Global Predictive AI In Media And Entertainment Market By Deployment Mode (Cloud-based, On-premises), By Company Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Application (Content Recommendations, Audience Insights and Targeting, Predictive Analytics for Performance, Revenue Optimization, Content Creation and Curation), By End-User (Broadcasting and Cable Networks, Streaming Platforms, Music Streaming Services, Gaming Industry, Film Production Studios, Advertising Agencies, Social Media Platforms, News and Publishing Houses), By Region And Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends And Forecast 2024-2033

- Published date: March 2024

- Report ID: 115429

- Number of Pages: 207

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

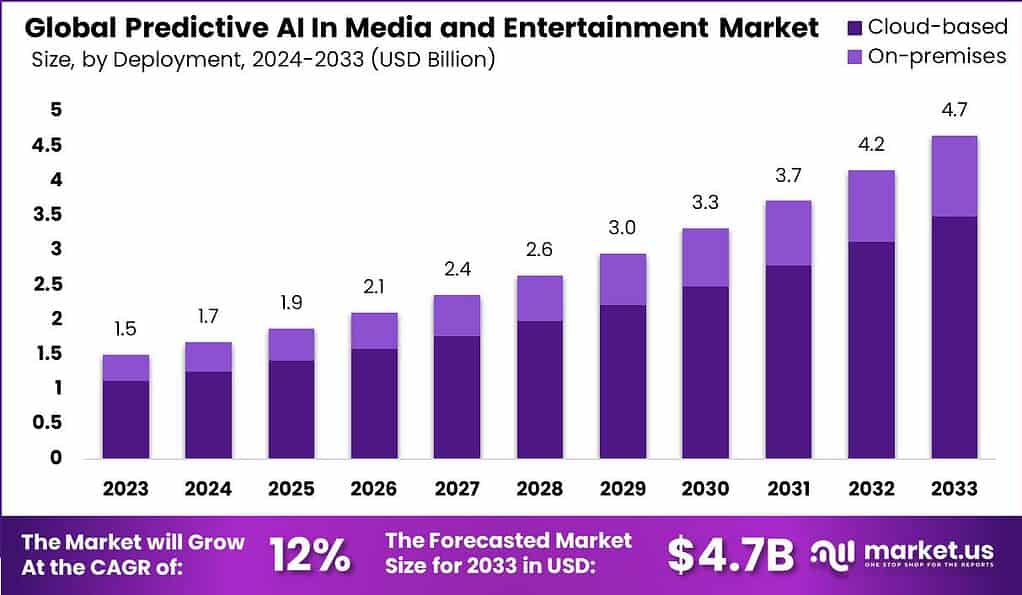

The Global Predictive AI In Media And Entertainment Market size is expected to be worth around USD 4.7 Billion by 2033, from USD 1.5 Billion in 2023, growing at a CAGR of 12.0% during the forecast period from 2024 to 2033.

Predictive AI in Media and Entertainment refers to the application of artificial intelligence techniques to predict and anticipate user preferences, behavior, and trends in the media and entertainment industry. By leveraging advanced algorithms and machine learning models, predictive AI enables media and entertainment companies to analyze large volumes of data and make accurate predictions about consumer preferences, content performance, audience engagement, and market trends.

The Predictive AI in Media and Entertainment market is experiencing significant growth due to the increasing demand for personalized and immersive content experiences. The market encompasses a wide range of solutions, including recommendation engines, content analytics platforms, predictive audience segmentation tools, and real-time content optimization systems.

According to a 2023 industry analysis conducted by PwC, a significant proportion of media executives have forecasted an upsurge in investments towards predictive analytics and artificial intelligence (AI) to augment user experiences. The findings reveal that over 80% of surveyed participants are either in the process of incorporating or planning to integrate AI technologies for enhancing content recommendations and personalizing advertising efforts within the forthcoming one to two years.

Prominent entities within the media sector have already commenced the exploitation of predictive AI to drive operational efficiencies and engagement. For instance, Netflix has achieved annual savings exceeding $1 billion by leveraging predictive algorithms to refine content recommendations. Similarly, Spotify has effectively utilized predictive AI for a multitude of applications ranging from content recommendations to targeted advertising, contributing to over 30% of its daily stream volumes.

