Global Premix Bottled Cocktails Market Size, Share Analysis Report By Primary Ingredient (Malt-based, Wine-based, Spirit-based, Others), By Additive Ingredient (Alcoholic, Non-alcoholic), By Bottle Size (Less than 250 ml, 250-350 ml, More than 350 ml), By Alcohol Content (Less than 5%, 5-8%, More than 8%), By Sales Channel (Liquor Store, Hypermarket/Supermarket, Convenience Store, Online Retail, Others) By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 172298

- Number of Pages: 363

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Primary Ingredient Analysis

- By Additive Ingredient Analysis

- By Bottle Size Analysis

- By Alcohol Content Analysis

- By Sales Channel Analysis

- Key Market Segments

- Emerging Trends

- Drivers

- Restraints

- Opportunity

- Regional Insights

- Key Players Analysis

- Recent Industry Developments

- Report Scope

Report Overview

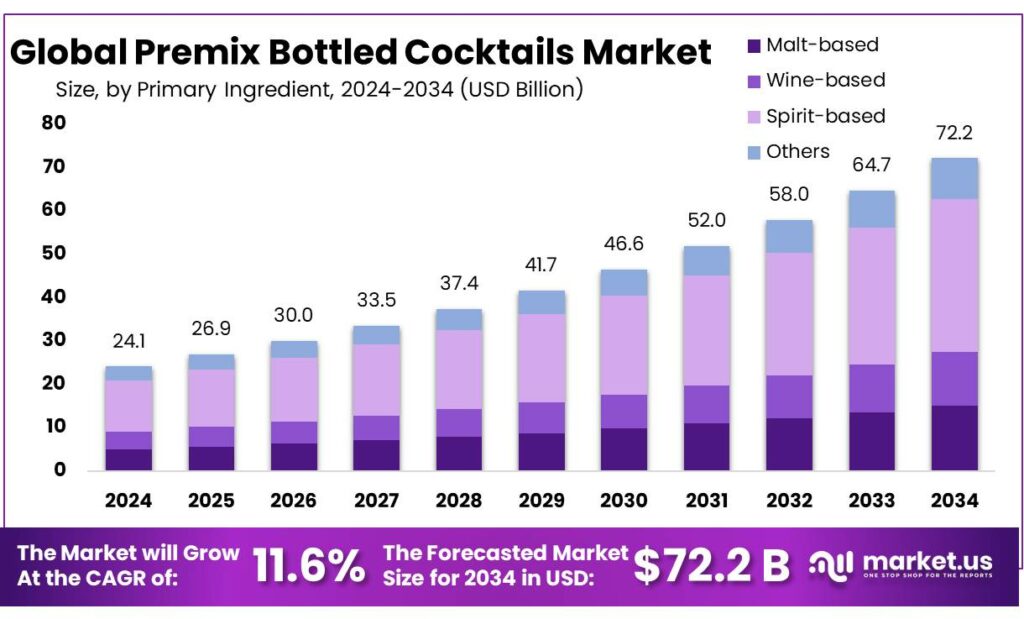

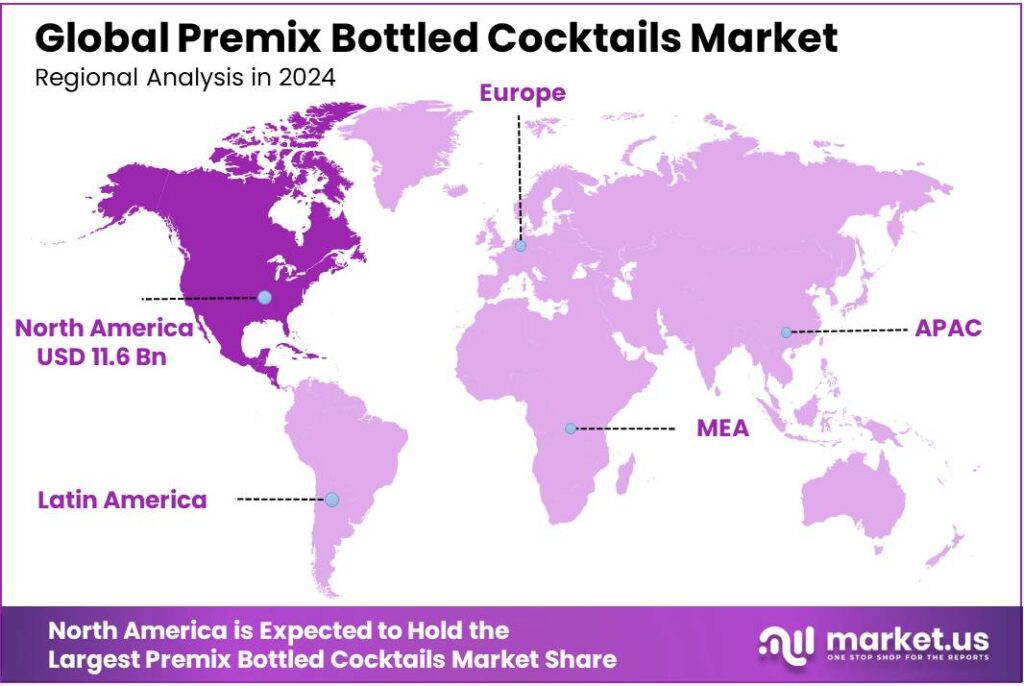

The Global Premix Bottled Cocktails Market size is expected to be worth around USD 72.2 Billion by 2034, from USD 24.1 Billion in 2024, growing at a CAGR of 11.6% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 48.4% share, holding USD 11.6 Billion in revenue.

Premix bottled cocktails sit at the intersection of convenience and premium bar culture. They package consistent flavor, portion control, and portability into a format that works for home entertaining, casual gatherings, and on-the-go occasions. In retail terms, the broader segment has become a material growth engine in beverage alcohol: NielsenIQ describes RTD/RTS as a $13.9 billion category, representing 12.5% of total beverage-alcohol dollar sales.

Key driving factors are strongly tied to convenience-led consumption and selective premiumisation. Industry outlook work from IWSR points to RTDs as a resilient growth pocket, forecasting RTD cocktails/long drinks volumes to double globally between 2019 and 2029, with North America seeing growth of up to +400% over that window—an indicator that packaged cocktail formats are still gaining structural share versus traditional on-premise-only cocktail occasions.

