Global Precision Machining Market Size, Share, Growth Analysis By Machine Type (Milling Machining, Laser Machining, Electric Discharge Machining, Turning, Grinding, Others), By Operation (Manual Operation, CNC Operation), By Material Type (Metals [Steel, Aluminum Alloys, Titanium Alloys, Others], Plastics & Polymers, Others), By End-Use Industry (Automotive, Aerospace & Defense, Medical & Healthcare, Electronics & Semiconductor, Industrial & Manufacturing, Energy & Power, Others), , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 175251

- Number of Pages: 341

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

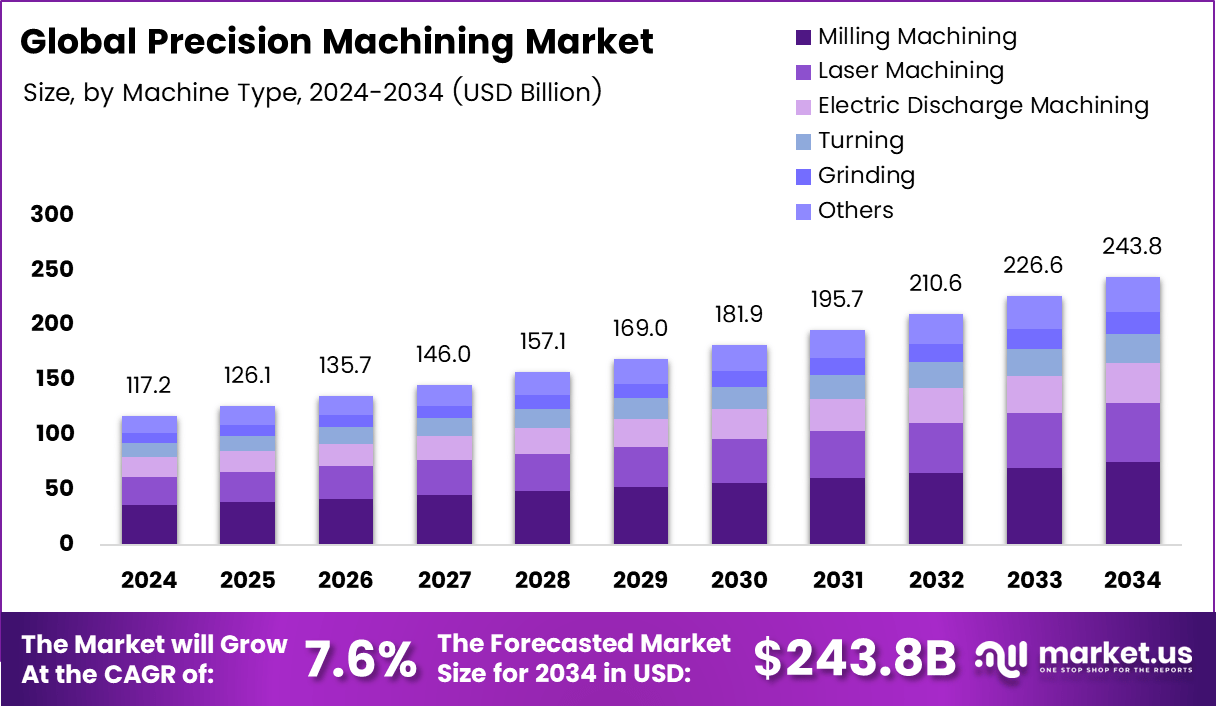

The Global Precision Machining Market size is expected to be worth around USD 243.8 Billion by 2035, from USD 117.2 Billion in 2025, growing at a CAGR of 7.6% during the forecast period from 2026 to 2035.

Precision machining is a high-accuracy manufacturing process that shapes materials, such as metals and composites, into complex parts with extremely tight tolerances, using computer-controlled (CNC) machines for cutting, milling, and turning, crucial for industries that require reliable components. It’s a subtractive method, starting with a block of material and removing excess to reveal the exact final form, ensuring perfect fit and function.