In April 2022, Warner Bros. Discovery announced an enhancement of their partnership with the AI startup Blackbird.AI. This collaboration is focused on employing predictive AI technologies to optimize supply chains and content pipelines. The initiative underscores Warner Bros. Discovery’s commitment to leveraging advanced AI solutions to streamline operations and enhance content delivery mechanisms.

Key Takeaways

- The global predictive AI in media and entertainment market is anticipated to witness substantial growth, with an estimated value reaching USD 4.7 billion by 2033. This growth trajectory reflects a robust Compound Annual Growth Rate (CAGR) of 12.0% from 2024 to 2033.

- Cloud-based deployment holds a significant market share, capturing over 75% in 2023. The cloud offers scalability, flexibility, and cost-efficiency, enabling media companies to leverage powerful AI capabilities without substantial upfront investments.

- In 2023, large enterprises dominated the predictive AI market in media and entertainment, with a share exceeding 63.4%. Their financial resources and infrastructure capabilities enable effective utilization of predictive AI solutions, driving data-driven decisions, personalized experiences, and competitive advantage.

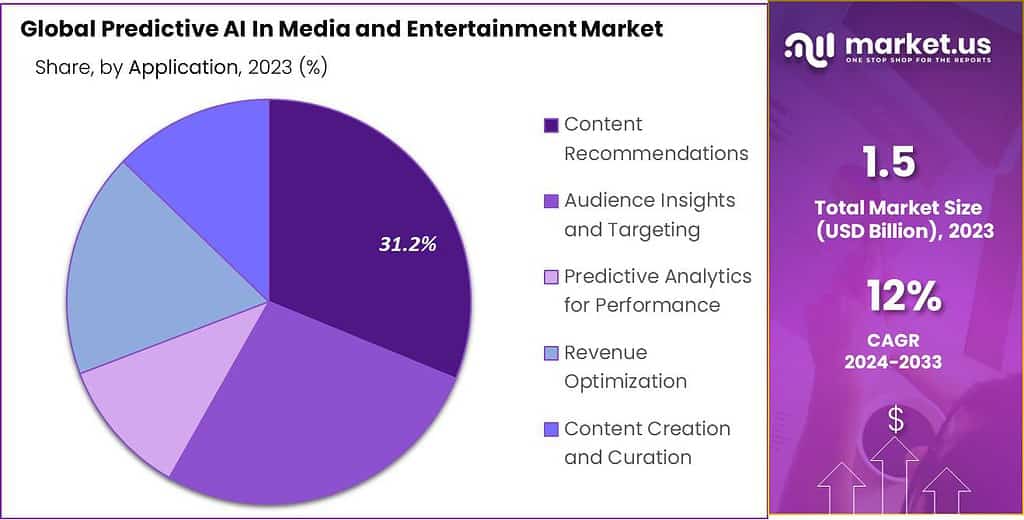

- Content recommendations emerged as a dominant segment in 2023, capturing over 31.2% market share. Personalized content suggestions enhance user engagement and satisfaction, crucial for streaming platforms, gaming industry, and online publications, driving growth and fostering user loyalty.

- Among end-users, streaming platforms held a dominant position, capturing more than 25% market share in 2023. The rapid growth of streaming services, coupled with predictive AI-driven personalized recommendations, enhances user experience, fosters user retention, and strengthens competitive positioning.

