Global Printed Electronic Materials Market Size, Share Analysis Report By Material Type (Inks and Substrate), By Application (Printed Electronic Sensors, Membrane Switches And Printed Keyboards, and Others), By End-Use (Consumer Electronics, Automotive And Transportation, Healthcare, Aerospace And Defence, Retail And Logistics, Energy And Power, and Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171547

- Number of Pages: 306

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

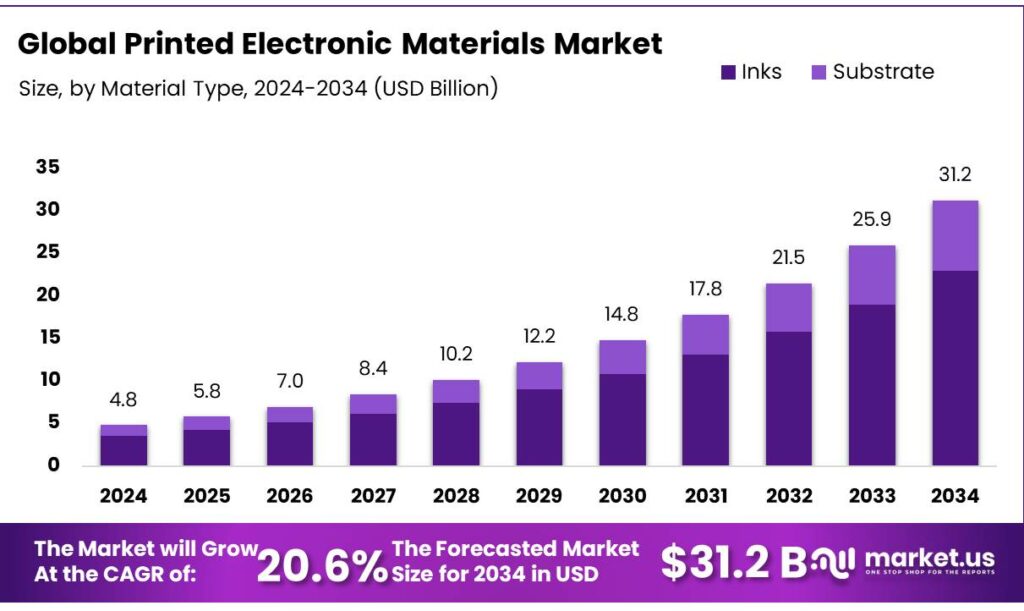

The Global Printed Electronic Materials Market size is expected to be worth around USD 31.2 Billion by 2034, from USD 4.8 Billion in 2024, growing at a CAGR of 20.6% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 44.9% share, holding USD 19.6 Billion in revenue.

Printed electronics is a technology that creates electronic circuits and devices by printing functional inks onto various flexible or rigid substrates such as plastic, paper, or textiles, using standard printing methods, such as inkjet, screen, and flexography. The printed electronic materials market is driven by the growing demand for lightweight and cost-effective electronic components, particularly in the consumer electronics industry. Printed electronics offer significant advantages, including flexibility, low-cost production, and the ability to integrate complex circuits into compact devices.

They are widely used in products such as smartphones, wearables, and IoT devices, where miniaturisation and energy efficiency are crucial. However, challenges such as scalability, reliability, and performance under harsh conditions hinder their broader adoption in various industries. Despite these hurdles, advancements in sustainable materials, such as organic inks and recyclable substrates, are enhancing the environmental appeal of printed electronics. Moreover, the Asia Pacific region leads the market, supported by its robust manufacturing capabilities and strong demand for consumer electronics, positioning it as a key hub for printed electronics innovation and production.

- According to a case study, the printed and flexible electronics could reduce electronic waste by up to 80% in disposable applications.

Key Takeaways

- The global printed electronic materials market was valued at US$4.8 billion in 2024.

- The global printed electronic materials market is projected to grow at a CAGR of 20.6% and is estimated to reach US$31.2 billion by 2034.

- On the basis of types of materials, inks dominated the printed electronic materials market, constituting 4% of the total market share.