The market is driven by the demand for high-quality, precise components across various industries, including automotive, aerospace, medical, and energy. Milling machining leads the market due to its versatility, ability to handle diverse materials, and suitability for complex geometries. Similarly, CNC operations dominate owing to their efficiency, precision, and ability to handle large-scale production. Metals, particularly steel, aluminum, and titanium, are the primary materials used due to their superior strength, durability, and resistance to heat and wear.

- According to the United Nations Industrial Development Organization, in the third quarter of 2025, the global manufacturing production increased by 0.7% and exports rose by 1.7%, showing differing quarter-on-quarter growth rates. However, as manufacturing industries thrive, it creates demand for precision machining.

The automotive sector is the largest consumer of precision machining, driven by high-volume production and the need for precise components in vehicle systems. The integration of automation and robotics is a growing trend, enhancing production efficiency and quality control. Moreover, the rising demand for precision components, driven by sectors such as automotive and medical, offers significant growth opportunities for the market.

- According to the National Bureau of Statistics of China, the manufacturing sector of the country, which heavily relies on precision machining technologies, accounts for over 30% of global industrial output.

Key Takeaways

- The global precision machining market was valued at USD117.2 billion in 2024.

- The global precision machining market is projected to grow at a CAGR of 7.6% and is estimated to reach USD243.8 billion by 2034.

- On the basis of types of machines, milling machining dominated the precision machining market, constituting 30.9% of the total market share.

- Based on the operation, CNC operation for the precision machining dominated the market, with a substantial market share of around 72.7%.

- Based on the material type, metals led the precision machining market, comprising 76.8% of the total market.

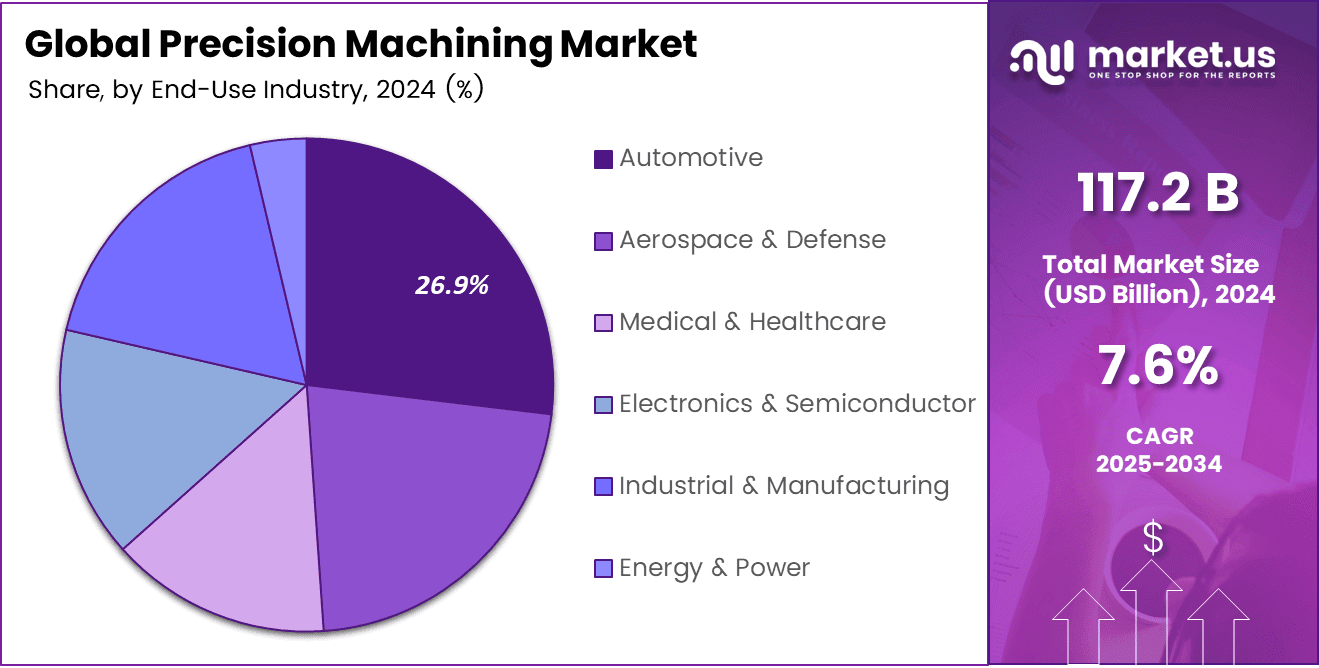

- Among the end-use industries, the automotive industry held a major share in the precision machining market, 26.9% of the market share.