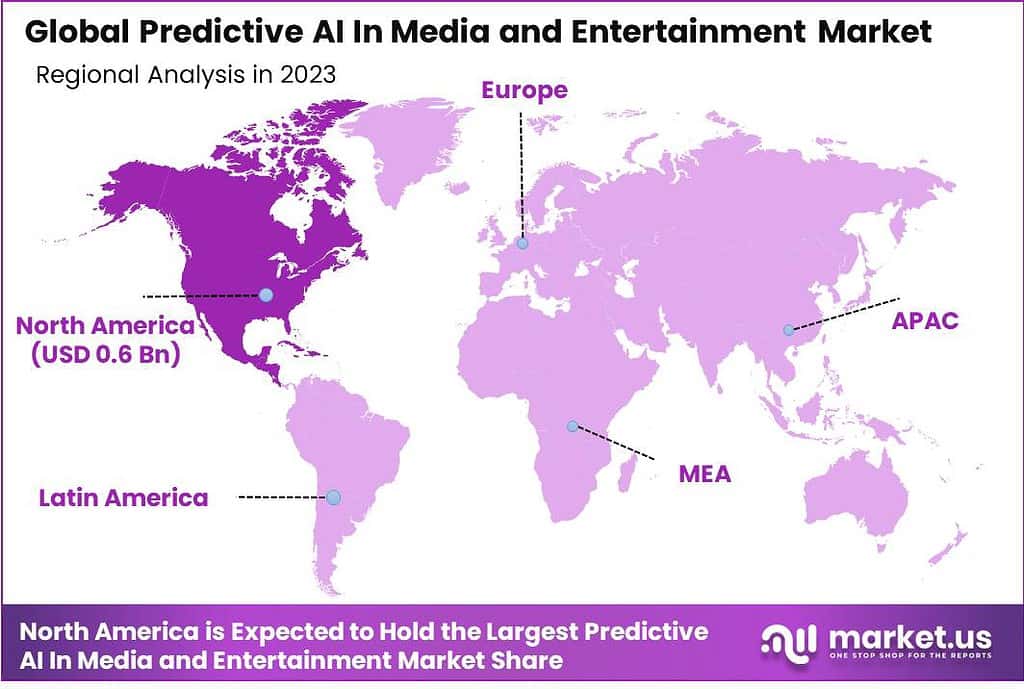

- North America led the predictive AI market in media and entertainment in 2023, with a share exceeding 42.8%. The region’s highly developed technological infrastructure, coupled with robust regulatory frameworks and a digitally savvy consumer base, fueled market growth. Europe showcased significant growth, driven by data protection emphasis and AI research investments.

- The Predictive AI Market size is poised for substantial growth, expected to jump from USD 14.9 Billion in 2023 to USD 108 Billion by 2033. This represents a growth rate, or CAGR, of 21.9% from 2024 to 2033.

- Similarly, the Generative AI in Media and Entertainment Market is on a trajectory from USD 1,412.7 Million in 2023 to USD 11,570 Million by 2032, with a CAGR of 26.3% during the same period.

- A reduction in content production costs by up to 20% could be achieved through predictive AI, per Accenture’s analysis. This results from more efficient audience analysis and content planning.

- According to industry executives, predictive AI is expected to significantly boost customer engagement and retention by 68%, thanks to personalized content and recommendations.

- About 50% of companies in the sector plan to apply predictive AI for content creation and scriptwriting, aiding in producing more compelling narratives.

- The effectiveness of advertising could see a 30% increase with the adoption of predictive AI, leading to more resonant targeted ads and personalized campaigns.

- Investment in predictive AI solutions for audience analysis and content planning is on the agenda for 72% of companies, aiming to refine content strategies to better match audience preferences.

- Predictive AI could improve content quality and relevance by 35%, ensuring that creators can deliver more engaging and meaningful content to their audience.

- Viewer engagement and retention could rise by 25% through the use of predictive AI, creating more personalized experiences that encourage audiences to return.

- Around 40% of media and entertainment companies are looking to utilize predictive AI for content licensing and rights management, streamlining negotiations and agreements.

- A significant 71% of executives believe predictive AI will improve audience measurement and analytics, leading to more informed decision-making based on accurate data insights.

By Deployment Mode Analysis

In 2023, the Cloud-based segment held a dominant market position within the predictive AI in media and entertainment market, capturing more than a 75% share. This substantial market share can be attributed to the cloud’s inherent advantages, including scalability, flexibility, and cost-efficiency. Cloud-based deployment allows media companies to leverage powerful AI and analytics capabilities without the need for substantial upfront investments in hardware and infrastructure.

