Global Programmatic Advertising Market By Type (Real-Time Bidding (RTB), Private Marketplace (PMP), Programmatic Direct), By Platform (Desktop, Mobile, Video, Social Media), By Ad Format (Display, Video, Native, Audio), Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: May 2024

- Report ID: 120323

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

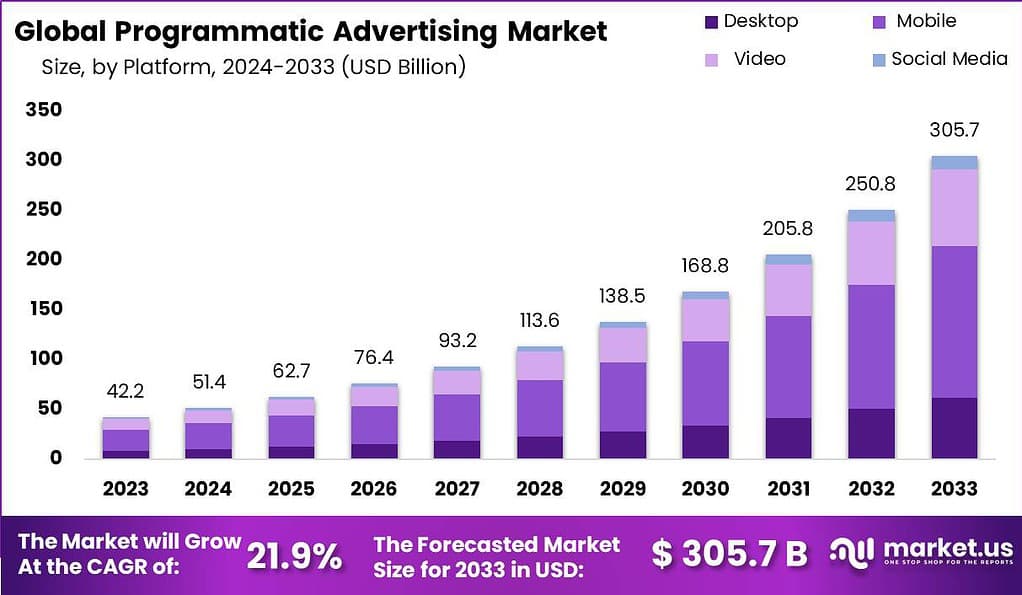

The Global Programmatic Advertising Market size is expected to be worth around USD 305.7 Billion By 2033, from USD 42.2 Billion in 2023, growing at a CAGR of 21.9% during the forecast period from 2024 to 2033.

Programmatic advertising refers to the automated buying and selling of digital advertising inventory through real-time bidding (RTB) and AI-driven algorithms. It streamlines the process of purchasing ad space across various online platforms, allowing advertisers to reach their target audiences more effectively and efficiently. Programmatic advertising uses data analysis, machine learning, and artificial intelligence to optimize ad placements and deliver personalized messages to the right audience at the right time.

The programmatic advertising market has experienced substantial growth in recent years. Advertisers are increasingly adopting programmatic advertising due to its advantages over traditional manual ad buying processes. The automation and data-driven nature of programmatic advertising enable better targeting, cost efficiency, and campaign optimization.

Advertisers can leverage vast amounts of data to identify and target specific audiences, ensuring that their ads reach the most relevant users. Additionally, programmatic advertising offers real-time insights and performance tracking, allowing advertisers to make data-informed decisions and adjust their campaigns in real-time for maximum effectiveness.

According to a report from Deloitte, In 2022, the digital advertising sector in the Netherlands experienced significant growth, with a 13% increase from the previous year. Advertisers invested over 3.5 billion euros in digital advertisements across the country. This surge indicates a robust expansion in the industry, highlighting the increasing importance of digital platforms in the advertising strategies of businesses.

Programmatic advertising is set to dominate the U.S. digital display advertising landscape, with projections suggesting it will comprise 88% of all spending, reaching $81 billion by 2023. Globally, the digital out-of-home (DOOH) advertising market is also poised for substantial growth. From a valuation of $19 billion in 2023, it is expected to expand to approximately $60 billion by 2033, growing at an annual rate of 11.8%.

