Global Purchase-Mortgage Market Size, Share, Industry Analysis Report By Type (Fixed-Rate, Floating-Rate), By Customer Type (Salaried, Self-Employed), By Provider (Public Sector Banks, Private Sector Banks, Housing Finance Companies (HFCs), Non-Banking Financial Companies (NBFCs)), By Regional Analysis, Global Trends and Opportunity, Future Outlook By 2025-2034

- Published date: Oct. 2025

- Report ID: 162603

- Number of Pages: 298

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaway

- Role of Generative AI

- Investment and Business Benefits

- U.S. Purchase-Mortgage Market Size

- Type Analysis

- Customer Type Analysis

- Provider Analysis

- Emerging Trends

- Growth Factors

- Key Market Segments

- Drivers

- Restraint

- Opportunities

- Challenges

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

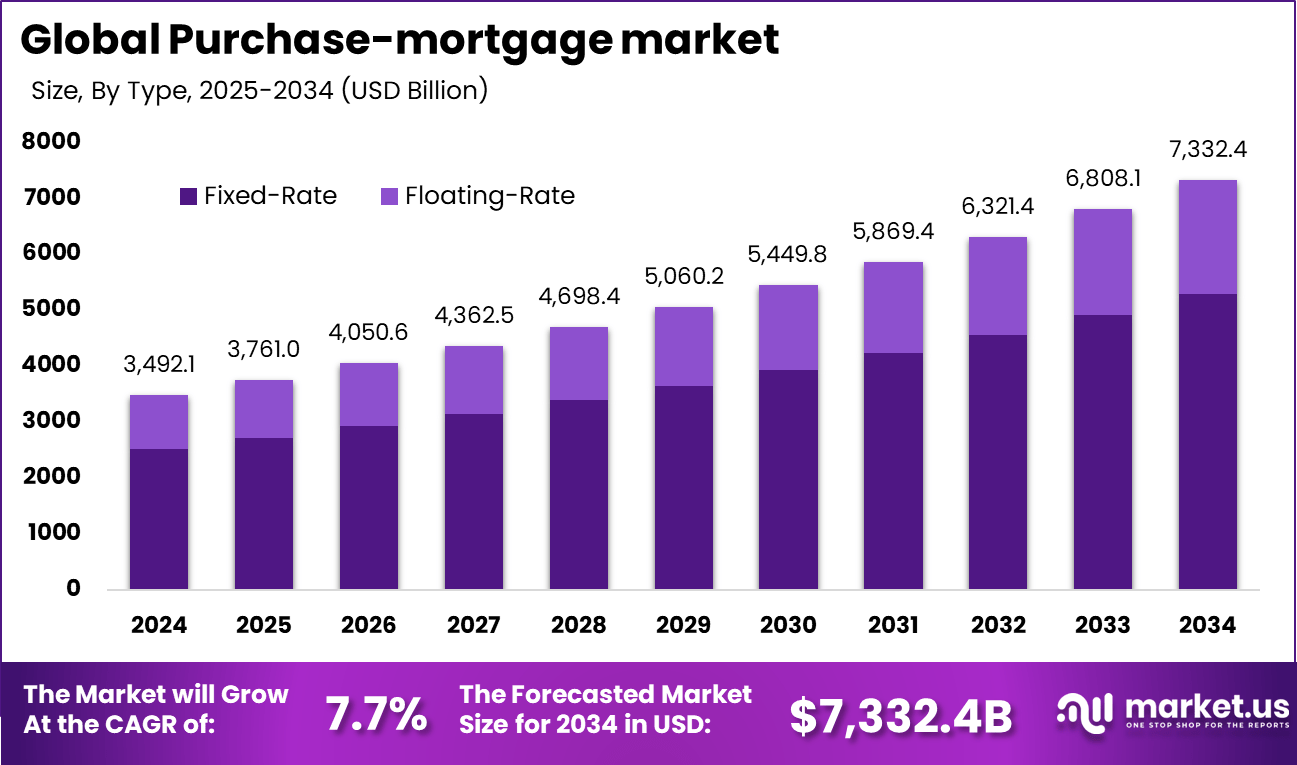

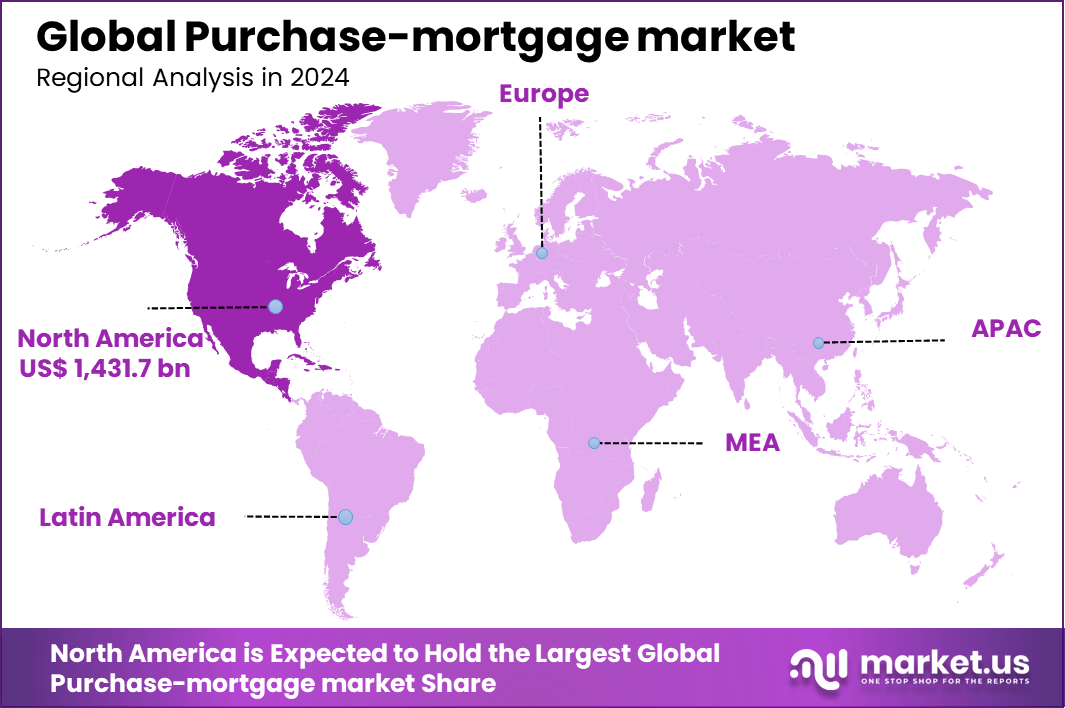

The Global Purchase-mortgage market size is expected to be worth around USD 7,332.4 billion by 2034, from USD 3,492.1 billion in 2024, growing at a CAGR of 7.7% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 41% share, holding USD 1,431.7 billion in revenue.

The Purchase Mortgage Market centers on home loans that buyers obtain to finance the purchase of residential properties. It is a fundamental segment of the broader mortgage and housing finance industry, supporting homeownership by facilitating the upfront capital needed to acquire homes. Despite fluctuations in interest rates, the purchase mortgage market remains a critical driver of real estate demand and economic activity, with buyers ranging from first-time homeowners to investors and families upgrading their residences.

Top Driving Factors in this market include the influence of interest rates set by monetary authorities like the Federal Reserve, which directly impact borrowing costs. Rising disposable incomes and ongoing urbanization also fuel demand for new homes and commercial properties. Additionally, changes in consumer behavior towards digital and low-contact services prompt lenders to innovate.