Furthermore, the cloud enables seamless updates and maintenance of AI models, ensuring that media and entertainment providers can quickly adapt to changing market dynamics and content consumption patterns. The cloud’s leading position is further reinforced by its ability to facilitate the management and analysis of vast datasets, which are fundamental to the successful application of predictive AI. With the increasing volume of data generated by online media consumption, cloud-based solutions offer an effective way to store, process, and analyze this data in real time.

This capability is crucial for generating accurate content recommendations, optimizing content distribution strategies, and personalizing advertising, thereby enhancing the overall user experience. Additionally, the global shift towards remote work and the demand for accessible, anywhere-anytime services have propelled the adoption of cloud-based solutions, making them the preferred choice for media companies aiming to innovate and maintain competitive edge.

Moreover, the scalability of cloud-based platforms allows media entities of all sizes to implement predictive AI technologies, democratizing access to advanced analytics and leveling the playing field between large conglomerates and smaller content creators. This scalability, combined with the reduced need for technical maintenance and the ability to swiftly respond to consumer trends, underscores why the cloud-based segment leads the market in predictive AI applications within the media and entertainment industry.

By Company Size Analysis

In 2023, the Large Enterprises segment held a dominant market position in the Predictive AI in Media and Entertainment sector, capturing more than a 63.4% share.

This segment’s leading position can be attributed to several key factors. Firstly, large enterprises in the media and entertainment industry typically have greater financial resources and infrastructure capabilities, allowing them to invest in advanced AI technologies and data analytics platforms.

These resources enable them to effectively leverage predictive AI solutions to analyze vast amounts of data, including user preferences, content performance, and market trends. By harnessing the power of predictive AI, large enterprises can make data-driven decisions, optimize their content strategies, and deliver personalized experiences to their audiences.

Additionally, large enterprises often possess extensive customer bases and content libraries, providing them with a wealth of data to train and refine predictive AI models. The availability of diverse and comprehensive data sets empowers these companies to build robust predictive models that can accurately anticipate user behavior and preferences. By understanding their audience’s interests and preferences, large enterprises can tailor their content offerings, improve customer engagement, and drive higher viewership or user engagement metrics.

Moreover, large enterprises typically have well-established partnerships and distribution networks, allowing them to reach a wider audience and maximize the impact of predictive AI technology. They have the resources to implement sophisticated recommendation engines, personalized advertising strategies, and content optimization techniques, further enhancing their competitive advantage in the market.

Overall, the large enterprises segment’s leading position in the Predictive AI in Media and Entertainment market is a result of their financial capabilities, access to extensive data, and the ability to deploy advanced AI technologies effectively. These factors enable them to leverage predictive AI to deliver personalized content experiences, optimize their content strategies, and stay ahead of the competition in an increasingly data-driven and competitive industry landscape.

By Application Analysis

In 2023, the Content Recommendations segment held a dominant market position in the Predictive AI in Media and Entertainment sector, capturing more than a 31.2% share.

The leading position of the Content Recommendations segment can be attributed to several factors driving its market growth. Firstly, personalized content recommendations have become a crucial component of media and entertainment platforms, as they enhance user engagement and satisfaction. With the exponential growth of content available across various channels, platforms, and genres, users often face challenges in discovering relevant content.

Predictive AI algorithms enable media and entertainment companies to analyze user preferences, viewing patterns, and historical data to deliver personalized content recommendations that match each user’s interests and preferences. Moreover, the Content Recommendations segment benefits from the availability of substantial user data, enabling accurate and effective personalization.

By leveraging predictive AI, media and entertainment companies can analyze vast amounts of user data, including viewing history, ratings, social media interactions, and demographic information. This data-driven approach allows content providers to understand individual preferences and offer targeted recommendations, resulting in increased user engagement, longer viewing sessions, and reduced churn rates.

Furthermore, the Content Recommendations segment is driven by the increasing adoption of streaming platforms and over-the-top (OTT) services. As these platforms compete for user attention, personalized content recommendations play a vital role in capturing and retaining audiences. By leveraging predictive AI, these platforms can suggest relevant content to users, improving content discovery and enhancing the overall user experience.