IWSR’s forward view suggests growth normalizes as the segment matures, with 2024–2029 volume CAGR expectations of +1% for the U.S., +3% for Japan, +7% for Brazil, and +3% for South Africa—useful signals for where bottlers and brand owners may prioritize capacity, route-to-market, and localized flavor strategies.

Key driving factors are convenience, quality standardization, and “responsible enjoyment” pressures that are steadily reshaping innovation. Health agencies continue to underline the risk backdrop: WHO notes alcohol’s contribution to mortality and provides global consumption indicators, reinforcing why many brands reformulate around lower sugar, lower ABV variants, and clearer serving guidance. In parallel, consumer moderation trends are visible in adjacent categories—for example, UK non/low-alcohol beer consumption has been cited at 200 million pints in 2025, signaling a broader shift toward “lighter” alcohol choices that premix portfolios can mirror via spritz-style and lower-strength bottled cocktails.

Regulation and policy also matter because labeling, tax treatment, and category definitions influence product design and route-to-market. In the U.S., the Craft Beverage Modernization Act (CBMA) provisions were made permanent via legislation signed on December 27, 2020 (TTB), affecting how producers think about scaling and compliance economics. Separately, TTB finalized modernization of labeling/advertising rules (published February 9, 2022 in the Federal Register), supporting clearer, more consistent communications—important for premix bottles that compete on flavor descriptors and “cocktail authenticity.”

Key Takeaways

- Premix Bottled Cocktails Market size is expected to be worth around USD 72.2 Billion by 2034, from USD 24.1 Billion in 2024, growing at a CAGR of 11.6%.

- Spirit-based held a dominant market position, capturing more than a 49.3% share.

- Mannan-oligosaccharides (MOS) held a dominant market position, capturing more than a 81.2% share.

- 250–350 ml held a dominant market position, capturing more than a 48.8% share.

- 5–8% held a dominant market position, capturing more than a 54.1% share.