- Based on the applications, printed electronic sensors dominated the printed electronic materials market, with a substantial market share of around 6%.

- Among the end-uses, consumer electronics held a major share in the printed electronic materials market, 4% of the market share.

- In 2024, the Asia Pacific was the most dominant region in the printed electronic materials market, accounting for 9% of the total global consumption.

Material Type Analysis

Inks Are a Prominent Segment in the Printed Electronic Materials Market.

The printed electronic materials market is segmented based on types of materials into inks and substrates. Inks led the printed electronic materials market, comprising 73.4% of the market share. Inks for printed electronics often generate more revenue than substrates due to their critical role in the performance and functionality of the devices. Printed inks, such as conductive, insulating, or semiconducting inks, are essential for creating the electrical circuits, sensors, and displays that define printed electronics.

These inks require advanced formulations, often incorporating precious materials such as silver, which increase their cost. While substrates are important, they serve as passive components, providing the foundational support for the printed circuits. The variety of substrate options, including plastic, paper, or metal foils, offers more cost-effective choices, limiting their revenue-generating potential compared to inks, which are more specialized and indispensable for the functionality of the end product.

Application Analysis

Printed Electronic Sensors Dominated the Printed Electronic Materials Market.

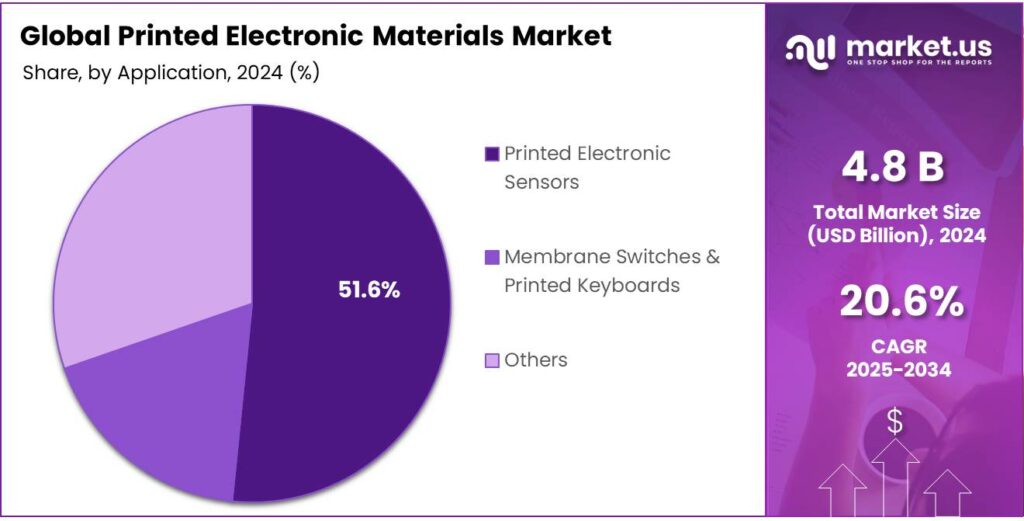

On the basis of applications, the printed electronic materials market is segmented into printed electronic sensors, membrane switches & printed keyboards, and others. The printed electronic sensors dominated the printed electronic materials market, comprising 51.6% of the market share, due to the broader range of applications and higher demand for sensors in various industries. Printed sensors are integral to the rapidly growing Internet of Things (IoT) market, used in devices ranging from wearables to automotive systems and healthcare equipment.

They enable real-time data collection, energy efficiency, and compact designs, driving their widespread adoption across sectors such as consumer electronics, healthcare, and industrial automation. In contrast, membrane switches and printed keyboards, while useful in niche applications, are relatively limited in their functionality and application. These components are more common in consumer electronics and industrial equipment; however, their growth is slower compared to the expanding use of sensors, which offer more versatility and integration opportunities across a wider array of smart devices and systems.

End-Use Analysis

Consumer Electronics Held a Major Share of the Printed Electronic Materials Market.