According to Freddie Mac, the average 30-year fixed mortgage rate declined to 6.19% for the week ending October 23, 2025, marking the lowest level in over a year. Earlier in 2025, the rate had exceeded 7%, reflecting a period of elevated borrowing costs. Data from The Economic Times indicates that rates averaged 6.27% around October 22, 2025, and 6.35% on October 15, 2025.

The pandemic accelerated the adoption of online mortgage applications and digital verification processes, creating more efficiency and better customer experiences. The market for purchase mortgages is driven primarily by stabilizing mortgage rates, which have eased borrowing costs compared to previous years. This improved affordability encourages more homebuyers, especially in the middle-income segment, to enter the market.

For instance, in March 2025, BNP Paribas introduced an AI-powered process designed to accelerate the approval of mortgage loans. This innovative approach leverages artificial intelligence to automate document verification, significantly reducing the time customers typically wait for loan approval. The automation not only speeds up the lending process but also enhances customer satisfaction by delivering faster and more efficient service.

Key Takeaway

- The Fixed-Rate segment dominated with 72.1%, indicating borrowers’ preference for stable interest rates amid fluctuating economic conditions.

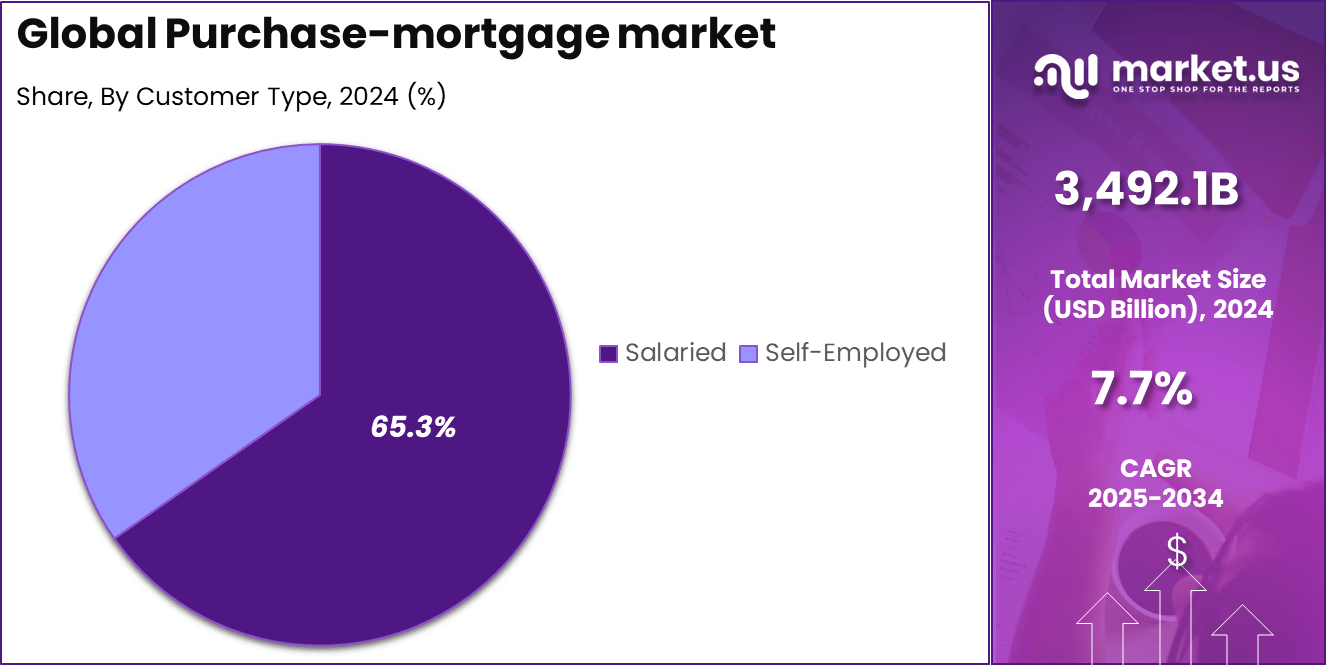

- The Salaried segment accounted for 65.3%, reflecting consistent income stability and easier loan eligibility among employed individuals.