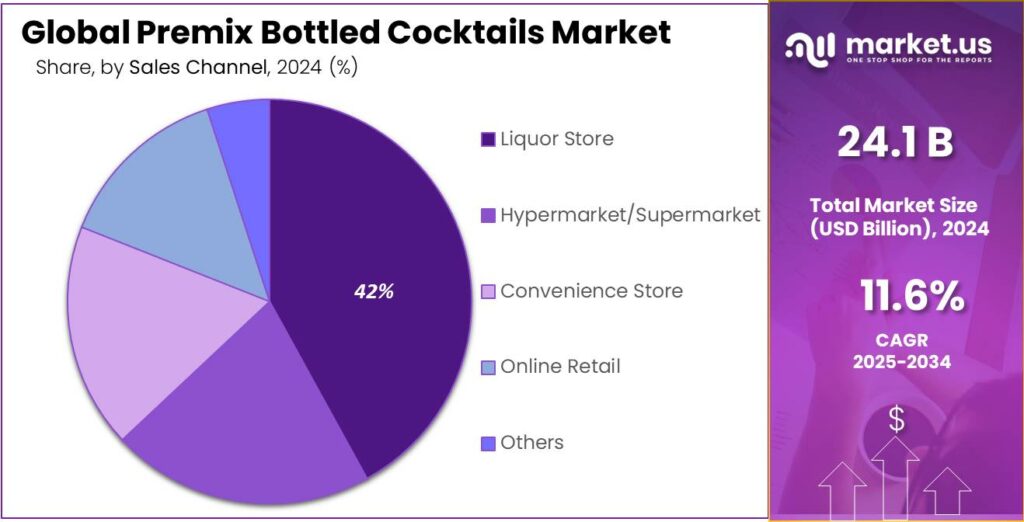

- Liquor Store held a dominant market position, capturing more than a 41.9% share.

- North America region emerged as the leading contributor to the global premix bottled cocktails market, commanding a substantial 48.40% share and an estimated value of USD 11.6 billion.

By Primary Ingredient Analysis

Spirit-based leads the market with a 49.3% share, supported by strong consumer preference for classic cocktail profiles.

In 2024, Spirit-based held a dominant market position, capturing more than a 49.3% share. This leadership was mainly supported by steady consumer demand for familiar alcohol bases such as vodka, rum, whiskey, and gin, which are widely associated with traditional cocktail experiences. Spirit-based premix bottled cocktails benefited from strong acceptance among urban consumers, where convenience and consistent taste were given high importance. The segment was also favored due to its broad availability across retail and on-trade channels, making it easier for consumers to access compared to niche or emerging formulations.

During 2024, manufacturers continued to focus on improving flavor balance and alcohol quality within spirit-based offerings, helping maintain trust and repeat purchases. Moving into 2025, the segment remained well-positioned as brands aligned their portfolios with premiumization trends while retaining simple, easy-to-drink formats. The dominance of spirit-based premix cocktails was further reinforced by their suitability for social occasions and at-home consumption, supporting stable demand without reliance on experimental ingredients.

By Additive Ingredient Analysis

Alcoholic additives dominate with an 81.2% share, driven by consumer demand for ready-to-drink authenticity.

In 2024, Mannan-oligosaccharides (MOS) held a dominant market position, capturing more than a 81.2% share. Within the premix bottled cocktails market by additive ingredient, alcoholic additives continued to play a central role in shaping product appeal and consumer acceptance. This dominance was largely attributed to the preference for beverages that closely replicate the taste, strength, and experience of freshly prepared cocktails. Alcoholic additives supported consistency in flavor and alcohol content, which remained a key buying factor for regular consumers in 2024.

The segment also benefited from strong penetration across retail shelves and licensed outlets, where consumers showed higher trust in products with clearly defined alcoholic composition. In 2025, demand for alcoholic additives remained stable as brands focused on maintaining balance between taste, alcohol intensity, and drinkability. The segment’s strong position was further supported by its alignment with social drinking occasions and at-home consumption trends, reinforcing its continued leadership without reliance on alternative or low-alcohol additives.

By Bottle Size Analysis

250–350 ml bottles lead with a 48.8% share, favored for easy handling and single-serve convenience.