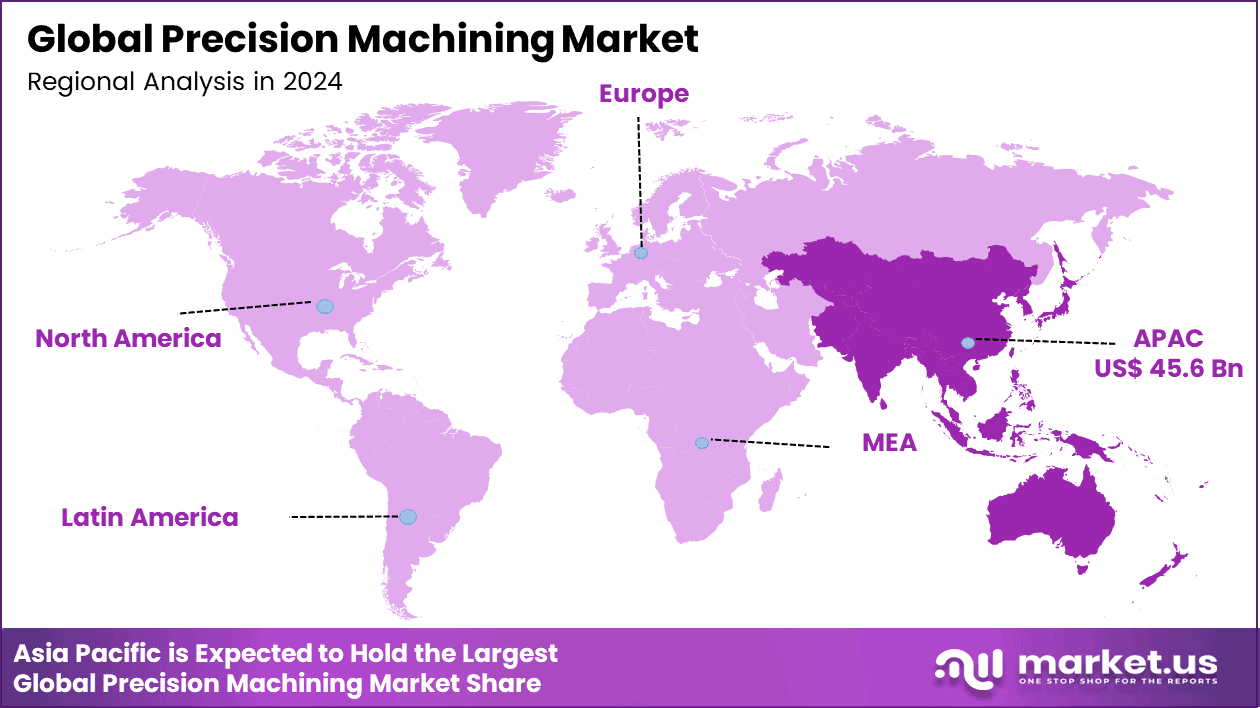

- In 2024, the Asia Pacific was the most dominant region in the precision machining market, accounting for 38.9% of the total global consumption.

Global Precision Machining Market Scope:

Machine Type Analysis

Milling Machines are a Prominent Segment in the Precision Machining Market.

The precision machining market is segmented based on types of machines into milling machining, laser machining, electric discharge machining, turning, grinding, and others. The milling machining led the precision machining market, comprising 30.9% of the market share, due to its versatility and ability to handle a broad range of materials and complex geometries. It allows for the creation of intricate features such as slots, pockets, and profiles with high precision.

Unlike laser machining, which is limited by material thickness and type, milling can accommodate hard and soft materials. Additionally, compared to electric discharge machining (EDM), milling is faster and more cost-effective for mass production. Additionally, it offers greater flexibility in modifying designs and is well-suited for multi-axis operations, enhancing its applicability in diverse industries.

Operation Analysis

CNC Operation Dominated the Precision Machining Market.

