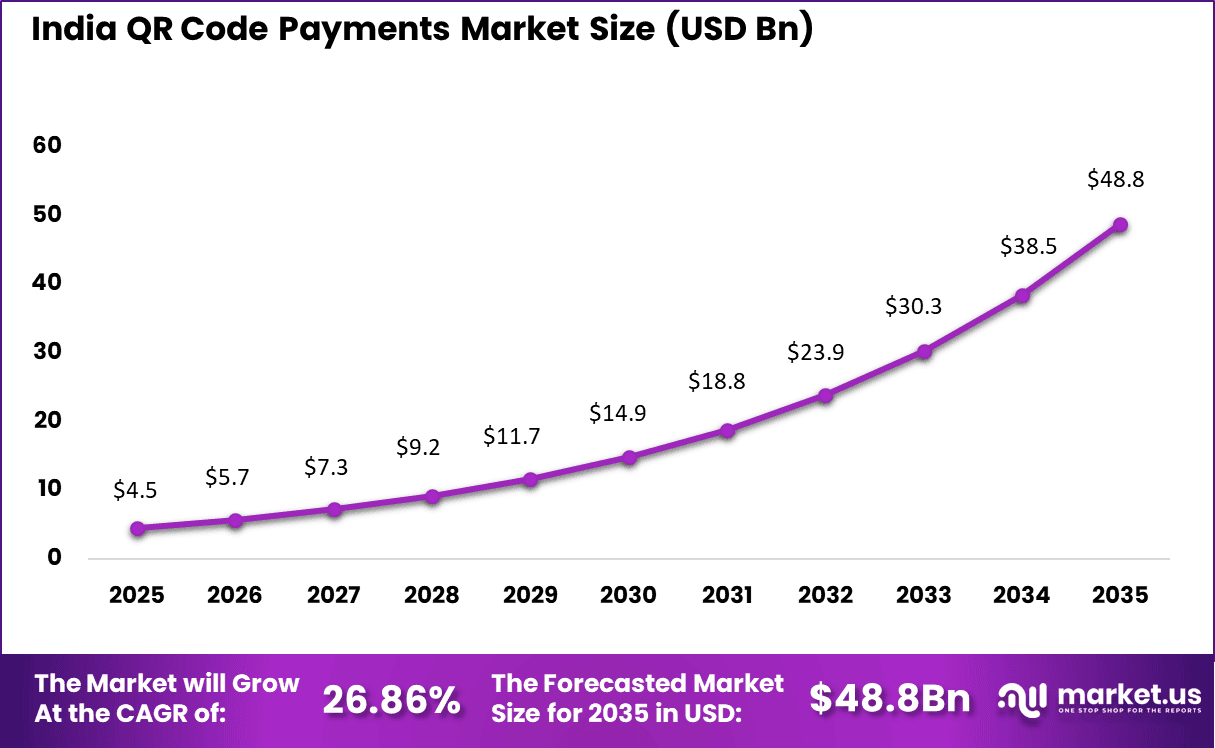

- Asia-Pacific accounted for 52.6% of the global market, with India valued at USD 4.52 billion and growing at a CAGR of 26.86%.

Drivers Impact Analysis

Key Driver Impact on CAGR Forecast (~)% Geographic Relevance Impact Timeline Rapid growth in smartphone and mobile internet penetration +6.2% Asia Pacific, Latin America Short to medium term Strong government support for digital and cashless payments +5.1% Asia Pacific, Europe Medium term Rising preference for contactless and low-cost payment methods +4.6% Global Short term Expansion of QR payments across retail, transport, and utilities +3.9% Asia Pacific, Emerging Markets Medium term Increasing adoption by small merchants and informal businesses +3.1% Asia Pacific, Africa Medium to long term Restraint Impact Analysis

Key Restraint Impact on CAGR Forecast (~%) Geographic Relevance Impact Timeline Security concerns related to QR code fraud and phishing -3.2% Global Short to medium term Limited interoperability across payment platforms -2.6% North America, Europe Medium term Dependence on internet connectivity and smartphones -2.1% Emerging Markets Medium term Consumer trust issues in high-value transactions -1.8% Global Short term Regulatory uncertainty in cross-border QR payments -1.5% Europe, North America Medium to long term Investor Type Impact Matrix

Investor Type Growth Sensitivity Risk Exposure Geographic Focus Investment Outlook Payment service providers Very High Medium Asia Pacific, Global Strong recurring transaction growth Fintech and super-app platforms Very High High Asia Pacific High scalability and ecosystem expansion Banks and financial institutions High Medium Asia Pacific, Europe Strategic relevance for retail payments Private equity firms Medium Medium Emerging Markets Consolidation and merchant network plays Venture capital investors Very High Very High Asia Pacific Suitable for high-growth and early-stage bets Technology Enablement Analysis

Technology Enabler Impact on CAGR Forecast (~%) Primary Function Geographic Relevance Adoption Timeline Mobile wallet and super-app integration +6.0% Seamless consumer payments Asia Pacific Short term Unified QR standards and interoperability frameworks +4.4% Cross-platform acceptance Asia Pacific, Europe Medium term AI-based fraud detection and transaction monitoring +4.1% Improved payment security Global Medium term Offline QR and low-bandwidth payment solutions +3.2% Inclusion in low-connectivity regions Emerging Markets Medium to long term Cloud-based payment processing infrastructure +2.8% Scalability and uptime Global Long term Component Analysis

Software and solutions account for 68.4% of the QR Code Payments market, showing that the core value lies in digital payment platforms rather than physical infrastructure. These solutions include QR code generation, transaction processing, security layers, and integration with banking and wallet systems.