- Public Sector Banks held 34.8% of the market, supported by competitive lending rates and government-backed mortgage programs.

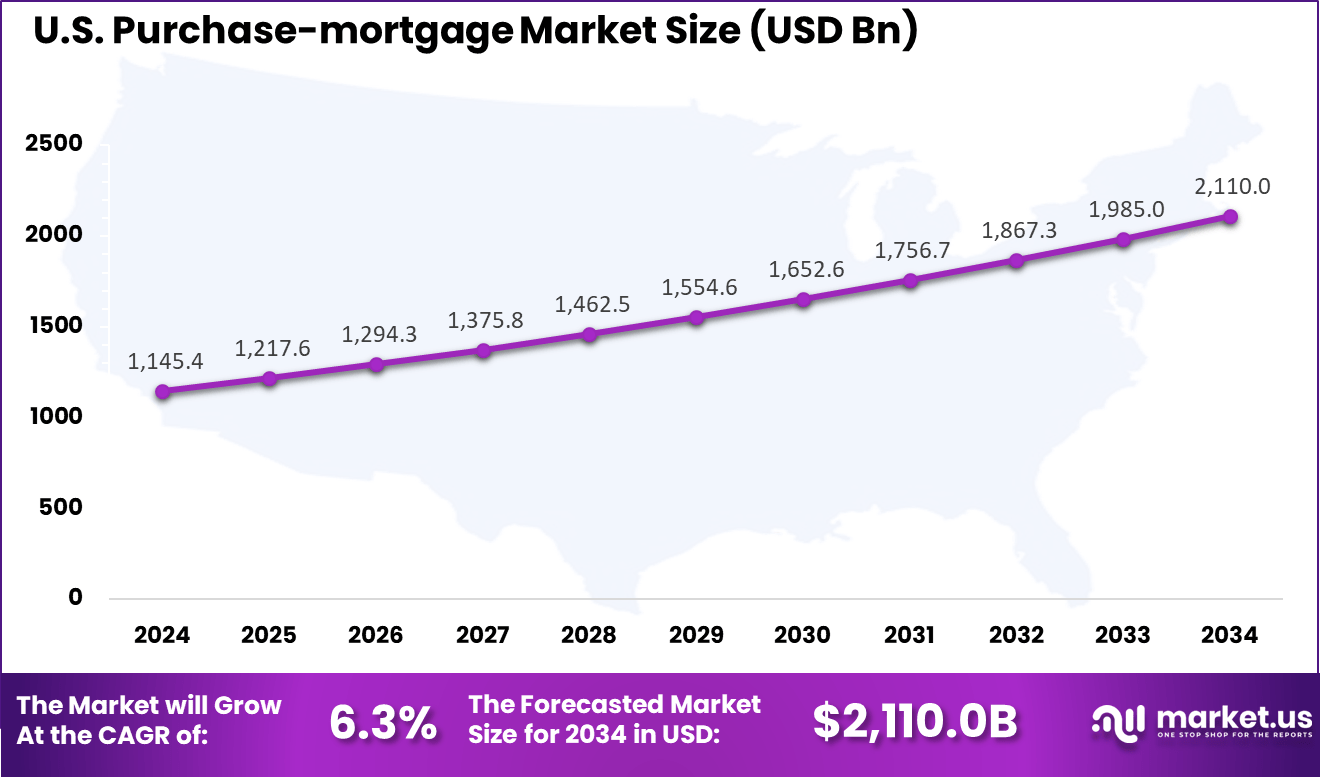

- The US market was valued at USD 1,145.4 Billion in 2024, expanding at a robust 6.3% CAGR, driven by steady housing demand and favorable credit conditions.