On the basis of the operation, the precision machining market is segmented into manual operation and CNC operation. The CNC operation dominated the precision machining market, comprising 72.7% of the market share, due to the need for high levels of skill and craftsmanship in certain specialized applications. Manual machining allows for more nuanced adjustments during production, which can be crucial for complex, small-scale, or one-off parts where flexibility is essential.

Similarly, it provides greater control over fine tolerances, especially in cases where the machines are not equipped to handle specific material properties or geometries. Additionally, manual operations may be preferred for smaller workshops with limited access to CNC equipment or in situations where low-volume production does not justify the cost of CNC setup.

Material Type Analysis

Precision Machining Products Mostly Utilize Metals as Raw Material.

Based on the material type, the precision machining market is divided into metals, plastics & polymers, and others. The metals dominated the precision machining market, with a notable market share of 76.8%, due to their superior mechanical properties, such as strength, hardness, and durability. Metals such as steel, aluminum, and titanium offer better performance in high-stress applications, where precise dimensional accuracy and resistance to wear, heat, and pressure are critical.

Unlike several plastics, metals maintain their structural integrity at higher temperatures, making them ideal for industries such as aerospace, automotive, and electronics. While plastics can be machined for lightweight, cost-sensitive applications, metals provide greater reliability and longevity, making them the preferred choice for most precision machining tasks.

End-Use Industry Analysis

The Automotive Sector Held a Major Share of the Precision Machining Market.

Among the end-use industries, 26.9% of the total global consumption of precision machining is for the automotive sector. Precision machining is predominantly used in the automotive sector due to the high volume of parts production and the need for cost-effective, high-precision components in mass manufacturing. Automotive applications often require a wide variety of precision parts, such as engine components, gears, and shafts, which demand strict tolerances and repeatability.

Furthermore, the automotive industry benefits from economies of scale, making it more feasible to invest in precision machining techniques. While sectors such as aerospace, defense, and medical require precision machining, their production volumes are smaller, and the complexity or regulatory constraints often necessitate specialized methods beyond typical mass-production machining.

Key Market Segments

By Machine Type:

- Milling Machining

- Laser Machining

- Electric Discharge Machining

- Turning

- Grinding

- Others

By Operation:

- Manual Operation

- CNC Operation

By Material Type:

- Metals

- Steel

- Aluminum Alloys

- Titanium Alloys

- Others

- Plastics & Polymers

- Others

By End-Use Industry:

- Automotive

- Aerospace & Defense

- Medical & Healthcare

- Electronics & Semiconductor

- Industrial & Manufacturing

- Energy & Power

- Others

Drivers

Rapid Adoption of Additive Manufacturing Drives the Precision Machining Market.

The adoption of additive manufacturing (AM), known as 3D printing, is increasingly driving the demand for precision manufacturing, particularly in aerospace and medical device production. For instance, as of late 2023, the U.S. Food and Drug Administration (FDA) had cleared over 100 medical devices manufactured using additive processes, indicating substantive integration of additive manufacturing into precision component fabrication workflows in regulated sectors such as orthopedics and dental implants. Similarly, in aerospace, certified utilization of AM components is expanding.

The European Union Aviation Safety Agency (EASA) has published dedicated certification guidance, Certification Memorandum CM-S-008, reflecting an established pathway for qualifying AM parts across categories with defined criticality classifications, evidencing systematic regulatory accommodation of additive techniques in precision parts manufacture. As medical device production and aerospace component production increasingly utilize additive manufacturing, this drives the demand for precision-machining components.

Restraints

Challenges in Balancing Cost Efficiency and Consumer Expectations in Precision Machining.

Balancing cost competitiveness with consumer expectations remains a significant challenge in the precision machining market. The manufacturers face intense cost pressures due to rising material costs, labor shortages, and increasing demand for high-precision components. The U.S. Bureau of Labor Statistics highlights a 5% increase in labor costs within the manufacturing sector since 2021, contributing to the pressure on profit margins for precision machining firms.

Additionally, the cost of raw materials such as steel and aluminum has risen by approximately 8% annually till 2023, according to data from the U.S. Department of Commerce, further complicating pricing strategies for companies. In contrast, the global demand for customized, high-precision parts is expected to grow, particularly in sectors such as aerospace and medical devices.