By End-User Analysis

In 2023, the Streaming Platforms segment held a dominant market position in the Predictive AI in Media and Entertainment sector, capturing more than a 25% share.

The leading position of the Streaming Platforms segment can be attributed to several key factors driving its market growth. Firstly, the rapid growth of streaming platforms, fueled by the increasing popularity of on-demand content consumption, has created a significant demand for predictive AI solutions. Streaming platforms rely on predictive AI algorithms to analyze user behavior, viewing patterns, and preferences, enabling them to deliver personalized content recommendations and enhance user engagement.

Furthermore, the Streaming Platforms segment benefits from the vast amounts of user data generated by these platforms. Streaming platforms collect data on user interactions, content preferences, ratings, and viewing history. By leveraging predictive AI, streaming platforms can analyze this data to gain insights into user preferences, predict content demand, and optimize content libraries. This enables them to curate personalized content catalogs, improve content discovery, and provide a compelling user experience.

Moreover, the Streaming Platforms segment is driven by the intense competition in the streaming industry. With numerous streaming platforms vying for user attention, predictive AI becomes a crucial tool for gaining a competitive edge. By leveraging predictive AI algorithms, streaming platforms can deliver personalized recommendations, tailor content offerings, and optimize user interfaces to enhance user satisfaction and drive user retention.

Overall, the leading position of the Streaming Platforms segment in the Predictive AI in Media and Entertainment market is attributed to the rapid growth of streaming platforms, the availability of extensive user data, and the need for personalized content recommendations. By leveraging predictive AI, streaming platforms can deliver tailored content experiences, improve content discovery, and enhance user engagement, leading to increased viewership and competitive advantage in the evolving media and entertainment landscape.

Key Market Segments

By Deployment Mode

- Cloud-based

- On-premises

By Company Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Content Recommendations

- Audience Insights and Targeting

- Predictive Analytics for Performance

- Revenue Optimization

- Content Creation and Curation

By End-User

- Broadcasting and Cable Networks

- Streaming Platforms

- Music Streaming Services

- Gaming Industry

- Film Production Studios

- Advertising Agencies

- Social Media Platforms

- News and Publishing Houses

Driver

Enhanced User Experience through Personalization

The integration of Predictive AI in the Media and Entertainment industry significantly enhances user experience through personalized content recommendations. By analyzing user data, including viewing habits, search history, and preferences, AI algorithms can tailor content suggestions, making them more relevant and engaging to individual users. This level of personalization not only improves user satisfaction but also increases the time spent on platforms, subscription renewals, and reduces churn rates.For streaming services, gaming platforms, and online publications, this ability to deliver a customized user experience is a key driver for growth. It encourages loyalty and attracts new users seeking a more personalized entertainment experience. The competitive edge gained through predictive AI-driven personalization is a major factor propelling the expansion of this market segment.

Restraint

Privacy Concerns and Data Security Issues

A significant restraint facing the adoption of Predictive AI in the Media and Entertainment industry is the growing concern over privacy and data security. The effectiveness of predictive algorithms depends on the collection, analysis, and storage of vast amounts of user data, raising ethical and legal issues regarding consumer privacy. As regulations like GDPR in Europe and CCPA in California impose stricter controls over data usage, media companies face challenges in balancing personalized services with user privacy rights.These concerns can lead to skepticism among users, potentially hindering the adoption rate of AI-enabled platforms. Moreover, the threat of data breaches and the misuse of personal information can damage trust and brand reputation, leading to a loss of subscribers and legal ramifications. Addressing these concerns while leveraging AI for personalization is a critical challenge for the industry.

Opportunity

Expansion into Emerging Markets

Predictive AI presents a significant opportunity for the Media and Entertainment industry to expand into emerging markets. These regions, characterized by rapidly increasing internet penetration and smartphone adoption, offer a fertile ground for digital entertainment platforms. Predictive AI can enable companies to understand and predict local content preferences, cultural nuances, and viewing habits, facilitating the creation or adaptation of content to meet regional demands. This targeted approach can significantly enhance user engagement and growth in new markets.Furthermore, AI-driven analytics can help identify untapped or underserved niches within these markets, providing a competitive advantage to early adopters. The expansion into emerging markets, supported by predictive AI, not only drives user base growth but also diversifies revenue streams, making it a lucrative opportunity for global media and entertainment enterprises.