- North America maintained dominance with a 41% global share, supported by a mature financial ecosystem and high homeownership rates.

Role of Generative AI

Generative AI is reshaping the purchase-mortgage market by automating tedious tasks such as document verification, data entry, and comprehensive loan assessments. This technology speeds up loan processing, enhances accuracy, and reduces underwriting costs. A recent survey found that adoption of generative AI in mortgage lending is growing steadily, with efficiencies cutting review times by over 50%.

In 2025, it is estimated that about 42% of mortgage lenders are actively incorporating generative AI to improve customer experience and operational workflows. The impact of generative AI extends to improving risk assessment by analyzing vast amounts of borrower data and regulatory disclosures quickly. This not only streamlines correspondent lending but also supports faster decision-making while maintaining compliance.

Investment and Business Benefits

Investment Opportunities in the purchase mortgage space are expanding as investors seek stable income streams and portfolio diversification. Mortgage loans, secured by real estate, provide an attractive risk-return profile with consistent interest payments. Investors can engage through direct lending, mortgage trusts, or mortgage-backed securities (MBS).

The commercial mortgage sector is gaining attention for higher yields, particularly in short-term bridge loans or specialized loans like construction financing. Technology-driven platforms also facilitate easier access for retail investors. However, risks such as borrower default and interest rate fluctuations require careful credit assessment and risk management.

Business Benefits for lenders and mortgage providers include increased operational efficiency, reduced processing errors, and a better borrower experience. Digital mortgage origination software helps automate end-to-end processes from the funding application. This not only lowers administrative costs but also speeds up decision-making and enhances compliance with regulatory demands.

U.S. Purchase-Mortgage Market Size

The market for purchase mortgages within the U.S. is growing tremendously and is currently valued at USD 1,145.4 billion, the market has a projected CAGR of 6.3%. The U.S. remains a key growth engine within the region, supported by sustained consumer confidence and innovation in digital mortgage processing. Structured loan products, combined with a stable job market, have strengthened borrowers’ purchasing capacity.

Government and regulatory support for affordable home programs also contributes to steady mortgage inflows. Together, these factors have created a balanced environment where both traditional lenders and fintech-driven mortgage platforms coexist, making the region’s market structurally sound and future-oriented.

For instance, In October 2025, Rocket Companies completed a $14.2 billion acquisition of Mr. Cooper Group, marking the largest independent mortgage deal in U.S. history. The merger unites Rocket Mortgage’s leadership in loan origination with Mr. Cooper’s position as the nation’s largest mortgage servicer, creating a combined portfolio serving nearly 10 million homeowners.

In 2024, North America held a dominant market position in the Global Purchase-mortgage market, capturing more than a 41% share, holding USD 1,431.7 billion in revenue. This dominance is due to the region’s robust homeownership culture, backed by steady employment rates and government support for housing finance.

Advanced digital mortgage platforms have improved access and ease of borrowing for a wide range of consumers, boosting overall market activity. Additionally, low mortgage default rates and favorable regulatory frameworks have reinforced investor confidence and lender participation in this market. This mix of economic stability, innovation, and policy support continues to fuel growth.

For instance, in March 2025, Bank of America reported a significant surge in mortgage applications, with an 80% increase in Q1 compared to the previous year. This surge was attributed to higher housing inventory levels and lower bond yields, which helped improve affordability. The bank’s executive highlighted that while mortgage rates remain volatile, the favorable market conditions are driving increased demand for purchase mortgages.

Type Analysis

In 2024, The Fixed-Rate segment held a dominant market position, capturing a 72.1% share of the Global Purchase-mortgage market. This dominance reflects the consistent preference of borrowers for interest stability and predictable repayment schedules, especially during cycles of fluctuating lending rates.

Many households see fixed-rate options to safeguard themselves against long-term rate uncertainty, providing a sense of financial discipline and planning comfort. The reliability of this structure often makes it the default choice for first-time homebuyers and middle-income groups seeking manageable risk.