Merchants and payment providers rely on software platforms to manage transactions, reconcile payments, and monitor activity in real time. Software-based systems are easy to deploy and update, which supports rapid adoption across different business sizes.

From an operational point of view, software solutions reduce dependency on costly hardware such as POS terminals. They also support scalability as transaction volumes increase. The strong share of this segment reflects market preference for flexible, low-cost, and easily integrable payment solutions that can be deployed across multiple locations and use cases.

Payment Type Analysis

Consumer-to-business payments represent 76.5% of the QR Code Payments market, making this the dominant transaction type. C2B payments are widely used for retail purchases, food services, transportation, and daily consumer spending. QR codes allow customers to make payments quickly using mobile wallets or banking apps by scanning a code at the point of sale.

This reduces checkout time and improves customer convenience. From a merchant perspective, C2B QR payments simplify payment acceptance and reduce cash handling. They also lower transaction costs compared to traditional card payments. The strong dominance of this segment reflects widespread consumer acceptance of QR-based payments for everyday purchases and routine transactions.

Transaction Channel Analysis

In-store transactions account for 59% of the QR Code Payments market, highlighting the importance of physical retail environments. QR codes are widely used at checkout counters, tables, and service points in brick-and-mortar stores. They enable contactless payments without the need for card readers or physical interaction, which improves transaction speed and hygiene.

Retailers benefit from faster checkout and reduced hardware investment. In-store QR payments also support small merchants who may not have access to traditional POS systems. The strong share of this segment reflects growing use of QR codes to modernize in-store payment experiences and improve operational efficiency.

End-User Analysis

Merchants account for 52.7% of end-user adoption, making them the largest user group in the QR Code Payments market. Small retailers, restaurants, service providers, and street vendors use QR codes to accept digital payments with minimal setup. QR-based systems are especially attractive to merchants due to low onboarding cost and ease of use.

For merchants, QR code payments improve cash flow visibility and reduce payment processing complexity. They also support faster settlement and better transaction tracking. The strong presence of this segment reflects merchant demand for simple, affordable, and reliable digital payment solutions that support daily business operations.

Emerging Trends

Key Trend Description Dynamic QR codes Merchant-generated codes with transaction details for security. Cross-border interoperability Global standards enable international QR acceptance. Biometric QR verification Face and fingerprint confirmation reduces fraud risks. Offline QR capabilities Works without internet for remote transactions. AR-enhanced payments Scannable codes with promotional overlays. Growth Factors

Key Factors Description Smartphone penetration boom Universal access drives consumer adoption. Merchant cost advantages Lower fees than card infrastructure. Financial inclusion push Unbanked populations access digital payments. Government digital initiatives UPI-style systems promote cashless economies. Pandemic contactless shift Hygiene preferences accelerate QR usage. Key Market Segments

By Component

- Software & Solutions

- Services

By Payment Type

- Peer-to-Peer

- Consumer-to-Business

- Business-to-Business

By Transaction Channel

- In-store

- Online

- Mobile App

By End-User

- Merchants

- Consumers

- Financial Institutions

Regional Analysis

Asia Pacific accounted for 52.6% share, supported by rapid expansion of mobile payments and strong adoption of QR based transaction models across retail, transportation, and peer to peer payments. The region has benefited from high smartphone penetration and widespread acceptance of low cost, interoperable payment solutions.

Demand has been driven by the need for fast, contactless transactions and financial inclusion across both urban and rural areas. Merchants and consumers have increasingly preferred QR code payments due to ease of use and minimal infrastructure requirements.

India reached a market value of USD 4.52 Bn and is projected to grow at a 26.86% CAGR, reflecting strong momentum in digital payments adoption. QR code payments have become a preferred method for everyday transactions across small merchants, large retailers, and service providers.

Growth has been driven by widespread use of real time payment systems and strong consumer trust in mobile based payment platforms. Low transaction costs and simple onboarding have accelerated adoption among micro and small businesses.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Driver Analysis

A key driver for the QR code payments market is the low cost and ease of deployment for merchants. QR payments require minimal infrastructure, often limited to a printed or digital code, which makes them attractive for small and medium sized businesses. This reduces the entry barrier for accepting digital payments, especially in price sensitive and informal retail environments. As a result, merchant acceptance continues to expand rapidly.