Based on the end-use, the printed electronic materials market is segmented into consumer electronics, automotive & transportation, healthcare, aerospace & defence, retail & logistics, energy & power, and others. Among the end-uses, 53.4% of the revenue in the printed electronic materials market is generated from consumer electronics. Printed electronics are most commonly used in consumer electronics due to the industry’s demand for lightweight, cost-effective, and compact components that can be mass-produced quickly.

Consumer electronics, such as smartphones, wearables, and smart home devices, require innovative features such as flexible displays, sensors, and low-cost, high-performance circuits, where printed electronics excel. These applications benefit from the ability to integrate functional, printed components while maintaining affordability and design flexibility. In contrast, industries such as automotive, healthcare, aerospace, and energy require higher reliability, durability, and performance under extreme conditions, which printed electronics technology struggles to meet. The relative limitations of printed electronics in terms of robustness, precision, and environmental resilience make them less suitable for critical systems found in these sectors.

Key Market Segments

By Material Type

- Inks

- Conductive Silver Inks

- Conductive Copper Inks

- Conductive Polymers Inks

- Others

- Substrate

- Sustainable Materials

- Non-Sustainable Materials

By Application

- Printed Electronic Sensors

- Membrane Switches & Printed Keyboards

- Others

By End-Use

- Consumer Electronics

- Automotive & Transportation

- Healthcare

- Aerospace & Defence

- Retail & Logistics

- Energy & Power

- Others

Drivers

Miniaturization of Electronic Elements Drives the Printed Electronic Materials Market.

The increasing demand for lightweight and miniature electronic devices has significantly influenced the growth of the printed electronic materials market. As consumer electronics become more compact, energy-efficient, and affordable, manufacturers are utilizing printed electronics to meet these requirements. Printed electronics, such as flexible circuits, offer substantial reductions in weight and size while maintaining high functionality. For instance, printed RFID tags, used for inventory tracking, are increasingly popular due to their ability to be integrated into products without adding bulk.

Moreover, the rapid adoption of printed electronics is driven by the amount of time taken for the production of devices compared to traditional methods. For instance, the complete printing of a simple RFID tag can be accomplished in under 10 seconds, a significant leap compared to traditional etching and assembly. Furthermore, the ability to print complex circuits on flexible substrates reduces production costs compared to traditional manufacturing methods, making it an attractive option for companies aiming to deliver innovative yet affordable products to consumers. For instance, as the circuits are printed rather than etched and assembled, manufacturing costs can be reduced by 30–70% depending on complexity and production volume.

Restraints

Lack of Scalability Might Hinder the Growth of the Printed Electronic Materials Market.

Despite the growing interest in printed electronic materials, challenges related to scalability and reliability pose significant barriers to their widespread adoption. One major concern is the difficulty in scaling up production to meet the high-volume demands of various industries. For instance, the development of printed solar cells through rapid Roll-to-Roll (R2R) manufacturing techniques aimed at minimizing material consumption. Initial research utilized glass substrates, indium-tin-oxide (ITO) for the transparent front electrode, spin coating for layer deposition, and vacuum deposition for the back electrode.

However, as production scaled up, it became evident that rigid substrates were incompatible with R2R processes, spin coating resulted in significant material waste, indium proved to be an expensive material, and vacuum deposition was not suitable for high-speed manufacturing. The printed circuits, though cost-effective in prototype stages, often face issues such as poor yield rates and variations in performance when produced in bulk. Additionally, the reliability of printed materials under harsh environmental conditions, such as temperature fluctuations, moisture, and mechanical stress, has been a limiting factor, particularly in industrial applications.

Opportunity

Demand from Consumer Electronics and Automotive Industries Creates Opportunities in the Printed Electronic Materials Market.

The consumer electronics and automotive industries are pivotal in driving the demand for printed electronic materials, opening significant opportunities in the market. In consumer electronics, the trend toward more sophisticated and compact devices, such as smartphones, wearables, and smart home products, has spurred the adoption of printed electronics. For instance, printed touch sensors and OLED displays are commonplace in high-end smartphones and televisions due to their flexibility, lightweight nature, and lower production costs.