The market shift toward fixed-rate loans also signals stronger consumer confidence and lender adaptability. Banks and financial institutions have refined underwriting methods to ensure better rate-lock mechanisms and transparent credit assessment. Borrowers are increasingly using digital interfaces to compare loan types, and fixed-rate products often stand out for clarity and lifetime value.

For Instance, in October 2025, Morgan Stanley emphasizes fixed-rate mortgages in their residential mortgage loan trusts, with portfolios strongly weighted toward fixed-rate products, providing stability for investors and borrowers. This approach aligns with market demand for predictable repayment plans amid slight fluctuations in interest rates.

Customer Type Analysis

In 2024, the Salaried segment held a dominant market position, capturing a 65.3% share of the Global Purchase-mortgage market. The market is showing its clear influence in driving housing finance growth. Stable income patterns and consistent credit histories allow them to access favorable loan terms and repayment flexibility.

Lenders prioritize this category because the repayment risk remains comparatively lower, making it a foundation of retail banking portfolios. The category has also benefited from increased employment security and an expanding professional class across urban centers. The salaried segment has also been quick to adopt digital loan services, using online approval systems and integrated payroll verification tools. This convenience has accelerated loan processing and improved access to competitive rates.

Coupled with supportive mortgage education programs, many working-class households view this phase as an opportunity to enter the homeownership cycle. With rising incomes and government incentives promoting affordable housing, salaried borrowers continue to anchor steady demand for home purchase financing.

Provider Analysis

In 2024, The Public Sector Banks segment held a dominant market position, capturing a 34.8% share of the Global Purchase-mortgage market. This dominance is due to their crucial role in maintaining market stability and credit trust. Their widespread branch networks, transparent rate structures, and customer familiarity keep them influential across rural and semi-urban markets.

They remain key supporters of middle-income borrowers who value reliable service and recognizable financial brands. Despite rising competition from private and fintech lenders, public banks retain a loyal customer base with long-standing credit relationships. Recent improvements in digital banking and faster credit processing have helped public sector lenders align with modern expectations.

Many have introduced simplified documentation and borrower-friendly schemes aimed at expanding financial inclusion. They are also leveraging data-driven credit models to make loan approvals faster while preserving traditional relationship-based lending. Their presence ensures balanced competition in the mortgage ecosystem and supports consistent credit flow across income categories.

For Instance, in June 2025, public sector banks like China Construction Bank and Commonwealth Bank of Australia have solidified their market presence with a 34.8% share of mortgage lending. These banks benefit from established trust and accessibility across diverse customer bases while upgrading digital loan systems to stay competitive.

Emerging Trends

Emerging trends in the purchase-mortgage market include the rise of digital mortgage platforms that simplify loan applications and approvals. Mortgage originations for purchases grew about 10% year-over-year in early 2025 despite higher interest rates, suggesting steady demand driven by increased housing inventory and digital convenience.

Additionally, new home inventories increased 8% year-over-year, fueling more purchase mortgage applications even as new home sales dipped slightly. Another emerging trend is the integration of AI and machine learning for more accurate credit scoring and fraud detection, which are becoming standard practices among lenders.

This trend supports tighter regulatory oversight and helps lenders manage risks while offering personalized lending products that cater to specific borrower needs. Mortgage refinancing activity also surged around 64% year-over-year, reflecting borrowers’ attempts to take advantage of improving mortgage rate conditions.

Growth Factors

Growth factors driving the purchase-mortgage market include rising urbanization and a growing middle class in developing economies, which have boosted housing demand and mortgage uptake. Governments promoting homeownership through incentives have played a key role, as 2025 saw increased access to affordable financing options.

The increasing role of fintech companies streamlining application processes has improved borrower accessibility, contributing significantly to market growth. Another growth factor is stable yet slightly fluctuating interest rates that continue to influence borrower behavior positively.