Marketers are increasingly recognizing the importance of programmatic advertising, with about 83% considering it crucial for their strategies. In Canada, programmatic advertising accounts for 84% of all display ads, indicating a strong adoption rate across North America.

In the U.S., programmatic connected TV (CTV) ad spending is anticipated to reach $21.5 billion this year, marking a 25% increase from the previous year. This growth highlights the channel’s significance, especially during the holiday season when competing effectively is vital. Similarly, mobile continues to lead in programmatic digital display ad spending, underscoring the importance of optimizing content for mobile devices, including vertical video placements.

Moreover, U.S. programmatic podcast ad spending is expected to see a remarkable 41.3% increase this year, reaching about $166.3 million. Although this figure is lower compared to CTV, the growth rate is significantly higher, making programmatic audio a promising avenue for brands with limited budgets.

The U.S. programmatic DOOH sector is also showing signs of recovery post-pandemic, with a projected growth of 48.2% this year, reaching $660 million. Although still behind CTV in terms of total spend, the rapid growth of DOOH indicates its potential as an integral part of effective advertising strategies, particularly during peak shopping periods.

Key Takeaways

- The Programmatic Advertising market size was valued at USD 42.2 billion in the year 2023 and is estimated to reach USD 305.7 billion in the year 2033 with a CAGR of 21.9% during the forecast period.

- Based on the type, the RTB segment is dominating the market with a share of 45%

- On the basis of platform, the mobile platform has the largest market share of 50% during 2023.

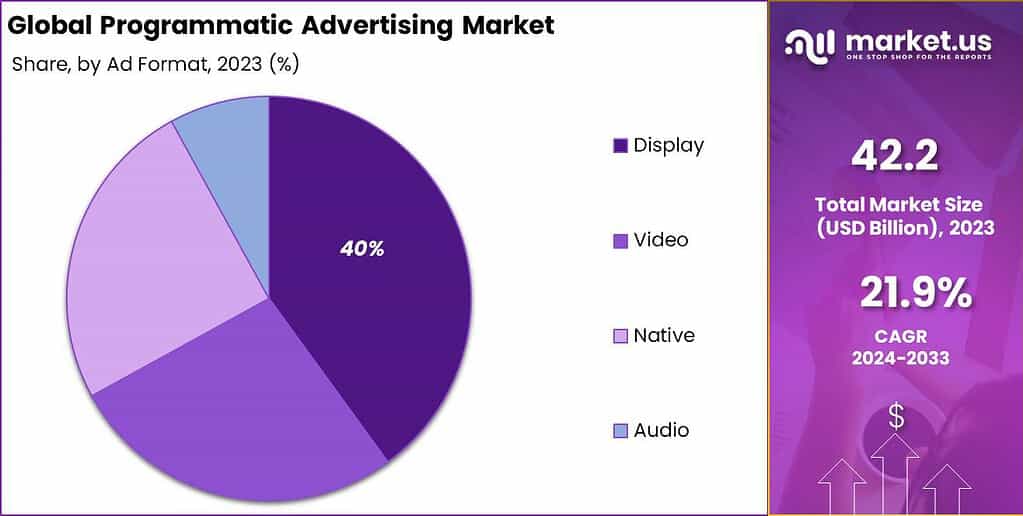

- Based on the ad format, the display segment has dominated the market with a share of 40% in the year 2023.

- Global programmatic budgets are expected to increase by over $300 billion in the next four years. This suggests a very significant expansion in the adoption and spending on programmatic advertising platforms and technologies across the world.

- Programmatic advertising is predicted to be a $62.7 billion market by 2025. This projected market size highlights the continued strong growth and maturation of the programmatic space.

- Around 50% of programmatic ad budgets are allocated to mobile. The dominance of mobile in programmatic advertising is clear, reflecting the shift of consumer attention and engagement to mobile devices.