Another strong driver is the growing consumer preference for contactless payment methods. Health awareness and convenience have increased demand for payment options that do not require physical contact with terminals or cash. QR code payments meet this requirement while also supporting fast transaction completion. This combination of safety and convenience is reinforcing consumer willingness to use QR based payments in high footfall locations.

Restraint Analysis

One major restraint is the dependence of QR code payments on smartphones and reliable internet connectivity. In regions with limited mobile data coverage or lower smartphone penetration, transaction completion can be inconsistent. This infrastructure dependency can slow adoption in rural or underdeveloped areas. As a result, QR payments may coexist with cash and card payments for longer periods in such markets.

Another restraint involves security concerns related to QR code fraud and tampering. Fraudsters can replace legitimate QR codes with malicious ones that redirect payments or collect sensitive information. While security controls exist, user awareness and education remain uneven. These risks can affect consumer trust if not addressed through safeguards and monitoring.

Opportunity Analysis

A significant opportunity lies in expanding QR code payments into everyday services such as utility bill payments, public transport, parking, and peer to peer transfers. Embedding QR payments into daily routines can increase transaction frequency and consumer reliance on this payment method. This expansion supports broader digital payment adoption and reduces cash dependency.

Another opportunity exists in improving interoperability across different QR payment systems. When users can scan one QR code using multiple payment apps, friction is reduced and acceptance improves. Interoperable frameworks can accelerate adoption among both merchants and consumers. This approach also supports cross border use cases and tourism related payments.

Challenge Analysis

A key challenge for the QR code payments market is maintaining a consistent and intuitive user experience across platforms. Differences in app interfaces, scanning processes, and authentication flows can create confusion for users. This inconsistency may reduce confidence and slow repeat usage. Standardized user journeys remain an important requirement for long term adoption.

Another challenge is balancing ease of use with strong security controls. QR payments are designed for speed and simplicity, but additional authentication steps may be required to prevent fraud. Introducing these safeguards without increasing checkout friction is technically and operationally complex. Payment providers must continuously refine this balance to sustain trust and usability.

Competitive Analysis

Global digital payment leaders such as PayPal, Square, and Stripe play a major role in QR code payment adoption. Their platforms enable fast merchant onboarding and seamless QR-based checkout. Integration with mobile wallets and fraud controls improves transaction security. These players benefit from wide merchant acceptance and developer-friendly APIs. Demand is driven by the need for low-cost, contactless payments across online and offline channels.

Super-app and wallet providers such as Alipay and WeChat Pay dominate high-volume QR transactions in Asia. Google Pay and Amazon Pay extend QR payments through large consumer ecosystems. Their strength lies in scale, user familiarity, and embedded loyalty features. Adoption is supported by high smartphone penetration and growing acceptance among small merchants and transit services.

Card networks and regional fintechs such as Visa and Mastercard support interoperability and security standards for QR payments. India-focused providers including Paytm, PhonePe, BharatPe, and Razorpay drive mass adoption through UPI-linked QR codes. Other players expand competition and regional reach.

Top Key Players in the Market

- PayPal

- Square

- Alipay

- WeChat Pay

- Google Pay

- Amazon Pay

- Stripe

- Mastercard

- Visa

- BharatPe

- Paytm

- PhonePe

- Razorpay

- SumUp

- iZettle

- Others

Future Outlook

Growth in the QR Code Payments market is expected to remain strong as consumers and merchants prefer simple and contactless payment methods. QR based payments are widely used in retail, food services, transport, and peer to peer transfers due to low setup cost and ease of use.

Rising smartphone penetration and support from banks and payment apps are driving wider acceptance. Over time, better security features, faster settlement, and integration with loyalty programs are likely to improve user trust and daily usage.

Recent Developments

- In 2025, Razorpay snagged PA-CB license in December 2025, enabling full cross-border payments for 10+ million businesses processing $150 billion yearly. It cements QR/UPI edge over Stripe in India. BharatPe, Paytm, PhonePe fueled UPI credit surge, RuPay hitting 28% cards via QR.

- In 2025, Square (Block) deepened QR for small merchants in unified POS, contactless focus. PayPal QR targeted SMEs with loyalty, multi-currency. Google Pay pushed UPI QR innovations for digital tools.

Report Scope

Report Features Description Market Value (2025) USD 14.3 Bn Forecast Revenue (2035) USD 118.2 CAGR(2025-2035) 23.50% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2035 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics and Emerging Trends Segments Covered By Component (Software & Solutions, Services), By Payment Type (Peer-to-Peer, Consumer-to-Business, Business-to-Business), By Transaction Channel (In-store, Online, Mobile App), By End-User (Merchants, Consumers, Financial Institutions) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape PayPal, Square, Alipay, WeChat Pay, Google Pay, Amazon Pay, Stripe, Mastercard, Visa, BharatPe, Paytm, PhonePe, Razorpay, SumUp, iZettle, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- PayPal

- Square

- Alipay

- WeChat Pay

- Google Pay

- Amazon Pay

- Stripe

- Mastercard

- Visa

- BharatPe

- Paytm

- PhonePe

- Razorpay

- SumUp

- iZettle

- Others