Despite higher rates overall, the spread between 30-year mortgage and treasury yields has narrowed by 22 basis points, offering partial relief to borrowers. This environment encourages sustained demand for purchase loans in regions with increased housing supply, supported by ongoing economic stability.

Key Market Segments

By Type

- Fixed-Rate

- Floating-Rate

By Customer Type

- Salaried

- Self-Employed

By Provider

- Public Sector Banks

- Private Sector Banks

- Housing Finance Companies (HFCs)

- Non-Banking Financial Companies (NBFCs)

Drivers

Stabilizing Mortgage Rates Boost Purchase Volume

Mortgage rates have shown a trend of gradual decline and relative stability, improving affordability for many potential buyers. This has encouraged a notable rise in purchase mortgage applications, especially as buyers feel more confident locking in rates. The easing of rates after a period of increases has helped reduce some of the financial pressure on homebuyers, making homeownership more attainable compared to recent times.

Additionally, this stable interest rate environment has supported a steady flow of mortgage originations. Buyers, including first-time purchasers, are more willing to enter the market when rates become predictable and less volatile. Financial institutions have also responded by offering competitive mortgage products, further facilitating purchase activity.

For instance, in August 2025, Morgan Stanley announced offering mortgage financing options to high-net-worth clients, helping them secure properties with flexible terms and attractive rates. They focus on personalized solutions for ultra-wealthy clients seeking to buy premium homes in major markets.

Restraint

High Home Prices Restrict Buyer Access

Despite more stable mortgage rates, persistently high home prices continue to pose a major hurdle for many buyers. The elevated cost of homes has limited affordability, particularly for first-time homebuyers and those with constrained budgets. As prices remain out of reach for a large portion of the market, the pace of new purchase mortgages is restrained.

This pricing challenge is compounded by limited inventory, as current homeowners with lower-rate mortgages are hesitant to sell. The resulting shortage of available homes pushes prices higher and discourages potential buyers from entering the market. This dynamic dampens the overall demand despite improvements in financing conditions.

For instance, in March 2025, U.S. Bank pointed out that even with raised government-backed loan limits, home prices remain a barrier. The bank’s head of retail home lending explained that down payments continue to challenge many buyers, despite better loan conditions and assistance programs designed for first-time buyers.

Opportunities

Growing Interest Among First-Time Buyers

First-time homebuyers represent a key opportunity for growth in the purchase mortgage market. Demographic shifts and governmental initiatives designed to foster homeownership have increased interest in this segment. Programs aimed at reducing entry barriers, coupled with favorable lending terms through government-backed loans, make homeownership more accessible to new buyers.

Furthermore, advancements in technology have streamlined mortgage lending processes, making it easier and faster for first-time buyers to secure financing. Digital mortgage platforms and automated underwriting reduce complexity and wait times, encouraging this customer base to proceed with home purchases.

For instance, in February 2025, Santander UK became the first major lender to reduce mortgage rates significantly, introducing sub-4% fixed rates for purchase mortgages at moderate loan-to-value ratios. This initiative aimed to activate purchase demand by lowering monthly costs and increasing product choices for buyers.

Challenges

Economic Uncertainty Causes Buyer Hesitation

Economic uncertainty remains a significant challenge for the purchase mortgage sector. Many potential buyers are holding off on making decisions due to concerns over job security, inflation, and the possibility of further changes in mortgage rates. This cautious approach has slowed market activity, as individuals wait to better understand future financial conditions.

Additionally, widespread expectations that mortgage rates may decline further contribute to purchasing delays. Buyers often adopt a “wait-and-see” mindset, hoping to secure even more favorable terms. This hesitation leads to softer demand and can cause fluctuations in market momentum, affecting lenders and real estate professionals alike.