Challenge

Keeping Pace with Rapid Technological Advances

A major challenge in leveraging Predictive AI within the Media and Entertainment sector is keeping pace with rapid technological advances. The field of artificial intelligence is evolving at an unprecedented rate, with new methodologies, algorithms, and data processing technologies emerging constantly. For media companies, this means continuous investment in R&D, training for staff, and updates to existing systems to incorporate the latest AI advancements. This necessity for ongoing adaptation can strain resources, especially for smaller players without the financial or technical capabilities of larger corporations.Additionally, the fast pace of innovation can lead to implementation challenges, as companies struggle to integrate new technologies in a way that aligns with their strategic objectives and operational capabilities. Staying ahead in this dynamic environment requires a commitment to innovation, flexibility in strategy, and a focus on building or acquiring the necessary technological expertise.

Regional Analysis

In 2023, North America held a dominant market position in the predictive AI in media and entertainment market, capturing more than a 42.8% share. The demand for Predictive AI In Media And Entertainment in North America was valued at US$ 40.6 billion in 2023 and is anticipated to grow significantly in the forecast period.

The region boasts a highly developed technological infrastructure, which facilitates the rapid adoption and integration of AI technologies within the media and entertainment sectors. Moreover, the presence of leading AI technology providers and pioneering media conglomerates in this region further propels the adoption of predictive AI solutions. These entities invest heavily in research and development, driving innovation and the implementation of AI in content creation, personalization, and consumer engagement strategies.

Additionally, North America’s robust regulatory framework and supportive policies for technology innovation have laid a fertile ground for AI advancements. The consumer market in this region, characterized by a high digital literacy rate and a strong appetite for new media and entertainment experiences, also plays a crucial role.

The demand for personalized content, along with the need for advanced analytics for consumer behavior prediction and targeted advertising, has surged. This demand is met by predictive AI technologies, which enable media companies to optimize their offerings and enhance viewer engagement through data-driven insights.

Europe, following North America, showcases a strong growth trajectory in the predictive AI in media and entertainment market. The region’s focus on data protection and ethical AI use, coupled with substantial investments in AI research and development, underpins its market expansion. Europe’s diverse media landscape and the increasing demand for content personalization and optimization strategies across its varied audience further drive the adoption of predictive AI solutions.

Key Regions and Countries Covered in this Report:

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

In the predictive AI in media and entertainment market of 2023, the landscape was prominently shaped by several key players, each contributing uniquely to the industry’s evolution. Amazon Web Services (AWS), Google Cloud Platform (GCP), and Microsoft Azure stood out as the technological powerhouses, offering robust cloud infrastructure and advanced AI tools.

These platforms facilitated scalable solutions for content management, distribution, and personalization, catering to the extensive demands of media companies and content creators. AWS, with its comprehensive suite of machine learning services, enabled unparalleled content recommendation algorithms and viewer engagement analytics. GCP and Azure, through their sophisticated AI and analytics capabilities, provided insights into consumer behavior and content performance, empowering media entities to optimize their strategies effectively.

IBM Watson and Adobe Sensei emerged as crucial players in enhancing content discovery and creation. IBM Watson’s AI-driven insights helped in curating personalized content experiences, while Adobe Sensei revolutionized content creation with its AI-powered creativity tools. Their contributions underscored the importance of AI in not only understanding audience preferences but also in aiding the creative process.

Top Market Leaders

- Amazon Web Services (AWS)

- Google Cloud Platform (GCP)

- Microsoft Azure

- IBM Watson

- Adobe Sensei

- Salesforce Einstein

- Pandora’s Next Big Sound

- Qloo

- Other Key Players

Recent Developments

1. Microsoft Azure:

- February 2023: Launched “Azure Cognitive Services for Media,” a suite of AI tools for video analysis, content moderation, and personalization.

- June 2023: Partnered with Dolby and Netflix to develop AI-powered solutions for improving video quality and accessibility.