In 2024, 250–350 ml held a dominant market position, capturing more than a 48.8% share. This bottle size was widely preferred as it matched single-serve and personal consumption needs, making it suitable for casual drinking occasions and controlled alcohol intake. During 2024, consumers increasingly chose this format for its portability and ease of storage, especially in urban households and small gatherings.

The size also supported consistent pricing, which helped maintain regular demand across different income groups. In 2025, the 250–350 ml segment continued to show strong acceptance as brands focused on compact packaging that reduced wastage and improved freshness after opening. Its dominance was further supported by its suitability for trial purchases, allowing consumers to explore different flavors without committing to larger volumes.

By Alcohol Content Analysis

5–8% alcohol content leads with a 54.1% share, balancing taste and moderate strength for wide appeal.

In 2024, 5–8% held a dominant market position, capturing more than a 54.1% share. This alcohol range was widely accepted as it offered a balanced drinking experience without being too strong, making it suitable for both casual and social occasions. During 2024, consumers showed a clear preference for premix cocktails that delivered flavor clarity while allowing longer consumption sessions, which supported steady demand for this segment. The 5–8% range also aligned well with responsible drinking trends, encouraging repeat purchases among young adults and working professionals. In 2025, the segment maintained its strong position as brands continued to focus on smooth taste profiles and easy-to-drink formulations within this alcohol range. Its dominance was further reinforced by its suitability for at-home use, small gatherings, and informal celebrations, supporting consistent volume sales across retail channels.

By Sales Channel Analysis

Liquor stores lead sales with a 41.9% share, supported by trusted purchasing and wide product choice.

In 2024, Liquor Store held a dominant market position, capturing more than a 41.9% share. This channel remained the preferred point of purchase as consumers valued the reliability, product authenticity, and in-store guidance available at liquor outlets. During 2024, liquor stores benefited from strong foot traffic, especially in urban and semi-urban areas, where premix bottled cocktails were increasingly stocked alongside traditional spirits.

The ability to compare brands and alcohol strengths in one location supported confident buying decisions. In 2025, liquor stores continued to retain their leading role as consumers favored immediate availability over delivery wait times. The segment’s dominance was further reinforced by regular promotions and bundle offers, which encouraged repeat purchases and supported steady volume growth.

Key Market Segments

By Primary Ingredient

- Malt-based

- Wine-based

- Spirit-based

- Others

By Additive Ingredient

- Alcoholic

- Non-alcoholic

By Bottle Size

- Less than 250 ml

- 250-350 ml

- More than 350 ml

By Alcohol Content

- Less than 5%

- 5-8%

- More than 8%

By Sales Channel

- Liquor Store

- Hypermarket/Supermarket

- Convenience Store

- Online Retail

- Others

Emerging Trends

Premium, Spirits-Based RTDs Are Replacing “Cheap Mix” Perceptions

A clear latest trend in premix bottled cocktails is the move toward premium, spirits-based recipes that try to taste closer to what a bartender would serve. Instead of relying on a malt base or “sweet mixer” profiles, brands are leaning into recognizable spirits styles, cleaner flavor cues, and more cocktail-faithful classics. This shift is not just a branding story—it shows up in the category mix. In the RTD market, spirits-based products now account for about 18% of total RTD volume, up from 8% in 2021, while malt-based RTDs still hold the largest share. That change signals that more shoppers are deliberately choosing the “spirits-like” experience, even if it costs more per serve.

Industry performance data also supports why companies are pushing premiumization so hard: premixed cocktails are one of the brighter spots in spirits. In the U.S., premixed cocktails reached about USD 3.3 billion in 2024, and the segment grew 16.5% year over year—adding roughly USD 468 million in additional revenue from 2023 to 2024. For decision-makers, numbers like these reduce the risk of investing in better ingredients, improved processing, and stronger packaging, because the segment is already proving it can scale.

Policy is quietly reinforcing this trend by making portable cocktails feel normal. A concrete example is the steady shift from temporary pandemic rules to permanent cocktails-to-go laws. Virginia became the 26th state to make cocktails-to-go permanent in March 2024, allowing cocktails-to-go sales from bars, restaurants, and distilleries under the legislation. Even when a consumer buys premix from a store rather than a restaurant, these government actions shape behavior: takeout and delivery occasions get culturally validated, and ready-to-serve cocktails fit those occasions naturally.