- Mobile programmatic ad spend is expected to surpass $32.1 billion by 2023. This aligns with the previous point, showing the rapid growth of mobile-focused programmatic ad spend in the coming years.

- Over 60% of total digital advertising spend is programmatic. This statistic underscores the central role programmatic is playing in the digital advertising ecosystem, with the majority of digital ad budgets now flowing through automated, data-driven platforms.

Type Analysis

Based on the type the market is segmented into Real-Time Bidding (RTB), Private Marketplace (PMP), and Programmatic Direct segment, where the RTB segment is dominating the market with a share of 45%. RTB offers marketers a tremendous deal of flexibility and control over their marketing initiatives. RTB gives advertisers the ability to instantly bid on individual ad impressions, giving them the precision targeting of certain audiences and the flexibility to modify their bidding strategy in response to data.

Because of this degree of fine-grained control, RTB is being widely used in programmatic advertising to help marketers maximize return on investment and optimize their ad spend. RTB makes use of algorithms and data-driven insights to enable dynamic ad targeting and optimization. Through real-time analysis of user data and behavioral signals, the RTB platform enhances relevance and placement effectiveness of advertisements by providing customized advertising experiences based on individual interests and behaviors.

With the help of this data-driven strategy, advertisers can connect with their target market at the ideal moment and place, increasing engagement and conversion rates. Furthermore, RTB encourages competition amongst advertisers, which enhances the effectiveness and openness of the ad buying procedure. The RTB platform guarantees fair market value for inventory by allowing numerous advertisers to bid simultaneously for ad impressions.

It also gives advertisers visibility into these figures. Because of the competition and transparency, advertisers are incentivized to keep refining their ad content and bidding tactics, which propels the growth of the RTB segment in the programmatic advertising market.

Platform Analysis

On the basis of platform, the market is segmented into Desktop, Mobile, Video and Social Media segment, where the mobile platform has the largest market share of 50% during 2023. Consumer behavior has undergone a fundamental shift due to the exponential rise in mobile device usage around the globe. People are now more dependent on smartphones and tablets for communication, content access, and decision-making.

The demand for mobile advertising solutions has increased as a result of the broad use of mobile devices, which has produced big and highly engaged audiences for advertisers to target. Advertisers may access rich and diversified data sources, such as location data, device identifiers, and application usage trends, through mobile devices like never before. Due to the abundance of data available, advertisers can provide mobile users with highly targeted and contextually relevant advertising experiences, increasing the efficacy and impact of their campaigns.

The proliferation of mobile applications has completely changed how users interact with brands and content, providing new avenues for advertisers to immerse people in live advertising campaigns. Advertisers can bid on ad placements in well-known mobile apps through this programmatic mobile advertising network, which helps them target users during crucial engagement moments.

Furthermore, the dominance of the mobile segment in the market has been strengthened by the efficiency and simplicity of mobile programmatic advertising, as well as its capacity to produce quantifiable outcomes and return on investment. Digital marketing tactics are anticipated to continue relying heavily on mobile programmatic advertising as mobile devices continue to dominate digital consumption habits and determine the future of advertising.

Ad Format Analysis

Based on the ad format, the market is segmented into Display, Video, Native and Audio segment, where the display segment has dominated the market with a share of 40% in the year 2023. The market domination of the display segment in programmatic advertising can be ascribed to multiple important reasons that highlight its adaptability, efficacy, and extensive uptake by sponsors.

Advertisers can interact with their target audience in a number of ways with display advertising’s array of ad formats, which include banners, rich media ads, video ads, and native ads. The demand for display advertising is fueled by advertisers’ ability to customize their campaigns to various audience preferences, goals, and creative requirements thanks to this flexibility.

By enabling advertisers to target people on the websites, applications, and social media platforms where they spend their time, display advertising gives them a wider audience and increased visibility. Advertisers can efficiently reach and engage audiences at scale thanks to this broad reach, which raises brand awareness, consideration, and conversion rates.