Similarly, in the automotive sector, the integration of printed electronics in areas such as infotainment systems, flexible displays, and advanced driver-assistance systems (ADAS) has become increasingly vital. Printed sensors, used for tire pressure monitoring or in battery management systems, offer cost-effective and efficient solutions for automotive manufacturers. Additionally, the growing emphasis on electric vehicles (EVs) highlights the role of printed electronics in enhancing battery systems and enabling lightweight components, which are crucial for improving vehicle performance and energy efficiency.

Trends

Shift Towards Sustainable and Eco-friendly Materials.

The shift towards sustainable and eco-friendly materials is becoming an increasingly important trend in the printed electronic materials market. As environmental concerns rise, manufacturers and consumers are seeking greener alternatives to traditional electronics production. Printed electronics, made from organic materials such as carbon-based inks and biodegradable substrates, offer a lower environmental footprint compared to conventional electronic components.

Additionally, the use of flexible, recyclable materials in devices such as wearable sensors and packaging for electronics helps minimize waste. This focus on sustainability aligns with global regulatory pressures for reducing electronic waste and carbon emissions. The companies in the printed electronics sector are increasingly exploring the use of renewable, non-toxic, and recyclable materials, driving innovation while supporting global sustainability goals. For instance, in February 2025, Henkel introduced industry-first silver inks and highly conductive silver inks based on recycled silver as raw material.

Geopolitical Impact Analysis

Geopolitical Tensions Are Reshaping the Dynamics of the Printed Electronic Materials Market.

The geopolitical tensions have had a profound impact on the printed electronic materials market, disrupting supply chains, manufacturing processes, and global trade dynamics. These tensions have caused the supply chain disruptions of major printed electronic raw materials, such as copper and certain polymers. For instance, trade tensions with China, one of the world’s largest processors of copper, have introduced tariff barriers and uncertainty, pushing importers to diversify their sourcing strategies.

Similarly, Russia, not being the largest copper producer, still contributes significantly to global metal exports. The sanctions placed by the U.S. and UK on Russia after its invasion of Ukraine have restricted its aluminum, nickel, and copper shipments, fueling price volatility. These restrictions have tightened copper supply, increasing sourcing risk for manufacturers. Additionally, these restrictions on the country have fueled the prices of certain polymers manufactured from petrochemicals.

Furthermore, the imposition of tariffs on Chinese-made components has led to delays and cost increases in the production of electronic devices that rely on printed electronics, including smartphones and wearables. To mitigate the risks, several companies are rethinking their sourcing strategies by diversifying their supply chains.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Printed Electronic Materials Market.