Drivers

Convenience-First Drinking Drives Premix Bottled Cocktail Growth

The biggest driver behind premix bottled cocktails is simple: people want a good drink with less effort and less risk. A bottled cocktail removes the guesswork of measuring spirits, buying multiple mixers, and getting the taste “right.” That matters at home, at parties, and even in small venues that cannot always rely on trained bartenders. In the U.S., this convenience shift shows up clearly in sales performance. “Cocktails/RTDs” delivered about USD 3.3 billion in supplier revenue in 2024, and it was one of the few spirits areas still expanding at scale.

The same industry data also shows why brands keep investing here: the category is adding incremental dollars, not just reshuffling spend. In 2024, Cocktails/RTDs grew about 16.5%, adding roughly USD 468 million in revenue year over year. This growth is meaningful because it suggests premix is solving a real consumer problem—time, convenience, and consistency—rather than being a short-lived flavor trend. When consumers can get a reliable “bar-style” serve in a ready format, they are more willing to try new brands, pay for better ingredients, and repeat-buy for gatherings.

Convenience is also being strengthened by how the product is sold and consumed. Policy changes that expanded off-premise access helped premixed cocktails become part of normal shopping behavior. Since the pandemic, 25 states plus Washington, D.C. have enacted laws to permanently allow cocktails-to-go, with additional states using temporary frameworks. Even when premix is sold through retail rather than restaurants, these policy moves shaped consumer expectations: “cocktails can travel,” and the format can fit delivery, takeout, and event occasions. That is a practical, government-enabled tailwind for a category built around portability.

Restraints

Regulatory and Tax Fragmentation Limits Scalable Growth

A major restraint for premix bottled cocktails is that rules and taxes don’t move in one clean line across markets. For producers, the product may look simple—spirit, flavor, water, maybe carbonation—but regulators often treat it differently depending on alcohol base, ABV, container size, and where it is sold. That creates a real “patchwork problem”: the same bottled cocktail can be legal in one channel, restricted in another, and taxed at a completely different rate once it crosses a state line or a border. This is not just paperwork. It shapes price on shelf, margins, and how fast a brand can expand.

In the United States, state-by-state tax variation is a practical example of this restraint. The Tax Foundation’s 2025 distilled spirits tax map shows the top state rate at USD 36.98 per gallon (Washington), with the next highest rates listed at USD 23.47 (Virginia) and USD 22.87 (Alabama). For a premix cocktail brand, those differences can quickly change the retail price and consumer demand, especially when shoppers can compare across nearby states or when distributors push back on high-tax markets. It also complicates national pricing strategies because the “same” product cannot carry the same shelf price everywhere without squeezing profitability somewhere in the chain.

Government policy can help, but it can also create uneven opportunity. A good illustration is cocktails-to-go. Industry updates note that Virginia became the 26th state to make cocktails-to-go permanent in March 2024, which shows progress, but also confirms that many states still operate under different rules or timelines.

Opportunity

Export-Led Premium RTDs Are a Big Opportunity

One of the clearest growth opportunities for premix bottled cocktails is taking a “local convenience product” and turning it into an export-ready, premium packaged drink. The reason is simple: premix is easier to ship and sell than a full bar experience, and it can carry the same brand cues that already work for spirits. In the U.S., the ready-to-drink “Cocktails/RTDs” segment is already proving it can scale—industry reporting points to about US$3.3 billion in revenue, with sales up 16.5% (around US$468 million added) in the latest year-on-year comparison.

The export channel itself is offering a real runway. The Distilled Spirits Council of the United States (DISCUS) reported U.S. spirits exports hit a record US$2.4 billion in 2024, up nearly 10% versus 2023. DISCUS also noted a 39% increase in exports to the European Union in 2024, helped by zero tariffs on spirits imports into the EU during that period. For premix bottled cocktails, this matters because it signals both demand and improving economics. If brands build RTD lines that meet EU labeling and ingredient rules from day one, they can ride the same export tailwinds that are already lifting core spirits.