Display advertising gives marketers access to strong targeting and measurement capabilities that let them precisely target and monitor particular audience segments. By using audience segmentation strategies and data-driven insights, advertisers can provide target audiences with individualized and pertinent advertising experiences, increasing the efficacy and impact of their display advertising campaigns.

Furthermore, the display segment’s dominance in the advertising market has been further cemented by the automation and efficiency provided by programmable technology, which enables advertisers to efficiently implement, optimize, and scale their display advertising campaigns with little to no manual intervention.

Key Market Segments

By Type

- Real-Time Bidding (RTB)

- Private Marketplace (PMP)

- Programmatic Direct

By Platform

- Desktop

- Mobile

- Video

- Social Media

By Ad Format

- Display

- Video

- Native

- Audio

Drivers

Increased need for multi-channel campaign management

The market for programmatic advertising is expanding due to the increased need for multi-channel campaign management (MCCM), which is being driven by several strong factors. Through MCCM, marketers may interact with customers via a range of platforms, including email newsletters, mobile apps, and social networking sites. This omnichannel strategy makes use of a variety of touchpoints where customers connect with brands and content to guarantee optimal reach and engagement.

Marketers can provide relevant and personalized messages that are based on the tastes and habits of certain individuals thanks to MCCM. Advertisers can implement programmatic advertising campaigns that are customized to their target audience segments by utilizing data analytics and audience insights, which will increase conversions. increased ROI and student conversion rates. Additionally, the growing complexity of the consumer experience is a driving force behind the demand for MCCM.

Advertisers require strong MCCM solutions to orchestrate consistent, integrated experiences across all touchpoints, increasing loyalty brand success and retention, as consumers travel fluidly between online and offline channels. Additionally, companies trying to boost their competitive edge and expedite marketing are adopting MCCM at a faster rate thanks to the advent of digital transformation. Because MCCM solutions help marketers efficiently improve their multi-channel marketing strategies, the market for programmatic advertising is increasing at a rapid rate.

Restraints

Absence of transparency

The programmatic advertising market’s absence of transparency poses a serious obstacle to its expansion and uptake. Ad tech platforms, publishers, and advertisers all suffer from a loss of confidence when there is a lack of transparency. Concerns around ad fraud, brand safety, and placement arise from the fact that advertisers frequently struggle to decide where to place their ads and whether they are reaching their intended audience.

The opacity impedes the capacity of advertisers to make well-informed decisions and efficiently optimize their advertising efforts. Transparency is made worse by the intricate web of intermediaries and ad exchanges that make up programmatic advertising. Due to their inability to monitor the expenditure of their advertising and comprehend the fees levied by various intermediaries, advertisers frequently experience inefficiencies and discrepancies in the effectiveness of their campaigns.

Additionally, attempts to address problems like ad blocking and fraud are hampered by a lack of openness. Advertisers may find it challenging to detect and address fraudulent conduct if they do not have a thorough understanding of the fundamental principles of programmatic advertising transactions. This could result in lost ad spend and a worse return on investment.

Furthermore, the market for programmatic advertising is less innovative and less growing when there is a lack of transparency. If advertisers believe the ecosystem is untrustworthy and opaque, they could be reluctant to invest in programmatic channels, which would impede the advancement of best practices and new technologies. To put it briefly, resolving the lack of transparency is essential to maximizing programmatic advertising’s potential and building stakeholder trust.

Opportunities

Increasing desire for efficiency and automation

There are great prospects for the programmatic advertising sector to flourish and gain more attention due to the increasing desire for efficiency and automation in advertising. Automation makes the process of purchasing ads and managing campaigns more streamlined, which enables advertisers to run their campaigns more profitably and efficiently.

Utilizing automation technology, programmatic advertising platforms improve budget allocation, target audience selection, and ad placement in real-time, minimizing manual intervention and boosting campaign performance. Through the use of data-driven insights and algorithms, automation helps advertisers reach audiences more precisely and relevantly while providing individualized ad experiences.