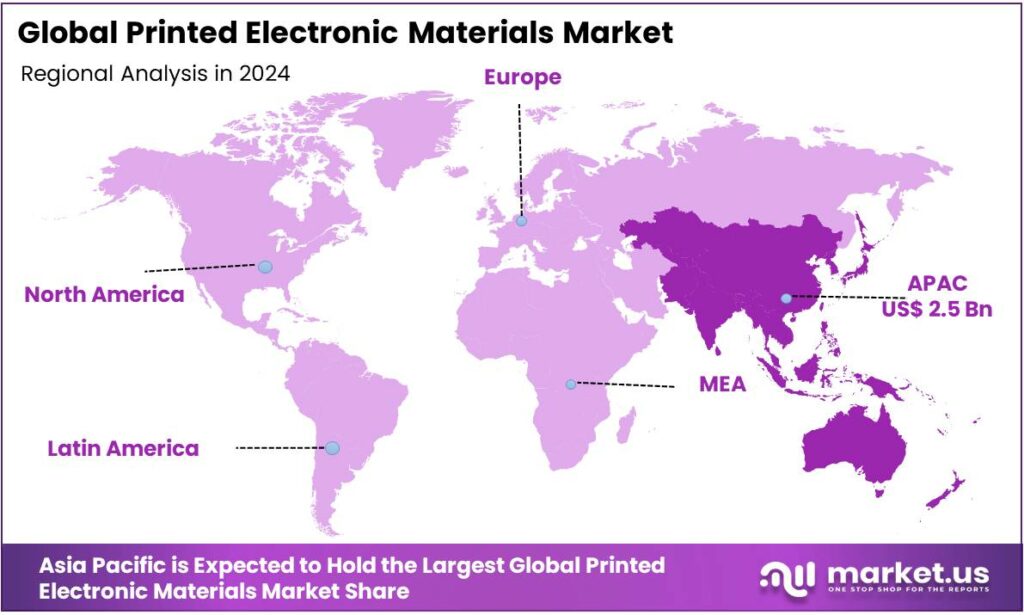

In 2024, the Asia Pacific dominated the global printed electronic materials market, holding about 52.9% of the total global consumption. The region holds the largest share of the global printed electronic materials market, driven by its robust manufacturing infrastructure and rapid technological advancements. Countries such as China, Japan, and South Korea are leading the charge, with significant investments in research and development to drive innovation in printed electronics.

For instance, Japan’s focus on flexible OLED displays has contributed to the region’s dominance. Additionally, the expansive consumer electronics industry in the region, particularly in the smartphone and wearables sectors, has accelerated the demand for printed electronics. The low-cost manufacturing capabilities in China, combined with the growing adoption of eco-friendly technologies, further enhance the appeal of the Asia Pacific for printed electronic materials.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The companies invest heavily in research and development to innovate and improve the performance of printed electronics, including enhancing the durability, conductivity, and scalability of inks and substrates to cater to emerging applications in sectors such as IoT, wearables, and smart packaging. In addition, the major players emphasize the partnerships with key players in industries such as consumer electronics, automotive, and healthcare, as they provide access to new customer bases and help integrate printed electronics into advanced products.

Similarly, companies emphasize geographical expansion, particularly targeting emerging markets where the demand for cost-effective, energy-efficient electronics is growing. Furthermore, major players focus on strategic acquisitions and collaborations with startups in related fields to enhance their technological capabilities and diversify their product portfolio.

The Major Players in The Industry

- BASF SE

- DuPont de Nemours, Inc.

- Henkel AG & Co. KGaA

- Nissha Co., Ltd.

- Sun Chemical

- Sigma-Aldrich

- InkTec

- Dycotec Materials

- Novacentrix

- Greatcell Solar Materials Pty Ltd

- Celanese Corporation

- Other Key Players

Key Development

- In April 2024, DuPont introduced the DuPont Pyralux ML Series of double-sided metal-clad laminates, a unique addition to its extensive family of Pyralux laminates for flexible and rigid-flex printed circuit boards (PCBs).

- In March 2025, Henkel announced a partnership with LPMS USA, a leader in low-pressure moulding solutions, for national distribution of their printed electronics inks and coatings.

Report Scope

Report Features Description Market Value (2024) USD 4.8 Bn Forecast Revenue (2034) USD 31.2 Bn CAGR (2025-2034) 20.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Material Type (Inks and Substrate), By Application (Printed Electronic Sensors, Membrane Switches & Printed Keyboards, and Others), By End-Use (Consumer Electronics, Automotive & Transportation, Healthcare, Aerospace & Defence, Retail & Logistics, Energy & Power, and Others) Regional Analysis North America – The US & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia & CIS, Rest of Europe; APAC– China, Japan, South Korea, India, ASEAN & Rest of APAC; Latin America– Brazil, Mexico & Rest of Latin America; Middle East & Africa– GCC, South Africa, & Rest of MEA Competitive Landscape BASF SE, DuPont de Nemours, Inc., Henkel AG & Co. KGaA, Nissha Co., Ltd., Sun Chemical, Sigma-Aldrich, InkTec, Dycotec Materials, Novacentrix, Greatcell Solar Materials Pty Ltd., Celanese Corporation, and Other Players. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Printed Electronic Materials MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Printed Electronic Materials MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- BASF SE

- DuPont de Nemours, Inc.

- Henkel AG & Co. KGaA

- Nissha Co., Ltd.

- Sun Chemical

- Sigma-Aldrich

- InkTec

- Dycotec Materials

- Novacentrix

- Greatcell Solar Materials Pty Ltd

- Celanese Corporation

- Other Key Players