There is also a product-level opportunity inside the broader RTD universe: consumers are shifting toward drinks that feel more like “real cocktails.” DISCUS-linked analysis highlights that spirits-based RTDs now represent about 18% of total RTD market volume, up from 8% in 2021. This is a big signal. It suggests people are increasingly choosing spirit-based recipes instead of cheaper bases. For manufacturers, that opens the door to premium pricing through better ingredients, higher-quality spirits, and recognizable cocktail recipes—while still keeping the convenience that made premix popular in the first place.

Regional Insights

North America dominates premix bottled cocktails with 48.40% share and an $11.6 Bn valuation, driven by mature consumption and strong retail ecosystems.

In 2024, the North America region emerged as the leading contributor to the global premix bottled cocktails market, commanding a substantial 48.40% share and an estimated value of USD 11.6 billion. The region’s dominance was supported by established drinking habits, high disposable incomes, and a well-developed distribution framework that ensured broad availability of ready-to-drink bottled cocktails across on-trade and off-trade channels.

In the United States and Canada, rapid adoption of convenient beverage formats and increased consumer interest in premium and craft-style premix offerings underpinned sustained growth throughout 2024. Urban lifestyle trends, particularly among millennials and working professionals, further reinforced consumption patterns favoring single-serve bottled cocktails that offer both quality and ease of use. The year saw robust expansion of product variety, including innovations in flavour profiles and packaging options that resonated with regional tastes.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Bacardi Limited remained a strong player in the premix bottled cocktails market in 2024, supported by its wide spirits portfolio and global distribution strength. The company operated in more than 160 countries and reported annual revenues of over USD 5 billion. Its ready-to-drink portfolio benefited from brand loyalty and premium positioning, supporting steady volume demand.

Diageo plc held a solid position in 2024, driven by its global scale and strong ready-to-drink expansion strategy. The company generated revenues exceeding USD 20 billion and maintained operations across more than 180 markets. Its premix bottled cocktails benefited from established brands and consistent retail presence, supporting high visibility and consumer trust.

In 2024, Pernod Ricard strengthened its presence in premix bottled cocktails through innovation and premium brand leverage. The company recorded revenues of around USD 13 billion and operated in over 160 countries. Its focus on flavor consistency and packaging appeal supported growing demand across urban and travel retail channels.

Top Key Players Outlook

- Bacardi Limited

- Diageo plc

- Pernod Ricard

- Brown-Forman Corporation

- Anheuser-Busch InBev

- Beam Suntory Inc.

- Constellation Brands, Inc.

- Campari Group

- Asahi Group Holdings, Ltd.

- Suntory Holdings Limited

Recent Industry Developments

Bacardi Limited employed over 8,000 people, maintained production across 11 countries, and distributed products in more than 160 markets worldwide, reinforcing its capability to scale RTD initiatives alongside its traditional spirits portfolio.

Diageo’s broader financial scale supported these initiatives, with revenue reported at USD 20.269 billion in 2024, operating income of USD 6.001 billion, and a global footprint spanning nearly 180 countries with approximately 30,000 employees.

Report Scope

Report Features Description Market Value (2024) USD 24.1 Bn Forecast Revenue (2034) USD 72.2 Bn CAGR (2025-2034) 11.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Primary Ingredient (Malt-based, Wine-based, Spirit-based, Others), By Additive Ingredient (Alcoholic, Non-alcoholic), By Bottle Size (Less than 250 ml, 250-350 ml, More than 350 ml), By Alcohol Content (Less than 5%, 5-8%, More than 8%), By Sales Channel (Liquor Store, Hypermarket/Supermarket, Convenience Store, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Bacardi Limited, Diageo plc, Pernod Ricard, Brown-Forman Corporation, Anheuser-Busch InBev, Beam Suntory Inc., Constellation Brands, Inc., Campari Group, Asahi Group Holdings, Ltd., Suntory Holdings Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Premix Bottled Cocktails MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Premix Bottled Cocktails MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Bacardi Limited

- Diageo plc

- Pernod Ricard

- Brown-Forman Corporation

- Anheuser-Busch InBev

- Beam Suntory Inc.

- Constellation Brands, Inc.

- Campari Group

- Asahi Group Holdings, Ltd.

- Suntory Holdings Limited