Programmatic advertising platforms can leverage machine learning and artificial intelligence (AI) to analyze vast volumes of data, spot trends, forecast customer behavior, and enhance targeting methods to meet advertising objectives and boost campaign efficacy. Moreover, automation enables marketers to expand their advertising campaigns across numerous platforms and channels, reaching consumers everywhere, at any time, with unified branding and messaging.

Programmatic advertising streamlines the process of reaching and interacting with target audiences across the digital environment by offering a single platform to manage campaigns across display, video, mobile, social, and other channels. Automation also creates new avenues for advertising creativity and experimentation, enabling marketers to swiftly and efficiently test and refine their efforts. Advertisers can drive progress by concentrating time and resources on creative strategy and campaign optimization by automating repetitive operations and optimizing campaign performance in real-time.

Challenges

Data privacy and regulatory concerns

The programmatic advertising sector faces notable obstacles due to data privacy and regulatory concerns, which impact both advertisers and consumers. As laws like the California Consumer Privacy Act (CCPA) and the General Data Protection Regulation (GDPR) are put into effect, worries about data privacy are intensifying.

In order to comply with these regulations, which place stringent restrictions on the gathering, storing, and use of personal data for advertising, advertisers must navigate complicated legal frameworks. Serious fines and harm to a brand’s reputation may arise from breaking these rules. Concerns over customer privacy and consent have been raised by the dependence on cookies and third-party data sources for targeting and tracking.

There has been a decrease in the quantity and quality of data available for targeting since a growing number of consumers are reluctant to divulge their personal information to advertising. This affects the efficacy of programmatic advertising campaigns by restricting marketers’ capacity to present relevant and tailored adverts to their target audiences.

Additionally, advertisers constantly have issues in striking a balance between the need for data-driven advertising and protecting consumer privacy due to the constantly changing legislation surrounding data privacy and customer expectations. To safeguard customer data and uphold openness and confidence in their advertising, advertisers need to make significant investments in data governance and compliance systems.

Latest Trends

Higher demand of augmented reality (AR) technology

With new prospects for rich and engaging advertising experiences, the high demand of augmented reality (AR) technology is an exciting trend for the programmatic advertising market. With the use of augmented reality (AR) technology, marketers can develop interactive and captivating ad campaigns that draw viewers in and encourage more involvement.

Advertisers can create immersive advertisements that conflate the real world and smart glasses by superimposing digital material over the real environment using AR-capable devices like smartphones and smart glasses. establishing enduring brand experiences online. AR technology enables contextual and highly targeted advertisement placement based on the surroundings and actions of actual users.

Advertisers can increase the efficacy of their campaigns by delivering timely and relevant augmented reality advertising that are customized to consumers’ individual interests and preferences by utilizing location-based data and contextual targeting capabilities. Additionally, programmatic advertising’s reach and influence are growing due to the broad use of augmented reality technology across a variety of businesses and customer demographics.

As more people utilize augmented reality (AR)-capable gadgets and apps for socializing, shopping, and entertainment, marketers will have more chances to exploit AR as a potent marketing tool. Furthermore, there are countless opportunities for creativity and innovation in programmatic advertising due to the dynamic and ever-evolving nature of augmented reality technology.

Augmented reality (AR) creates new channels for brands to communicate with customers and engage in meaningful interactions, ranging from gamified advertising experiences to virtual try-on experiences and product representations. To put it briefly, the widespread use of augmented reality technology is a significant development that will influence programmatic advertising going forward, providing advertisers with previously unheard-of chances to create compelling advertising campaigns.