- October 2023: Announced the general availability of “Project Bonsai,” a platform for building and deploying custom AI models for various applications, including media content creation and optimization.

2. IBM Watson:

- April 2023: Released “Watson Media & Entertainment Insights,” a suite of AI tools for predicting content performance, understanding audience preferences, and optimizing marketing campaigns.

- August 2023: Partnered with ViacomCBS to leverage Watson AI for personalized content recommendations and targeted advertising.

- December 2023: Acquired the startup “Cloudant,” enhancing its capabilities in managing and analyzing large-scale media data.

3. Adobe Sensei:

- March 2023: Unveiled “Sensei Creative AI,” a set of AI tools for automating tedious tasks like video editing and generating creative content suggestions.

- July 2023: Integrated Sensei AI with Adobe Premiere Pro, enabling automatic speech-to-text transcription and real-time content analysis.

- November 2023: Partnered with WWE to use Sensei AI for analyzing fan sentiment and tailoring content recommendations.

Report Scope

Report Features Description Market Value (2023) US$ 1.5 Bn Forecast Revenue (2033) US$ 4.7 Bn CAGR (2024-2033) 12.0% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Cloud-based, On-premises), By Company Size (Small and Medium Enterprises (SMEs), Large Enterprises), By Application (Content Recommendations, Audience Insights and Targeting, Predictive Analytics for Performance, Revenue Optimization, Content Creation and Curation), By End-User (Broadcasting and Cable Networks, Streaming Platforms, Music Streaming Services, Gaming Industry, Film Production Studios, Advertising Agencies, Social Media Platforms, News and Publishing Houses) Regional Analysis North America – The U.S. & Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands & Rest of Europe; APAC- China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam & Rest of APAC; Latin America- Brazil, Mexico & Rest of Latin America; Middle East & Africa- South Africa, Saudi Arabia, UAE & Rest of MEA Competitive Landscape Amazon Web Services (AWS), Google Cloud Platform (GCP), Microsoft Azure, IBM Watson, Adobe Sensei, Salesforce Einstein, Pandora’s Next Big Sound, Qloo, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is Predictive AI in Media and Entertainment?Predictive AI in Media and Entertainment refers to the use of artificial intelligence (AI) and machine learning (ML) algorithms to analyze data and predict future trends, behaviors, and preferences in the media and entertainment industry.

How big is Predictive AI In Media And Entertainment Market?The Global Predictive AI In Media And Entertainment Market size is expected to be worth around USD 4.7 Billion by 2033, from USD 1.5 Billion in 2023, growing at a CAGR of 12.0% during the forecast period from 2024 to 2033.

What are the Key Drivers of the Predictive AI In Media And Entertainment Market?The Predictive AI in Media and Entertainment market is driven by the increasing demand for personalized content and recommendations, the growing volume of data generated by digital platforms and devices, the need for media companies to optimize their marketing strategies, and the emergence of new technologies such as machine learning and natural language processing.

What are the Challenges in Implementing Predictive AI In Media And Entertainment?Challenges include the quality and quantity of data available for training predictive AI models, the complexity of AI algorithms, the integration of predictive AI into existing workflows and systems, and ethical and privacy concerns associated with the use of predictive AI.

Who are the top players in the Predictive AI In Media And Entertainment Market?Key players covered in the report include Amazon Web Services (AWS), Google Cloud Platform (GCP), Microsoft Azure, IBM Watson, Adobe Sensei, Salesforce Einstein, Pandora's Next Big Sound, Qloo, Other Key Players

Which region is expected to dominate the Predictive AI In Media And Entertainment Market?In 2023, North America held a dominant market position in the predictive AI in media and entertainment market, capturing more than a 42.8% share.

Predictive AI In Media and Entertainment MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample

Predictive AI In Media and Entertainment MarketPublished date: March 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Amazon Web Services (AWS)

- Google Cloud Platform (GCP)

- Microsoft Azure

- IBM Watson

- Adobe Sensei

- Salesforce Einstein

- Pandora's Next Big Sound

- Qloo

- Other Key Players