This creates an imbalance between production costs and consumer demands, compelling manufacturers to adopt advanced technologies such as automation and digital twins. While these technologies offer long-term benefits, their upfront costs can exacerbate financial pressure, presenting a delicate balance for firms to maintain profitability while fulfilling high consumer expectations.

Growth Factors

High Demand for Precision Components from Various Industries Creates Opportunities in the Precision Machining Market.

The demand for precision components from multiple industry sectors generates concrete demand for precision machining. For instance, the Ministry of Micro, Small & Medium Enterprises (MSME) of the Government of India reported that tool rooms and technical institutions supported under national programmes developed 437 types of precision components and manufactured around 54000 such components to substitute imports and support technology-intensive applications through March 2024, evidencing institutional efforts to meet diversified industrial demands via precision machining capabilities. Additionally, the automotive production volumes correlate with precision machining requirements.

For instance, the global automotive sector, accounting for 75.5 million vehicle units in 2024, in which each vehicle comprises precision-machined parts such as engine elements, transmission components, and safety systems. As there is a significant rise in sales of vehicles, there is a consistent demand for precision machining in the market.

Consequently, the structured industrial output across various sectors, such as automotive, generates quantifiable demand for high-precision components, creating opportunities for precision machining capacity aligned with institutional manufacturing objectives.

Emerging Trends

Integration of Automation and Robotics.

The adoption of automation and robotics within precision machining is evident through measurable increases in industrial robot deployment and operational density. For instance, according to the International Federation of Robotics (IFR), the global stock of operational industrial robots in manufacturing exceeded 4.6 million units in 2024, representing a 9% year-on-year increase from the previous year and marking sustained growth in automated-capable machinery across manufacturing sectors that include precision machining applications.

In addition, the annual installations of industrial robots remain elevated, with 542,000 new units installed in 2024, maintaining levels above 500,000 for the fourth consecutive year. Similarly, the robot density, a standardized measure expressed as the number of robots per 10,000 manufacturing employees, has substantially increased over recent years. The global average robot density more than doubled from 74 units to 162 units between 2016 and 2023.

The manufacturers reliant on precision machining processes are integrating robotics at an increasing scale to support tasks such as machine tending, real-time quality inspection, and automated material handling. The aggregate growth in robot stock and robot density implies broader systemic adoption of automated and robotic systems across high-precision manufacturing environments where tolerance and throughput demands are stringent.

Geopolitical Impact Analysis

Severely Affected Supply Chains in the Precision Machining Market Amid Geopolitical Tensions.

The geopolitical tensions, particularly those involving major global powers such as the United States, China, and Russia, have had notable implications for the precision machining market by influencing the movement of critical inputs and equipment. In particular, trade restrictions and tariffs on key manufacturing materials have impacted supply chains.

In October 2025, China’s Ministry of Commerce and General Administration of Customs issued export controls under its Export Control Law, requiring export licenses for categories of artificial diamond micropowders, single crystals, wire saws, and grinding wheels, materials integral to ultra-precision machining and finishing operations, which have been effective since November 2025. These controls extended to related rare-earth and high-tech materials and equipment, signaling state-level prioritization of strategic supply-chain leverage over unfettered export flows.

The U.S. Department of Commerce reported that tariffs on Chinese-made machine tools have raised costs for U.S. manufacturers, forcing them to either absorb the added expense or seek alternative suppliers. Similarly, escalating trade barriers have created a fragmented global market for precision machining components, particularly in regions reliant on cross-border trade flows.

Moreover, the geopolitical tensions have prompted a rethinking of supply chain strategies, with EU member states diversifying sources of critical materials for precision machining, such as rare earth metals and high-grade steel, marking a 5% increase in intra-EU imports of metals. The expansion of dual-use export controls to rare earths and magnet materials further restricts global access to components fundamental to high-precision machining, such as permanent magnets for precision actuators and control systems. These disruptions have increased uncertainty in global manufacturing, affecting production timelines and the availability of high-precision parts. These tensions are materially reshaping the precision machining market’s supply chains and access to specialized inputs.