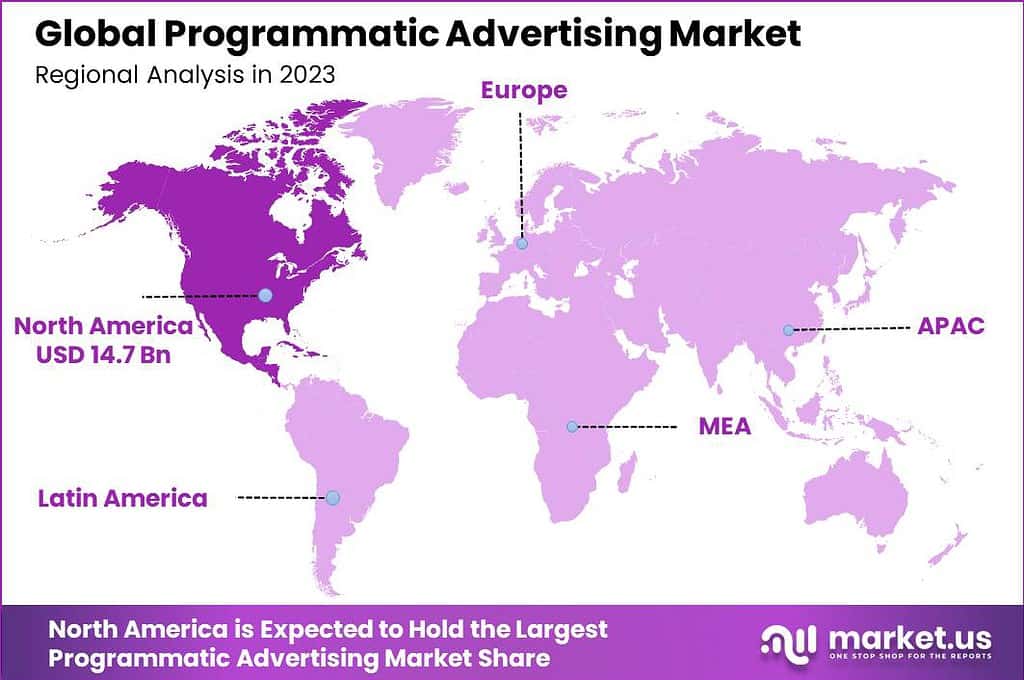

Regional Analysis

In 2023, North America held a dominant market position in the programmatic advertising market, capturing more than a 35% share. This leadership can primarily be attributed to the advanced digital infrastructure and the high penetration of programmatic technology across various industries in the region.

The region’s sophisticated digital infrastructure, developed advertising ecosystem, and robust adoption of potent programmatic technologies are the main reasons for North America’s leadership in the programmatic advertising business. With a high rate of smartphone penetration, extensive Internet access, and sophisticated data infrastructure, North America boasts a highly developed digital infrastructure. Because of this increased level of digital maturity, programmatic advertising is flourishing and advertisers are able to target sizable, active audiences on a range of digital platforms and channels.

Many of the biggest technology and advertising businesses in the world, like Google, Facebook, and Amazon, are based in North America. These companies have made significant investments in technology and advertising platforms. These businesses solidify North America’s leadership in the industry by promoting innovation and the adoption of programmatic advertising solutions through the use of their extensive resources, data capabilities, and expertise.

The advertising industry in North America is developed and fiercely competitive, with a large number of publishers, agencies, advertisers, and ad technology companies. This ecosystem promotes cooperation, creativity, and investment in programmatic advertising, which propels the technology’s broad acceptance and expansion throughout numerous sectors and verticals.

Furthermore, the robust regulatory structure and business climate in North America offer a steady and advantageous atmosphere for the expansion of programmatic advertising. Advertisers and tech providers can operate in the market with confidence and certainty if there are clear norms and guidelines on data privacy, consumer protection, and advertising practices.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The programmatic advertising market is supported by a robust ecosystem of key players, each contributing unique technologies and services that drive the industry forward. Google LLC and Facebook Inc. are leading the charge, leveraging their extensive user data and advanced machine learning algorithms to offer targeted advertising solutions that are both effective and scalable. These platforms benefit from enormous global reach and sophisticated data analytics capabilities, enabling advertisers to achieve unprecedented precision and efficiency in their campaigns.