For instance, in October, ANZ Bank indicated it might join a 5% deposit scheme for first-home buyers after initially opting out. This change reflects an effort to ease entry barriers during ongoing economic uncertainties, including inflation and job market volatility, which contribute to buyer hesitation.

Key Players Analysis

The Purchase-Mortgage Market is led by global financial institutions such as JPMorgan Chase & Co., Bank of America Corporation, Wells Fargo & Co., and Citigroup Inc. These major U.S. lenders dominate home financing through large-scale mortgage origination, refinancing programs, and digital lending platforms. Their extensive customer bases, competitive interest rates, and advanced underwriting technologies drive consistent growth in both residential and commercial mortgage segments.

International banking leaders including Barclays plc, HSBC Group, BNP Paribas Personal Finance, and Santander Consumer Finance play a crucial role in Europe’s and Asia’s mortgage lending landscape. Their portfolios include cross-border financing, fixed and variable rate mortgages, and sustainable home loans. These institutions are increasingly adopting AI-based credit scoring and digital approval systems to streamline loan processing and improve customer experience.

Emerging and regionally focused lenders such as ANZ Bank, Commonwealth Bank of Australia, China Construction Bank, Morgan Stanley, Goldman Sachs, Charles Schwab & Co., and Rocket Mortgage, along with other participants, contribute through retail banking innovation and online mortgage platforms. Their emphasis on mobile-first solutions, flexible repayment options, and data-driven risk assessment continues to modernize mortgage origination and expand access to credit in global housing markets.

Top Key Players in the Market

- Morgan Stanley

- S. Bank

- Barclays plc

- BNP Paribas Personal Finance

- Santander Consumer Finance

- ANZ Bank

- Commonwealth Bank of Australia

- China Construction Bank

- Rocket Mortgage

- Wells Fargo & Co.

- Bank of America Corporation

- JPMorgan Chase & Co.

- Citigroup Inc.

- HSBC Group

- Goldman Sachs

- Charles Schwab & Co.

- Others

Recent Developments

- In February 2025, Barclays introduced new mortgage products, including a 5.29% two-year fixed-rate and a green home 5-year fixed rate at around 4.13%, alongside rate cuts on existing products. These targeted first-time buyers and buy-to-let customers in the UK market.

- In March 2025, BNP Paribas Personal Finance advanced its commitment to sustainable financing by rolling out energy-efficient home loans and services, contributing to a net-zero carbon economy objective by 2050. They focus on products supporting energy transition technologies like solar and smart home systems.

Report Scope

Report Features Description Market Value (2024) USD 3,492.1 Bn Forecast Revenue (2034) USD 7,332.4 Bn CAGR(2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue forecast, AI impact on Market trends, Share Insights, Company ranking, competitive landscape, Recent Developments, Market Dynamics, and Emerging Trends Segments Covered By Type (Fixed-Rate, Floating-Rate), By Customer Type (Salaried, Self-Employed), By Provider (Public Sector Banks, Private Sector Banks, Housing Finance Companies (HFCs), Non-Banking Financial Companies (NBFCs) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of Latin America; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Morgan Stanley, U.S. Bank, Barclays plc, BNP Paribas Personal Finance, Santander Consumer Finance, ANZ Bank, Commonwealth Bank of Australia, China Construction Bank, Rocket Mortgage, Wells Fargo & Co., Bank of America Corporation, JPMorgan Chase & Co., Citigroup Inc., HSBC Group, Goldman Sachs, Charles Schwab & Co., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to choose from: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users, Printable PDF)

-

-

- Morgan Stanley

- S. Bank

- Barclays plc

- BNP Paribas Personal Finance

- Santander Consumer Finance

- ANZ Bank

- Commonwealth Bank of Australia

- China Construction Bank

- Rocket Mortgage

- Wells Fargo & Co.

- Bank of America Corporation

- JPMorgan Chase & Co.

- Citigroup Inc.

- HSBC Group

- Goldman Sachs

- Charles Schwab & Co.

- Others