Regional Analysis

Asia Pacific Held the Largest Share of the Global Precision Machining Market.

In 2024, the Asia Pacific dominated the global precision machining market, holding about 38.9% of the total global consumption, driven by significant industrial demand, technological advancements, and manufacturing capabilities. The region benefits from a robust manufacturing base, particularly in China, Japan, South Korea, and India, where precision machining is integral to industries such as automotive, aerospace, and electronics.

Additionally, external robotics installation data indicate that China alone was responsible for approximately 54% of global industrial robot installations in 2024, reinforcing the concentration of automated manufacturing activity in the Asia Pacific. Furthermore, according to the Japan Machine Tool Builders’ Association (JMTBA), Japan’s exports of machine tools, essential for precision machining, were JPY208.7 million, underscoring the region’s competitive edge in the sector.

Furthermore, South Korea continues to prioritize high-precision manufacturing techniques, with a strong focus on advancing automation and precision tool technology. These factors collectively establish Asia Pacific as the dominant region in the global precision machining market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Precision Machining Company Insights

To gain a competitive edge in the precision machining market, players often focus on several strategic activities. They invest in advanced technologies, such as CNC machines, additive manufacturing, and automation, to enhance precision and reduce production time. Additionally, players prioritize continuous improvement in process optimization and quality control to ensure high tolerance and defect-free parts. Furthermore, they focus on expanding their capabilities to handle a wider range of materials, including advanced alloys and composites. Similarly, companies emphasize geographic expansion to access new markets or develop specialized expertise in high-demand industries like automotive or aerospace.

Top Key Players in the Market

- Yijin Hardware

- Foshan Iwon Metal Products

- Portland Precision Manufacturing Co.

- Ultra Precision Machining & Grinding

- Ace Precision Machining

- Precipart

- Cox Manufacturing

- Hastreiter Industries Corp.

- Metal Craft

- Owens Industries, LLC.

- Riverside Machine & Engineering

- Hanz Manufacturing

- Xometry

- Protolabs

- Amtek, Inc.

- Matsuura Machinery

- Threadlock Precision

- Other Key Players

Recent Developments

In December 2025, Yijin Hardware, a leading provider of precision manufacturing services, unveiled an expansion of its OEM sheet metal fabrication capabilities to address the growing demand for high-quality, precision-engineered components in sectors such as automotive, aerospace, medical, and energy.

In January 2026, Threadlock Precision, an expanding network of precision manufacturing firms, announced its acquisition of Kremin Inc., a Michigan-based CNC machining company with over 40 years of experience serving the aerospace, defense, and medical sectors.

Report Scope

Report Features Description Market Value (2025) USD 117.2 Billion Forecast Revenue (2035) USD 243.8 Billion CAGR (2026-2035) 7.6% Base Year for Estimation 2025 Historic Period 2020-2024 Forecast Period 2026-2035 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Machine Type (Milling Machining, Laser Machining, Electric Discharge Machining, Turning, Grinding, and Others), By Operation (Manual Operation and CNC Operation), By Material Type (Metals, Plastics & Polymers, and Others), By End-Use Industry (Automotive, Aerospace & Defense, Medical & Healthcare, Electronics & Semiconductor, Industrial & Manufacturing, Energy & Power, and Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Yijin Hardware, Foshan Iwon Metal Products, Portland Precision Manufacturing Co., Ultra Precision Machining & Grinding, Ace Precision Machining, Precipart, Cox Manufacturing, Hastreiter Industries Corp., Metal Craft, Owens Industries, LLC., Riverside Machine & Engineering, Hanz Manufacturing, Xometry, Protolabs, Amtek, Inc., Matsuura Machinery, Threadlock Precision, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Yijin Hardware

- Foshan Iwon Metal Products

- Portland Precision Manufacturing Co.

- Ultra Precision Machining & Grinding

- Ace Precision Machining

- Precipart

- Cox Manufacturing

- Hastreiter Industries Corp.

- Metal Craft

- Owens Industries, LLC.

- Riverside Machine & Engineering

- Hanz Manufacturing

- Xometry

- Protolabs

- Amtek, Inc.

- Matsuura Machinery

- Threadlock Precision

- Other Key Players