The Trade Desk Inc. and Adobe Inc. are also significant contributors to the market. The Trade Desk specializes in providing a media buying platform that empowers advertisers to purchase ad impressions from a wide range of sources, focusing on optimizing the cost-effectiveness and performance of ad campaigns. Adobe Inc., on the other hand, offers Adobe Advertising Cloud, which integrates seamlessly with its suite of creative and analytics products, providing a comprehensive solution for designing, executing, and measuring the impact of digital advertising campaigns.

Top Key Players in the Market

- Google LLC

- Facebook Inc.

- The Trade Desk Inc.

- Adobe Inc.

- Amazon Advertising LLC

- Verizon Media

- AppNexus (Xandr)

- MediaMath Inc.

- Oath Inc. (now part of Verizon Media)

- BeeswaxIO Corporation

- Adform

- Rubicon Project Inc.

- PubMatic Inc.

- OpenX Technologies Inc.

- Index Exchange Inc.

- Others

Recent Developments

- In May 2024, CNN International Commercial (CNNIC) and WBD (Warner Bros. Discovery) Sports Europe have aligned to offer unparalleled access to premium, Programmatic Guaranteed brand solutions.

- In March 2024, LS Digital has launches a new technology for the programmatic marketing, named CoMMeT, to ease the challenge faced by brands and advertising agencies.

Report Scope

Report Features Description Market Value (2023) USD 42.2 Bn Forecast Revenue (2033) USD 305.7 Bn CAGR (2024-2033) 21.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered by Type (Real-Time Bidding (RTB), Private Marketplace (PMP), Programmatic Direct) by Platform (Desktop, Mobile, Video, Social Media), by Ad Format (Display, Video, Native, Audio) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Google LLC, Facebook Inc., The Trade Desk Inc., Adobe Inc., Amazon Advertising LLC, Verizon Media, AppNexus (Xandr), MediaMath Inc., Oath Inc. (now part of Verizon Media), BeeswaxIO Corporation, Adform, Rubicon Project Inc., PubMatic Inc., OpenX Technologies Inc., Index Exchange Inc., Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three license to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is programmatic advertising?Programmatic advertising is the automated buying and selling of online ad space using software and algorithms. It replaces traditional methods that involve human negotiations and manual insertion orders.

How big is Programmatic Advertising Market?The Global Programmatic Advertising Market size is expected to be worth around USD 305.7 Billion By 2033, from USD 42.2 Billion in 2023, growing at a CAGR of 21.9% during the forecast period from 2024 to 2033.

What are the key factors driving the growth of the Programmatic Advertising Market ?The growth of the Programmatic Advertising Market is driven by increased digital media consumption, advancements in AI and machine learning, and the growing demand for personalized and real-time advertising.

What are the current trends and advancements in Programmatic Advertising Market ?Current trends include the rise of programmatic TV and audio ads, the integration of advanced data analytics, the use of blockchain for transparency, and a shift towards privacy-centric approaches.

Who are the leading players in the Programmatic Advertising Market ?Google LLC, Facebook Inc., The Trade Desk Inc., Adobe Inc., Amazon Advertising LLC, Verizon Media, AppNexus (Xandr), MediaMath Inc., Oath Inc. (now part of Verizon Media), BeeswaxIO Corporation, Adform, Rubicon Project Inc., PubMatic Inc., OpenX Technologies Inc., Index Exchange Inc., Others

What are the major challenges and opportunities in the Programmatic Advertising Market ?Major challenges include data privacy concerns, ad fraud, and the complexity of the digital advertising ecosystem. Opportunities lie in leveraging AI for better targeting, expanding into new digital formats, and enhancing transparency with blockchain technology.

Programmatic Advertising MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample

Programmatic Advertising MarketPublished date: May 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Google LLC

- Facebook Inc.

- The Trade Desk Inc.

- Adobe Inc.

- Amazon Advertising LLC

- Verizon Media

- AppNexus (Xandr)

- MediaMath Inc.

- Oath Inc. (now part of Verizon Media)

- BeeswaxIO Corporation

- Adform

- Rubicon Project Inc.

- PubMatic Inc.

- OpenX Technologies Inc.

- Index Exchange Inc.

- Others